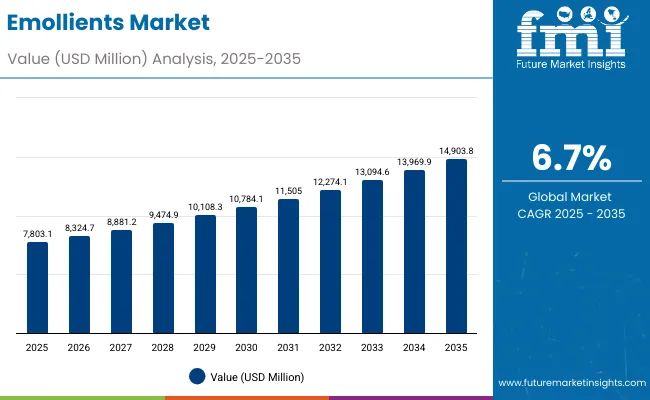

The Emollients Market is expected to record a valuation of USD 7,803.1 million in 2025 and USD 14,903.8 million in 2035, with an increase of USD 7,100.7 million, which equals a growth of 91% over the decade. The overall expansion represents a CAGR of 6.7% and a near 2X increase in market size.

Emollients Market Key Takeaways

| Metric | Value |

|---|---|

| Emollients Market Estimated Value in (2025E) | USD 7,803.1 million |

| Emollients Market Forecast Value in (2035F) | USD 14,903.8 million |

| Forecast CAGR (2025 to 2035) | 6.70% |

During the first five-year period from 2025 to 2030, the market increases from USD 7,803.1 million to USD 10,784.1 million, adding USD 2,981.0 million, which accounts for 42% of the total decade growth. This phase records steady adoption in facial skincare, body creams, and sun care, driven by consumer need for moisturization and advanced barrier protection. Ester oils dominate this period as they cater to over 34% of demand due to their compatibility and sensory benefits across multiple personal care applications.

The second half from 2030 to 2035 contributes USD 4,119.7 million, equal to 58% of total growth, as the market jumps from USD 10,784.1 million to USD 14,903.8 million. This acceleration is powered by rising cosmeceutical demand, OTC pharma-grade emollients, and clean-label natural butters gaining traction in both premium and mass skincare lines. Pre-blended bases and encapsulated systems gain wider adoption for efficiency and stability, while waxy solids and cream/gel bases expand their role in multifunctional formulations. Regional growth in Asia, especially China and India, elevates the global profile of natural oils and herbal emollients as mainstream categories.

From 2020 to 2024, the Emollients Market grew steadily, driven by personal care and cosmetic adoption. During this period, the competitive landscape was dominated by multinationals, with top suppliers controlling key innovation in chemistry categories such as ester oils and hydrocarbons. Market leadership was tied to performance attributes including stability, spreadability, and cost efficiency, while natural butters remained niche. Services and novel delivery formats were limited, and value creation primarily centered around traditional free-form emollients.

Demand for emollients will expand to USD 7,803.1 million in 2025, and the revenue mix will shift as pre-blended and encapsulated systems grow beyond 25% share over the decade. Traditional ester oil leaders face competition from suppliers offering bio-based and multifunctional formulations. Companies are repositioning portfolios to include plant-derived oils, biodegradable ingredients, and high-purity fatty alcohols. Competitive advantage is now moving away from pure chemistry supply to integrated solutions, sensory-modifying blends, and scalable delivery systems that serve both mass personal care and cosmeceutical markets.

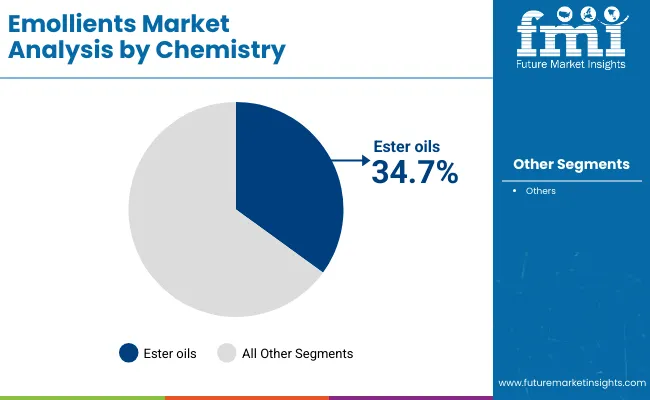

Advances in formulation science have expanded the role of emollients from simple moisturizers to multifunctional agents that enhance texture, spreadability, and skin barrier protection. Ester oils dominate due to their sensory appeal and broad compatibility, while natural butters and oils are gaining momentum with clean beauty positioning. The increasing prevalence of skin dryness, premature aging, and pollution-driven sensitivity has intensified demand for high-performing moisturization solutions.

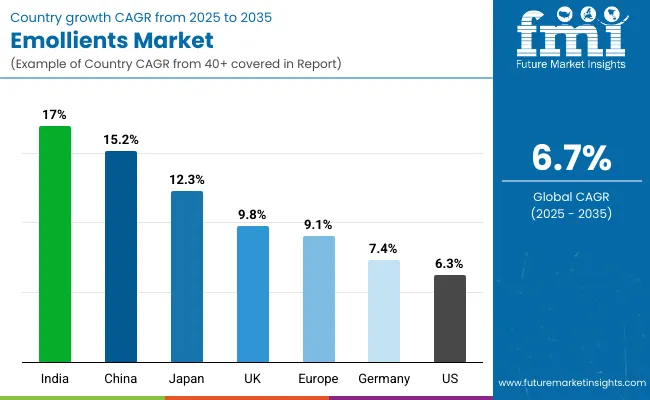

Expansion in personal care and cosmeceuticals is driving innovation, with growing use of free form and pre-blended bases for faster product launches. Encapsulation technologies further enable controlled release and improved stability in sunscreens and OTC pharma-grade skincare. India and China are emerging as high-growth markets with CAGR rates of 17.0% and 15.2% respectively, reflecting rising income levels and wider consumer access to premium skincare. Developed markets like the USA and Europe remain innovation-driven hubs, integrating sustainability, vegan formulations, and dermatological validation as major growth levers.

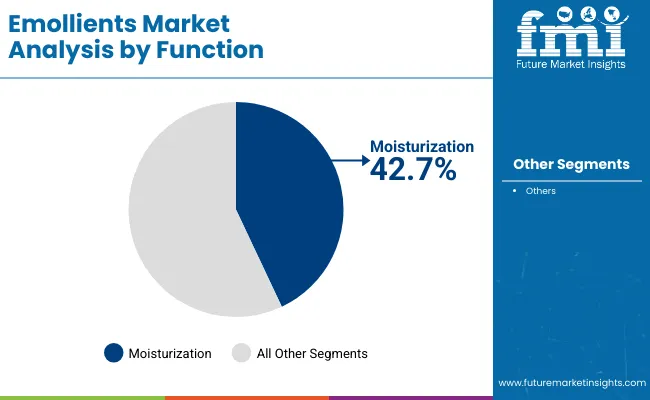

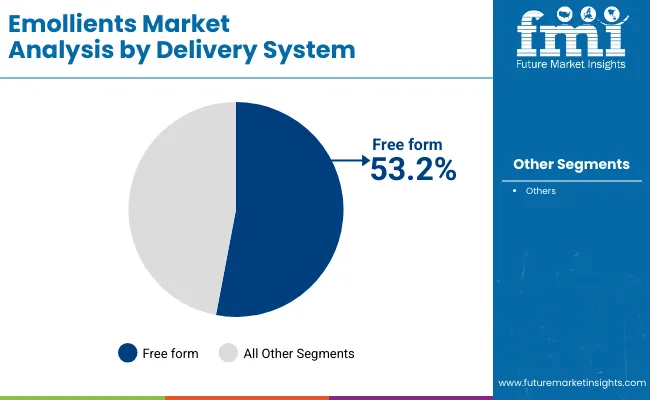

The market is segmented by chemistry, function, delivery system, physical form, application, end use, and geography. Chemistry includes ester oils, hydrocarbons, fatty alcohols, and natural butters and oils, representing the essential formulation base. Functions span moisturization, skin barrier protection, texture enhancement, and slip & spreadability. Delivery systems comprise free form, pre-blended bases, and encapsulated designs. Physical forms range from liquid oils and waxy solids to cream/gel bases. Applications cover facial skincare, body lotions and creams, hair conditioners, and sun care. End uses include personal care brands, cosmeceuticals, and pharmaceutical OTC. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Chemistry | Value Share% 2025 |

|---|---|

| Ester oils | 34.7% |

| Others | 65.3% |

The ester oils segment is projected to contribute 34.70% of the Emollients Market revenue in 2025, maintaining its position as the leading chemistry category. This dominance is attributed to their multifunctional performance, including superior skin-feel, compatibility with diverse formulations, and enhanced oxidative stability. Ester oils are widely used in facial creams, body lotions, and sun care products due to their lightweight texture and ability to impart smooth spreadability.

Their demand is further boosted by formulators who prioritize esters for premium skincare products that balance efficacy with sensory appeal. Continuous innovation has led to ester oils with varying polarity, viscosity, and volatility, enabling targeted applications across cosmeceuticals and OTC products. With growing consumer demand for non-greasy, fast-absorbing formulations, ester oils are expected to remain a cornerstone in the global emollients portfolio throughout the forecast period.

| Function | Value Share% 2025 |

|---|---|

| Moisturization | 42.7% |

| Others | 57.3% |

Moisturization accounts for 42.70% of the Emollients Market in 2025, valued at USD 3,331.92 million, and stands as the most critical function category. Consumer lifestyles marked by exposure to pollution, harsh climates, and increasing prevalence of skin dryness have driven the centrality of moisturization claims in personal care. This demand is especially high in facial skincare and body cream formulations, where hydration is perceived as the primary benefit.

Innovation in humectant-emollient blends, synergistic formulations with natural oils, and dermatologically tested long-lasting hydration solutions is shaping the market. Consumers are increasingly opting for products with validated efficacy in skin barrier repair, supporting the moisturization segment’s leadership. As hydration becomes the foundation of skincare routines globally, this segment is expected to remain the largest functional driver of the market.

| Delivery System | Value Share% 2025 |

|---|---|

| Free form | 53.2% |

| Others | 46.8% |

Free form emollients hold 53.20% of the Emollients Market in 2025, valued at USD 4,151.25 million, making them the leading delivery system. Their ease of incorporation into diverse formulations, from lotions to sun care and hair conditioners, ensures their widespread use across personal care and pharmaceutical OTC applications.

This segment benefits from flexibility, lower formulation costs, and adaptability to varying viscosity and texture requirements. Free form systems also appeal to smaller brands and contract manufacturers due to reduced complexity in supply and blending. While encapsulated and pre-blended formats are gaining traction, free form retains dominance as it continues to serve as the foundation for scalable, efficient formulation in high-volume product lines.

Rising Shift Toward Cosmeceutical-Grade Skincare

The demand for emollients is being accelerated by the growth of cosmeceuticals, which combine cosmetic benefits with pharmaceutical efficacy. Emollients such as ester oils and fatty alcohols are critical in stabilizing bioactive formulations while enhancing skin penetration of active ingredients. For example, moisturization accounts for 42.70% of market share in 2025 (USD 3,331.92 million), and this is increasingly tied to claims such as "clinically proven hydration" and "dermatologist-tested barrier repair." This segment is growing as consumers seek products addressing skin conditions like eczema, sensitivity, and premature aging, driving higher-value formulations and premium emollient adoption.

Emergence of Asia as a High-Growth Consumption Hub

Markets such as China (CAGR 15.2%) and India (CAGR 17.0%) are leading demand, fueled by rising disposable incomes, rapid urbanization, and younger demographics embracing skincare routines. Local brands are expanding with formulations centered on natural butters and oils, which align with regional preferences for plant-based and Ayurvedic-inspired products. The global suppliers are actively localizing portfolios to cater to this demand, with a sharp increase in sourcing and processing of indigenous oils such as shea, mango, and coconut. This regional consumption surge is directly reshaping global capacity allocation and R&D strategies.

Volatility in Natural Raw Material Supply Chains

While natural butters and oils are gaining share, their supply is highly dependent on agricultural yield cycles, weather conditions, and geopolitical factors. This creates pricing volatility that affects both formulators and end-product manufacturers. Shea butter and cocoa butter, for example, face disruptions from West Africa’s climate shifts and socio-economic instabilities. Such fluctuations undermine long-term cost predictability and make large-scale adoption more challenging for mainstream personal care brands, especially in price-sensitive regions.

Regulatory and Sustainability Pressures on Petrochemical-Derived Emollients

Hydrocarbon-based emollients face increasing scrutiny due to environmental and health regulations, particularly in Europe and North America. Restrictions on mineral oil derivatives and stricter requirements for biodegradability are pushing companies to shift portfolios, often at higher reformulation costs. This transition limits the scalability of lower-cost emollients in high-volume mass-market applications, slowing growth for players reliant on legacy hydrocarbon-based solutions.

Acceleration of Encapsulation and Pre-Blended Emollient Systems

While free form emollients still dominate with 53.20% share in 2025 (USD 4,151.25 million), encapsulated systems are rapidly gaining traction for their ability to protect actives, enhance stability, and enable controlled release. Sunscreens, anti-aging creams, and OTC products are increasingly adopting these systems to deliver differentiated claims. Pre-blended bases are also popular among indie and mid-sized brands, offering time-to-market advantages and formulation consistency. This trend reflects a structural shift in how emollients are being delivered, moving from raw inputs to semi-formulated bases.

Premiumization Through Sensory and Multi-Functional Innovation

Ester oils and novel butters are being engineered not just for moisturization but also for sensory effects such as non-greasy feel, quick absorption, and silky finish. Consumer demand for "luxury-like sensorial experiences" in everyday skincare is driving R&D toward multifunctional emollients that combine hydration, barrier repair, and textural enhancement. This is particularly visible in Japan (CAGR 12.3%), where sensory appeal plays a decisive role in consumer purchasing behavior. Global suppliers are responding by launching portfolios of emollients optimized for skin feel, texture, and claim substantiation.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.2% |

| USA | 6.3% |

| India | 17.0% |

| UK | 9.8% |

| Germany | 7.4% |

| Japan | 12.3% |

| Europe | 9.1% |

China and India are set to be the fastest-growing markets for emollients, with CAGRs of 15.2% and 17.0% respectively between 2025 and 2035. This surge is driven by rising disposable incomes, expanding middle-class populations, and a strong cultural emphasis on skincare routines. In India, urbanization and increased awareness of dermatological health are fueling demand for moisturization and barrier-protection formulations, with natural oils and butters resonating strongly due to Ayurvedic and plant-based traditions.

China, on the other hand, is witnessing accelerated adoption of premium and cosmeceutical-grade products, supported by a thriving e-commerce ecosystem and consumer preference for multifunctional skincare. Both markets are attracting significant investments from multinational suppliers who are localizing product portfolios and expanding partnerships with regional brands to capture this momentum.

Developed economies continue to provide stability and innovation-led growth in the emollients market. The USA, with a 6.3% CAGR, remains a hub for advanced formulation development, particularly in OTC pharmaceutical skincare and high-performance moisturizers, with ester oils holding strong adoption in personal care. Europe, growing at 9.1%, is shaped by regulatory drivers around sustainability and clean-label formulations, leading to increased use of bio-based esters and fatty alcohols.

Within Europe, Germany (7.4%) is focused on dermocosmetic solutions with strong clinical validation, while the UK (9.8%) shows rapid traction for vegan and cruelty-free product claims. Japan, with a 12.3% CAGR, emphasizes sensory and textural innovations, ensuring emollients that deliver luxury-like feel while maintaining high efficacy. Collectively, these regions highlight a dual-speed market dynamic where Asia leads growth by volume and Europe/North America anchor growth by innovation and premiumization.

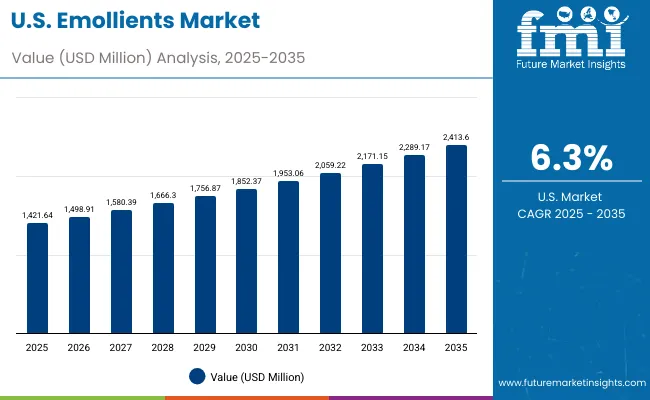

| Year | USA Emollients Market (USD Million) |

|---|---|

| 2025 | 1421.64 |

| 2026 | 1498.91 |

| 2027 | 1580.39 |

| 2028 | 1666.30 |

| 2029 | 1756.87 |

| 2030 | 1852.37 |

| 2031 | 1953.06 |

| 2032 | 2059.22 |

| 2033 | 2171.15 |

| 2034 | 2289.17 |

| 2035 | 2413.60 |

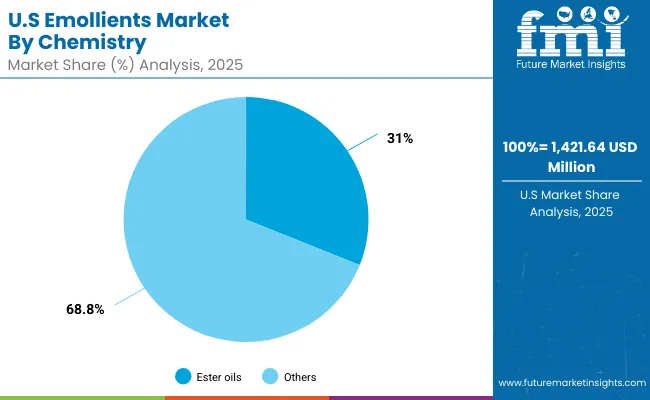

The Emollients Market in the United States is projected to grow at a CAGR of 6.3% from 2025 to 2035, supported by the steady adoption of advanced skincare and OTC formulations. Facial moisturizers and body creams remain the most significant contributors, with ester oils accounting for 31% of the USA chemistry segment in 2025 (USD 443.55 million). Dermatology-focused products are gaining traction, especially in anti-aging and barrier-repair applications. Growth is also being driven by rising demand for multifunctional emollients in sunscreens, where texture, spreadability, and skin-feel improvements are key. Digital-first beauty brands and cosmeceutical players are actively shaping the USA market by pushing innovation around encapsulated and bio-based emollients.

The Emollients Market in the United Kingdom is forecast to expand at a CAGR of 9.8% through 2035. Demand is largely driven by strong consumer preference for vegan, cruelty-free, and sustainable skincare solutions. Natural butters and oils are gaining popularity, especially in body care and artisanal formulations marketed as "clean beauty." The country’s thriving personal care startup ecosystem and government-backed sustainability initiatives are accelerating adoption of biodegradable and plant-derived emollients. Premiumization is evident in facial care, with moisturizers and anti-aging creams integrating ester oils and specialty blends for sensorial enhancements.

India is projected to grow at the fastest CAGR globally at 17.0% between 2025 and 2035. Rising middle-class incomes, rapid urbanization, and growing adoption of skincare routines in tier-2 and tier-3 cities are fueling expansion. Body lotions, fairness creams, and herbal-based moisturizers are leading categories, with natural butters and plant oils preferred due to cultural familiarity with Ayurvedic solutions. Multinationals are partnering with domestic brands to localize offerings, while educational campaigns are expanding awareness of skincare science. Cosmeceutical demand is also on the rise, with urban consumers increasingly opting for barrier-protecting and dermatologist-approved products.

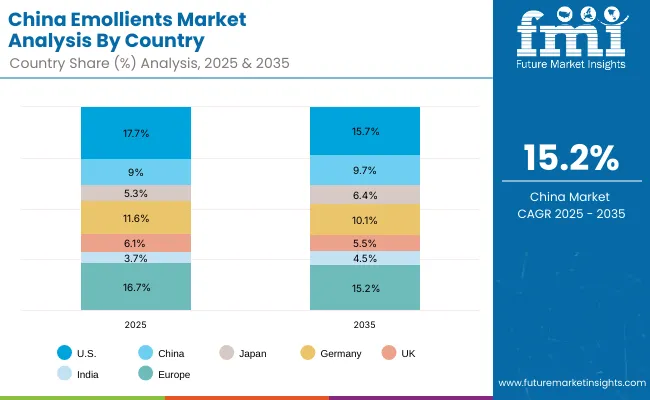

| Countries | 2025 Share (%) |

|---|---|

| USA | 17.7% |

| China | 9.0% |

| Japan | 5.3% |

| Germany | 11.6% |

| UK | 6.1% |

| India | 3.7% |

| Europe | 16.7% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 15.7% |

| China | 9.7% |

| Japan | 6.4% |

| Germany | 10.1% |

| UK | 5.5% |

| India | 4.5% |

| Europe | 15.2% |

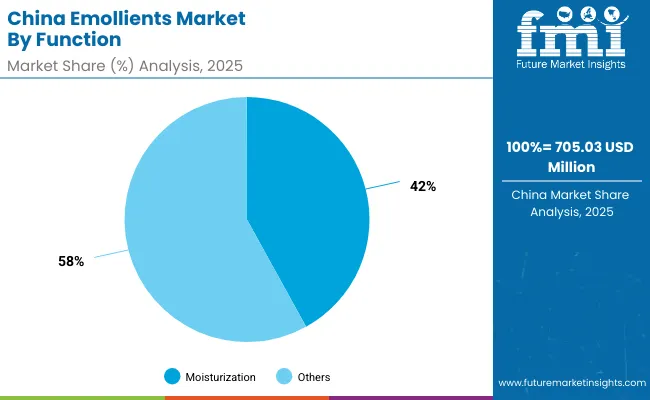

The Emollients Market in China is projected to grow at a CAGR of 15.2%, the second-highest globally. Expansion is driven by premium skincare, cosmeceuticals, and the rising demand for multifunctional products that combine hydration with whitening and anti-aging benefits. In 2025, moisturization leads the function segment with 42% share (USD 296.11 million), underscoring the centrality of hydration in Chinese beauty routines. E-commerce platforms are amplifying adoption, as cross-border and domestic brands compete aggressively with clean-label and sensory-enhanced formulations. Affordable yet high-quality emollient-based products from local suppliers are accelerating penetration into mass-market and rural consumer segments.

| USA By Chemistry | Value Share% 2025 |

|---|---|

| Ester oils | 31% |

| Others | 68.8% |

The Emollients Market in the United States is projected at USD 1,421.64 million in 2025, expanding steadily at a CAGR of 6.3% through 2035. Ester oils contribute 31% of the chemistry segment, reflecting their entrenched role in personal care and OTC dermatology formulations. Their multifunctionality spanning moisturization, spreadability, and texture enhancement makes them indispensable in body lotions, facial creams, and sunscreens. Hydrocarbons and fatty alcohols complement the portfolio but face increasing pressure from clean-label regulations, prompting stronger interest in bio-based esters and natural butters.

Growth is further supported by the USA consumer preference for dermatology-backed skincare, especially in barrier-repair and anti-aging products. OTC pharmaceutical categories are expanding, driven by a rising incidence of sensitive skin and eczema, where emollients form the therapeutic backbone. Brands are also responding to demand for multifunctional and sensorially rich formulations that blend performance with eco-conscious sourcing. With encapsulated delivery and hybrid formulations gaining traction, the USA is expected to remain a core innovation hub for the global market.

| China By Function | Value Share% 2025 |

|---|---|

| Moisturization | 42% |

| Others | 58.0% |

The Emollients Market in China is valued at USD 705.03 million in 2025, making up 9.0% of the global market, and is forecast to expand at a CAGR of 15.2% through 2035. Moisturization leads the functional category at 42% share, underscoring hydration as the cornerstone of Chinese skincare routines. Rising consumer sophistication, particularly in urban centers, is fueling demand for multifunctional products that combine moisturization with whitening, anti-aging, and barrier repair.

Digital-first sales channels, particularly cross-border e-commerce, are reshaping the competitive landscape by providing consumers access to both global premium brands and innovative local players. Affordable natural butters and esters produced domestically are expanding accessibility to rural and mass-market consumers. Meanwhile, encapsulated systems are gaining traction in premium sun care and cosmeceutical offerings due to their perceived efficacy and advanced positioning. China’s scale, combined with local manufacturing competitiveness, positions it as a central growth engine for the global emollients industry.

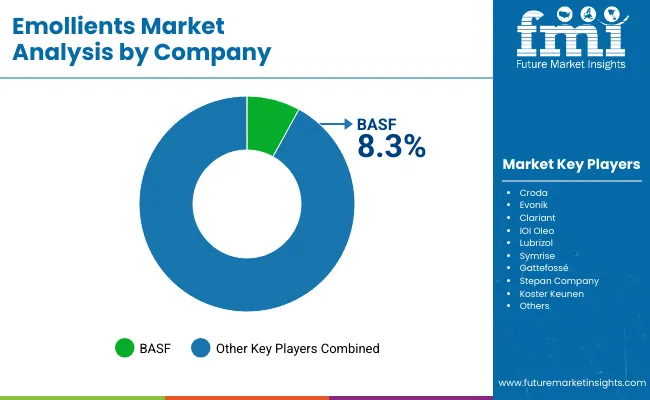

| Global Value Share 2025 | |

| BASF | 8.3% |

| Others | 91.7% |

The Emollients Market is moderately fragmented, with large multinationals and specialized suppliers competing across chemistry types and applications. BASF holds the leading position with 8.3% share in 2025, underpinned by a broad portfolio of ester oils, fatty alcohols, and sustainable emollients tailored for both mass-market and premium segments. Other global leaders such as Croda, Evonik, and Clariant are actively investing in bio-based and multifunctional emollients, aligning portfolios with clean-label and eco-friendly formulations. Their focus extends to delivery innovations like pre-blended and encapsulated systems, designed to accelerate time-to-market for brand partners.

Mid-sized innovators including Symrise, Gattefossé, and IOI Oleo specialize in sensorially enhanced and natural emollients, responding to strong demand in Europe and Asia for premium textures and plant-derived solutions. Regional players like Koster Keunen and Stepan Company leverage niche expertise in waxes and oils to serve specialized applications such as balms and haircare. Competitive differentiation is shifting from raw chemistry supply toward integrated solutions that balance efficacy, sensory performance, and sustainability. With consumer expectations evolving rapidly, success increasingly hinges on ecosystem innovation, supply chain resilience, and partnerships with fast-moving personal care brands.

Key Developments in Emollients Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Chemistry | Ester oils, Hydrocarbons, Fatty alcohols, Natural butters and oils |

| Function | Moisturization, Skin barrier protection, Texture enhancement, Slip & spreadability agents |

| Delivery System | Free form, Pre-blended bases, Encapsulated |

| Physical Form | Liquid oil, Waxy solid, Cream/gel base |

| Application | Facial skincare, Body lotions and creams, Hair conditioners, Sun care |

| End Use | Personal care brands, Cosmeceuticals, Pharmaceutical OTC |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Croda, Evonik, Clariant, IOI Oleo, Lubrizol, Symrise, Gattefossé, Stepan Company, Koster Keunen |

| Additional Attributes | Dollar sales by chemistry type, function, and delivery system; adoption trends in moisturization, barrier protection, and sensorial innovation; rising demand for bio-based and sustainable emollients; sector-specific growth in personal care and cosmeceuticals; expansion of encapsulated and pre-blended delivery formats; regional trends influenced by clean beauty and digital commerce adoption; innovation in ester oil blends, natural butters, and advanced fatty alcohol derivatives. |

The Emollients Market is estimated to be valued at USD 7,803.1 million in 2025.

The market size for the Emollients Market is projected to reach USD 14,903.8 million by 2035.

The Emollients Market is expected to grow at a CAGR of 6.7% between 2025 and 2035.

The key chemistry types in the Emollients Market are ester oils, hydrocarbons, fatty alcohols, and natural butters and oils.

In terms of function, moisturization is projected to command 42.70% share in the Emollients Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emollients in Personal Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae-Based Emollients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA