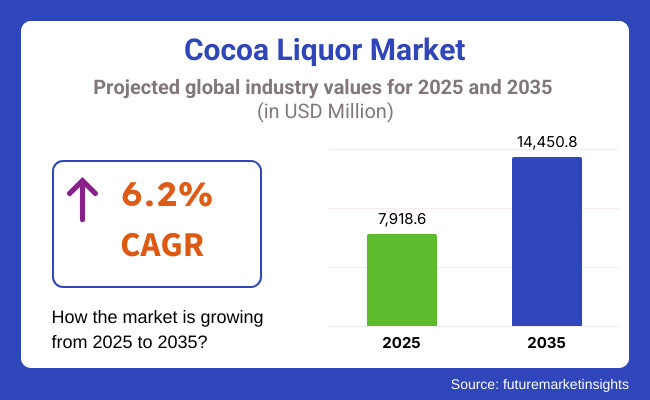

The global cocoa liquor market is estimated to be worth USD 7,918.6 million in 2025 and is projected to reach USD 14,450.8 million by 2035, expanding at a CAGR of 6.2% over the assessment period of 2025 to 2035. The widening market, which is mainly driven by increased consumer preference for natural and premium chocolate ingredients, has also paved the way for manufacturers to invest in smart process techniques and eco-friendly sourcing modalities.

With these multipronged strategies in place, leading manufacturers are on a path to address the need for high-quality cocoa liquor by expanding production capacities and optimizing supply chains.

Giants like Barry Callebaut, Cargill, and Olam Cocoa are massively investing in state-of-the-art production facilities, which ensures cost-effectiveness while also maintaining the unique taste profiles required for premium chocolate use. The companies also plan to collaborate with cocoa-growing areas to ensure the supply of top-quality resources through the implementation of strategic partnerships.

The trend of seeking natural and organic soluctions is not only modifying the cocoa liquor section, but also the manufacturers are promoting responsible sourcing and ethical production. The emphasis on the absence of synthetic additives and artificial flavorings has contributed to the need for organic and single-origin cocoa liquor, which has resulted in a major shift in producers' marketing and transitional product development.

Through its genuine ethical sourcing credentials, companies like Valrhona and Guittard are successfully attracting eco-friendly customers while attending to market demands.

Moreover, the increasing launch of artisanal and craft chocolate brands is driving the demand for superior cocoa liquor, as chocolatiers mainly choose high-quality and responsibly produced cocoa. The increasing demand for dark chocolate, which is due to its health advantages, is also boosting the market that, in turn, is compelling the manufacturers to innovate cocoa liquor of various cocoa concentrations and, as a result, satisfy the varied tastes of the consumers.

Furthermore, the progress in processing technology not only allows for the enhancement of flavor retention but also helps to increase production efficiency. The introduction of advanced fermentation and roasting techniques is helping the producers to produce a cocoa liquor product with a different flavor profile, creating an even bigger market for it.

The commitment of stakeholders to sustainability, innovation, and product excellence, which together will ensure a steady momentum for the cocoa liquor market, empowers the industry to reach new levels.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global cocoa liquor industry. This analysis highlights key shifts in market performance and revenue realization trends, providing valuable insights for stakeholders.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.6% |

| H2 (2024 to 2034) | 6.2% |

| H1 (2025 to 2035) | 5.7% |

| H2 (2025 to 2035) | 6.3% |

The first half of the year, or H1, spans from January to June, while the second half, H2, covers the period from July to December. In the first half (H1) of the decade from 2025 to 2035, the industry is projected to grow at a CAGR of 6.2%, followed by an increased growth rate in the second half (H2).

The sector witnessed an increase of 10 BPS in H1, while H2 recorded a slight increase of 10 BPS. Moving forward, continued investments in production capabilities and rising demand for natural cocoa ingredients are expected to support sustained market expansion

Emergence of Single-Origin Cocoa Liquor

Shift: Consumers are increasingly gravitating toward single-origin cocoa liquor, valuing distinct flavor profiles and traceability in chocolate products. Premium and artisanal chocolate brands are driving this demand, emphasizing regional variations in cocoa flavor influenced by terroir.

Countries like Ecuador, Ghana, and Madagascar are becoming hotspots for high-quality single-origin cocoa liquor as consumers seek authentic, transparent, and ethically sourced ingredients. The growing interest in origin-specific chocolate is reshaping procurement strategies and highlighting the importance of direct trade relationships.

Strategic Response: Manufacturers are expanding their single-origin cocoa liquor portfolios to cater to gourmet and premium chocolate brands. Valrhona has introduced limited-edition single-origin cocoa liquor from specific regions, enhancing traceability and exclusivity.

Meanwhile, Barry Callebaut has invested in direct partnerships with cocoa farmers, ensuring fair trade and superior quality. Premium chocolate makers like Amedei are leveraging single-origin cocoa liquor to craft high-end confections, reinforcing brand prestige and authenticity.

Surging Demand for High-Cocoa Content Liquor

Shift: Consumers are showing a growing preference for high-cocoa-content chocolate, driven by health consciousness and a desire for intense, rich flavors. Dark chocolate variants with 70% or higher cocoa content are witnessing increased demand, particularly in North America and Europe, where functional benefits such as antioxidants and reduced sugar content appeal to health-conscious buyers. This shift is pressuring manufacturers to enhance their production of high-cocoa-content liquor while maintaining quality and consistency.

Strategic Response: Leading cocoa liquor producers are refining fermentation and roasting techniques to create smooth, palatable, high-cocoa-content liquor. Cargill has launched new processing methods to ensure bitterness reduction without additives, while Lindt is expanding its range of ultra-dark chocolates with premium cocoa liquor formulations. Specialty brands such as Hotel Chocolat are also leveraging direct sourcing to maintain quality in high-percentage cocoa products.

Rise of Cocoa Liquor in Non-Chocolate Applications

Shift: The use of cocoa liquor is expanding beyond traditional chocolate manufacturing into bakery, confectionery spreads, and beverages. Cocoa-infused alcoholic drinks, gourmet pastries, and premium spreads are gaining popularity, particularly in Europe and Asia, where innovative formulations are attracting culinary professionals and health-conscious consumers alike. This trend is diversifying the application base for cocoa liquor, prompting manufacturers to explore new processing and formulation techniques.

Strategic Response: Producers are developing specialized cocoa liquor variants tailored for non-chocolate applications. Olam Cocoa has introduced a line of cocoa liquor with optimized viscosity for beverage formulations, while Ferrero is innovating cocoa liquor-based spreads to enhance flavor complexity. High-end bakeries and patisseries are sourcing artisanal cocoa liquor to create premium pastries, reinforcing the ingredient’s versatility and elevating its market value.

Intensified Investments in Fine-Flavor Cocoa Varieties

Shift: The demand for fine-flavor cocoa liquor is on the rise as premium chocolate brands focus on complex, aromatic profiles. This trend is particularly strong in gourmet and bean-to-bar chocolate segments, where consumers appreciate floral, fruity, or nutty flavor notes. With fine-flavor cocoa accounting for only a small percentage of global cocoa production, supply chain exclusivity is becoming a crucial competitive advantage for manufacturers.

Strategic Response: Companies are forming exclusive agreements with cocoa cooperatives to secure access to rare fine-flavor beans. Felchlin has introduced a limited-edition cocoa liquor sourced from Venezuelan criollo beans, while Guittard is investing in fermentation research to enhance natural flavor expression. Additionally, some chocolate brands are offering transparency in sourcing, showcasing fine-flavor cocoa liquor as a premium differentiator in the luxury chocolate market.

The global cocoa liquor market displays a range of multinational corporations (MNCs), regional players, and Chinese manufacturers, thereby making the situation competitive for the market. MNCs are the main players in the industry because of their well-functioning supply chains, solid brand image, and wide-reaching global distribution networks.

These companies buy cocoa beans from the major producing areas, such as West Africa, Latin America, and Southeast Asia, to maintain a constant supply of high-quality cocoa liquor. The firms' dabbling in modern processing technologies and taking part in sustainability initiatives pull them forward even more.

Regional players are much more than just cover-ups in places like West Africa, where the production of artisanal chocolate and specialty products made with cocoa is on the rise. Ethical sourcing, direct trade with cocoa farmers, and just the right spices are attributes that these companies often promote. Moreover, they gain from their solid connections with local confectionery and bakery producers that further their growth and market share.

The rise of Chinese manufacturers is one of the features of that imperceptible but influential change, and it is caused by increased local consumption of quality cocoa and chocolates.

The new middle-class consumers of the People's Republic of China are pushing retailers to make more high-quality chocolate and are thereby moving the factories into a position of increased capacity by not only building their orocessing lines but also teaming up with different suppliers. Furthermore, the country is on a mission to build a stronger infrastructure for cocoa processing, which has led to the demand for more cocoa beans brought in to be turned into liquor.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Country | United States |

|---|---|

| Market Volume (USD Million) | 1,010.00 |

| CAGR (2025 to 2035) | 3.70% |

| Country | Germany |

|---|---|

| Market Volume (USD Million) | 735.8 |

| CAGR (2025 to 2035) | 2.70% |

| Country | China |

|---|---|

| Market Volume (USD Million) | 857.4 |

| CAGR (2025 to 2035) | 5.60% |

| Country | Japan |

|---|---|

| Market Volume (USD Million) | 402.7 |

| CAGR (2025 to 2035) | 6.80% |

| Country | United Kingdom |

|---|---|

| Market Volume (USD Million) | 735.8 |

| CAGR (2025 to 2035) | 2.70% |

The United States is a prominent player in the global cocoa liquor market, with a projection of USD 1,010.0 million and a CAGR of 3.7% from 2025 to 2035. The major reason for the increase in sales volume is the rising consumer interest in premium and organic chocolate products, along with the health benefits associated with eating dark chocolate.

The manufacturers are making a move to their target consumers by the extension of their offering with single-origin and high-cocoa-content chocolate for the health-conscious and discerning consumers. The shift towards clean-label and fair-trade products is a further driver for the companies to become transparent in their supply chains while also employing sustainable sourcing practices, in turn creating a positive impact on the sector development.

China's cocoa liquor bazaar is anticipated to hit USD 857.4 million in 2025, flourishing at a vigorous CAGR of 5.6% throughout the projected timeline. The rapid expansion of the middle class and the increasing impact of Western consumer culture have had a significant effect on chocolate consumption, which has soared notably for upscale and artisanal products.

The local companies are continuously upgrading their processing units and entering into partnerships with international cocoa suppliers to satisfy the ever-growing demand. Moreover, the company's focus on innovation of goods, such as new flavors and health-conscious chocolate variants, has broadened its customer base. E-commerce portals are further instrumental in enhancing the market reach of cocoa products by facilitating their delivery to the whole nation.

Japan's cocoa liquor market is anticipated to achieve a volume of USD 402.7 million in 2025, reflecting a CAGR of 6.8% in the period till 2035. The Japanese cocoa liquor market is marked by a high demand for premium and carefully crafted chocolate goods. A growing number of consumers are looking for more high-end options, such as single-origin and bean-to-bar chocolates, which exhibit particular flavor and craftsmanship.

Consequently, the manufacturers are encouraged to prioritize quality procurement, careful processing, and product innovations. Tanpan also recognizes the health advantages of the cocoa tablets for dark chocolate, which has increased rather than decreased its consumption with the enterprises rolling out the goods that are catered for the health-conscious seeker without sacrificing flavors and quality.

| Segment | Value Share (2025) |

|---|---|

| Dutch Cocoa (By Product Type) | 21% |

The global cocoa liquor market share is dominated by Dutch cocoa, with a holding of 63.4%. This is expected to grow to around USD 3,210.5 million in 2025. Its advantage largely comes from the fact that it has a milder flavor, less acidity, and a higher degree of solubility than the competition, making it the first choice for producers of chocolates and confections.

The alkalization of the cocoa not only enhances its color but also gives it a more appealing texture, which helps to fuel this trend in the premium chocolate segment. Chocolate manufacturers are taking advantage of the Dutch cocoa to make pleasantly smooth and high-quality chocolate products following the demands of consumers who are in quest for exquisite taste and texture.

Furthermore, the potential for Dutch cocoa to last longer and the processing improvements that it has brought are the main reasons for its presence in various sectors. Companies such as Barry Callebaut and Cargill are leading the way in technological advancements for the production of Dutch cocoa and the continuous rise in global demand.

| Segment | Value Share (2025) |

|---|---|

| Chocolate & Confectionery (By Application) | 21% |

In 2025, chocolate and confectionery markets are projected to consume up to 52.8% of the total cocoa liquor share, which amounts to USD 2,678.9 million in revenue. The growth of the cocoa liquor market is mainly driven by the rising demand for high-quality and artisanal chocolates, with consumers preferring more cocoa and richer flavors. Particularly, dark chocolate is the most popular for its perceived health benefits associated with antioxidant-rich diets.

To meet the changing preferences of consumers, manufacturers are coming up with diverse formulations, for instance, organic, single-origin, and functional chocolates. The general trend of premium chocolates is also encouraging more investments in high-quality cocoa liquor procurement and processing technologies.

Furthermore, well-known confectionery companies like Lindt, Ferrero, and Hershey's are focusing on a strategy to increase their product ranges by utilizing cocoa liquor to improve product quality, flavor, and texture in their luxury chocolate lines.

With the significant changes in the global cocoa liquor trade, its demand seems to rise as more consumers opt for better quality and sustainably sourced cocoa products.

The main actors in this sector are focusing on extending their market coverage by making strategic investments, bringing forth new products, and following sustainable sourcing procedures. The competition realm has seen alliances between global corporates and local farms to increase output and cater to the new needs of health-oriented and ethically driven buyers.

The market is segmented into Dutch and Natural cocoa liquor.

The market is categorized into Forastero, Criollo, Trinitario, and other cocoa varieties.

The market includes wafers, blocks, chips, and liquid forms.

The market is divided into chocolate and confectionery, ice cream, food and beverage coatings, beverages, bakery, and other applications.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The global cocoa liquor market is expected to grow at a CAGR of 6.2% during the forecast period from 2025 to 2035.

The market is projected to reach approximately USD 14,450.8 million by 2035.

The chocolate and confectionery application segment is expected to witness the fastest growth, driven by increasing consumer demand for premium and artisanal chocolate products.

Key factors include rising consumer preference for high-quality chocolate products, increasing awareness of the health benefits associated with cocoa, and expanding applications of cocoa liquor in various food and beverage industries.

Leading companies include Barry Callebaut AG, Cargill, Incorporated, Olam International Limited, Blommer Chocolate Company, and Nestlé S.A.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Cocoa Variety, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Cocoa Variety, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Cocoa Variety, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Cocoa Variety, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Cocoa Variety, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Cocoa Variety, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Cocoa Variety, 2018 to 2033

Table 36: Europe Market Volume (Tons) Forecast by Cocoa Variety, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Cocoa Variety, 2018 to 2033

Table 46: Asia Pacific Market Volume (Tons) Forecast by Cocoa Variety, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: Asia Pacific Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Asia Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Cocoa Variety, 2018 to 2033

Table 56: MEA Market Volume (Tons) Forecast by Cocoa Variety, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 58: MEA Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: MEA Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Cocoa Variety, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Cocoa Variety, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Cocoa Variety, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Cocoa Variety, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Cocoa Variety, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Cocoa Variety, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Cocoa Variety, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Cocoa Variety, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Cocoa Variety, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Cocoa Variety, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Cocoa Variety, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Cocoa Variety, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Cocoa Variety, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Cocoa Variety, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Cocoa Variety, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Cocoa Variety, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Cocoa Variety, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Cocoa Variety, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Cocoa Variety, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Cocoa Variety, 2018 to 2033

Figure 105: Europe Market Volume (Tons) Analysis by Cocoa Variety, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Cocoa Variety, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Cocoa Variety, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 109: Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Cocoa Variety, 2023 to 2033

Figure 118: Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Cocoa Variety, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Cocoa Variety, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Tons) Analysis by Cocoa Variety, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Cocoa Variety, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Cocoa Variety, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Cocoa Variety, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Cocoa Variety, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Cocoa Variety, 2018 to 2033

Figure 165: MEA Market Volume (Tons) Analysis by Cocoa Variety, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Cocoa Variety, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Cocoa Variety, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 169: MEA Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: MEA Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Cocoa Variety, 2023 to 2033

Figure 178: MEA Market Attractiveness by Form, 2023 to 2033

Figure 179: MEA Market Attractiveness by Application, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cocoa Fiber Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Flavanol Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Based Polyphenols Market Size and Share Forecast Outlook 2025 to 2035

Liquor Flavored Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Cocoa Shell Fiber Market Analysis - Size, Share & Forecast 2025 to 2035

Cocoa Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Nibs Market Size, Share, and Forecast 2025-2035

Cocoa Maker Market Size, Growth, and Forecast 2025 to 2035

Liquor Confectionery Market Insights - Indulgent Sweets & Alcohol-Infused Treats 2025 to 2035

Cocoa Derivatives Market Analysis by Type, Category, Application and Region through 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Cocoa Bean Extract Market Trends - Nature & Cocoa Type Insights

Liquor Flavored Cigars Market

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Organic Cocoa Market Growth - Applications & Industry Trends

Alkalized Cocoa Powder Market Size and Share Forecast Outlook 2025 to 2035

Ethylhexyl Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA