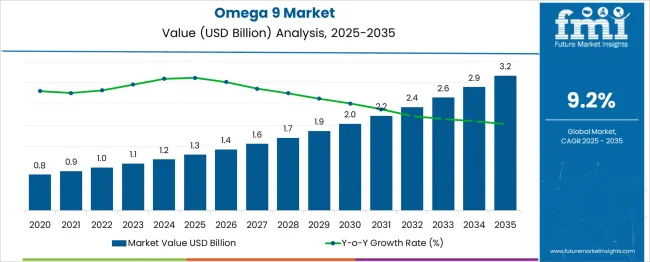

The Omega-9 Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period. This translates to an absolute dollar opportunity of USD 1.9 billion, reflecting strong momentum across nutraceuticals, functional foods, and clinical dietary formulations. Between 2025 and 2030, the market is projected to grow from USD 1.3 billion to USD 2.0 billion, creating a five-year absolute gain of USD 0.7 billion.

The YoY growth pattern is relatively stable, with incremental increases of USD 0.1 to 0.2 billion annually. This steady expansion is largely driven by heightened awareness of heart-healthy fats, particularly oleic acid, and their role in reducing LDL cholesterol and inflammation. Consumer interest in minimally processed, plant-derived oils such as high-oleic sunflower, canola, and olive oils is fueling demand. The market also benefits from rising adoption of omega-9 in personal care products due to its emollient properties, especially in moisturizers and anti-aging formulations. North America and Europe currently lead consumption, while Asia-Pacific is experiencing faster growth due to increasing disposable income and health-conscious dietary shifts. Omega-9’s dual utility in food and cosmetics offers a robust platform for diversified growth across both mature and emerging markets.

| Metric | Value |

|---|---|

| Omega-9 Market Estimated Value in (2025 E) | USD 1.3 billion |

| Omega-9 Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

Oleic acid, the principal form of Omega-9, is gaining prominence for its role in maintaining cholesterol balance and reducing cardiovascular risk. As food manufacturers reformulate products to meet clean-label and health-centric preferences, Omega-9-rich oils are being incorporated extensively into mainstream food offerings.

Regulatory approvals and nutrition labelling that highlight Omega-9’s health contributions have further boosted its adoption across developed and emerging regions. Additionally, technological advancements in oil refining and fatty acid extraction are enhancing the purity and shelf life of Omega-9 ingredients, opening new application areas in skincare formulations and pharmaceutical emulsions.

With consumer behavior shifting toward natural and preventive wellness solutions, Omega-9 is expected to remain a core component of lipid-based health strategies. The market outlook remains positive, with opportunities for expansion in fortified food categories, medical nutrition, and natural cosmetics.

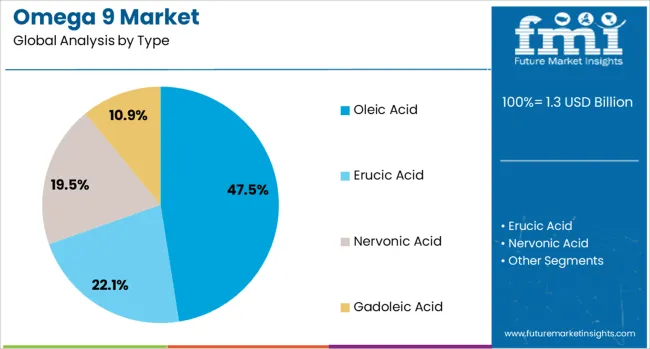

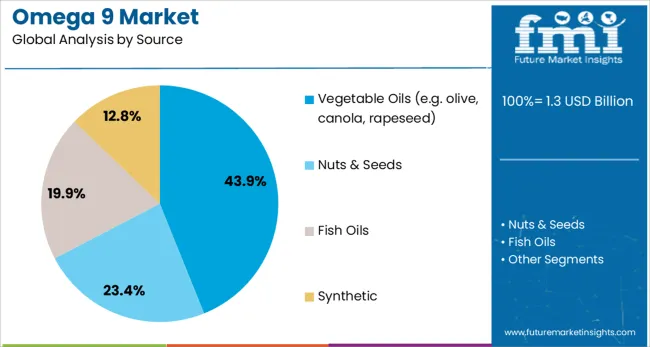

The omega-9 market is segmented by type, source, application, end‑use industry, and geographic regions. By type, the omega-9 market is divided into Oleic Acid, Erucic Acid, Nervonic AcidGadoleic Acid. In terms of source, the omega-9 market is classified into Vegetable Oils (e.g. olive, canola, rapeseed), Nuts & Seeds, Fish OilsSynthetic.

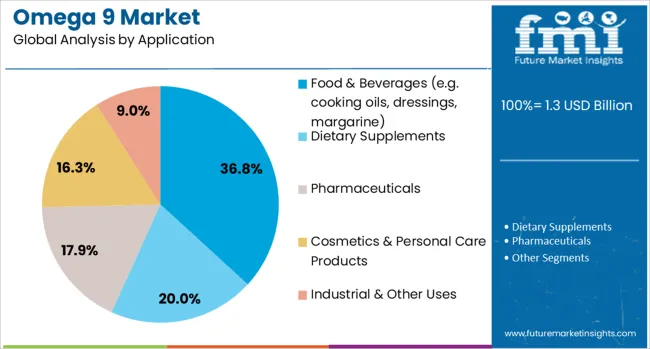

Based on application, the omega-9 market is segmented into Food & Beverages (e.g. cooking oils, dressings, margarine), Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care ProductsIndustrial & Other Uses. By end‑use industry, the omega-9 market is segmented into Food & Beverage Industry, Nutraceuticals & Dietary Supplements, Pharmaceutical Industry, Cosmetic & Personal Care IndustryOthers. Regionally, the omega-9 industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Oleic acid is expected to account for 47.5% of the Omega 9 market revenue share in 2025, positioning it as the dominant type within the category. Its prominence is attributed to its high bioavailability, chemical stability, and compatibility with a broad range of food and nutraceutical formulations. Oleic acid has been widely utilized for its cholesterol-regulating properties, making it a preferred lipid source in cardiovascular health applications.

Its strong oxidative stability under high temperatures supports its use in cooking oils and industrial food processing, where longer shelf life and performance are critical. The increasing inclusion of oleic acid in dietary supplements and medical nutrition products is being driven by its anti-inflammatory and metabolic benefits.

Moreover, advancements in extraction from high-oleic seed varieties have improved yield efficiency, reducing production costs and enhancing its commercial viability. As clinical and functional food applications expand, oleic acid is expected to maintain its leadership, supported by its well-documented health effects and processing flexibility.

Vegetable oils such as olive, canola, and rapeseed are projected to hold 43.9% of the Omega-9 market revenue share in 2025, making them the leading source segment. The dominance of this segment is rooted in the widespread availability and scalability of oilseed cultivation across various climatic regions. These oils are naturally rich in oleic acid and are favored for their mild flavor, stability, and suitability for both culinary and industrial applications.

The continued consumer preference for non-GMO, plant-based ingredients has reinforced demand for vegetable-derived Omega 9 sources. Additionally, the use of sustainable and traceable farming practices in olive and canola oil production has aligned with rising demand for ethical sourcing and clean-label formulations.

Advances in cold-press and solvent-free extraction methods have preserved the nutritional integrity of these oils, further boosting their use in premium food and skincare products. As demand for heart-healthy oils continues to rise, vegetable oils are anticipated to remain the primary carriers of Omega 9 across global markets.

The food and beverages application segment is estimated to capture 36.8% of the Omega 9 market revenue share in 2025, reflecting its substantial role in the overall demand landscape. The use of Omega 9 in cooking oils, salad dressings, spreads, and margarine has been steadily increasing, driven by consumer interest in healthier fat alternatives. Food manufacturers are reformulating products to reduce saturated and trans fats, integrating Omega 9-rich ingredients to meet evolving regulatory and health standards.

Its functional role in enhancing product texture, flavor stability, and shelf life without compromising on nutritional value has contributed to its wide adoption. Marketing campaigns emphasizing cardiovascular benefits and clean-label transparency have further influenced buying behavior.

Additionally, urbanization and changing dietary patterns are driving the consumption of packaged and convenience foods fortified with Omega-9. As health-conscious consumers seek functional foods that align with preventive wellness, the food and beverage industry is expected to continue leading the market in Omega-9 applications.

Growing interest in heart health and wellness supports steady demand for omega-9 fatty acids. Their use in cooking oils and supplements continues to expand across global markets.

Consumers are choosing oils rich in omega-9 fatty acids, such as olive and canola oil, due to their reputation for supporting cardiovascular health. These oils gain traction as healthier alternatives to saturated fats and find wide application in cooking, salad dressings, and spreads. Food manufacturers emphasize omega-9 content in their marketing to appeal to health-conscious buyers seeking natural ways to maintain wellness. This trend is strongest in regions where public awareness about dietary fats and heart disease is high. As more consumers replace traditional oils with omega-9-rich options, producers respond by improving supply chains and product quality. This growing preference not only drives volume growth but also encourages innovation in oil blends and packaging tailored to convenience and freshness, helping omega-9 maintain its relevance in a crowded market.

Omega-9 fatty acids are increasingly incorporated into nutritional supplements aimed at promoting overall health and managing inflammation. Supplement makers develop soft gels, capsules, and liquid formulations to meet consumer demand for versatile delivery options. Marketing highlights benefits such as cardiovascular support and improved metabolic function, resonating with wellness-focused individuals. The rise in lifestyle-related health concerns and aging populations contribute to sustained interest in omega-9 supplements. Manufacturers are focusing on clean-label ingredients and easy-to-consume forms to attract diverse consumer groups. This focus on quality, safety, and convenience helps expand omega-9’s presence beyond traditional food applications into targeted supplement markets. The broadening range of available products enhances accessibility and fosters continuous market growth.

Producers of Omega‑9 products depend heavily on oils like olive, macadamia, avocado, and high‑oleic seed oils, all sensitive to climate, geography, and agricultural yield. Fluctuations in crop output or disruptions in processing capacity can cause raw material shortages, especially for cold‑pressed or organic variants with premium positioning. Suppliers face supply chain interruptions from geopolitical shifts, freight delays, and seasonal harvest variability. These constraints directly influence pricing—small‑batch producer reports highlight steep cost increases under supply stress. Brands sourcing from high‑oleic seed oil producers may need long-term contracts or supplier integration to stabilize availability. Producers lacking diversified sourcing or vertically integrated capacity may struggle to sustain production schedules or pricing commitments in mid‑ and premium‑tier segments. This volatility hinders consistent product rollout and can deter entrants with limited sourcing resilience.

Manufacturers are increasingly using cold‑press and supercritical CO₂ extraction methods to obtain purer, minimally processed Omega‑9 oils. These approaches enhance nutrient retention, reduce oxidation risk, and support clean-label positioning. Sensory stability and shelf life improve, making microencapsulated and emulsified formats feasible for inclusion in functional foods, RTD beverages, and powdered blends. Brands focus on traceable sourcing, solvent‑free extraction, and sustainable packaging to meet evolving consumer expectations. These innovations support product differentiation in competitive markets where health‑focused messaging and ingredient transparency matter. Enhanced extraction processes also offer improved yield and lower chemical residue risk, raising overall quality and consumer confidence across wellness and culinary segments.

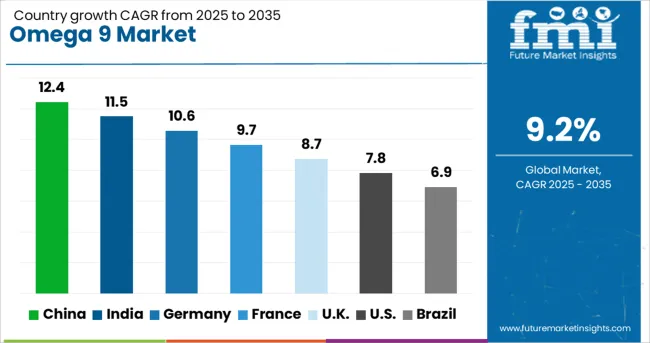

The global omega 9 market is projected to grow at a CAGR of 9.2% through 2035, supported by increasing incorporation in dietary supplements, functional foods, and personal care products. Within the BRICS nations, China leads with 12.4% growth, driven by expanded extraction facilities and rising domestic demand. India follows closely at 11.5%, where oilseed processing and refined product manufacturing have been enhanced. In the OECD region, Germany reports 10.6% growth, backed by rigorous quality assurance and strong export activities. France, growing at 9.7%, has witnessed steady consumption in nutrition and cosmetic sectors. The United Kingdom, at 8.7%, shows ongoing demand tied to health food markets and pharmaceutical formulations. Regulatory oversight has focused on purity verification, product labeling, and trade compliance. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The Omega 9 market in China is projected to grow at a CAGR of 12.4%, driven by increased use in edible oils, nutraceuticals, and personal care products. High-oleic acid oils have been incorporated into cooking oils aimed at heart health. Extraction capacities have been expanded to meet rising demand from food processors and supplement manufacturers. Refined oleic acid concentrates are being supplied to cosmetic formulators for anti-aging skincare lines. Packaging formats with oxygen and light barriers have been adopted to preserve fatty acid stability. Product testing for oxidative stability and purity has been standardized to meet regulatory requirements. Collaborative sourcing with oilseed growers has ensured steady raw material availability. Expansion of ready-to-eat and fortified food sectors has further supported Omega 9 uptake.

The Omega 9 market in the United Kingdom is progressing at a CAGR of 8.7%, supported by demand from functional food manufacturers, dietary supplements, and personal care products. Microencapsulated Omega 9 powders have been incorporated into bakery and beverage products for improved stability and mixing. Specialized oleic acid blends have been developed for sports nutrition and meal replacement products. Quality assurance protocols for peroxide value and fatty acid content have been widely adopted. Ingredient suppliers and formulators have collaborated to expand applications in ready-to-drink nutritional beverages. Packaging innovations protecting against oxidation and light exposure have been introduced. Market expansion has focused on consumers seeking balanced fatty acid intake and improved health benefits.

In India, omega 9 market is advancing at a CAGR of 11.5%, supported by rising use in edible oils, dietary supplements, and traditional medicine. Cold-pressed oils rich in oleic acid have been adopted by food manufacturers targeting health-conscious consumers. Bulk Omega 9 concentrates are being supplied to nutraceutical firms and personal care product manufacturers. Packaging innovations focusing on product freshness and shelf life have been introduced. Demand from Ayurvedic and herbal product sectors has been strengthened with the integration of Omega 9 components. Quality assurance protocols have been enhanced for fatty acid profiling. Partnerships with agricultural cooperatives have optimized oilseed quality and supply stability.

Omega 9 market in Germany is growing at a CAGR of 10.6%, supported by applications in functional foods, supplements, and cosmetic products. Refined oleic acid blends have been incorporated into fortified bakery and dairy items. Liquid Omega 9 emulsions are being supplied for beverage formulations focusing on cardiovascular benefits. Extraction and purification processes have been refined to enhance product purity and reduce contaminants. Compliance with European food and cosmetic safety regulations has been ensured through rigorous testing. Demand from clinical nutrition and elder care product manufacturers has been increasing. Packaging technologies minimizing exposure to light and oxygen have been implemented. Strategic collaborations have enabled expanded product range and application development.

Omega 9 market is expanding in France at a CAGR of 9.7%, fueled by use in nutritional supplements, culinary oils, and cosmeceuticals. Refined high-oleic oils with tailored fatty acid profiles have been supplied to premium food producers. Cold-extraction techniques have been employed to retain natural antioxidants and flavor. Bulk Omega 9 concentrates have been provided to pharmaceutical and cosmetic manufacturers. Packaging with UV protection has been adopted to extend product shelf life. Applications in bakery and confectionery sectors have grown, with customized oleic acid blends developed for specific needs. Stability testing and fatty acid profiling have been standardized across production sites. Partnerships with oilseed cultivators have been established to ensure quality and supply.

Dow AgroSciences (now part of Corteva) leads the market with extensive global infrastructure and production capacity, supplying high-stability, food-grade Omega-9 oils for packaged foods, foodservice, and functional nutrition. Its oils are favored for their neutral taste, high smoke point, and positive impact on cardiovascular health, making them suitable for both culinary and commercial uses. Other major players focus on purity and application specialization. Haihang Industry produces high-purity omega-9 oils that are commonly used in cosmetics, dietary supplements, and personal care formulations where skin absorption and oxidative stability are critical.

Connoils supports a broad range of customized formulations, including food-grade, cosmetic, and industrial omega-9 oils, tapping into markets such as lubricants and bio-based chemical applications. Biovaxia Pharma delivers pharmaceutical-grade omega-9 derivatives, contributing to drug delivery systems and clinical nutrition products. Meanwhile, Vibcare Pharma targets the nutraceutical and therapeutic segments with solutions that emphasize bioavailability and formulation precision. Together, these companies address a wide spectrum of end-use demands by focusing on custom processing, compliance with international standards, and adaptability across industries from health and wellness to industrial manufacturing.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Type | Oleic Acid, Erucic Acid, Nervonic Acid, and Gadoleic Acid |

| Source | Vegetable Oils (e.g. olive, canola, rapeseed), Nuts & Seeds, Fish Oils, and Synthetic |

| Application | Food & Beverages (e.g. cooking oils, dressings, margarine), Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care Products, and Industrial & Other Uses |

| End‑Use Industry | Food & Beverage Industry, Nutraceuticals & Dietary Supplements, Pharmaceutical Industry, Cosmetic & Personal Care Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DowAgroSciences(Corteva, HaihangIndustry, Connoils, BiovaxiaPharma, and VibcarePharma |

| Additional Attributes | Dollar sales by Omega-9 types including oleic acid and its derivatives, by end-use in food, dietary supplements, cosmetics, and pharmaceuticals, and by geographic region such as North America, Europe, and Asia-Pacific; demand driven by heart health awareness and plant-based diets; innovation in high-purity formulations and sustainable sourcing; costs affected by raw material fluctuations; emerging uses in functional foods and skincare. |

The global omega-9 market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the omega-9 market is projected to reach USD 3.2 billion by 2035.

The omega-9 market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in omega-9 market are oleic acid, erucic acid, nervonic acid and gadoleic acid.

In terms of source, vegetable oils (e.g. olive, canola, rapeseed) segment to command 43.9% share in the omega-9 market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA