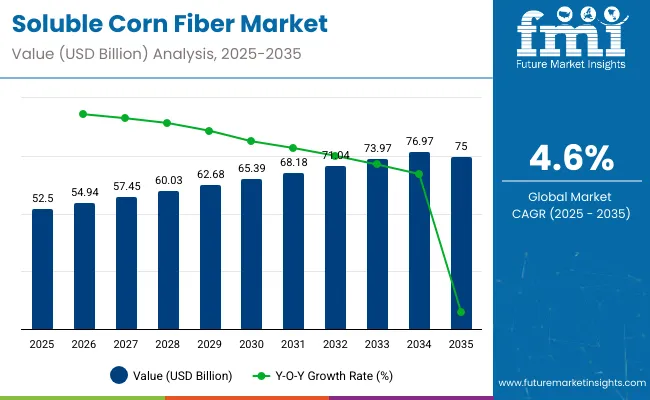

The global soluble corn fiber market size stands at USD 52.5 billion in 2025. The market is anticipated to expand at a CAGR of 4.6% from 2025 to 2035, reaching a projected value of USD 75 billion by 2035. This growth is driven by increasing consumer awareness of digestive health and the rising demand for dietary fiber in functional foods and beverages.

Soluble corn fiber is widely used as a low-calorie sweetener and bulking agent in health-conscious food products, making it popular in the formulation of reduced-sugar and high-fiber goods. Expanding applications in baked products, dairy, and nutritional supplements are also contributing to the rising consumption of soluble corn fiber worldwide.

Looking forward, the soluble corn fiber market is likely to witness a steady growth as food manufacturers increasingly reformulate products to meet consumer preferences for cleaner labels and healthier ingredients. With the rise in lifestyle-related health issues such as obesity and diabetes, there is growing demand for ingredients that support metabolic and gut health without compromising on taste or texture.

Soluble corn fiber is likely to gain traction as a key component in functional foods, offering prebiotic benefits and improving digestive balance. Innovations in food technology and processing methods are likely to enhance the solubility and stability of corn fiber in various formulations, further expanding its applicability across diverse food and beverage categories.

Government regulations in the soluble corn fiber market primarily focus on food safety, labeling requirements, and health claims. Regulatory agencies such as the USA Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) govern the use of dietary fibers in consumer products, ensuring they meet safety standards and are supported by scientific evidence for any health-related claims.

Label transparency and accurate representation of fiber content are critical, especially in products targeting health-conscious consumers. As the demand for functional ingredients grows, regulatory oversight is likely to become more stringent, pushing manufacturers to maintain compliance while innovating responsibly.

Soluble corn fiber is considered a functional ingredient and often falls under both food additive and dietary fiber regulations. Compliance with these frameworks is essential for manufacturers to market products legally and build consumer trust, especially in health-conscious and regulated markets like the U.S., EU, and parts of Asia-Pacific.

Soluble corn fiber, widely used in functional foods, beverages, and dietary supplements, has seen increasing integration into various distribution and innovation channels. From retail expansion to advanced formulation technologies, the market is adapting rapidly to health-conscious consumer demand.

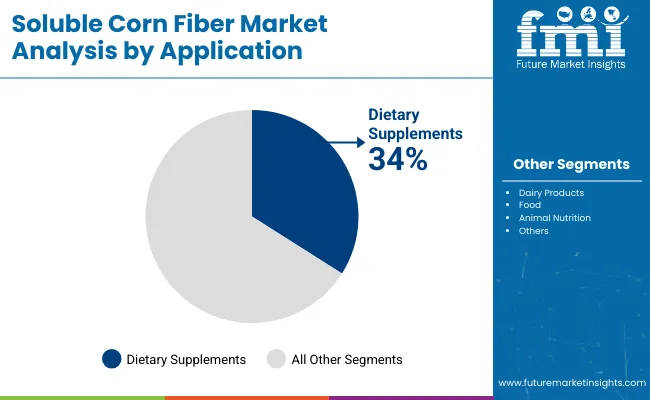

The market is segmented based on application, form, and region. By application, the key segments include dairy products, food processing, dietary supplements, and animal nutrition. In terms of form, the market is divided into powder and liquid. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, and the Middle East & Africa.

The dietary supplements segment is poised to experience the fastest growth, with a CAGR of 8.6% from 2025 to 2035. This rapid expansion is largely driven by rising consumer awareness of health and wellness, coupled with an increasing preference for preventive healthcare solutions. As individuals become more health-conscious, personalized nutrition is becoming a significant focus, with dietary supplements playing a key role in addressing specific health concerns such as immunity, digestion, and overall wellness.

E-commerce platforms are contributing significantly to the market’s growth by providing convenient access to a wide variety of dietary supplements. In regions like North America and Western Europe, health-conscious consumers are driving the demand for natural and organic products. Meanwhile, the dairy products segment continues to perform steadily, supported by a robust global demand for both traditional dairy and plant-based alternatives. Innovations in dairy alternatives, such as plant-based milk and yogurt, further enhance the growth prospects of this segment.

The food processing segment remains critical as food manufacturers continue to seek advanced ingredients to improve texture, flavor, and nutritional value in food products. Lastly, animal nutrition shows moderate yet steady growth, benefiting from the increasing global demand for high-quality feed to support livestock productivity.

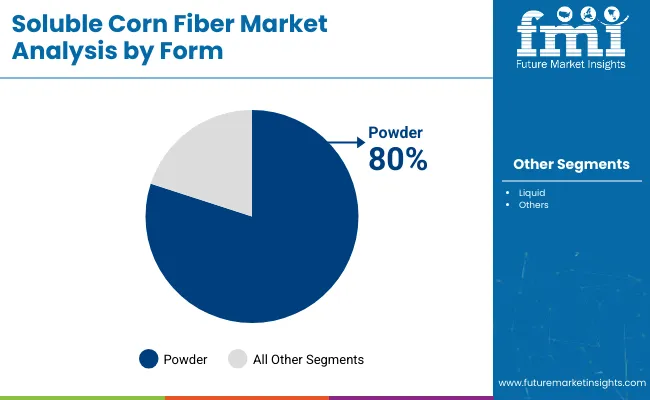

The powder form captures 80% of the market share, driven by the many advantages of powdered products, including longer shelf life, convenience, and versatility across various applications. Powdered products are easy to transport, have a long shelf life, and can be incorporated into a wide range of formulations, making them a preferred choice in industries like dietary supplements, food processing, and animal nutrition.

Furthermore, innovations in powder technology, including advanced encapsulation techniques, are expected to accelerate market expansion, particularly in functional foods and supplements. The ability to create easy-to-use formulations that enhance nutritional content without altering the flavor or texture of end products adds to the appeal of powdered forms.

On the other hand, the liquid form continues to dominate in sectors such as dairy, beverages, and pharmaceuticals. Liquids are favored for their bioavailability and ease of consumption, particularly in ready-to-consume meals and beverages. While the Liquid form experiences slower growth compared to powder, it continues to hold a significant market share due to the ongoing demand for convenience and immediate consumption. Its continued dominance in sectors requiring quick absorption and simplicity in use ensures its pivotal role in the market despite the rise of powdered alternatives.

Consumer awareness of the value of eating a healthy diet has increased as lifestyle-related diseases like diabetes and obesity are becoming more common. Customers are actively looking for food and drink items that can improve their health which is fueling the demand for functional ingredients like soluble corn fiber worldwide and propelling market expansion.

Increased market demand is anticipated as a result of consumers growing preference for clean-label products such as soluble corn fiber. Soluble corn fiber adoption in a variety of applications is probably going to be driven by consumers looking for products with identifiable processed ingredients.

Companies can gain a competitive edge by positioning their products as cleaner alternatives by highlighting the natural qualities of soluble corn fiber. By adding soluble corn fiber to clean-label products you can reach a wider audience and open up new business prospects. By diversifying their product lines and increasing their global footprint manufacturers are likely to invest in R&D to produce new formulations and applications that satisfy clean label preferences.

Tier 1 companies comprises industry leaders acquiring a 70% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 20%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

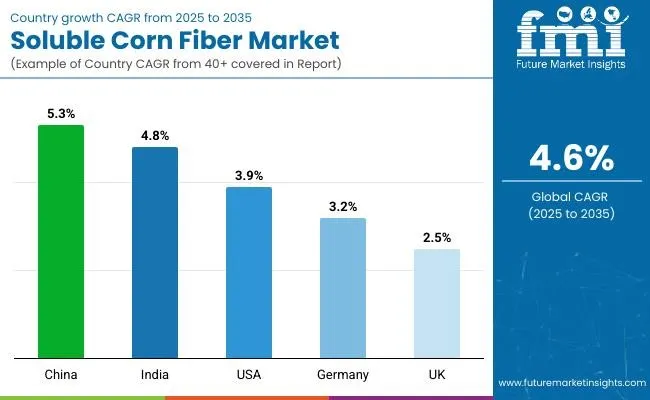

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and China come under the exhibit of high consumption, recording CAGRs of 3.9%, 3.2% and 5.3%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 3.9% |

| Germany | 3.2% |

| China | 5.3% |

Due to growing interest in digestive health there is a growing need for clean-label and functional ingredients in the US. This trend is supported by the use of soluble corn fiber as a prebiotic fiber. Its uses in lowering sugar and improving the nutritional value of different food items appeal to Americans who are concerned about their health.

The market for soluble corn fiber in China is expanding significantly due to consumers growing desire for healthier food options. Chinese consumers are growing more health-conscious and the markets trend toward nutritionally enhanced products is well-suited to the functional and prebiotic qualities of soluble corn fiber. Since it enhances digestive health and can be used in lower-calorie and sugar-free formulations soluble corn fiber is a preferred ingredient in the Chinese food industry.

The growing demand for the product has been fueled by the German consumers preference for natural and healthful ingredients as well as their attention to digestive health. The German food industry prefers soluble corn fiber because of its prebiotic and functional qualities.

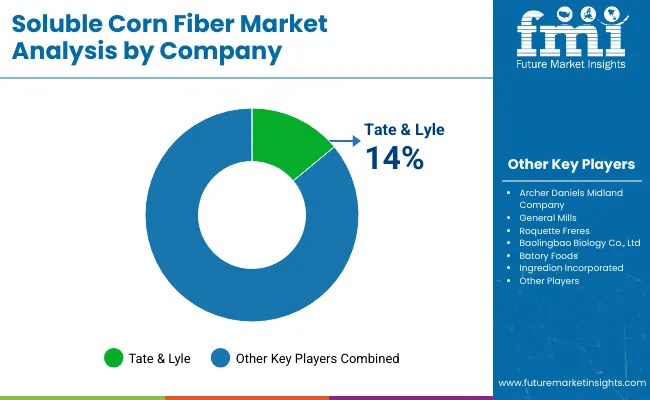

The soluble corn fiber market is highly competitive, with major global players such as Archer Daniels Midland, Cargill, Ingredion, Tate & Lyle, and Roquette Frères dominating the landscape. These companies maintain a strong presence through extensive distribution networks, ongoing research and development, and innovative product lines that align with health and wellness trends.

ADM leads with its Fibersol products, while Ingredion offers functional solutions like VERSAFIBE. Cargill continues to expand its portfolio to meet rising demand for clean-label and low-sugar options. Tate & Lyle and Roquette focus on prebiotic and sustainable offerings. Smaller firms and alternative fiber sources like inulin and resistant starch add further competition, driving differentiation through quality, functionality, and targeted marketing strategies.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 52.5 billion |

| Projected Market Size (2035) | USD 75 billion |

| Overall Market CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Analysis Parameter | Revenue in USD billion/Volume in Metric Tons |

| By Application | Dairy Products, Food Processing, Dietary Supplements, and Animal Nutrition |

| By Form | Powder and Liquid |

| By Regions | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, and Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Archer Daniels Midland Company, Tate & Lyle, General Mills, Roquette Freres, Baolingbao Biology Co., Ltd, Batory Foods, Ingredion Incorporated, Muby Chemicals, Cargill, and Jianlong Biotechnology Co., Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

By product type, methods industry has been categorized into powder and liquid

By form, industry has been categorized into Dairy Products, Food, Dietary supplements and Animal Nutrition

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The global soluble corn fiber market is anticipated to grow from USD 52.5 billion in 2025 to USD 75 billion by 2035, expanding at a CAGR of 4.6% from 2025 to 2035.

The dietary supplements segment is projected to experience the fastest growth, with a CAGR of 8.6%, driven by increasing consumer awareness of health and wellness and a preference for preventive healthcare solutions.

The powder form of soluble corn fiber captures 80% of the market share in 2025, owing to its benefits in shelf life, convenience, and versatility in various applications such as dietary supplements, food processing, and animal nutrition.

The growth is driven by increasing demand for dietary fiber in health-conscious food and beverage products, consumer awareness of digestive health, the popularity of low-calorie sweeteners, and the rising demand for clean-label ingredients in functional foods.

Key players in the market include Archer Daniels Midland Company, Tate & Lyle, General Mills, Roquette Freres, Baolingbao Biology Co., Ltd., Batory Foods, Ingredion Incorporated, Muby Chemicals, Cargill, and Jianlong Biotechnology Co., Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 4: Global Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Global Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 10: North America Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 12: North America Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 16: Latin America Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: Latin America Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 22: Western Europe Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Western Europe Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 28: Eastern Europe Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Eastern Europe Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 40: East Asia Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: East Asia Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Form, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Form, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Tons) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 9: Global Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 13: Global Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 16: Global Market Attractiveness by Form, 2024 to 2034

Figure 17: Global Market Attractiveness by End Use, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Form, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 27: North America Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 31: North America Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 34: North America Market Attractiveness by Form, 2024 to 2034

Figure 35: North America Market Attractiveness by End Use, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Form, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 45: Latin America Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: Latin America Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Form, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Form, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 63: Western Europe Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 67: Western Europe Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Form, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Form, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Form, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Form, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Form, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Form, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 117: East Asia Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 121: East Asia Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Form, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Form, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Form, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Form, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Soluble Corn Fiber in EU Size and Share Forecast Outlook 2025 to 2035

Soluble-Film Cutters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Soluble Milk Protein Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Soluble Fiber Market

Analysis and Growth Projections for Insoluble Dietary Fiber Business

Fat Soluble Vitamins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oil Soluble Flavors Market

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Pods and Capsules Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water-Soluble Retinol Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Polymer Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Detergent Pods Market Size and Share Forecast Outlook 2025 to 2035

Water Soluble Fertilizers Market Trends 2025 to 2035

Water Soluble Pods Packaging Market Analysis by Material Type, Product Type, End Use, Thickness Type, and Region Forecast Through 2035

Key Companies & Market Share in the Water Soluble Detergent Pods Sector

Competitive Breakdown of Water-Soluble Packaging Companies

Water Soluble Vitamins Market

Water-Soluble Flavors Market

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA