The ASEAN Omega 3 market is set to grow from an estimated USD 520.7 million in 2025 to USD 1,199.1 million by 2035, with a compound annual growth rate (CAGR) of 9.4% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 520.7 million |

| Projected ASEAN Value (2035F) | USD 1,199.1 million |

| Value-based CAGR (2025 to 2035) | 9.4% |

The ASEAN Omega-3 market maintains fast expansion because consumers recognize the medical advantages of DHA and EPA Omega-3 fatty acids. These vital unsaturated fatty acids serve multiple health benefits which include improved cardiovascular health and brain function and complete wellness benefits.

People throughout the ASEAN region are becoming more conscious about their health which drives demand up for omega-3 supplements as well as omega-3-fortified foods.

The market for Omega-3 supplements receives increased demand because consumers now actively pursue preventive healthcare solutions against cardiovascular disease and cognitive decline. The growing aging population of Japan and Singapore generates extra demand for Omega-3 products because senior citizens actively seek supplements to protect their heart and brain systems.

The continuous growth of ASEAN's food and beverage sector induces industry leaders to integrate Omega-3 fatty acids into new dairy products and snacks and functional foods. The increasing consumer trend toward plant-based eating necessitates manufacturers to find new Omega-3 sources from algae oil because of product market innovation.

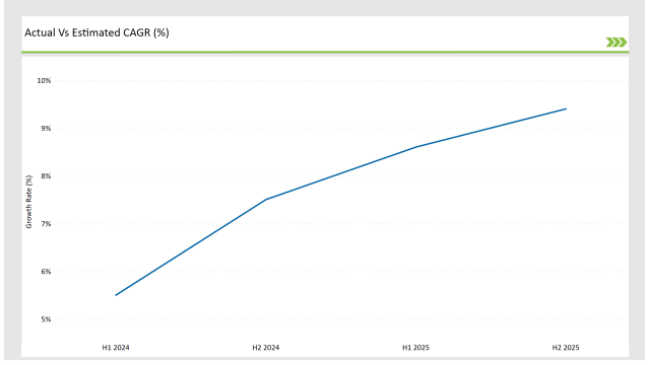

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Omega 3 market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Omega 3 market, the sector is predicted to grow at a CAGR of 3.2% during the first half of 2024, increasing to 4.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 5.4% in H1 but is expected to rise to 9.4% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | DSM Nutritional Products launched a new line of plant-based Omega-3 supplements in March 2024. |

| 2024 | BASF introduced a new Omega-3 fatty acid formulation for functional foods in April 2024. |

| 2024 | Omega Protein Corporation expanded its product portfolio by launching a new range of Omega-3 fortified snacks in May 2024. |

| 2024 | AlgaVia announced a partnership with a leading beverage company to develop Omega-3 infused drinks in June 2024. |

Rising Demand for Plant-Based Omega-3 Sources

ASEAN market demand for plant-based Omega-3 resources grows swiftly due to rising vegetarian and vegan diet popularity. Consumer awareness regarding diet has grown along with their search for non-traditional fish oil supplements. Young adults together with people who observe dietary limitations show the highest rate of interest in this new market trend.

The production of algal oil from algae shows growth as a widely accepted plant-source for Omega-3 DHA fatty acids. This sustainable oil source gives direct access to Omega-3 fats without causing negative outcomes from ocean pollution or overfishing problems. The developing market for plant-based nutrition has motivated numerous businesses to allocate funding for algal oil research leading to new product development.

Integration of Omega-3 in Functional Foods and Beverages

Omega-3 fatty acids have gained substantial importance in creating functional foods and beverage products within the ASEAN market. Manufacturers continue to add Omega-3 to various products like dairy items and snacks as well as ready-to-drink beverages because consumers want both convenience and nutrient-rich options.

The market demand for Omega-3 consumption continues to rise because consumers recognize the health benefits which include better heart wellbeing and brain health and reduced body inflammation. The easy-to-use nature of pre-made food products enables consumers to easily add Omega-3 into their meals making the market trends more favorable.

People who follow wellness practices watch preventive health with interest because they want to discover functional foods which provide additional advantages. Manufacturers remain active in developing refined Omega-3 products which attract consumers because of their functional health benefits.

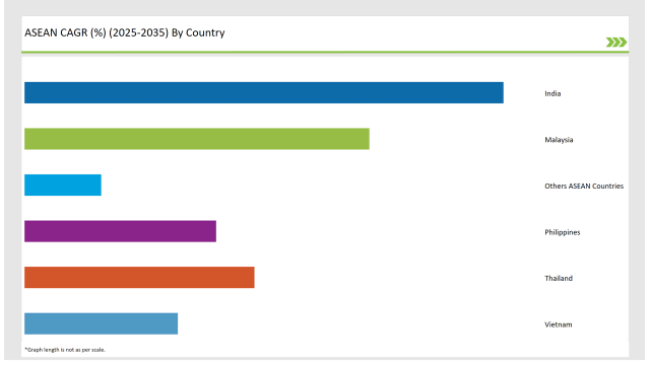

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The latest economic and social trends in India have allowed the country's Omega-3 market to flourish due to the ubiquity of health awareness and increasing lifestyle-related diseases. The awareness of nutrition among the Indian population as an essential factor in the prevention of diseases is increasing. People, for example, tend to relate this with heart health, cognitive function, and joint support.

Consequently, it is the prominent demand for Omega-3 supplements and fortified foods that will be the result of this trend. Answer to: India-facing Omega-3 market is booming growth via powerful people's health care and lifestyle disease's prevalence. A high percentage of the Indian population is subject to nutritional diseases strongly increasing their awareness of nutrition and health.

This consumer behavioral shift is directly connected to demand for Omega-3 supplements and fortified foods. Indeed, the Indian middle class is growing stronger and richer than ever meaning that more and more people can buy their goods.

Thailand has become a significant player in the ASEAN market for Omega-3 products due to the enormous backing of a commercially successful seafood industry and a strong export-oriented focus. The country has a longstanding reputation of eating seafood that has opened the door to the popularity and acceptance of Omega-3 fatty acids among consumers.

The Thai market is home to a myriad of Omega-3 products such as supplements, functional foods, and fortified beverages. The rise in the cognitive and heart-health-focused benefits associated with Omega-3 has led to an increase in demand for these supplements on both domestic and international markets.

The central location of Thailand, and the availability of a reliable supply chain system have made this country a preferred destination for Omega-3 production and exports. The government has been pushing a lot to support the health and wellness sector, thus, facilitating investments in research and development that will lead to the enhancement of product quality and innovation.

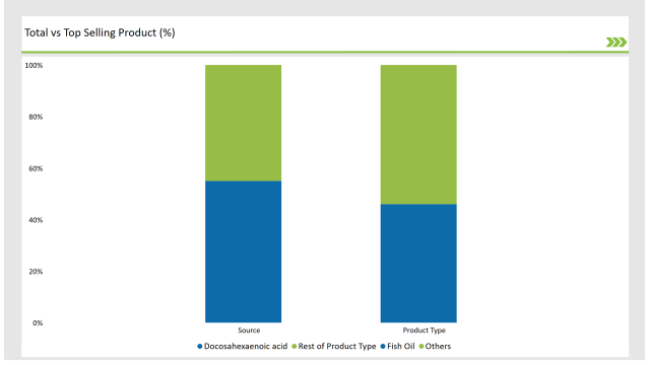

Docosahexaenoic acid (DHA) is the most prominent Omega-3 fatty acid

Standing as the main fatty acid in the Omega-3 category in the ASEAN market, Docosahexaenoic acid (DHA) also carries a significant mark in the entire Omega-3 production. Fish oil is the prime source for DHA and is recognized for its various health benefits, particularly, benefits to brain health, eye health, and heart health.

The consumption of DHA is mainly driven by its function in cognitive development and it is the favorite among parents who want to assist their children's brain development with it. Moreover, the demand for supplements is also increasing as people are becoming more aware of the Omega-3 fatty acids role during pregnancy and lactation.

Fish oil remains the most widely used source of Omega-3 fatty acids

Currently, fish oil is the number one source of Omega-3 fatty acids used in the ASEAN market and it represents a major portion of the total Omega-3 fish oil production. As omega 3 is a real beneficial factor for consumer's health, being high in both eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), fish oil is the prodct that the customers are looking for.

Health oil consumption is synonymous with Omega-3 polyunsaturated fatty acids, and the consumers that contribute mostly to sales of it are the ones who are health-conscious. Studies have always been showing the positive impact of EPA and DHA on the heart including the fact that they cut down the levels of triglycerides, they have a blood pressure lowering effect, and they improve the overall health of the heart.

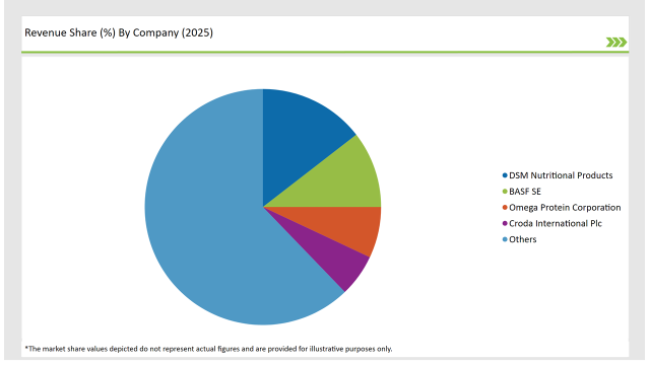

2025 Market Share of ASEAN Omega 3 Manufacturers

Note: The above chart is indicative

At present, the rivalry among companies in the ASEAN Omega-3 sector seems to be getting fiercer, as various players compete for their share of the market. Prominent firms in the market embrace both the historic entities of Omega-3 manufacturers and new entrants who concentrate on ground-breaking products and eco-friendly practices.

The competitive scene is marked by a number of elements such as product quality, pricing, distribution channels, and brand reputation. A standout approach with the companies to get an upper hand on their rivals is concentrating on sustainability.

This Segment further Categorise into DHA, EPA, and ALA

This Segment further Categorise into Fish Oil, Algal Oil, Krill Oil, Flaxseed, Chia Seeds

This Segment further Categorise Soft Gels/Capsules, Oil, Gummies, and Powder

This Segment further Categorise Dietary Supplements, Food & Beverages, Pharmaceuticals, Pet & Animal Feed

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Omega 3 market is projected to grow at a CAGR of 9.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,199.1 million.

India are key Country with high consumption rates in the ASEAN Omega 3 market.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA