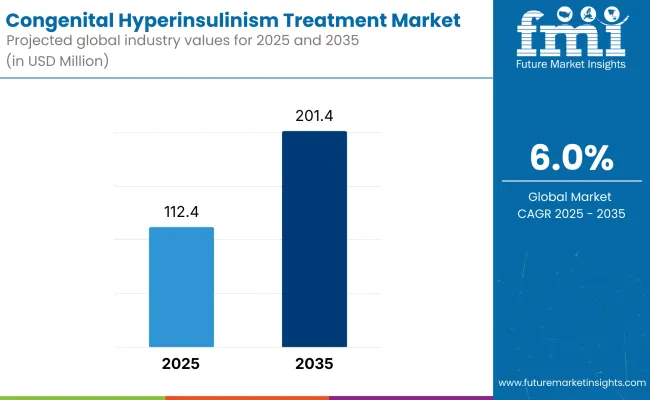

The congenital hyperinsulinism treatment market is estimated to witness robust development from 2025 to 2035 owing to the introduction of quality treatment solutions, increased investment in research activities and the growth of congenital hyperinsulinism disorder cases worldwide. In 2025, the market is valued at USD 112.4 million and advanced to be worth USD 201.4 million in 2035, growing at a thumping CAGR of 6%.

There are many reasons stoking that growth. The rising prevalence of genetic disorders, the growing use of gene therapies, and ongoing development of innovative drug formulations are all driving the growth of the market. Moreover, the increasing awareness for early disease detection and soaring healthcare spending in developing economies are also broadening the market opportunities.

However, high treatment costs, lack of qualified specialized healthcare professionals, and difficulties in regulation will continue to be major hindrances, despite the promising outlook. Industry concerns include focused efforts on clinical trials, partnerships, and the development of better drugs to improve treatment and access.

Increasing emphasis on novel therapeutic approaches, government scrutiny towards the treatment for rare disease, and enhancing patient awareness programs are anticipated to fuel the Congenital Hyperinsulinism Treatment Market during the coming decade. By constantly innovating, the future of drug development, genetic therapies, and the industry as a whole has the potential for considerable growth and patient improvements.

The North America congenital hyperinsulinism treatment market is prevalent and driven by the region's developed healthcare infrastructure, increased research and funding on drugs, and the presence of key pharmaceutical providers. The United States is ahead of the region with growing numbers of clinical trials and FDA approvals for novel therapies.

Increasing availability of genetic screening programs and early diagnosis initiatives are anticipated to propel market growth. However, factors such as high treatment costs and limited awareness in some regions may restrict market growth.

Congenital hyperinsulinism treatment in the European region is a prominent market with countries such as Germany, France, and the United Kingdom leading the way in the field. Key growth driver is government-backed initiatives and rare disease awareness programs.

The market also faces challenges such as the need for stringent regulatory frameworks and reimbursement hurdles that could hinder technology penetration. Nonetheless; treating options are being driven by new clinical outcomes, and new partnerships between academic/public research institutes and pharma.

Some of the other regions which are contributing to the growth of the congenital hyperinsulinism treatment market are Asia-Pacific, owing to the increasing healthcare access and rise in genetic disorder awareness in this region including countries like China, India and Japan.

While some regions face challenges due to limited healthcare infrastructure, government initiatives to improve pediatric care and a growing focus on rare disease research are creating new opportunities. The mergers and acquisitions facilitate companies to expand with strategic alliances and regional modes.

Challenges

Limited Treatment Options and High Costs

A new drug for Congenital Hyperinsulinism (CHI) a rare and difficult to treat disorder has comment on the rarity of this condition, with poor treatment options. Existing treatment options like diazoxide & octreotide have undesirable side effects & variable efficacy. Moreover, not only do high treatment costs have a major financial impact on patients and healthcare systems, but the cost of treatment rising for pancreatectomy and investigational gene therapies is also prohibitively expensive.

The urgent need for effective, affordable and targeted treatments is ever critical. Increased research funding and clinical trials designing novel therapies such as long-acting formulations and precision medicine are crucial in addressing these challenges. Regulatory incentives and patient assistance programs may also enhance access to new therapies.

Opportunities

Advancements in Gene Therapy and Personalized Medicine

With the development of gene therapy and personalized medicine, the CHI treatment market is large and offers lots of opportunities. Advancements in genomic research and molecular diagnostics are opening the door to targeted therapies that treat the root causes of hyperinsulinism. Further, companies are trying out new drug formulations such as GLP-1 receptor modulators and CRISPR based neurodegenerative drugs to help patients.

Moreover, AI-based diagnostics will facilitate the expansion of new-born screening programs and improve early detection with treatment. Biopharmaceutical innovation and market expansion will be further spurred by increased biopharmaceutical research investment, as well as the collaborations between academic institutions and biotech firms.

New diagnostic tools (e.g. next generation sequencing) and drugs for the management of CHI, were described between 2020 and 2024. Improved understanding of the disease was made possible by new therapies and larger registries of affected patients. But high treatment costs and regulatory hurdles restricted market penetration. Company’s targeted clinical trials and orphan drug designations to speed the approval process.

Gene-editing therapies, artificial-intelligence (AI)-driven treatment algorithms, and innovative drug delivery systems are expected to drive transformative changes in the coming 2025 to 2035 market. The future belongs to personalized medicine, with treatment plans tailored to individuals’ genetic profiles. The data-generated competitiveness of CHI with global investment and supportive policies point to a radical improvement across a range of accessibility measurements.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Orphan drug designations and clinical trials |

| Technological Advancements | Advances in molecular diagnostics and drug discovery |

| Industry Adoption | Limited to pediatric endocrinology centres |

| Supply Chain and Sourcing | Reliance on imported specialty drugs |

| Market Competition | Presence of a few key players |

| Market Growth Drivers | Increased awareness and genetic testing availability |

| Sustainability and Energy Efficiency | Limited eco-conscious manufacturing practices |

| Consumer Preferences | Demand for effective and accessible treatments |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Accelerated approval pathways for gene therapies |

| Technological Advancements | CRISPR-based therapies and AI-driven personalized medicine |

| Industry Adoption | Widespread integration into global healthcare systems |

| Supply Chain and Sourcing | Expansion of biopharmaceutical manufacturing hubs |

| Market Competition | Rise of new biotech start-ups specializing in rare disease therapies |

| Market Growth Drivers | Innovations in precision medicine and targeted gene therapies |

| Sustainability and Energy Efficiency | Adoption of green biopharmaceutical production methods |

| Consumer Preferences | Preference for minimally invasive, curative therapies |

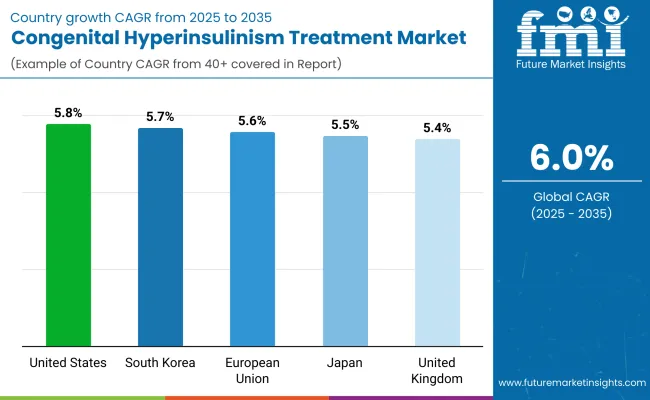

The United States accounts for the largest share of the global congenital hyperinsulinism market, followed by Europe as well as Asia-Pacific owing to the well-established healthcare infrastructure. New ways of treating rare diseases like targeted therapies and gene-based methods of treatment are being developed faster than before, thanks to more funding for research.

Thanks to campaigns from organisations like the Congenital Hyperinsulinism International (CHI) Foundation, however, awareness of the disease is growing and so is access to early diagnosis and specialist treatment. Market expansion is also supported by the increasing expansion of neonatal screening programs and government support for orphan drug development.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

The United Kingdom congenital hyperinsulinism treatment market is expected to witness moderate growth owing to the support from National Health Service (NHS) and numerous rare disease research initiatives. There are a few specialist places such as Great Ormond Street Hospital who play a central role in the care of these patients.

Market growth is being driven by the growing emphasis towards precision medicine, combined with an increase in clinical trials for new therapeutic agents. Such testing, along with government support for new-born screening programs and patient advocacy groups, is leading to earlier diagnosis and better management of the condition.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

Countries such as Germany, France, and Spain in the European Union are demanding advanced diagnostic methodologies and medical therapies, contributing to the growth of the congenital hyperinsulinism treatment market. New Orphan Drug laws and regulatory authorities such as the EMA are stimulating orphan drug development and, in turn, providing the pharmaceutical industry with financial incentives to develop CHI as an innovative product.

Furthermore, the presence of specialized treatment centres and increasing collaborations between research institutions and biotech companies are also expected to drive this market. Furthermore, efforts by public health organizations emphasizing the early detection of diseases and improvement of neonatal care are considerably driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.6% |

As a result of improvements in genetic research, personalized medicine, and taking on new drug therapies, Japan's congenital hyperinsulinism treatment market is growing. Government policies in the country give new treatments for rare diseases high priority, and research grant funding is directed to this type of drugs, facilitating drug development.

Japan has vast potential in the CHI treatment market owing to the increasing adoption of next-generation sequencing (NGS) for early diagnosis and ease of access to futuristic healthcare infrastructure. Drug companies are actively pursuing research partnerships to make more effective, targeted therapies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

The tractable congenital hyperinsulinism treatment market in South Korea is being primarily driven by improvements in neonatal care, growing healthcare expenditure, and increasing adoption of advanced medical technologies. The market is being driven by the country's commitment to research rare diseases and increase government funding for pediatric healthcare.

Moreover, partnerships between hospitals, biotech companies, and academic institutions are speeding up the time frame for new treatment strategies. Other factors that are contributing to the growth of the market include efforts to improve new-born screening programs and expand patient access to specialized treatments.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

Congenital hyperinsulinism (HI) is a rare genetic disorder that leads to excessive insulin production and severe hypoglycaemia. Congenital hyperinsulinism is a rare genetic disorder of excessive insulin secretion that results in persistent hypoglycaemia in neonates and infants. Without prompt treatment, the condition can cause profound neurological injury or developmental delays.

The modernization of diagnostic abilities, the procurement of new therapeutic entities and the development of surgical techniques have greatly improved the care of this condition leading to an increase in the demand for treatment.

Moreover, healthcare professionals and research organizations are actively investigating therapeutic approaches tailored to treat congenital hyperinsulinemia with maximum efficacy for enhanced patient outcomes.

Adoption of both pharmaceutical and surgical treatment approaches has been reinforced by a growing emphasis on early detection and precision medicine, as well as genetic counselling. It will lead to better penetration of drug for sensitive, effective and individualized solutions in the treatment of affected individuals.

Medical treatment is still the cornerstone in the management of congenital hyperinsulinism, with diazoxide and octreotide being the most commonly used drugs. They promote the regulation of insulin release, preventing serious hypoglycaemia and the need for surgery.

The first-line medication for congenital hyperinsulinism, diazoxide, acts by opening ATP-sensitive potassium channels in pancreatic beta cells, and thus inhibits the secretion of insulin. It has been widely used, as it is effective in controlling hypoglycaemia in patients with diffuse forms of HI.

Diaz oxide’s widespread use in hospitals and pediatric care settings can be attributed to its ease of administration (oral formulations) and long clinical history of approval. On the other hand, their associated adverse effects including fluid retention, hypertrichosis or gastrointestinal tract irritations need close follow-up and individualized titration.

Octreotide (synthetic somatostatin analog) has emerged as a second-line treatment for individuals who don't respond to diazoxide or develop side effects. Octreotide is administered by subcutaneous or intravenous injection to lower insulin secretion by inhibiting calcium channel activity in pancreatic beta cells.

This medication is especially useful in cases of severe or transient forms of hyperinsulinism that are inadequately responsive to diazoxide. While effective, prolonged use of octreotide should be considered carefully as it may affect gastrointestinal motility and growth hormone release in children.

Glucagon injection for rapid increase in sugar in hypoglycemic episodes, other than diazoxide and octreotide. Moreover, advanced explorations of new drug formulations, combination therapies, and gene-approaches are ongoing with the goal of improving pharmacological management of HI subjects. As clinical trials continue and regulatory approvals gain momentum, the pharmaceutical section of the congenital hyperinsulinism treatment market is set to undergo further development and advancement.

However, on the basis of application, hospitals and specialty clinics dominate the healthcare facilities for the diagnosis, treatment and management of congenital hyperinsulinism. These centers offer specialized care, expertise, and technology, making them critical distribution channels for HI therapies.

Hospitals are the treatment centers for children diagnosed with congenital hyperinsulinism shortly after birth. Continuous glucose monitoring (CGM) systems, as well as intravenous glucose infusions, are available in neonatal intensive care units (NICUs) and pediatric endocrinology departments, and expert medical teams handle hypoglycaemic episodes carefully.

Hospitals are essential for administering first-line drug therapies, investigating surgical solutions, and providing genetic testing to pinpoint the cause of hyperinsulinism. Due to the rise of telemedicine services and AI-powered diagnostic tools, hospitals are still extending their capabilities to provide early diagnosis and tailored treatment strategies for HI patients.

Long-term disease management and post-surgery follow-up are also vital components of care, and the pediatric endocrine and metabolic disorder centers are specialized clinics. These programs prioritize personalized treatment plans, diet management, and regular checking of glucose levels to provide the best care for patients.

Several specialty clinics partner with pharmaceutical companies, research institutions, and healthcare policymakers to advance clinical trials, patient education initiatives, and innovative therapeutic approaches to congenital hyperinsulinism.

Additionally, recent advances in genetic counselling, minimally invasive surgical techniques, and experimental treatment protocols have bolstered the position of hospitals and clinics in the HI treatment landscape. As these healthcare organizations increase investments toward implementation of both pediatric endocrinology research and multidisciplinary care models, they will remain the dominant treatment centers for congenital hyperinsulinism far into the future.

The Congenital Hyperinsulinism (CHI) Treatment Market is witnessing considerable growth owing to the rising cases of congenital hyperinsulinism, a rare but severe condition that leads to excessive secretion of insulin and, consequently, persistent hypoglycaemia. Market expansion has been driven by advancements in genetic research, early diagnostic tools, and enhanced treatment strategies.

Several initiatives for supporting the treatment of people with rare diseases in humans have increased awareness of rare and treatable diseases, such as CHI, throughout the global NICE and H2020 communities. Biopharmaceutical companies are developing new treatment strategies such as pancreatic targeting drugs, gene therapies, and less invasive surgical procedures for managing this complication.

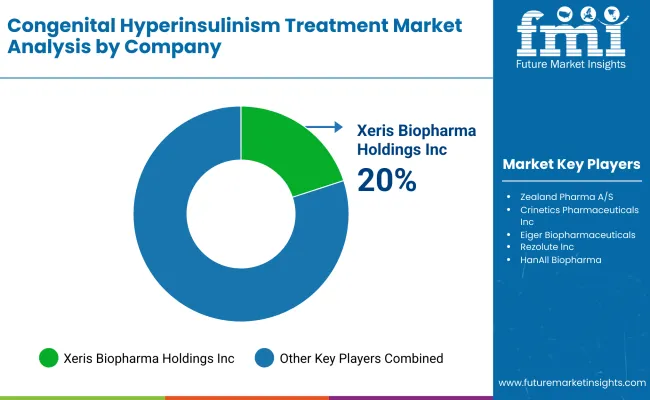

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Xeris Biopharma Holdings, Inc. | 20-25% |

| Zealand Pharma A/S | 15-20% |

| Crinetics Pharmaceuticals, Inc. | 10-15% |

| Rezolute, Inc. | 8-12% |

| Hanmi Pharmaceutical Co., Ltd. | 5-10% |

| Other Industry Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Xeris Biopharma Holdings, Inc. | Creates glucagon formulations such as Gvoke HypoPen for treating severe hypoglycemia. |

| Zealand Pharma A/S | Dasiglucagon seems to be an innovative glucagon analogue for the management of congenital hyperinsulinism. |

| Crinetics Pharmaceuticals, Inc. | Focuses currently on small molecular therapy’s directed against hyperinsulinism and endocrine disorders. |

| Rezolute, Inc. | Develops experimental treatments for rare pediatric metabolic disorders, including congenital hyperinsulinism. |

| Hanmi Pharmaceutical Co., Ltd. | Provides long-acting injectable options for patients with endocrine disorders, such as CHI. |

Key Company Insights

Xeris Biopharma Holdings, Inc. (20-25%)

Xeris is a top contender in the congenital hyperinsulinism treatment market, as its ready-to-use glucagon formulations like Gvoke HypoPen have better adoption than any other product in the market. Specialized approaches to stabilized glucagon formulations and user-friendly administration methods strengthen acute hypoglycemia management.

Zealand Pharma A/S (15-20%)

Zealand Pharma is important in congenital hyperinsulinism treatment, especially dasiglucagon, a new glucagon analog to treat hyperinsulinemic hypoglycemia. The company is investing deeply in clinical trials and regulatory approvals to expand their reach.

Crinetics Pharmaceuticals, Inc. (10-15%)

Crinetics specializes in small-molecule drugs that target hyperinsulinism and rare endocrine disorders. This includes non-invasive drug candidates to stabilize glucose levels for CHI patients in its pipeline.

Rezolute, Inc. (8-12%)

One of these, RZ358, is being developed by Rezolute and is a monoclonal antibody therapy that modulates insulin receptor activity to prevent severe hypoglycemia in patients with CHI. Company's partnerships with strategic collaborators are resulting in clinical advantages.

Hanmi Pharmaceutical Co., Ltd. (5-10%)

Hanmi specializes in long-acting injectable therapies for endocrine-related diseases. The firm is investigating pancreas-targeted therapies for congenital hyperinsulinism.

Other Key Players (30-40% Combined)

Several companies are driving market innovation through advanced drug formulations, gene therapies, and targeted endocrine treatments. Notable players include:

The overall market size for the congenital hyperinsulinism treatment market was USD 112.4 million in 2025.

The congenital hyperinsulinism treatment market is expected to reach USD 201.4 million in 2035.

The congenital hyperinsulinism treatment market is expected to grow at a CAGR of 6% during the forecast period.

The demand for the congenital hyperinsulinism treatment market will be driven by increasing awareness and diagnosis of the condition, advancements in treatment options, rising investments in rare disease research, growing pediatric healthcare expenditure, and the development of novel therapeutic approaches.

The top five countries driving the development of the congenital hyperinsulinism treatment market are the USA, Germany, UK, Japan, and China.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Treatment Methods, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Treatment Methods, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Treatment Methods, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Treatment Methods, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Asia Pacific Market Value (US$ Million) Forecast by Treatment Methods, 2018 to 2033

Table 15: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: MEA Market Value (US$ Million) Forecast by Treatment Methods, 2018 to 2033

Table 18: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Treatment Methods, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Treatment Methods, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Treatment Methods, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Treatment Methods, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Treatment Methods, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Treatment Methods, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Treatment Methods, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Treatment Methods, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Treatment Methods, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Treatment Methods, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Treatment Methods, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Treatment Methods, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Treatment Methods, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Treatment Methods, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Treatment Methods, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Treatment Methods, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Treatment Methods, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Treatment Methods, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Treatment Methods, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Europe Market Attractiveness by Treatment Methods, 2023 to 2033

Figure 59: Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Asia Pacific Market Value (US$ Million) by Treatment Methods, 2023 to 2033

Figure 62: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Asia Pacific Market Value (US$ Million) Analysis by Treatment Methods, 2018 to 2033

Figure 68: Asia Pacific Market Value Share (%) and BPS Analysis by Treatment Methods, 2023 to 2033

Figure 69: Asia Pacific Market Y-o-Y Growth (%) Projections by Treatment Methods, 2023 to 2033

Figure 70: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Asia Pacific Market Attractiveness by Treatment Methods, 2023 to 2033

Figure 74: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 75: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 76: MEA Market Value (US$ Million) by Treatment Methods, 2023 to 2033

Figure 77: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: MEA Market Value (US$ Million) Analysis by Treatment Methods, 2018 to 2033

Figure 83: MEA Market Value Share (%) and BPS Analysis by Treatment Methods, 2023 to 2033

Figure 84: MEA Market Y-o-Y Growth (%) Projections by Treatment Methods, 2023 to 2033

Figure 85: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: MEA Market Attractiveness by Treatment Methods, 2023 to 2033

Figure 89: MEA Market Attractiveness by Application, 2023 to 2033

Figure 90: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Congenital Amegakaryocytic Thrombocytopenia (CAMT) Market

Congenital Adrenal Hyperplasia Treatment Market Analysis and Forecast by Type, Treatment, End User, and Region through 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Algae Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Water Treatment System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA