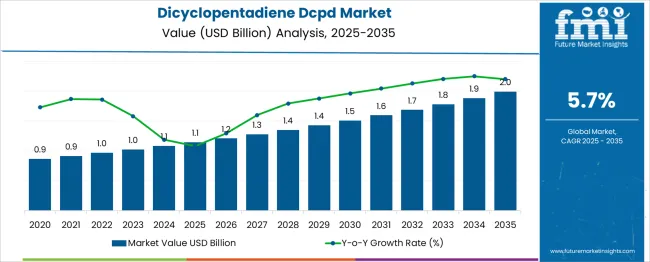

The Dicyclopentadiene DCPD Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. The dicyclopentadiene (DCPD) market is projected to demonstrate moderate elasticity to macroeconomic indicators. As a key feedstock in the production of resins, plastics, and specialty chemicals, DCPD demand is closely tied to the performance of end-use industries such as automotive, construction, marine, and electronics. During periods of strong industrial output and infrastructure investment, DCPD consumption tends to rise steadily, indicating positive but not highly elastic growth. Fluctuations in crude oil prices also play a crucial role, as DCPD is a byproduct of naphtha cracking.

Increasing oil prices can increase production costs, potentially dampening margins and slowing market expansion unless offset by downstream demand. Moreover, construction spending, GDP growth rates, and automotive manufacturing indices strongly influence DCPD volumes, particularly in developing economies where industrialization is still accelerating. However, the market shows some resilience to recessionary cycles, owing to the indispensable nature of DCPD in various resin formulations and long-term infrastructure projects. Environmental regulations promoting sustainable and high-performance materials further stabilize demand. Thus, while DCPD shows a moderate elasticity to macroeconomic shifts, its trajectory remains largely positive, aligned with industrial and manufacturing cycles.

| Metric | Value |

|---|---|

| Dicyclopentadiene DCPD Market Estimated Value in (2025 E) | USD 1.1 billion |

| Dicyclopentadiene DCPD Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The Dicyclopentadiene (DCPD) market is witnessing consistent growth, fueled by its expanding use in high-performance resins, adhesives, and specialty polymers. Increased demand from automotive, construction, and electronics sectors is supporting consumption of DCPD-based intermediates, particularly where high thermal stability and impact resistance are required.

Capacity expansion across refining and petrochemical plants is ensuring stable raw material availability, while downstream manufacturers are aligning formulations with regulatory trends focused on low-VOC and sustainable material solutions. Integration of DCPD into high-strength, lightweight composites is gaining momentum amid rising requirements for durability and corrosion resistance.

Additionally, innovation in DCPD purification and hydrogenation processes is enhancing quality grades and improving overall yield. The market outlook remains positive, driven by product demand from emerging economies and advances in process technology enabling better cost-performance ratios.

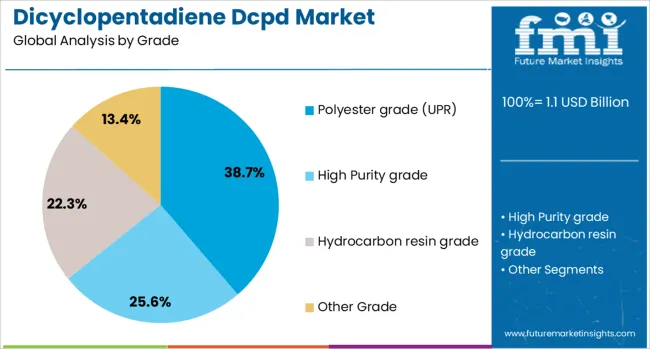

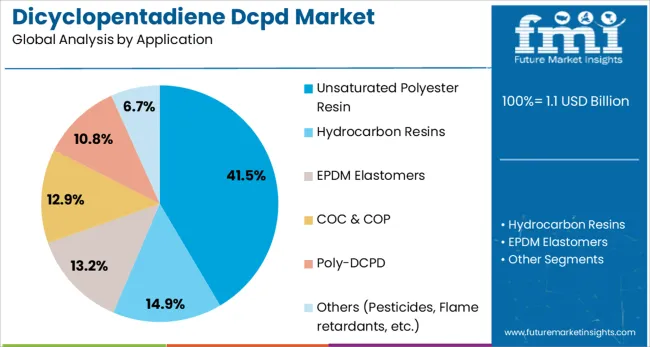

The dicyclopentadiene DCPD market is segmented by grade, application, and geographic regions. The dicyclopentadiene DCPD market is divided by grade into Polyester grade (UPR), High Purity grade, Hydrocarbon resin grade, and Other Grade. In terms of application, the dicyclopentadiene DCPD market is classified into Unsaturated Polyester Resin, Hydrocarbon Resins, EPDM Elastomers, COC & COP, Poly-DCPD, and Others (Pesticides, Flame retardants, etc.). Regionally, the dicyclopentadiene DCPD industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyester grade DCPD is projected to account for 38.70% of the total revenue in 2025, making it the leading grade segment in the global DCPD market. This leadership is being driven by its widespread adoption in the production of unsaturated polyester resins due to favorable reactivity, cost efficiency, and compatibility with other feedstocks.

The grade's thermal and mechanical stability properties make it suitable for molding compounds, panels, and composites used in automotive and construction applications. Polyester-grade DCPD also supports reduced shrinkage and improved fiber wetting in fiberglass-reinforced plastics, which has been critical in improving product durability and aesthetics.

As manufacturers seek to replace styrene in resin systems for environmental compliance and odor control, demand for DCPD as a safer alternative continues to rise.

Unsaturated polyester resin is anticipated to contribute 41.50% of the overall market share by 2025, securing its position as the dominant application segment. Its leading share is supported by extensive use in the production of fiberglass-reinforced plastics, sanitaryware, and construction composites.

The material’s adaptability across multiple end-use industries including marine, transportation, and building materials—has ensured consistent volume demand. DCPD-based UPRs are preferred for their low viscosity, high impact resistance, and affordability, making them well-suited for mass production processes.

Enhanced compatibility with fillers and reinforcement agents has allowed formulators to customize resin performance based on mechanical and chemical requirements. In addition, the growing use of DCPD-modified UPRs in low-emission and recyclable thermosetting systems is reinforcing their role in the transition toward sustainable materials.

The Dicyclopentadiene market is steadily growing as demand rises from automotive, building materials, and marine sectors. DCPD is widely used in resins, inks, paints, and adhesives for its excellent chemical resistance and structural properties. Companies are focusing on production optimization and application diversification. Market expansion is influenced by the shift toward lightweight composite materials and sustainable construction practices. Strategic collaborations, regional expansions, and innovations in catalyst systems are playing a critical role in enhancing market competitiveness and meeting evolving end-user expectations.

The demand for DCPD is significantly driven by its use in manufacturing unsaturated polyester resins and ethylene propylene diene monomer. These materials are critical for producing automotive parts, electrical enclosures, and fiberglass-reinforced plastics. As the automotive and marine industries seek lightweight and durable alternatives to metal components, DCPD-based resins offer the needed structural performance and corrosion resistance. Furthermore, construction applications are also expanding due to DCPD’s role in producing resins for panels, roofing, and insulation. EPDM rubber, made using DCPD, is widely used in weather-sealing systems for windows, doors, and vehicle components. The need for long-lasting sealing and flexibility under varying temperatures boosts the compound’s value across markets. As sectors like automotive, electrical, and building materials emphasize high-performance materials, DCPD remains a preferred raw material for polymer and resin systems that enable strength, resilience, and design flexibility.

Despite promising benefits, the AI in agriculture market faces challenges related to data privacy and infrastructure limitations. Collecting and processing large volumes of farm data raises concerns about ownership, security, and misuse of sensitive information. Farmers and agribusinesses may hesitate to share data due to fears of exploitation or lack of clear regulations governing data handling. Additionally, many rural and underdeveloped areas still lack the necessary internet connectivity, reliable power sources, and technical expertise required to deploy AI solutions effectively. These infrastructural gaps limit the reach of AI technologies, particularly in developing regions where agriculture remains a primary livelihood. Furthermore, the cost of implementing AI systems and training personnel can be prohibitive for small-scale farmers, hindering widespread adoption. Addressing these challenges requires collaborative efforts among technology providers, governments, and agricultural communities to build trust and improve accessibility.

Technological advancements in DCPD purification and catalyst systems are enabling manufacturers to offer higher purity grades with improved consistency. These enhancements are especially important for applications that demand low-odor and low-color resins, such as specialty coatings, inks, and high-performance composites. Innovation in metathesis technology and process intensification allows for better yield, lower emissions, and improved product stability. Companies adopting closed-loop systems and advanced distillation are also able to reduce waste and lower operational costs. This not only supports environmental goals but also boosts overall profitability. Moreover, new developments in hydrogenation and polymerization techniques allow for tailored DCPD derivatives with custom performance attributes, opening up novel applications in electronics, automotive interiors, and aerospace materials. Manufacturers focused on technology-driven improvements are better positioned to serve end-users requiring exact specifications and consistency in quality. These technical innovations are instrumental in expanding DCPD’s reach into high-value segments where performance standards are increasingly stringent.

The DCPD market is shaped by geographical disparities in production capacity and end-use demand. While regions like Asia-Pacific host a significant portion of global production due to integrated petrochemical facilities, North America and Europe remain key consumers due to advanced manufacturing sectors and mature infrastructure. This imbalance often leads to a high volume of interregional trade, exposing the market to risks from transportation costs, tariffs, and geopolitical events. Regional policy differences regarding environmental regulations also affect how DCPD is produced and traded. For instance, stricter emission norms in certain regions may increase production costs or shift demand to cleaner alternatives. In contrast, emerging economies are witnessing rising DCPD consumption due to expanding construction and automotive industries. To address these supply-demand gaps, several players are investing in capacity expansion, logistics networks, and long-term contracts. Effective global supply chain coordination is becoming essential for ensuring timely availability and price stability in regional markets.

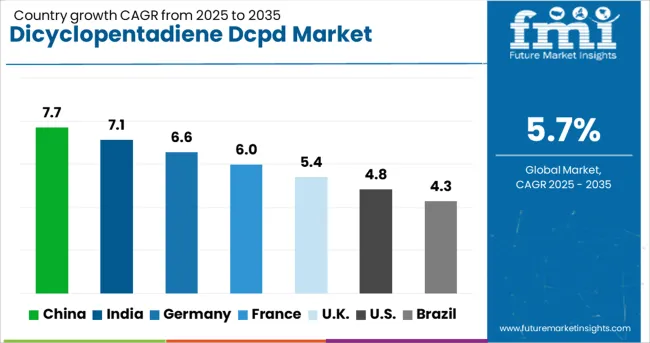

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

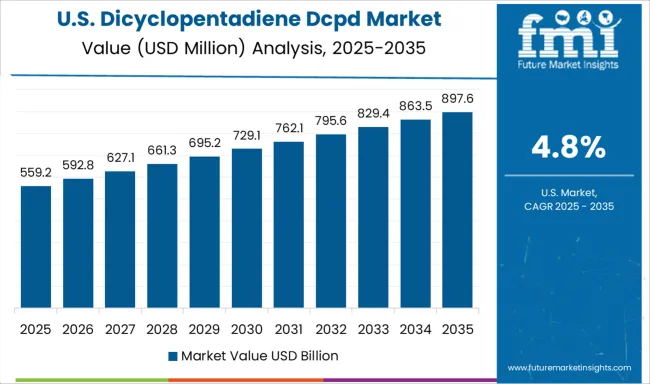

| USA | 4.8% |

| Brazil | 4.3% |

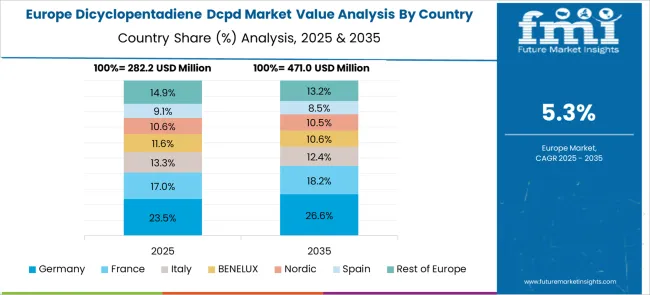

The global dicyclopentadiene (DCPD) market is projected to grow at a CAGR of 5.7%, driven by rising demand across automotive, construction, and marine industries. China leads with a strong 7.7% growth rate, supported by extensive manufacturing capacity and increasing use of DCPD in resins and polymers. India follows at 7.1%, fueled by expanding industrial applications and infrastructure development. Germany records a 6.6% growth rate, reflecting demand in high-performance materials and advanced chemical processing. The United Kingdom shows stable growth at 5.4%, supported by niche applications and technological integration. The United States, as a mature market, grows at 4.8%, shaped by regulatory standards and the presence of established end-user industries. These countries are advancing the market through production efficiency, evolving environmental compliance, and application-driven innovation. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the Dicyclopentadiene (DCPD) market with a 7.7% CAGR, supported by strong demand from the automotive, construction, and electronics sectors. DCPD is widely used in resins, coatings, and thermoplastics, and China’s industrial growth continues to drive its consumption. Local manufacturers are expanding production capacity to meet rising domestic and export demand. Advancements in catalyst technologies and process efficiency are improving product quality and reducing environmental impact. The growing composites industry, particularly for lightweight automotive parts, is a key contributor to market growth. Integration of DCPD into specialty polymers and high-performance resins is also expanding its industrial applications.

India is seeing a 7.1% CAGR in the Dicyclopentadiene market, driven by growth in construction chemicals, paints, and advanced materials. As infrastructure projects expand, the need for resins and polymers derived from DCPD is rising steadily. Domestic manufacturers are increasing their refining and chemical production capacity to support downstream demand. Import substitution policies and Make in India initiatives are encouraging local production of value-added chemicals. Research into new uses for DCPD in insulation, adhesives, and marine composites is further boosting interest. Expansion of the transportation and packaging sectors also contributes to long-term market prospects.

Germany is experiencing a 6.6% CAGR in the Dicyclopentadiene market, driven by demand in specialty chemicals, automotive materials, and eco-friendly coatings. The country’s engineering and manufacturing industries use DCPD in a wide range of high-performance polymers and resins. Sustainability targets are encouraging the development of bio-based alternatives and cleaner production technologies. DCPD’s role in lightweight composite materials is expanding, particularly for electric vehicles and energy-efficient construction. Collaboration between chemical firms and academic institutions is driving innovation in resin formulation and process optimization.

The United Kingdom is recording a 5.4% CAGR in the Dicyclopentadiene market, supported by moderate demand in paints, rubber, and specialty polymers. DCPD use in automotive repair compounds and marine coatings is maintaining steady growth. Regulatory focus on cleaner chemical processes is encouraging local producers to invest in sustainable manufacturing. Partnerships between chemical firms and R&D institutions are driving innovations in modified DCPD-based materials. The ongoing shift to green construction materials is also contributing to demand for resins with improved weather and chemical resistance.

The United States is showing a 4.8% CAGR in the Dicyclopentadiene market, with stable demand across automotive, construction, and packaging industries. DCPD is used in the production of unsaturated polyester resins and hydrocarbon resins, essential for adhesives and coatings. Manufacturers are optimizing production lines to enhance efficiency and reduce emissions. The shift toward lightweight materials in automotive design continues to support DCPD-based composites. Regulatory standards on VOC content are influencing product formulations. Innovation in packaging and sealant applications is also opening new growth avenues for DCPD derivatives.

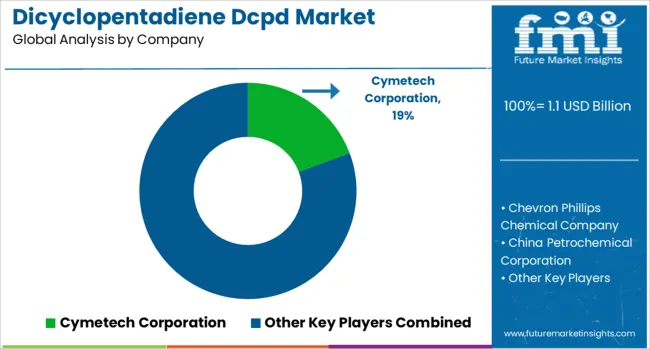

The Dicyclopentadiene (DCPD) Market is driven by rising demand from key end-use sectors such as automotive, construction, marine, and plastics. DCPD is a chemical intermediate primarily used in the production of resins, polymers, and specialty chemicals. Its high reactivity and low cost make it valuable in manufacturing unsaturated polyester resins (UPR), hydrocarbon resins, and EPDM elastomers, which are widely applied in body panels, adhesives, paints, and coatings. Several global companies are leading the market with their extensive production capabilities and distribution networks. Cymetech Corporation is one of the key producers specializing in high-purity DCPD used in performance polymers and resins. Chevron Phillips Chemical Company and Royal Dutch Shell plc (Shell Chemicals) are major players with vertically integrated operations, ensuring consistent supply of raw materials like naphtha and crude C5.

Asian giants such as China Petrochemical Corporation (Sinopec) and Nanjing Yuangang Fine Chemical Co. cater to the growing domestic and international demand from Asia-Pacific, particularly China. Other notable contributors include Braskem, LyondellBasell Industries Holdings B.V, and The Dow Chemical Company, all of which have a strong presence in the petrochemical industry and support the market through innovation and scalable production. Companies such as Maruzen Petrochemical, Zibo Luhua Hongjin New Material Co., and Tokyo Chemical Industry Co., Ltd. (TCI Chemicals) provide specialty-grade DCPD for advanced chemical applications. Texmark Chemicals Inc and Sunny Industrial System GmbH focus on tailored chemical solutions and logistics for niche markets. With rising industrialization, increasing infrastructure development, and growing polymer consumption globally, the DCPD market is expected to maintain a steady growth trajectory. Expansion of downstream applications and capacity investments by key players will further enhance market penetration over the coming years.

As confirmed by recent industry disclosures, major DCPD producers ExxonMobil, Shell, Zeon, and LyondellBasell are expanding capacity and focusing on high-purity grades. Their strategies emphasize reliability, polymer innovation, and sustainability. Target applications include automotive, wind energy, and electronics, aligning with long-term growth trends in advanced materials and lightweight composites.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Grade | Polyester grade (UPR), High Purity grade, Hydrocarbon resin grade, and Other Grade |

| Application | Unsaturated Polyester Resin, Hydrocarbon Resins, EPDM Elastomers, COC & COP, Poly-DCPD, and Others (Pesticides, Flame retardants, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cymetech Corporation, Chevron Phillips Chemical Company, China Petrochemical Corporation, Braskem, Maruzen Petrochemical, LyondellBasell Industries Holdings B.V, Nanjing Yuangang Fine Chemical Co, NOVA Chemicals, Royal Dutch Shell plc (Shell Chemicals), Sunny Industrial System GmbH, Texmark Chemicals Inc, The Dow Chemical Company, Tokyo Chemical Industry Co., Ltd. (TCI Chemicals), and Zibo Luhua Hongjin New Material Co. |

| Additional Attributes | Dollar sales vary by grade and application, with resin grade leading, while high‑purity grade grows fastest; by application, UPR dominates, with hydrocarbon resins expanding rapidly; by region, Asia‑Pacific leads, North America and Europe focus on high-performance uses. Growth accelerates via composites, automotive, and sustainable innovations, despite substitution and feedstock volatility. |

The global dicyclopentadiene DCPD market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the dicyclopentadiene DCPD market is projected to reach USD 2.0 billion by 2035.

The dicyclopentadiene DCPD market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in dicyclopentadiene DCPD market are polyester grade (upr), high purity grade, hydrocarbon resin grade and other grade.

In terms of application, unsaturated polyester resin segment to command 41.5% share in the dicyclopentadiene DCPD market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA