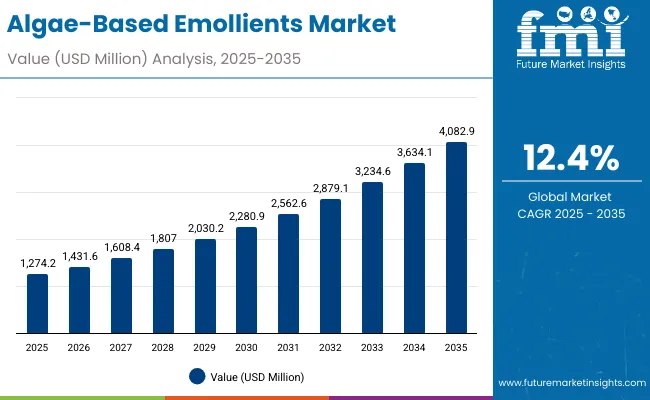

The Algae-Based Emollients Market is expected to record a valuation of USD 1,274.2 million in 2025 and USD 4,082.9 million in 2035, with an increase of USD 2,808.7 million, which equals a growth of 220% over the decade. The overall expansion represents a CAGR of 12.4% and a 3.2X increase in market size.

Algae-Based Emollients Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,274.2 million |

| Market Forecast Value in (2035F) | USD 4,082.9 million |

| Forecast CAGR (2025 to 2035) | 12.4% |

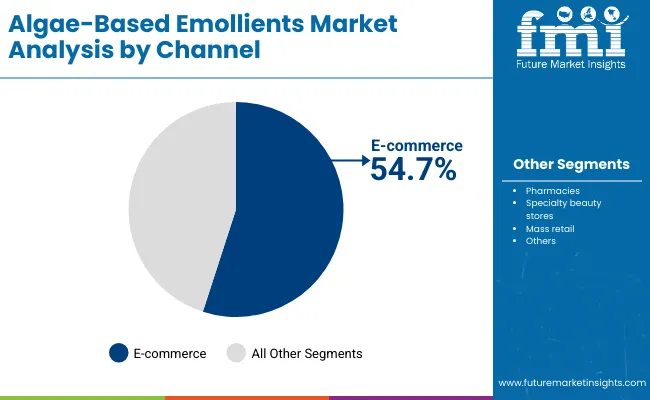

During the first five-year period from 2025 to 2030, the market increases from USD 1,274.2 million to USD 2,280.9 million, adding USD 1,006.7 million, which accounts for 35.8% of the total decade growth. This phase records steady adoption in hydration-focused skincare, anti-aging, and repair & soothing applications, driven by the need for natural and marine-sourced alternatives. Creams & lotions dominate this period as they cater to over half of consumer routines, while e-commerce channels capture 54.7% share due to growing D2C and digital-first beauty strategies.

The second half from 2030 to 2035 contributes USD 1,802.0 million, equal to 64.2% of total growth, as the market jumps from USD 2,280.9 million to USD 4,082.9 million. This acceleration is powered by widespread deployment of sustainable and vegan formulations, premiumization in serums and oils, and strong penetration in Asia, particularly China (15.2% CAGR) and India (17.0% CAGR). The adoption of clean-label and eco-friendly marine actives expands significantly, while pharmacy and specialty beauty stores gain incremental share through premium launches. E-commerce platforms expand recurring revenues via subscription models, propelling online retail beyond a 60% share in some regions.

From 2020 to 2024, the Algae-Based Emollients Market grew steadily, driven by consumer inclination towards marine-sourced natural actives. During this period, the competitive landscape was fragmented, with premium marine-sourced brands and clean-label specialists controlling niche segments. Leaders such as Biotherm, La Mer, and Blue Lagoon Iceland capitalized on hydration and anti-aging positioning, while indie brands like Haeckels and Osea Malibu attracted vegan and eco-conscious buyers. Competitive differentiation relied on sustainability credentials, brand storytelling, and claim authenticity, while mass players entered primarily through creams & lotions. Services and recurring subscription-based models had minimal traction, contributing less than 10% of the total market value.

Demand for algae-based emollients will expand to USD 1,274.2 million in 2025, and the revenue mix will shift as sustainable, vegan, and clean-label claims grow to over 60% share by 2035. Traditional marine beauty leaders face rising competition from eco-first startups offering algae-rich formulations, subscription-based replenishment packs, and e-commerce-driven distribution. Major beauty conglomerates are pivoting to hybrid models, integrating digital personalization, AI-based skin analysis, and retail-pharma collaborations to retain relevance. Emerging entrants specializing in bio-fermented marine actives, biodegradable packaging, and direct-to-consumer sales are gaining share. The competitive advantage is moving away from heritage luxury positioning alone to holistic sustainability, digital ecosystem strength, and recurring revenue streams.

Advances in marine biotechnology have improved extraction and stabilization of algae-derived actives, allowing for more effective incorporation into skincare formulations. Hydration & moisture retention emollients have gained popularity due to their suitability for daily routines and visible efficacy in maintaining skin elasticity. The rise of natural marine-sourced claims has contributed to enhanced consumer trust and wider adoption across mass retail and premium channels. Industries such as beauty, personal care, and dermatology are driving demand for algae-based solutions that can deliver hydration, barrier protection, and anti-aging benefits without synthetic additives.

Expansion of eco-friendly and vegan skincare has fueled market growth. Innovations in cream-based formulations, sustainable packaging, and retail channel strategies are expected to open new application areas. Segment growth is expected to be led by hydration & moisture retention in function categories, creams & lotions in product types, and e-commerce in distribution channels due to their precision targeting and adaptability to consumer expectations.

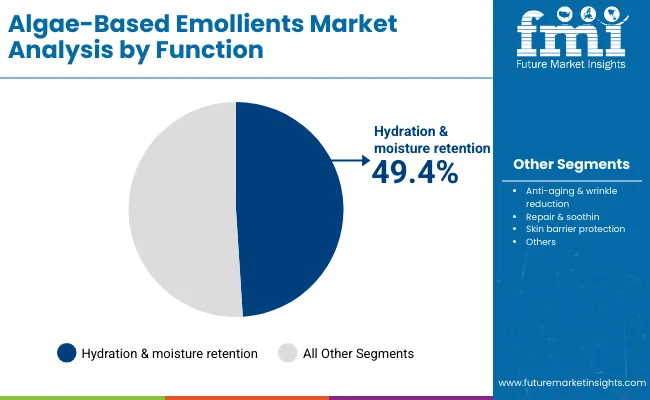

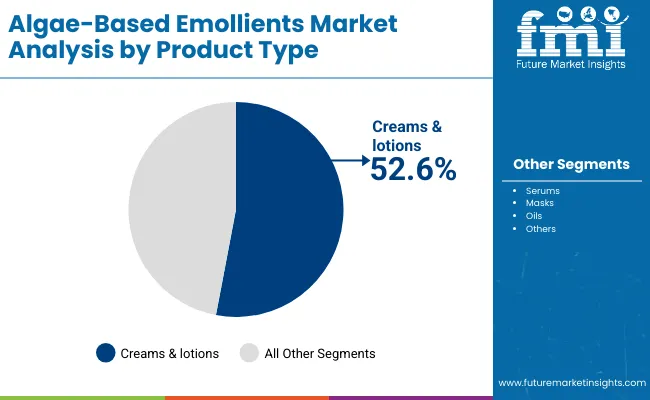

The market is segmented by function, product type, channel, claim, and region. Functions include hydration & moisture retention, anti-aging & wrinkle reduction, repair & soothing, and skin barrier protection, highlighting the skincare outcomes driving adoption. Product type classification covers creams & lotions, serums, masks, and oils to cater to different consumer routines. Based on channel, the segmentation includes e-commerce, pharmacies, specialty beauty stores, and mass retail. Claims encompass natural marine-sourced, vegan, sustainable/eco-friendly, and clean-label, reflecting the rising importance of conscious beauty. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with country-specific emphasis on the USA, China, India, Germany, the UK, and Japan.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Hydration & moisture retention | 49.4% |

| Others | 50.6% |

The hydration & moisture retention segment is projected to contribute 49.4% of the Algae-Based Emollients Market revenue in 2025, maintaining its lead as the dominant functional category. This is driven by increasing consumer demand for algae-based formulations that enhance skin hydration, elasticity, and barrier function. The polysaccharides and bioactive compounds present in marine algae are highly effective at binding water molecules, making them a cornerstone ingredient in hydrating skincare lines.

The segment’s growth is also supported by rising awareness of skin health, particularly in urban populations exposed to pollution and stress that cause dryness. Premium skincare brands are prioritizing hydration-focused product innovation, particularly in creams, lotions, and serums, that deliver visible results. As clean-label and vegan trends expand, algae-based hydration formulations are increasingly integrated into both mass-market and luxury portfolios. The hydration & moisture retention segment is expected to remain the backbone of algae-based emollient adoption globally.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams & lotions | 52.6% |

| Others | 47.4% |

The creams & lotions segment is forecasted to hold 52.6% of the market share in 2025, led by its extensive application in daily skincare routines. These formats are favored for their versatility, ease of use, and ability to deliver consistent hydration and barrier protection, making them suitable for a wide consumer base across demographics and regions.

The segment’s dominance is reinforced by their distribution through e-commerce and pharmacy channels, ensuring accessibility and repeat purchase. Innovations in lightweight textures, algae-enriched moisturizing complexes, and multifunctional day and night creams have accelerated adoption. As consumers increasingly seek sustainable and natural alternatives, creams & lotions incorporating algae-based emollients are expected to continue their dominance in the market.

| Channel Segment | Market Value Share, 2025 |

|---|---|

| E-commerce | 54.7% |

| Others | 45.3% |

The e-commerce segment is projected to account for 54.7% of the Algae-Based Emollients Market revenue in 2025, establishing it as the leading distribution channel. This channel is preferred due to its ability to offer consumers direct access to premium, vegan, and sustainable algae-based formulations, coupled with convenience and personalization.

The rise of digital-first skincare brands, subscription-based models, and online-exclusive launches has accelerated adoption. Global beauty players and niche marine-focused brands alike are leveraging e-commerce platforms to expand reach and highlight sustainability credentials. With strong consumer reliance on online reviews, social media campaigns, and influencer partnerships, the e-commerce segment is expected to retain its leading role and drive incremental revenues across regions.

Drivers

Rising Demand for Natural and Marine-Sourced Ingredients

The biggest driver for the Algae-Based Emollients Market is the growing consumer preference for natural, sustainable, and marine-sourced ingredients in skincare and personal care products. Consumers, especially in North America and Europe, are increasingly skeptical of synthetic ingredients due to concerns over skin sensitivity, long-term health effects, and environmental impact. Algae, rich in polysaccharides, minerals, fatty acids, and antioxidants, has become synonymous with hydration, barrier protection, and anti-aging efficacy. This demand is reinforced by premium beauty brands like La Mer, Biotherm, and Blue Lagoon Iceland, which market algae as their hero ingredient. With clean-label, vegan, and eco-friendly positioning gaining traction, algae-based emollients are seen as both efficacious and ethical, which drives adoption across creams, lotions, serums, and oils.

Expansion of E-commerce and Direct-to-Consumer Channels

The second key driver is the strong growth of e-commerce, which already accounts for over 54% of global sales in 2025. Online platforms have enabled niche and indie algae-based brands like Haeckels and Osea Malibu to directly engage with eco-conscious consumers, bypassing traditional retail barriers. E-commerce also allows targeted digital campaigns, personalized product recommendations, and subscription-based delivery models, which enhance consumer loyalty and repeat purchase behavior. Moreover, the pandemic accelerated digital beauty adoption, and the trend has not only persisted but strengthened with the integration of AR/VR-based virtual try-ons and AI skin assessments. The accessibility of algae-based products across global e-commerce platforms makes this a major growth accelerator for the market.

Restraints

High Production and Extraction Costs of Algae-Based Ingredients

One of the strongest restraints for the Algae-Based Emollients Market is the high cost associated with algae cultivation, harvesting, and bioactive extraction. Compared to plant oils or synthetic emollients, algae-based actives require advanced biotechnological processes, often involving photobioreactors, cold-press extraction, or fermentation to preserve nutrient density. These processes are capital- and energy-intensive, making final formulations relatively more expensive. For brands targeting mass-market consumers in emerging economies, this price premium limits adoption. While luxury and dermocosmetic brands can absorb these costs, scaling algae-based emollients to mid-tier price points remains a major challenge.

Supply Chain Instability and Regional Dependency

The availability of high-quality marine algae is often geographically concentrated, with Iceland, France, and East Asian coastal regions being key sources. Fluctuations in oceanic ecosystems due to climate change, overharvesting, or marine pollution can disrupt supply. Regulatory hurdles related to sustainable sourcing and marine biodiversity protection also add complexity for manufacturers. Brands that rely heavily on single-source algae extracts risk supply interruptions, leading to inconsistent product availability and increased costs. This restraint particularly impacts emerging indie brands that lack the diversified sourcing networks of larger conglomerates.

Key Trends

Shift Toward Sustainable and Clean-Label Marine Beauty

One of the defining trends in the Algae-Based Emollients Market is the alignment with sustainability, eco-friendly packaging, and clean-label formulations. Consumers are no longer just seeking hydration or anti-aging efficacy; they want transparency in sourcing, carbon-neutral production, and biodegradable packaging. Brands like REN Clean Skincare and Elemis emphasize recyclability and ocean-safe formulations, while startups are innovating with zero-waste packaging concepts. This sustainability-first positioning enhances brand credibility, particularly among younger demographics such as Gen Z and Millennials, who drive demand for vegan and natural cosmetics. This trend is expected to deepen, with algae not only marketed for skin benefits but also as a symbol of ocean conservation.

Rapid Growth in Asia-Pacific, Led by China and India

The Asia-Pacific region, particularly China (15.2% CAGR) and India (17% CAGR), is emerging as the fastest-growing hotspot for algae-based emollients. Rising disposable incomes, urbanization, and beauty awareness have created strong demand for premium and functional skincare products. Chinese consumers are increasingly drawn to marine-inspired beauty trends influenced by both K-beauty and luxury European labels. In India, Ayurveda-inspired claims combined with vegan and sustainable algae formulations are accelerating adoption. As multinational brands launch algae-based lines tailored to Asian skin concerns such as pollution protection, hydration, and brightening the region is expected to outpace traditional strongholds like North America and Europe in growth momentum.

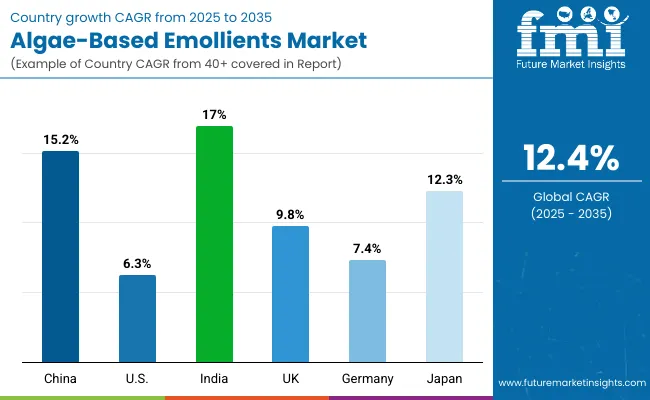

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.2% |

| USA | 6.3% |

| India | 17.0% |

| UK | 9.8% |

| Germany | 7.4% |

| Japan | 12.3% |

Between 2025 and 2035, the Algae-Based Emollients Market will see the strongest expansion in Asia, with India (17.0% CAGR) and China (15.2% CAGR) leading the charge. This growth is driven by rising middle-class spending power, increasing awareness of marine-sourced beauty, and strong consumer preference for hydration and brightening solutions. In India, algae-based emollients are gaining momentum within Ayurveda-inspired, vegan, and clean-label positioning, which resonates with health-conscious buyers. In China, the influence of K-beauty and premium global brands has spurred adoption of creams and serums that emphasize hydration and anti-aging, supported by e-commerce platforms like Tmall and JD.com. Together, China and India are set to reshape global demand patterns, accounting for a rapidly expanding share of the total market by 2035.

In contrast, mature markets such as the USA (6.3% CAGR), Germany (7.4% CAGR), and UK (9.8% CAGR) will continue to grow at steady but moderate rates, largely driven by premiumization, sustainability, and eco-labeling. The USA market is buoyed by hydration & moisture retention products, but its lower CAGR reflects market maturity and brand saturation. In Europe, the UK shows stronger momentum compared to Germany, reflecting higher consumer interest in vegan, sustainable, and marine-sourced beauty lines.

Meanwhile, Japan (12.3% CAGR) represents a balanced growth profile, where algae-based emollients benefit from the country’s longstanding tradition of marine-inspired beauty rituals and the popularity of functional skincare formats like serums and masks. Overall, while Western markets remain important revenue contributors, the future growth engine of the market will decisively shift toward Asia-Pacific.

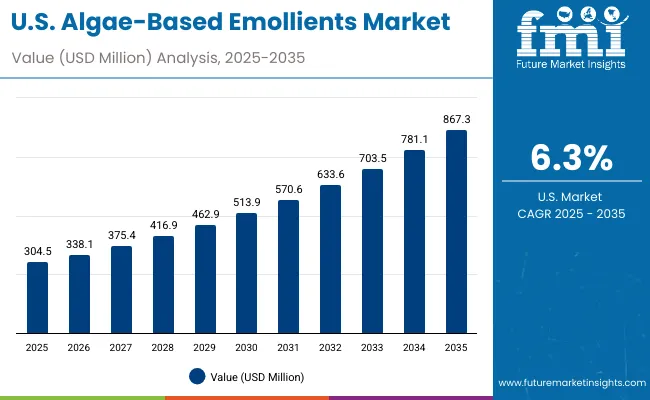

| Year | USA Algae-Based Emollients Market (USD Million) |

|---|---|

| 2025 | 304.5 |

| 2026 | 338.1 |

| 2027 | 375.4 |

| 2028 | 416.9 |

| 2029 | 462.9 |

| 2030 | 513.9 |

| 2031 | 570.6 |

| 2032 | 633.6 |

| 2033 | 703.5 |

| 2034 | 781.1 |

| 2035 | 867.3 |

The Algae-Based Emollients Market in the United States is projected to grow at a CAGR of 6.3%, led by strong demand for hydration & moisture retention products and clean-label skincare. Premium brands such as La Mer and Biotherm are fueling interest in marine-sourced formulations, while indie brands like Osea Malibu are expanding vegan and eco-conscious positioning. Pharmacies and e-commerce channels dominate, reflecting consumer trust in clinically proven skincare and the convenience of online distribution. Growth is further supported by rising awareness of skin barrier protection among urban populations.

The Algae-Based Emollients Market in the United Kingdom is expected to grow at a CAGR of 9.8%, supported by demand for vegan, sustainable, and eco-labeled beauty products. British consumers are increasingly drawn to brands that emphasize natural marine-sourced ingredients and environmental responsibility. Companies like Elemis and Haeckels are leveraging this trend by introducing algae-based creams, serums, and oils that align with eco-conscious values. Online retail is thriving, while specialty beauty stores in urban centers are expanding algae-focused product portfolios.

India is witnessing rapid growth in the Algae-Based Emollients Market, which is forecast to expand at a CAGR of 17.0% through 2035. Consumer preference for Ayurveda-inspired, natural, and vegan formulations is boosting algae integration into skincare lines. Domestic and international players are positioning algae emollients as hydration and brightening solutions, resonating with Indian consumers’ demand for multifunctional products. E-commerce penetration into tier-2 and tier-3 cities is accelerating market reach, while pharmacies and specialty stores are tapping into growing urban middle-class demand.

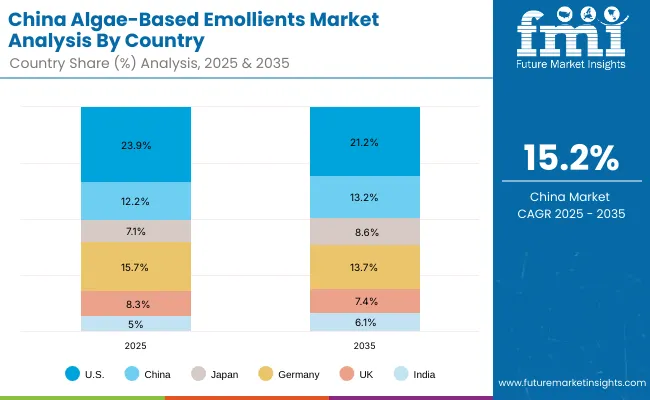

The Algae-Based Emollients Market in China is expected to grow at a CAGR of 15.2%, one of the highest globally. This momentum is driven by the influence of K-beauty, premium European brands, and the increasing focus on hydration and anti-aging. Domestic companies are innovating with algae-based serums and creams, supported by large-scale e-commerce platforms such as Tmall and JD.com. Municipal interest in sustainable marine ingredients and rising urban middle-class disposable incomes are accelerating demand. Premium skincare is thriving, but affordable algae-based creams are also gaining traction in the mass retail segment.

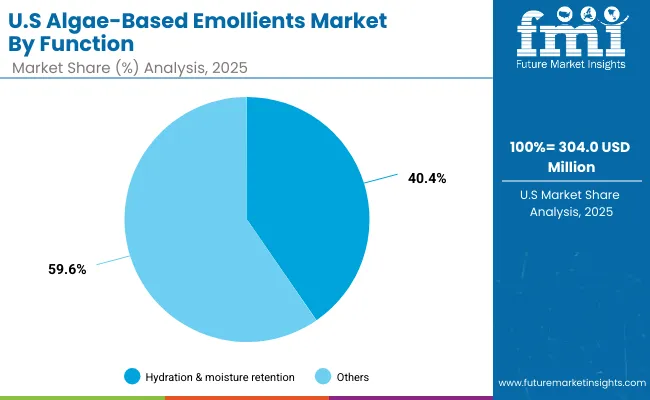

| Function Segment | Market Value Share, 2025 |

|---|---|

| Hydration & moisture retention | 40.4% |

| Others | 59.6% |

The Algae-Based Emollients Market in the United States is valued at USD 304.0 million in 2025, with hydration & moisture retention leading at 40.4%, followed by other functions at 59.6%. The dominance of hydration solutions reflects USA consumers’ focus on moisture balance, skin barrier protection, and long-term anti-aging routines. These attributes resonate strongly in a mature market where premium skincare purchases are anchored in clinically validated results. With algae extracts rich in polysaccharides and antioxidants, hydration-oriented creams, lotions, and serums have become core to consumer daily regimens.

This advantage positions hydration as a primary growth driver across mass retail, pharmacy, and online channels. Anti-aging and repair-oriented formulations remain competitive but are generally integrated into multi-functional hydration products. The convergence of clean-label claims, vegan positioning, and e-commerce subscription models further strengthens adoption. By 2035, hydration-based algae emollients will remain a cornerstone of USA beauty portfolios, sustaining growth despite market maturity.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams & lotions | 49.7% |

| Others | 50.3% |

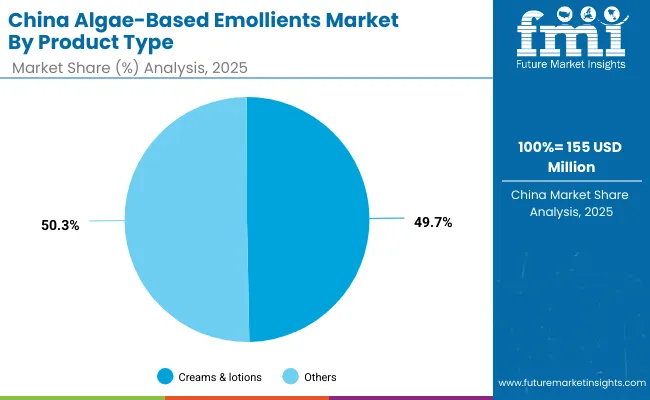

The Algae-Based Emollients Market in China is valued at USD 155 million in 2025 (estimated from global share), with creams & lotions leading at 49.7%, followed by other product types at 50.3%. The dominance of creams & lotions is tied to Chinese consumers’ preference for multifunctional hydration and brightening solutions, which align with both daily care and long-term skin wellness goals. K-beauty influence and premium European imports reinforce algae-based creams as an aspirational choice, particularly among urban middle-class consumers.

This advantage positions creams & lotions as a key gateway to marine-based formulations, while serums and masks are expected to see faster growth in premium segments. Affordable launches by local brands are helping democratize access to algae actives across wider demographics. E-commerce channels such as Tmall and JD.com are accelerating brand visibility, enabling rapid adoption in tier-2 and tier-3 cities. By 2035, China’s algae-based skincare will outpace mature markets, driven by domestic innovation and global brand collaborations.

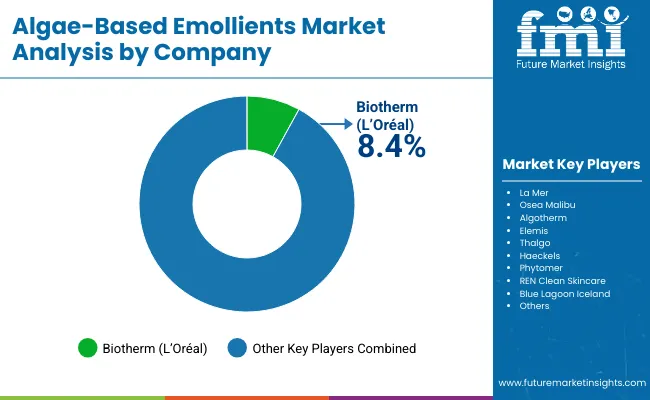

The Algae-Based Emollients Market is moderately fragmented, with global luxury brands, clean-label innovators, and niche marine specialists competing across diverse application areas. Global leaders such as Biotherm, La Mer, and Blue Lagoon Iceland hold significant share, driven by strong brand equity, premium positioning, and heritage in marine-based skincare. Their strategies emphasize hydration, anti-aging efficacy, and ocean-inspired storytelling that resonates with affluent consumers in North America, Europe, and Asia. Indie and mid-sized brands such as Osea Malibu, Haeckels, and Algotherm are capitalizing on vegan, sustainable, and clean-label claims. Their strength lies in community-driven marketing, eco-conscious formulations, and niche targeting across pharmacies and specialty stores. This segment is accelerating adoption in younger demographics seeking authenticity and environmental responsibility.

Specialized providers like Thalgo, Phytomer, and REN Clean Skincare focus on application-specific innovation ranging from spa-based algae therapies to clinical dermocosmetic solutions. Their adaptability to local preferences and partnerships with salons, spas, and wellness clinics enhance visibility beyond traditional retail. Competitive differentiation is shifting away from luxury branding alone toward integrated sustainability ecosystems, including biodegradable packaging, carbon-neutral sourcing, and recurring subscription-based sales. As algae-based emollients gain traction in both premium and mass segments, the market will reward players capable of combining efficacy with transparency, scalability, and environmental stewardship.

Key Developments in Algae-Based Emollients Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,274.2 million |

| Function | Hydration & moisture retention, Anti-aging & wrinkle reduction, Repair & soothing, Skin barrier protection |

| Product Type | Creams & lotions, Serums, Masks, Oils |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, Mass retail |

| Claim | Natural marine-sourced, Vegan, Sustainable/eco-friendly, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Biotherm, La Mer, Osea Malibu, Algotherm, Elemis, Thalgo, Haeckels, Phytomer, REN Clean Skincare, Blue Lagoon Iceland |

| Additional Attributes | Dollar sales by function and product type, adoption trends in hydration and anti-aging skincare, rising demand for vegan and natural marine-sourced claims, segment-specific growth in creams & lotions, e-commerce and pharmacy channel expansion, integration of clean-label and eco-friendly packaging, regional trends influenced by K-beauty and Ayurveda, and innovations in algae-derived emollient complexes. |

The Algae-Based Emollients Market is estimated to be valued at USD 1,274.2 million in 2025.

The market size for the Algae-Based Emollients Market is projected to reach USD 4,082.9 million by 2035.

The Algae-Based Emollients Market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in the Algae-Based Emollients Market are creams & lotions, serums, masks, and oils.

In terms of product type, creams & lotions segment to command 52.6% share in the Algae-Based Emollients Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emollients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Emollients in Personal Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA