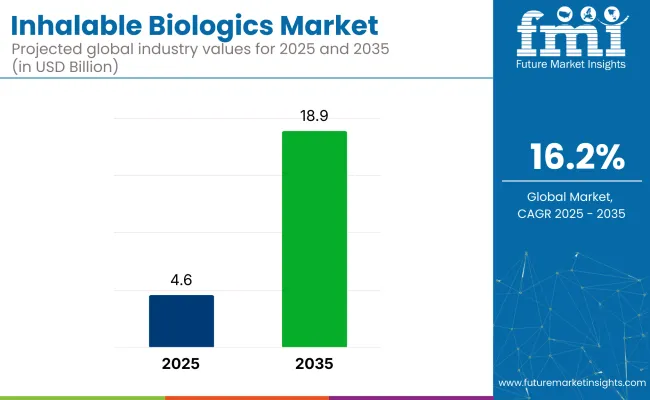

The global inhalable biologics market will witness remarkable growth, expanding from USD 4.6 billion in 2025 to nearly USD 18.9 billion by 2035, registering a CAGR of 16.2%.

This surge is primarily driven by the increasing global burden of respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and pulmonary fibrosis, alongside rising patient preference for non-invasive and lung-targeted therapies. Inhalation therapies provide advantages such as localized delivery, enhanced bioavailability, and minimized systemic side effects, making them a favorable alternative to injectable or oral biologics.

A recent industry development occurred in June 2025, when Intertek officially expanded its pharmaceutical GMP laboratory in Melbourne, UK. This upgrade is designed to bolster its biologics testing services, with a particular focus on inhaled and nasal drug development, including cutting-edge mRNA and nucleotide-based therapeutics.

Regionally, North America continues to lead due to its developed healthcare infrastructure and high biologics adoption rates, while the Asia Pacific region is expected to register the fastest growth. Factors such as rising healthcare awareness and improvements in medical access are driving market uptake across emerging economies like China and India. Key players include AstraZeneca, Insmed, Pulmatrix, Amgen, and Novartis.

The industry holds specific shares in its parent markets. In the biologics market, the inhalable biologics market accounts for a relatively small share, estimated at around 2-4%, as biologics primarily focus on injectable therapies. In the inhalation drug delivery market, it holds a share of about 15-20%, driven by the increasing adoption of inhalable biologic therapies. Within the broader pharmaceutical market, the share is approximately 1-3%, reflecting the growing interest in non-injection-based biologic therapies.

The respiratory drug market contributes about 5-7% to the overall market, as inhalable biologics are increasingly used to treat respiratory conditions. In the medical device market, the inhalable biologics sector holds around 3-5%, as it is heavily dependent on specialized delivery devices like inhalers and nebulizers.

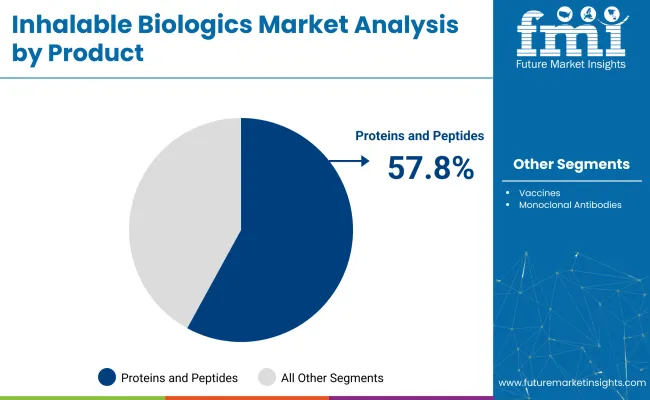

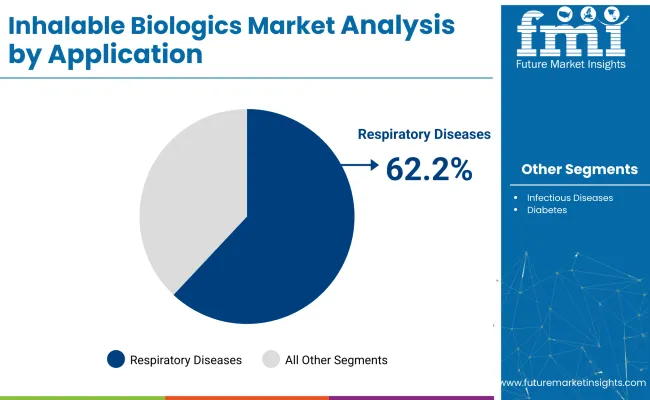

Proteins and peptides, respiratory disease applications, dry powder inhalers, and hospital pharmacies drive the market, offering high compatibility, stability, patient compliance, and specialized storage advantages by 2025.

Proteins and peptides are expected to lead the product segment with a 57.8% share in 2025.

The respiratory diseases segment will remain dominant, capturing 62.2% of the market in 2025. Rising incidences of asthma, COPD, and pulmonary fibrosis across developed nations are fueling demand for targeted inhalable treatments.

Dry powder inhalers (DPIs) are projected to dominate the dosage form category with a 38.5% market share by 2025.

Hospital pharmacies will dominate the distribution channel with a 49.7% market share in 2025 due to their capacity to manage cold-chain-sensitive biologics and offer specialized dispensing.

Regulatory approvals in respiratory disease and innovation in inhalation devices and formulators are driving market growth. These trends support wider adoption and improved patient outcomes.

Growing Focus on Respiratory Disease Treatments with FDA-Approved Biologics

Pulmonary delivery of biologics is being prioritized for chronic respiratory diseases. FDA approvals for inhalable treatments in COPD and asthma have set precedents. For example, mepolizumab (Nucala) recently gained FDA approval for COPD with eosinophilic phenotype following asthma indications. Dupilumab (Dupixent) was also approved as first biologic maintenance therapy for COPD.

These approvals validate the use of inhalable monoclonal antibodies. Market confidence has increased. Pipelines with next-gen inhaled biologics, including long-acting IL5 agents and inhalable vaccines, are being accelerated. Clinicians are now being encouraged to adopt device-enabled biologic therapies for respiratory management.

Advances in Device Technology and Formulation Methods

Innovation in delivery devices and formulations is improving therapeutic potential of these biologics. Dry powder inhalers (DPIs) are being favored due to stability and ease of use. Nebulizers and soft mist inhalers are being redesigned to ensure optimal lung deposition of proteins, peptides and RNAi therapeutics.

Collaborations between device companies (e.g., Iconovo and Lonza) have been announced to develop inhalable biologic formulations using spray-drying technology. Regulatory emphasis on device-drug combinations has placed quality control at priority. These advancements are driving adoption by improving dosing accuracy, patient compliance, and product scalability.

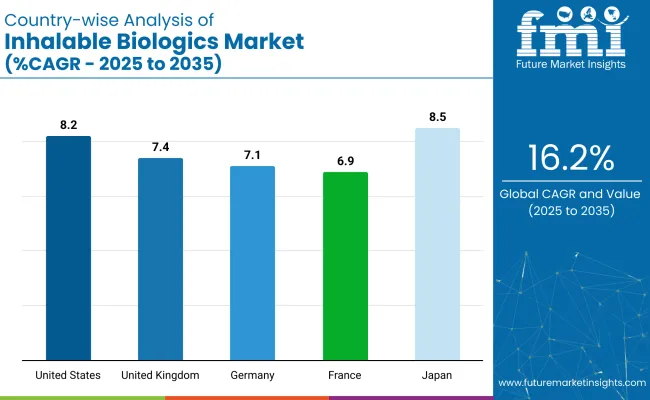

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 8.2% |

| United Kingdom | 7.4% |

| Germany | 7.1% |

| France | 6.9% |

| Japan | 8.5% |

OECD countries, including the United States and the United Kingdom, are witnessing strong growth in the industry. The United States, with a projected CAGR of 8.2% from 2025 to 2035, leads the charge, driven by rising respiratory diseases and FDA support for biologic inhalation therapies. Top companies like AstraZeneca, Pfizer, and Amgen are investing in monoclonal antibodies and protein-based formulations.

The USA benefits from a well-built clinical trial network, extensive health insurance coverage, and partnerships between biotech startups and established pharma giants, accelerating market maturation. In the United Kingdom, projected to grow at 7.4% CAGR, the NHS’s commitment to patient-centric care and a cost-effective biologics focus enhances market adoption. Companies like GSK and Oxford Biomedica are developing biologic therapies for asthma, COPD, and rare pulmonary diseases.

In the ASEAN region, Japan is expected to be the fastest-growing market, with a projected CAGR of 8.5%. Japan’s aging population and advanced pharmaceutical research are key drivers, with companies like Takeda and Astellas investing in the industry. Government initiatives promoting healthcare innovation and reimbursement for biologics further stimulate market growth.

Germany, within the OECD, is projected to grow at a steady 7.1% CAGR, with its leadership in precision medicine and personalized biologic treatments, driven by companies like Boehringer Ingelheim and Bayer. France, within the EU, is expected to grow at 6.9% CAGR, supported by strong clinical research, government health initiatives, and advancements in inhalable biologic therapies for rare diseases.

The report covers in-depth analysis of 40+ countries. Five top performing countries are highlighted below.

The United States dominates, with a projected CAGR of 8.2% from 2025 to 2035. Growth is fueled by the rising prevalence of respiratory diseases and the FDA’s supportive regulatory pathway for biologic inhalation therapies. Top companies like AstraZeneca, Pfizer, and Amgen are focusing on monoclonal antibodies and innovative protein-based formulations to address the demand for inhalable treatments.

The United Kingdom is expected to grow at a CAGR of 7.4% from 2025 to 2035, driven by the country’s established healthcare system and a focus on cost-effective biologics. NHS’s commitment to patient-centric respiratory care is encouraging the use of biologic inhalation therapies. The UK’s established biopharmaceutical sector, supported by firms like GSK and Oxford Biomedica, is developing biologic solutions for asthma, COPD, and rare pulmonary diseases.

Germany's inhalable biologics market is projected to grow at a steady CAGR of 7.1% from 2025 to 2035, supported by strong research in precision medicine and biotechnology. The country’s leadership in personalized medicine aligns well with the demand for tailored inhalable therapies for chronic respiratory conditions like asthma and COPD. Companies like Boehringer Ingelheim and Bayer are focusing on the development of innovative therapies that promise improved patient outcomes.

The France inhalable biologics market is expected to grow at a CAGR of 6.9% from 2025 to 2035, fueled by the country’s strong clinical research focus and biotechnology sector. French companies are pioneering in the development of inhalable monoclonal antibodies and therapeutic proteins, especially targeting rare pulmonary diseases. Government-driven health initiatives and public-private collaborations are accelerating innovation and improving the availability of these therapies.

Japan will be the fastest-growing market for inhalable biologics, with a CAGR of 8.5% from 2025 to 2035. The nation's advanced pharmaceutical research and an aging population are key drivers of demand for inhalable treatments targeting age-related respiratory diseases. Companies like Takeda and Astellas are investing in biologic formulations suitable for inhalation, contributing to the development of new therapeutic options.

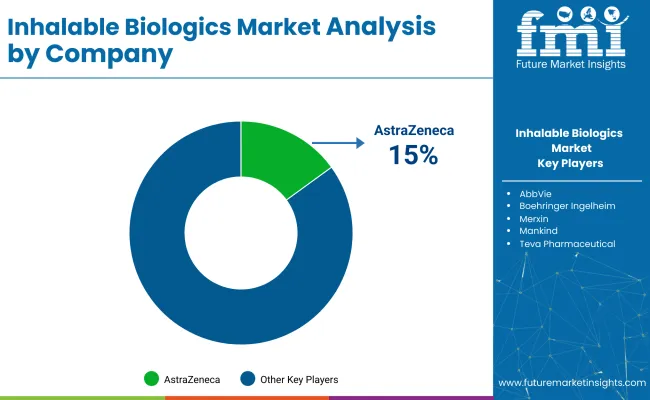

The industry is moderately consolidated, with topcompanies like AstraZeneca, Boehringer Ingelheim, and F. Hoffmann-La Roche Ltd. holding large market shares because of advanced R&D, proprietary delivery platforms, and regulatory expertise. Emerging players, such as MannKind Corporation, Kamada Pharmaceuticals, and CanSino Biologics, focus on niche therapies and regional markets to build their presence.

Growing demand for inhalable biologics is fueled by rising respiratory disease cases, including asthma and COPD. Key manufacturers have brought innovations in dry powder inhalers (DPIs), soft mist inhalers (SMIs), and improved formulations to enhance bioavailability, therapeutic efficiency, and patient adherence across markets.

Recent Inhalable Biologics Market News

| Report Attributes | Details |

|---|---|

| Market Size (2025E) | USD 4.6 billion |

| Projected Market Size (2035F) | USD 18.9 billion |

| CAGR (2025 to 2035) | 16.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value & thousand units volume |

| By Product Type (Segment 1) | Proteins and Peptides, Vaccines, Monoclonal Antibodies |

| By Application (Segment 2) | Respiratory Diseases, Infectious Diseases, Diabetes |

| By Dosage Form (Segment 3) | Dry Powder Inhalers, Metered Dose Inhalers, Nebulizers, Soft Mist Inhalers |

| By Distribution Channel (Segment 4) | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| Countries Covered | USA, Canada, Germany, UK, France, Spain, Italy, Netherlands, China, Japan, India, Australia, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE |

| Key Players Influencing the Market | AbbVie, AstraZeneca, Boehringer Ingelheim, CanSino Biologics, Chiesi Pharmaceuticals, F. Hoffmann-La Roche, Kamada Pharmaceuticals, MannKind, Merxin, Teva Pharmaceutical, United Therapeutics |

| Additional Attributes | Dollar sales, share, innovative inhalable drug delivery, market growth by respiratory disease burden, biologics pipeline advancements, and inhaler device design improvements |

Proteins and peptides, vaccines, and monoclonal antibodies.

Respiratory diseases, infectious diseases, and diabetes.

Dry powder inhalers (DPIs), metered dose inhalers (MDIs), nebulizers, and soft mist inhalers (SMIs).

Hospital pharmacies, retail pharmacies, and online pharmacies.

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa.

The market is projected to reach USD 18.9 billion by 2035.

The market is expected to grow at a CAGR of 16.2% between 2025 and 2035.

The market size is projected to be USD 4.6 billion in 2025.

Proteins and peptides will dominate the product segment with a 57.8% share in 2025.

Dry powder inhalers are projected to account for 38.5% of the dosage form market share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biologics Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Biologics Market Analysis - Growth & Forecast 2025 to 2035

Competitive Overview of Biologics Regulatory Affairs Market Share

Middle East & Africa (MEA) Biologics and Biosimilar Market Analysis by Drug, Drug Class, Dosage Form, Indication, Distribution Channel, and Country through 2035

Orthobiologics Market is segmented by Product Type and End User from 2025 to 2035

Spine Biologics Market Size and Share Forecast Outlook 2025 to 2035

Retinal Biologics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Biologics Market - Size, Share, and Forecast 2025-2035

Global Respiratory Biologics Market Analysis – Size, Share & Forecast 2024-2034

Subcutaneous Biologics Market

Biosimilar and Biologics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Self-administered Biologics Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in Anti-Inflammatory Biologics

Retinal Drugs And Biologics Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA