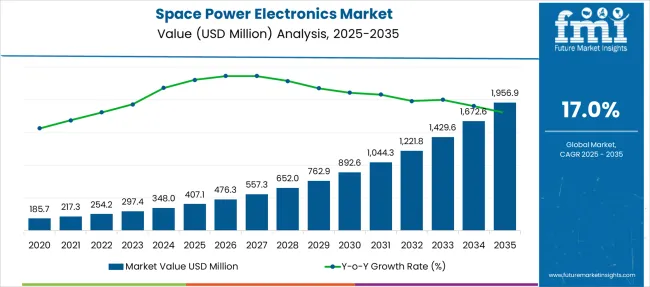

The Space Power Electronics Market is estimated to be valued at USD 407.1 million in 2025 and is projected to reach USD 1956.9 million by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period. Year-on-year growth rates peak in the early phase between 2026 and 2028, reaching above 18%, before gradually declining to nearly 10% by 2035. The market demonstrates an absolute dollar opportunity of USD 1,549.8 million, highlighting substantial investment potential. A five-year growth analysis shows that 2025 to 2030 accounts for an increase of over 119%, while 2030-2035 adds nearly 95% more value, indicating strong but decelerating momentum.

The overall growth curve follows an S-shape, with early acceleration and a gradual taper after 2031, marking the inflection point. This trend suggests that while the market experiences robust expansion initially, players will need to adopt technology differentiation, cost optimization, and efficiency improvements to sustain growth. The share of incremental gains is heavily skewed toward the first decade, emphasizing the urgency for early investment. The data indicates a high-growth market in its emerging phase, creating strategic opportunities for regional penetration, advanced power module integration, and partnerships across satellite and space system applications.

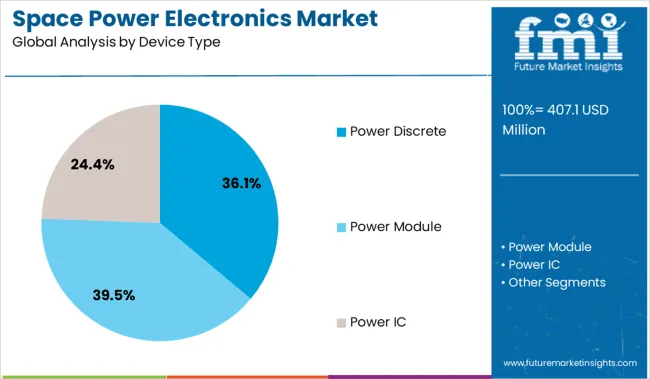

In terms of device type, power modules hold the largest share at 39.5%, closely followed by Power Discretes at 36.1%. Power ICs account for 24.4%, reflecting increasing integration for compact and efficient spacecraft systems. By application, satellites dominate with 47.2% share, underscoring the surge in satellite launches for communication, defense, and Earth observation. Spacecraft and launch vehicles contribute 22.5%, highlighting their importance in interplanetary missions, whereas rovers and space stations collectively add about 30%, signaling niche but high-value demand segments.

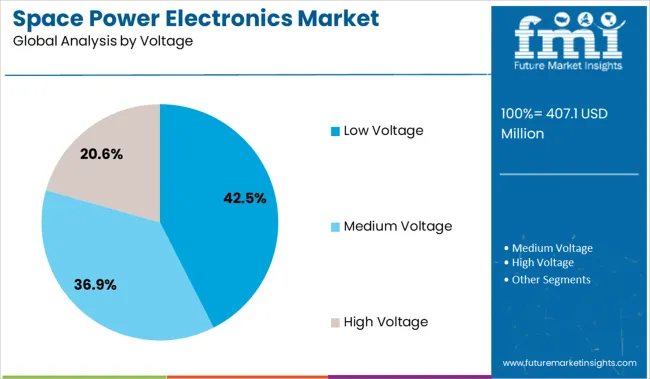

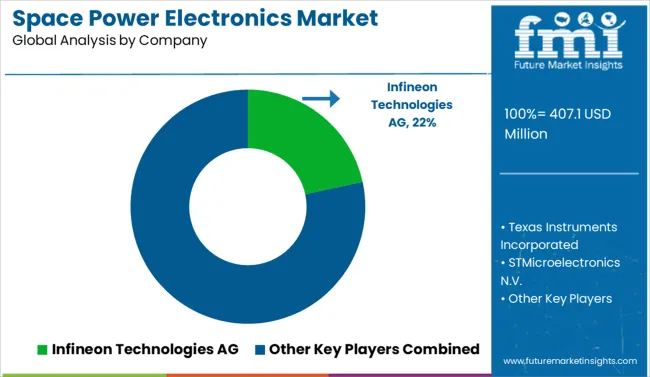

Current rating segmentation shows 25-50A leads at 39.3%, followed by up to 25A at 38.4%, while over 50A accounts for 22.3%, indicating moderate demand for high-power systems used in advanced propulsion and defense platforms. From a voltage perspective, low voltage dominates at 42.5%, with medium voltage at 36.9%, suggesting ongoing design optimization for lightweight, low-power electronics in satellites. On the competitive front, Infineon Technologies AG leads with 22% share, reflecting strong positioning in radiation-hardened semiconductors. This structural analysis shows an industry leaning toward modularization, low-voltage architectures, and satellite-focused innovation, with competitive intensity shaping future technology investments.

| Metric | Value |

|---|---|

| Space Power Electronics Market Estimated Value in (2025E) | USD 407.1 million |

| Space Power Electronics Market Forecast Value in (2035F) | USD 1956.9 million |

| Forecast CAGR (2025 to 2035) | 17.0% |

The space power electronics market is driven by the rising deployment of satellites, increased investment in space exploration programs, and the commercialization of low Earth orbit (LEO) missions. As satellite constellations and interplanetary missions become more frequent, the need for efficient, compact, and radiation-hardened power electronic systems has intensified.

These systems play a crucial role in regulating power supply, managing thermal loads, and ensuring mission-critical reliability in extreme environments. Additionally, the miniaturization of satellite components and the shift toward electric propulsion systems are pushing manufacturers to innovate in design and material efficiency.

The future growth trajectory is expected to be supported by international collaborations in deep space programs, the emergence of private aerospace ventures, and the integration of AI-powered diagnostics in onboard power management. With power systems forming the backbone of satellite operations, continued advancements in performance and durability will remain essential to market evolution.

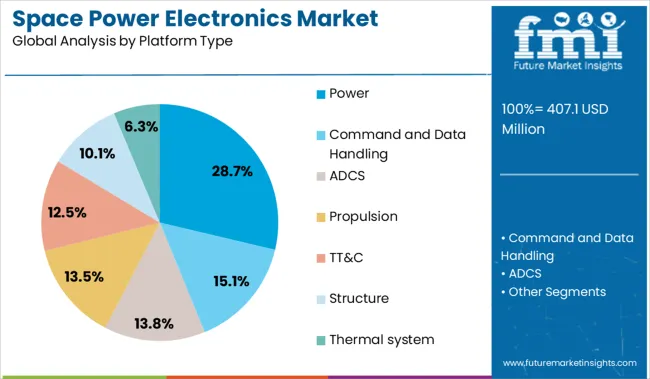

The space power electronics market is segmented by device type, platform type, voltage, current, application, and region. By device type, the market includes power discrete, power module, and power IC, supporting advanced electrical control in space systems. Platform type segmentation covers power, command and data handling, ADCS, propulsion, TT&C, structure, and thermal systems, reflecting diverse operational functions in space missions. Voltage categories comprise low voltage, medium voltage, and high voltage systems, while current ranges include up to 25A, 25-50A, and over 50A for various load requirements. Applications include satellites, spacecraft and launch vehicles, rovers, and space stations. Geographically, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The power discrete segment leads the space power electronics market by capturing a 36.1% share within the device type category, reflecting its critical role in enabling efficient and targeted control of electrical power in space applications. Discrete components such as diodes, transistors, and thyristors are favored for their ability to offer precise energy switching, thermal stability, and robust operation in radiation-prone environments.

Their simplicity, reliability, and adaptability to customized configurations make them indispensable in spacecraft subsystems, particularly for power conditioning, conversion, and distribution. As demand for high-efficiency and lightweight electronics intensifies, advancements in wide bandgap semiconductors like SiC and GaN are further propelling the adoption of discrete power devices.

The segment continues to benefit from defense and commercial space agencies seeking long-duration reliability in mission-critical systems. Growth is expected to remain steady as modular spacecraft architectures and small satellite platforms integrate discrete components to optimize performance and cost-efficiency.

The power platform segment holds a significant 28.7% share, driven by its core role in ensuring stable energy distribution and conversion throughout various space systems. These platforms encompass integrated power units that regulate voltage, distribute power across payloads, and manage energy storage, forming the backbone of any functional spacecraft.

Their application spans across communications, observation, and scientific missions, where mission longevity and uninterrupted performance are paramount. Growth in this segment is fueled by increasing payload complexity and the rising adoption of electric propulsion systems that demand consistent and efficient power flows.

The expansion of satellite mega-constellations and deeper space exploration efforts also place greater emphasis on scalable and fault-tolerant power platforms. The platform’s contribution to mission success, energy conservation, and payload integrity underscores its sustained demand across both governmental and commercial aerospace projects.

The low voltage segment leads the voltage category with a 42.5% market share, supported by its dominance in small satellite and subsystem applications where lower power levels are sufficient and efficiency is prioritized. This segment is characterized by electronics that operate below 100V, typically used in command systems, data handling units, and low-power instruments.

The increasing miniaturization of spaceborne technology has driven the preference for low voltage electronics, offering reduced heat generation, improved efficiency, and compact integration into satellite systems. Additionally, advancements in low voltage regulation and fault-tolerant circuitry have enhanced system reliability in radiation-intensive environments.

The proliferation of CubeSats and other small satellite missions, often supported by academic, defense, and private-sector entities, further strengthens the segment’s position. With satellite platforms increasingly adopting agile power architectures, the demand for low voltage systems is expected to grow as a foundational requirement for safe, efficient, and scalable space operations.

Electronic power systems for satellites, deep-space probes, and space stations are evolving rapidly. In 2024, more than 60% of new satellite missions in LEO and MEO adopted modular power electronics using gallium nitride or radiation-hardened silicon carbide components. Geospatial, broadband, and defense payloads collectively drove growth, while micro- and nanosatellite constellations accelerated demand for compact DC-DC converters and MPPT charge controllers. Power management integrated with telemetry now supports real-time system health diagnostics. Vendors are tightening integration between solar arrays, batteries, and power distribution units, enabling higher power density and longer mission lifetimes.

Use of GaN and SiC components in power electronics is reshaping payload design through efficiency gains and reduced volume. Radiation-hardened DC-DC converters built on SiC now provide up to 98% conversion efficiency in solar-electric satellite systems. GaN-based PEMs (power electronics modules) have reduced size by 25-30% compared with silicon designs, helping integrate higher-power payloads into 150-300 kg spacecraft. In megaconstellation networks, system vendors report a 12 % reduction in thermal management overhead. Silicon carbide flight controllers now support thrust modulator units in deep space platforms, while modular silicon chips offer scalability from medium Earth orbit missions to interplanetary crafts.

Scaling advanced power modules remains challenging due to component validation, long qualification cycles, and supply fragility. Radiation-hardened GaN and SiC part lead times range from 24 to 36 weeks. Missions in early 2025 reported up to 18 % schedule slippage due to delayed power module certification. Qualification testing for ionizing dose tolerance (LET) and thermal cycling adds 8-10 weeks per batch. Smaller satellite integrators often face procurement minimums above USD 125k per lot, constraining cost flexibility. Lifecycle cost modeling shows that failure rates during LEO commissioning can add 9-11 % to operational margins. These constraints slow broader adoption while limiting entrants to high-margin mission segments.

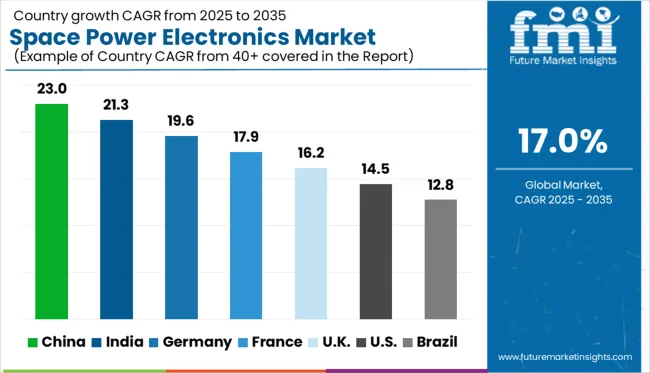

| Country | CAGR |

|---|---|

| China | 23% |

| India | 21.3% |

| Germany | 19.6% |

| France | 17.9% |

| UK | 16.2% |

| USA | 14.5% |

| Brazil | 12.8% |

Global space robotics market demand is projected to rise at a 5% value-based CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 5.8%, followed by India at 5.6%, and the United States at 5.3%, while Japan posts 4.9% and Germany records 4.7%. These rates translate to a growth premium of +16% for China, +12% for India, and +6% for the United States versus the baseline, while Germany shows slower growth. Divergence reflects local catalysts: increasing investments in space exploration and robotics in China and India, steady growth driven by ongoing space missions in the United States, and more moderate growth in Japan and Germany due to market maturity and competition from other space technologies.

China’s space power electronics market is projected to grow at a 23.0% CAGR between 2025 and 2035, outpacing the global average by 6%. The domestic production of LEO satellite constellations, advanced onboard power systems, and increasing launch frequencies is driving growth. DC-DC converters and radiation-hardened components have been prioritized for communication and reconnaissance satellites. State-funded programs are supporting local firms that build flight-proven EPS modules. Cross-border collaboration with Central Asian and African nations has also created downstream demand for low-cost modular systems. Private aerospace firms have ramped up production of gallium nitride (GaN) devices, aimed at weight reduction and efficiency optimization. Demand continues to be concentrated around Beijing, Xi’an, and Shanghai due to established aerospace manufacturing infrastructure.

India’s space power electronics market is forecast to grow at a CAGR of 21.3% from 2025 to 2035, surpassing the global benchmark by 4.3%. Expansion is led by demand from both government missions and private space startups, particularly for micro-satellite and remote sensing payloads. Indigenous development of high-efficiency PDU (power distribution units) and low-loss regulators has gained traction, especially in Bengaluru and Hyderabad. Initiatives under the Indian National Space Promotion and Authorization Center (IN-SPACe) have reduced entry barriers for new vendors. Use of silicon carbide components is rising among private-sector integrators. Export activity is also on the rise, with Southeast Asian satellite operators sourcing modular power blocks from Indian suppliers. End-use is now split between scientific and commercial satellite domains.

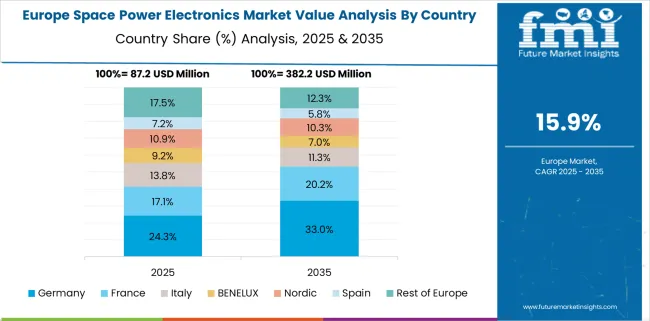

Germany is projected to grow at a CAGR of 19.6% between 2025 and 2035, outperforming the global average by 2.6%. ESA partnerships, defense-related payload integration, and university-led CubeSat programs have fueled procurement of high-reliability converters and solid-state switches. Growth in demand has come largely from Baden-Württemberg and Bavaria, where aerospace subcontracting activity is highest. Procurement of GaN and SiC components has increased for thermal efficiency and mass reduction. Several Tier 2 contractors are licensing interface control architectures developed by DLR for advanced EPS applications. Although vertically integrated platforms remain rare, component specialization has deepened. German-built EPS systems are also being used in lunar payloads under multinational collaborations.

France’s market is projected to grow at a CAGR of 17.9% between 2025 and 2035, slightly above the global average by 0.9%. CNES and ArianeGroup are driving most of the procurement, primarily for high-power satellite buses and launch system avionics. Focus remains on multi-output regulators and EMI-filtering modules integrated within mission-critical payloads. French contractors have adopted low-volume, high-performance components sourced from national R&D labs. The emphasis is on flight heritage and qualification compliance rather than volume scalability. In-house ASIC-based regulation units have entered testing across two military payload programs. Most demand remains tied to institutional projects, though small commercial integrators are entering lower orbit segments. Export demand is relatively muted compared to Germany or the UK.

The UK market is expected to grow at a CAGR of 16.2% from 2025 to 2035, underperforming the global average by 0.8%. Most demand originates from CubeSat and Earth observation platforms tied to civil agencies and academic programs. Emphasis remains on compact power modules with radiation tolerance optimized for LEO exposure. London, Oxfordshire, and Glasgow lead in component innovation, including fault-tolerant regulators and high-density step-down converters. Spaceport Cornwall supports commercial output and Shetland launch projects, but the scale of its subsystems remains modest. Imports from the EU and the USA remain critical for advanced microcontroller integration. UK-led projects have a strong academic and prototyping base but are slower to scale toward full-flight constellations.

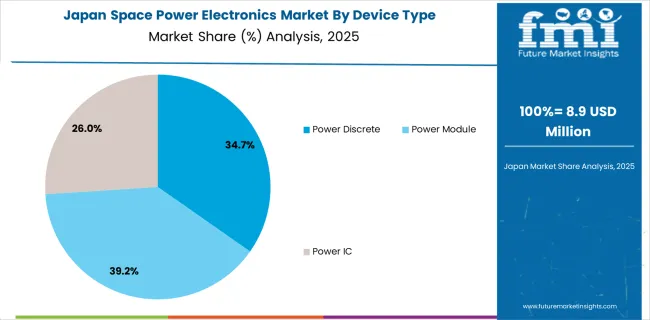

Japan’s space power electronics market is projected to reach USD 8.9 million in 2025, with power modules capturing 39.2%, power discretes accounting for 34.7%, and power ICs representing 26%. The dominance of power modules is driven by their ability to combine multiple functions in a compact structure, improving thermal management and reducing system weight, which is critical for satellite and launch vehicle applications. Power discretes maintain strong relevance for their reliability in radiation-intensive conditions, while power ICs face slower adoption due to rigorous qualification standards for space-grade integration. This structure indicates a shift toward modular solutions for efficiency and space optimization.

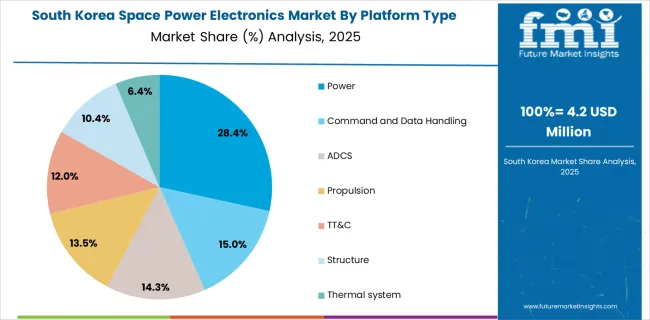

South Korea's space power electronics market is valued at USD 4.2 million in 2025, with platform type distribution led by the power segment at 28.4%, followed by command and data handling at 15.0% and ADCS at 14.3%. The leadership of the power segment is driven by its essential role in meeting energy requirements for satellites, propulsion systems, and thermal management. Growing investments in satellite programs and small launch platforms are increasing demand for efficient power solutions that enhance system reliability. Command and data handling ranks second due to rising requirements for secure and real-time data transmission, while ADCS remains critical for precise navigation and spacecraft orientation.

The space power electronics market is highly specialized, characterized by stringent reliability standards and long qualification cycles, creating high entry barriers and favoring established technology leaders. Infineon Technologies AG leads through advanced radiation-tolerant components engineered for thermal stability and mission assurance, catering to spacecraft, satellites, and propulsion systems.

Texas Instruments and Analog Devices focus on ICs, DC-DC converters, and voltage regulators designed for satellite platforms and deep-space exploration missions, emphasizing size optimization and energy efficiency in harsh orbital conditions. STMicroelectronics and Onsemi bring differentiation with wide-bandgap semiconductors such as SiC and GaN, which enable higher power density and efficiency within weight-constrained space environments.

Renesas Electronics specializes in radiation-hardened microcontrollers and gate drivers tailored for propulsion and payload electronics, aligning with increasing demand for modular and integrated power architectures. Meanwhile, BAE Systems delivers customized space-grade power modules for defense-oriented programs and commercial aerospace, leveraging strong partnerships with government agencies and satellite integrators.

Market dynamics remain shaped by rigorous qualification standards, mission assurance protocols, and extended design cycles, which slow new supplier participation. Competitive differentiation increasingly depends on radiation hardening expertise, thermal management innovation, and the ability to integrate AI-based health monitoring into power modules.

Key Developments in the Space Power Electronics Market

Recent developments center on radiation-hardened component innovation, wide-bandgap semiconductor integration, and AI-driven power management. Companies are advancing SiC and GaN-based devices to enhance efficiency and power density in size-constrained space systems. Infineon and STMicroelectronics lead in high-reliability designs, while Renesas expands microcontroller portfolios for propulsion and payload systems. Strategic collaborations with space agencies and satellite OEMs accelerate qualification cycles and ensure compliance with rigorous standards. Firms also invest in thermal management technologies and modular architectures to meet the rising demand for small satellites and reusable launch platforms, driving performance and lifecycle optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 407.1 Million |

| Device Type | Power Discrete, Power Module, and Power IC |

| Platform Type | Power, Command and Data Handling, ADCS, Propulsion, TT&C, Structure, and Thermal system |

| Voltage | Low Voltage, Medium Voltage, and High Voltage |

| Current | Upto 25A, 25-50A, and Over 50A |

| Application | Satellite, Spacecraft & Launch Vehicle, Rovers, and Space Stations |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Infineon Technologies AG, Texas Instruments Incorporated, STMicroelectronics N.V., Onsemi, Renesas Electronics Corporation, BAE Systems plc, and Analog Devices, Inc. |

| Additional Attributes | Dollar sales by platform type and power level, growing demand in satellite constellations and deep space missions, stable integration in launch vehicles and space stations, advancements in radiation-hardened components and high-efficiency converters support mission reliability and power density optimization |

The global space power electronics market is estimated to be valued at USD 407.1 million in 2025.

The market size for the space power electronics market is projected to reach USD 1,956.9 million by 2035.

The space power electronics market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in space power electronics market are power discrete, power module and power ic.

In terms of platform type, power segment to command 28.7% share in the space power electronics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Space-based C4ISR Market Size and Share Forecast Outlook 2025 to 2035

Space Lander and Rover Market Size and Share Forecast Outlook 2025 to 2035

Space Frame Market Size and Share Forecast Outlook 2025 to 2035

Space Situational Awareness Market Size and Share Forecast Outlook 2025 to 2035

Space Robotics Market Size and Share Forecast Outlook 2025 to 2035

Space On Board Computing Platform Market Size and Share Forecast Outlook 2025 to 2035

Space Militarization Market Size and Share Forecast Outlook 2025 to 2035

Space Economy Market Size and Share Forecast Outlook 2025 to 2035

Space Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Space Tourism Providers

Space Tourism Industry Analysis by Supplier, by Age Group, by Tourism Type, by Demographics, by Nationality, by Booking Channel, by Tour Type, and by Region - Forecast for 2025 to 2035

Spacer Tapes Market Insights & Growth Outlook through 2034

Space DC-DC Converter Market Insights – Growth & Forecast 2024-2034

Space-Based Solar Power Market Size and Share Forecast Outlook 2025 to 2035

In Space Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA