The Europe Omega 3 market is set to grow from an estimated USD 1,545.6 million in 2025 to USD 3,284.7 million by 2035, with a compound annual growth rate (CAGR) of 7.8% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 1,545.6 million |

| Projected Europe Value (2035F) | USD 3,284.7 million |

| Value-based CAGR (2025 to 2035) | 7.8% |

The European market for Omega-3 has seen steady growth in the last couple of years with increasing awareness among people about health benefits from the consumption of Omega-3 fatty acids and its usage in several industries, which include food & beverages, nutraceuticals, pharmaceuticals, and cosmetics.

Omega-3s comprise eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA, which are polyunsaturated fatty acids. Primarily sourced from marine-based origins such as fish oil, krill oil, and algae oil, these fatty acids are important for the well-being of heart health, lowering inflammation, promoting brain functionality, and preserving eyesight.

As consumer awareness of the importance of maintaining good cardiovascular health and mental well-being increases, demand for Omega-3-rich products continues to grow.

A trend toward more conscious health is noticed in the ever-growing population where natural and preventative health solutions, such as supplementation with Omega-3, represent a choice among consumers who consider a healthier lifestyle. DSM Nutritional Products, BASF SE, and Royal DSM are the major players in the European market, well known for their innovations in Omega-3 formulations as well as sustainable sourcing practices.

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Omega 3 market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.2% (2024 to 2034) |

| H2 2024 | 4.0% (2024 to 2034) |

| H1 2025 | 5.1% (2025 to 2035) |

| H2 2025 | 6.4% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Omega 3 market, the sector is predicted to grow at a CAGR of 3.2% during the first half of 2024, with an increase to 4.0% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 5.1% in H1 but is expected to rise to 6.4% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Product Launch: A new line of Omega-3 supplements, formulated with plant-based algal oil, aimed at vegan consumers. This launch targets the growing demand for plant-based alternatives to traditional fish oil supplements. |

| March 2024 | Partnership Announcement: A strategic partnership between BASF SE and a leading algae production company to enhance the production of sustainable Omega-3 DHA from algae, targeting both dietary supplements and the food & beverage industries. |

| January 2024 | Market Expansion: DSM Nutritional Products launched a new range of Omega-3-enriched functional beverages, aimed at health-conscious consumers looking for convenient and healthy ways to boost their Omega-3 intake. |

High demand for algal oil in plant-based omega-3 products

Omega-3 sources in the market that are derived from fish have shifted to plant-based alternatives. Nowadays, this demand is high and is seen, especially in vegans and vegetarians.

With the growth in sustainability, overfishing, and environmental considerations of fishing methods, the main source of algae oil has gained importance in meeting the DHA requirement, particularly for brain and eye health. Due to the lack of fish oil production, legal oil is considered to be a panacea for all the problems concerning the fishing industry and the depletion of marine resources.

The growing population of people opting for veganism and the expanding environmental and ethical issues concerning products based on animals has led to the increasing demand for algae-made Omega-3 products. Some of the companies that are proving to be the pioneers in this field are DSM Nutritional Products and BASF SE.

Their algal oil-based Omega-3 supplements are top quality as they are working with continuous development which sees them as the leaders in plant-based nutrition. These same firms, besides, are working towards making the Omega-3 from algal species more bioavailable and quickly absorbed, therefore health-conscious consumers will find products more attractive.

Innovations in Omega-3 Delivery Formats in the form of Gummies and Powders

The most noticeable trend in the European Omega-3 market is that of innovation in delivery formats, especially gummies and powders. Capsule and liquid oils have long dominated the market for Omega-3, but now there has been a clear trend toward more convenient and consumer-friendly formats.

Especially the gummies that have gained tremendous popularity in the market due to ease of ingestion, good taste, and especially because they attract both children and adults who, in turn, find the standard capsules hard to swallow.

More individuals are also getting omega-3 gummies as a more fun and easy way to provide for their total health, as most people despise the fish oil taste and texture. Companies are also coming up with Omega-3 gummies in a variety of flavours and formulations to suit various consumer preferences. Another innovative development is the creation of Omega-3 powders, which make it possible to include these essential fatty acids in food and beverages daily.

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| United Kingdom | 25% |

| France | 20% |

| Italy | 15% |

| Others | 10% |

Germany is one of the leading countries in the European Omega-3 market, driven by a growing awareness of the health benefits of Omega-3 fatty acids and a robust demand for dietary supplements. German consumers are particularly health-conscious, with a strong preference for functional foods that offer specific health benefits. This is endorsed by the growing demand for Omega-3 supplements, a common product among those supporting heart health, brain function, and overall wellness.

Germany also boasts a mature market for functional foods and beverages containing Omega-3, such as Omega-3-fortified snacks and smoothies, as well as dairy products. The positive outlook is further enhanced by a robust regulatory regime for dietary supplements in Germany to ensure the quality and safety of Omega-3 products. Besides, the high population of vegans and vegetarians in Germany has increased the demand for plant-based Omega-3 alternatives, like algal oil.

The United Kingdom is another main player in the European Omega-3 market and is expected to grow rapidly, both in the Omega-3 supplement and functional food sectors. In the UK, Omega-3 fatty acids have been widely appreciated for their health benefits, with consumer demand for supplements containing Omega-3 increasing steadily. The market for Omega-3 supplements is particularly strong in the form of capsules and soft gels, which are convenient for consumers seeking targeted health benefits.

Furthermore, the UK's aging population is a major driver of growth in the Omega-3 market, as older adults are increasingly looking for natural ways to maintain cognitive function, heart health, and joint mobility. In addition, UK consumers have developed an interest in functional foods with Omega-3 enrichment, which includes snacks, beverages, and dairy products. Consumers are trying to include beneficial fats into their daily diet.

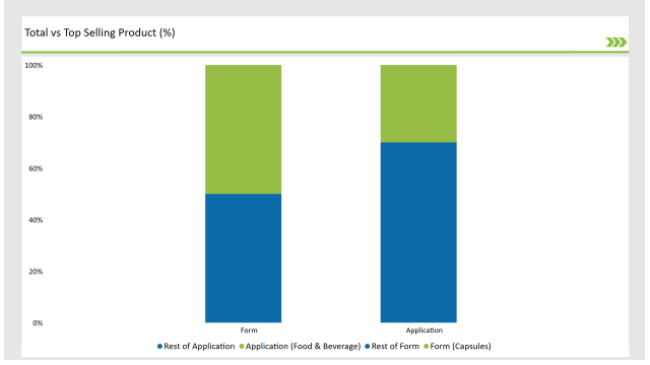

% share of Individual Categories Form and Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Form (Capsules) | 50% |

| Remaining segments | 50% |

Robust Growth in Capsules and Soft Gels

Omega-3 dietary supplements have been one of the most massive contributors to the growth of the European Omega-3 market. Among the most common forms of Omega-3 supplements, capsules, and soft gels have witnessed the maximum demand due to their benefits in ease of consumption and accurate dosage.

Capsules and soft gels are the most popular ones, especially those targeting specific health benefits, for example, heart health, cognitive function improvement, and a decrease in inflammation.

Furthermore, the increasing demand for Omega-3 fatty acids in the prevention of chronic conditions, such as cardiovascular diseases and arthritis, has escalated the need for these supplements.

There's also the potential to improve their bioavailability and stability, even when the supplementation is in Omega-3 supplemented soft gels and capsules forms, thereby making them more viable for the targeted consumers. Such supplement forms as soft gels and capsules appeal to the health-conscious elderly aged adults, due to their easy digestibility characteristics.

| Main Segment | Market Share (%) |

|---|---|

| Application (Food & Beverage) | 30% |

| Remaining segments | 70% |

Increasing Popularity of using Omega-3 in the Food & Beverage Industry

Omega-3-enriched functional foods have grown to become the fastest-growing market segment in Europe, as increasingly more consumers search for convenient, tasty ways of adding essential fatty acids to their diets.

Omega-3-fortified Snacks, beverages, and dairy products have gained popularity lately as the need for functional food providing some health benefits is increasing. This particular trend is quite important for Omega-3-enriched drinks, which include smoothies and juices, and provide an easy, convenient means by which consumers can supplement diets with more Omega-3.

Moreover, Omega-3-fortified snacks like bars and cereals are increasingly marketed as healthy, on-the-go options for busy consumers. With a rise in the demand for omega-3 products, the food and beverage sector is responding with an incorporation of these essential fatty acids into virtually all types of food products - from breakfast food to desserts. As consumers take care of themselves, this demand is likely to increase.

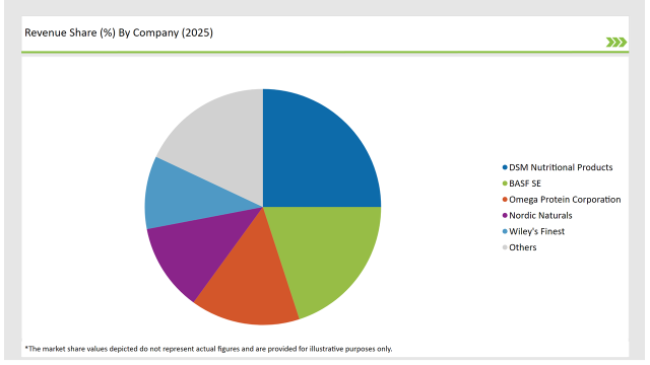

2025 Market share of Europe Omega 3 manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| DSM Nutritional Products | 25% |

| BASF SE | 20% |

| Omega Protein Corporation | 15% |

| Nordic Naturals | 12% |

| Wiley's Finest | 10% |

| Others | 18% |

Note: The above chart is indicative in nature

The European Omega-3 sector is primarily ruled by only a few essential companies which, together, are held responsible for the larger part of the market. These organizations are not just involved in the research, development, and production of Omega-3 products, but they are also influential in charting the market routes.

Global leaders like DSM Nutritional Products, BASF SE, and Royal DSM are the Tier 1 companies in the Omega-3 sector. The enterprises in question have impeccable capabilities for research and development and they have an extensive distribution network.

Some of the Tier 2 companies, such as Lonza Group and Sabinsa Corporation, are located in the region and provide niche Omega-3 products including algae-based Omega-3 and other innovative formulations. Most of these companies concentrate on niche market sectors and collaborate closely with local distributors of particular markets in Europe.

Tier 3 companies are smaller enterprises that are often centered on local or regional markets. These businesses may concentrate on certain delivery formats, for instance, Omega-3 gummies or powders, or deliver more customized products to fulfil particular consumer needs.

Although these businesses are not as broadly distributed as Tier 1 and Tier 2 companies, they are, nonetheless, of crucial importance for the local satisfaction of demand and the realization of freshwater innovation across the Omega-3 market.

As per Product Type, the industry has been categorized into Docosahexaenoic acid (DHA), Eicosapentaenoic acid (EPA), and Alpha-linolenic acid (ALA).

As per Source Type, the industry has been categorized into Fish Oil, Krill Oil, Algal Oil, Flaxseed, Chia Seeds.

As per Form Type, the industry has been categorized into Soft Gels/Capsules, Oil, Powder, Gummies.

As per Application, the industry has been categorized into Dietary Supplements, Food & Beverages, Pharmaceuticals, Pet & Animal Feed.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Omega 3 market is projected to grow at a CAGR of 7.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 3,284.7 million.

Key factors driving the omega-3 market in Europe include the increasing consumer awareness of the health benefits associated with omega-3 fatty acids, such as improved heart health, cognitive function, and anti-inflammatory properties. Additionally, the rising demand for dietary supplements and functional foods that promote overall wellness, along with the growing trend of preventive healthcare, is further fueling market growth. The shift towards natural and clean label products is also encouraging manufacturers to innovate and offer high-quality omega-3 sources derived from fish oil, algae, and other sustainable sources.

Italy, France, and UK are the key countries with high consumption rates in the European Omega 3 market.

Leading manufacturers include DSM Nutritional Products, BASF SE, Omega Protein Corporation, Nordic Naturals, and Wiley's Finest known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Omega-3 Concentrates Market Insights – Growth, Demand & Forecast 2025-2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA