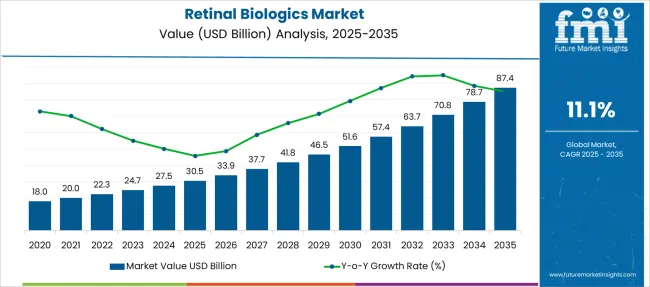

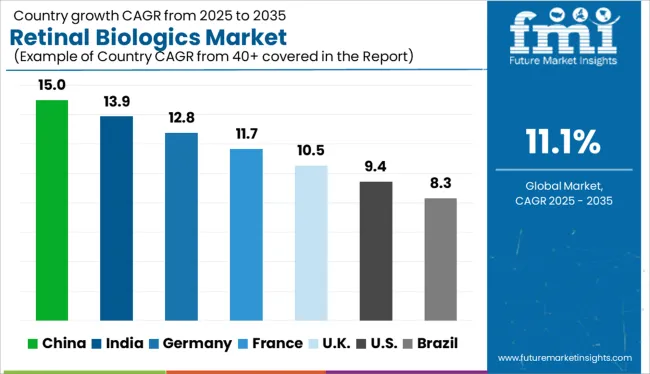

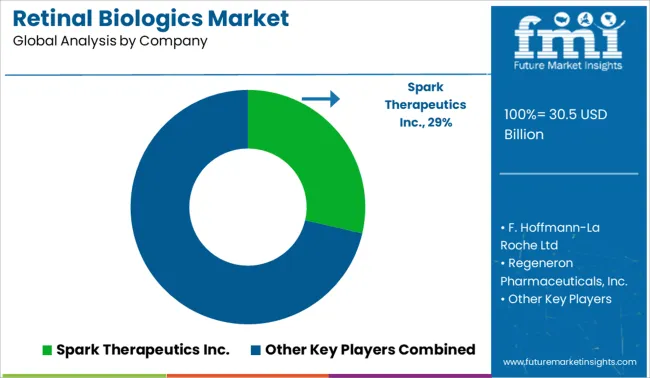

The Retinal Biologics Market is estimated to be valued at USD 30.5 billion in 2025 and is projected to reach USD 87.4 billion by 2035, registering a compound annual growth rate (CAGR) of 11.1% over the forecast period.

| Metric | Value |

|---|---|

| Retinal Biologics Market Estimated Value in (2025 E) | USD 30.5 billion |

| Retinal Biologics Market Forecast Value in (2035 F) | USD 87.4 billion |

| Forecast CAGR (2025 to 2035) | 11.1% |

The retinal biologics market is expanding rapidly, driven by advancements in targeted therapies and increasing prevalence of retinal diseases. The rise in age-related macular degeneration and other vision impairments has increased the demand for effective treatments that can slow disease progression and preserve sight.

Healthcare providers have emphasized early intervention and personalized treatment regimens, which have supported adoption of biologic drugs in retinal care. Improved diagnostic techniques and patient awareness have contributed to earlier detection and timely treatment initiation.

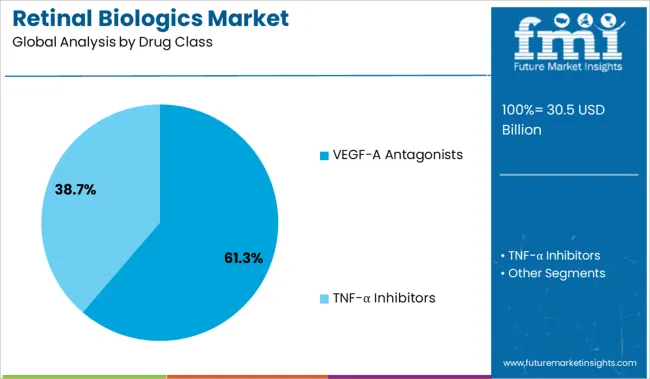

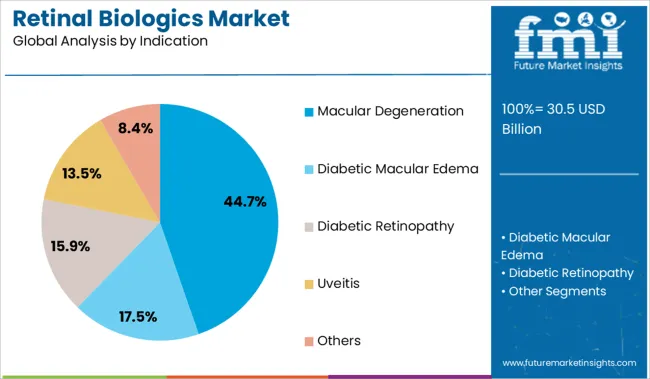

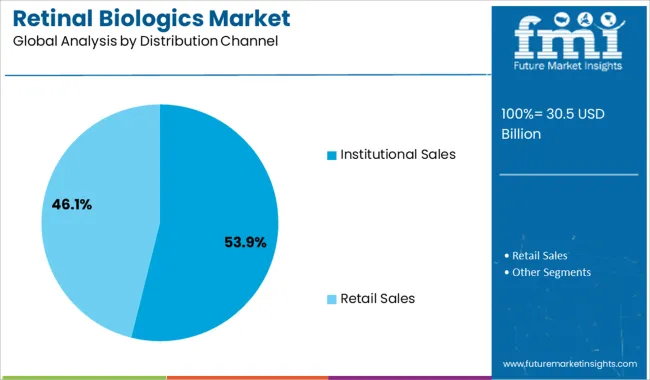

The growing availability of advanced biologic formulations and expanding healthcare infrastructure have further accelerated market growth. Looking ahead, innovation in drug delivery systems and increased focus on long-term treatment efficacy are expected to shape the market. Segment growth is projected to be led by VEGF-A antagonists in drug class, macular degeneration as the key indication, and institutional sales as the primary distribution channel.

The market is segmented by Drug Class, Indication, and Distribution Channel and region. By Drug Class, the market is divided into VEGF-A Antagonists and TNF-α Inhibitors. In terms of Indication, the market is classified into Macular Degeneration, Diabetic Macular Edema, Diabetic Retinopathy, Uveitis, and Others. Based on Distribution Channel, the market is segmented into Institutional Sales and Retail Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The VEGF-A antagonists segment is expected to hold 61.3% of the retinal biologics market revenue in 2025, leading the drug class category. This growth is attributed to the proven efficacy of VEGF-A inhibitors in reducing abnormal blood vessel growth and leakage in retinal diseases. Their ability to improve or stabilize vision has made them a preferred choice among ophthalmologists.

The segment benefits from widespread clinical adoption supported by established treatment protocols and ongoing research to enhance drug formulations. Additionally, VEGF-A antagonists have become the standard of care for several retinal conditions, driving sustained demand.

Advances in dosing frequency and delivery methods have further improved patient compliance and treatment outcomes.

The macular degeneration segment is projected to account for 44.7% of the market revenue in 2025, dominating the indication category. The high prevalence of age-related macular degeneration, especially in aging populations, has made it a primary focus for retinal biologics development and usage.

Clinical emphasis on preserving central vision and preventing disease progression has led to widespread use of biologic treatments in this indication. Public health initiatives aimed at increasing awareness and screening for macular degeneration have contributed to earlier diagnosis and timely therapy initiation.

The segment’s growth is also supported by advancements in combination therapies and personalized treatment approaches tailored to disease severity.

The institutional sales segment is projected to represent 53.9% of the retinal biologics market revenue in 2025, maintaining its position as the leading distribution channel. This segment’s growth is driven by the concentration of specialized retinal treatment facilities and hospitals that administer biologic therapies under controlled clinical settings.

Institutional purchasing enables bulk procurement and consistent supply chain management, supporting large-scale treatment programs. Additionally, institutions have the infrastructure for proper drug storage and administration, which is critical for biologics.

The segment benefits from growing collaborations between healthcare providers and manufacturers to ensure availability and affordability of treatments. Increasing patient volumes at specialized centers are expected to sustain the dominance of institutional sales in the market.

| Particulars | Details |

|---|---|

| H1, 2024 | 11.08% |

| H1, 2025 Projected | 11.14% |

| H1, 2025 Outlook | 10.94% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 20 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 14 ↓ |

According to Future Market Insights' analysis, the global retinal biologics market expects to drop by 14 Basis Point Share (BPS) in H1-2025 as compared to H1-2024. Whereas in comparison to H1-2025 Projected value, the market during H1-2025 outlook period will show a dip of 20 BPS.

The availability of very few retinal biologics, their severe side effects, rigorous regulatory standards involved with obtaining biologics approvals, and the exorbitant cost of effective drugs and biologics are all contributing factors to the drop in BPS values.

The market will however witness a positive growth outlook over the forecast period, owed to the increasing intensive research activities for the production of novel biologics for novel disease therapeutics.

The key development in the market includes innovations in ocular drug delivery to the retina with the development of intravitreal drugs. The retinal biologics market is subject to macroeconomic and industrial factors in accordance to stringent regulatory standards and approval activities for biologics.

Rising Burden of Retinal Diseases to Boost Overall Market Growth

From 2013 to 2024, the global retinal biologics market registered significant gains, experiencing a CAGR worth 10.2%

Retinal biologics are bioengineered molecules that are implanted inside the eyes to heal chronic retinal diseases. Biologics are generally produced from living organisms such as microorganisms, or animal or plant cells. Some of the retinal biologics used for retinal diseases are Eylea, Lucentis, Humira, Macugen, and others.

Increased frequency of retinal diseases such as age-related macular degeneration around the world is driving the market expansion. According to WHO statistics, nearly 2.2 billion individuals worldwide suffer from near or distance vision impairment. As the prevalence of vision impairment rises, the need for effective therapeutic alternatives, such as retinal biologics, is rising as well.

Retinal biologics are a new class of medications that target specific markers in the patient's body to alleviate the symptoms of a variety of systemic or ocular disorders that present in the eye.

Considering these factors, the market is projected to witness high growth over the forecast period, registering an impressive CAGR of 11.1% to reach USD 87.4 Billion by 2035.

Rising R&D Activities in Retinal Gene Therapies to Fuel Market Expansion

The market will be driven by a strong focus on R&D connected with retinal gene therapies conducted by different institutes, biologics firms, and innovative product releases by prominent market participants in the form of biologics and implants. Efforts to develop a complementary therapeutic treatment will boost the market growth.

Market Growth Complemented by Increasing Burden of Retinal Diseases

Diabetic retinopathy has been a rising concern as the disease leads to vision loss among type I and type II adult diabetic patients. Diabetic macular edema also results from the consequences of diabetic retinopathy, which leads to the swelling of the macula. Moreover, increasing burden of other retinal diseases such as uveitis and orbital inflammation is another factor surging demand for retinal drugs and biologics.

Retinal gene therapy is a therapeutic approach wherein inherited defective genes are replaced by treatment with DNA or RNA. Retinal gene therapy is considered to be a significant approach as there occurs less contamination, and the viral vector can easily accommodate within the eyes.

Regulatory Obstructions Likely to Hinder Demand for Retinal Biologics

Limited availability of retinal biologics, hazardous biologic side effects, and limited access for retinal biologics and efficient treatments due to higher costs are restraining the market growth.

The market is being challenged by the side effects of retinal biologics, which include retinal tear, sickness, and eye pain. Governing authorities' strict regulatory compliances associated with biologics approval are impeding industry growth.

Ongoing Advancements in Biologics for Retinal Treatment

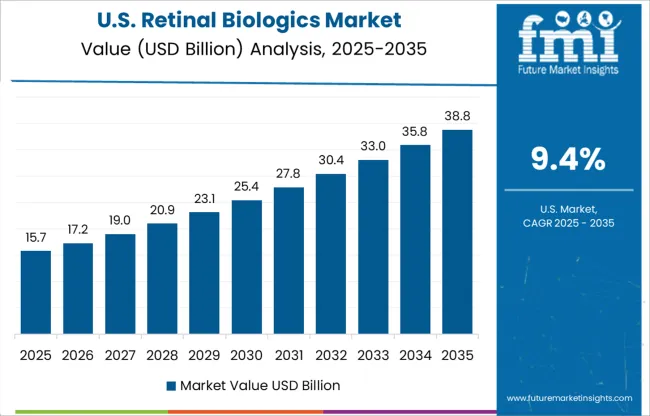

North America is expected to have a significant share in the global retinal biologics market. Continuous improvements in healthcare infrastructure, as well as an increase in the number of cases of retinal illnesses and favorable reimbursement policies, are expected to promote market expansion in the region.

Prominent presence of key manufacturers and increased healthcare spending are driving market growth in the region. Growing diabetes population is a major driver in the development of biologics for retinal treatment in North America.

Increased Prevalence of Diabetic Macular Edema to Augment Demand for Retinal Biologics

Diabetic retinopathy is a disease that affects people who have diabetes. Diabetic retinopathy is the major cause of new incidents of blindness in adults aged 20 to 74 years in the United States.

According to a new research study released by the Centers for Disease Control and Prevention, more than 100 million persons in the United States currently have diabetes or prediabetes.

In addition, researchers are working on innovative strategies to treat diabetic macular edema. As a result, rising R&D spending in the country as well as risk factors that contribute to disease development will have an impact on the retinal biologics market in the USA over the forecast period.

Rising Efforts for Development of Retinal Drugs to Drive Market Growth.

The market in China is expected to grow due to rapidly rising cases of uveitis, diabetic retinopathy, and macular degeneration. Diabetes is exacerbated by a shift in lifestyle and an increase in bad eating habits, as a result of these factors, the global market for retinal drugs and biologics is expected to expand significantly.

Along with increasing incidence of eye diseases, there are a growing number of research initiatives focused on retinal drugs. Furthermore, growing geriatric population, which is becoming a target patient pool for retinal biologics, will boost market growth in China.

VEGF-A Antagonists Most Preferred as They are Largely Tolerated & Give Instant Results to Eye Disorders.

VEGF-A antagonists are used to treat eye damage and enhance corneal wound healing. The global retinal biologics market is also expected to be fueled by the rising prevalence of other retinal illnesses such as orbital inflammation and uveitis.

VEGF-A antagonists are commonly given for the treatment of diabetic retinopathy and diabetic macular edema. In the case of non-infectious uveitis, it is seen to be the ideal alternative to typical suppressing treatments.

Many firms have focused on VEGF-A antagonists because they reduce angiogenesis. Manufacturers are investing in the development of retinal biologics in a similar field due to the widespread acceptance of VEGF-A antagonist therapy.

Increasing Adoption of Retinal Biologics for Macular Degeneration Treatment

Macular degeneration indication is expected to account 36.9% share of the retinal biologics market in 2025. Macular Degeneration is a vision loss condition that affects the macula.

Despite the availability of improved treatment alternatives, the global retinal biologics market is likely to benefit from the increased prevalence of macular degeneration. According to the American Macular Degeneration Foundation, the prevalence is higher than the combined rates of cataracts and glaucoma in over 10 million Americans (AMDF).

Because macular degeneration primarily affects adults aged 50 and over, the prevalence of MD continues to go up, despite improving treatment choices, as the population ages.

Several companies are entering into licensing and collaboration agreements to expand their products into various countries across the world to cater to unmet demand. Leading market players are concentrating their efforts on research & development to discover new medications and improve treatment options.

For instance,

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2013 to 2024 |

| Market Analysis | Value in USD Million |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Mexico, Argentina, Germany, Italy, France, UK, Nordic, Spain, Japan, China, India, Malaysia, Thailand, Australia, GCC Countries, South Africa, Turkey |

| Key Market Segments Covered | Drug Class, Indication, Distribution Channel, Region |

| Key Companies Profiled | Spark Therapeutics, Inc.; F. Hoffmann-La Roche Ltd.; Regeneron Pharmaceuticals, Inc.; AbbVie Inc.; Amgen Inc.; Novartis Pharma AG; MeiraGTx Limited; Oxurion NV; Santen Pharmaceutical Co., Ltd.; Bayer AG; Bausch Health Companies Inc.; Merck & Co., Inc. |

| Pricing | Available upon Request |

The global retinal biologics market is estimated to be valued at USD 30.5 billion in 2025.

The market size for the retinal biologics market is projected to reach USD 87.4 billion by 2035.

The retinal biologics market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in retinal biologics market are vegf-a antagonists and tnf-α inhibitors.

In terms of indication, macular degeneration segment to command 44.7% share in the retinal biologics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retinal Drugs And Biologics Market

Biologics Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Retinal Laser Photocoagulation Market Size and Share Forecast Outlook 2025 to 2035

Biologics Market Analysis - Growth & Forecast 2025 to 2035

Retinal Gene Therapy Market – Trends & Forecast 2025 to 2035

Retinal Vein Occlusion Treatment Market - Outlook 2025 to 2035

Competitive Overview of Biologics Regulatory Affairs Market Share

Retinal Vasculitis Treatment Market – Growth & Forecast 2024 to 2034

Middle East & Africa (MEA) Biologics and Biosimilar Market Analysis by Drug, Drug Class, Dosage Form, Indication, Distribution Channel, and Country through 2035

Orthobiologics Market is segmented by Product Type and End User from 2025 to 2035

Vitreoretinal Surgery Devices Market Size and Share Forecast Outlook 2025 to 2035

Spine Biologics Market Size and Share Forecast Outlook 2025 to 2035

Virtual Retinal Display Market Insights - Trends & Forecast 2025 to 2035

Handheld Retinal Scanners Market

Inherited Retinal Diseases Treatment Market Size and Share Forecast Outlook 2025 to 2035

Inhalable Biologics Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Veterinary Biologics Market - Size, Share, and Forecast 2025-2035

Global Respiratory Biologics Market Analysis – Size, Share & Forecast 2024-2034

Subcutaneous Biologics Market

Biosimilar and Biologics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA