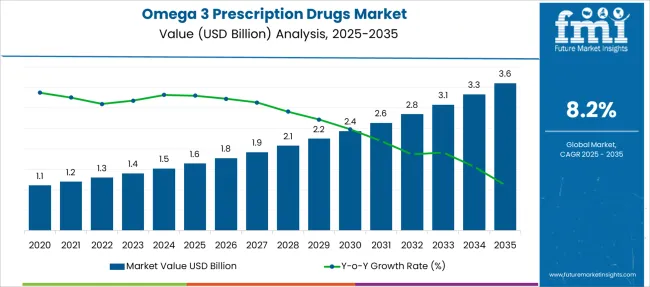

The Omega 3 Prescription Drugs Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

| Metric | Value |

|---|---|

| Omega 3 Prescription Drugs Market Estimated Value in (2025E) | USD 1.6 billion |

| Omega 3 Prescription Drugs Market Forecast Value in (2035F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The Omega 3 Prescription Drugs market is undergoing accelerated growth due to increased recognition of omega 3 fatty acids as critical therapeutic agents in managing chronic inflammatory and cardiovascular conditions. With rising prevalence of lifestyle-related diseases, demand for prescription-based omega 3 formulations has significantly strengthened in clinical practice. Regulatory approvals for specialized drugs that offer purified forms of eicosapentaenoic acid have improved physician confidence in recommending these therapies for high-risk patients.

Market expansion is being further supported by the continuous stream of clinical evidence linking omega 3 intake to improved cardiovascular outcomes, especially among statin-treated individuals. Aging populations, coupled with the global burden of dyslipidemia and triglyceride abnormalities, are also contributing to the rising prescription volumes.

Advancements in drug formulation technology, combined with payer support for evidence-backed therapies, are expected to create sustained opportunities for growth. Overall, strategic emphasis on therapeutic efficacy, quality of life improvement, and long-term prevention of cardiac events is shaping the market’s forward trajectory..

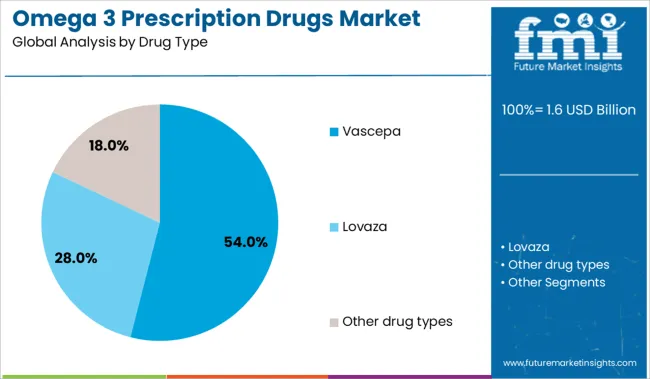

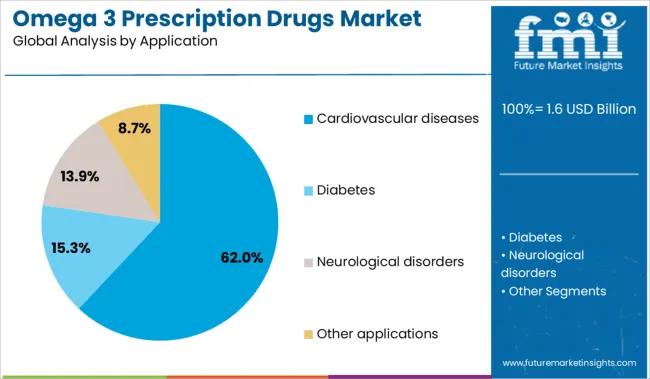

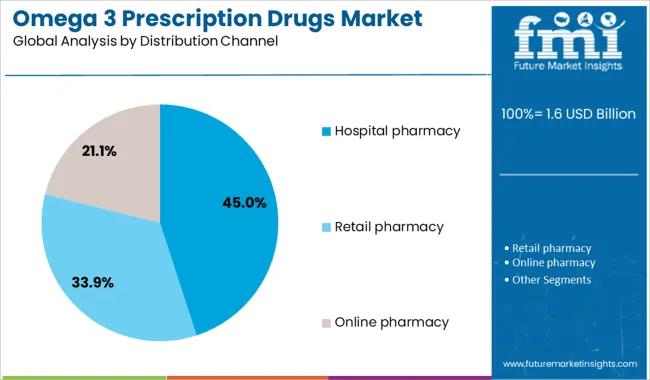

The market is segmented by Drug Type, Application, and Distribution Channel and region. By Drug Type, the market is divided into Vascepa, Lovaza, and Other drug types. In terms of Application, the market is classified into Cardiovascular diseases, Diabetes, Neurological disorders, and Other applications. Based on Distribution Channel, the market is segmented into Hospital pharmacy, Retail pharmacy, and Online pharmacy. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Vascepa drug type segment is anticipated to account for 54% of the Omega 3 Prescription Drugs market revenue share in 2025, making it the leading product in this category. This leadership has been attributed to the drug's high purity profile and its specific indication for reducing cardiovascular risk among patients with elevated triglyceride levels despite statin therapy. Clinical trials have demonstrated significant outcomes in lowering adverse cardiovascular events, which has driven its widespread adoption among cardiologists and primary care physicians.

The differentiated mechanism of action provided by icosapent ethyl has also enhanced its positioning over generic or mixed omega 3 alternatives. Reimbursement support and guideline endorsements have further strengthened its market penetration, especially in high-risk patient populations.

The preference for Vascepa has been supported by its well-documented safety profile and the ability to deliver therapeutic benefits without adversely impacting low-density lipoprotein cholesterol levels. As healthcare providers increasingly prioritize evidence-based prevention strategies, Vascepa’s share is expected to remain strong in the competitive landscape..

The cardiovascular diseases application segment is expected to capture 62% of the Omega 3 Prescription Drugs market revenue share in 2025, emerging as the dominant therapeutic area. This trend has been driven by the escalating global burden of cardiovascular conditions and the clinical need for adjunctive therapies that address residual risk in statin-treated patients. Omega 3 prescription drugs have demonstrated efficacy in reducing triglyceride levels and systemic inflammation, two critical factors contributing to atherosclerosis progression.

Healthcare providers have increasingly prescribed these agents as part of comprehensive lipid management protocols aimed at secondary prevention. Regulatory support for indications tied to major adverse cardiac events has further reinforced utilization in cardiology practices.

The high prevalence of metabolic disorders such as diabetes and obesity has also intensified the demand for cardiovascular protective agents. As long-term cost savings and patient outcome improvements become key priorities for healthcare systems, the cardiovascular segment is expected to maintain its leading role within the market..

The hospital pharmacy segment is projected to hold 45% of the Omega 3 Prescription Drugs market revenue share in 2025, establishing itself as the leading distribution channel. Growth in this segment has been influenced by the increasing rate of inpatient and outpatient prescriptions initiated in hospital settings following acute cardiac events or during routine management of high-risk patients. Hospitals have been the primary setting for initiating evidence-based cardiovascular interventions, including omega 3 therapies prescribed for triglyceride reduction.

The presence of clinical pharmacy teams and access to patient diagnostic profiles have supported appropriate and timely therapy decisions. Additionally, hospital pharmacies maintain streamlined supply chains and adherence to formulary guidelines, ensuring availability of high-quality branded therapies such as Vascepa.

Integration of omega 3 prescription drugs into discharge medication protocols and post-event care plans has further enhanced their uptake in this channel. As hospitals remain central to initiating advanced cardiovascular therapies, this distribution segment is anticipated to retain its strong influence on market growth..

These developments suggest that label expansions and supportive reimbursement strategies are positioning prescription omega‑3 drugs as integral components of lipid management, shifting their use beyond adjunctive supplementation to evidence-based pharmacotherapies.

Cardiovascular Disease prevalence Fuels Drug Demand

The increase in cardiovascular health incidents has been recognized as a key factor boosting demand for prescription omega‑3 products. In 2023, drugs containing EPA, such as Vascepa, were prescribed widely to control elevated triglycerides in patients at risk of heart disease. By 2024, expanded clinical protocols had led to wider adoption in both outpatient and hospital settings for lipid management. In 2025, more patients were being treated under adjunctive therapy plans that addressed cardiovascular risk through triglyceride reduction. These trends indicate that cardiovascular disease burdens are being translated directly into prescription volume increases.

In 2023, expanded prescribing of EPA-rich formulations was seen as a landmark cardiovascular outcome, which encouraged practitioners to use prescription omega‑3 drugs for patients with high triglycerides. During 2024, indications were broadened to include hypertriglyceridemia and nonalcoholic fatty liver disease, with payers increasingly covering novel EPA-only drugs under cardiovascular reimbursement pathways. By 2025, combination regimens featuring EPA alongside statins and PCSK9 inhibitors were being piloted in clinical settings, enabling broader patient adoption

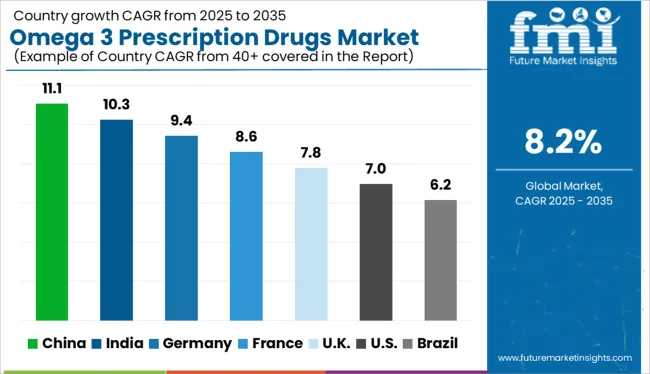

| Country | CAGR |

|---|---|

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The omega 3 prescription drugs market is projected to expand at a global CAGR of 8% from 2025 to 2035. China leads with 11.1%, followed by India at 10.3% and Germany at 9.4%. France records stable growth at 8.6%, while the United Kingdom posts the lowest among the profiled countries at 7.8%. Demand in China and India is shaped by high cardiovascular disease prevalence and expanding statin-adjunct usage. Germany benefits from long-chain omega 3 ethyl ester adoption in lipid clinics. France supports growth through specialist prescriptions for hypertriglyceridemia. The UK shows slower uptake due to generic substitution and cost-effectiveness concerns.

China is projected to lead the omega 3 prescription drugs market with an 11.1% CAGR, backed by rising hyperlipidemia cases and cardiovascular therapy expansion. Prescription omega 3 formulations, including EPA-DHA ethyl esters, are being used in statin-adjunct treatment plans. Hospitals in Tier-1 and Tier-2 cities are adopting branded prescription omega 3s in cardiac rehabilitation protocols. Domestic firms are also scaling up refined fish oil APIs for chronic disease portfolios.

India is forecast to grow its omega 3 prescription drugs market at a 10.3% CAGR, supported by high incidence of triglyceride-linked disorders and lifestyle disease burdens. Cardiologists prescribe prescription-grade omega 3s for metabolic syndrome, especially in Tier-1 clinics. Domestic pharma companies produce cost-effective generic formulations for wide distribution. Nutritional physicians are also endorsing omega 3 prescriptions in diabetic and prediabetic groups.

Germany is projected to expand its omega 3 prescription drugs market at a 9.4% CAGR, driven by medical-grade EPA therapies prescribed for severe hypertriglyceridemia. Physicians frequently prescribe long-chain omega 3s in conjunction with statins to manage residual cardiovascular risk. Hospital formularies increasingly favor prescription omega 3s for patients with intolerance to fibrates or niacin. Local pharmaceutical brands offer purified and odorless variants to improve adherence.

France is forecast to grow at an 8.6% CAGR in the omega 3 prescription market, supported by specialist-driven use in lipid and endocrine disorders. Hospital-based prescriptions dominate due to tightly controlled formulary inclusion criteria. Cardiovascular risk management programs at regional centers include EPA-DHA capsules as a secondary intervention tool. However, over-the-counter omega 3 use overlaps with prescription categories, limiting unique growth.

The United Kingdom is projected to grow its omega 3 prescription drugs market at a 7.8% CAGR, with clinical uptake limited by NHS cost controls and generic competition. While prescribed omega 3s are used in cardiovascular risk reduction, prescriber preference leans toward broader lipid-lowering drugs. Branded omega 3s have limited differentiation from high-quality OTC supplements. Academic trials continue to support therapeutic efficacy in secondary prevention, though reimbursement hurdles remain.

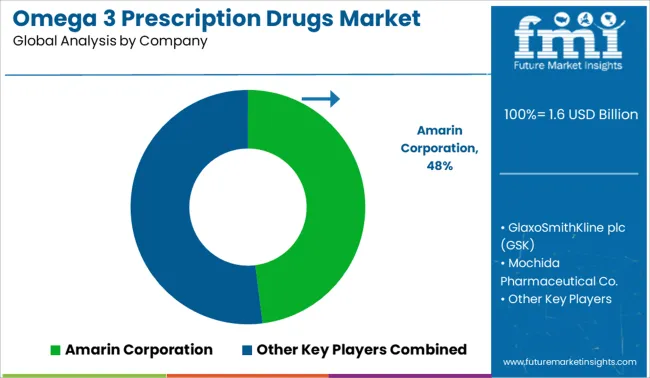

The omega‑3 prescription drugs market is moderately consolidated, led by Amarin Corporation with a significant market share. The company holds a dominant position through its Vascepa® brand, built on prescription-grade icosapent ethyl, supported by cardiovascular outcome data and strong regulatory approvals. Dominant player status is held exclusively by Amarin Corporation. Key players include GlaxoSmithKline plc (GSK), Mochida Pharmaceutical Co., BASF SE, and KD Pharma Group, each offering omega‑3–based therapeutics or active ingredients designed for triglyceride reduction, cardiovascular risk mitigation, and prescription-grade lipid formulations. Emerging players are limited in this segment due to high clinical trial barriers and the need for FDA-compliant formulations. Market demand is driven by the growing burden of cardiovascular disease, wider physician adoption of high-EPA therapies, and increased awareness of prescription omega‑3 efficacy over conventional supplements.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Drug Type | Vascepa, Lovaza, and Other drug types |

| Application | Cardiovascular diseases, Diabetes, Neurological disorders, and Other applications |

| Distribution Channel | Hospital pharmacy, Retail pharmacy, and Online pharmacy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amarin Corporation, GlaxoSmithKline plc (GSK), Mochida Pharmaceutical Co., BASF SE, KD Pharma Group, and Others |

| Additional Attributes | Dollar sales by drug type (EPA-only, EPA + DHA combination), Dollar sales by indication (hypertriglyceridemia, cardiovascular risk management), Trends in ultra‑purity formulations and plant‑based omega‑3 alternatives, Use of capsule vs liquid oral delivery, Growth in adjunctive therapy and preventive cardiovascular health, Regional adoption patterns—North America leading (~45% share), Asia‑Pacific fastest CAGR. |

The global omega 3 prescription drugs market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the omega 3 prescription drugs market is projected to reach USD 3.6 billion by 2035.

The omega 3 prescription drugs market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in omega 3 prescription drugs market are vascepa, lovaza and other drug types.

In terms of application, cardiovascular diseases segment to command 62.0% share in the omega 3 prescription drugs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Omega-6 Market Size and Share Forecast Outlook 2025 to 2035

Omega-9 Market Size and Share Forecast Outlook 2025 to 2035

Omega-3 Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Omega-3 in Animal Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Omega-3 Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Outlook of Omega-3 Pet Supplement by Pet, Type, Form, Application and Other Types Through 2035

Omega 3 Ingredients Market Trends - Health Benefits & Demand 2024 to 2034

Cytomegalovirus Treatment Market Size and Share Forecast Outlook 2025 to 2035

UK Omega 3 Market Analysis – Size, Demand & Forecast 2025-2035

USA Omega 3 Market Insights – Growth, Trends & Industry Outlook 2025-2035

USA Omega-3 Concentrates Market Report – Trends, Demand & Outlook 2025-2035

Algae Omega Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Evaluating Algae Omega Market Share & Key Manufacturers

ASEAN Omega 3 Market Growth - Demand, Innovations & Forecast 2025 to 2035

Europe Omega-3 Concentrates Market Insights – Growth, Demand & Forecast 2025-2035

Europe Omega 3 Market Trends – Size, Share & Forecast 2025-2035

EPA DHA Omega 3 Ingredients Market Size and Share Forecast Outlook 2025 to 2035

UK Algae Omega Market Analysis – Demand, Growth & Forecast 2025-2035

Australia Omega-3 Market Insights – Size, Share & Industry Trends 2025-2035

Bio-Inspired Omega Fatty Acids Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA