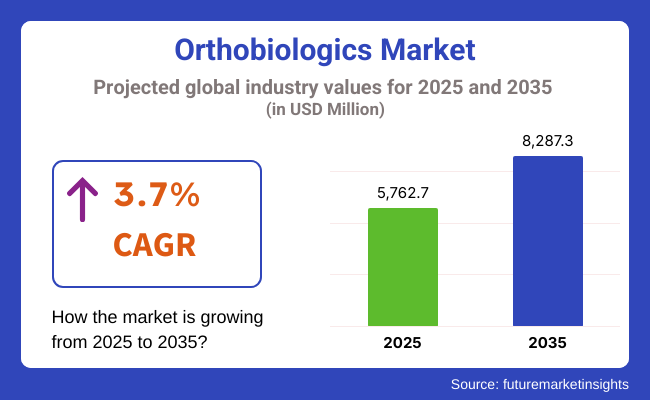

The global Orthobiologics Market is projected to be valued at USD 5,762.7 million in 2025, reaching USD 8,287.3 million by 2035, with a compound annual growth rate (CAGR) of 3.7% during the forecast period. Growth is underpinned by the increasing incidence of musculoskeletal conditions such as osteoarthritis, fractures, and spinal disorders, particularly in aging and physically active populations.

The growing demand for minimally invasive and regenerative therapies in orthopedic surgery and sports medicine is accelerating the adoption of biologically derived products, including stem cells, bone grafts, platelet-rich plasma (PRP), and bone morphogenetic proteins (BMPs). Surgeons are showing increased confidence in these modalities, which are clinically proven to enhance bone regeneration and reduce recovery times.

Additionally, research investments are driving the development of synthetic bone substitutes and targeted cell-based therapies to meet unmet clinical needs. The expanding use of orthobiologics in ambulatory surgical centers (ASCs) and outpatient settings, driven by their procedural efficiency and cost-effectiveness, further supports market momentum. As regulatory frameworks evolve and clinical evidence accumulates, emerging economies are poised to benefit from broader access, aided by favorable reimbursement and regenerative medicine policies.

Key players dominating the orthobiologics market include Zimmer Biomet, Medtronic, Stryker, Bioventus, Smith & Nephew, Orthofix, and Arthrex. These companies are driving innovation through a mix of product launches, strategic acquisitions, and collaborative clinical trials. In 2024, Zimmer Biomet introduced Velofuse Gel and Velofuse Putty, injectable spinal bone graft substitutes tailored for spine surgeries.

Meanwhile, LG Chem expanded its market presence by launching Synovian in China via its partner Yifan Pharmaceutical. “We will accelerate market penetration through a strategic collaboration framework to meet the needs of Chinese arthritis patients seeking new treatment options,” said Hwang In-cheol, Senior Vice President of LG Chem’s Primary Care Division. “By leveraging the competitive advantage of Synovian, China’s first single-injection osteoarthritis treatment, we aim to lead a paradigm shift in treatment.” Such initiatives reflect a broader industry trend toward regionalized strategies, enhanced market access, and clinical validation programs designed to facilitate hospital adoption and procedural integration.

North America continues to lead the orthobiologics market, driven by high procedural volumes across spinal fusion, osteoarthritis interventions, and sports-related surgeries. The USA in particular benefits from strong reimbursement support, surgeon familiarity with biologic implants, and active participation in academic research validating synthetic and cell-based grafts.

Moreover, clinical preferences are shifting toward next-generation orthobiologics that minimize donor site morbidity while improving surgical outcomes. In Europe, steady growth is being supported by public sector investments in regenerative surgery and standardization of biologics in spinal and fracture repair.

National initiatives and EU-level funding for implant registries and biologics R&D have contributed to broader adoption. Additionally, efforts to address the growing surgical backlog in aging populations and to expand outpatient orthopedic pathways are increasing the demand for off-the-shelf synthetic grafts and injectable orthobiologic solutions.

In 2025, bone graft substitutes are expected to maintain their leading position in the orthobiologics market, accounting for 49.8% of total revenue. Their dominance is primarily attributed to the rising preference for synthetic and allogeneic grafts over autografts, owing to reduced surgical morbidity and reliable product availability.

The growing prevalence of spinal fusion surgeries, trauma procedures, and complex orthopedic reconstructions has elevated the need for bioengineered grafts offering osteoconductive and osteoinductive properties. Regulatory approvals for hybrid biomaterials and injectable formulations have further enabled their integration into both hospital and ASC workflows.

Clinical validation through post-market surveillance and comparative trials has reinforced surgeon trust. Additionally, manufacturers are investing in ready-to-use delivery formats that enhance intraoperative efficiency and adaptability. As health systems prioritize cost-effective, outcome-driven care models, bone graft substitutes are anticipated to retain their prominence across a wide range of geographies and procedural indications.

Hospitals are projected to capture 47.4% of global revenue in the orthobiologics market by 2025, making them the largest end-user segment. This leading share is supported by the high concentration of complex orthopedic and spinal surgeries conducted in tertiary care centers and specialized surgical institutions.

Hospitals are better positioned to deploy advanced biologic technologies, thanks to their access to multidisciplinary surgical teams, clinical trial infrastructure, and integrated procurement systems. Furthermore, reimbursement policies often favor orthobiologic integration in hospital-based procedures, especially under bundled payment models.

Strategic alliances between hospital systems and biologics manufacturers have facilitated the early adoption of novel regenerative therapies, including those with synthetic composites and stem-cell enhancements. These collaborations also enable the implementation of evidence-based protocols and outcome tracking, reinforcing the value proposition of orthobiologics in hospital settings. With procedural complexity and biologic innovation both on the rise, hospitals are expected to remain the primary channel for orthobiologics utilization through 2035.

Reimbursement challenges hinder the orthobiologics market growth

The cost of bone grafting and orthobiologic products makes it difficult to obtain sufficient reimbursement. Long and extensive clinical studies to prove the safety and efficacy of bone-healing products only further complicate the reimbursement process. In addition, a lack of codes for specific reimbursement and minimal data to differentiate orthobiologic products from conventional treatments add to the hindrance.

Orthobiologics are fairly new in the marketplace and, naturally, hence, they attract lower reimbursement rates. On the flip side, Medicare and private insurers continue to reduce their reimbursement rates, so that orthopedic practices are pressured even more into maintaining profitability. The economic restraints, in turn, are barriers against patient access to orthobiologic treatments and impede market growth. Therefore, billing practices must be tweaked further, and other independent avenues of revenue should be explored.

The increasing focus on personalized medicine offers avenues for growth

Indications for increasing personalized medicine offer pathways into more customized biologics for the individual patient, thereby enhancing efficacy. Innovations-evolving to expand, such as stem cell research, tissue engineering, and hopefully other new methods of regenerative therapy. Expanding incidence of musculoskeletal injury conditions internationally calls for more effective options for faster healing.

Creating networks between medical device manufacturers with compelled pharmaceutical companies and their resourced research community will pave the way for progress in novel orthobiologic products and their applications across therapeutic areas. Emerging markets also offer a huge growth potential because of their availability for and adoption of low-cost specialized treatments developed for such market entry.

Revolutionizing Orthobiologics: Minimally Invasive Therapies and Advanced Imaging for Enhanced Healing

Orthobiologics market is evolving fast into developments with minimally invasive processes. These procedures mostly incorporate stem cells, platelet-rich plasma (PRP), or growth factors and are meant to stimulate natural healing mechanisms materializing into minor incisions and requiring less time.

As demand for minimally invasive treatments progresses even higher, technologies like biomaterial scaffolds are advancing to precisely repair defects in damaged tissues. Such technologies work to not only avert risks such as infections and complications but also meet patient expectations for quicker recovery, less cost, and better outcomes. All these aspects are paving the way for overall market growth.

The increasing application of advanced imaging technologies, however, is another emerging trend in the field of orthobiologics. The high utility of such procedures as MRI (Nuclear Magnetic Resonating Imaging), CT scan, and 3D imaging has significantly improved the exactness of regenerative treatments through a highly detailed view of the affected area.

These advanced imaging technologies facilitate the accurate planning and monitoring of such therapies as stem cell injection or tissue-engineered products and enhance their target accuracy and probable outcome. After all, the incorporation of imaging and biologic treatments opens new avenues in personalized medicine, essentially offering personalized solutions to musculoskeletal disorders and greatly increasing their recovery rates.

Advancing Orthobiologics: Stem Cell and Exosome Therapies Transforming Musculoskeletal Regeneration

Progress in Stem Cell Therapy: Orthobiologic therapies as regenerative stem cell therapies have proved alternative means to conventional therapies. Most of the research rests on mesenchymal stem cells (MSCs) and how they turn on regenerative processes within bone, cartilage, and soft tissue.

Essentially, these therapies serve to treat musculoskeletal disorders with added advantages of quick recovery and less invasive methods. Certainly, with approvals from regulatory bodies, stem cell-based treatments seem to be on their way to mainstream clinical practice for specific orthopedic needs.

Use of Exosome-Centered Therapy: Exosome therapy is a newly springing aspect of regenerative medicine that offers a promising scope of great utility in cell signaling and tissue restoration. Blood-derived, stem cell-exosomes make a relevant contribution to bone-healing, anti-inflammation and cartilage-regeneration roles.

In intercellular transfer of molecular information make them a promising alternative in orthobiologic therapies brazen possibilities for injuries and outcomes in musculoskeletal conditions. Apparently, any emerging possibilities from exosome based therapies would be one of the significant breakthrough agents.

Between 2020 and 2024, the orthobiologic market sustained balanced growth. The rising incidences of musculoskeletal disorders and sport injuries were the main contributor. Bone graft substitutes, stem cell therapy, and platelet-rich plasma (PRP) therapies accelerate recovery. They have been claimed to have hastened healing in some patients. Complementary technologies such as 3D-printed bone grafts and autologous cell-based therapies will yield better outcomes.

The cost of these treatments is too high, regulations complex, and reimbursement policies too erratic for these therapies to gain popularity-riskier still in developing markets. From 2025, emerging up to 2035, next-generation biologics such as gene therapy and advanced tissue engineering will propel the market.

AI-guided tailor-made regenerative medicine also stands to develop. Streamlined regulations will favor innovations in orthobiologics, while sustainability efforts will gear towards eco-friendly biomaterials and supply chain resilience, thus boosting the global potential for regenerative orthopedic treatments.

Market Outlook

The explanation behind this emerging market is the rise in musculoskeletal disorder and sports injuries cases and the growing need for minimally invasive types of treatment. The advanced and emerging regenerative medicine technologies such as stem cells, platelet-rich plasma (PRP), and bone marrow-derived treatments are creating new windows of therapy for degenerative disease and injuries.

The leading country in orthobiologics continues to be the USA, with most major healthcare institutions and research centers carrying out clinical trials and product development. Investments made in research and development continuously expand options offered by orthobiologic treatment, producing better solutions for joint reconstruction, spinal surgery, and repair of soft tissue.

Besides, the increasing adoption of personalized medicine makes it likely that the usage of orthobiologics rises hence improving patient outcomes. But the high cost involved with the management of these treatments as well as regulatory complexities can be factors that may limit the adoption of certain population segments.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

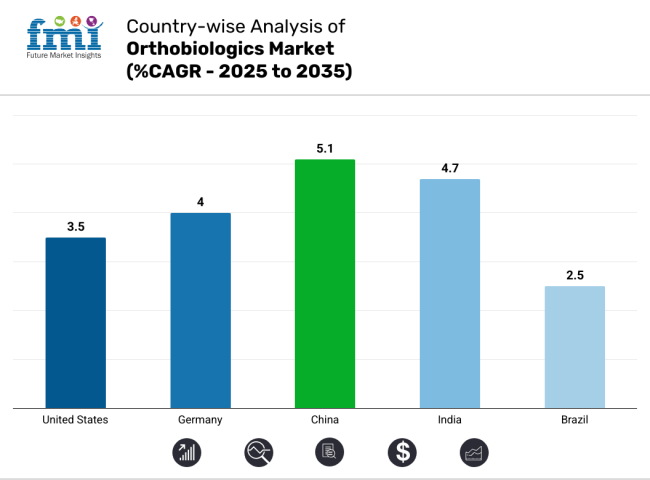

| United States | 3.5% |

Market Outlook

Germany is supported by excellent healthcare infrastructures, great investments in healthcare. With both an aging population and the ever-increasing incidence of orthopedic conditions, the demand for effective treatments for musculoskeletal disorders is rising. The country benefits from other collaborations between top academic institutions and industrial players, advancing the development of innovative orthobiologic products.

The health care system in Germany is pretty well developed, hence new therapies, such as stem cell treatments, PRP, and bone marrow aspirates, are all integrated into the therapeutic chain for clinical application in joint reconstruction, spinal surgery, and cartilage repair.

Nevertheless, challenges remain, such as complex regulatory requirements and regional disparities in treatment access. Regardless, owing to its strength in the market gave by great research and development activity, Germany is expected to speed up its growth and acceptance of orthobiologics.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.0% |

Market Outlook

The projected growth of musculoskeletal disorders is considered in conjunction with the population explosion. It is also considered alongside the rapidly accelerating pace of healthcare advancement. Over the past few years, the aging population affected by orthopedic issues has been searching for promising regenerative medicine treatments. These treatments are for conditions such as osteoporosis and arthritis.

The classical orthobiologics market is flourishing. This growth is partly due to the use of injectables such as stem cells, platelet-rich plasma (PRP), and autologous chondrocyte implantation (ACI). Practitioners use these injectables to treat joint and cartilage conditions.

Further, growing incidents of research and development activity in China would be propelling the innovation curve through synergy between local and international players. But the obstacles in the way of adoption are regulatory barriers, inconsistent access to next-generation treatments, and the absence of a overall reimbursement policy that could slow down the pace of adoption across the nation.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.1% |

Market Outlook

While the rapidly increasing aging population in India is primarily driving the growth of the orthobiologics market along with the rising incidence of musculoskeletal injuries and sports injuries, the increasing acceptance of advanced orthopedic treatments such as stem cell therapy, platelet-rich plasma (PRP), and bone marrow aspirates for their merits of healing and reducing recovery time continues to increase demand levels.

Issues related to public awareness of regenerative medicine and patient preferences for non-invasive techniques or at least minimally invasive techniques in the wake of ever-increasing standards of healthcare are on the rise. Investments worth millions are being poured into India's healthcare sector in the shape of medical research and development, most recently with the increase in collective working ventures with various hospitals, research institutes, and pharma companies.

Although alternative treatment modes, including orthobiologic treatments, are beginning to gain traction within the mainstream acceptance of conventional surgical procedures, obstacles, such as treatment affordability, roadblocks in infrastructure, and the regulating process, may impede widespread adoption in some territories.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.7% |

Market Outlook

The Brazilian orthobiologics market is on an impressive growth path; increasing incidence of musculoskeletal disorders and improved treatment calls for an adverse effect on orthopedics. Constantly increasing growth of the healthcare system with rising disposable income is giving more and more patients access to advanced therapies like stem cell injection, platelet-rich plasma (PRP), and bone marrow-based therapies.

With an important concentration in medical R&D in regenerative medicine, Brazil has promoted interactions among the academia and industry that favor development of sophisticated orthobiologic solutions for joint reconstruction, spinal surgery, and soft tissue repair. Also, the incessantly heightened medical tourism in Brazil, especially in regenerative medicine, adds up to the growth of the market.

Some of the impediments needed to curtail the uptake of orthobiologics in underprivileged regions comprise unequal access to healthcare, regulatory compliance issues, and extremely high pricing for advanced therapies. Certainly, however, innovations in treatment and growing numbers of patients should drive sustained growth in the market, notwithstanding the challenges.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 2.5% |

The orthobiologics market is said to rise with evolving demand in regenerative medicine. This demand is driven by a rising number of increasing incidences of musculoskeletal disorders. Emerging frontiers of biologic therapies' applications also contribute to this growth. Players in the market turn to innovations to stay ahead.

Regulatory approvals are another key factor. Strategic partnership practices help improve their competitive positioning. The market is intensely fragmented. Medical device manufacturers and even biotech firms invest massively in next-generation orthobiologic solutions.

Medtronic plc

Medtronic is a pioneer in the sector of orthobiologics. The company's product offerings are very comprehensive regarding biologic therapies, which include bone morphogenetic proteins (BMPs) and various allograft solutions.

Stryker Corporation

Stryker Corporation specializes in synthetic bone grafting materials and offers all of the demineralized bone matrices. The company focuses its innovations on regenerative medicine.

Johnson & Johnson (DePuy Synthes)

DePuy Synthes has a specialization in advanced stem cell therapies and orthopedic biologics. It also invests in research-focused regenerative.

Zimmer Biomet Holdings, Inc.

Autologous cell-based and PRP therapies are the best-known therapies that Zimmer Biomet has come to be known for. They are indicated for use during bone healing and soft tissue repair.

Several other companies contribute to the orthobiologics market. Notable players include:

Bone Growth Stimulators, Viscosupplements, and Bone Graft Subsitute

Hospitals, Ambulatory Surgical Centers, Orthopedic Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Orthobiologics Market was USD 5,762.7 million in 2025.

The Orthobiologics Market is expected to reach USD 8,287.3 million in 2035.

Increasing prevalence of musculoskeletal disorders has significantly increased the demand for Orthobiologics.

The top key players that drives the development of Orthobiologics Market are Medtronic plc, Sanofi SA, Depuy Synthes, Zimmer Biomet, and Bioventus.

Bone graft subsitute by product type is Orthobiologics Market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 13: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 15: Asia Pacific excluding Japan Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 16: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 17: Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 18: Japan Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 19: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 20: Middle East & Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 21: Middle East & Africa Market Value (US$ Million) Forecast by End User, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Asia Pacific excluding Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Asia Pacific excluding Japan Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: Asia Pacific excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 65: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 68: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Asia Pacific excluding Japan Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 71: Asia Pacific excluding Japan Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: Asia Pacific excluding Japan Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: Asia Pacific excluding Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 74: Asia Pacific excluding Japan Market Attractiveness by End User, 2023 to 2033

Figure 75: Asia Pacific excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 76: Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: Japan Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 80: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 83: Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Japan Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 86: Japan Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: Japan Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Japan Market Attractiveness by End User, 2023 to 2033

Figure 90: Japan Market Attractiveness by Country, 2023 to 2033

Figure 91: Middle East & Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Middle East & Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: Middle East & Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 95: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Middle East & Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 98: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: Middle East & Africa Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 101: Middle East & Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: Middle East & Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: Middle East & Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Middle East & Africa Market Attractiveness by End User, 2023 to 2033

Figure 105: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA