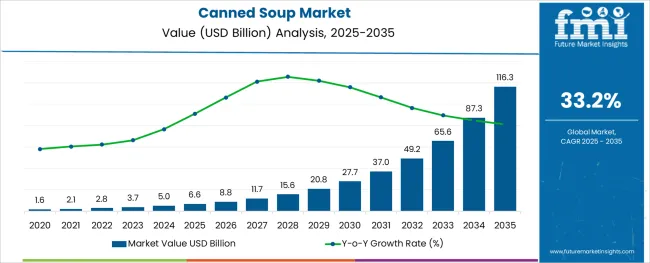

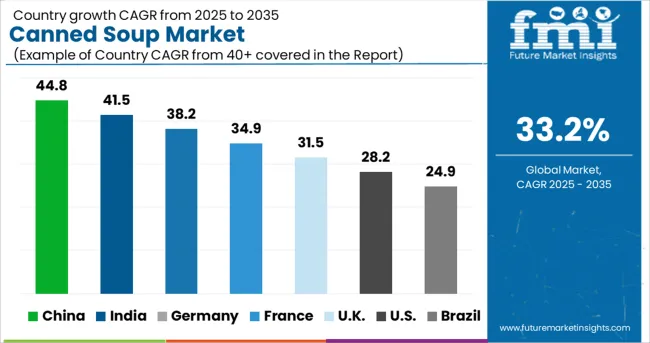

The Canned Soup Market is estimated to be valued at USD 6.6 billion in 2025 and is projected to reach USD 116.3 billion by 2035, registering a compound annual growth rate (CAGR) of 33.2% over the forecast period.

The canned soup market is undergoing a notable transformation driven by changing consumer preferences for convenient, shelf-stable, and nutritionally balanced meal options. Rising urbanization and increasingly fast-paced lifestyles have accelerated demand for ready-to-eat and easy-to-prepare food products, with canned soups securing a resilient position within this category.

The market has maintained steady volume growth, underpinned by innovation in flavors, clean-label formulations, and the extension of organic and low-sodium variants targeting health-conscious demographics. In the forthcoming years, a positive outlook is anticipated as brands invest in sustainable packaging solutions and reformulate recipes to align with evolving dietary trends.

A resurgence of interest in traditional and comfort foods, particularly in North America and parts of Europe, is expected to fuel further consumption. Additionally, improvements in food preservation techniques and distribution networks are poised to enhance product accessibility across emerging economies. The market's ability to deliver value through affordability, extended shelf-life, and broad flavor profiles positions it for consistent growth in both retail and foodservice channels.

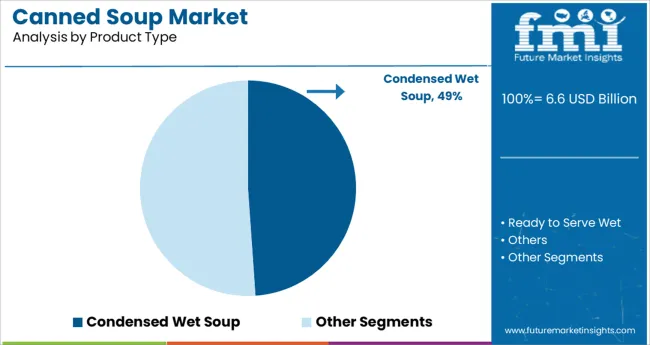

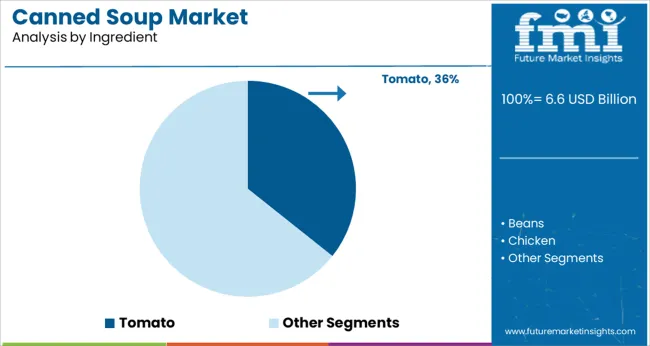

The market is segmented by Product Type, Ingredient, and Processing and region. By Product Type, the market is divided into Condensed Wet Soup, Ready to Serve Wet, and Others. In terms of Ingredient, the market is classified into Tomato, Beans, Chicken, Beef, Artichokes, Mixed Vegetables, and Other Ingredients.

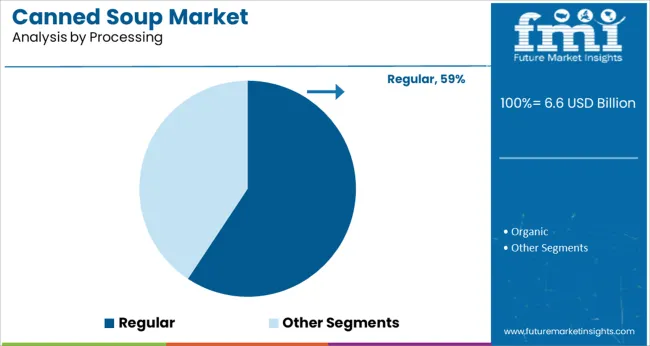

Based on Processing, the market is segmented into Regular and Organic. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The condensed wet soup segment accounted for approximately 48.9% of the total canned soup market share, solidifying its position as the market leader within the product type category. Its dominance has been sustained by strong consumer affinity for versatile, easy-to-store, and value-driven meal options. Condensed soups are often preferred for their concentrated flavor profiles and the ability to serve as both standalone meals and cooking ingredients.

The segment's growth is further supported by ongoing product innovation, including healthier variants with reduced sodium, organic ingredients, and preservative-free options. Retail chains and supermarket shelves continue to allocate considerable space to condensed soup offerings, indicating persistent retail demand. Moreover, as private label brands expand their presence in this category, price-sensitive consumers are increasingly drawn toward competitively priced alternatives.

The adaptability of condensed wet soups for both quick consumption and incorporation into recipes has ensured its broad consumer appeal. Future performance is likely to remain steady as manufacturers introduce contemporary flavors and functional formulations targeting health-focused and younger demographics.

Within the ingredient category, the tomato segment led with a 35.7% market share, reflecting its enduring popularity as a staple flavor in the canned soup market. The consistent demand for tomato-based soups is attributed to their widespread culinary acceptance, affordability, and perceived nutritional value, particularly their richness in antioxidants like lycopene.

This segment has benefitted from the resurgence of traditional comfort foods and the incorporation of tomatoes in diverse ethnic-inspired and fusion recipes. Manufacturers have strategically capitalized on this trend by introducing tomato variants infused with herbs, spices, and functional ingredients aimed at enhancing health benefits.

Additionally, the versatility of tomato soups as standalone meals or bases for other dishes has sustained high household penetration rates. Consumer preference for familiar and nostalgic flavors continues to support this segment’s resilience. Moving forward, enhanced formulations with organic tomatoes and reduced additives are expected to reinforce its dominant position in the market.

In terms of processing methods, the regular canned soup segment commanded a significant 59.3% market share, retaining its leadership in this category. Its enduring appeal lies in the traditional preparation and full-bodied flavor it offers, catering to consumers seeking a hearty, ready-to-eat meal solution.

The segment has remained a staple in retail and institutional channels, driven by its affordability, extended shelf life, and widespread availability across varied distribution platforms. While the market has witnessed gradual growth in health-focused and specialized soup formulations, regular processed soups continue to attract a core customer base resistant to significant dietary shifts.

Brand loyalty within this segment remains relatively high, particularly among older demographics and consumers in regions where canned soups constitute a household staple. The anticipated introduction of new flavor variants and value packs, coupled with efficient promotional campaigns by leading brands, is projected to sustain this segment’s growth trajectory over the medium term.

According to Future Market Insights, increased consumption of processed foods is surging across the globe, improving the demand for canned soup. Factors such as an increase in the working population, a fast-paced lifestyle, and per capita spending on processed food goods, all contribute to this shift in consumption patterns.

The canned soup industry is growing due to the high demand for ready-to-eat food products, shift in dietary choices, and increasing health concerns. Canned soups are convenient and ready-to-eat food product that is widely available.

It is simple to process and takes less time to prepare. Furthermore, demand for canned soup products is expected to boost by rising preferences for processed foods due to their health benefits.

Individuals' hectic lifestyles are driving the demand for healthier food products that are simple to prepare and store while providing great nutritional value to consumers. Further, the expansion of the convenience food products industry is owing to the increased spending on processed food products, especially by millennials.

According to the study, over 30% of consumers’ monthly income is spent on ready-to-eat or on-the-go snack goods. Furthermore, sales through online distribution channels have boosted the demand in the convenience food sector, particularly canned soups.

The UK Canned Soup Market to Gain Traction Amid High Presence of Leading Soup Companies

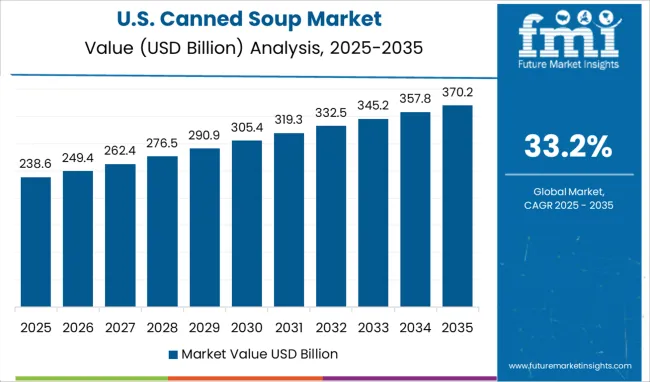

Sales of canned soup in Europe are expected to reach USD 868 Million, accounting for 31% of the global market, followed by the USA accounting for 22% of the demand share in the market.

The UK has a more working population as compared to other countries in Europe, which is driving up demand for convenience foods. Furthermore, the canned soup industry is being driven by the high presence of key companies that offers high-nutrition components in canned soups. Also, frequent product launches by various companies will propel growth in the market.

Prevalence of Obesity in the USA to Boost Canned Soup Sales

The rising prevalence of obesity in the USA, and increasing health awareness campaigns have surged the demand for boxed soups with natural, fresh ingredients and minimal preservatives. The canned soup market in the USA will gain traction due to packaged soup consumption.

This is allowing producers to expand their product variety with more flavour and taste options, as well as health claims. The USA canned soup industry is well-established and the flourishing manufacturing industry has made it a prospective market for overseas soup makers.

Hence, key players are eyeing the USA market to expand their companies using various packaging techniques, including canned soup. Increased product variety and active marketing by market players will further boost the market.

Condensed Soup Demand to Increase at a Significant Rate

The canned soup market is segmented into condensed and ready-to-eat. As per FMI, the condensed category led the market in 2024 and is expected to retain its dominance through 2025 & beyond. Condensed canned soups are made with a wide range of flavours and foods that are strong in nutritional content.

Consumption of condensed soup has several health benefits since it is a concentrated supply of protein and calcium, which are essential for body development. As a result, the market for condensed soup is expected to increase significantly.

Organic Canned Soup to Remain Highly Sought-After

Growing awareness of unhealthy lifestyles will increase the demand in the organic soups industry. Several food products, including fowl and chicken, are injected with hormones and other artificial ingredients to encourage growth.

Fruits, which are readily available, are not immune to this trend. Fruits are also prone to coloring, flavoring, and unnatural growth. This is projected to increase the demand for organic food products, fueling the demand in the market.

Key Players to Collaborate with Online Channels to Increase their Revenue

The hypermarkets/supermarkets category dominated the market, while the online segment is expected to expand at the fastest rate. To attract customers canned soups are displayed in an appealing assortment on the shelves of hypermarkets and supermarkets.

These stores bring together products from several brands in one location at lower costs than traditional distribution channels. Additionally, products from various brands are displayed nearby to assist buyers in selecting appropriate products in less time.

The global canned soup market is expected to become more concentrated with an increasing number of global and regional players. Campbell Soup Company accounted for the highest proportion of the global canned soup market due to its diverse product range, which includes condensed soups, microwaveable soups, ready-to-eat soups, organic soups, and others.

Some of the recent development in the canned soup market is as follows:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | billion for Value and Million. Sq. M. for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; and the Middle East & Africa |

| Key Countries Covered | USA, China, Germany, UK, China, India, Japan, Australia, and GCC Countries |

| Key Segments Covered | Type, Category, Processing, Distribution Channel, and Region |

| Key Companies Profiled | Campbell Soup Company; Amy’s Kitchen Inc; General Mills Inc.; The Kraft Heinz Company; Baxters Food Group; Unilever; Struik Foods Europe NV; Vanee Foods Company; BCI Foods Inc.; Hain Celestial |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global canned soup market is estimated to be valued at USD 6.6 billion in 2025.

It is projected to reach USD 116.3 billion by 2035.

The market is expected to grow at a 33.2% CAGR between 2025 and 2035.

The key product types are condensed wet soup, ready to serve wet and others.

tomato segment is expected to dominate with a 35.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Canned Tuna Business Landscape.

Canned Mackerel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Anchovy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Seafood Market Size, Growth, and Forecast for 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Canned Tuna Ingredients Market Analysis by Ingredients Type and End User Through 2035

Canned Meat Market Insights - Industry Growth & Demand 2025 to 2035

Leading Providers & Market Share in Canned Tuna Industry

Canned Legumes Market Insights – Protein-Packed Convenience Foods 2025 to 2035

Canned Pasta Market Trends - Convenience & Consumer Preferences 2025 to 2035

Canned Salmon Market Analysis by Source, Species, Form, and Sales Channel Through 2035

Canned Mushroom Market Analysis by Nature, Product Type, Form, and End-Use Application Through 2035

Market Share Insights of Canned Food Packaging Providers

Analysis and Growth Projections for Canned Foods Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA