The UK Canned Tuna market is expected to reach USD 512.2 million in 2025 and is projected to reach a total value of USD 909.8 million by 2035. This represents a compound annual growth rate (CAGR) of 5.9% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 512.2 million |

| Industry Value (2035F) | USD 909.8 million |

| CAGR (2025 to 2035) | 5.9% |

The UK canned tuna market is steadfastly climbing, primarily fostered by the growing tendency of consumers to opt for ready-made, protein-packed, and shelf-stable food choices. Canned tuna is a regular item in UK households, thanks to its economical price, multi-functionality, and long-term storage period.

Apart from that, it is the number one ingredient in salads, sandwiches, pasta dishes, and ready-to-eat meals for many people, who look for quick and nutritious meal solutions. Canned tuna is also easy to store and prepare which adds to its essential nature as a pantry staple for busy consumers and meal planners.

The market is certainly making the most out of the healthy eating trend being so popular and the increase in how many consumers focus on protein in their diet. Tuna is the key source for lean protein and omega-3 fatty acids, which are according to the consumer’s choice for eating healthy and functional foods.

This has caused more people to include canned tuna in their diets, in a meal program with more protein, ketogenic diet, and in the fitness programs. The naturally preserved, low sodium, and additive-free tuna options are also requested more which is due to the fact that numerous people now take a special interest in Clean Label Foods.

The increase in the popularity of sustainable and responsibly sourced seafood has resulted in the growing demand for MSC-certified and pole-and-line caught tuna products. A number of UK consumers are increasingly opting for ethical consumption, which prompts manufacturers to broaden their product lines with more sustainable alternatives and to optimize traceability within their supply chains.

Brands that proactively convey the message of sustainable practices and being transparent in sourcing have come out on top in the market. Furthermore, product packaging innovations like easy-open cans, resealable lids, and single-serve pouches provide consumer convenience and thus carry the sales in supermarkets and online retail channels.

The private-label brands that are in competition with the major tuna brands are laying down the law concerning pricing and sustainability which are the primary factors that decide the consumer’s vote in the UK market for canned tuna. In addition, the growing e-commerce platforms and doorstep delivery choices continue to drive the sales and the accessibility of canned tuna products.

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Canned Tuna market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | John West launched a new range of low-sodium canned tuna, catering to health-conscious consumers looking for reduced-salt options. |

| April 2024 | Tesco introduced an exclusive private-label sustainable tuna line, certified by the MSC, to meet rising consumer demand for eco-friendly choices. |

| June 2024 | Princes Group partnered with UK fisheries to enhance sustainable tuna sourcing initiatives, reinforcing its commitment to responsible seafood production. |

| August 2024 | A report from UK Seafood Association indicated a 12% increase in demand for pole-and-line caught canned tuna, reflecting consumer preference for ethical sourcing. |

| October 2024 | Sainsbury’s expanded its selection of flavored canned tuna, featuring new spicy, herb-infused, and international-inspired varieties to attract younger consumers. |

Surge in Interest in Environmentally Friendly and Fairly Caught Tuna

The popularity of tuna that is caught in an environmentally-friendly manner has gone up drastically as people are looking for MSC-certified and pole-and-line caught options actively. The brands that prove traceability and localization are stealing the show as the main driver of the purchasing behavior change brought on by shoppers' environmental awareness.

Companies adopt block chain for food transparency, like tuna that consumers can track from ocean to can. Increased shareholder awareness of sustainability in seafood is reflected in the companies' attempts to go green in their fishing methods and packaging.

Increase in the Variety of Flavored and Ready-to-Eat Tuna Products

The development of the flavored canned tuna products, that are selling well, is like a new wave in the market with bears introducing herb-infused, spicy, and Mediterranean-style varieties. These innovations are introduced for the convenience of the customers who are always in a hurry looking for the ready-to-eat options that need almost no preparation.

Tuna salads, snack packs, and options that come pre-seasoned, in particular, Russia's working-class people and the students, prefer. In addition, the fascination with foreign foods has given the manufacturers the idea of launching region-specific flavors such as teriyaki tuna, which is the Asian version, and chili-lime tuna, which is of Latin American origin.

Private-Label Brands Are the Ones That Are Taking Over

Supermarkets are now going for gold and are on the lookout for deals in their shelf space of the canned tuna series, thus yammering the price down resulting in customers getting better decisions to save their finances. Stores such as Tesco, Sainsbury's, and ASDA are moving to expand their stocks by adding impressive sections, which include discounted, environmentally friendly options.

Private-label brands are now also bringing in gourmet and the officially certified organic tuna as part of the show and catching the eyes of those who are premium shoppers. Thanks to the improved designs used for packaging and advertising, private-label brands are cracking even more into the UK tinned tuna market.

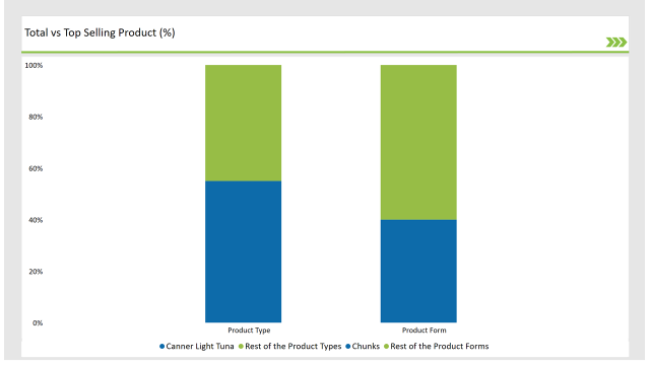

% share of Individual categories by Product Type and Form in 2025

Canned light tuna is the predominant type of canned tuna in the UK, taking up 50% of the shelf space. It is loved for its gentle taste, cheap price, and the number of dishes one can make with this product which is enough to make it a household product. Back then, the high number of canner light tuna found in supermarkets, private-label ranges, and bulk-buy promotions brought this brand on the top.

Besides, canner light tuna is very popular in food service brands because of its low costs and adaptability to various cuisines including Mexican and Italian. Because of its long shelf life, it is a fantastic product to keep a stock for the emergencies and for the preppers who are stockpiling products in the UK.

Chunks show up with a 40% market slice as they possess the proverbial qualities being the most convenient choice for salads, pasta, and sandwiches. This method of tuna has a fan base among people who want to add the texture and enjoy ease of preparation during their everyday cooking. Retailers and brands are still marketing canned tuna with chunk forms throughout the collaboration of recipes and campaigns on meal inspiration.

Furthermore, the increase of chunk-style tuna's presence in meal kits as well as in pre-portioned meal plans contributes to this improvement. Besides, numerous private-label and premium brands have also started to prepare chunk tuna with different flavors such as olive oil, lemon zest, and smoked ones for improved food experiences.

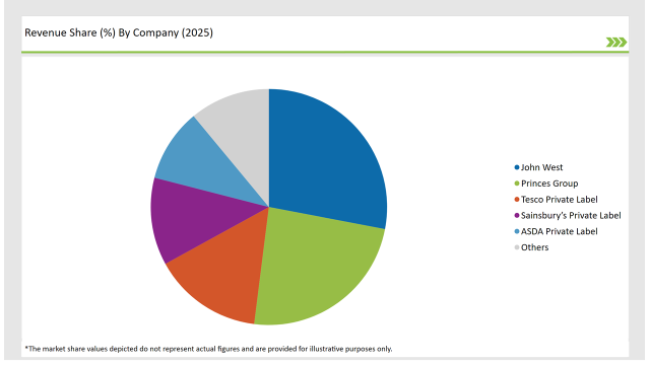

2025 Market share of UK Canned Tuna suppliers

Note: above chart is indicative in nature

The canned tuna market in the UK is marginally focused; there are established brands as well as players are resisting against the competition of private-label supermarket brands. Prominent producers such as John West, Princes Group, Tesco Private Label, and Sainsbury's Private Label among many others dominate the market via product innovation and sustainability commitments.

In order to be in the race, manufacturers tend to launch products of new flavors, work on sustainable fishing arrangements, and give out packaging that is easy to use. The rising e-commerce and direct-to-consumer delivery of specialist seafood also means a change in distribution strategies.

The manufacturers have made bold strides in the flavor innovations area, the establishment of sustainable fishing practices, and the implementation of practical packaging formats to remain competitive in the market. The increase in e-commerce and direct-to-consumer fish supply chains is as much a political as a practical as a change in strategy.

The UK canned tuna market is set for its continuous growth, which will be backed by product differentiation and the implementation of ethical sourcing initiatives, as consumers continue to strive for sustainability, convenience, and high-protein diets.

Canned White Tuna, Canned Light Tuna, Canned Specialty Tuna

Chunk, Solid, Flakes, Others

Unflavored, Flavored

B2B/HoReCa, B2C, Hypermarkets/Supermarkets, Convenience Stores, Online Retail, Others.

Within the Forecast Period, the UK Canned Tuna market is expected to grow at a CAGR of 5.9%.

By 2035, the sales value of the UK Canned Tuna industry is expected to reach USD 909.8 million.

Key factors propelling the UK Canned Tuna market include the rising increasing consumer demand for convenient, protein-rich, and shelf-stable food options.

Prominent players in the UK Canned Tuna manufacturing include John West, Princes Group, Tesco Private Label, and Sainsbury’s. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Ready-to-eat Canned Tuna in UK Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Canned Tuna Business Landscape.

Canned Tuna Ingredients Market Analysis by Ingredients Type and End User Through 2035

Leading Providers & Market Share in Canned Tuna Industry

USA Canned Tuna Market Insights – Demand, Size & Industry Trends 2025-2035

ASEAN Canned Tuna Market Analysis – Size, Share & Forecast 2025–2035

Europe Canned Tuna Market Growth – Trends, Demand & Innovations 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Ready-to-eat Canned Tuna Market Size and Share Forecast Outlook 2025 to 2035

Latin America Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

Canned Mackerel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA