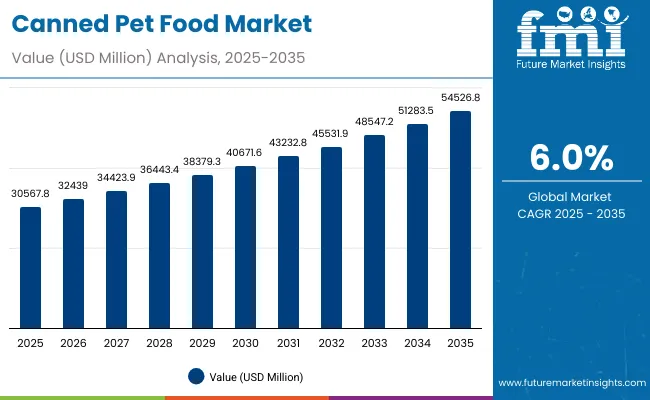

The Canned Pet Food Market is expected to record a valuation of USD 30,567.8 million in 2025 and USD 54,526.8 million in 2035, with an increase of nearly USD 23,959.0 million, which equals a growth of ~1.8X over the decade. The overall expansion represents a CAGR of 6.0% and more than a 1.8X increase in market size.

Canned Pet Food Market Key Takeaways

| Metric | Value |

|---|---|

| Canned Pet Food Market Estimated Value (2025E) | USD 30,567.8 million |

| Canned Pet Food Market Forecast Value (2035F) | USD 54,526.8 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 30,567.8 million to USD 40,671.6 million, adding 10,103.8 million, which accounts for 42% of the total decade growth. This phase records steady adoption in premium canned diets, grain-free recipes, and functional nutrition formats, driven by the rising demand for pet humanization and veterinary-recommended diets. Dog food dominates this period as it caters to over half of global demand, while meat-based formulas (chicken and beef leading) continue to anchor category growth.

The second half from 2030 to 2035 contributes 13,855.2 million, equal to 58% of total growth, as the market jumps from USD 40,671.6 million to USD 54,526.8 million. This acceleration is powered by widespread adoption of clean-label, organic, and human-grade canned diets, along with rapid expansion in emerging Asian markets such as China, India, and South Korea. Exotic proteins and insect-based canned formulations gain ground, reflecting sustainability trends. Cat food captures higher incremental growth during this phase, supported by rising cat ownership in urban centers across Europe and East Asia. Digitalization of sales channels, including direct-to-consumer subscription boxes and online retailers, enhances penetration and pushes premiumization trends forward.

From 2020 to 2024, the Canned Pet Food Market expanded steadily, driven by increased adoption of premium wet food formats and rising consumer shift toward high-quality protein sources. During this period, the competitive landscape was dominated by large multinationals (Nestlé Purina, Mars Petcare, Hill’s, Blue Buffalo) controlling nearly 70% of global revenue, focusing on dog and cat food innovations. Competitive differentiation relied on nutritional science, taste palatability, and premium branding, while small private labels and regional brands strengthened their presence through affordable canned food formats. Sustainability and recyclability of packaging were secondary but emerging considerations, while direct-to-consumer models gained modest traction, contributing less than 10% of overall value.

Demand for canned pet food will expand to USD 30,567.8 million in 2025, and the revenue mix will shift as organic, human-grade, and insect-based formulations grow to a combined >25% share by 2035. Traditional leaders face rising competition from emerging Asian and Latin American brands that focus on local protein sources (duck, fish, venison) and regional flavor preferences. Major global vendors are pivoting to hybrid models combining veterinary nutrition, e-commerce subscriptions, and premium packaging innovation to retain relevance. The competitive advantage is moving away from price-driven volume sales alone toward nutrition science, sustainability credentials, and omnichannel distribution ecosystems.

The growth of the Canned Pet Food Market is driven by rising pet humanization, where owners treat pets as family members and seek higher-quality nutrition. Advances in pet food science have improved the formulation of canned diets, offering enhanced digestibility, better palatability, and targeted health benefits. This has allowed manufacturers to position canned food as not only a convenient choice but also a premium option aligned with wellness and lifestyle trends. Increasing consumer preference for products with organic, clean-label, and human-grade attributes has further reinforced growth, especially across developed regions where transparency and naturalness are highly valued.

At the same time, sustainability concerns are shaping the market, with plant-based and insect-based canned foods emerging as viable alternatives to traditional meat-based proteins. These innovations cater to eco-conscious buyers while also addressing demand for hypoallergenic and novel protein diets. Distribution dynamics are also accelerating growth, with online retail, subscription models, and direct-to-consumer platforms broadening access and allowing for personalized offerings. In addition, veterinary-recommended prescription canned diets are strengthening the therapeutic niche, particularly for aging pets with special dietary needs. Together, these factors ensure that canned pet food is evolving from a commodity into a science-driven, lifestyle-aligned product category, fueling consistent market expansion.

| Pet Type | Value Share (2025) |

|---|---|

| Dog | 55.1% |

| Cat | 40.2% |

| Others (Small mammals, reptiles) | 4.7% |

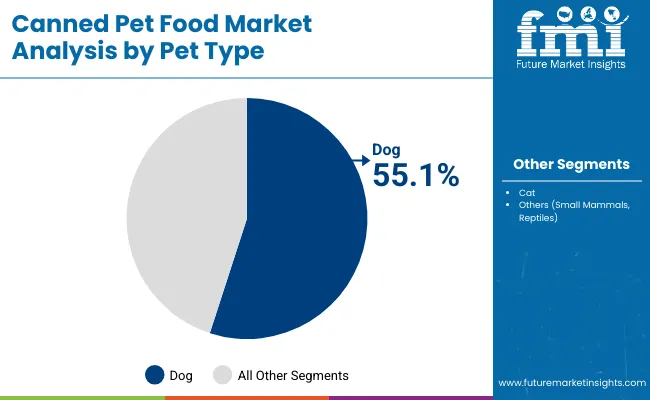

The dog segment is projected to contribute 55.1% of the Canned Pet Food Market revenue in 2025, maintaining its lead as the dominant category. This is driven by higher per-dog food intake, rising demand for functional and grain-free canned formulas, and strong adoption of veterinary diets. Cats, however, are expanding faster with a 5.0% CAGR, supported by growing urban cat ownership in Europe and East Asia.

| Ingredient Type | Value Share (2025) |

|---|---|

| Meat-based | 68.4% |

| Others | 31.6% |

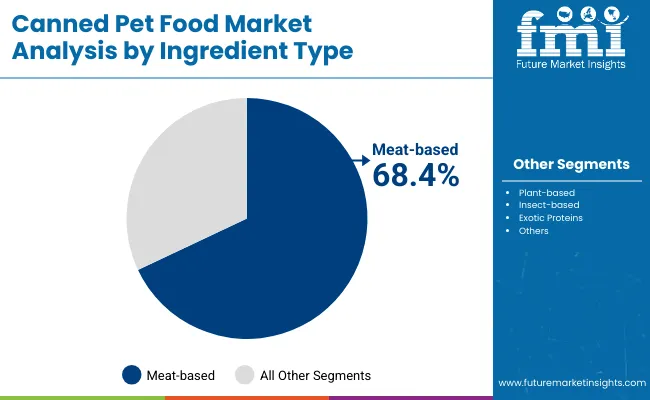

The meat-based segment is forecasted to hold 68.4% of the market share in 2025, led by chicken and beef which remain staples in canned food diets. Growth is further supported by lamb, turkey, and fish, each catering to premium preferences. Meanwhile, insect-based and plant-based diets are expanding faster, driven by sustainability concerns and consumer willingness to experiment with alternative proteins. Exotic proteins are also rising in importance for premium and hypoallergenic formulations.

| Product Claim | Value Share (2025) |

|---|---|

| Grain-Free | 28.4% |

| Others | 71.6% |

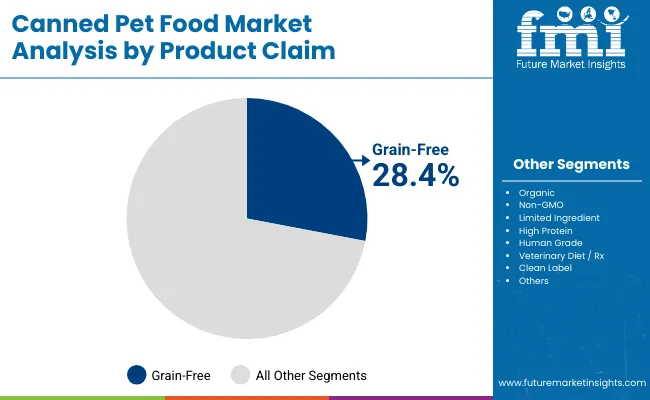

The grain-free segment is projected to account for 28.4% of global revenues in 2025, maintaining its lead as the most preferred product claim. Its popularity is rooted in consumer perception of improved digestibility and natural formulations. However, clean-label and human-grade categories are forecasted to grow faster, driven by demand for ingredient transparency and equivalence to human food quality. Veterinary Rx diets retain a strong niche presence but expand more slowly compared to lifestyle-driven claims.

Rising premiumization and changing dietary preferences are fueling demand in the Canned Pet Food Market, while structural challenges such as cost pressures and packaging complexities remain significant. The following factors illustrate the unique drivers, restraints, and emerging trends shaping growth between 2025 and 2035.

Expansion of Protein-rich and Functional Diets

The dominance of meat-based canned food, accounting for 68.4% of global value in 2025, underscores the strong consumer demand for protein-rich diets. Within this category, chicken and beef continue to lead, while functional diets formulated with added vitamins, probiotics, and immune-boosting ingredients are becoming key growth engines. Canned formats also support therapeutic and prescription formulations prescribed by veterinarians, particularly for senior pets with kidney, digestive, or allergy-related conditions. This functional orientation is ensuring canned food is no longer a discretionary choice but a core part of pet health management.

Rising Urban Cat Ownership and Shift Toward Premium Wet Food

Cats are the fastest-growing consumer base in the canned segment, expanding at a 5.0% CAGR compared to 4.5% for dogs. Urban households in Europe, Japan, and South Korea are increasingly adopting cats due to smaller living spaces, creating a natural pull toward wet food, which is easier for feline digestion and preferred for its texture. Premium canned cat food with high-moisture content is gaining traction, particularly in Asia-Pacific, where urbanization and lifestyle changes are reshaping household pet preferences. This shift is creating disproportionate growth opportunities for cat-focused product lines.

High Cost Gap Between Dry and Canned Food

Canned pet food remains significantly more expensive than dry kibble, which limits penetration in middle-income households, especially in South Asia, Latin America, and parts of Eastern Europe. With global pet food inflation tied to meat prices and supply chain volatility, canned products often face affordability challenges in mass-market channels. This persistent cost differential restricts market expansion beyond affluent urban buyers, slowing down broader adoption despite strong consumer interest.

Packaging and Recycling Infrastructure Challenges

The reliance on aluminum cans, tin packaging, and multi-layer pouches creates a complex supply chain for manufacturers and distributors. Recycling rates for pet food cans remain uneven across regions, and the additional costs of sustainable packaging formats increase production expenses. Smaller brands find it difficult to scale due to these packaging burdens, while emerging markets with underdeveloped recycling systems struggle to integrate canned products sustainably. This acts as a structural restraint on long-term volume growth.

Adoption of Insect-based and Exotic Protein Canned Diets

Consumer openness to novel proteins is shaping the future of canned formulations. Insect-based canned food, with a CAGR of 6.8% between 2025 and 2035, is gaining popularity in Europe and East Asia as an environmentally sustainable and hypoallergenic alternative. Exotic proteins such as duck, venison, and kangaroo are increasingly positioned in the premium segment, particularly for pets with sensitivities. These innovations are expanding product variety while aligning with global sustainability priorities.

Acceleration of Online Retail and Subscription-based Models

Digital platforms are reshaping how canned pet food is purchased and consumed. Online retail already accounts for a rising share in North America, Europe, and China, while subscription-based direct-to-consumer models are ensuring consistent demand for premium products. These models allow brands to bundle specialty diets, offer personalized nutrition plans, and create loyalty through recurring deliveries. By 2035, online and D2C sales are expected to represent one of the fastest-growing distribution channels, particularly for premium and therapeutic canned diets.

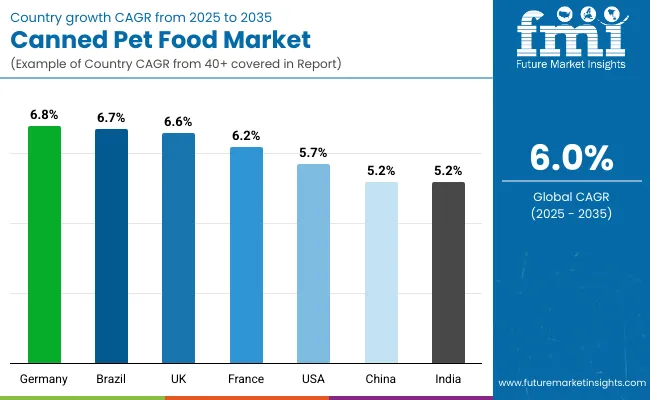

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.2% |

| India | 5.2% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 6.6% |

| USA | 5.7% |

| Brazil | 6.7% |

The Canned Pet Food Market shows a pronounced regional disparity in adoption speed, strongly influenced by urbanization, pet ownership trends, and premiumization of diets. Asia-Pacific emerges as the fastest-growing region, anchored by China at 5.2% CAGR and India at 5.2%. This acceleration is driven by rising pet adoption rates, growing middle-class income levels, and expanding availability of premium canned products through online channels. China’s regulatory support for domestic pet food manufacturing and growing popularity of imported premium brands are accelerating demand, while India’s trajectory reflects rising awareness of pet health, strong growth in urban cat ownership, and rapid adoption of canned food formats among tier-1 and tier-2 cities.

Europe maintains a strong growth profile, led by Germany at 6.8%, France at 6.2%, and the UK at 6.6%, supported by consumer preference for natural, organic, and grain-free canned products. High penetration of cats in urban households and strict regulatory compliance around food labeling keep Europe ahead of other regions in clean-label and sustainability-focused offerings. North America shows steady expansion, with the USA at 5.7% CAGR, reflecting maturity in pet ownership but growing premiumization and online channel adoption. Growth in North America is more value-driven, with strong demand for functional, veterinary-prescribed, and human-grade canned diets that support long-term health and wellness.

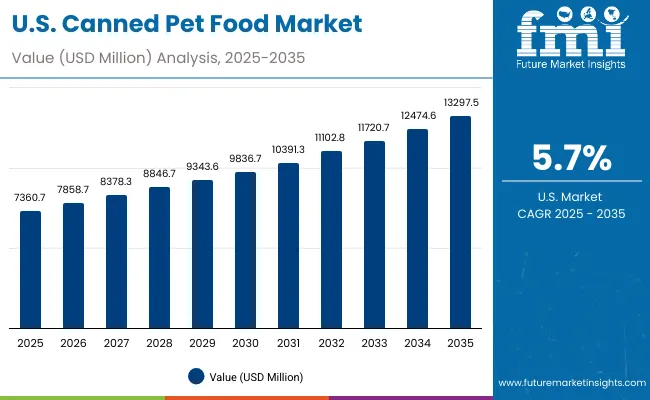

| Year | USA Canned Pet Food Market (USD Million) |

|---|---|

| 2025 | 7,360.7 |

| 2026 | 7,858.7 |

| 2027 | 8,378.3 |

| 2028 | 8,846.7 |

| 2029 | 9,343.6 |

| 2030 | 9,836.7 |

| 2031 | 10,391.3 |

| 2032 | 11,102.8 |

| 2033 | 11,720.7 |

| 2034 | 12,474.6 |

| 2035 | 13,297.5 |

The Canned Pet Food Market in the United States is projected to grow at a CAGR of 6.1%, led by increased investment in premium formulations and veterinary diet adoption. Grain-free and limited-ingredient products are recording a notable year-on-year rise, particularly among health-conscious dog owners. The cat segment is also growing steadily, with wet food becoming a preferred choice in urban households. Adoption is expanding in therapeutic niches such as kidney and digestive care, as veterinary clinics increasingly recommend specialized canned diets. E-commerce penetration is strong, with subscription-based models gaining traction for premium brands. High demand for functional nutrition and human-grade formulations is creating opportunities for bundled offerings and private-label growth in pet specialty retail.

The Canned Pet Food Market in the United Kingdom is expected to grow at a CAGR of 6.6%, supported by applications in premium cat food, veterinary-recommended diets, and functional formulations. The cat ownership rate in the UK has surged, driving demand for moisture-rich canned formats aligned with urban living. Pet owners are gravitating toward organic, non-GMO, and human-grade labels, particularly in urban centers such as London and Manchester. Specialty retailers and supermarkets are offering expanded shelf space for premium wet food brands, while direct-to-consumer startups are introducing personalized meal subscription boxes. Sustainability is a key driver, with recyclable aluminum cans and eco-friendly packaging gaining prominence alongside plant-based and insect-based diet launches.

India is witnessing rapid growth in the Canned Pet Food Market, which is forecast to expand at a CAGR of 5.2% through 2035. Rising disposable income and urbanization have led to increased pet ownership, especially among nuclear families in metro and tier-2 cities. Premium canned products are gaining visibility through online marketplaces and specialty retail, with international brands expanding their footprint. The dog segment continues to dominate, but the cat segment is recording higher incremental growth, supported by wet food adoption for indoor pets. Veterinary-prescribed diets are also gaining ground, particularly in metropolitan cities where clinical awareness is higher.

The Canned Pet Food Market in China is expected to grow at a CAGR of 5.2%, one of the highest among leading economies. This momentum is driven by rising premiumization, rapid expansion of cat ownership, and increased adoption of online retail channels. Domestic brands are gaining share by offering competitively priced canned diets, while international brands dominate the super-premium segment. Municipal initiatives to promote recycling and food safety compliance are reinforcing consumer confidence. Online platforms such as JD.com and Tmall are fueling direct-to-consumer subscription growth, ensuring steady demand for both premium and veterinary diets. Growth is further supported by innovative product launches, including insect-based and human-grade formulations.

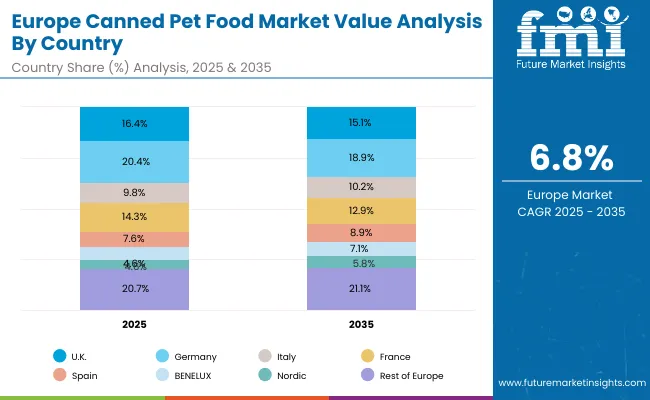

| Sub-regions | 2025 Share |

|---|---|

| UK | 16.4% |

| Germany | 20.4% |

| Italy | 9.8% |

| France | 14.3% |

| Spain | 7.6% |

| BENELUX | 6.2% |

| Nordic | 4.6% |

| Rest of Europe | 20.7% |

| Sub-regions | 2035 Share |

|---|---|

| UK | 15.1% |

| Germany | 18.9% |

| Italy | 10.2% |

| France | 12.9% |

| Spain | 8.9% |

| BENELUX | 7.1% |

| Nordic | 5.8% |

| Rest of Europe | 21.1% |

The Canned Pet Food Market in Germany is projected to grow at a CAGR of 6.8%, underpinned by strong demand for grain-free, organic, and limited-ingredient diets. German consumers emphasize sustainability and ingredient transparency, making clean-label products highly popular. Specialty retailers dominate distribution, while veterinary clinics play a key role in recommending therapeutic canned diets. Cat ownership is expanding rapidly in urban households, and exotic proteins such as venison and duck are gaining share in premium categories. Packaging innovation, particularly recyclable tin cans and lightweight pouches, is reinforcing consumer trust and aligning with EU circular economy goals.

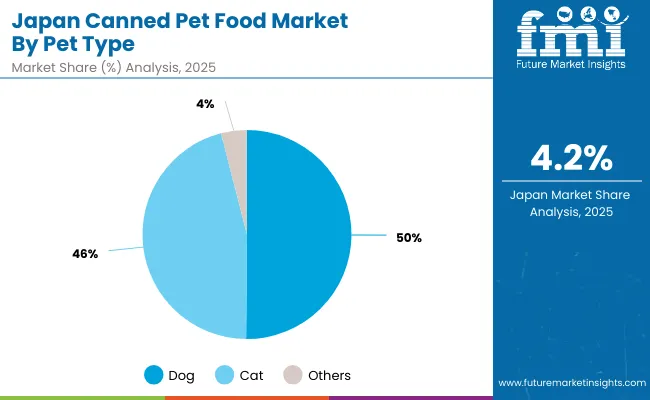

| Pet Type Segment | Value Share, 2025 |

|---|---|

| Dog | 50.2% |

| Others | 49.8% |

The Canned Pet Food Market in Japan is projected at USD 1,370.7 million in 2025, with dogs leading at 50.2% share, closely followed by cats at 45.9%. This reflects Japan’s balanced pet ownership profile, where cats are increasingly gaining prominence in urban households. Growth is supported by a preference for moisture-rich diets, particularly in senior pets where canned food offers improved hydration and palatability. Premium positioning is reinforced by human-grade and clean-label offerings, which align with Japan’s strong emphasis on quality and safety. Domestic brands are expanding their footprint in the mid-premium category, while international brands continue to dominate the super-premium tier with specialized functional products.

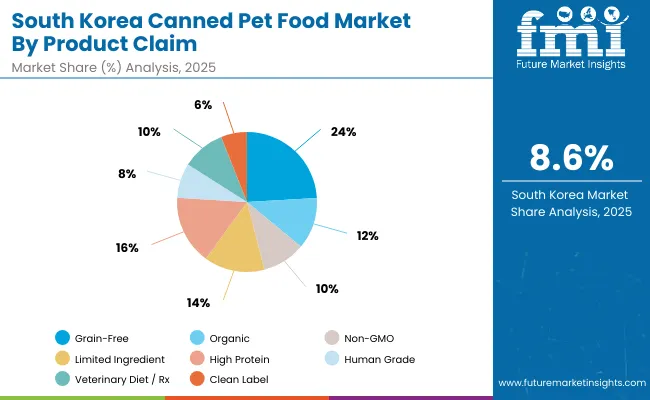

| Product Claim Segment | Value Share, 2025 |

|---|---|

| Grain-Free | 24.1% |

| Others | 75.9% |

The Canned Pet Food Market in South Korea is valued at USD 649.3 million in 2025, with grain-free products leading at 24.1%. The dominance of grain-free diets reflects South Korean consumers’ focus on naturalness, digestibility, and premium positioning. Functional claims such as high-protein, limited-ingredient, and organic are also growing, but grain-free remains the strongest differentiator in marketing and consumer preference. Younger urban consumers are driving demand for cat food, with a preference for premium canned diets over dry formats. The market is also benefiting from rapid adoption of online subscription channels and rising disposable incomes in metropolitan areas such as Seoul and Busan.

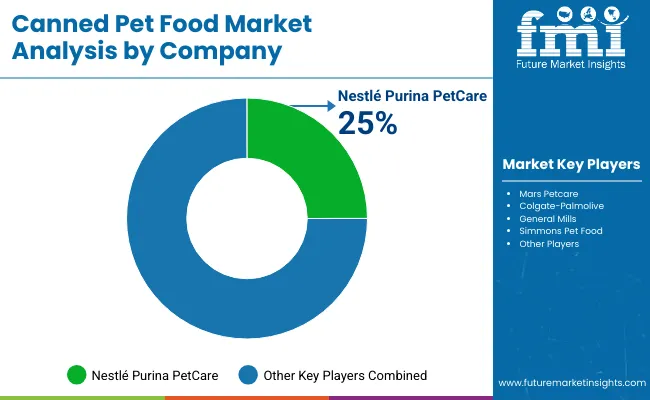

The Canned Pet Food Market is moderately consolidated, with multinational leaders, strong regional players, and private-label manufacturers competing across diverse product categories. Global leaders such as Nestlé Purina PetCare, Mars Petcare, and Colgate-Palmolive collectively command a significant portion of the market, leveraging their extensive brand portfolios, research-backed formulations, and distribution dominance across both developed and emerging markets. Nestlé Purina PetCare, leading with an estimated 25.0% share in 2025, anchors its position through flagship brands such as Purina, Fancy Feast, and Pro Plan, which cover mass, premium, and super-premium tiers. The company continues to drive growth with innovation in functional canned diets, veterinary prescription ranges, and sustainability-focused packaging.

Established multinationals including Mars Petcare (with Pedigree, Whiskas, Sheba, and Royal Canin) and Colgate-Palmolive (Hill’s Science Diet and Hill’s Prescription Diet) emphasize scientific nutrition and therapeutic wet diets, reinforcing their credibility among veterinary professionals and health-conscious owners. These companies are investing heavily in specialized formulations targeting digestive health, renal care, and weight management, allowing them to capture incremental growth in the premium and Rx diet segments.

General Mills, through Blue Buffalo, has successfully expanded its natural and grain-free canned offerings, building strong brand equity in North America’s premium pet care segment. Simmons Pet Food, as a co-manufacturer and private-label leader, underpins growth by supplying cost-effective canned products to major retailers, supporting affordability in mid-market and economy tiers.

Competitive differentiation in the Canned Pet Food Market is shifting away from volume-driven strategies to ecosystem-driven value propositions. Multinationals are increasingly investing in omnichannel distribution strategies, particularly e-commerce and direct-to-consumer subscriptions, to enhance consumer engagement. Innovation pipelines are also focused on transparency-driven product claims, including organic, human-grade, and insect-based formulations, which align with evolving consumer expectations. Regional challengers and private labels continue to expand aggressively, capitalizing on affordability and localized protein sourcing, while global leaders double down on R&D, sustainability initiatives, and advanced packaging to retain market dominance in a rapidly evolving competitive environment.

Key Developments in Canned Pet Food Market

| Item | Value |

|---|---|

| Quantitative Units | USD 30,567.8 million |

| Pet Type | Dog, Cat, Others (Small mammals, reptiles) |

| Ingredient Type | Meat-based (Beef, Chicken, Lamb, Turkey, Fish), Plant-based (Vegetables, Grains, Pulses), Insect-based, Exotic Proteins (Duck, Venison, Kangaroo) |

| Product Claim | Grain-Free, Organic, Non-GMO, Limited Ingredient, High Protein, Human Grade, Veterinary Diet / Rx, Clean Label |

| Life Stage | Puppy / Kitten, Adult, Senior, All Life Stages |

| Form / Texture | Pâté, Stew / Chunk in Gravy, Loaf, Morsels / Cuts, Shredded / Flaked |

| Packaging Format | Aluminum Cans, Tin Cans, Pouches, Tubs & Trays |

| Price Tier | Economy, Mid-range, Premium, Super Premium |

| Sales Channel | Supermarkets / Hypermarkets, Pet Specialty Stores, Online Retailers, Veterinary Clinics, Convenience Stores, Direct-to-Consumer (D2C), Club Stores |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Nestlé Purina PetCare, Mars Petcare, Colgate-Palmolive, General Mills, Simmons Pet Food |

| Additional Attributes | Dollar sales by pet type, ingredient type, and product claim; adoption trends across premiumization, veterinary diets, and human-grade categories; rising demand for grain-free and clean-label canned diets; sector-specific growth in cats, especially in urban households; contribution of functional, therapeutic, and sustainability-led formulations; channel-wise revenue split for supermarkets, specialty retail, and online subscriptions; packaging innovation in recyclable cans and lightweight pouches; regional growth trends led by the USA, China, and India; competitive benchmarking among global leaders and private labels. |

The Canned Pet Food Market is estimated to be valued at USD 30,567.8 million in 2025.

The market size for the Canned Pet Food Market is projected to reach USD 54,526.8 million by 2035.

The Canned Pet Food Market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in the Canned Pet Food Market are dog, cat, others; meat-based, plant-based, insect-based, exotic proteins; grain-free, organic, non-GMO, limited ingredient, high protein, human grade, veterinary diet / Rx, clean label; life stage, form/texture, packaging, and price tier.

In terms of pet type, the dog segment is forecasted to command 55.1% share in the Canned Pet Food Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Canned Tuna Business Landscape.

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

Canned Mackerel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Anchovy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Canned Tuna Ingredients Market Analysis by Ingredients Type and End User Through 2035

Canned Meat Market Insights - Industry Growth & Demand 2025 to 2035

Canned Pasta Market Trends - Convenience & Consumer Preferences 2025 to 2035

Canned Legumes Market Insights – Protein-Packed Convenience Foods 2025 to 2035

Leading Providers & Market Share in Canned Tuna Industry

Canned Mushroom Market Analysis by Nature, Product Type, Form, and End-Use Application Through 2035

Canned Salmon Market Analysis by Source, Species, Form, and Sales Channel Through 2035

Canned Vegetable Market Growth – Preservation & Industry Demand 2024-2034

Canned Sardine Market Growth – Sustainable Seafood & Industry Demand 2024-2034

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Canned Food Packaging Providers

Analysis and Growth Projections for Canned Foods Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA