The USA Omega 3 market is expected to reach USD 1,904.9 million in 2025 and is projected to experience robust year-over-year growth to reach a total value of USD 4,457.8 million by 2035. This represents a compound annual growth rate (CAGR) of 8.9% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 1,904.9 million |

| Projected USA Value (2035) | USD 4,457.8 million |

| Value-based CAGR (2025 to 2035) | 8.9% |

The USA Omega 3 market is all set for exponential growth in awareness regarding health benefits, such as cardiovascular health improvement, cognitive function, and anti-inflammatory action. Due to wide application beyond dietary supplements in functional foods, pharmaceuticals, and pet nutrition, the market is rapidly diversifying.

Technological innovation in encapsulation and emulsification, meeting the demands of consumers on convenience, taste, and bioavailability, are been effectively exploited.

The increasing demand for sustainable and plant-based sources of Omega 3, such as algal oil, reflects an emphasis on both environmental and ethical concerns. Companies increasingly focus on traceability and quality assurance, spending on certification processes to attract healthy-conscious consumers.

Strategic partnerships and acquisitions are thus supporting market leaders to expand their portfolio and geographic footprint. The USA continues to take the lead globally in innovation through the development of new products of Omega 3 and sustainability practices.

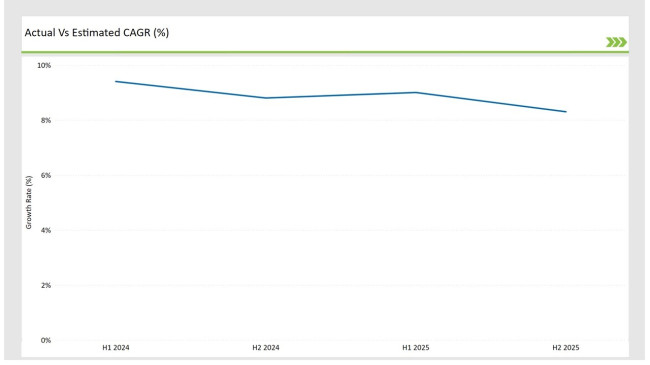

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Omega 3 market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 9.4% |

| H2 Growth Rate (%) | 8.8% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 9.0% |

| H2 Growth Rate (%) | 8.4% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the USA market, the natural food colors sector is predicted to grow at a CAGR of 9.4% during the first half of 2024, with an increase to 8.8% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 9.0% in H1 but is expected to rise to 8.4% in H2.

These figures reflect the evolving consumer demand for Omega 3 products, driven by growing dietary supplement consumption, advancements in sustainable sourcing, and innovations in product formats. This semi-annual breakdown is crucial for refining business strategies and capitalizing on seasonal and demographic trends.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Nordic Naturals launched a new algae-based Omega 3 line targeting vegan consumers. This innovative product line combines high-potency DHA and EPA with sustainable sourcing practices, addressing the growing demand for plant-based alternatives. |

| 2024 | Nature Made expanded its Omega 3 offerings with a high-strength EPA soft gel supplement. The product aims to provide cardiovascular health benefits and cater to consumers prioritizing heart disease prevention. |

| 2024 | NOW Foods partnered with a marine research organization to develop eco-friendly sourcing methods for fish oil. This collaboration emphasizes sustainable practices, ensuring minimal environmental impact and high product quality. |

| 2024 | Nutrigold introduced a kid-friendly gummy Omega 3 supplement. These DHA-enriched gummies support brain development in children and address common nutritional gaps, offering a palatable solution for younger demographics. |

| 2024 | Life Extension unveiled a liquid Omega 3 concentrate designed for improved bioavailability and absorption. Targeting older adults and individuals with swallowing difficulties, the product provides a convenient and effective alternative to capsules. |

Innovations in Delivery Formats

The USA Omega 3 market is witnessing innovation in delivery formats in the form of gummies, powders, and emulsified oils. These innovations make the product tastier, easier to consume, and more compliant with dietary needs. This opens the market to a wider population.

For example, Nutrigold's DHA-enriched gummies cater to children and make Omega 3 supplementation accessible to families. Liquid concentrates by Life Extension are for older adults who want an alternative to the traditional capsules. Functional beverages, emulsified products, expand the applications for furthering the use of Omega 3. The sustainment of demand from both health and convenience levels is ensured with these innovations.

Sustainability Gains Momentum

The USA Omega 3 has engraved sustainability as a core element. Companies began to tread along the path of sustainability in sourcing, such as algal oil production, to abate concerns about the environmental impact.

Algal oil is also rich in DHA and offers a plant-based alternative to fish oil while reducing the exploitation of marine resources. Brands like Nordic Naturals have led this change by ensuring that their practices jibe with consumer expectations of traceability and sustainability.

Environmental awareness is also being shown by companies through steps such as partnerships with marine research organizations, which do the work of strengthening the trust of the consumer and improves the equity of the brand, thus utilizing sustainability as a competitive advantage.

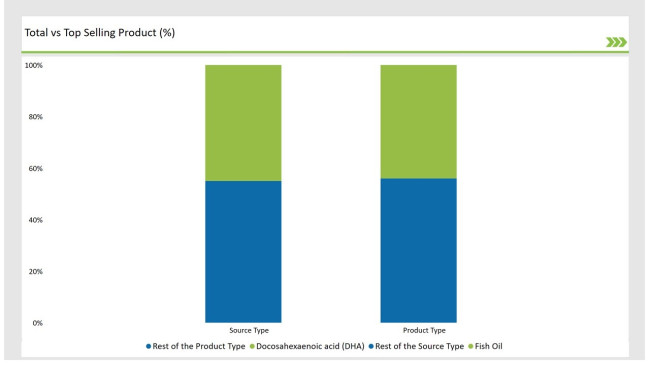

% share of Individual categories by Product Type and Source Type in 2025

DHA shows high growth due to its role in cognitive & cardiovascular health

Docosahexaenoic acid (DHA) is at the top of the list with a 45% share, which is generally known to support cognitive development and heart health. It's used to market DHA-based supplements in pregnant women, children, and seniors.

The 39% for EPA is attributed mainly to its anti-inflammatory aspect, and it also facilitates the management of joint health and inhibits cardiovascular risks. Alpha-linolenic acid or ALA which is derived from plant-based sources such as flaxseed, chia seeds are growing steadily that caters vegan and allergen-conscious consumers seeking Omega-3 supplementation.

Krill Oil gaining share due to its better absorption rate & anti-oxidant benefits

Fish oil is the dominant market share of 51%, as it is of high bioavailability and well-established for improving heart and brain health. Krill oil, of 21% market share, is increasingly finding popularity because it has better absorption rates, besides having more antioxidant properties of astaxanthin.

The rest of the market share falls under algal oil, flaxseed, and chia seeds. These plant-based sources are integral in premium dietary supplement and functional food formulation applications, offering many applications for any consumer group.

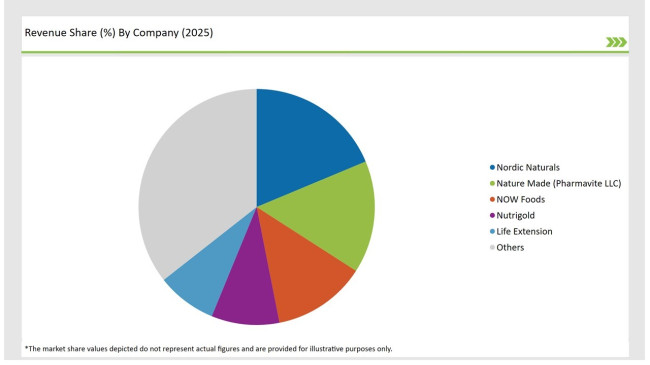

The USA Omega 3 market is moderately concentrated, with Tier-1 companies such as Nordic Naturals, Nature Made, and NOW Foods holding about 47% market share. However, Nordic Naturals differentiates itself through products that focus on algal oil; Nature Made differentiates based on its affordable and accessible Omega 3 supplement.

Tier-2 companies such as Nutrigold and Life Extension account for 30% of the market with products such as gummy-style for kids and high-potency liquid concentrates.

Tier-3 and regional players such as Carlson Labs and GNC Holdings, comprising 23%, cater to the niche markets and localized needs of consumers. The competitive dynamics keep forcing the companies to innovate continuously, making sure that product diversity is created and different consumer preferences are met.

Docosahexaenoic acid (DHA), Eicosapentaenoic acid (EPA), and Alpha-linolenic acid (ALA).

Fish Oil, Krill Oil, Algal Oil, Flaxseed, and Chia Seeds.

Soft Gels/Capsules, Oils, Powders, and Gummies.

Dietary Supplements, Food & Beverages, Pharmaceuticals, and Pet & Animal Feed.

The USA Omega 3 market is expected to grow at a CAGR of 8.9% from 2025 to 2035.

The industry’s value is projected to reach USD 4,457.8 million by 2035.

Key drivers include increasing awareness of Omega 3’s health benefits, advancements in sustainable sourcing, and innovative product formats.

Dietary Supplements lead the applications, with 47% market share in 2025, followed by Food & Beverages at 28%.

Prominent players include Nordic Naturals, Nature Made, NOW Foods, Nutrigold, and Life Extension.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Omega-3 Concentrates Market Report – Trends, Demand & Outlook 2025-2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA