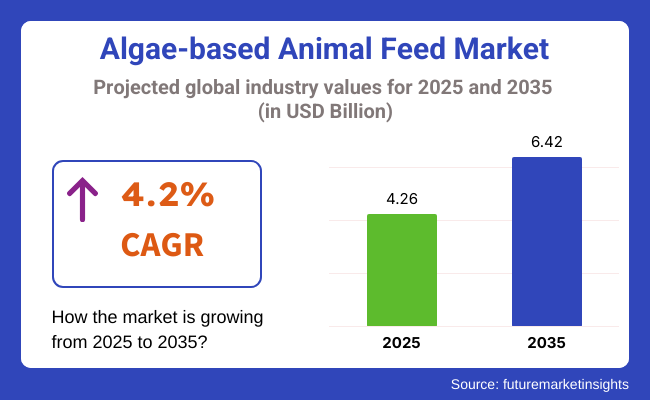

The value of the global algae-based animal feed market in 2025 was USD 4.26 billion and is expected to grow at a 4.2% CAGR from 2025 to 2035. The value of the global industry is expected to become USD 6.42 billion by 2035. Rising demand for high-nutrient, environmentally friendly feed alternatives as the livestock and aquaculture sectors transition towards climate-friendly production is one of the primary reasons behind the growth.

Algae feed products are gaining popularity because they have a high level of protein, omega-3 fatty acids and trace elements critical for animal growth and immunity. These characteristics make algae a performance-based alternative to the traditional fishmeal and soybean feeds, especially in aquaculture and poultry, where the health and feed conversion ratio is the critical performance metric.

Improvements in biotechnological processing and algal growing technologies-such as closed-loop photobioreactors and fermenters-are decreasing costs while increasing consistency and nutritional content. This technological change is allowing algae feeds to become increasingly commercially viable in local industries, particularly in North America, Europe and certain Asia-Pacific areas where incentives for sustainable agriculture are on the rise.

The demand for livestock produced more sustainably and ethically by consumers is encouraging feed firms to reformulate products from environmentally friendly inputs. Algae cultivation provides a low-resource and high-efficiency alternative that aligns with global environmental goals and, hence, growing popularity for feed formulation in the future.

Over the forecast horizon, the algae animal feed industry will continue to evolve through strategic alliances among biotech entrepreneurs, agri-produces, and regulators. The emphasis on nutritional optimization, supply chain strength, and international regulatory harmonization will take center stage in actualizing the full industry potential in the next decade.

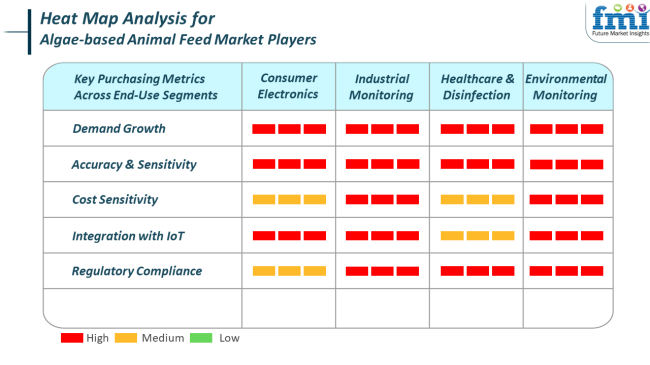

One might say that the industry is a little too far removed from conventionally understood electronic or industrial products. However, the demand for precision, automation, and sustainability present in algae-based animal feed corresponds, on a very different level, to trends found in the sectors adjacent to these industries.

In the present-day scenario of livestock farming, wherein aquaculture and poultry farming dominate, the integrated technologies find an increasing application in feed efficiency and environmental condition management, mirroring principles of industrial-grade monitoring and healthcare-grade controls.

With this juxtaposition between certain medicals and disinfectants, one sees the unified set of priorities: biological safety, ingredient traceability, and optimized nutrient profiles. Therefore, these demand accuracy and regulatory compliance, which go a long way in ensuring animal health alongside meeting export standards for both meat and dairy products.

In environmental monitoring, algae-based feed has ushered in a paradigm shift toward ecological stewardship. The push for low-carbon inputs, minimizing waste, and regulatory alignment has intensified. Algal farming stands tall as a scaleable, eco-friendly answer. Such hybrid purchasing drivers will determine factors in how agricultural stakeholders appraise and embrace next-generation feed solutions.

One of the core risks facing the industry is the limited scalability of algae cultivation technologies in comparison to traditional feed production. Despite progress in bioreactor and fermentation methods, many operations still face challenges with volume production, which can hinder industry competitiveness in regions where cost-per-ton is a determining factor.

Additionally, inconsistencies in international feed regulations present hurdles for cross-border trade and standardization. Algae-based products often fall under novel feed ingredient classifications, necessitating lengthy approval timelines. This lack of regulatory harmonization may deter manufacturers from rapid geographic expansion or delay the introduction of new formulations.

Lastly, the sensitivity of algae to contamination and climatic conditions poses a risk to supply stability. Fluctuations in biomass yields or disruptions in cultivation environments can impact feed consistency and commercial reliability. Addressing this will require enhanced biosecurity protocols and robust quality assurance systems to ensure uninterrupted supply and long-term customer confidence in algae-derived feeds.

Between 2020 and 2024, the industry experienced growth due to rising demand for sustainable feed options and growing concern about the sustainability of conventional feed sources like soy and corn. Aquaculture saw more consumption of algae feed due to its health properties, such as omega-3 fatty acids, supporting the health of fish. The application of technology for growing algae to produce made the production cheaper, and hence the product was now affordable for the masses.

Sustainability continued to be a decision-making consideration factor, placing algae-based animal feed in the spotlight as the sustainable agriculture solution.In the next few years, algae-based animal feed will see phenomenal growth due to advances in technology for farming and growing regulatory support for sustainable practices. Adoption of smart farming techniques such as vertical farming and automation will enhance the efficiency of algae production.

Improved strains of algae with better nutritional values will be engineered, further raising the value of algae-based feed. Ruminant and poultry expansion will expand its use, boosting animal health and feed efficiency. Algae feed will be one of the key drivers for sustainable agriculture by 2035, lowering carbon footprint and enhancing food security.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Greening of our environment, increasing demand for healthier options. | Advances in farm technology, regulatory support, and pragmatic nutrition. |

| Sustainable methods of algae cultivation and improved productivity in feed manufacturing. | Smart farms, automation of farm processes, new-generation algae varieties. |

| Increasing business in aquaculture, first-time applications in livestock. | Poultry, ruminant, and other large-scale livestock species. |

| Great, but varying levels of support for sustainable feeds. | Increased endorsement from regulators, with the focus being on sustainability as well as on innovation. |

| Environmental markets for environmentally compliant, healthier feeds. | Transition to tailored, health-focused animal nutrition. |

| Scalability, cost of production, and ignorance. | Reducing feed cost, scalability, and maintaining product affordability. |

The industry is anticipated to be dominated by nutritional additives, with a projected industry share of 22.5% within the overall industry in 2025, followed closely by feed enzymes at 14%.

With high concentrations of proteins, essential fatty acids (especially Omega-3s like EPA and DHA), vitamins, and minerals, nutritional additives from microalgae like Spirulina, Chlorella, and Schizochytrium have gained recognition for their important applications in aquaculture, poultry, and livestock sectors. These additives are utilized to improve growth rates, immune function, and feed conversion efficiency in the above industries.

The shift toward sustainable and connected farm-to-fork systems has also increased the demand for more alternatives to fishmeal- and soy-based ingredients, thus adding to the segment. Companies such as Alltech, DSM, and Corbion have spearheaded a wave of algae-based nutritional solutions with clean-label renewable alternatives in lockstep with performance goals and ESG mandates.

Feed enzymes, which constitute 14% of the industry, are crucial to humans improving the digestibility of animal feed by digesting complex nutrients into forms that can be absorbed. Enzymes derived from algae have been increasingly employed for the specific digestibility of some feed components, such as phytate, cellulose, and non-starch polysaccharides.

Several surface or algae/biotechnology-improved enzymes such as phytase, xylanase, cellulase, and amylase work together for better digestion of nutrients within an animal's body, thereby reducing wastage as well as environmental hindrances.

Such examples include research firms such as Novozymes and BASF that use microalgae as a sustainable source for enzyme production in poultry and swine diets. Additionally, new start-ups such as Enbiosis and Algenuity are developing algae-derived enzyme blends designed to work synergistically with probiotics and prebiotics to optimize gut health and nutrient uptake.

Both nutrient additives and feed enzymes are set to see further uptake under the algae-based feed formulations in the ever-increasing priority lists for sustainability, animal health, and affordability across the animal nutrition industry.

In 2025, poultry will account for 34% of the industry, making it the leading algae-based animal feed segment by livestock type. This will be followed by aquaculture, which will account for 27.5% of the total.

Due to steady improvement in the demand for sustainable and highly digestible sources of protein in broilers and layers, algae-derived feed products have begun to attract attention. The feed products that algae-derived products contain from Spirulina and Chlorella contain several essential amino acids and hormonal pigments (beta-carotene and astaxanthin).

As well as immune enhancement substances that induce better egg quality, meat pigmentation, and bird immunity; poultry producers are increasingly using algae-derived DHA and EPA as a source of omega-3 fatty acids, as opposed to synthetic or fish oil-derived omega-3s, to enhance the nutritional quality of eggs. Everyone, from Alltech to Cargill, is busy investing in algae-enhanced poultry feeding formulas to conform with clean-label and antibiotic-free production standards.

The same level comes next with 27.5% of the industry share, which is also an extremely rapidly growing use type of algae-based feeds because of the increased global demand for seafood, along with the environmental concerns associated with traditional fishmeal and fish oil. Omega-3-rich microalgae-Schizochytrium and Nannochloropsis-have extensive coupling participations in lipids sourced from fish in feeds for various fish species: salmon, shrimp, tilapia, and other farmed fish.

Algal feeds improve production performance, increase disease resistance, and promote improved water quality in recirculation. Major players making waves in this domain are Corbion, Veramaris, and Algama, innovating viable algae-based lipid and protein solutions that are scalable and traceable.

Thus, algae-based feed inputs become crucial to high-performance diets in both poultry and aquaculture, determining the direction for long-term growth as sustainable and functional nutrition emerges out loud as a theme in the animal feed industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.9% |

| UK | 6.8% |

| France | 6.5% |

| Germany | 6.7% |

| Italy | 6.3% |

| South Korea | 7.1% |

| Japan | 6.4% |

| China | 8.4% |

| Australia-NZ | 6.6% |

The USA industry will advance at 7.9% CAGR between the years under review. This strong growth path is driven by increasing demand for algae-based and high-protein feed ingredients in the aquaculture and livestock industries. Growing knowledge of algae's nutritional value, including omega-3 fatty acids and bioactive molecules, is driving its use among feed producers.

Regulatory endorsement of new feed ingredients and R&D investments by leading agricultural biotechnology companies are also supporting industry penetration. The growing organic livestock sector is also driving demand for clean-label and sustainable inputs such as algae. The USA is also supported by a well-established aquaculture industry that is slowly moving toward greener feeding practices.

The technological innovation in algae growing systems, such as photobioreactors and open pond systems, enables scalable production for industrial feed applications. Increasing cooperation between startups and feed multinationals is speeding up product development.

In addition, consumer-driven demand for ethically raised animal products indirectly impacts feed formulation strategies, complementing the use of algae-based solutions. The strong purchasing power and robust feed production infrastructure of the USA are anticipated to support long-term industry growth.

The UKindustry is anticipated to grow at 6.8% CAGR over the period of study. The increasing emphasis on circular agriculture and sustainable animal husbandry is a major driver encouraging the use of algae-based feed ingredients. The aquaculture industry, with an emphasis on salmon farming, is turning to alternative feed ingredients to minimize reliance on wild-caught fishmeal.

Algal-based feed is becoming popular as a source of high-quality essential fatty acids and micronutrients that enhance animal health and optimize feed conversion ratios. Policies in the government to reduce greenhouse gas emissions from agriculture are driving innovation in feed composition. Public and private investment-funded research projects are supporting the creation of commercially scalable algae biomass production for feed purposes.

Consumer awareness of humane animal farming methods is affecting feed manufacturers to utilize more environmentally friendly input sources. The availability of technologically advanced production systems and high quality standards is responsible for the growth potential of this industry segment. Although the UKindustry is smaller than that of global giants, it offers a dynamic situation influenced by sustainability requirements and changing customer expectations.

The Frenchindustry will expand at 6.5% CAGR throughout the research timeline. Being equipped with an established livestock industry along with expanding aquaculture activities, France is becoming increasingly interested in functional as well as sustainable feed options.

Algae feed provides dense nutrition and has the potential to replace traditional protein sources such as soybean meal and fishmeal as a feasible alternative. The pressure to cut carbon footprints in farm supply chains is inspiring domestic feed makers to seek out renewable and less land-hungry inputs.

Facilitative policy environments and investment in algae research facilities are helping to fuel industry growth. French universities and biotechnology firms are actively looking into algae growing techniques and nutrient characterization to customize feed products for individual livestock requirements.

Organic and antibiotic-free meat product demand is driving the composition of feeds, and algae are being projected as the clean and biosecure solution. The alignment of algae feed with France's national objectives regarding sustainability and animal welfare positions the country well to be a key player in long-term industry interaction.

The industry in Germany is likely to grow at 6.7% CAGR over the period of study. Germany's strong emphasis on sustainable agriculture and conservation of the environment has positioned it as an important player in the shift towards alternate feed sources. The industry for algae-based animal feed is gaining from growth in government incentives for research and adoption of green technologies in food and agriculture businesses.

Germany's industry for large-scale livestock offers vast potential for adoption of algae feed. Developed biotechnology facilities and research institutions are promoting collaborations aimed at maximizing algae strains for better feed efficacy.

Domestic feed manufacturing companies are investigating algae as an add-on in compound feeds to support animal well-being, digestive well-being, and minimize the intake of synthetic additives. Demand for ethically sourced and environmentally friendly animal products among consumers is shaping purchasing practices throughout the supply chain. The industrial effectiveness and quality assurance focus of the country create a conducive environment for expanding algae-based feed applications throughout poultry, dairy, and aquaculture operations.

The Italy industry will grow at 6.3% CAGR over the study period. Italy's farming heritage and rich food culture are being increasingly dovetailed with innovation in sustainable practice. Interest in using algae as an animal feed ingredient is picking up pace because it is in accordance with organic agricultural practices and could improve the nutritional value of animal products.

Regions bordering oceans engaged in aquaculture, especially for fish species in the Mediterranean, are looking at using algae-based feeds to maintain the health of fish and decrease overexploitation dependence on marine materials.

Italian animal feed producers are investing in domestic algae production, frequently in partnership with marine research centers and agri-tech companies. Government policies favoring bioeconomy projects are also stimulating the adoption of sustainable feed ingredients.

Moreover, domestic and export demand for high-quality meat and dairy products is driving producers to embrace new, functional ingredients. As Italy continues to develop its agri-food supply chain with a focus on sustainability, the use of algae-based feeds is poised to be a key driver of future growth.

The South Korea industry is anticipated to expand at 7.1% CAGR over the study period. Being one of Asia's technologically advanced economies, South Korea is actively working on sustainable innovations in aquaculture and agriculture. The use of algae-based animal feed is aided by national policies aimed at boosting food security and lowering reliance on imported raw feed materials.

Local aquaculture facilities are of special interest in algae as an input feed because it is a high-protein content material with the ability to enhance fish immunity and growth. R&D activities supported by government programs are spurring the formation of commercial-sized algae production facilities that are compatible with animal feeding.

South Korean companies are also looking into fermentation and bioreactor-based culturing methods in order to achieve a stable feedstock supply. The country's livestock industry is reacting to industry demand for traceable, high-quality animal products, making feed manufacturers include environmentally friendly and scientifically proven ingredients such as algae. Generally, the industry's innovative policies and focus on development make it an enabling platform for algae animal feed solutions growth.

The Japan industry will grow at a 6.4% CAGR over the period under study. Japan's established aquaculture sector and intense interest in food safety and quality are key drivers for the adoption of algae-based animal feed. The nation is seeing increasing focus on sustainable agriculture and alternative proteins as a result of environmental and resource constraints. Algae provides functional advantages of enhanced digestibility, immune function support, and superior nutrient profiles that justify its use in premium aquaculture and livestock applications.

Public and private investment in sustainable agriculture practices and marine biotechnology are enabling pilot projects and commercial trials of algae in feed applications. Academic research and innovation centers are creating tailor-made solutions as per local livestock nutritional needs.

Japan's strong food safety controls and focus on traceability align with the benefits offered by controlled algae production systems. As part of broader efforts to secure sustainable food systems, the integration of algae-based feed is expected to become a more prominent strategy in Japan’s agriculture sector.

The Chinese industry will grow at an 8.4% CAGR over the study period. China hosts the biggest aquaculture and livestock feed industry in the world, creating huge opportunities for the adoption of algae-based feed. Concerns over the environmental implications of conventional feed ingredients and the quest for more sustainable practices in animal husbandry are spurring demand for algae. With the nation still dealing with pollution and ecological deterioration, feed ingredients with fewer environmental costs are becoming increasingly popular.

Chinese farm policy becomes more and more favorable to biotechnology and sustainable innovation. Several government-sponsored projects are investing in algae research and infrastructure development as a means to decrease dependence on imported feed sources.

The expansion of high-quality meat and aquaculture production, especially for domestic markets, demands feed options that promote animal health, efficiency of growth, and product quality. China's capacity to roll out large-scale agricultural reforms rapidly makes it a pioneer in algae feed deployment. Growth in the industry is also underpinned by an emerging middle class that is calling for safer, cleaner, and more sustainable food products.

The Australia-New Zealand industry is projected to grow at 6.6% CAGR over the study period. The region's focus on regenerative agriculture and sustainable aquaculture practices creates rich soil for algae-based feed solutions. Algae-derived ingredients are being considered for both ruminant and aquaculture feed because of their potential to improve feed efficiency and lower methane emissions.

This is in line with regional climate objectives and consumer demands for low-impact animal farming. Both countries' innovative ecosystems are driving cross-sector partnerships among agri-tech companies, oceanic research institutes, and feed manufacturers.

Regulatory receptiveness to new feed materials and public financing support are spurring commercial demand for algae production. Australia and New Zealand's high export intensity, particularly in high-quality meat and dairy products, encourage the industry to use feed practices that satisfy high global sustainability standards. The shared emphasis on animal welfare, traceability, and product differentiation is likely to be the foundation of consistent growth in the use of algae-based animal feed in the region.

The industry is becoming increasingly competitive. It is adopting the same strategy as extra nutrition and sustainability in aquaculture, poultry, and livestock to become more appealing brands. Cargill Inc. and Archer Daniels Midland Company (ADM) have further expanded the industry through their vertically integrated supply chains, as well as investments in algae-derived omega-3 and protein alternatives. The giants are increasing their production capabilities and entering into global partnerships to scale algae feed solutions for commercial aquaculture.

DIC Corporation and Koninklijke DSM NV are also actively innovating in the field of microalgae fermentation and bioengineering, especially concerning DHA- and EPA-rich feed ingredients that are becoming increasingly popular in fish farming, alongside pet nutrition. Joint ventures and targeted acquisitions from DSM upon precision fermentation propel the company to become a leader in high-purity algae oils.

Mid-tier players such as Roquette Frères, Sun Chlorella, and Cellana LLC are deepening their differentiation within niche sectors by offering functional algae ingredients with additional health benefits, including immunity boosters and prebiotics. Corbion (through TerraVia Holdings) continues to maintain strength in specialty algae oils and proteins for sustainable aquaculture.

Startups such as Algama Foods, HOWND, and Yunnan Green-A-Bio-engineering research their specializations in regional innovation as well as expansion through plant-based transitions primarily focused within Asia-Pacific and Europe.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Cargill Inc. | 18-21% |

| Archer Daniels Midland Co. | 14-17% |

| Koninklijke DSM NV | 12-15% |

| DIC Corporation | 9-12% |

| Corbion (TerraVia Holdings) | 7-10% |

| Other Players | 27-33% |

| Company Name | Offerings & Activities |

|---|---|

| Cargill Inc. | Algae-based omega-3 feed, scalable aquaculture applications, sustainability partnerships. |

| ADM | Algae protein concentrates, animal feed supplements, R&D in alternative proteins. |

| Koninklijke DSM NV | High-purity omega-3 from algae, joint ventures in precision fermentation. |

| DIC Corporation | Spirulina-based animal nutrition, innovation in microalgae cultivation. |

| Corbion (TerraVia) | DHA-rich algae oils, tailored aquafeed ingredients, and partnerships in marine ecosystems. |

Key Company Insights

Cargill Inc. (18-21%)

Maintains dominance through aggressive algae R&D, investment in large-scale production, and partnerships with feed producers.

Archer Daniels Midland Co. (14-17%)

Expands algae portfolio with alternative proteins, leveraging its existing global footprint in feed manufacturing.

Koninklijke DSM NV (12-15%)

Integrates biotechnology and fermentation expertise for tailored algae solutions, especially for fish and pet feed.

DIC Corporation (9-12%)

Focuses on spirulina and chlorella-based feed ingredients, offering a competitive edge in high-nutrient applications.

Corbion (7-10%)

It specializes in sustainable aquaculture feed ingredients and builds long-term ties with marine feed formulators.

By additive type, the industry is segmented into feed preservatives, feed antioxidants, feed emulsifiers, feed acidifiers, silage additives, feed prebiotics, feed probiotics, feed enzymes, feed colorants, feed flavors, feed sweeteners, and nutritional additives.

By livestock, the industry is categorized by livestock into ruminant, poultry, swine, aquaculture, and pet animals.

By form, the industry is analyzed by form into liquid, dry, and granules.

By region, the industry is assessed across North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The industry is slated to reach USD 4.26 billion in 2025.

The industry is projected to reach a size of USD 6.42 billion by 2035.

Key companies include Cargill Inc., Archer Daniels Midland Company, DIC Corporation, Koninklijke DSM NV, Roquette Frères, Sun Chlorella, Cellana LLC, Fuji Chemical Industries Co., Ltd., Algama Foods, Corbion (TerraVia Holdings), HOWND, and Yunnan Green-A-Bio-engineering Co Ltd.

China, slated to grow at 8.4% CAGR during the forecast period, is poised for the fastest growth.

Nutritional additives are being widely used.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Additive Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Additive Type, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Livestock, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Livestock, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Additive Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Additive Type, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Livestock, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Livestock, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Additive Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Additive Type, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Livestock, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Livestock, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Additive Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Additive Type, 2018 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Livestock, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Livestock, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ million) Forecast by Additive Type, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Additive Type, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Livestock, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Livestock, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ million) Forecast by Additive Type, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Additive Type, 2018 to 2033

Table 45: South Asia Market Value (US$ million) Forecast by Livestock, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Livestock, 2018 to 2033

Table 47: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ million) Forecast by Additive Type, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Additive Type, 2018 to 2033

Table 53: Oceania Market Value (US$ million) Forecast by Livestock, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Livestock, 2018 to 2033

Table 55: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 57: MEA Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ million) Forecast by Additive Type, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Additive Type, 2018 to 2033

Table 61: MEA Market Value (US$ million) Forecast by Livestock, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Livestock, 2018 to 2033

Table 63: MEA Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Additive Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Livestock, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Additive Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Additive Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Additive Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Additive Type, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Livestock, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Livestock, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 21: Global Market Attractiveness by Additive Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Livestock, 2023 to 2033

Figure 23: Global Market Attractiveness by Form, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Additive Type, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Livestock, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Additive Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Additive Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Additive Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Additive Type, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Livestock, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Livestock, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 45: North America Market Attractiveness by Additive Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Livestock, 2023 to 2033

Figure 47: North America Market Attractiveness by Form, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Additive Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Livestock, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Additive Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Additive Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Additive Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Additive Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Livestock, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Livestock, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Additive Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Livestock, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Additive Type, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Livestock, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Additive Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Additive Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Additive Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Additive Type, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by Livestock, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Livestock, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 93: Europe Market Attractiveness by Additive Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Livestock, 2023 to 2033

Figure 95: Europe Market Attractiveness by Form, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ million) by Additive Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ million) by Livestock, 2023 to 2033

Figure 99: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ million) Analysis by Additive Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Additive Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Additive Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Additive Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) Analysis by Livestock, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Livestock, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 113: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Additive Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Livestock, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ million) by Additive Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ million) by Livestock, 2023 to 2033

Figure 123: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 124: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ million) Analysis by Additive Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Additive Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Additive Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Additive Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ million) Analysis by Livestock, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Livestock, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 137: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Additive Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Livestock, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ million) by Additive Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ million) by Livestock, 2023 to 2033

Figure 147: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 148: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ million) Analysis by Additive Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Additive Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Additive Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Additive Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ million) Analysis by Livestock, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Livestock, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 161: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Additive Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Livestock, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ million) by Additive Type, 2023 to 2033

Figure 170: MEA Market Value (US$ million) by Livestock, 2023 to 2033

Figure 171: MEA Market Value (US$ million) by Form, 2023 to 2033

Figure 172: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ million) Analysis by Additive Type, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Additive Type, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Additive Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Additive Type, 2023 to 2033

Figure 181: MEA Market Value (US$ million) Analysis by Livestock, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by Livestock, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Livestock, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Livestock, 2023 to 2033

Figure 185: MEA Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 189: MEA Market Attractiveness by Additive Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by Livestock, 2023 to 2033

Figure 191: MEA Market Attractiveness by Form, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microalgae-Based Aquafeed Market – Growth & Sustainable Feed Trends

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Growth Promoter Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA