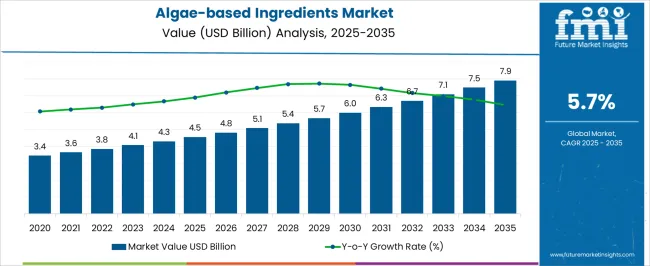

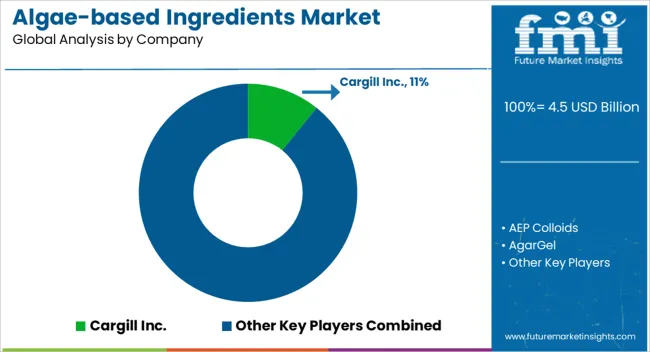

The algae-based ingredients market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 7.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

This steady trajectory reflects increasing applications in food, nutraceuticals, cosmetics, and bio-based materials. Regulatory factors are expected to play a decisive role in shaping the industry’s pace and direction across the forecast horizon. Food safety standards are one of the most influential aspects, as algae-based proteins, lipids, and additives must comply with stringent approvals from agencies such as the US FDA and EFSA in Europe. Regulatory clearance often determines speed-to-market and adoption in mainstream food sectors. Environmental policies encouraging renewable and low-carbon raw materials further strengthen demand, especially in regions that incentivize algae cultivation for reducing resource-intensive farming.

The regulatory scrutiny around production processes, labeling transparency, and allergen assessments introduces compliance costs for producers. Trade policies and harmonized standards also affect global expansion, particularly as algae-derived biofuels and cosmetics penetrate international markets. The balance between supportive environmental regulations and strict food and safety compliance creates both opportunities and cost challenges. The regulatory framework is expected to ensure consumer trust while encouraging sustainable scaling, making compliance a critical competitive differentiator in the market’s future growth.

| Metric | Value |

|---|---|

| Algae-based Ingredients Market Estimated Value in (2025 E) | USD 4.5 billion |

| Algae-based Ingredients Market Forecast Value in (2035 F) | USD 7.9 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The algae based ingredients market represents a growing part of the global bio based ingredients sector, valued for its versatility across food, feed, nutraceuticals, and personal care. Within the natural food ingredients market, it accounts for about 5.4%, supported by rising consumer demand for plant derived alternatives. In the dietary supplements sector, it secures 4.7%, reflecting the use of algae derived omega 3, proteins, and antioxidants. Across the animal feed additives industry, the segment holds 3.9%, highlighting its role in enhancing nutrition and sustainability. Within the cosmetics and personal care ingredients market, it maintains 3.3%, driven by algae based extracts for skin and hair applications. In the pharmaceutical excipients category, algae ingredients represent 2.8%, underscoring growing research in drug delivery and therapeutic formulations. Recent developments in this market have emphasized scaling cultivation technologies, diversifying applications, and strengthening supply chains.

Advances in photobioreactors and open pond systems have improved productivity, while innovations in biorefinery approaches have enhanced extraction of high value compounds. Food manufacturers are increasingly incorporating algae proteins and hydrocolloids into functional products to meet clean label preferences. Partnerships between algae producers and cosmetics brands are expanding, focusing on natural active ingredients with anti-aging and hydration properties. In aquaculture and animal nutrition, algae based feeds are gaining traction as alternatives to fishmeal and synthetic additives. The sustainability concerns have accelerated research in carbon capturing algae systems, linking environmental benefits with industrial application. These trends indicate how functionality, innovation, and eco efficiency are shaping the market.

The algae-based ingredients market is experiencing notable expansion, driven by rising consumer demand for plant-based and sustainable raw materials across food, cosmetics, pharmaceuticals, and nutraceuticals. Industry publications and product innovation announcements have highlighted algae’s versatility, offering high-value compounds such as proteins, amino acids, lipids, and pigments. The shift toward natural ingredients in response to clean-label trends has further accelerated adoption in both developed and emerging markets.

Additionally, advancements in algae cultivation technologies, including photobioreactors and controlled open-pond systems, have improved production efficiency and yield consistency. Strategic investments from biotechnology firms and cross-industry collaborations are enhancing product development pipelines, while supportive regulatory frameworks are facilitating commercial adoption.

With increasing awareness of algae’s nutritional and functional benefits, the market outlook remains positive, supported by a growing portfolio of high-quality, application-specific ingredients.

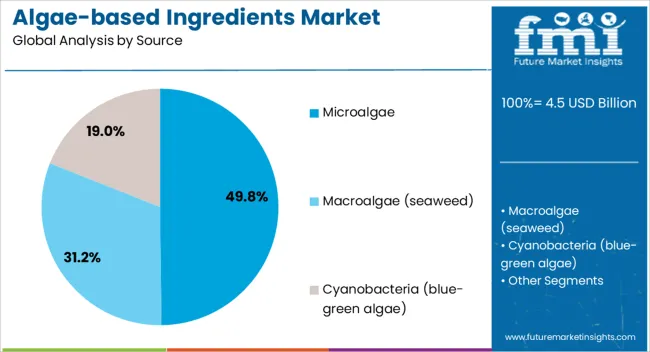

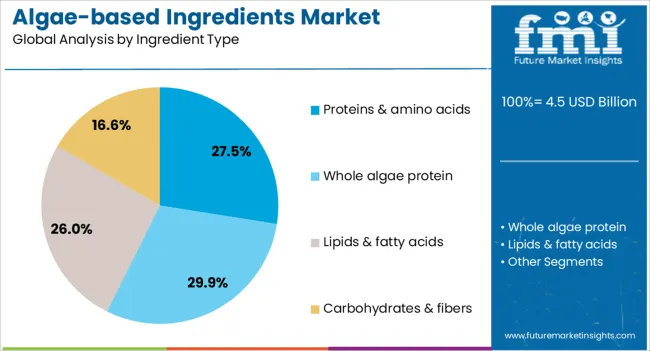

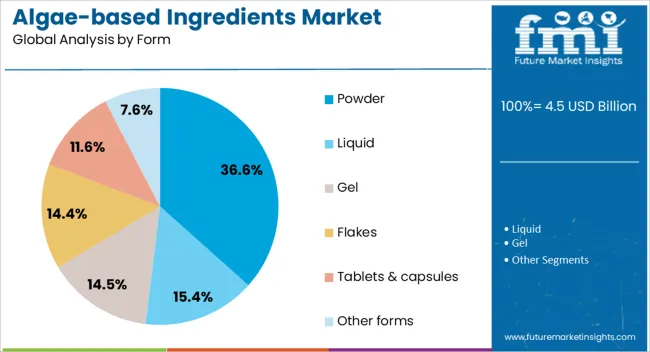

The algae-based ingredients market is segmented by source, ingredient type, form, production method, application, end use industry, and geographic regions. By source, algae-based ingredients market is divided into microalgae, macroalgae (seaweed), and cyanobacteria (blue-green algae). In terms of ingredient type, algae-based ingredients market is classified into proteins & amino acids, whole algae protein, lipids & fatty acids, carbohydrates & fibers, pigments & antioxidants, vitamins & minerals, whole algae ingredients, and other ingredient types. Based on form, algae-based ingredients market is segmented into powder, liquid, gel, flakes, tablets & capsules, and other forms. By production method, algae-based ingredients market is segmented into open pond systems, closed systems, photobioreactors, fermenters, other closed systems, hybrid systems, wild harvesting (for macroalgae), and other production methods. By application, algae-based ingredients market is segmented into food & beverage, dietary supplements, animal feed, cosmetics & personal care, pharmaceuticals, biofuels & bioenergy, and other applications. By end use industry, algae-based ingredients market is segmented into food & beverage industry, nutraceutical industry, animal feed industry, cosmetics & personal care industry, pharmaceutical industry, energy industry, and other end use industries. Regionally, the algae-based ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The microalgae segment is projected to contribute 49.8% of the algae-based ingredients market revenue in 2025, maintaining its leadership within the source category. This growth has been supported by microalgae’s high concentration of bioactive compounds, including proteins, omega-3 fatty acids, antioxidants, and pigments, which have found extensive application across multiple industries. Controlled cultivation methods have enabled consistent quality and year-round production, improving supply reliability. Consumer perception of microalgae as a premium, nutrient-dense source has strengthened its market positioning, especially in dietary supplements and functional foods. Furthermore, ongoing research into novel strains with enhanced nutrient profiles has expanded the range of commercial applications, reinforcing the segment’s competitive advantage.

The proteins & amino acids segment is forecasted to account for 27.5% of market revenue in 2025, driven by the increasing demand for alternative protein sources in food and nutritional products. Algae-derived proteins and amino acids have gained recognition for their high digestibility, complete amino acid profile, and allergen-free characteristics. These attributes align closely with consumer preferences for plant-based and functional foods that support active lifestyles and health-conscious diets. Additionally, sports nutrition brands and specialized medical nutrition products have incorporated algae-based proteins to meet clean-label and sustainability requirements. As production technologies advance and economies of scale reduce costs, the Proteins & Amino Acids segment is expected to see wider adoption in mainstream markets.

The powder segment is projected to hold 36.6% of algae-based ingredients market revenue in 2025, maintaining its position as the preferred form. This dominance is attributed to powder’s extended shelf life, ease of transportation, and versatility in formulation. Powdered algae ingredients are easily incorporated into beverages, bakery items, supplements, and skincare formulations without altering the product’s stability. Manufacturers have favored the powder format for its compatibility with existing production processes and its ability to deliver concentrated nutrient content. Moreover, consumer-facing products containing algae powders benefit from simpler storage and handling, which supports both retail and bulk distribution channels. With continuous innovation in drying and processing technologies, the Powder segment is expected to strengthen its role as a primary delivery form in the algae-based ingredients market.

The market has been expanding rapidly as industries explore bio-based alternatives for nutrition, cosmetics, pharmaceuticals, and industrial applications. Algae serve as rich sources of proteins, lipids, polysaccharides, antioxidants, vitamins, and minerals, making them highly versatile in formulation. Microalgae and macroalgae are being increasingly studied and commercialized due to their capacity for fast growth, carbon sequestration, and low land requirement compared with traditional crops. Applications in food and beverages, dietary supplements, animal feed, biofuels, and personal care have been gaining strong traction. Market expansion is further supported by advancements in cultivation technologies and bioprocessing methods.

Food and nutraceutical applications have been key drivers of the algae-based ingredients market, with spirulina, chlorella, and omega-3-rich algae oils gaining particular importance. These ingredients are widely recognized for their protein density, essential fatty acids, and antioxidant properties. Algae-derived omega-3 fatty acids are increasingly being preferred over fish oil due to concerns over marine resource depletion and contamination issues. Microalgae powders are also incorporated into snacks, bakery items, and beverages to enhance their nutritional profile. Growing consumer preference for plant-based proteins has further increased the demand for algae ingredients, particularly in vegan and vegetarian diets. Nutraceutical firms have been introducing algae-based supplements in capsule, tablet, and powder formats. This dynamic reflects how algae-based ingredients are increasingly integrated into mainstream food and wellness sectors, offering functional and clean-label benefits.

Personal care and cosmetic industries have embraced algae-based ingredients due to their bioactive properties, such as hydration, anti-aging, and antioxidant effects. Extracts from macroalgae are being widely incorporated into skincare creams, serums, shampoos, and sunscreens, enhancing product efficacy and natural appeal. The presence of polysaccharides and pigments provides soothing, protective, and revitalizing benefits, while carotenoids and chlorophylls add natural coloring and UV protection. Companies have been leveraging algae-derived components to differentiate their portfolios with sustainable and high-performance offerings. Consumer inclination toward natural and marine-based cosmetic ingredients has been fueling this trend. The algae cultivation requires fewer land resources, making it appealing to industries seeking eco-friendly raw materials. These developments indicate how algae-based ingredients are shaping the growth of the personal care sector while broadening their role in high-value formulations.

Beyond food and cosmetics, algae-based ingredients are being deployed in industrial and animal feed applications, reflecting the breadth of their utility. In aquaculture, algae serve as critical feed additives due to their rich protein and lipid content, improving fish growth, immunity, and pigmentation. Algae biomass is also used for livestock feed to enhance nutritional value and reduce dependence on synthetic additives. In industrial applications, algae are being explored as sources for bioplastics, biofertilizers, and wastewater treatment agents due to their nutrient-absorbing capacity. The use of algal biofuels is under continued research and pilot-scale projects, though cost remains a barrier. The wide functional potential of algae underscores their role not only as nutritional additives but also as sustainable industrial raw materials, offering a diverse spectrum of opportunities across sectors.

Technological innovation has been central to the algae-based ingredients market, particularly in cultivation systems, bioreactors, and harvesting methods. Advances in photobioreactors and open pond systems have improved yields, while genetic engineering techniques are enhancing productivity and bioactive compound concentration. Downstream processing innovations have also lowered extraction costs, making commercial deployment more viable. However, significant challenges persist in achieving large-scale production with consistent quality. Factors such as contamination, seasonal variability, and high capital investment limit scalability. The energy requirements for drying and extraction contribute to higher production costs. Market growth will therefore rely on continued innovation in low-cost cultivation and efficient processing technologies. These efforts will be essential for unlocking the full commercial potential of algae-based ingredients and expanding their integration into global industries.

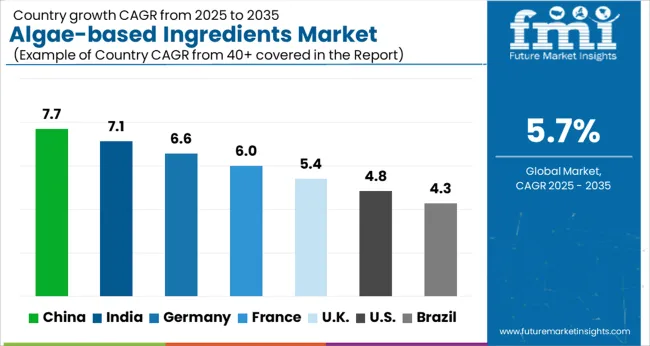

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

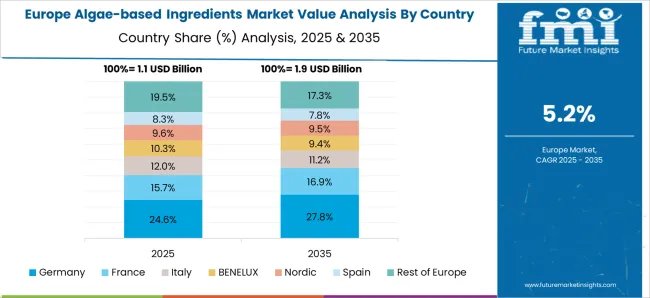

The market is witnessing consistent growth as applications in food, nutraceuticals, cosmetics, and pharmaceuticals gain importance. China leads with a growth rate of 7.7%, supported by large scale cultivation and industrial scale processing facilities. India records 7.1%, driven by expanding dietary supplement demand and investments in marine biotechnology. Germany holds 6.6%, where strong research frameworks and sustainability focused industries foster advanced applications. The United Kingdom secures 5.4%, reflecting moderate uptake in food and personal care sectors. The United States shows 4.8%, where product development and specialized health applications provide growth opportunities. Together, these countries highlight a shift toward natural and functional ingredient where algae serve as a versatile and sustainable source of bioactive compounds. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is anticipated to grow at a CAGR of 7.7%, driven by the rapid expansion of the food and beverage, cosmetics, and pharmaceutical industries. Demand for natural and functional ingredients is influencing manufacturers to increase investments in algae-derived proteins, lipids, and bioactive compounds. Chinese companies are working with research organizations to optimize algae cultivation and improve extraction technologies. Applications in dietary supplements, skincare products, and fortified foods are expanding as consumer awareness of plant-based alternatives grows. The country’s strong biotechnology ecosystem supports scaling of algae-based solutions across commercial sectors. Regulatory encouragement toward alternative proteins and natural additives is also supporting market penetration. China’s role in large-scale algae cultivation positions it as a global supplier in the algae-based ingredients industry.

The market in India is forecast to expand at a CAGR of 7.1%, supported by increasing demand across food, nutraceuticals, and pharmaceuticals. Indian consumers are showing rising preference for plant-derived and natural ingredients, creating opportunities for algae-based proteins, fatty acids, and pigments. Research collaborations are enhancing algae cultivation practices, particularly in coastal regions, to improve yields and reduce costs. Food manufacturers are incorporating algae ingredients into health-oriented products such as fortified drinks, snacks, and dietary supplements. Cosmetics and personal care companies are also exploring algae extracts for skincare and haircare formulations. Government initiatives promoting biotechnology and alternative protein development are reinforcing the market outlook. India’s diverse climatic conditions allow year-round algae cultivation, strengthening its production potential for both domestic and global supply chains.

Germany is expected to grow at a CAGR of 6.6%, reflecting strong momentum from the food and healthcare industries. German companies are advancing algae cultivation and processing technologies, with emphasis on sustainability and resource efficiency. Algae-based proteins, pigments, and omega fatty acids are being integrated into nutritional supplements, bakery items, and specialty beverages. Pharmaceutical and cosmetic companies are exploring algae compounds for antioxidant and anti-inflammatory properties. Government-supported research projects are focused on bioeconomy solutions, with algae considered a key resource for future biobased materials. Partnerships between biotechnology firms and food producers are strengthening commercialization opportunities. The increasing popularity of vegan and health-focused diets is further enhancing the market outlook. Germany’s emphasis on circular economy strategies strengthens adoption of algae-based ingredients.

The market in the United Kingdom is projected to register a CAGR of 5.4%, driven by the rising integration of plant-based and natural additives in consumer products. The food and beverage industry is focusing on algae-derived proteins, lipids, and thickeners to cater to health-conscious and vegan consumers. Skincare and personal care sectors are testing algae extracts for their antioxidant and hydrating properties, expanding commercial applications. Research institutions are collaborating with biotechnology firms to enhance algae cultivation methods suitable for domestic environments. The government’s support for low-carbon and sustainable food production aligns with algae ingredient development. Import reliance is currently significant, but local startups are working on commercial algae farms to meet growing demand. Algae-based ingredients are expected to achieve broader use across dietary and wellness industries.

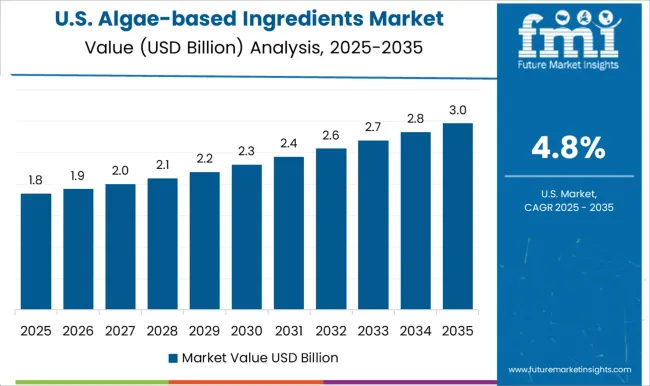

The market in the United States is anticipated to record a CAGR of 4.8%, supported by growing applications in food, nutraceuticals, and pharmaceuticals. Companies are investing in large-scale algae cultivation and bioprocessing technologies to enhance commercial output. Nutritional supplements enriched with omega fatty acids, proteins, and antioxidants are among the fastest-growing applications. The cosmetics industry is adopting algae extracts for anti-aging and skin-nourishing products. Collaborations between biotechnology startups and large food corporations are facilitating innovation and scaling. The regulatory environment is encouraging natural alternatives and clean-label product development, reinforcing algae’s role in mainstream consumer markets. However, production costs remain a limiting factor, prompting investment in advanced cultivation systems. With rising consumer focus on wellness, algae-based ingredients are expected to see steady adoption in the USA

The market is advancing as food, nutraceutical, cosmetic, and pharmaceutical sectors adopt algae-derived components for their functional, nutritional, and sustainable properties. Cargill Inc. remains a global leader by investing in algae-based proteins, omega-3 fatty acids, and specialty ingredients to support health-driven and plant-based product innovation. Corbion has built expertise in microalgae fermentation technologies, enabling tailored solutions for dietary supplements, personal care, and aquaculture nutrition. CP Kelco USA Inc focuses on hydrocolloids sourced from seaweed and algae, supplying stabilizers and texturizers to the food and beverage industry. AEP Colloids, AgarGel, Hispanagar SA, and Marine Hydrocolloids specialize in agar production from red algae, serving confectionery, dairy, microbiological media, and biopharmaceutical applications.

Aliga Microalgae and Taiwan Chlorella Manufacturing Company emphasize high-value microalgae products, particularly chlorella and spirulina, which are in demand as natural colorants, antioxidants, and dietary supplements. Triton is innovating in sustainable algae cultivation, focusing on food-grade and specialty applications. Together, these companies demonstrate how algae-based ingredients are reshaping supply chains with functional, nutritional, and clean-label advantages.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 billion |

| Source | Microalgae, Macroalgae (seaweed), and Cyanobacteria (blue-green algae) |

| Ingredient Type | Proteins & amino acids, Whole algae protein, Lipids & fatty acids, Carbohydrates & fibers, Pigments & antioxidants, Vitamins & minerals, Whole algae ingredients, and Other ingredient types |

| Form | Powder, Liquid, Gel, Flakes, Tablets & capsules, and Other forms |

| Production Method | Open pond systems, Closed systems, Photobioreactors, Fermenters, Other closed systems, Hybrid systems, Wild harvesting (for macroalgae), and Other production methods |

| Application | Food & beverage, Dietary supplements, Animal feed, Cosmetics & personal care, Pharmaceuticals, Biofuels & bioenergy, and Other applications |

| End Use Industry | Food & beverage industry, Nutraceutical industry, Animal feed industry, Cosmetics & personal care industry, Pharmaceutical industry, Energy industry, and Other end use industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill Inc., AEP Colloids, AgarGel, Aliga Microalgae, Bioriginal Food & Science Corp, Corbion, CP Kelco USA Inc, Gino Biotech, Hispanagar SA, Marine Hydrocolloids, Taiwan Chlorella Manufacturing Company, and Triton |

| Additional Attributes | Dollar sales by ingredient type and application, demand dynamics across food, cosmetics, and pharmaceuticals sectors, regional trends in algae cultivation and processing, innovation in extraction methods, nutrient density, and formulation versatility, environmental impact of sustainable sourcing and carbon absorption, and emerging use cases in plant-based nutrition, bioactive compounds, and eco-friendly personal care products. |

The global algae-based ingredients market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the algae-based ingredients market is projected to reach USD 7.9 billion by 2035.

The algae-based ingredients market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in algae-based ingredients market are microalgae, spirulina (arthrospira), chlorella, dunaliella, haematococcus, schizochytrium, nannochloropsis, other microalgae, macroalgae (seaweed), red seaweed (rhodophyta), brown seaweed (phaeophyceae), green seaweed (chlorophyta), other macroalgae, cyanobacteria (blue-green algae), aphanizomenon flos-aquae and other cyanobacteria.

In terms of ingredient type, proteins & amino acids segment to command 27.5% share in the algae-based ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Examining Savory Ingredients Market Share & Industry Leaders

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Perfume Ingredients Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Caramel Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA