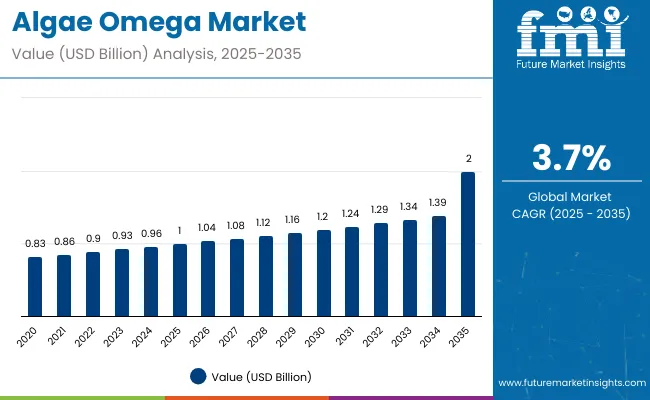

The algae omega market is to be valued at USD 1.0 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period. The market adds an absolute dollar opportunity of USD 1.0 billion during this period. This reflects a 2.0 times growth at a CAGR of 3.7%. The market evolution will be shaped by rising consumer demand for plant-based omega sources, growth in dietary supplements and functional foods, and sustainability concerns driving the shift away from fish oil.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1 billion |

| Projected Value (2035F) | USD 2 billion |

| CAGR (2025 to 2035) | 3.7% |

By 2030, the market is likely to reach USD 1.5 billion, accounting for USD 0.5 billion in incremental value over the first half of the decade. The remaining USD 0.5 billion is expected during the second half, suggesting a balanced growth pattern supported by strong expansion in North America, Europe, and Asia-Pacific.

Companies such as BASF SE, Koninklijke DSM NV, Archer Daniels Midland Company, and Qualitas Health are strengthening their market positions through investments in R&D, large-scale algae cultivation, and partnerships with nutraceutical and infant formula manufacturers. Strategic focus is on improving bioavailability, product stability, and sustainability certifications, which will be key differentiators in the competitive landscape.

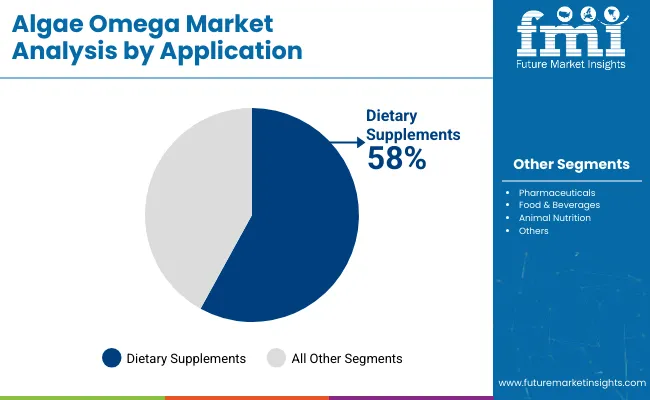

The market holds a strong position across its parent industries, reflecting its rising adoption in nutraceuticals, functional foods, infant nutrition, and pharmaceuticals. Within the dietary supplements category, algae omega contributes notably with an estimated 58% share, as consumers increasingly shift toward plant-based omega-3 sources. In the functional foods and beverages market, its share is estimated at around 12%, supported by fortified dairy, bakery, and beverage formulations

. Within the omega-3 ingredients market, algae omega accounts for nearly 25%, reflecting its growing appeal as a sustainable alternative to fish oil. In the infant formula segment, its share is 18%, driven by regulatory approvals and clinical evidence supporting DHA benefits. Across these parent markets, algae omega’s contribution underscores both its nutritional importance and sustainability advantage.

The market is being driven by rising health awareness, expanding demand for plant-based alternatives, and increasing incorporation of DHA/EPA in functional nutrition. Innovations are being observed in microencapsulation, bioavailability enhancement, and cost-efficient algae cultivation technologies, aligning with consumer preferences for purity and sustainability.

Developments include capacity expansions in North America, Europe, and Asia-Pacific, where nutraceutical and infant nutrition demand is accelerating. Trends show a shift toward vegan, contaminant-free, and eco-friendly omega sources; however, algae omega continues to face cost challenges compared to fish oil. Growing regulatory support, sustainability certifications, and strategic collaborations among global and regional players are shaping R&D directions and influencing competitive positioning.

Algae omega’s unique ability to deliver plant-based, sustainable sources of DHA and EPA is driving its adoption across global nutrition industries. Its functional benefits, including support for cognitive, cardiovascular, and prenatal health, make it indispensable in dietary supplements, infant nutrition, functional foods, and pharmaceuticals, where purity, efficacy, and sustainability are critical.

Rising demand for vegan and contaminant-free alternatives to fish oil is further propelling market growth, supported by increasing consumer health awareness, clean-label product preferences, and expansion of the nutraceutical sector. Technological advancements in microalgae cultivation, bioavailability improvement, and microencapsulation are enhancing product quality, stability, and cost efficiency, making algae omega more competitive in mainstream applications.

Government support for sustainable nutrition initiatives, coupled with regulatory approvals for DHA/EPA inclusion in infant formulas and fortified foods, is strengthening the market outlook. As industries increasingly prioritize sustainability, product differentiation, and scalability, algae omega continues to gain traction. With manufacturers and end-users focusing on innovation, certifications, and partnerships for large-scale distribution, the market is set to witness steady expansion across dietary supplements, functional foods, and clinical nutrition applications.

The market is segmented by type, form, concentration, sales channel, packaging, application, and region. By type, the market is categorized into EPA (Eicosapentaenoic acid), ALA (Alpha-linolenic acid), and DHA (Docosahexaenoic acid). By form, the market is segmented into capsules, powder, and liquid. By concentration, the market is divided into concentrated, high-concentrated, and low-concentrated variants.

By sales channel, the market is bifurcated into online and offline distribution. By packaging, the market is segmented into tetra packs, bulk, and bottles. By application, the market is segmented into dietary supplements, pharmaceuticals, food & beverages, animal nutrition, and others. Regionally, the market spans across North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dietary supplements segment dominates the application category with 58% of the market share in 2025, driven by rising consumer preference for plant-based omega-3 sources. Algae-derived DHA and EPA are increasingly used in capsules, soft gels, and gummies targeted at heart health, cognitive support, and prenatal nutrition.

Manufacturers favor algae omega in dietary supplements because it offers a sustainable, vegan, and contaminant-free alternative to traditional fish oil, aligning with clean-label and eco-conscious consumer demand. Its clinical backing for brain, eye, and cardiovascular health further cements its leadership in this category.

Ongoing innovations in bioavailability enhancement, taste masking, and microencapsulation technologies are improving product acceptance. With growing adoption among health-conscious, vegetarian, and vegan populations, the dietary supplements segment is expected to remain the cornerstone of algae omega consumption globally.

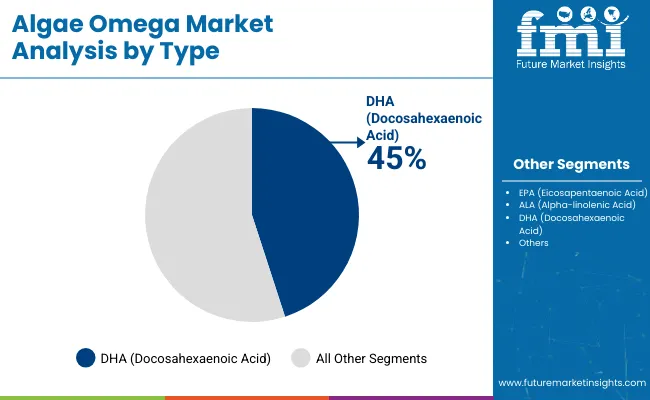

The DHA segment holds a dominant position with 45% of the market share in the type category, supported by its extensive applications in infant formula, nutraceuticals, and clinical nutrition. DHA derived from algae is a primary omega-3 fatty acid essential for brain, eye, and prenatal development, making it the most in-demand algae omega type.

Infant formula manufacturers, in particular, prefer algae-derived DHA due to regulatory approvals, purity, and traceability, which help meet safety and sustainability standards. Similarly, supplement makers use algae DHA as a direct alternative to fish-derived DHA, enabling broader market access to vegetarian and vegan consumers.

Investments in large-scale algae cultivation, improved extraction methods, and strain optimization are enhancing DHA yields and reducing production costs. With its strong clinical evidence and broad industry adoption, DHA is expected to retain its leadership position, driving the majority of revenue growth within the algae omega market.

In 2024, global algae omega demand grew steadily, with North America and Europe together accounting for over 55% of total consumption. Applications include dietary supplements, infant nutrition, functional foods, pharmaceuticals, and animal nutrition. Manufacturers are investing in advanced algae cultivation, improved extraction methods, and microencapsulation technologies to enhance bioavailability, stability, and sustainability. Cost-effectiveness, clean-label positioning, and plant-based advantages continue to support market penetration. Algae omega products are increasingly being adopted in health-conscious and vegan formulations, further driving market growth.

Rising Health Awareness and Nutritional Demand Drives Algae Omega Adoption

The dietary supplements and infant nutrition sectors are the largest consumers of algae omega, leveraging its high DHA/EPA content, vegan origin, and contaminant-free profile. With global demand for heart health, cognitive support, and prenatal nutrition increasing, algae-derived omega-3 oils are witnessing expanded adoption. Algae omega is estimated to account for a significant share of global omega-3 consumption, particularly in dietary supplements, where it offers a sustainable alternative to fish oil. Rising awareness of sustainable nutrition, along with expansion of functional foods and fortified beverages, further strengthens growth prospects.

High Production Costs and Regulatory Approval Timelines Restrain Expansion

Market growth faces limitations due to high production costs compared to fish oil, limited large-scale algae cultivation infrastructure, and the need for continuous R&D in strain optimization. Regulatory approval processes for novel algae strains and fortified applications can delay product launches in certain regions. Price sensitivity in emerging markets also constrains adoption, as fish oil remains a lower-cost alternative. These restraints place pressure on manufacturers to enhance cost efficiency, improve yields, and maintain product traceability, while balancing scalability and affordability.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| China | 4.0% |

| India | 3.8% |

| Germany | 3.5% |

| Japan | 3.4% |

| UK | 3.3% |

| Canada | 3.2% |

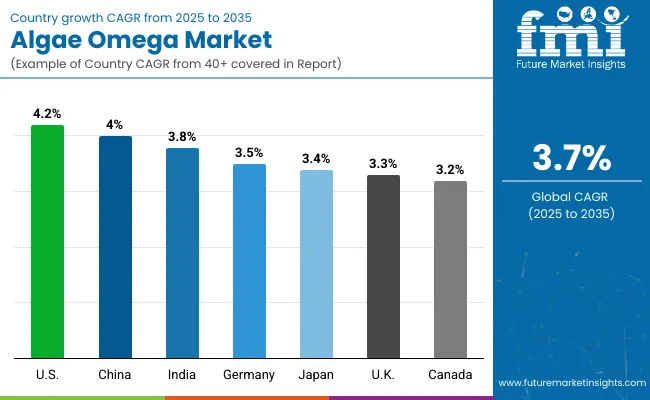

The algae omega market shows varied growth trajectories across the top seven countries. The USA leads with the highest projected CAGR of 4.2% from 2025 to 2035, supported by strong demand for dietary supplements, infant nutrition, and functional foods. China maintains steady growth at 4.0%, driven by increasing health awareness, rising middle-class incomes, and expansion of nutraceutical manufacturing.

India follows at 3.8%, benefiting from growing supplement consumption and government initiatives promoting health and wellness. Germany (3.5%) and Japan (3.4%) show moderate growth, supported by established supplement markets and regulatory approvals for DHA/EPA inclusion. TheUK (3.3%) and Canada (3.2%) experience steady growth, reflecting rising adoption of vegan and clean-label omega products.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

The algae omega market in the USA is projected to expand at a CAGR of 4.2% from 2025 to 2035, driven by strong demand for dietary supplements, infant nutrition, and functional foods. Health-conscious consumers increasingly prefer plant-based, contaminant-free DHA and EPA, supporting market penetration. Manufacturers are investing in microalgae cultivation, bioavailability enhancement, and microencapsulation technologies to meet growing demand.

Key Statistics:

Revenue from algae omega in China is projected to grow at a CAGR of 4.0% from 2025 to 2035, reflecting rising nutraceutical adoption and functional food fortification. Major consumption hubs include Guangdong and Jiangsu provinces, where supplement and infant formula manufacturing are concentrated. Companies are investing in sustainable production methods and large-scale algae cultivation to meet domestic and export demands.

Key Statistics:

Sales of algae omega in India are expected to grow at a CAGR of 3.8% from 2025 to 2035, driven by rising health awareness, dietary supplement adoption, and infant nutrition fortification. Supplement manufacturers in Maharashtra, Karnataka, and Delhi are expanding production capacity, relying increasingly on algae-derived DHA/EPA. Growing emphasis on clean-label and plant-based products is encouraging investment in sustainable production technologies.

Key Statistics:

Revenue from algae omega in Germany is projected to grow at a CAGR of 3.5% from 2025 to 2035, supported by high-value dietary supplements and functional foods. Manufacturers focus on traceable, contaminant-free DHA/EPA sources to meet stringent food and supplement regulations. The clean-label and vegan positioning of algae omega strengthens its appeal in both retail and clinical nutrition segments.

Key Statistics:

Sales of algae omega in Japan are projected to grow at a CAGR of 3.4% from 2025 to 2035, reflecting rising health-conscious consumer demand and integration in infant nutrition and functional beverages. Japanese manufacturers emphasize high-purity DHA/EPA and clinical substantiation, supporting widespread adoption. Innovation in microencapsulation and taste-masking technologies is enhancing product appeal, while partnerships with global nutraceutical brands are expanding market reach. Government initiatives promoting maternal and child health supplements are further boosting demand.

Key Statistics:

The algae omega market in the UK is expected to expand at a CAGR of 3.3% from 2025 to 2035, driven by dietary supplements and vegan/plant-based nutrition trends. Regulatory emphasis on supplement safety and clean-label standards shapes market dynamics. Manufacturers focus on sustainable sourcing and eco-certified production to meet consumer and retailer requirements. Rising popularity of functional foods and fortified beverages supports category expansion, while strategic collaborations between algae producers and supplement brands strengthen distribution networks.

Key Statistics:

Demand for algae omega in Canada is projected to grow at a CAGR of 3.2% from 2025 to 2035, supported by increasing supplement consumption and functional food fortification. Manufacturers focus on sustainable algae sourcing and quality assurance, aligning with consumer demand for vegan and clean-label products. Growing interest in preventive healthcare and wellness supplements is driving consumer adoption, while investments in scalable cultivation technologies are enhancing supply stability and cost efficiency.

Key Statistics:

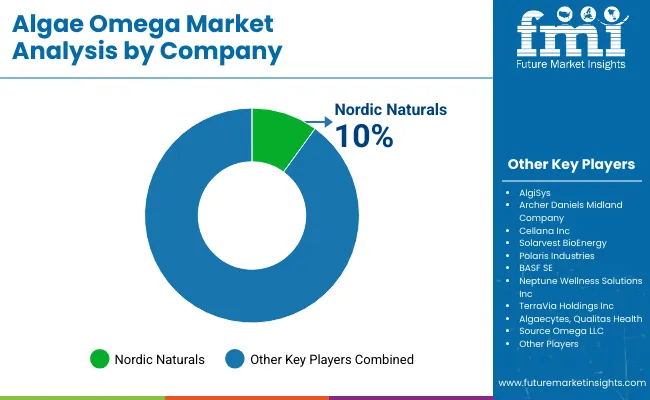

The market is moderately consolidated, comprising a mix of multinational nutraceutical corporations, specialized algae producers, and regional supplement manufacturers. Key players include Nordic Naturals, AlgiSys, Archer Daniels Midland Company, Cellana Inc, Solarvest BioEnergy, BASF SE, Neptune Wellness Solutions Inc, Algaecytes, Qualitas Health, Source Omega LLC, Novotech Nutraceuticals Inc, Koninklijke DSM NV. These companies leverage advanced algae cultivation technologies, extraction methods, and extensive distribution networks to supply dietary supplements, infant nutrition, functional foods, pharmaceuticals, and animal nutrition products.

The market is characterized by a significant share of DHA-based algae omega, accounting for 45% in 2025, driven by its high demand in infant nutrition and cognitive health supplements. Capsules and powders dominate the form segment due to longer shelf life, ease of dosing, and better bioavailability, while liquids are gaining traction in fortified beverages and functional foods. Companies are emphasizing product innovation, clinical substantiation, and quality assurance to meet evolving consumer expectations and regulatory standards.

Strategic initiatives such as mergers and acquisitions, partnerships, regional expansions, and R&D in bioavailability and sustainable cultivation are common among market players seeking to strengthen their presence. Firms are also focusing on sustainable sourcing, traceability, and eco-certified production to address consumer demand for plant-based, contaminant-free omega-3 oils. In summary, the algae omega market is evolving with established and emerging companies striving to enhance their competitive positions through innovation, sustainability initiatives, and expanded global reach, shaping the industry’s dynamics and growth trajectory.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1 billion |

| Form | Capsule, Powder, and Liquid |

| Type | DHA (Docosahexaenoic acid), EPA (Eicosapentaenoic acid), and ALA (Alpha- linolenic acid) |

| Concentration | Concentrated, High-Concentrated, and Low-Concentrated |

| Sales Channel | Online and Offline |

| Packaging | Tetra Pack, Bulk, and Bottle |

| Application | Dietary Supplements, Pharmaceuticals, Food & Beverages, Animal Nutrition, and Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Nordic Naturals, AlgiSys , Archer Daniels Midland Company, Cellana Inc , Solarvest BioEnergy , BASF SE, Neptune Wellness Solutions Inc , Algaecytes , Qualitas Health, Source Omega LLC, Novotech Nutraceuticals Inc , Koninklijke DSM NV, and Others |

| Additional Attributes | Dollar sales by type and application, regional demand trends, competitive landscape, consumer preferences for plant-based vs. traditional omega-3, innovations in algae extraction, quality standardization, and sustainable sourcing practices |

As per Type, the industry has been categorized into EPA (Eicosapentaenoic acid), ALA (Alpha-linolenic acid) and DHA (Docosahexaenoic acid).

As per Form, the industry has been categorized into Capsule, Powder and Liquid.

As per Concentration, the industry has been categorized into Concentrated, High-Concentrated and Low-Concentrated.

As per Sales Channel, the industry has been categorized into Online and Offline.

As per Packaging, the industry has been categorized into Tetra Pack, Bulk and Bottle.

As per Application, the industry has been categorized into Dietary Supplements, Pharmaceuticals, Food & Beverages, Animal Nutrition and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

The global algae omega market is estimated to be valued at USD 1.0 billion in 2025.

The market size for algae omega is projected to reach USD 2.0 billion by 2035.

The algae omega market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The DHA (Docosahexaenoic acid) segment is projected to lead in the algae omega market with 45% market share in 2025.

In terms of application, dietary supplements segment is projected to command 58% share in the algae omega market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaluating Algae Omega Market Share & Key Manufacturers

UK Algae Omega Market Analysis – Demand, Growth & Forecast 2025-2035

Europe Algae Omega Market Insights – Size, Demand & Industry Trends 2025-2035

Asia-Pacific Algae Omega Market Report – Trends, Demand & Industry Outlook 2025-2035

Algae-Polymer Extruders Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Algae-Based Eco-Pigments Market Size and Share Forecast Outlook 2025 to 2035

Algae-Based Anti-Aging Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae-based Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Algae-Based Emollients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Algae Biofuel Prospects Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae-based Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae-based Animal Feed Market Growth, Trends and Forecast from 2025 to 2035

Algaecides Market Assessment and Forecast for 2025 to 2035

Algae-based food additive market analysis by product type, source, functionality, application and by region growth, trends and forecast from 2025 to 2035

Algae Fats Market Trends - Sustainable Fat Innovations 2025 to 2035

Algae Proteins Market Trends – Sustainable Nutrition & Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA