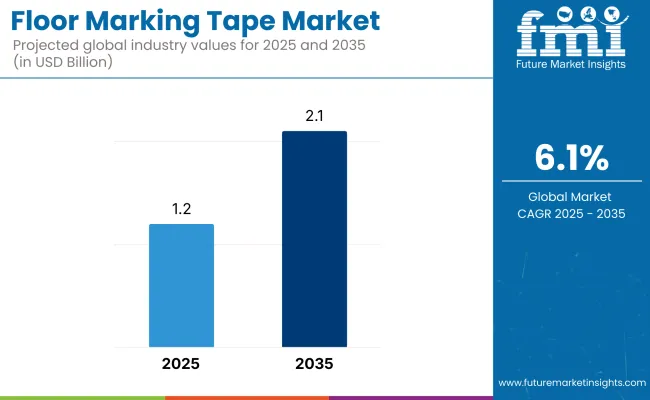

The floor marking tape market is projected to expand from USD 1.2 billion in 2025 to USD 2.1 billion by 2035, reflecting a total increase of USD 0.9 billion over the ten-year period. This represents a 75.0% overall growth, supported by a compound annual growth rate (CAGR) of 6.1%. Over the forecast timeline, the market grows by a 1.7 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.2 billion |

| Industry Value (2035F) | USD 2.1 billion |

| CAGR (2025 to 2035) | 6.1% |

In the first half of the decade (2025–2030), the market rises from USD 1.2 billion to USD 1.6 billion, contributing USD 0.4 billion, or 44.4% of the decade’s total growth. Demand in this phase is fueled by occupational safety regulations and lean manufacturing practices, with applications expanding in warehouses, manufacturing plants, and logistics hubs. PVC-based tapes with high-visibility pigments dominate due to their durability, slip resistance, and compliance with OSHA and ANSI color codes.

In the second half (2030–2035), the market advances from USD 1.6 billion to USD 2.1 billion, contributing USD 0.5 billion, or 55.6% of the total growth. Adoption accelerates with the rise of automation in industrial facilities and the integration of smart, sensor-embedded tapes that can track traffic patterns and wear over time. Eco-friendly adhesive formulations and recyclable substrates gain traction as sustainability policies tighten across global manufacturing and warehousing sectors.

From 2020 to 2024, the floor marking tape market grew from USD 0.9 billion to USD 1.1 billion, driven by hardware-centric adoption in industrial facilities, warehouses, and commercial spaces to improve safety, organization, and compliance with workplace regulations. During this period, the competitive landscape was dominated by adhesive tape manufacturers controlling nearly 70% of total revenue, with leaders such as 3M Company, Brady Corporation, and Shurtape Technologies, LLC focusing on high-durability PVC and vinyl tapes designed for heavy-traffic areas. Competitive differentiation relied on adhesion strength, abrasion resistance, and compliance with OSHA or ISO safety color codes, while software-enabled safety management systems were often bundled with broader facility solutions rather than acting as standalone revenue drivers. Service-based models, including installation and on-site audits, contributed less than 10% of total market value as most users opted for in-house application.

Demand for floor marking tape will expand to USD 2.1 billion in 2035, and the revenue mix will shift as digital integration, smart floor labeling, and customized safety solutions grow to over 40% share. Traditional adhesive manufacturers face increasing competition from innovation-focused players offering IoT-enabled floor sensors, RFID-embedded labels, and AR-compatible safety guides.

Increasing emphasis on workplace safety, lean manufacturing practices, and regulatory compliance is driving the growth of the floor marking tape market. These tapes are widely used in industrial, commercial, and institutional environments to designate pathways, mark hazardous zones, and improve visual communication on production floors. The global shift toward safer and more organized work environments, reinforced by occupational health and safety regulations, is accelerating adoption.

PVC, vinyl, and polyester-based floor marking tapes have gained popularity due to their durability, adhesive strength, and resistance to abrasion, chemicals, and moisture. Advances in high-visibility color printing, reflective finishes, and anti-slip coatings have improved functionality, making these tapes suitable for both indoor and outdoor use. Easy application and removal without damaging surfaces also contribute to their operational efficiency.

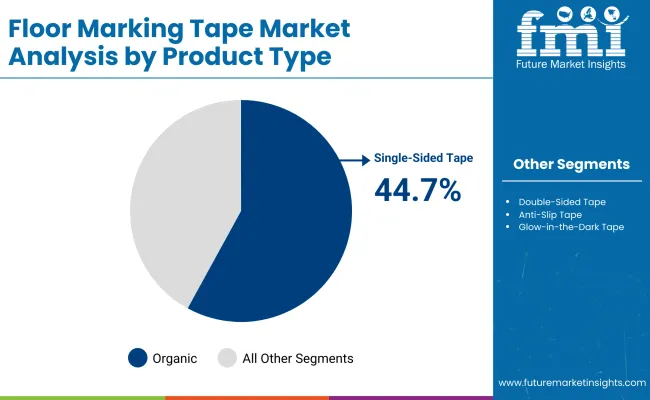

The market is segmented by product type, material type, adhesive type, application, end-use industry, and region. Product type includes single-sided tape, double-sided tape, anti-slip tape, glow-in-the-dark tape, and reflective tape, each serving distinct visibility, safety, and functional requirements across industrial and public environments. Material type segmentation comprises polyvinyl chloride (PVC), vinyl, polypropylene (PP), polyester (PET), and polylactic acid, offering a balance between durability, flexibility, and environmental performance.

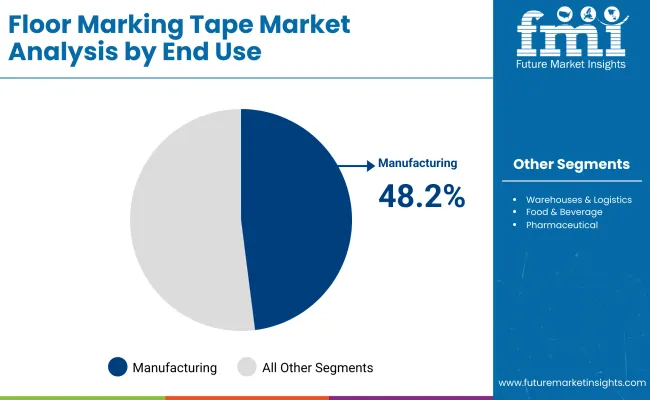

Adhesive type includes rubber-based adhesive, acrylic-based adhesive, silicone-based adhesive, and pressure-sensitive adhesive, enabling varied bonding strengths and surface compatibility. Application areas include aisle marking, hazardous zone marking, floor identification, workflow & lean 5S guidance, sports courts/event floors, and social distancing marking, reflecting both operational efficiency and safety compliance functions. End-use industries include manufacturing facilities, warehouses & logistics, food & beverage, pharmaceuticals, and healthcare, where visual communication and hazard prevention are critical. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The single-sided tape segment is expected to account for the highest share of 44.7% in 2025. Adoption is fueled by its fast, low-skill installation, minimal downtime, and straightforward replacement versus paints or epoxies. Facilities favor single-sided formats for routine maintenance, quick layout changes, and seasonal reconfiguration especially in high-throughput plants and distribution centers where every minute of line time matters.

Beyond speed, single-sided floor tapes deliver reliable adhesion, clear color coding, and clean removability that protects floors. They support lean/5S initiatives with crisp edges and high-visibility pigments, and they’re compatible with textured, sealed, or polished concrete. As EHS teams standardize visual management, single-sided solutions remain the default for scalable, compliant floor demarcation.

The manufacturing facilities end-use segment is projected to lead with a 48.2% share in 2025. Plants rely on floor marking to delineate workcells, pedestrian aisles, forklift lanes, WIP staging, and emergency egress routes core controls under audit by safety and quality teams. Frequent line changeovers and SKU proliferation increase the need for tapes that can be applied, repositioned, and removed without surface damage.

With continuous improvement programs and visual factory standards, manufacturers prioritize durable, color-stable tapes that resist abrasion, chemicals, and cart traffic. High-contrast patterns (chevrons, hatchings) and pre-printed messages further streamline training and compliance. As factories digitize, floor markings also serve as physical anchors for connected workflows (e.g., AGV paths, kanban zones), reinforcing their central role on the shop floor.

Polyvinyl chloride (PVC) is expected to lead the material type category with a 46.2% share in 2025. PVC tapes balance tensile strength with flexibility, enabling tight turns around corners, posts, and drains while maintaining edge integrity. Their dense, pigmented films deliver long-lasting color and gloss retention under harsh lighting and frequent washdowns.

PVC also offers scuff resistance and shock absorption that protect graphics from pallet jacks and forklifts. Coupled with strong adhesives, PVC constructions provide a high-service-life option for warehouses and plants seeking fewer replacements and predictable TCO. Availability in a wide palette and custom prints makes PVC the go-to for standardized visual management systems.

Rubber-based adhesive systems are projected to lead the adhesive type category at 37.3% in 2025. They deliver immediate, aggressive tack that bonds quickly even on challenging substrates or slightly dusty surfaces minimizing prep time and enabling rapid reopen of traffic lanes.

These formulations perform well on colder floors where acrylics can struggle to wet out, making them ideal for ambient swings and dock areas. While acrylics offer longer-term UV/chemical resistance in some settings, rubber-based systems remain the preferred choice where fast grip, quick installs, and reliable adhesion under rolling loads are the priority.

The aisle marking application is anticipated to hold a 28.1% share in 2025, reflecting its foundational role in warehouse and production layouts. Clear aisles reduce congestion, improve picker efficiency, and separate industrial vehicles from pedestrians key to reducing recordable incidents.

Programs aligned with 5S and visual workplace standards rely on consistent aisle colors, widths, and symbols for instant comprehension. As e‑commerce and just‑in‑time operations intensify material flow, durable aisle tapesoften paired with corner, T-, and L‑markersenable fast reconfiguration and continuous compliance without paint fumes or curing time.

Adhesion challenges on uneven surfaces and durability concerns in high-traffic areas limit broader application, even as demand grows across manufacturing, warehousing, healthcare, and public infrastructure for cost-effective, high-visibility floor marking solutions that enhance safety, navigation, and compliance.

Safety Compliance and Lean Manufacturing Practices Driving Adoption

Floor marking tape usage is expanding rapidly in industrial and commercial settings due to its role in workplace organization, hazard identification, and compliance with safety regulations. In manufacturing plants, tapes are integral to 5S and Lean practices demarcating work zones, walkways, and storage areas to streamline operations and reduce accidents. Warehouses use color-coded markings to guide forklift traffic and indicate hazard zones, while healthcare facilities employ them for patient flow management.

Surface Adhesion and Wear Resistance Limitations

Despite their utility, floor marking tapes face performance limitations in certain environments. On porous, dusty, or oily surfaces, adhesion can weaken, leading to premature peeling or lifting. In heavy-traffic zones especially where forklifts or pallet jacks operate abrasion can reduce tape visibility and lifespan, requiring frequent replacement. Exposure to moisture, chemicals, or extreme temperatures can further degrade adhesive performance and material integrity.

Advancements in High-performance Materials and Customization Options

A leading trend in the market is the development of high-durability PVC, vinyl, and polyester tapes with reinforced adhesives designed for extreme industrial conditions. Manufacturers are offering products with enhanced slip resistance, UV stability, and chemical resistance to meet the demands of both indoor and outdoor applications. Custom printing capabilities now allow companies to integrate logos, QR codes, or bilingual safety messages directly onto the tape surface, expanding functionality beyond visual guidance.

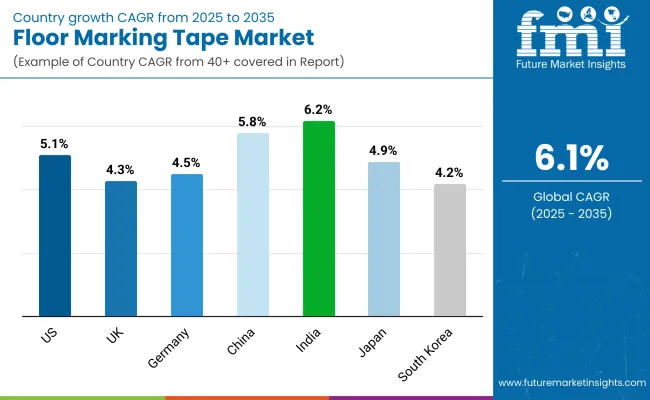

The floor marking tape market is expanding steadily as industrial safety compliance, warehouse organization, and lean manufacturing principles gain traction. Demand is supported by manufacturing modernization, regulatory workplace safety mandates, and the rise of e-commerce logistics. Emerging economies such as India and China are driving rapid adoption in manufacturing and warehousing, while developed countries are focusing on high-durability, chemical-resistant, and OSHA/ISO-compliant tape solutions.

The USA market is expected to grow at a CAGR of 5.1%, driven by OSHA-compliant floor marking in manufacturing facilities, logistics hubs, and retail warehouses. Custom color-coded tapes for safety zones, equipment marking, and lean workflows are widely adopted.

Germany’s market is forecast to expand at a CAGR of 4.5%, supported by strict workplace safety regulations and lean manufacturing standards in automotive and engineering sectors. Demand for eco-friendly adhesive technologies is also rising.

The UK market is projected to grow at a CAGR of 4.3%, fueled by adoption in healthcare facilities, logistics hubs, and food processing units. High-visibility tapes with anti-bacterial coatings are emerging as a niche growth area.

China’s market is set to grow at a CAGR of 5.8%, driven by large-scale manufacturing, smart warehouse development, and industrial safety upgrades. Local production ensures affordability and fast customization.

India’s market is expected to grow at the highest CAGR of 6.2%, driven by MSME factory safety modernization and government workplace compliance drives. Affordable adhesive tapes are being adopted in both organized and unorganized sectors.

Japan’s market is projected to expand at a CAGR of 4.9%, supported by precision manufacturing, robotics integration, and high workplace safety culture. Long-lasting, thin-profile tapes are in demand for cleanroom and electronics assembly areas.

South Korea’s market is set to grow at a CAGR of 4.2%, with demand fueled by semiconductor fabs, automotive plants, and logistics automation. Tapes with advanced adhesive technology that can withstand chemical exposure are preferred.

The floor marking tape market is moderately fragmented, with global adhesive product leaders, safety identification specialists, and industrial marking solution providers competing across manufacturing, logistics, retail, and public infrastructure sectors. Global leaders such as 3M Company, Brady Corporation, and Avery Dennison Corporation hold significant market share, driven by high-durability adhesive technologies, compliance with OSHA and ANSI safety standards, and integration with visual workplace management systems. Their strategies increasingly emphasize heavy-duty PVC and polyester backing, high-visibility color coding, and solvent-free adhesive innovations for sustainability.

Established mid-sized players including Intertape Polymer Group Inc., Shurtape Technologies, LLC, and Tesa SE are advancing adoption through abrasion-resistant tapes, removable and repositionable adhesive formats, and customizable print options for branding or hazard communication. These companies serve both industrial and commercial environments, offering products optimized for quick installation, minimal downtime, and compatibility with diverse floor surfaces.

Key Development of Floor Marking Tape Market

| Item | Value |

| Quantitative Units | USD 1.2 Billion |

| By Product Type | Single-Sided Tape, Double-Sided Tape, Anti-Slip Tape, Glow-in-the-Dark Tape, and Reflective Tape |

| By Material Type | Polyvinyl Chloride (PVC), Vinyl, Polypropylene (PP), Polyester (PET), and Polylactic Acid |

| By Adhesive Type | Rubber-Based Adhesive, Acrylic-Based Adhesive, Silicone-Based Adhesive, and Pressure-Sensitive Adhesive |

| By Application | Aisle Marking, Hazardous Zone Marking, Floor Identification, Workflow & Lean 5S Guidance, Sports Courts / Event Floors, and Social Distancing Marking |

| By End-Use Industry | Manufacturing Facilities, Warehouses & Logistics, Food & Beverage, Pharmaceuticals, and Healthcare |

| Key Companies Profiled | 3M Company, Brady Corporation, Shurtape Technologies, LLC, Intertape Polymer Group Inc., Avery Dennison Corporation, and Tesa SE |

| Additional Attributes | Rising demand for high-durability tapes in industrial safety compliance, increasing adoption in workflow optimization and lean manufacturing setups, growth in anti-slip and reflective tapes for hazardous zones, strong demand from logistics and warehouse automation, expansion in sports and event marking applications, innovation in eco-friendly adhesive formulations, regulatory focus on workplace safety standards, surge in customized print tapes for brand visibility, increasing replacement demand in high-traffic facilities, and strong market presence in North America, Europe, and Asia-Pacific |

The global floor marking tape market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the floor marking tape market is projected to reach USD 2.1 billion by 2035.

The floor marking tape market is expected to grow at a CAGR of 6.1% between 2025 and 2035.

The key product types in the floor marking tape market include single-sided tape, double-sided tape, reflective tape, and anti-slip marking tape.

In terms of product type, the single-sided tape segment is expected to account for the highest share of 44.7% in the floor marking tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Floor Screed Market Size and Share Forecast Outlook 2025 to 2035

Floor Standing Filtered Bottle Filling Stations Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Floor Transition Strips Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Floor Scales Market Size and Share Forecast Outlook 2025 to 2035

Floor Lamp Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaning and Mopping Machine Market Size and Share Forecast Outlook 2025 to 2035

Flooring Market Size and Share Forecast Outlook 2025 to 2035

Floor Displays Market Growth from 2025 to 2035

Flooring and Carpets Market - Trends, Growth & Forecast 2025 to 2035

Floor Grinding Machine Market

Bus Flooring Market Growth – Trends & Forecast 2025 to 2035

Eco Flooring Market Analysis - Growth, Demand & Forecast 2025 to 2035

Gas Floor Fryers Market

Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Underfloor Air Distribution Systems Market

Vinyl Flooring Market Growth - Trends & Forecast 2025 to 2035

Pelvic Floor Diagnostics Market - Demand & Forecast 2025 to 2035

Pelvic Floor Stimulators Market – Trends & Forecast 2025 to 2035

Pelvic Floor Diagnostic Testing Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA