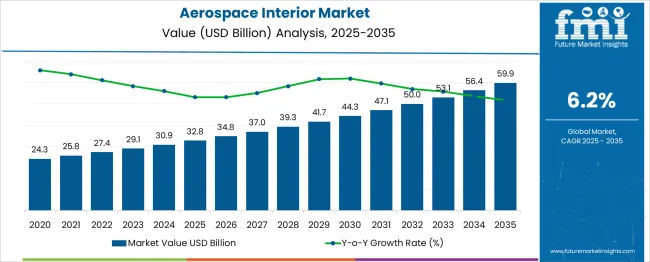

The aerospace interior market is expected to grow from USD 32.8 billion in 2025 to USD 59.9 billion by 2035, with a CAGR of 6.2%. A market share erosion or gain analysis indicates a steady, incremental increase in market value driven by several factors, with an overall gain in market share. Between 2025 and 2030, the market grows from USD 32.8 billion to USD 44.3 billion, contributing USD 11.5 billion in growth, with a CAGR of 6.4%. This early growth is driven by the continuous evolution of passenger comfort, safety standards, and growing demand for advanced, sustainable materials in cabin interiors, including seating, lighting, and storage solutions.

The market share remains strong during this period, with aerospace companies increasingly investing in innovative solutions that align with consumer preferences for luxury, comfort, and efficiency. From 2030 to 2035, the market continues its upward trajectory, expanding from USD 44.3 billion to USD 59.9 billion, contributing USD 15.6 billion in growth, with a CAGR of 6.1%. This phase shows a slight deceleration in growth, indicating market maturation.The overall market share continues to expand as new technologies, such as advanced lighting systems, better materials for noise reduction, and more efficient seating arrangements, become more widespread across commercial and private aviation sectors.

| Metric | Value |

|---|---|

| Aerospace Interior Market Estimated Value in (2025 E) | USD 32.8 billion |

| Aerospace Interior Market Forecast Value in (2035 F) | USD 59.9 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The aerospace interior market is witnessing notable expansion, primarily driven by the modernization of aircraft fleets, increasing air passenger traffic, and demand for elevated inflight experiences. Airlines are increasingly investing in interior upgrades to differentiate service offerings and improve passenger satisfaction, which has led to significant advancements in cabin design, seating ergonomics, and material selection.

The push for lightweight and durable components is being addressed by the integration of smart materials, modular seating systems, and digitally connected cabin elements. Aircraft manufacturers and tier-1 suppliers are prioritizing innovations that enhance spatial efficiency, reduce weight, and enable real-time monitoring of cabin components.

Moreover, the acceleration of narrow-body aircraft production for short to medium-haul routes, especially across Asia and the Middle East, is influencing procurement patterns toward scalable interior solutions. Over the next decade, the market is poised to benefit from the intersection of sustainability, digitalization, and customization, paving the way for the next generation of aerospace interiors that align with both airline economics and evolving passenger expectations.

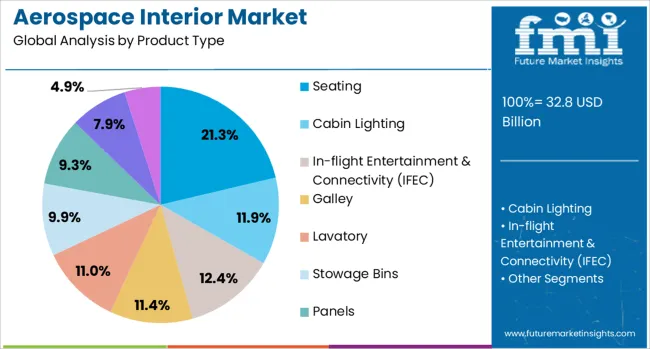

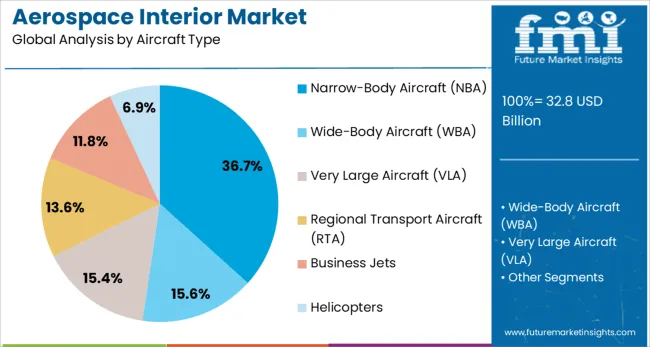

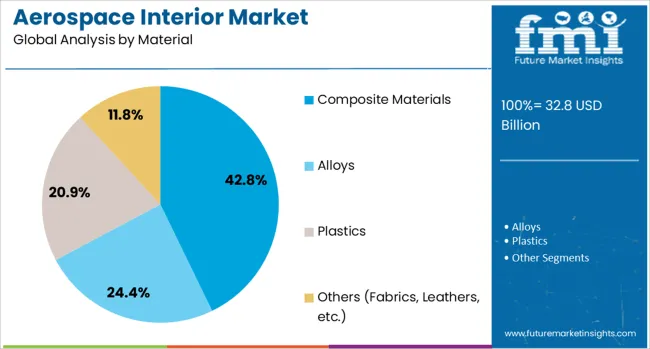

The aerospace interior market is segmented by product type, aircraft type, material, end use, and geographic regions. By product type, the market is divided into Seating, Cabin Lighting, In-flight Entertainment & Connectivity (IFEC), Galley, Lavatory, Stowage Bins, Panels, Windows Others (Flooring, Sidewalls, etc.). In terms of aircraft type, the market is classified into Narrow-Body Aircraft (NBA), Wide-Body Aircraft (WBA), Very Large Aircraft (VLA), Regional Transport Aircraft (RTA), Business Jets, Helicopters. Based on material, the market is segmented into Composite Materials, Alloys, Plastics, Others (Fabrics, Leathers, etc.). By end use, the market is segmented into OEM (Original Equipment Manufacturer) Aftermarket. Regionally, the aerospace interior industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The seating segment is expected to account for 21.3% of the aerospace interior market’s total revenue in 2025, maintaining a strong foothold due to its central role in passenger experience and cabin configuration. The growth of this segment has been driven by rising airline investments in comfort-oriented cabin upgrades and space optimization strategies.

Enhanced demand for ergonomic, lightweight, and modular seat structures has led to greater adoption of software-enabled seating designs that offer customizable recline, electronic controls, and integrated inflight entertainment systems. Seating also contributes significantly to overall cabin weight, prompting manufacturers to shift toward advanced composites and additive manufacturing for frame reduction without compromising durability.

With premium economy seating formats expanding globally, airlines are utilizing seat customization as a competitive lever to enhance brand differentiation. Integration with sensor-based occupancy detection and smart cabin management systems has further elevated the strategic value of seating in the evolving aircraft interior ecosystem.

Narrow-body aircraft are projected to contribute 36.7% of the aerospace interior market revenue share in 2025, emerging as the dominant aircraft type segment. This growth has been influenced by the widespread adoption of single-aisle aircraft for high-frequency short to medium-haul operations.

Increased production rates from major aircraft OEMs and demand from budget carriers have driven the need for cost-efficient, easily reconfigurable interior solutions tailored for narrow-body layouts. Airlines operating these aircraft have prioritized maximizing seat density and cabin efficiency while ensuring passenger comfort, leading to the deployment of thinner seat backs, optimized galley placement, and compact lavatory modules.

Additionally, interiors in this segment have become a focal point for low-cost carriers aiming to offer differentiated cabin classes and ancillary service revenue. The demand for quick maintenance turnaround and modular retrofitting has further advanced the development of standardized yet upgradeable interiors specifically engineered for narrow-body platforms.

Composite materials are forecast to represent 42.8% of the aerospace interior market revenue in 2025, asserting their dominance due to performance efficiency and weight reduction capabilities. The segment’s growth has been supported by the increasing emphasis on lightweight structures to improve fuel efficiency and lower carbon emissions.

Composite materials offer superior strength-to-weight ratios, corrosion resistance, and design flexibility, making them ideal for use in panels, seat frames, overhead bins, and lavatory components. The integration of fiber-reinforced polymers and thermoplastic composites in interior structures has enabled longer product life cycles and enhanced cabin aesthetics without adding weight.

Manufacturers have also prioritized recyclable and fire-resistant composites in compliance with stringent aerospace safety regulations. As interior systems become more modular and aircraft OEMs pursue sustainable cabin strategies, composite materials are playing a pivotal role in supporting multifunctional design requirements and optimizing cabin space utilization.

The aerospace interior market is expanding due to the rising demand for improved passenger comfort, safety, and cabin aesthetics in commercial aircraft. As airlines and aerospace manufacturers focus on enhancing the in-flight experience, innovations in seating, lighting, and entertainment systems are gaining traction. The increasing air travel demand and growing emphasis on lightweight, durable materials are driving the market.

Despite challenges such as high costs of advanced materials and regulatory compliance, opportunities lie in the development of next-generation cabin designs, eco-friendly materials, and the growing number of aircraft deliveries.

The demand for enhanced passenger comfort and safety is a major driver of the aerospace interior market. As global air travel continues to grow, airlines are prioritizing the improvement of the in-flight experience, leading to the adoption of innovative seating arrangements, advanced entertainment systems, and customizable cabin designs. Manufacturers are integrating cutting-edge materials and technologies to create lighter, more durable, and more comfortable interiors. In addition, there is a growing focus on safety features such as fire-resistant materials and emergency evacuation systems. As airlines aim to differentiate themselves by offering superior cabin experiences, the market for high-quality aerospace interiors continues to grow.

A significant challenge in the aerospace interior market is the high cost of advanced materials and interior systems. High-performance materials such as lightweight composites, custom seating, and advanced cabin lighting systems come with substantial development and production costs. These high costs can limit the adoption of premium interiors, particularly for low-cost carriers or smaller airlines. The strict regulatory standards concerning safety, flammability, and environmental compliance create additional hurdles for manufacturers. The need to meet these requirements without compromising on design and functionality adds complexity to the production process, increasing both time and costs for manufacturers.

The growing demand for new aircraft deliveries and technological advancements presents significant opportunities in the aerospace interior market. With a rising number of aircraft deliveries, airlines are looking to update and upgrade their cabin interiors to meet passenger expectations. Technological innovations, such as the integration of smart cabin systems, advanced lighting, and improved seating solutions, offer substantial opportunities for growth. The development of lightweight materials and eco-friendly solutions provides a chance for manufacturers to cater to the rising demand for more efficient and sustainable interiors. Expanding aircraft fleets, particularly in emerging markets, also presents untapped potential for the market.

A major trend in the aerospace interior market is the integration of smart cabin features that enhance passenger experience and operational efficiency. These features include intelligent lighting systems, seat controls, and personalized entertainment options that improve in-flight comfort. Another growing trend is the use of eco-friendly materials in interior design, as manufacturers seek to meet both consumer demand for greener options and regulatory requirements. These materials, including recycled composites and bio-based alternatives, help reduce the environmental impact of manufacturing while maintaining high-quality standards. The integration of these smart and sustainable solutions is reshaping the future of aerospace interiors.

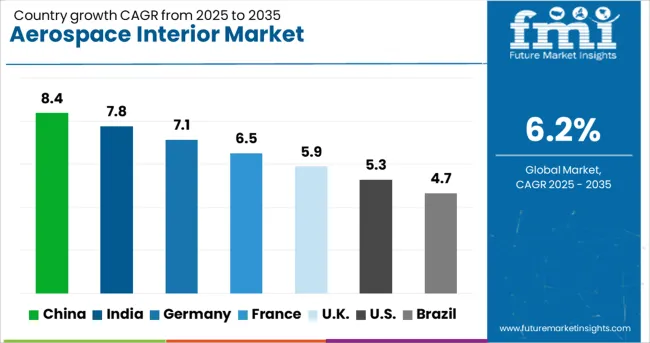

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

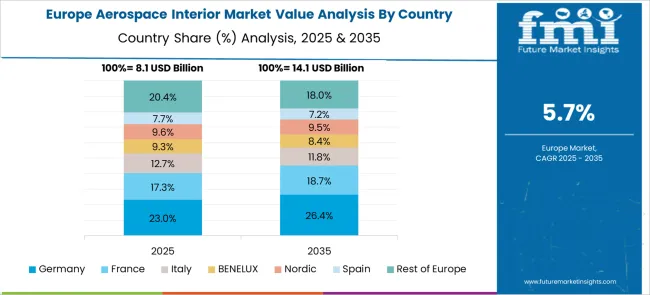

The aerospace interior market is projected to grow at a global CAGR of 6.2% from 2025 to 2035. China leads the market with 8.4%, followed by India at 7.8%, and France at 6.5%. The United Kingdom is expected to grow at 5.9%, while the United States is projected to grow at 5.3%. The market in China and India is driven by rapid expansion in the aerospace industry, rising demand for commercial aircraft, and the adoption of innovative interior materials. In OECD countries like France, the UK, and the USA, growth is steady, supported by advancements in passenger comfort and aircraft modernization. The analysis spans 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 8.4% through 2035, driven by the country’s rapid growth in the aerospace sector. With a booming commercial aircraft industry and the rise in domestic air travel, China’s aerospace interior market is set to expand significantly. The growing demand for advanced materials in aircraft interiors, such as lightweight composites and durable seating solutions, is pushing the market forward. The Chinese government’s support for domestic aircraft manufacturers is contributing to the market's growth.

India is projected to grow at a CAGR of 7.8% through 2035, driven by the expanding aviation industry. As air travel continues to rise, India’s demand for modern aerospace interiors is growing. The increase in air traffic and the introduction of new airlines in the region are factors fueling this demand. With the adoption of new technologies and materials for enhancing passenger comfort and safety, India’s aerospace interior market is poised for strong growth. The country’s focus on increasing domestic air travel also adds to the demand for advanced aircraft interior solutions.

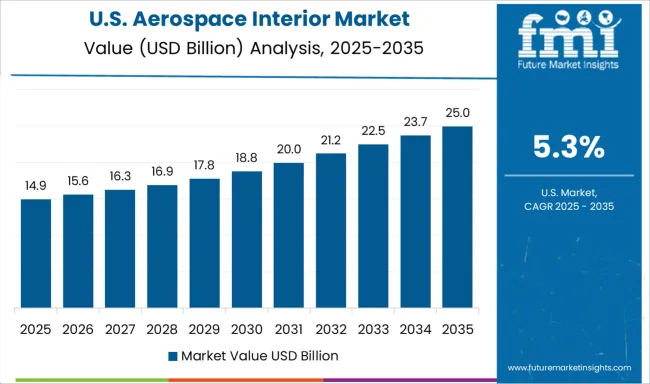

The United States is projected to grow at a CAGR of 5.3% through 2035, with the demand for aerospace interiors driven by the ongoing trend of improving passenger experience. As one of the leading markets for commercial aviation, the USA continues to modernize aircraft interiors to meet consumer expectations for comfort and luxury. Advanced materials, such as lightweight composites and noise-reducing solutions, are in high demand. The focus on enhancing in-flight experiences is a major factor propelling the aerospace interior market in the USA

Germany is projected to grow at a CAGR of 7.1% through 2035, supported by the country’s leadership in the aerospace industry. The demand for innovative and comfortable interiors is increasing as Germany continues to modernize its fleet of aircraft. With a growing focus on passenger comfort, the need for high-quality, durable, and lightweight materials for aircraft interiors is driving market growth. The country’s push for more eco-friendly and efficient materials in aerospace manufacturing is further accelerating this trend.

The United Kingdom is projected to grow at a CAGR of 5.9% through 2035, with the demand for aerospace interiors driven by advancements in passenger experience technologies and modern aircraft fleet upgrades. The UK has seen a rise in demand for eco-friendly materials in aircraft interiors, as airlines focus on reducing carbon footprints. As commercial aviation continues to expand, the demand for high-quality, durable, and innovative aerospace interior solutions is expected to grow. UK-based airlines are also investing in cabin upgrades to enhance the passenger experience, further driving market demand.

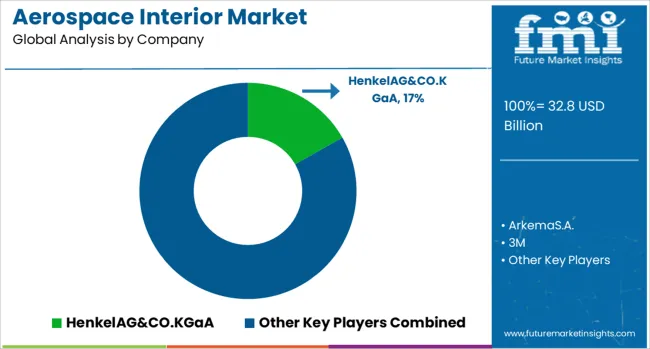

The aerospace interior market is driven by key players specializing in providing advanced materials, adhesives, coatings, and solutions for aircraft interiors, emphasizing performance, safety, and design aesthetics. Henkel AG & CO. KGaA is a leading player, offering a wide range of aerospace interior materials, including high-performance adhesives and coatings, designed to meet stringent safety standards. Arkema S.A. and 3M also contribute significantly, providing specialized materials such as high-strength polymers and lightweight composite materials for cabin components, including seating, paneling, and flooring.

Huntsman Corporation and Solvay S.A. focus on offering high-performance resins and composites, catering to the growing demand for lightweight, durable, and fire-resistant materials used in aircraft interiors. Hexcel Corporation is a leader in advanced composite materials, offering products for cabin components that improve structural integrity and reduce weight.Delo Industries and Avery Dennison Corporation provide adhesives, films, and coatings tailored for the aerospace sector, emphasizing reliability, durability, and ease of processing for interior applications.

Their solutions help improve the longevity and appearance of interior components while ensuring safety in the event of a fire or impact. Competitive differentiation in this market is driven by material performance, weight reduction, regulatory compliance, and the ability to provide innovative solutions for modern aircraft interior designs. Barriers to entry include stringent regulatory standards, high R&D investment, and technological complexity. Strategic priorities include developing lightweight, eco-friendly materials, improving fire resistance, and expanding product offerings to meet evolving industry needs.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product Type | Seating, Cabin Lighting, In-flight Entertainment & Connectivity (IFEC), Galley, Lavatory, Stowage Bins, Panels, Windows, and Others (Flooring, Sidewalls, etc.) |

| Aircraft Type | Narrow-Body Aircraft (NBA), Wide-Body Aircraft (WBA), Very Large Aircraft (VLA), Regional Transport Aircraft (RTA), Business Jets, and Helicopters |

| Material | Composite Materials, Alloys, Plastics, and Others (Fabrics, Leathers, etc.) |

| End Use | OEM (Original Equipment Manufacturer) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Safran Seats; Collins Aerospace; Recaro Aircraft Seating; Diehl Aviation; Jamco; Geven; Thompson Aero Seating; STELIA Aerospace (Airbus Atlantic); FACC; AIM Altitude; Panasonic Avionics; Thales (InFlyt Experience). |

| Additional Attributes | Dollar sales by material type (adhesives, composites, coatings, films) and end-use segments (seating, cabin interiors, flooring, panels, storage). Demand dynamics are driven by increasing passenger comfort requirements, the growing focus on lightweight materials, and regulatory mandates for safety and fire resistance in aviation. Regional trends show strong growth in North America and Europe, with expanding opportunities in Asia-Pacific driven by increasing air travel and demand for new aircraft. |

The global aerospace interior market is estimated to be valued at USD 32.8 billion in 2025.

The market size for the aerospace interior market is projected to reach USD 59.9 billion by 2035.

The aerospace interior market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in aerospace interior market are seating, cabin lighting, in-flight entertainment & connectivity (ifec), galley, lavatory, stowage bins, panels, windows and others (flooring, sidewalls, etc.).

In terms of aircraft type, narrow-body aircraft (nba) segment to command 36.7% share in the aerospace interior market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Interior Swinging Door Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA