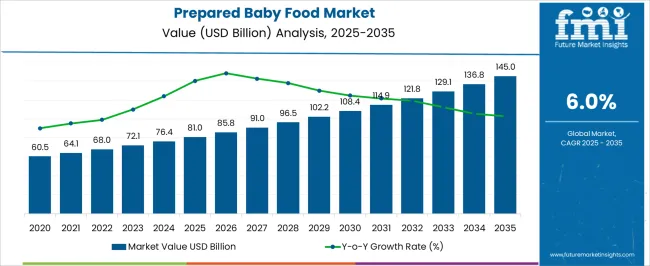

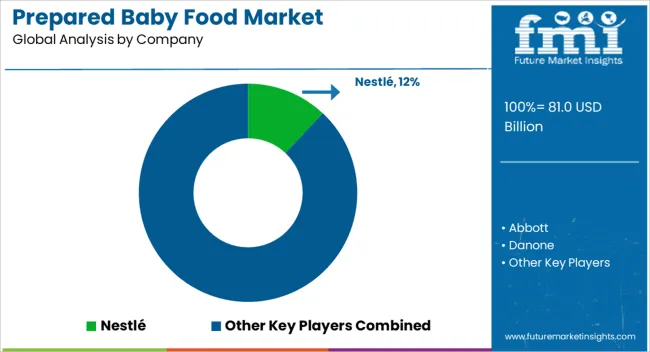

The prepared baby food market is estimated to be valued at USD 81.0 billion in 2025 and is projected to reach USD 145.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

Regulations surrounding infant nutrition are among the most stringent in the food sector, as they directly address consumer trust and child health outcomes. Global authorities such as the US FDA, the European Food Safety Authority, and regional food regulators in Asia set specific requirements for nutritional content, permissible additives, and contamination thresholds. These measures directly impact production costs and compliance structures across manufacturers. Mandatory labeling rules, including transparency of ingredient sourcing and allergen information, reinforce consumer confidence but also increase operational scrutiny. In addition, regulatory pressures are driving reformulation trends toward reduced sugar and salt levels, as well as the exclusion of artificial preservatives.

Trade regulations further influence regional supply chain dynamics, particularly for companies operating across borders where standards vary significantly. Environmental regulations addressing sustainable packaging are also shaping cost structures, compelling producers to invest in recyclable and eco-friendly materials. The projected growth from USD 81.0 billion to USD 145.0 billion reflects not only rising demand but also the market’s ability to adapt to evolving regulatory landscapes. Compliance remains a decisive factor shaping competitive differentiation and long-term adoption across regions.

| Metric | Value |

|---|---|

| Prepared Baby Food Market Estimated Value in (2025 E) | USD 81.0 billion |

| Prepared Baby Food Market Forecast Value in (2035 F) | USD 145.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The prepared baby food market is regarded as a focused and steadily growing segment across multiple parent industries. It is estimated to hold 6.8% of the infant nutrition and formula market, reflecting demand for ready-to-feed, puree, and cereal-based options. Within packaged foods and convenience foods, a 4.3% share is observed, driven by busy household adoption and value-added packaging. The health and wellness food products market accounts for 3.9%, with nutrient-enriched products addressing infant developmental needs. Retail grocery and e-commerce contribute 5.1%, highlighting accessibility and brand reach. Organic and natural baby food products represent 2.7%, supported by rising preference for additive-free, clean-label ingredients.

Recent industry trends in the prepared baby food market include focus on organic, allergen-free, and nutrient-fortified formulations. Groundbreaking developments include shelf-stable products with minimal processing, single-serve packaging innovations, and incorporation of probiotics and plant-based ingredients for enhanced digestive health. Key players are pursuing partnerships with ingredient suppliers, pediatric nutrition experts, and retail chains to expand product availability. Strategies also involve direct-to-consumer subscription models, fortified product lines, and baby food customization options. Regional growth is led by North America and Europe due to established distribution networks, while Asia-Pacific is witnessing rapid adoption driven by increasing awareness of infant nutrition. Continuous emphasis on safety, clean labeling, and functional health benefits is shaping market expansion.

The market is experiencing notable growth, driven by increasing parental focus on nutrition, safety, and convenience for infant diets. Rising awareness of the importance of early childhood nutrition, coupled with advancements in product formulations, has enhanced the market’s appeal across both developed and emerging economies. Manufacturers are introducing innovative products enriched with essential vitamins, minerals, and probiotics to address evolving dietary needs.

Urbanization and the growing number of working parents have further propelled demand for ready-to-use baby food solutions, as they offer time efficiency without compromising on quality. Stringent safety regulations and quality certifications have reinforced consumer trust in branded products, while expanding retail and e-commerce channels are improving accessibility worldwide.

With increasing disposable incomes and a heightened emphasis on health-conscious parenting, the Prepared Baby Food market is expected to sustain steady growth Future opportunities are anticipated in fortified and organic product lines, along with personalized nutrition offerings tailored to specific infant development stages.

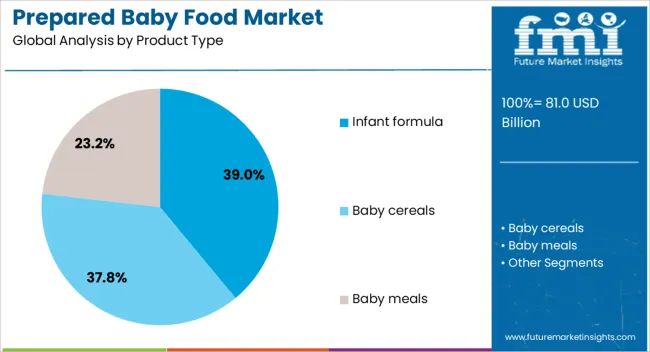

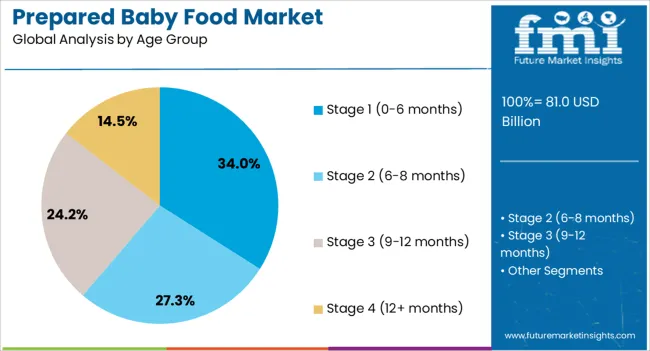

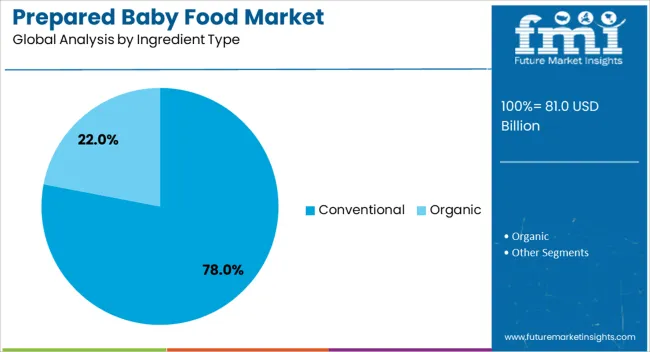

The prepared baby food market is segmented by product type, age group, ingredient type, packaging type, distribution channel, and geographic regions. By product type, prepared baby food market is divided into infant formula, baby cereals, baby meals, baby snacks, baby beverages, and others. In terms of age group, prepared baby food market is classified into stage 1 (0-6 months), stage 2 (6-8 months), stage 3 (9-12 months), and stage 4 (12+ months). Based on ingredient type, prepared baby food market is segmented into conventional and organic. By packaging type, prepared baby food market is segmented into jars and bottles. By distribution channel, prepared baby food market is segmented into supermarket & hypermarket, speciality stores, convenience stores, online retail, company website, e commerce platform, subscription services, pharmceuticals and drug stores, and others. Regionally, the prepared baby food industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The infant formula segment is projected to hold 39% of the market revenue share in 2025, making it the leading product type. Growth in this segment has been driven by the need to provide a reliable alternative to breastfeeding, particularly in households where breastfeeding is not possible or is supplemented.

Advances in formulation technology have enabled the creation of infant formula products that closely mimic the nutritional profile of breast milk, ensuring essential protein, fat, and micronutrient intake. Rising healthcare recommendations for fortified infant diets and the availability of specialized formulas for specific health conditions have further increased adoption.

The segment’s expansion is also supported by strong brand presence, widespread distribution networks, and rigorous safety testing standards, which have built significant consumer trust With increasing global birth rates in certain regions and growing awareness regarding balanced early-life nutrition, infant formula is expected to maintain its leadership position within the market.

The Stage 1 (0-6 months) segment is expected to command 34% of the market revenue share in 2025, positioning it as the leading age group category. This segment’s dominance has been influenced by the high nutritional dependency of infants during their first six months, requiring specialized food products that support optimal growth and immune development.

The demand for Stage 1 products has been strengthened by pediatric recommendations for nutrient-rich, easily digestible formulations during this critical developmental stage. Manufacturers have focused on creating gentle, allergen-minimized products with balanced compositions to meet the unique digestive capabilities of newborns.

Enhanced availability through retail and online channels has further facilitated consumer access, while ongoing product innovation continues to broaden choices for parents As healthcare awareness increases and more parents seek premium quality and safety assurances for newborn nutrition, the Stage 1 category is set to remain a primary driver of market revenue.

The conventional ingredient type segment is projected to hold 78% of the market revenue share in 2025, making it the dominant ingredient category. This segment’s strength is attributed to the widespread availability, affordability, and established consumer familiarity with conventional ingredients. Large-scale production capabilities and streamlined supply chains have allowed manufacturers to meet high-volume demand consistently, ensuring competitive pricing.

Conventional formulations often incorporate trusted, time-tested ingredients that align with long-standing dietary practices, contributing to broad consumer acceptance. Furthermore, conventional products have benefited from improvements in processing and preservation techniques, enhancing both safety and shelf life without compromising taste or nutritional value.

The ability to cater to mass-market needs while maintaining compliance with stringent regulatory standards has reinforced the segment’s leading position As affordability and accessibility remain important considerations for many households, the conventional ingredient type is expected to retain its market dominance in the foreseeable future.

The market has expanded due to rising awareness of infant nutrition, convenience-driven lifestyles, and increasing availability of fortified products. Ready-to-eat and easy-to-prepare meals have been preferred by caregivers seeking balanced nutrition and hygiene assurance for infants. The market has witnessed growth across purees, cereals, snacks, and dairy-based meals, with both domestic and international brands competing for consumer attention. Investments in research and development have resulted in products enriched with vitamins, minerals, and probiotics. Packaging innovations, extended shelf life, and growing retail and e-commerce distribution channels have further reinforced market adoption globally.

Growing emphasis on infant health and nutritional needs has been a significant driver of the market. Parents and caregivers have increasingly sought products that provide essential nutrients for cognitive and physical development, including vitamins, iron, protein, and DHA. Pediatric recommendations and public health campaigns have encouraged the selection of fortified prepared meals over homemade alternatives to ensure consistency in quality and hygiene. Additionally, specialized products for infants with allergies, lactose intolerance, or digestive sensitivity have been developed to cater to specific health needs. This focus on nutrition has strengthened the adoption of prepared baby food across urban and semi-urban populations.

Busy lifestyles and increased participation of women in the workforce have reinforced the demand for ready-to-eat and easy-to-prepare baby food options. These products have been designed to reduce preparation time while maintaining nutritional quality and safety. Single-serve portions, resealable pouches, and pre-cooked meals have simplified feeding routines for parents. E-commerce platforms and modern retail chains have enhanced accessibility, enabling caregivers to purchase products conveniently. The combination of convenience, safety, and shelf stability has contributed to wider adoption in both urban and semi-urban households, making lifestyle factors a central market driver.

Continuous innovation in product formulation and fortification has played a critical role in market growth. Companies have introduced organic options, gluten-free cereals, dairy-based meals, and fruit and vegetable purees with natural flavors and functional additives. Advanced fortification with vitamins, minerals, probiotics, and prebiotics has been aimed at supporting immunity, digestion, and overall infant development. Packaging technology, including vacuum sealing and thermal sterilization, has improved product stability and shelf life. Manufacturers have also emphasized taste, texture, and aroma to encourage acceptance by infants. These innovations have expanded the variety of products available, supporting adoption across diverse consumer segments and regional markets.

Strict regulatory standards and safety protocols have shaped the prepared baby food market by ensuring product quality and hygiene. Authorities in various regions have established guidelines for ingredient sourcing, fortification, and labeling. Quality certifications, hazard analysis, and batch testing have been increasingly applied to maintain compliance. Manufacturers have invested in advanced processing, packaging, and storage technologies to meet these requirements. While regulatory adherence has added production costs, it has reinforced consumer confidence, making certified products more attractive. Continuous monitoring and adherence to quality standards have been essential in building trust among parents and driving consistent market growth globally.

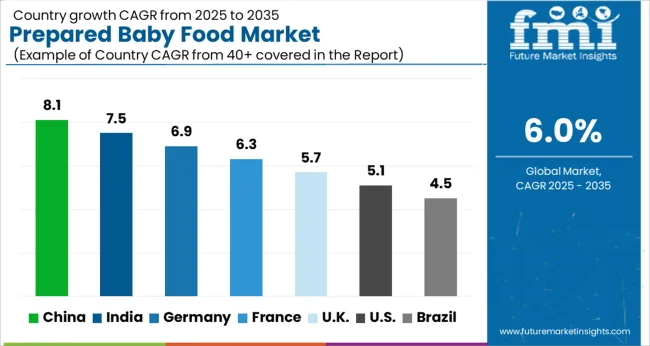

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

China led the market with a forecast growth rate of 8.1%, supported by higher demand for convenient and nutritionally balanced infant food products. India followed at 7.5%, driven by rising consumption of packaged baby food due to lifestyle changes and increasing awareness of child nutrition. Germany recorded 6.9%, where strong regulatory standards and consumer preference for organic and fortified baby foods supported steady adoption. The United Kingdom achieved 5.7%, with product innovation and growing availability of premium brands contributing to market development. The United States registered 5.1%, where the demand for clean-label and allergen-free baby food options sustained market growth. Together, these countries form a diversified framework of consumer demand, product development, and regulatory-driven adoption shaping the global prepared baby food market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expanding at a CAGR of 8.1% in the market, driven by rapid adoption of packaged nutrition products for infants and toddlers. Shifts in consumer lifestyles and rising awareness regarding nutrition are supporting this growth. Domestic manufacturers are focusing on premium product categories including organic, fortified, and specialized formulations. International brands are strengthening their presence through partnerships and acquisitions to meet the evolving expectations of Chinese parents. Convenience, safety, and nutritional value remain the primary factors shaping purchasing decisions. With the growing influence of online retail channels, accessibility to diverse baby food categories has widened. These developments ensure steady momentum for prepared baby food in China as parents increasingly prioritize high-quality and trusted nutritional options.

India is recording a CAGR of 7.5% in the market, supported by growing awareness about child nutrition and a rising preference for convenient packaged foods. Parents are increasingly relying on trusted brands to ensure safety, hygiene, and nutritional adequacy. Local producers are diversifying offerings by introducing rice-based, cereal-based, and fruit-based preparations tailored to regional consumption patterns. Multinational firms are also strengthening their foothold through strategic marketing and wider distribution networks. The rapid expansion of modern retail and online grocery services is further fueling access to a broad variety of products. A focus on natural ingredients and minimal processing is resonating well with health-conscious parents, contributing to India’s steady market growth.

Germany is advancing at a CAGR of 6.9% in the market, led by strong emphasis on high nutritional standards and consumer preference for premium products. German parents place significant value on organic certification, traceability, and safety standards in baby food purchases. Manufacturers are innovating with clean-label products, allergen-free variants, and sustainable packaging to meet consumer expectations. The retail landscape, including supermarkets and pharmacies, continues to dominate distribution, although e-commerce platforms are steadily gaining traction. With regulatory frameworks ensuring strict compliance, Germany remains a mature and highly competitive market for prepared baby food. These dynamics are reinforcing the position of Germany as a hub for premium, safe, and transparent infant nutrition solutions.

The United Kingdom is progressing at a CAGR of 5.7% in the market, driven by rising preference for convenient and nutritionally balanced options. Parents are seeking ready-to-eat solutions that combine taste, safety, and health benefits. Manufacturers are focusing on innovative flavors, natural ingredients, and organic variants to meet evolving demand. Retailers are enhancing visibility by dedicating larger shelf space to baby nutrition categories. Growing adoption of online grocery platforms has widened access to niche and premium products. With increased scrutiny around additives and preservatives, producers are reformulating offerings to appeal to health-conscious parents. These factors are shaping the UK market toward cleaner, safer, and more diverse prepared baby food categories.

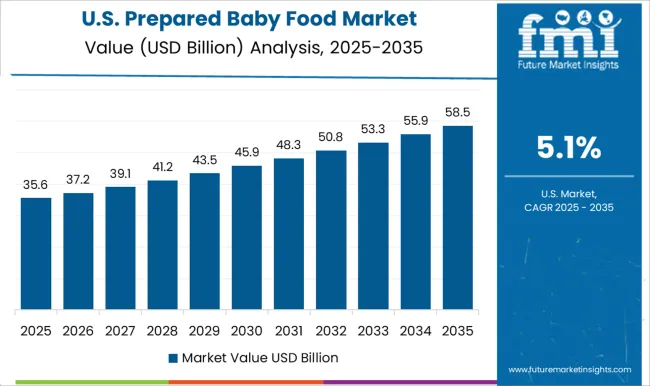

The United States is witnessing a CAGR of 5.1% in the market, supported by consumer demand for convenience, safety, and premium nutrition. Parents are showing greater interest in organic, non-GMO, and additive-free products that align with healthy lifestyles. Domestic and international brands are competing through innovative packaging, clean labels, and fortified nutrition solutions. Distribution is expanding across supermarkets, specialty stores, and digital retail platforms. Marketing strategies highlighting transparency and sourcing are resonating strongly with parents. With increasing focus on healthier infant diets, the US prepared baby food market is expected to evolve steadily toward premiumization and product diversification.

The market is led by multinational food and nutrition companies that provide ready-to-eat baby meals, cereals, purees, and formula-based complementary products. Nestlé holds a dominant presence through its Gerber brand, offering extensive product varieties with emphasis on infant nutrition and global distribution. Abbott contributes with specialized formulations designed to meet nutritional requirements of infants, often focusing on science-driven innovation and clinically tested blends. Danone strengthens the market with a broad portfolio of baby food and infant formula under multiple brands, expanding its reach across developed and emerging economies. Reckitt through Mead Johnson Nutrition plays a critical role by supplying trusted infant nutrition solutions widely used in households and healthcare recommendations.

Kraft Heinz through Gerber, alongside Hero Group and Hain Celestial, further diversifies the competitive landscape by addressing organic and natural product demand, offering cleaner-label alternatives in developed markets. These players contribute not only through product innovation but also by aligning with regulatory requirements and advancing baby food safety standards. Collectively, the market is characterized by global reach, strong brand equity, and increasing diversification into organic, allergen-free, and fortified baby foods. This competitive ecosystem ensures broad accessibility and choice, shaping consumption patterns for prepared baby food worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 81.0 Billion |

| Product Type | Infant formula, Baby cereals, Baby meals, Baby snacks, Baby beverages, and Others |

| Age Group | Stage 1 (0-6 months), Stage 2 (6-8 months), Stage 3 (9-12 months), and Stage 4 (12+ months) |

| Ingredient Type | Conventional and Organic |

| Packaging Type | Jars and bottles |

| Distribution Channel | Supermarket & hypermarket, Speciality stores, Convenience stores, Online retail, Company website, E commerce platform, Subscription services, Pharmceuticals and drug stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé, Abbott, Danone, Reckitt / Mead Johnson (brands), Kraft Heinz / Gerber, and Hero / Hain Celestial / Others |

| Additional Attributes | Dollar sales by product type and distribution channel, demand dynamics across infant nutrition and convenience-focused households, regional trends in packaged baby food adoption, innovation in organic ingredients, formulations, and packaging, environmental impact of sourcing and packaging waste, and emerging use cases in premium nutrition and fortified food products. |

The global prepared baby food market is estimated to be valued at USD 81.0 billion in 2025.

The market size for the prepared baby food market is projected to reach USD 145.0 billion by 2035.

The prepared baby food market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in prepared baby food market are infant formula, _standard, _follow up, _speciality, _growing up, baby cereals, _rice, _wheat, _oat based, _multi grain, _other, baby meals, _pureed fruits, _pureed vegetables, _pureed meat and proteins, _mixed meals, _soups & broths, baby snacks, _biscuits & cookies, _puffs & crisps, _teething biscuits, _fruit snacks, _other, baby beverages, _fruit juice, _vegetable juice, _infant tea, _other, others and _other.

In terms of age group, stage 1 (0-6 months) segment to command 34.0% share in the prepared baby food market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Prepared Flour Mixes Market Analysis by Product and application Through 2035

Analysis and Growth Projections for Gluten Free Prepared Food Market

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Diaper Market Growth, Forecast, and Trend Analysis 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Baby Sling Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Holder Market Size and Share Forecast Outlook 2025 to 2035

Baby Toddler Bar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baby Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Milk Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA