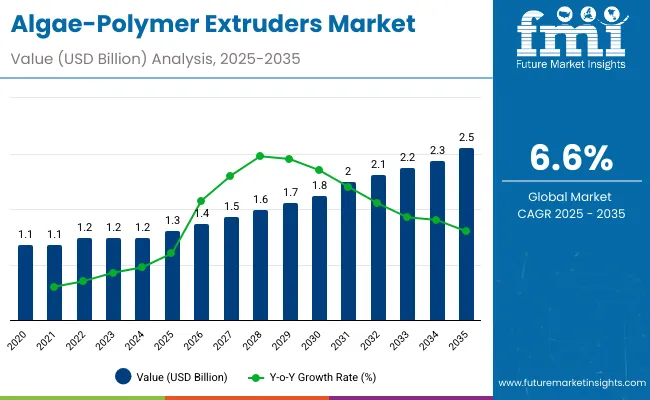

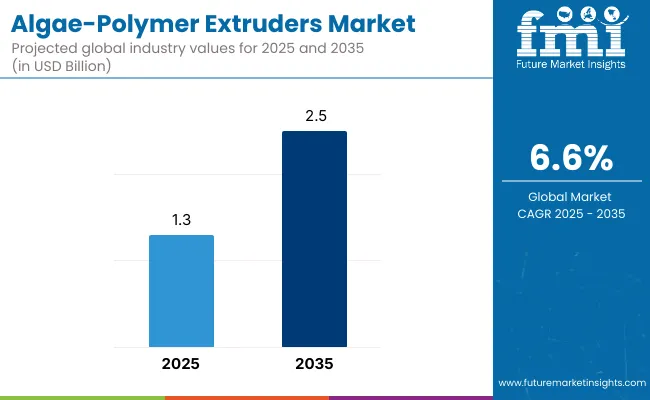

The global algae-polymer extruders market will expand from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, at a CAGR of 6.6%. Growth is driven by increased use of bio-based polymers and government initiatives promoting sustainable plastics. Algae-based polyethylene remains the top choice for extrusion due to its cost efficiency and environmental advantages. Twin-screw systems are increasingly favored for high-throughput compounding. Rising food packaging demand and industrial adoption of biodegradable materials across Asia-Pacific are reinforcing market growth through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.3 billion |

| Market Forecast (2035) | USD 2.5 billion |

| Growth Rate | 6.6% |

Between 2020 and 2024, algae-derived biopolymers emerged as a sustainable alternative to petroleum-based plastics. Extruder manufacturers integrated energy-efficient designs and automation to improve compound dispersion and reduce waste. By 2035, global revenues will double, supported by advanced twin-screw technologies and R&D in algae cultivation for polymer feedstock. Asia-Pacific will remain the dominant production hub, while Europe and North America focus on scaling bio-resin extrusion for packaging and consumer applications.

Market expansion is driven by bio-economy policies, packaging sustainability goals, and demand for recyclable materials. Algae-based polymers provide carbon-neutral alternatives with excellent mechanical and barrier performance. Continuous innovation in extruder technology enables higher throughput, reduced energy consumption, and improved polymer homogeneity, fueling large-scale adoption in packaging, agriculture, and consumer sectors.

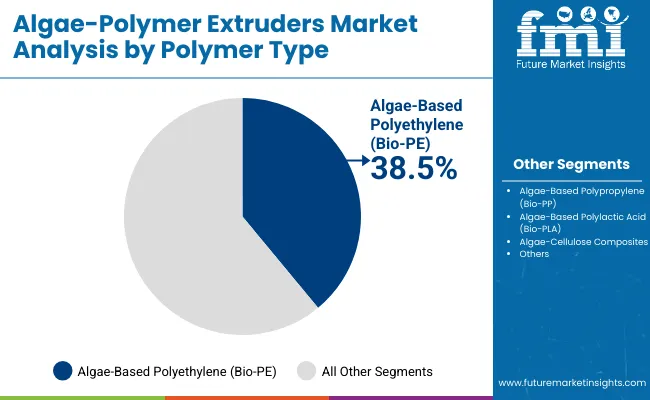

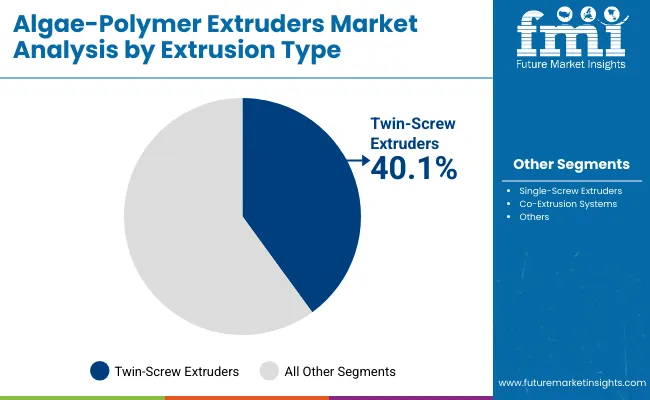

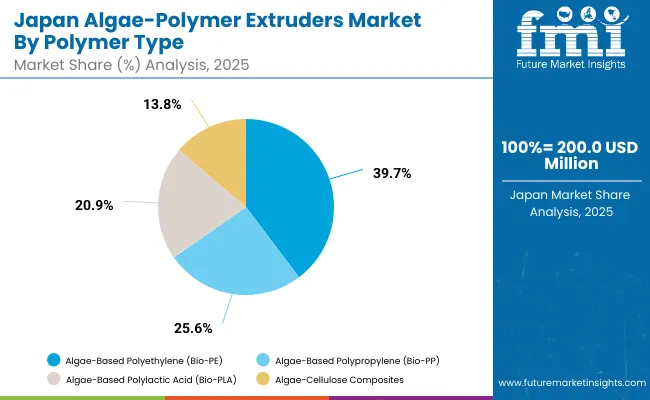

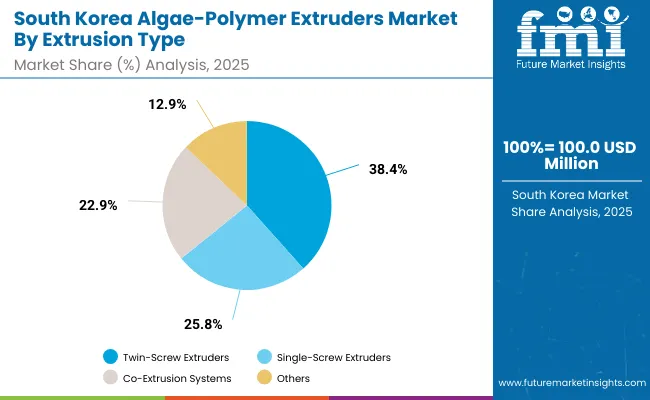

The market is segmented by polymer type, extrusion type, application, end-use industry, and region. Polymer types include algae-based polyethylene (Bio-PE), polypropylene (Bio-PP), polylactic acid (Bio-PLA), and algae-cellulose composites. Extrusion types cover twin-screw, single-screw, and co-extrusion systems. Applications include film, sheet, profile, and fiber extrusion, while end-uses encompass food & beverage packaging, agriculture, consumer goods, and industrial production.

Algae-based polyethylene (Bio-PE) is projected to hold 38.5% of the market in 2025, favored for its flexibility, chemical stability, and ease of processing on conventional extrusion lines. It combines the performance of traditional PE with improved biodegradability, making it ideal for packaging films and molded products.

Its compatibility with large-scale production supports rapid commercialization across consumer and industrial applications. The expansion of renewable feedstock sourcing and lower carbon footprint reinforce its sustainability profile. As regulatory incentives grow, Bio-PE continues to lead the polymer type category within algae-based material extrusion.

Twin-screw extruders are expected to capture 40.1% of the market in 2025, driven by their superior mixing capability and high output efficiency. They ensure uniform dispersion of algae-derived polymers, resulting in consistent product quality for packaging and industrial components.

Energy-efficient motor systems and modular barrel configurations enhance production flexibility. These machines enable continuous operation for complex bio-compounding processes, reducing waste and improving repeatability. As bio-polymer manufacturing expands, twin-screw extruders remain the technology standard for precision and scalability.

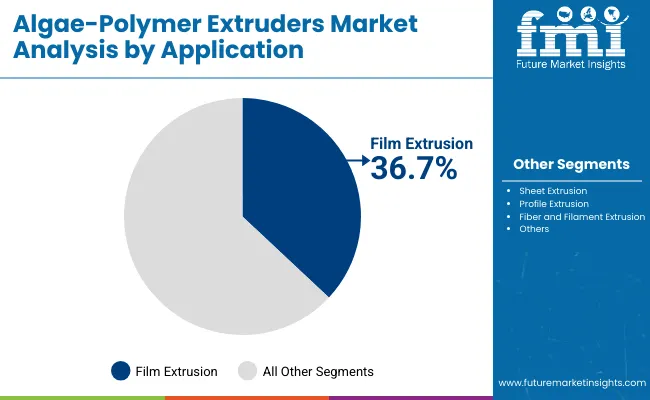

Film extrusion is forecast to represent 36.7% of the market in 2025, supported by its role in producing thin, biodegradable films for food wraps, agricultural mulch sheets, and industrial liners. The process delivers lightweight yet durable films with excellent transparency and mechanical strength.

Manufacturers prefer algae-based film extrusion for its reduced environmental impact and material versatility. Recyclable film structures further strengthen adoption across food and agropack sectors. As sustainable packaging becomes mainstream, film extrusion continues to anchor growth in algae-polymer processing.

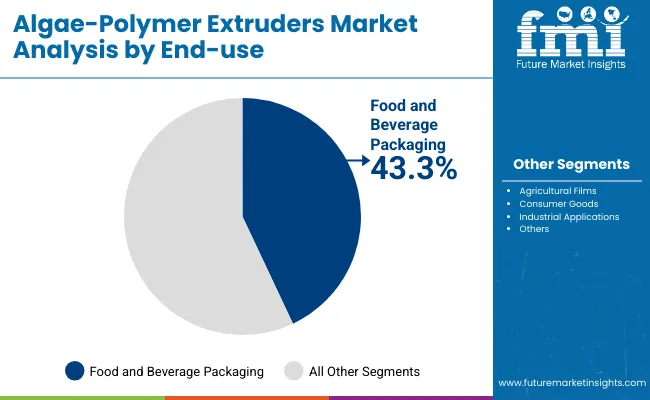

The food and beverage packaging segment is projected to account for 43.3% of the market in 2025, driven by global efforts to reduce plastic waste and adopt biodegradable materials. Algae-based polymers provide safe, renewable alternatives for flexible films, trays, and liners used in food applications.

Brand-led sustainability commitments and evolving regulations accelerate their incorporation into mainstream packaging lines. Enhanced barrier performance and cost competitiveness make algae-based solutions increasingly viable. With strong industry backing, food and beverage packaging remains the dominant end-use sector driving long-term market growth.

The market’s momentum is being fuelled by expanding sustainability regulations and a strong industrial pivot toward algae-based bioplastics, fostering eco-friendly material innovation. However, high processing costs and limited large-scale algae biomass production continue to constrain adoption. Promising opportunities arise from advancements in bio-resin formulations and next-generation extrusion automation. Emerging trends include closed-loop extrusion systems and hybrid polymer composites for enhanced strength and durability.

The global algae-polymer extruders market is expanding as bio-plastic innovation aligns with sustainability and circular economy mandates. Asia-Pacific dominates manufacturing due to large-scale bio-feedstock production and low-cost extrusion systems. Europe’s market is driven by regulatory incentives promoting recyclable polymers and advanced automation, while North America focuses on R&D and technology-driven process optimization. Integration of AI-based process control, precision twin-screw designs, and hybrid algae-resin compounding is accelerating the shift toward high-performance sustainable packaging worldwide.

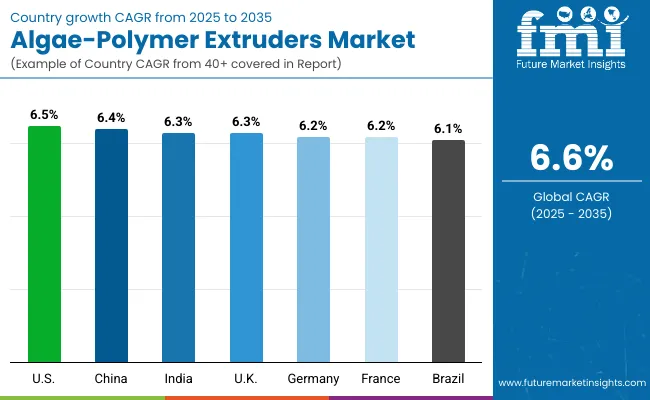

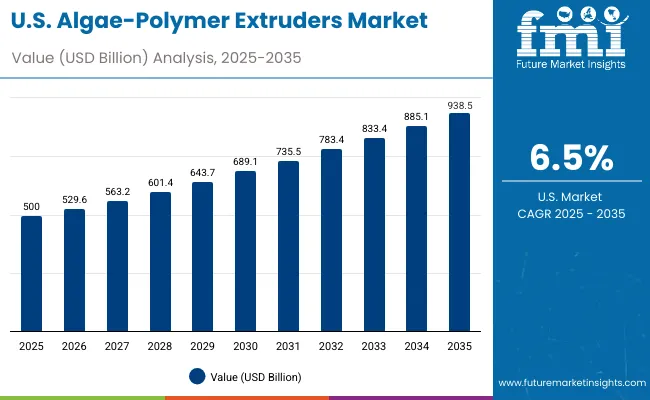

The USA will grow at 6.5% CAGR, supported by the integration of algae-based polymers in food, beverage, and industrial packaging. Adoption of energy-efficient extruder lines is increasing as sustainability mandates expand. Domestic R&D investments in extrusion efficiency and feedstock utilization are strengthening the local bio-polymer ecosystem. Collaborations between research labs and manufacturers are advancing large-scale bioplastic innovation.

Germany will expand at 6.2% CAGR, driven by innovation in precision extrusion and smart manufacturing control systems. The nation’s strong mechanical engineering base supports advancements in bio-polymer processing technology. Partnerships with academic institutions are promoting sustainable extrusion designs and energy-efficient equipment. Germany’s emphasis on eco-industrial manufacturing continues to make it a leader in bioplastic production innovation.

The UK will grow at 6.3% CAGR, focusing on agriculture and consumer packaging sectors adopting algae-based biopolymers. Export demand for bio-resins and compounding systems is rising due to international sustainability initiatives. Manufacturers are transitioning toward recyclable and compostable film extrusion applications. Increasing automation in small-scale production facilities supports regional competitiveness.

China will grow at 6.4% CAGR, led by rapid capacity expansion in algae-polymer plants and mass extrusion lines. Domestic manufacturing of cost-effective extrusion systems is improving accessibility for packaging and textile sectors. Automation and digital control integration across compounding facilities enhance production scalability. Export activity in algae-based polymers and extruder machinery continues to strengthen China’s global influence.

India will grow at 6.3% CAGR, supported by increased use of algae-derived polymers in packaging and agriculture films. Government-led green manufacturing initiatives are boosting local adoption of sustainable materials. Local OEMs are expanding mid-scale extruder manufacturing with a focus on affordability and efficiency. Growing awareness of compostable plastic alternatives is driving investment across domestic packaging industries.

Japan will grow at 6.9% CAGR, emphasizing advanced material research in hybrid algae-cellulose composites. Compact twin-screw extruders are becoming standard for precision processing and reduced energy consumption. The market is moving toward lightweight, high-strength packaging and medical-grade bio-material applications. Collaboration between industrial and academic R&D centers continues to reinforce Japan’s leadership in biopolymer engineering.

South Korea will lead with 7.0% CAGR, advancing high-tech film extrusion through digital manufacturing and precision R&D. The country’s innovation in algae-polymer reinforcement is improving tensile strength and durability in bio-plastic applications. Growth is strongly supported by exports of advanced extrusion machinery and biopolymer feedstocks. Integration of AI and robotics in extrusion systems enhances global competitiveness.

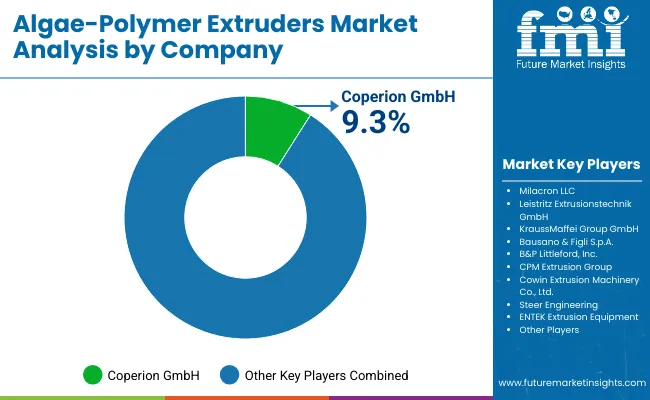

The market is moderately consolidated with key participants such as Coperion GmbH, Milacron LLC, Leistritz Extrusions technik GmbH, Krauss Maffei Group GmbH, Bausano & Figli S.p.A., B&P Littleford Inc., CPM Extrusion Group, Cowin Extrusion Machinery Co. Ltd., Steer Engineering, and ENTEK Extrusion Equipment. Companies emphasize high-output twin-screw innovations, biodegradable compound handling, and AI-based quality monitoring.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion (2025 baseline) |

| By Polymer Type | Algae-Based Polyethylene (Bio-PE), Bio-PP, Bio-PLA, Algae-Cellulose Composites |

| By Extrusion Type | Twin-Screw, Single-Screw, Co-Extrusion Systems |

| By Application | Film Extrusion, Sheet Extrusion, Profile Extrusion, Fiber & Filament Extrusion |

| By End-Use Industry | Food & Beverage Packaging, Agricultural Films, Consumer Goods, Industrial Applications |

| Key Companies Profiled | Coperion GmbH, Milacron LLC, Leistritz Extrusionstechnik GmbH, KraussMaffei Group GmbH, Bausano & Figli S.p.A., B&P Littleford Inc., CPM Extrusion Group, Cowin Extrusion Machinery Co. Ltd., Steer Engineering, ENTEK Extrusion Equipment |

| Additional Attributes | Market driven by sustainable biopolymers, energy-efficient extrusion, and eco-compliance innovation |

The market size of the Algae-Polymer Extruders Market in 2025 is USD 1.3 billion.

The market size of the Algae-Polymer Extruders Market in 2035 is USD 2.5 billion.

The CAGR of the Algae-Polymer Extruders Market is 6.6%.

Algae-Based Polyethylene (Bio-PE) leads the market in 2025 with 38.5% share.

Twin-Screw Extruders with 40.1% share dominates the market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Twin Screw Extruders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA