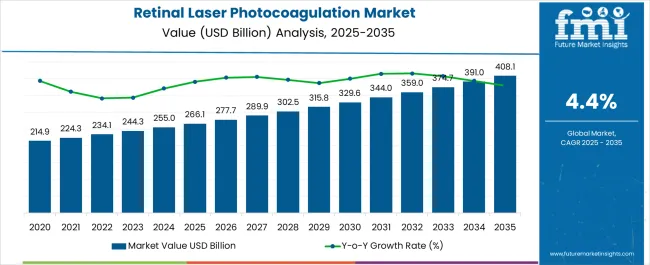

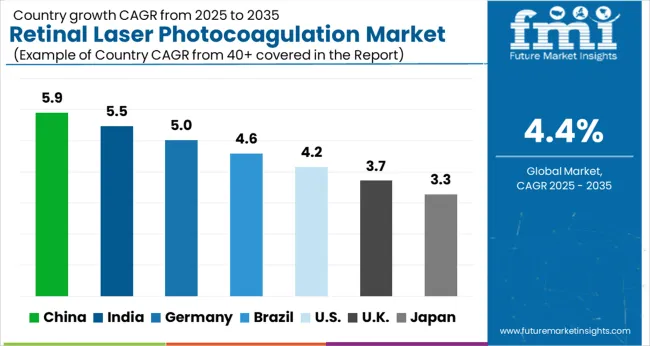

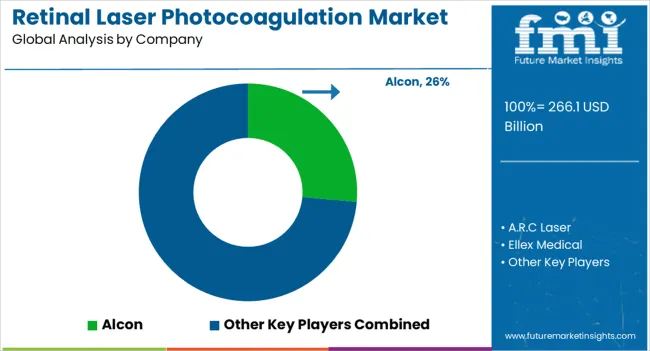

The Retinal Laser Photocoagulation Market is estimated to be valued at USD 266.1 billion in 2025 and is projected to reach USD 408.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Retinal Laser Photocoagulation Market Estimated Value in (2025 E) | USD 266.1 billion |

| Retinal Laser Photocoagulation Market Forecast Value in (2035 F) | USD 408.1 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The retinal laser photocoagulation market is expanding due to the rising prevalence of diabetic retinopathy, age related macular degeneration, and other retinal vascular disorders. Growing awareness regarding early treatment to prevent vision impairment, coupled with increasing access to advanced ophthalmic care, is driving adoption.

Advancements in laser technology, including improved wavelength precision, reduced collateral damage, and enhanced safety profiles, are making these treatments more effective and widely accepted. Healthcare systems are placing emphasis on early detection and timely intervention, which has accelerated the demand for retinal photocoagulation procedures.

Moreover, a surge in the diabetic population worldwide and supportive reimbursement frameworks in developed markets are further encouraging procedural adoption. The outlook remains strong as investments in specialized ophthalmic devices and the expansion of treatment facilities in emerging economies continue to foster sustainable growth opportunities..

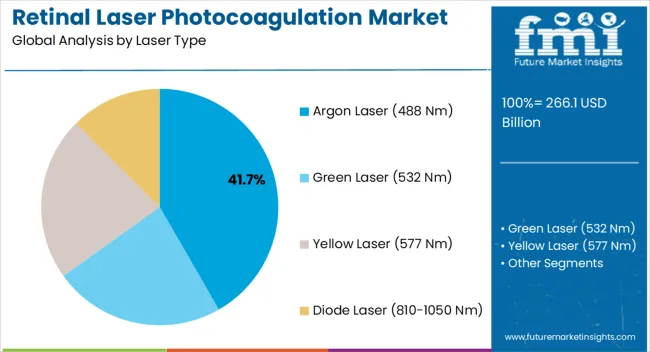

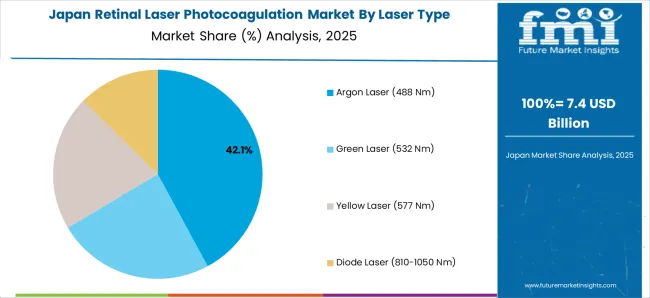

The argon laser type segment is projected to represent 41.70% of total market revenue by 2025, making it the leading laser type. Its dominance is attributed to its precision, safety, and established clinical effectiveness in treating retinal conditions.

Argon lasers are widely recognized for producing consistent therapeutic outcomes while minimizing damage to surrounding tissues. Their adoption has been reinforced by their reliability, adaptability, and integration into standard ophthalmic practices.

Continuous improvements in energy delivery and device ergonomics have further supported their widespread use, consolidating their leadership in the laser type category.

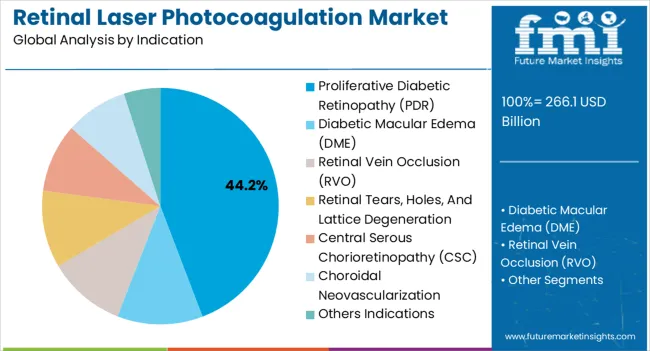

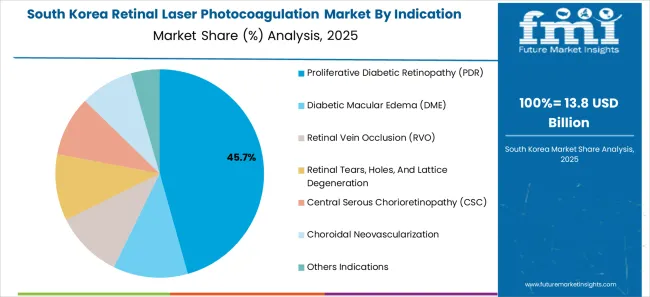

The proliferative diabetic retinopathy indication segment is anticipated to hold 44.20% of market revenue by 2025, positioning it as the dominant treatment area. This leadership is driven by the rising incidence of diabetes and the associated burden of vision threatening complications.

Photocoagulation is considered a gold standard intervention for PDR, as it prevents disease progression and preserves functional vision. Healthcare providers have prioritized early detection and management strategies, resulting in sustained demand for laser procedures in this indication.

Additionally, clinical guidelines and government supported diabetes programs have reinforced adoption, ensuring continued growth of this segment within ophthalmic care.

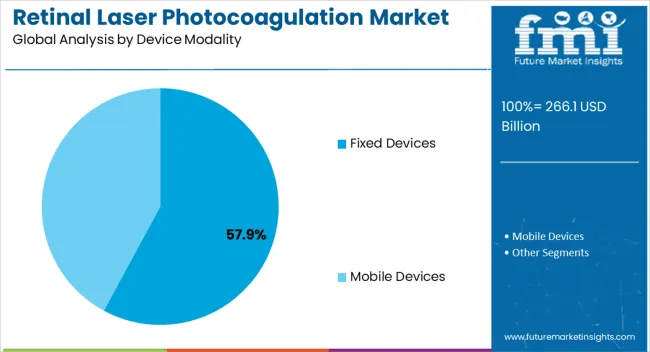

The fixed devices modality segment is expected to command 57.90% of total revenue by 2025, establishing itself as the dominant modality. This growth is linked to their integration into specialized ophthalmic clinics and hospitals, offering stable platforms for high precision treatments.

Fixed devices deliver superior imaging integration, improved energy stability, and enhanced safety features, making them indispensable for complex retinal procedures. Their ability to support high patient volumes and ensure consistent therapeutic outcomes has further reinforced their adoption.

As healthcare infrastructure expands and patient awareness grows, fixed devices are expected to maintain their leadership in the device modality category.

From 2020 to 2025, the global retinal laser photocoagulation experienced a CAGR of 4.4%, reaching a market size of USD 266.1 million in 2025.

From 2020 to 2025, the global retinal laser photocoagulation industry witnessed steady growth due to growing emphasis on adoption of telemedicine, Combination therapies involving retinal laser photocoagulation and other treatment modalities continue to gain attention.

The combination of retinal laser photocoagulation with anti-VEGF injections or corticosteroid implants has shown promise in treating conditions such as diabetic macular edema and retinal vein occlusion.

Future Forecast for Retinal laser photocoagulation Industry:

Looking ahead, the global retinal laser photocoagulation industry is expected to rise at a CAGR of 4.6% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 408.1 million by 2035.

The retinal laser photocoagulation industry is expected to continue its growth trajectory from 2025 to 2035, driven by increasing technological advancements and integration of AI. Partnerships and collaborations can accelerate the development and commercialization of advanced retinal laser photocoagulation devices and expand market opportunities.

Ongoing research and development efforts focused on further understanding retinal disorders, improving treatment protocols, and developing innovative laser systems and techniques can unlock new opportunities in the retinal laser photocoagulation market.

Continued investment in research can lead to the discovery of novel treatment targets, better understanding of disease mechanisms, and the development of more effective and safer treatment options.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 408.1 million |

| CAGR % 2025 to End of Forecast (2035) | 4.8% |

The retinal laser photocoagulation industry in the United States is expected to reach a market size of USD 408.1 million by 2035, expanding at a CAGR of 4.8%. In United States, Subthreshold laser therapy is an emerging trend in retinal laser photocoagulation. This technique involves delivering laser energy at a level below the threshold of inducing visible retinal burns.

Subthreshold laser therapy aims to achieve therapeutic effects while minimizing the visible tissue damage and potential complications associated with traditional laser photocoagulation. It is being explored as a potential treatment option for diabetic macular edema and other retinal conditions.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 13.9 million |

| CAGR % 2025 to End of Forecast (2035) | 4.0% |

The retinal laser photocoagulation industry in the United Kingdom is expected to reach a market value of USD 13.9 million, expanding at a CAGR of 4.0% during the forecast period. Micro pulse laser technology is gaining popularity in the UK for retinal laser photocoagulation.

This technique utilizes repetitive short pulses of laser energy with intervals of rest, allowing for better heat dissipation and minimizing damage to the surrounding retinal tissue. Micropulse laser photocoagulation offers a more gentle and potentially less destructive treatment approach, particularly in the management of macular edema and retinal vascular disorders.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 35.1 million |

| CAGR % 2025 to End of Forecast (2035) | 5.5% |

The retinal laser photocoagulation industry in China is anticipated to reach a market size of USD 35.1 million, moving at a CAGR of 5.5% during the forecast period. Telemedicine is becoming more prevalent in China, especially in remote areas where access to specialized retinal care is limited. Telemedicine platforms enable remote assessment, diagnosis, and treatment planning for retinal conditions.

This trend improves access to retinal laser photocoagulation for patients in underserved regions and helps in timely identification and management of retinal disorders.

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 24.7 million |

| CAGR % 2025 to End of Forecast (2035) | 5.3% |

The retinal laser photocoagulation industry in Japan is estimated to reach a market size of USD 24.7 million by 2035, thriving at a CAGR of 5.3%. Navigated laser technology, which involves the integration of imaging and laser systems, is gaining popularity in Japan. This technology allows for precise targeting of laser treatment based on real-time imaging, such as optical coherence tomography (OCT). Navigated laser photocoagulation improves treatment accuracy and reduces the risk of damage to healthy retinal tissue.

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 15.3 million |

| CAGR % 2025 to End of Forecast (2035) | 4.9% |

The retinal laser photocoagulation industry in South Korea is expected to reach a market size of USD 15.3 million, expanding at a CAGR of 4.9% during the forecast period. There is an increasing use of combination therapies involving retinal laser photocoagulation and other treatment modalities, such as anti-VEGF injections or corticosteroids. Combination therapies aim to provide comprehensive and synergistic effects in the management of retinal diseases, particularly conditions like diabetic retinopathy and macular edema.

Argon laser is expected to dominate the retinal laser photocoagulation industry with a CAGR of 5.3% from 2025 to 2035. This segment captures a significant market share in 2025 due to its precision, coagulative effect & better penetration.

Argon laser systems offer precise & accurate targeting of the retina. The laser beam can be focused on specific areas of the retina requiring treatment, such as abnormal blood vessels or areas of retinal damage, allowing for precise & controlled application. This laser works by creating controlled thermal burns in the targeted retinal tissue.

Proliferative diabetic retinopathy (PDR) are expected to dominate the retinal laser photocoagulation industry with a CAGR of 5.0% from 2025 to 2035. This segment captures a significant market share in 2025 as it helps in management of vascular regression, reducing the risk of vision loss & ischemic retina treatment.

PDR is often associated with areas of ischemic retina, where retina lacks sufficient blood supply. Retina laser photocoagulation can target these ischemic areas to stimulate oxygen & nutrient delivery to the targeted regions, potentially improving retinal health.

Fixed Devices is expected to dominate the retinal laser photocoagulation industry with a CAGR of 4.5% from 2025 to 2035. This segment captures a significant market share in 2025 as many fixed devices are equipped with integrated imaging systems such as fundus cameras or optical coherence tomography (OCT) modules. These imaging capabilities provide real-time visualization of the retina, allowing for accurate targeting of the laser treatment to specific areas of interest.

The hospital segment is expected to dominate the retinal laser photocoagulation industry with a CAGR of 2.9% from 2025 to 2035. This segment captures a significant market share in 2025 as hospitals are typically having designated laser suites & treatment rooms equipped with advanced laser systems specifically designed for retinal procedures. These rooms provide a controlled & sterile environment where photocoagulation procedures can be performed safely & effectively.

The retinal laser photocoagulation is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must develop effective conjugates.

Key Strategies Used by the Participants

Product Development

Companies invest heavily in research and development to deliver lasers that improve efficiency, dependability, and cost-effectiveness. Product innovation allows businesses to differentiate themselves from their competition while also catering to the changing demands of their clients.

Strategic Alliances & Collaborations

Key industry leaders frequently develop strategic partnerships and collaborations with other companies in order to harness their strengths and increase their market reach. Companies might also gain access to new technology and markets through such agreements.

Expansion into Emerging Markets

The retinal laser photocoagulation is expanding rapidly in emerging regions such as China and India. Key firms are enhancing their distribution networks and developing local manufacturing facilities to increase their presence in these areas.

Acquisitions and mergers

Mergers and acquisitions are frequently used by key players in the retinal laser photocoagulation business to consolidate their market position, extend their product range, and gain access to new markets.

Key Developments in the Retinal Laser Photocoagulation:

The global retinal laser photocoagulation market is estimated to be valued at USD 266.1 billion in 2025.

The market size for the retinal laser photocoagulation market is projected to reach USD 408.1 billion by 2035.

The retinal laser photocoagulation market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in retinal laser photocoagulation market are argon laser (488 nm), green laser (532 nm), yellow laser (577 nm) and diode laser (810-1050 nm).

In terms of indication, proliferative diabetic retinopathy (pdr) segment to command 44.2% share in the retinal laser photocoagulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retinal Biologics Market Size and Share Forecast Outlook 2025 to 2035

Retinal Gene Therapy Market – Trends & Forecast 2025 to 2035

Retinal Vein Occlusion Treatment Market - Outlook 2025 to 2035

Retinal Vasculitis Treatment Market – Growth & Forecast 2024 to 2034

Retinal Drugs And Biologics Market

Vitreoretinal Surgery Devices Market Size and Share Forecast Outlook 2025 to 2035

Virtual Retinal Display Market Insights - Trends & Forecast 2025 to 2035

Handheld Retinal Scanners Market

Inherited Retinal Diseases Treatment Market Size and Share Forecast Outlook 2025 to 2035

Laser Transverse Mode Teaching Instrument Market Forecast and Outlook 2025 to 2035

Laser Welding Equipment Market Forecast and Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Cloths Market Size and Share Forecast Outlook 2025 to 2035

Laser Dazzler Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Laser Marking Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA