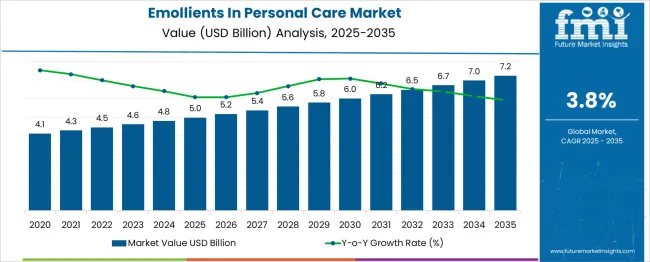

The global emollients in personal care market is likely to expand from USD 5 billion in 2025 to approximately USD 7.2 billion by 2035, recording an absolute increase of USD 2.25 billion over the forecast period. This translates into a total growth of 45.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.8% between 2025 and 2035. Market size is expected to grow by nearly 1.45X during the same period, supported by increasing consumer demand for natural and eco-efficient personal care products, growing awareness of skin health benefits, and expanding cosmetics industry worldwide.

Between 2025 and 2030, the emollients in the personal care market are projected to expand from USD 5 billion to USD 5.96 billion, resulting in a value increase of USD 0.98 billion, which represents 43.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing consumer preference for eco-efficient and natural personal care ingredients, expanding awareness of green chemistry benefits, and growing demand for bio-based emollients across skincare and cosmetic applications.

From 2030 to 2035, the market is forecast to grow from USD 5 billion to USD 7.2 billion, adding another USD 1.27 billion, which constitutes 56.4% of the ten-year expansion. This period is expected to be characterized by advancements in green emollient technologies, expansion of eco-efficient sourcing initiatives, and development of innovative bio-based formulations that meet evolving consumer preferences for environmentally responsible personal care products.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 5 billion |

| Forecast Value in (2035F) | USD 7.2 Billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

Market expansion is being supported by increasing consumer awareness of ingredient safety and environmental impact, driving demand for natural and eco-efficient emollients that provide effective skin conditioning without synthetic additives. Growing emphasis on clean beauty trends and transparency in cosmetic formulations is creating opportunities for green emollients derived from renewable sources that meet consumer expectations for natural personal care products.

The expanding global cosmetics and personal care industry is driving sustained demand for diverse emollient solutions that enhance product texture, sensory properties, and skin benefits across skincare, haircare, and color cosmetic applications. Regulatory developments promoting eco-efficient ingredients and environmental responsibility are encouraging personal care manufacturers to adopt green emollients that support corporate eco-friendly goals while maintaining product performance standards.

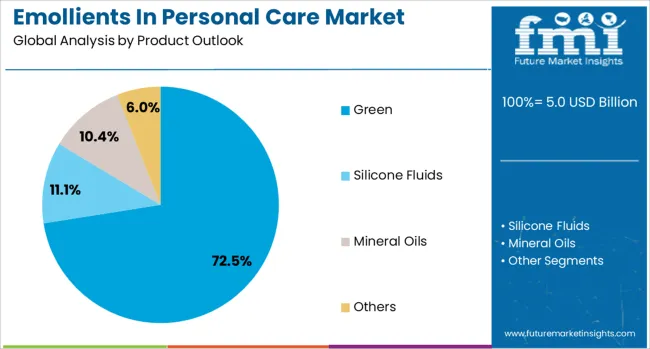

The market is segmented by product type and region. By product type, the market is divided into green emollients (including bio-based esters, bio-based alkanes, vegetable oils, and others), silicone fluids (including cyclomethicones, dimethicones, and others), mineral oils (including petrolatum, paraffinum liquid, synthetic hydrocarbons such as isododecane and isohexadecane), and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Green emollients are projected to account for 72.5% of the Emollients in the Personal Care market in 2025. This leading share is supported by increasing consumer preference for natural and eco-efficient ingredients, growing awareness of environmental benefits, and expanding availability of high-performance bio-based emollient alternatives. Green emollients include bio-based esters, bio-based alkanes, vegetable oils, and other naturally derived ingredients that provide effective skin conditioning while meeting clean beauty standards. The segment benefits from supportive regulatory frameworks and growing corporate eco-efficient commitments across the personal care industry.

The emollients in the personal care market are advancing steadily due to increasing consumer demand for natural ingredients and growing awareness of eco-efficient beauty practices. However, the market faces challenges including higher costs of green emollients compared to conventional alternatives, supply chain complexities for bio-based raw materials, and technical performance requirements that must be maintained while transitioning to eco-efficient formulations. Innovation in green chemistry and eco-efficient sourcing continues to influence emollient technology development.

The growing emphasis on eco-efficiency is driving the development of sophisticated bio-based emollients that match or exceed the performance characteristics of conventional synthetic alternatives while providing superior environmental profiles. Advanced biotechnology and green chemistry processes enable the production of high-purity natural emollients with consistent quality, enhanced stability, and optimized sensory properties. These innovative solutions support clean beauty formulations while meeting demanding performance requirements across diverse personal care applications.

Modern emollient manufacturers are implementing comprehensive eco-efficient initiatives that encompass renewable feedstock sourcing, environmentally responsible production processes, and circular economy principles that minimize waste and environmental impact. Advanced supply chain management systems enable traceability, quality assurance, and eco-efficient sourcing verification that support corporate eco-efficiency goals while ensuring reliable ingredient availability for personal care applications.

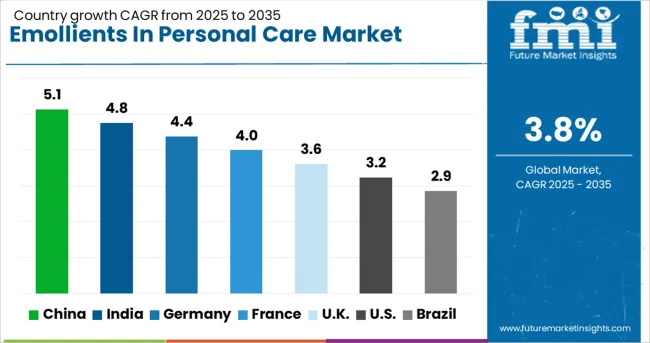

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4% |

| United Kingdom | 3.6% |

| United States | 3.2% |

| Brazil | 2.9% |

The emollients in personal care market is growing across global markets, with China leading at a 5.1% CAGR through 2035, driven by expanding cosmetics industry and increasing domestic production capabilities for both conventional and green emollients, followed by India at 4.8% supported by growing middle-class population and expanding domestic cosmetics manufacturing sector, while Germany records 4.4% emphasizing green chemistry development and premium applications, France grows at 4% with luxury cosmetics industry strength and natural beauty trend adoption, the United Kingdom shows 3.6% growth focusing on natural beauty and eco-efficient innovation, the United States expands at 3.2% with market diversification and clean beauty trends. Brazil maintains 2.9% growth, supported by natural resource advantages and the development of the personal care market, which creates diverse opportunities for emollient suppliers across multiple consumer segments and application categories.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from emollients in personal care in China is projected to exhibit the highest growth rate with a CAGR of 5.1% through 2035, driven by expanding cosmetics industry, growing consumer spending on personal care products, and increasing domestic production capabilities for both conventional and green emollients. The country's comprehensive manufacturing infrastructure and large consumer market are creating substantial demand for diverse emollient solutions across skincare, haircare, and color cosmetic applications. Major chemical companies are establishing production facilities to serve domestic and international markets.

Revenue from emollients in personal care in India is expanding at a CAGR of 4.8%, supported by growing middle-class population, increasing awareness of personal care benefits, and expanding domestic cosmetics manufacturing sector that drives demand for quality emollient ingredients. The country's traditional knowledge of natural ingredients and growing modern cosmetics industry are creating opportunities for both conventional and green emollient applications. International and domestic companies are investing in local production and sourcing capabilities.

Demand for emollients in personal care in Germany is projected to grow at a CAGR of 4.4%, supported by leadership in green chemistry development, established cosmetics industry, and strong consumer preference for high-quality, eco-efficient personal care products that utilize advanced emollient technologies. German companies are implementing comprehensive sustainability initiatives that encompass green emollient development and responsible sourcing practices. The market is characterized by emphasis on innovation, quality, and environmental responsibility.

Demand for emollients in personal care in France is expanding at a CAGR of 4.0%, driven by established luxury cosmetics industry, strong consumer appreciation for quality ingredients, and growing emphasis on natural and eco-efficient beauty products that require high-performance emollient solutions. French companies are developing innovative emollient formulations that combine traditional expertise with modern sustainability requirements. The market benefits from comprehensive regulatory frameworks and sophisticated consumer preferences.

Demand for emollients in personal care in the U.K. is growing at a CAGR of 3.6%, supported by strong natural beauty market, established personal care industry, and growing consumer preference for eco-efficient and ethically sourced ingredients that support responsible beauty practices. British companies are implementing comprehensive sustainability initiatives that prioritize green emollients and transparent sourcing practices. The market is characterized by focus on innovation and consumer education.

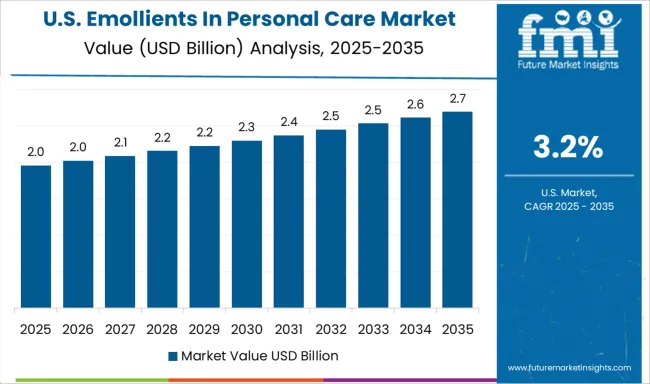

Demand for emollients in personal care in the U.S. is expanding at a CAGR of 3.2%, driven by diverse consumer markets, established cosmetics industry, and growing clean beauty trend that creates demand for natural and eco-efficient emollient solutions across multiple product categories. Large personal care companies are implementing comprehensive ingredient sustainability programs that prioritize green emollients and responsible sourcing. The market benefits from advanced research capabilities and diverse consumer preferences.

Revenue from emollients in personal care in Brazil is growing at a CAGR of 2.9%, driven by abundant natural resources, growing personal care market, and increasing consumer awareness of ingredient benefits that support demand for both conventional and green emollient solutions. The country's biodiversity and agricultural capabilities provide opportunities for indigenous emollient ingredient development. Companies are leveraging natural resource advantages to develop eco-efficient emollient solutions.

The emollients in personal care market is growing across global markets, with China leading at a 5.1% CAGR through 2035, driven by expanding cosmetics industry and increasing domestic production capabilities for both conventional and green emollients, followed by India at 4.8% supported by growing middle-class population and expanding domestic cosmetics manufacturing sector. Germany records 4.4% emphasizing green chemistry development and premium applications, while France grows at 4.0% with luxury cosmetics industry strength and natural beauty trend adoption, the United Kingdom shows 3.6% growth focusing on natural beauty and eco-efficient innovation, the United States expands at 3.2% with market diversification and clean beauty trends, and Brazil maintains 2.9% growth supported by natural resource advantages and personal care market development.

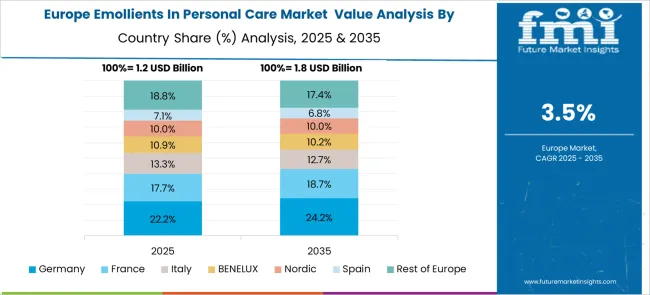

The European emollients in personal care market is characterized by advanced regulatory frameworks and sophisticated consumer preferences that promote high-quality, eco-efficient ingredient solutions across diverse personal care applications. Countries across the region are implementing comprehensive sustainability initiatives that encompass green emollient development, responsible sourcing practices, and circular economy principles that minimize environmental impact while maintaining product performance standards. The market benefits from established cosmetics industry clusters, comprehensive research infrastructure, and strong consumer awareness of ingredient quality and environmental responsibility that creates long-term growth opportunities for innovative emollient solutions.

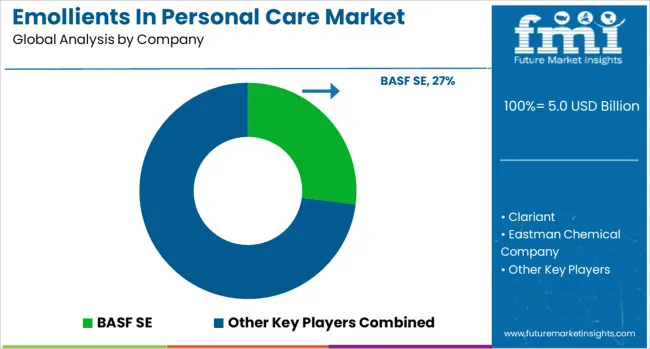

The emollients in personal care market is defined by competition among specialty chemical companies, personal care ingredient suppliers, and eco-efficient technology developers offering diverse emollient solutions for cosmetic and personal care applications. Companies are investing in green chemistry development, eco-efficient sourcing initiatives, product innovation, and application support to deliver high-performance emollient ingredients that meet evolving consumer preferences for natural and eco-efficient personal care products. Strategic partnerships, technology licensing, and sustainability certifications are central to strengthening product portfolios and market positioning.

Major emollient suppliers maintain comprehensive production capabilities and extensive technical support services that enable personal care manufacturers to develop innovative formulations with superior sensory properties and consumer appeal. BASF SE, Germany-based, offers comprehensive emollient portfolios emphasizing sustainability and performance optimization across diverse personal care applications. Clariant provides specialty emollient solutions with focus on natural ingredients and eco-efficient sourcing practices.

Eastman Chemical Company delivers advanced emollient technologies with emphasis on bio-based alternatives and environmental responsibility. The Lubrizol Corporation, Covestro AG, and Evonik Industries AG offer specialized emollient formulations with comprehensive technical support and application development capabilities. Hallstar and Croda International PLC provide innovative emollient solutions emphasizing natural ingredients, eco-efficient sourcing, and superior performance characteristics that meet demanding personal care application requirements across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.2 billion |

| Product Type | Green (Bio-based Esters, Bio-based Alkanes, Vegetable Oils, Others), Silicone Fluids (Cyclomethicones, Dimethicones, Others), Mineral Oils (Petrolatum, Paraffinum Liquid, Synthetic Hydrocarbons), Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | BASF SE; Clariant; Eastman Chemical Company; The Lubrizol Corporation; Covestro AG; Evonik Industries AG; Hallstar; Croda International PLC |

| Additional Attributes | Dollar sales by product type, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established chemical companies and specialty ingredient suppliers, adoption of green chemistry and eco-efficient manufacturing processes, integration with clean beauty trends and natural ingredient preferences, innovations in bio-based emollient technologies and eco-efficient sourcing practices, and development of high-performance natural alternatives that meet demanding personal care application requirements. |

The global emollients in personal care market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the emollients in personal care market is projected to reach USD 7.2 billion by 2035.

The emollients in personal care market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in emollients in personal care market are green, _biobased esters, _biobased alkanes, _vegetable oils, _others, silicone fluids, _cyclomethicones, _dimethicones, _others, mineral oils, _petrolatum, _paraffinum liquid (mineral oil), _synthetic hydrocarbons (isododecane and isohexadecane) and others.

In terms of , segment to command 0.0% share in the emollients in personal care market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emollients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Algae-Based Emollients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Invar Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Road Test Instruments Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Driving Technology Solution Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Infertility Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA