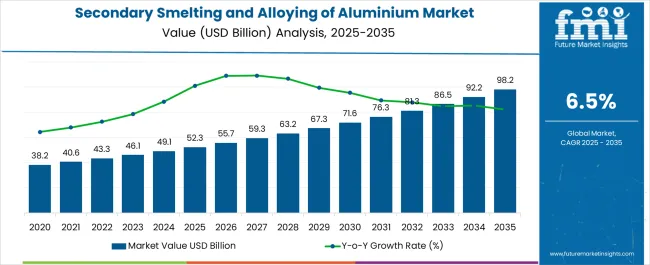

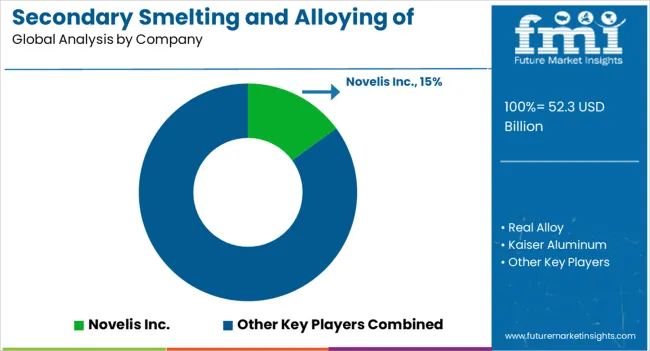

The secondary smelting and alloying of aluminium market is estimated to be valued at USD 52.3 billion in 2025 and is projected to reach USD 98.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The market maturity curve shows early adoption during 2020–2024, with annual growth from 38.2 to 49.1 USD billion, as recyclers and manufacturers tested alloying processes and smelting efficiency. By 2025, adoption begins scaling, driven by rising demand for recycled aluminium and diversified alloy applications. Between 2025–2030, the market grows from 52.3 to 71.6 USD billion, reflecting optimized production, broader acceptance, and expanding industrial applications. From 2030–2035, growth moderates as consolidation occurs, with leading producers capturing a majority of market share. The adoption lifecycle follows this progression. During 2020–2024, early adopters validate process reliability, material quality, and cost-effectiveness, creating reference cases for wider uptake.

From 2025–2030, scaling occurs as production facilities expand, supply chains stabilize, and procurement becomes standardized. By 2030–2035, consolidation dominates: late entrants follow established alloying and smelting practices, mergers and partnerships shape competitive dynamics, and procurement emphasizes cost control and efficiency. The market transitions from experimental adoption through rapid scale-up to a mature phase characterized by predictable demand, optimized production workflows, and well-established supplier relationships.

| Metric | Value |

|---|---|

| Secondary Smelting and Alloying of Aluminium Market Estimated Value in (2025 E) | USD 52.3 billion |

| Secondary Smelting and Alloying of Aluminium Market Forecast Value in (2035 F) | USD 98.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

Seasonality in the secondary smelting and alloying of aluminium market is influenced by industrial production cycles, construction activity, and automotive manufacturing schedules. Data shows that Q2 and Q3 often account for 40–45% of annual demand, coinciding with peak manufacturing and construction periods, while Q1 typically records 10–15% lower activity, reflecting post-year-end inventory adjustments. Seasonal fluctuations in scrap aluminium availability also impact supply, creating short-term spikes of 5–10% above baseline. Suppliers and smelters coordinate production, alloying schedules, and logistics around these seasonal patterns to maintain steady supply and meet industrial demand without overstocking during slower periods.

Cyclicality in this market reflects broader investment and replacement cycles in industrial facilities. Major smelting and alloying capacity expansions generally follow 5–7 year cycles, generating periodic surges in demand that can increase annual market size by USD 3–5 billion. Additionally, shifts in regulations, trade policies, or aluminium pricing can temporarily accelerate or slow procurement, producing short-term spikes of 5–10% above expected growth. These cyclical patterns overlay the underlying CAGR of 6.5%, creating alternating periods of rapid expansion and moderate stabilization. Recognizing these cycles allows producers to optimize production planning, inventory management, and supply chain coordination.

The market is experiencing steady growth, driven by the increasing emphasis on sustainable production practices and the rising availability of recyclable aluminium scrap. This sector plays a critical role in reducing the carbon footprint of the aluminium industry by enabling efficient recovery and reuse of aluminium materials. The ability to process diverse scrap inputs into high-quality alloys has positioned secondary smelters as a key contributor to circular economy initiatives.

Market expansion is also being influenced by the growing demand from industries such as automotive, construction, and packaging, where aluminium’s lightweight, corrosion resistance, and cost-effectiveness are valued. Technological advancements in sorting, refining, and melting processes are improving yield and quality, making recycled aluminium a competitive alternative to primary production.

Regulatory pressures for greener manufacturing and cost advantages associated with secondary smelting are expected to sustain demand The long-term outlook remains positive as industries increasingly prioritize resource efficiency and environmentally responsible material sourcing.

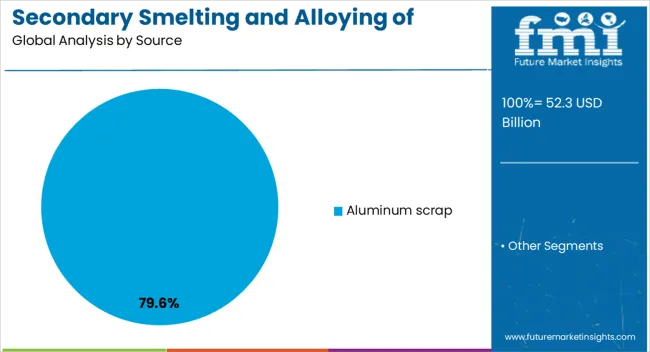

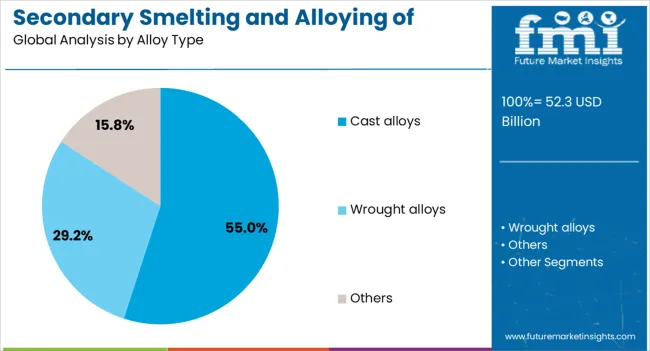

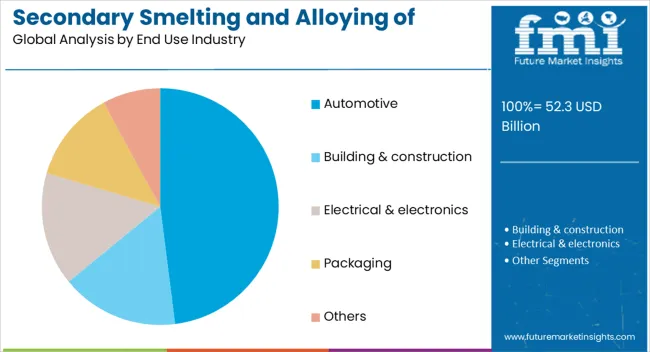

The secondary smelting and alloying of aluminium market is segmented by source, alloy type, end use industry, and geographic regions. By source, secondary smelting and alloying of aluminium market is divided into aluminum scrap, dross and skimmings, and other secondary sources. In terms of alloy type, secondary smelting and alloying of aluminium market is classified into cast alloys, wrought alloys, and others. Based on end use industry, secondary smelting and alloying of aluminium market is segmented into automotive, building & construction, electrical & electronics, packaging, and others. Regionally, the secondary smelting and alloying of aluminium industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aluminum scrap segment is projected to account for 79.60% of the secondary smelting and alloying of aluminium market revenue share in 2025, making it the dominant source segment. This leadership position is supported by the widespread availability of post-consumer and industrial aluminium scrap, which serves as a cost-effective feedstock for smelters. The ability to recycle aluminium multiple times without loss of quality has driven its preference among manufacturers aiming to meet sustainability targets. The growing adoption of closed-loop recycling systems in industries such as automotive and packaging has increased the supply of high-grade scrap. Additionally, the lower energy requirements for processing scrap compared to primary aluminium production have reinforced its appeal from both economic and environmental perspectives. Enhanced scrap collection networks, along with improved segregation and pre-treatment technologies, are enabling higher recovery rates This has ensured a consistent and reliable supply chain for smelters, cementing aluminum scrap’s leading role in the market.

The cast alloys segment is expected to hold 55% of the market revenue share in 2025, making it the leading alloy type. This dominance is attributed to the extensive use of cast alloys in high-volume manufacturing processes that require complex shapes and high strength-to-weight ratios. Cast alloys derived from secondary aluminium offer excellent machinability, corrosion resistance, and thermal conductivity, making them suitable for diverse industrial applications. The automotive sector, in particular, has contributed to the demand for these alloys in engine components, wheels, and structural parts. Their versatility in meeting varied performance specifications has further expanded their adoption across industries. Advances in alloy formulation through secondary smelting processes have improved mechanical properties, enabling their use in more demanding applications With the cost advantages of using recycled feedstock and the push for lightweight materials, cast alloys have continued to secure a strong position in the market.

The automotive segment is projected to capture 48% of the market revenue share in 2025, positioning it as the leading end-use industry. This growth has been driven by the increasing incorporation of lightweight materials in vehicle manufacturing to improve fuel efficiency and meet stringent emission regulations. Secondary aluminium alloys have become a preferred choice for producing components such as engine blocks, transmission cases, and body structures due to their durability, strength, and corrosion resistance. The use of recycled aluminium has also supported the automotive industry’s sustainability goals by reducing carbon emissions associated with material production. Technological improvements in secondary smelting have enabled the delivery of alloys with consistent quality that meet automotive standards. Moreover, the cost benefits of using recycled aluminium compared to primary production have encouraged widespread adoption The global shift towards electric vehicles, which require lightweight yet robust materials, is expected to further reinforce the automotive sector’s leading position in this market.

The secondary smelting and alloying of aluminium market is expanding as industries focus on recycling aluminium scrap into high-quality alloys for automotive, aerospace, construction, and packaging sectors. Europe and North America dominate due to mature recycling infrastructure and stringent environmental regulations, while Asia-Pacific is experiencing rapid growth driven by industrial demand and aluminium scrap availability. Key players such as Hydro Aluminium, Constellium, Novelis, Aleris (part of Novelis), and UACJ Corporation leverage advanced melting and alloying technologies to improve quality, energy efficiency, and yield. The market balances cost-effective recycling with high-purity alloy production.

Secondary aluminium production depends on the availability and quality of scrap, including post-consumer and industrial aluminium. Variability in scrap composition requires precise sorting, controlled melting, and alloying to achieve consistent chemical profiles. Companies like Constellium and Novelis use advanced sensor-based sorting, automated dosing, and continuous quality monitoring to maintain alloy standards for automotive and aerospace applications. Regions with segregated scrap streams, like Europe, achieve higher quality output, while emerging markets process mixed scrap requiring more refining. Maintaining consistent alloy quality is critical for meeting end-user requirements and reducing defects in high-performance applications.

Secondary smelting and alloying are energy-intensive processes, with electricity costs impacting profitability. Efficient furnace designs, heat recovery systems, and optimized melting cycles help reduce energy consumption while maintaining production output. Hydro Aluminium and other major players implement regenerative melting and automated alloy dosing to enhance efficiency. Mature facilities in Europe and North America demonstrate higher energy efficiency, whereas emerging Asia-Pacific plants face operational cost pressures but benefit from abundant scrap availability. Effective energy management is key to lowering production costs and maintaining competitiveness in global markets.

Environmental regulations influence smelting and alloying operations through emissions limits, waste handling requirements, and occupational safety rules. European players must adhere to strict emission controls and alloy purity standards, requiring investment in filtration, dust collection, and monitoring systems. In less-regulated regions, plants may have greater operational flexibility but must ensure alloy quality for export markets. Aleris and Novelis focus on certified processes that comply with multiple regional standards, supporting access to international customers. Compliance with environmental and safety regulations is a critical factor affecting market acceptance and long-term growth.

Global market leaders target high-value applications with specialty alloys for automotive, aerospace, and high-strength industrial components. Companies like UACJ Corporation and Novelis invest in R&D to enhance alloy performance, reduce defects, and improve yield. Strategic partnerships with OEMs secure long-term demand and reinforce market positioning. Regional players often focus on commodity alloys for construction or packaging applications. Leadership in technology, quality control, and supply chain integration provides competitive advantages and drives market penetration across global and regional segments.

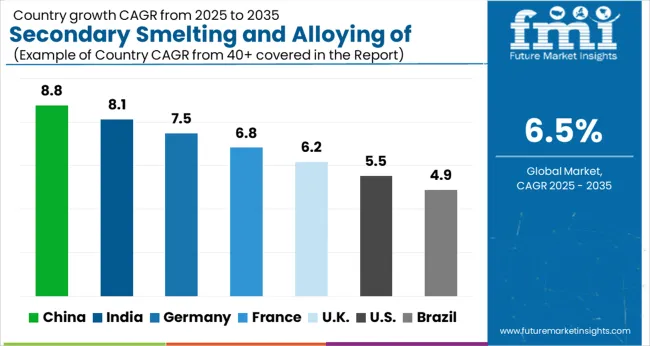

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global Secondary Smelting and Alloying of Aluminium Market is projected to grow at a CAGR of 6.5% through 2035, supported by increasing demand across automotive, aerospace, and industrial applications. Among BRICS nations, China has been recorded with 8.8% growth, driven by large-scale production and deployment in aluminum recycling and alloying facilities, while India has been observed at 8.1%, supported by rising utilization in automotive and industrial aluminum components. In the OECD region, Germany has been measured at 7.5%, where production and adoption for alloying and secondary smelting applications have been steadily maintained. The United Kingdom has been noted at 6.2%, reflecting consistent use in industrial and automotive aluminum applications, while the USA has been recorded at 5.5%, with production and utilization across aerospace, automotive, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The secondary smelting and alloying of aluminium market in China is growing at a CAGR of 8.8%, driven by rising demand from automotive, construction, aerospace, and packaging industries. Increasing adoption of lightweight aluminium alloys for fuel efficiency, structural applications, and sustainable manufacturing practices is supporting market expansion. Technological advancements in smelting, alloying, and recycling processes improve energy efficiency and product quality. Government initiatives promoting aluminium recycling, sustainability, and industrial modernization further boost growth. China’s well-established aluminium production infrastructure and growing industrial base create opportunities for secondary smelting and alloying operations. Demand for high-strength, corrosion-resistant, and lightweight aluminium alloys for automotive and construction applications continues to accelerate market adoption. With a focus on cost-efficient production, energy conservation, and material performance, China is expected to remain a key growth hub for the secondary smelting and alloying of aluminium market.

The secondary smelting and alloying of aluminium market in India is expanding at a CAGR of 8.1%, fueled by growing industrialization, automotive production, and infrastructure development. Increasing utilization of aluminium alloys for lightweight vehicles, energy-efficient buildings, and packaging applications is driving market growth. Advancements in smelting and alloying technologies improve product performance, energy efficiency, and process sustainability. Government initiatives promoting metal recycling, industrial modernization, and sustainable manufacturing support market adoption. Rising demand from automotive, aerospace, construction, and electrical industries encourages secondary smelting operations. India’s expanding aluminium processing capacity and focus on lightweight, corrosion-resistant materials further contribute to market growth. Technological innovations, cost efficiency, and environmentally responsible processes are strengthening the market for secondary smelting and alloying of aluminium in India, positioning the country as a growing hub in the Asia-Pacific region.

The secondary smelting and alloying of aluminium market in Germany is growing at a CAGR of 7.5%, driven by high demand from automotive, aerospace, and industrial manufacturing sectors. Focus on lightweight, corrosion-resistant, and high-performance aluminium alloys supports adoption in structural and functional applications. Technological advancements in alloying, casting, and smelting processes improve energy efficiency, product quality, and recyclability. Germany’s stringent environmental regulations and emphasis on sustainability encourage the use of secondary aluminium and recycled materials. Demand from automotive manufacturers for fuel-efficient and lightweight components further accelerates market growth. Strong industrial infrastructure, coupled with innovation in alloy development and efficient production methods, positions Germany as a significant market for secondary smelting and alloying of aluminium. The combination of regulatory compliance, industrial demand, and technological advancement ensures steady expansion in Germany.

The secondary smelting and alloying of aluminium market in the United Kingdom is expanding at a CAGR of 6.2%, driven by growing demand from automotive, construction, and industrial applications. Lightweight and corrosion-resistant aluminium alloys are increasingly used to improve fuel efficiency, structural integrity, and sustainability. Advanced smelting and alloying technologies enhance energy efficiency, product quality, and recyclability. Government initiatives supporting sustainable manufacturing, metal recycling, and industrial modernization encourage market growth. Rising demand from automotive manufacturers and construction projects promotes secondary aluminium adoption. Technological innovations, operational efficiency, and environmental compliance are key factors driving market development. The UK market continues to benefit from a focus on lightweight materials, sustainable production processes, and expanding industrial applications, ensuring steady growth in the secondary smelting and alloying of aluminium segment.

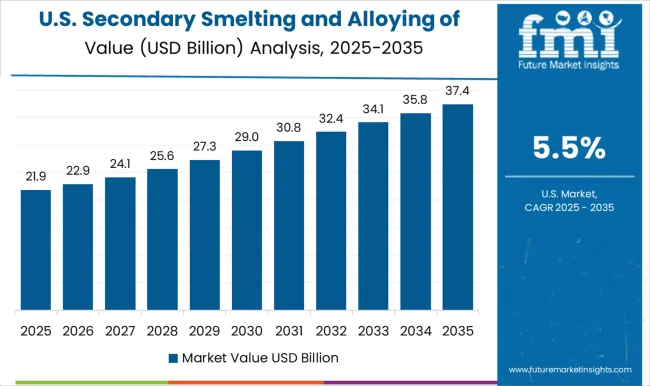

The secondary smelting and alloying of aluminium market in the United States is growing at a CAGR of 5.5%, driven by demand from automotive, aerospace, packaging, and construction industries. Lightweight, high-strength, and corrosion-resistant aluminium alloys are increasingly adopted for fuel-efficient vehicles, structural applications, and industrial components. Technological advancements in smelting, alloying, and recycling enhance product quality, energy efficiency, and sustainability. Government initiatives promoting aluminium recycling, industrial modernization, and environmental compliance further support market expansion. The USA market benefits from strong industrial infrastructure, robust automotive manufacturing, and growing demand for sustainable production practices. Rising emphasis on operational efficiency, cost reduction, and innovative alloy solutions ensures continued growth in the secondary smelting and alloying of aluminium market across the United States.

The secondary smelting and alloying of aluminium market plays a crucial role in the global aluminium value chain, focusing on recycling scrap aluminium and producing high-quality alloys for automotive, aerospace, construction, and packaging industries. Secondary aluminium production offers significant energy savings and environmental benefits compared to primary aluminium, making it increasingly important amid sustainability and circular economy initiatives. Novelis Inc. is a leading player in this market, providing advanced recycling and alloying solutions to produce lightweight, high-performance aluminium sheets and extrusions. Real Alloy specializes in secondary smelting and alloying services, delivering customized aluminium alloys to meet specific customer requirements across automotive and industrial sectors.

Kaiser Aluminum focuses on high-strength, precision-engineered aluminium products through its secondary smelting operations, serving aerospace, defense, and specialty applications. Constellium offers innovative alloying solutions and recycled aluminium products for packaging, automotive, and industrial markets. Norsk Hydro ASA emphasizes sustainable production and efficient secondary smelting technologies to optimize alloy quality and reduce carbon footprint. Hindalco Industries leverages its global aluminium recycling network to supply secondary alloys for diverse industrial applications. In addition to these global leaders, numerous regional players contribute significantly by providing localized smelting and alloying services, supporting regional demand while enhancing sustainability in the aluminium supply chain.

| Item | Value |

|---|---|

| Quantitative Units | USD 52.3 billion |

| Source | Aluminum scrap, Dross and skimmings, and Other secondary sources |

| Alloy Type | Cast alloys, Wrought alloys, and Others |

| End Use Industry | Automotive, Building & construction, Electrical & electronics, Packaging, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Novelis Inc., Real Alloy, Kaiser Aluminum, Constellium, Norsk Hydro ASA, Hindalco Industries, and Other regional players |

| Additional Attributes | Dollar sales by type including recycled aluminium ingots, billets, and sheets, application across automotive, aerospace, construction, and packaging industries, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing aluminium recycling, demand for lightweight and durable materials, and sustainability initiatives in manufacturing. |

The global secondary smelting and alloying of aluminium market is estimated to be valued at USD 52.3 billion in 2025.

The market size for the secondary smelting and alloying of aluminium market is projected to reach USD 98.2 billion by 2035.

The secondary smelting and alloying of aluminium market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in secondary smelting and alloying of aluminium market are aluminum scrap, dross and skimmings and other secondary sources.

In terms of alloy type, cast alloys segment to command 55.0% share in the secondary smelting and alloying of aluminium market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Secondary Alkane Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Secondary Containment Trays Market Size and Share Forecast Outlook 2025 to 2035

Secondary Myelofibrosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Secondary Nutrients Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Analysis - Size, Share, and Forecast 2025 to 2035

Industry Share & Competitive Positioning in Pharmaceutical Secondary Packaging

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Lead Smelting and Refining Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Fishing Boat Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Ammonium Sulphate Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Foil Seal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aluminium Chloride Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium Market Analysis - Size, Share & Forecast 2025 to 2035

Aluminium-Free Deodorant Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Aluminium Bottle Providers

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Competitive Breakdown of Aluminium Cup Suppliers

Aluminium Cup Market Trends - Size, Growth & Demand 2025 to 2035

Aluminium Ion Battery Market Growth - Trends & Forecast 2025 to 2035

Aluminium Bottle Market Growth – Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA