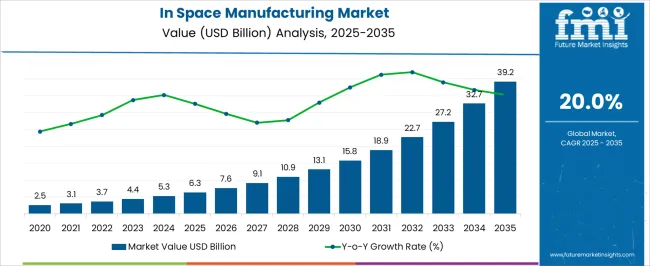

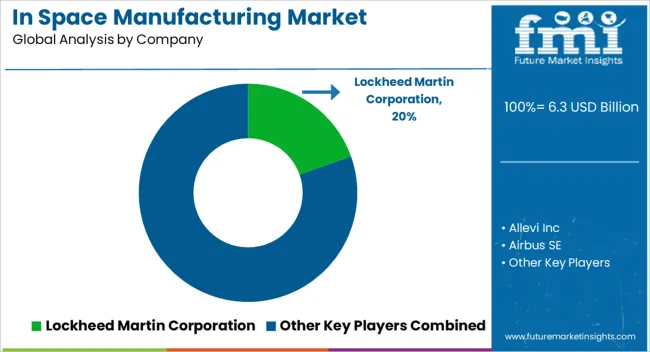

The in-space manufacturing market is valued at USD 6.3 billion in 2025 and is expected to reach USD 39.2 billion by 2035, growing at a CAGR of 20.0%. Seasonality and cyclicality detection indicate that market expansion is influenced by technology deployment timelines, launch schedules, and investment cycles rather than traditional seasonal patterns. Early growth phases, from 2025 to 2028, reflect the initial deployment of demonstration missions, pilot manufacturing projects, and the establishment of supply chains for in-orbit assembly, 3D printing, and materials processing. These activities create short-term spikes in demand for specialized equipment, components, and supporting infrastructure.

From 2028 to 2032, cyclical fluctuations become more pronounced as multiple private and public space missions coordinate with manufacturing timelines. Investment cycles, regulatory approvals, and launch vehicle availability drive periods of accelerated adoption, followed by brief plateaus when projects transition from development to operational stages. By 2033 to 2035, seasonality moderates as the market stabilizes with recurring manufacturing missions, higher-frequency launches, and broader commercialization of in-space processes.

Detection of these cycles is critical for stakeholders, allowing suppliers, investors, and service providers to align production, inventory, and R&D efforts with periods of peak activity while preparing for temporary slowdowns.

| Metric | Value |

|---|---|

| In Space Manufacturing Market Estimated Value in (2025 E) | USD 6.3 billion |

| In Space Manufacturing Market Forecast Value in (2035 F) | USD 39.2 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

Space agencies and government programs contribute about 26%, funding research, technology demonstration, and infrastructure development. Materials and advanced manufacturing suppliers represent roughly 18%, offering specialized metals, polymers, and 3D printing feedstocks compatible with microgravity environments.

Private space startups and commercial operators hold close to 12%, deploying manufacturing payloads and service contracts. Software and automation solution providers make up the remaining 7%, supplying design, process control, and monitoring platforms for in-orbit operations. The market is advancing as microgravity manufacturing gains commercial viability. 3D printing of metals and polymers in orbit has increased production efficiency by 15–20% compared to terrestrial prototypes.

Pharmaceutical and biomaterial experiments in space are rising, with ~25% growth year-on-year in payloads focused on drug development and tissue engineering. Satellite component manufacturing is expanding, reducing launch dependency and lead times by 10–12%. Partnerships between private companies and government agencies are accelerating demonstration missions and scaling modular manufacturing platforms. Additionally, the development of reusable in-space infrastructure is supporting continuous operations and lowering operational costs for long-duration missions.

The in-space manufacturing market is gaining momentum as advancements in orbital production technologies enable the fabrication of high-value materials and components beyond Earth’s gravity. Space agency initiatives, private aerospace investment, and strategic partnerships between research institutions and commercial operators have accelerated the commercialization of manufacturing in microgravity.

Industry announcements have highlighted breakthroughs in producing materials with enhanced properties in space, ranging from advanced fiber optics to bioprinted tissues. The reduced influence of gravity in orbital environments allows for higher precision, improved purity, and unique structural characteristics that cannot be replicated on Earth.

Growth is also supported by the expanding availability of orbital platforms, such as space stations and dedicated manufacturing modules, which are providing cost-effective access to production capabilities. As launch costs continue to decline and reusable spacecraft become standard, the market is expected to witness expanded adoption across both government and commercial sectors. Future growth will be driven by increased demand for microgravity-enabled products with applications in communications, pharmaceuticals, and advanced materials.

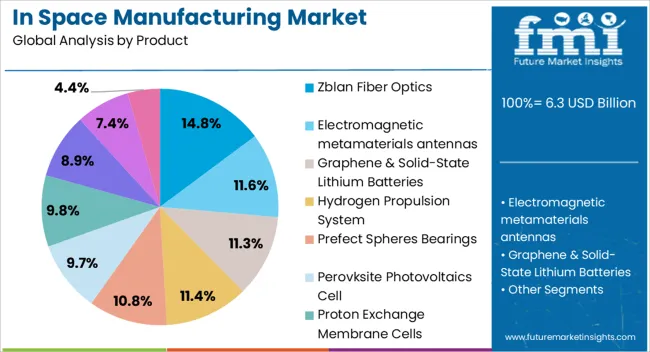

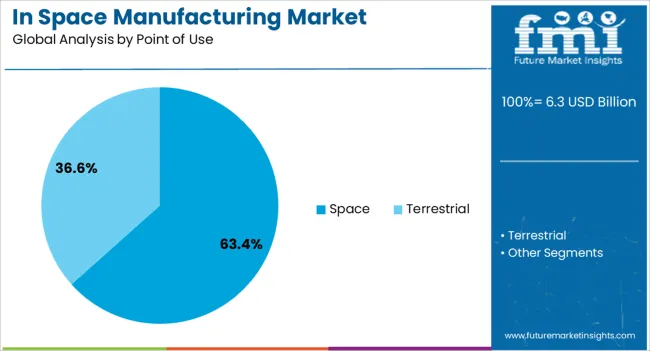

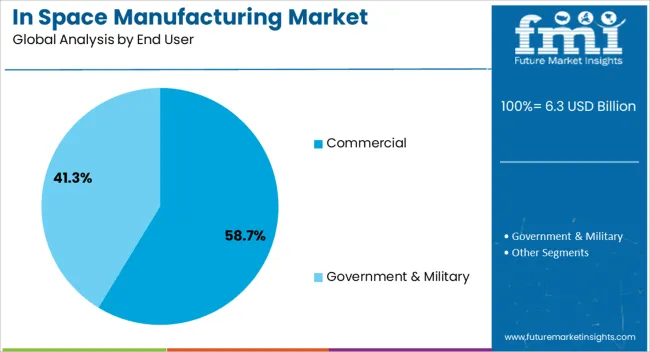

The in space manufacturing market is segmented by product, point of use, end user, and geographic regions. By product, in space manufacturing market is divided into Zblan Fiber Optics, Electromagnetic metamaterials antennas, Graphene & Solid-State Lithium Batteries, Hydrogen Propulsion System, Prefect Spheres Bearings, Perovksite Photovoltaics Cell, Proton Exchange Membrane Cells, Quantum Dot Display, Traction Motor, and Zeolite Crystals. In terms of point of use, in space manufacturing market is classified into Space and Terrestrial. Based on end user, in space manufacturing market is segmented into Commercial and Government & Military. Regionally, the in space manufacturing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ZBLAN Fiber Optics segment is projected to account for 14.8% of the in-space manufacturing market revenue in 2025, establishing itself as a critical product category. Growth in this segment has been driven by ZBLAN’s superior optical transmission capabilities, which are further enhanced when manufactured in microgravity, resulting in fewer structural defects.

Space-based production mitigates crystallization issues that occur under Earth’s gravity, yielding fibers with higher performance in telecommunications and data transfer applications. Industry trials and space mission experiments have demonstrated that ZBLAN produced in orbit exhibits reduced attenuation, enabling more efficient long-distance signal transmission.

The increasing need for high-bandwidth communication infrastructure has heightened interest in this segment, especially among commercial telecom providers. With growing investment in space-based manufacturing facilities and planned production scale-up missions, ZBLAN Fiber Optics are expected to remain a prominent focus within the in-space manufacturing ecosystem.

The Space segment is projected to hold 63.4% of the in-space manufacturing market revenue in 2025, leading due to its role as the immediate operational environment for production and utilization. This dominance stems from the capacity to manufacture and deploy components directly in orbit, eliminating the need for launch from Earth and reducing associated costs.

Space-based utilization allows for the production of large or fragile structures, such as telescopes, antennas, and habitat modules, which benefit from assembly in microgravity. Industry updates have highlighted that in-orbit manufacturing shortens supply chains for space missions and improves operational flexibility.

Additionally, the emergence of on-orbit servicing and assembly capabilities has created opportunities for continuous production and maintenance of space infrastructure. As the number of satellites, space stations, and commercial platforms increases, the Space segment is expected to remain the primary point of use for in-space manufacturing outputs.

The Commercial segment is projected to contribute 58.7% of the in-space manufacturing market revenue in 2025, maintaining its leadership due to expanding private sector investment and commercialization of microgravity-enabled products. Private aerospace companies, telecom operators, and advanced material manufacturers have shown growing interest in leveraging space manufacturing for competitive advantages in performance and innovation.

Commercial entities benefit from the potential to develop premium-grade materials, pharmaceuticals, and precision components with unique characteristics only achievable in space. Industry trends have pointed to increased partnerships between commercial firms and space agencies to access orbital production facilities and share research capabilities.

The decline in launch costs and the advent of commercial space stations have further lowered entry barriers for private sector participation. As market competition intensifies and demand for specialized high-value products rises, the Commercial segment is expected to remain a driving force in the growth and diversification of in-space manufacturing.

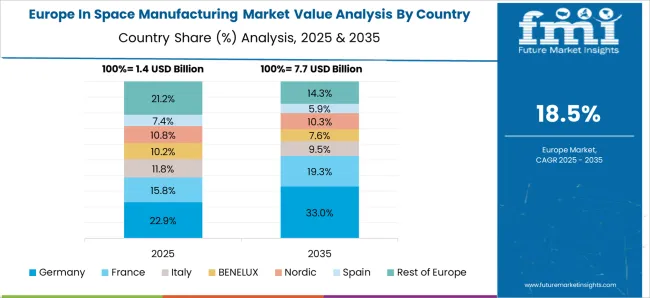

The in-space manufacturing market is gaining momentum due to the increasing deployment of satellites, space stations, and orbital research platforms. Manufacturing in microgravity enables the production of high-purity materials, advanced pharmaceuticals, and precision components that are challenging to produce on Earth. North America and Europe are leading adoption due to established aerospace programs and commercial space initiatives, while Asia Pacific is emerging with growing investment in orbital infrastructure.

Advancements in robotics, 3D printing, and automated assembly systems are driving operational efficiency. Rising interest from commercial space ventures and government agencies is expected to sustain market growth by enabling on-demand production, reducing launch dependencies, and improving mission flexibility across the aerospace and defense sectors.

The expansion of orbital infrastructure, including satellites, space stations, and research platforms, is a key driver for in-space manufacturing. Microgravity conditions enable production of advanced materials, high-quality fibers, and unique alloys with superior structural properties. Increased satellite constellations and long-duration missions demand on-site manufacturing to reduce payload weight and launch frequency. Government and commercial entities are investing in space-based laboratories and robotic systems to facilitate production in orbit. The combination of orbital infrastructure development and technological advancements in additive manufacturing is strengthening the adoption of in-space production capabilities.

3D printing and additive manufacturing in orbit create significant growth opportunities for the in-space manufacturing market. Microgravity enables production of components with reduced defects and enhanced mechanical properties compared with Earth-based manufacturing. Materials such as high-strength alloys, optical fibers, and pharmaceuticals benefit from orbital processing. Commercial ventures are exploring on-demand manufacturing of replacement parts and experimental products, minimizing reliance on resupply missions. Manufacturers focusing on scalable, modular 3D printing platforms and specialized material development are positioned to capture long-term demand. These technologies also enable faster prototyping and testing for research missions, supporting scientific and industrial objectives in space.

Commercial and research entities are increasingly adopting in-space manufacturing for product development, pharmaceuticals, and microgravity experimentation. Applications include high-precision optical components, biologics, and experimental materials. Private companies and research institutions are leveraging orbital laboratories to reduce lead time, improve material properties, and conduct tests not possible on Earth. Space tourism infrastructure and long-duration exploration missions are driving further adoption. Integration of robotics, autonomous systems, and advanced sensors is enhancing operational efficiency. These trends indicate a growing shift toward commercial utilization of orbital manufacturing beyond traditional research, enabling cost-effective production and increased mission capability.

The high cost of launch services, orbital deployment, and in-space equipment presents significant barriers. Regulatory complexities related to space operations, safety standards, and intellectual property pose additional challenges. Development of reliable, autonomous manufacturing systems requires substantial R&D investment. Smaller entities face difficulties in securing funding and integrating technologies into operational missions. Companies optimizing system efficiency, modular designs, and strategic partnerships are better positioned to overcome cost and regulatory constraints. Addressing these challenges is critical to enabling broader adoption and sustaining long-term growth in the in-space manufacturing sector.

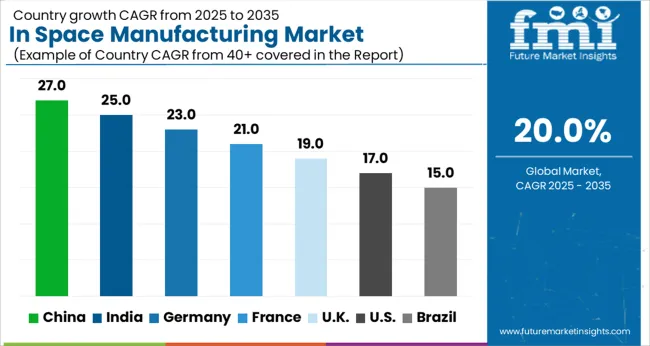

| Country | CAGR |

|---|---|

| China | 27.0% |

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

| USA | 17.0% |

| Brazil | 15.0% |

The space manufacturing market is growing at a global CAGR of 20% from 2025 to 2035, fueled by increasing satellite production, private space ventures, and government-backed aerospace programs. China leads at 27.0%, +35% above the global benchmark, supported by BRICS-driven investments in orbital manufacturing facilities, satellite constellations, and advanced materials research. India follows at 25.0%, +25% over the global average, reflecting strong growth in space technology initiatives, government space programs, and emerging private aerospace enterprises. Germany records 23.0%, +15% above the global CAGR, shaped by OECD-backed innovation in high-precision components, satellite manufacturing, and additive manufacturing technologies. The United Kingdom posts 19.0%, slightly below the global rate, influenced by selective adoption in specialized aerospace manufacturing projects. The United States stands at 17.0%, −15% under the global benchmark, reflecting mature aerospace infrastructure and a focus on incremental innovation. BRICS economies drive rapid expansion, while OECD nations emphasize technological precision and sustainable space manufacturing practices.

China is leading the in-space manufacturing market with a CAGR of 27.0%, driven by aggressive government investment in space infrastructure, satellites, and orbital manufacturing facilities. The country is advancing production of high-value materials such as fiber optics, semiconductors, and specialized alloys directly in microgravity to enhance quality and performance. Partnerships between aerospace agencies and private enterprises are accelerating R&D for in-orbit fabrication and assembly. China's increasing number of space missions and focus on space station capabilities are expanding the scope of in-space manufacturing technologies. Domestic innovation hubs and supply chain integration are strengthening the country’s global position.

India is recording a CAGR of 25.0% in the in-space manufacturing market, supported by growing national space program initiatives and international collaborations. ISRO and private space startups are focusing on orbital experiments, microgravity material synthesis, and small satellite assembly. Investment in R&D infrastructure and orbital deployment capabilities is increasing to accelerate high-value production in space. India's focus on cost-efficient manufacturing and regional partnerships enhances its competitive position. Demand for microgravity-fabricated materials in pharmaceuticals, electronics, and aerospace components is contributing to robust growth.

Germany is advancing at a CAGR of 23.0% in the in-space manufacturing market, driven by aerospace R&D and advanced materials production. Focus areas include additive manufacturing in orbit, microgravity crystal growth, and high-precision component fabrication. Collaboration between space agencies and industrial partners is expanding capabilities for both satellites and orbital manufacturing. Germany’s strong engineering and materials science expertise is supporting efficient adoption of in-space manufacturing technologies. Export of microgravity-fabricated components for aerospace and defense is also contributing to growth.

The United Kingdom is recording a CAGR of 19.0% in the in-space manufacturing market, supported by growing commercial space ventures and government funding for orbital research. Microgravity experiments, orbital assembly, and 3D printing of high-performance materials are driving adoption. Partnerships with European and USA space agencies are enhancing technology transfer and collaborative development. The country is focusing on small satellite manufacturing and specialized materials production to meet both domestic and export requirements. Investment in space innovation hubs and research facilities is further accelerating market growth.

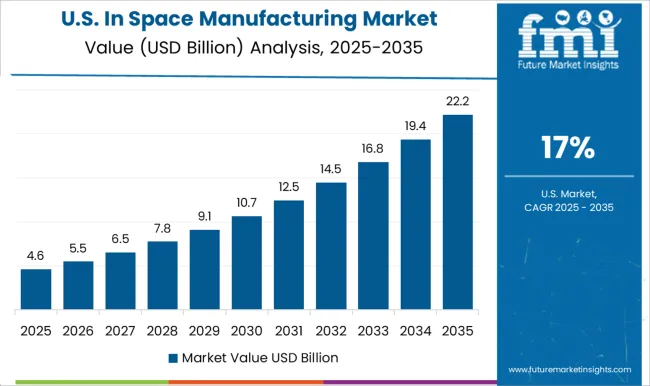

The United States is progressing at a CAGR of 17.0% in the in-space manufacturing market, driven by NASA, private aerospace firms, and commercial orbital ventures. Focus areas include in-orbit additive manufacturing, high-value crystal growth, and advanced material production for satellites and space vehicles. Investment in orbital laboratories and microgravity R&D is expanding to enhance technological capabilities. Private companies are scaling operations for commercial applications, including pharmaceuticals, semiconductors, and aerospace components. Strategic partnerships between government and private entities are accelerating adoption and deployment of in-space manufacturing technologies.

The in-space manufacturing market is driven by aerospace and technology companies developing systems and materials for production in microgravity environments. Lockheed Martin Corporation is assumed to be the leading player, supported by advanced platforms for space-based assembly, additive manufacturing, and high-precision components. Airbus SE and Northcorp Grumman Corporation maintain competitive positions by providing modular manufacturing solutions for satellites, spacecraft structures, and experimental payloads. Allevi Inc. and Astrobotic Technology, Inc. focus on bioprinting and robotic assembly technologies designed for microgravity, optimizing performance, precision, and process reliability. Axiom Space, Inc. and Sierra Nevada Corporation contribute with commercial in-orbit fabrication platforms and specialized space habitat manufacturing solutions that enhance material handling and production efficiency.

Echodyne Corporation and Global Graphene Group, Inc. (G3) strengthen market reach through high-performance materials, including graphene-based components, that support lightweight, durable, and conductive structures. Le Verre Fluore Fiber Solutions provides specialized fibers and composites for space manufacturing applications, emphasizing thermal stability and material consistency. Product brochures highlight modular fabrication units, robotic manipulators, additive manufacturing systems, and advanced material platforms suitable for space-based environments. Features such as precision deposition, automation, reduced material waste, and in-situ assembly capabilities are emphasized. Technical support, remote operation guidance, and integrated monitoring systems are presented as key elements to ensure consistent output and mission reliability. Collectively, these companies focus on advancing in-orbit production capabilities, enabling innovative space applications, and providing scalable solutions to support research, commercial, and industrial objectives in low-Earth orbit and beyond.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.3 Billion |

| Product | Zblan Fiber Optics, Electromagnetic metamaterials antennas, Graphene & Solid-State Lithium Batteries, Hydrogen Propulsion System, Prefect Spheres Bearings, Perovksite Photovoltaics Cell, Proton Exchange Membrane Cells, Quantum Dot Display, Traction Motor, and Zeolite Crystals |

| Point of Use | Space and Terrestrial |

| End User | Commercial and Government & Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin Corporation, Allevi Inc, Airbus SE, Astrobotic Technology, Inc., Axiom Space, Inc., Echodyne Corporation., Global Graphene Group, Inc. (G3), Le Verre Fluore Fiber Solutions, Northcorp Grumman Corporation, and Sierra Nevada Corporation |

| Additional Attributes | Dollar sales by manufacturing type and application, demand dynamics across satellites, spacecraft components, and space habitats, regional trends across North America, Europe, and Asia-Pacific, innovation in 3D printing, in-orbit assembly, and microgravity-enabled materials, environmental impact of launch emissions and space debris, and emerging use cases in on-demand satellite parts, space construction, and extraterrestrial resource utilization. |

The global in space manufacturing market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the in space manufacturing market is projected to reach USD 39.2 billion by 2035.

The in space manufacturing market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in in space manufacturing market are zblan fiber optics, electromagnetic metamaterials antennas, graphene & solid-state lithium batteries, hydrogen propulsion system, prefect spheres bearings, perovksite photovoltaics cell, proton exchange membrane cells, quantum dot display, traction motor and zeolite crystals.

In terms of point of use, space segment to command 63.4% share in the in space manufacturing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Invar Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Road Test Instruments Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Driving Technology Solution Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Infertility Treatment Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Interactive Whiteboard Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA