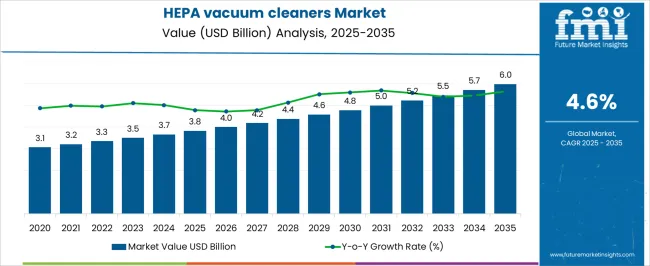

The HEPA vacuum cleaners Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 6.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| HEPA vacuum cleaners Market Estimated Value in (2025 E) | USD 3.8 billion |

| HEPA vacuum cleaners Market Forecast Value in (2035 F) | USD 6.0 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The HEPA vacuum cleaners market is witnessing steady expansion as consumers and industries increasingly prioritize air quality, hygiene, and effective dust removal. The market is being shaped by rising awareness about indoor air pollution and its link to respiratory illnesses, driving adoption across both residential and commercial sectors. The ability of HEPA filters to trap fine particles including allergens, bacteria, and dust mites has positioned these vacuum cleaners as essential in maintaining healthier environments.

Growth is being further supported by advancements in motor efficiency, compact product design, and integration of smart features that enhance user convenience while reducing energy consumption. Regulations emphasizing environmental safety and workplace health are reinforcing the role of HEPA technology as a standard in cleaning equipment.

With increasing urbanization, smaller living spaces, and heightened demand for wellness-oriented appliances, the market outlook remains positive Future growth opportunities are expected through innovation in lightweight, cordless models and multifunctional vacuum cleaners designed to serve diverse cleaning applications.

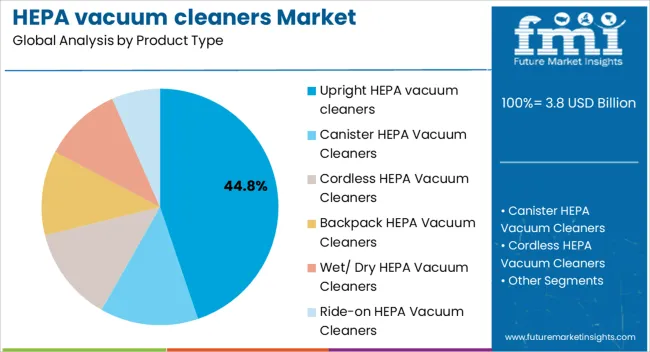

The hepa vacuum cleaners market is segmented by product type, end use, and geographic regions. By product type, hepa vacuum cleaners market is divided into Upright HEPA vacuum cleaners, Canister HEPA Vacuum Cleaners, Cordless HEPA Vacuum Cleaners, Backpack HEPA Vacuum Cleaners, Wet/ Dry HEPA Vacuum Cleaners, and Ride-on HEPA Vacuum Cleaners.

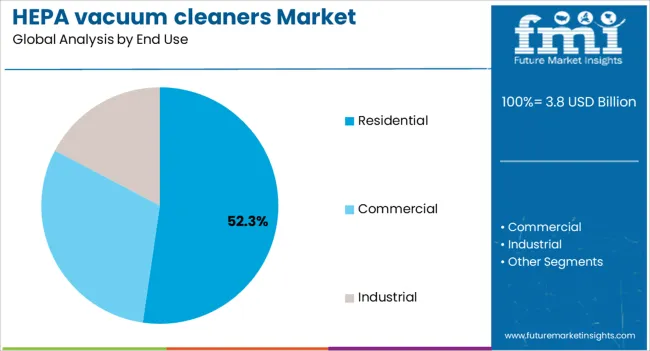

In terms of end use, hepa vacuum cleaners market is classified into Residential, Commercial, and Industrial. Regionally, the hepa vacuum cleaners industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The upright HEPA vacuum cleaners segment is projected to hold 44.80% of the HEPA vacuum cleaners market revenue in 2025, making it the leading product type. This segment has gained prominence due to its strong suction power, larger dust capacity, and ergonomic design, which make it well-suited for cleaning large floor areas efficiently. The durability and performance of upright models have reinforced their position in households and institutional settings where frequent cleaning is required.

Their ability to integrate advanced HEPA filtration with adjustable cleaning modes has improved overall effectiveness in removing fine dust particles and allergens. The growing consumer preference for upright models has also been driven by convenience, as many feature self-propelled mechanisms and easy maneuverability despite their size.

Continued innovation in corded and cordless versions, coupled with improved bagless technology, has further expanded adoption With the rising focus on deep cleaning solutions and allergen-free indoor spaces, the upright HEPA vacuum cleaners segment is expected to maintain its leading share and continue as a preferred choice among consumers.

The residential segment is expected to account for 52.30% of the HEPA vacuum cleaners market revenue in 2025, making it the dominant end use category. Growth in this segment is being driven by heightened consumer awareness regarding the health risks associated with poor indoor air quality and rising prevalence of allergies and asthma. Residential buyers are increasingly opting for HEPA vacuum cleaners as a preventive solution to minimize exposure to fine dust particles, pet dander, and environmental pollutants.

The affordability and accessibility of these products through both online and offline channels have contributed to widespread household adoption. Compact designs, cordless functionality, and quieter operation have been particularly appealing in urban settings where convenience and space optimization are important.

The trend toward smart home appliances has also supported growth, as many HEPA vacuum cleaners now feature connectivity with digital assistants and mobile applications for enhanced control As consumer lifestyles continue to shift toward wellness and convenience, the residential segment is expected to sustain its leadership, supported by ongoing product innovations and demand for healthier living environments.

Many end use industries require the use of enclosures that cleaned of airborne contaminants. The growing demand for allergen-free and containment-free environments during the production of microprocessors and other small technological components is trending. The end users allergic to pet dander, mold spores, dust mites, pollen, and any other tiny airborne allergens are upgrading to HEP vacuum cleaners.

High-efficiency Particulate Air vacuum cleaners or HEPA vacuum cleaners are the advanced version of conventional vacuum cleaners which contain filters to trap extremely small particles. HEPA vacuum cleaners are considered ideal choice to trap 99.97% of all airborne particles larger than 0.001mm range. HEPA vacuum cleaners are significantly used in food manufacturing, cement dust clean-up, factory cleaning, lead dust remediation, among others.

Furthermore, clean room sterilization, radioactive dust removal, and other uses in plant exhaust where the demand for strictly controlled air pollutant levels equip HEP vacuum cleaners in their premises. The American Lung Association has become a health partner with HEPA vacuum cleaners manufacturers to commercialize their products and contribute more towards air quality. The end users keep various factors such as cost, type of use, noise level, aesthetics, bags or bins, reach, weight, power, and size in mind while shopping for HEPA vacuum cleaners.

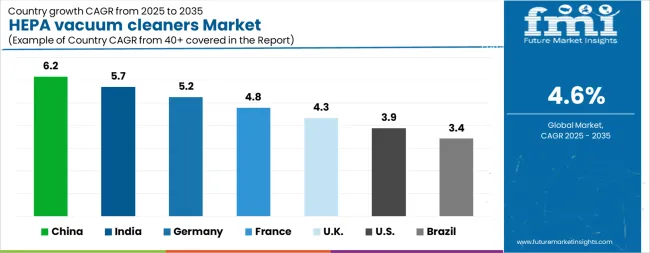

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.7% |

| Germany | 5.2% |

| France | 4.8% |

| UK | 4.3% |

| USA | 3.9% |

| Brazil | 3.4% |

The HEPA vacuum cleaners Market is expected to register a CAGR of 4.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.2%, followed by India at 5.7%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Brazil posts the lowest CAGR at 3.4%, yet still underscores a broadly positive trajectory for the global HEPA vacuum cleaners Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.2%.

The USA HEPA vacuum cleaners Market is estimated to be valued at USD 1.3 billion in 2025 and is anticipated to reach a valuation of USD 2.0 billion by 2035. Sales are projected to rise at a CAGR of 3.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 184.4 million and USD 104.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Product Type | Upright HEPA vacuum cleaners, Canister HEPA Vacuum Cleaners, Cordless HEPA Vacuum Cleaners, Backpack HEPA Vacuum Cleaners, Wet/ Dry HEPA Vacuum Cleaners, and Ride-on HEPA Vacuum Cleaners |

| End Use | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

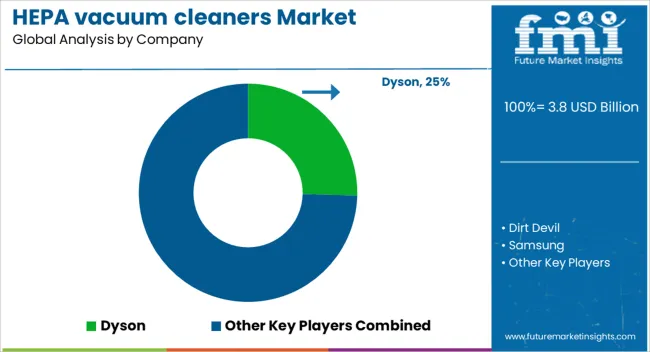

| Key Companies Profiled | Dyson, Dirt Devil, Samsung, Electrolux, Vacmaster, Karcher, Honeywell, Miele, Philips, LG Electronics, and Nilfisk |

The global HEPA vacuum cleaners market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the HEPA vacuum cleaners market is projected to reach USD 6.0 billion by 2035.

The HEPA vacuum cleaners market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in HEPA vacuum cleaners market are upright HEPA vacuum cleaners, canister HEPA vacuum cleaners, cordless HEPA vacuum cleaners, backpack HEPA vacuum cleaners, wet/ dry HEPA vacuum cleaners and ride-on HEPA vacuum cleaners.

In terms of end use, residential segment to command 52.3% share in the HEPA vacuum cleaners market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HEPA Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Hepatic Markers Market Size and Share Forecast Outlook 2025 to 2035

Hepatitis C Virus (HCV) Testing Market Size and Share Forecast Outlook 2025 to 2035

Hepatocellular Carcinoma HCC Treatment Market Size and Share Forecast Outlook 2025 to 2035

Hepatitis - B Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Heparin-Induced Thrombocytopenia (HIT) Treatment Market - Trends & Forecast 2025 to 2035

Hepatic Encephalopathy Treatment Market Trends, Analysis & Forecast by Drug Class, Diagnosis, Route of Administration, Distribution Channel and Region through 2035

The Hepatitis B Diagnostic Tests Market is segmented by product type & end user from 2025 to 2035

Competitive Landscape of HEPA Air Purifier Providers

Heparin Market

Rapid Hepatitis Testing Market – Demand & Forecast 2025 to 2035

Chronic Hepatitis B Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Ischemic Hepatitis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Unresectable Hepatocellular Carcinoma Market - Growth & Outlook 2025 to 2035

Veno-Occlusive Hepatic Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Vacuum-Refill Units Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vacuum Leak Detectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA