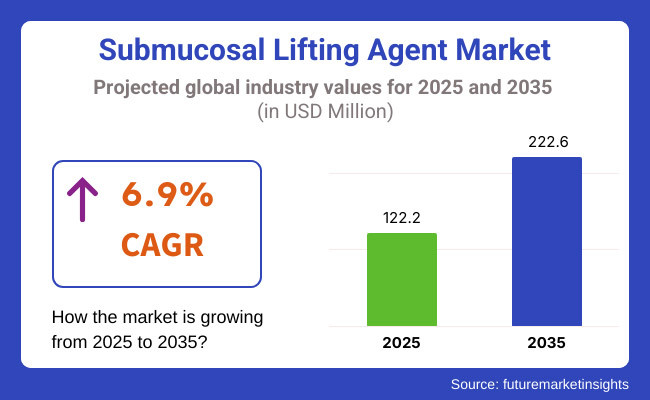

Between 2025 and 2035, the increase in the submucosal lifting agent market will be greatly helped by the use of innovative endoscopic procedures and the increasing frequency of gastrointestinal disorders. The industry is forecast to grow at a robust CAGR of 6.9%, thereby reaching USD 122.2 million by 2025 and its estimated industry value of USD 222.6 million in 2035.

Based on application, the report scope includes submucosal lifting agents in polyps and tumors resection, where demand for submucosal lifting agents is likely to be influenced by the increasing penetration of minimally invasive procedures in gastroenterology.

The growing number of cases of colorectal cancer worldwide further fuels the demand for efficient endoscopic treatments. The major industry players are concentrating on R&D activities that enhance procedural efficiency by producing biocompatible and long-lasting lifting agents.

In addition, it is growing due to supportive regulatory approvals and increasing healthcare spending in emerging industries. Asia-Pacific is anticipated as the fastest developing region because of growing recognition and improved health care infrastructure, and North America and Europe will proceed dominating the industry share. The constantly improving technologies, therefore, stimulate industry growth over the next decade.

Evolution in Submucosal Lifting Agent Industry Landscape

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate growth due to rising endoscopic procedures | Accelerated growth with wider adoption of advanced lifting agents |

| Traditional agents with shorter lifting duration | Next-generation agents with enhanced biocompatibility and longer effect |

| Gradual approvals in key regions like the USA and Europe | Streamlined approval processes and expanded approvals in emerging industries |

| Limited to advanced healthcare facilities | Widespread adoption across hospitals and ambulatory centers |

| Rising colorectal cancer cases and demand for minimally invasive procedures | Continued increase in gastrointestinal diseases and technological advancements |

| Dominated by a few key players | Increased competition with new entrants and product innovations |

| Strong presence in North America and Europe | Rapid growth in Asia-Pacific and Latin America |

| Initial R&D investments in novel lifting agents | Higher investments in bioengineered and long-lasting solutions |

| Limited access in developing regions | Improved accessibility and affordability in emerging industries |

FMI conducted a comprehensive submucosal lifting agent industry survey involving stakeholders, including healthcare professionals, manufacturers, and regulatory bodies. The survey was conducted for the purpose of gaining insights regarding the current industry dynamics, challenges, and future growth prospects.

It was one of the few studies highlighting the emerging trend of increasing demand for minimally invasive procedures, which necessitated effective agents for submucosal lifting. These agents should play the role of a good partner to help patients increase the safety and efficacy of endoscopic resections in clinical practice, healthcare professionals said. Manufacturers noted ongoing R&D efforts toward innovation and product formulation improvements with a special emphasis on biocompatibility and long-lasting lifting effect.

Those are two key findings from a survey of regulatory bodies that took part in the survey described during a presentation about a EUREKA staff background paper. They cited a shift towards stricter assessments to confirm the safety of the patients being treated, which has led manufacturers to comply with higher standards and more thorough clinical trials. This change is expected to enhance the trust and actual usage of new submucosal lifting agents in clinics.

Overall, the FMI survey was reflective of a general spirit among stakeholders to shore up existing challenges and take advantage of emerging opportunities. Collectively, these insights point to a favorable outlook for the submucosal lifting agent industry, enabled by the advent of technology, along with a common ground towards improving patient outcomes.

Government policies significantly influence the development, approval, and commercialization of submucosal lifting agents. Regulations vary by country, affecting industry dynamics differently across regions. Below is a table outlining specific regulations by country:

| Countries | Regulations Impacting the Submucosal Lifting Agent Industry |

|---|---|

| United States | The Food and Drug Administration (FDA) classifies submucosal lifting agents as Class II medical devices, requiring 510(k) preindustry notification. Recent recalls, such as the Class 2 Device Recall of Boston Scientific's ORISE Gel, highlight the FDA's stringent monitoring to ensure safety and efficacy. |

| European Union | The European Medicines Agency (EMA) oversees the approval process, with devices needing to meet the Medical Device Regulation (MDR) standards. The MDR emphasizes clinical evaluation and post-industry surveillance, impacting how manufacturers conduct trials and monitor product performance. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) regulates medical devices, including submucosal lifting agents. The approval process involves rigorous clinical testing and quality assurance measures, aligning with global standards to ensure patient safety. |

| China | The National Medical Products Administration (NMPA) requires local clinical trials for medical devices, including submucosal lifting agents, even if they are approved elsewhere. This regulation affects the timeline and strategy for foreign manufacturers entering the Chinese industry. |

| India | The Central Drugs Standard Control Organization (CDSCO) classifies these agents under medical devices, necessitating adherence to the Medical Device Rules, 2017. Recent efforts to harmonize with international standards aim to streamline approvals and boost industry growth. |

| Category | Details |

|---|---|

| Leading Companies | Dentsply Sirona; KaVo Dental; EMS Dental; ACTEON Group; Hu-Friedy |

| Market Share |

|

| Key Strategies |

|

| Developments in 2024 |

|

| Mergers & Acquisitions |

|

| Industry Trends |

|

The submucosal lifting agent industry is a subset of the medical device and biotechnology industry in general, and an integral part of the endoscopic and minimally invasive surgical device segment. Such agents can be utilized in gastrointestinal (GI) endoscopy, especially in procedures such as endoscopic mucosal resection (EMR) and endoscopic submucosal dissection (ESD), facilitating polyp and early-stage tumor resection.

The Macro-Economic View (2025 to 2035)

The industry for submucosal lifting agents is likely to witness steady growth, attributed to the rising incidence rates of colorectal cancer, growing adoption of minimally invasive procedures, and advances in endoscopic technologies. Demand for efficient lifting agents is anticipated to be on the rise due to global healthcare systems focusing on cost beneficial and outpatient base treatments. Economic trends such as healthcare expenditure, reimbursement policies as well as regulatory changes also impact global industry.

The industry in North America and Europe will lead due to well-established healthcare infrastructure and early adoption of advanced technologies, while Asia-Pacific will record fastest growth on account of improving healthcare facilities and increasing awareness regarding gastrointestinal diseases. And government policies and reimbursement structures will continue to be essential for industry penetration, especially in emerging economies.

Furthermore, the competition will also be defined by mergers, acquisitions, and R&D investments and the push for innovative, stable, and biocompatible formulations. In this changing landscape, where global health priorities are gradually moving in favor of preventive care and early disease detection, the demand for advanced submucosal lifting agents is expected to rise significantly in the annual outlook period (2023-2035), ensuring healthy industry growth through 2035.

The current submucosal lifting agent products are also evolving as scientists develop more efficient ingredient formulations for both procedural efficiency and patient outcomes. Lifting Agent innovation has previously opted for class vectors - this includes Poloxamer 188 and Polyoxyl-15-hydroxystearate, Gellan gum and Polysaccharide, Sodium Hyaluronate, Cellulose, Absorbable Starch Polymers, and Poloxamers.

These ingredients work on achieving a better viscosity, retention time, and biocompatibility, all of which are considered key to an efficient submucosal elevation in endoscopy. Companies are developing more stable and long-lasting formulations to improve precision and reduce complications. With demand for advanced lifting agents set to rise as healthcare providers look for solutions that offer improved lesion removal with minimal tissue damage.

Regulatory expectations and sustainability goals are also driving companies towards biodegradable and naturally derived ingredients. New product launches Core Competencies that will Shape the Competitive Landscape During the Forecast PeriodClinical trials and Regulatory approvals.

The indication for use of submucosal lifting agents is generally limited to treatment of polyps, adenomas, early-stage carcinoma, and gastrointestinal mucosal lesions. Increasing cases of colorectal and gastrointestinal cancers are driving the wider use of these agents in endoscopic procedures that are rapidly gaining popularity due to their minimally invasive nature.

Healthcare professionals are focusing on the rapid diagnosis and elimination of precancerous lesions, thus driving the demand for better lifting solutions. This has caught the attention of endoscopists around the world for the potential of these agents to create a safer working environment during polyp and adenoma resections.

These applications will continue to grow steadily as ESD and EMR techniques are more advanced. New methods that combine artificial intelligence for lesion detection may also help increase adoption by enhancing procedural accuracy. The continued demand for precise and effective submucosal lifting will be one of the main factors influencing purchasing decisions, as healthcare institutions will prefer those products that show consistent results and better handling characteristics.

Since a significant volume of endoscopic procedures are performed for gastrointestinal ailments in hospitals, they are the leading end users of submucosal lifting agents. The prestigious medical facilities and large hospitals which have a dedicated gastroenterology department are investing in state-of-the-art lifting agents for better patient outcomes and shorter procedure time. It is being more commonly used by specialty clinics in developed areas, where outpatient endoscopic techniques are rising.

With a preference shift from patients towards minimally invasive procedure delivery in an ambulatory environment, a demand from surgical centers is growing. As such, these procedures focus on low-cost solutions for improved safety, reinforcing the need for lifting agents in their toolbox. With an advanced landscape, the industry is expected to be propelled by a rising number of specialist endoscopy centers, especially in the Asia-Pacific and Latin America region.

As new clinical protocols come into play, including the need to lift patients in isolation, healthcare providers are searching for lifting agents that will meet their requirements, forcing manufacturers to create tailored solutions for various care modalities. Technologies for advanced gastrointestinal treatment will become more prevalent in facilities, which will further change the end-user landscape.

The submucosal lifting agent industry is expected to have lucrative growth opportunities owing to the technological upgrades in the endoscopic procedures, rising cases of gastrointestinal disorders and the global trend of minimally invasive treatment. Emerging industries in Asia-Pacific, Latin America, and the Middle East are becoming hotspots for expansion owing to the improving healthcare infrastructure and rising patient awareness.

The growing use of artificial intelligence (AI) and robotics in endoscopic surgeries will also contribute to the use of effective lifting agents that can enable more accurate and safe resections. Additionally, a growing trend in the industry is towards biodegradable and longer acting formulations that provide longer tissue elevation, minimizing the need for repeat injections in the course of a procedure.

With this, companies need to associate with healthcare organizations and research organizations for the next generation of lifting agents. Fuelling clinical trials and getting necessary regulatory approvals in major industries such as United States, Europe & Japan, will help garner faster acceptance and adoption.

Investments and partnerships with local distributors in industries with developing economies may also yield positive results through increased industry penetration and improved accessibility. Instead, manufacturers must also stress sustainability by creating eco-conscious formulations that meet the global trend toward regulatory action for safer and more biodegradable medical supplies.

Consider price structures that are cost-efficient but high performing enough to service both premium and budget industry segments. This will facilitate a competitive edge through value-based solutions such as discounted or bundled products with complementary endoscopic tools. The uptake will also depend heavily on digital marketing aimed at endoscopists and healthcare professionals.

Regulatory compliance still dominates, and companies need to take a proactive approach to the changing guidelines to avoid industry entry barriers. Innovations, global expansion, and strategic partnerships addressing clinical needs and economic constraints are the key factors expected to shape the submucosal lifting agent industry over the forecast period.

In the United States, the retraction of submucosal lifting agents' industry is projected to experience growth at a CAGR of 6.8% over the period of 2025-2035. A robust healthcare infrastructure in the country, rising preference for minimally invasive procedures, and increasing awareness regarding early cancer detection, are driving the country’s industry expansion.

The high incidence of colonic disorders provides a potential factor driving the demand for efficient lifting agents which augment the efficacy of the endoscopic mucosal resection (EMR) or endoscopic submucosal-dissection (ESD) procedures. As a result, the FDA's regulatory oversight increases the rigorous standards new formulations must meet for safety and efficacy, impacting the competitive dynamics.

Major players are investing in research and clinical trials to create next-generation biodegradable and long-lasting agents. In addition, leading medical device companies and increasing healthcare spending are also contributing to this end.

The submucosal lifting agent industry in Germany is expected to grow at a CAGR of 7.9% during the period of 2025-2035. It is a major industry owing to the advanced medical infrastructure and emphasis on minimally invasive treatment. As hospitals and surgical centers have quickly adopted endoscopic technologies, there will long be a focus on effective high-performance lifting agents that provide reliable submucosal elevation and minimization of complications during lesion removal.

The Federal Institute for Drugs and Medical Devices (BfArM) holds regulatory oversight keeping a check on the efficacy and safety of products, likening the industry competitiveness. Now companies are working on research partnerships and clinical trials in Germany to launch innovative lifting agents aimed at European health care providers. Furthermore, the demand for efficient gastrointestinal treatment solutions is being propelled by the accelerating aging population and by the rising screening programs.

In the United Kingdom, the projected growth rate for the submucosal lifting agent industry is 6.3% CAGR, during the period of 2025 to 2035. The healthcare sector in Japan is mainly concentrated on early cancer diagnosis and minimally invasive treatment methods, thus driving the demand for sophisticated lifting agents. In fact, hospitals and specialty clinics are now increasingly adopting these more precise solutions to help increase procedure efficiency and improve surgical safety.

Tools that help achieve long-lasting submucosal elevation are especially needed now that many endoscopic procedures are being done on an outpatient basis. The technologies required in their development should not run contrary to regulatory frameworks set out by the Medicines and Healthcare products Regulatory Agency (MHRA), which maintain compliance with safety standards and promote innovation by manufacturers.

The expansion of the industry is due to the increase in colorectal cancer screening programs and encouraging gastrointestinal health by the government. Moreover, product availability and industry penetration are expected to be enhanced due to strategic alliances between domestic and foreign companies.

Surgical adhesive registration in Japan between 2025 and 2035 is estimated to have 6.0 percent compound annual growth rate (CAGR) in Japan's submucosal lifting agent industry. Interestingly, the country is known for a high level of focus on technological innovation and advanced healthcare infrastructure, signifying as a global hub.

Gastrointestinal diseases prevalence is high due to urban lifestyle, which has led to an increase in endoscopic procedures infusion rate, leading to high-performance lifting agent demand. Hospitals and surgical centers are investing in solutions that improve procedural precision and shorten patient recovery.

The Pharmaceuticals and Medical Devices Agency (PMDA) is a key part of this process, responsible for vetting new products and monitoring their effectiveness and safety. Japan coats the cutting edge of R&D, with new generation lifting agents being developed by Japanese manufacturers to enhance clinical outcomes further. Moreover, collaborative efforts with global companies are encouraging improving product quality and availability in different regions.

The submucosal lifting agent industry in China is projected to expand at a CAGR of 7.2% between 2025 and 2035. Rising investment in the healthcare sector, growing awareness about colorectal cancer screening, and a rising number of endoscopic procedures are propelling industry growth. Gastrointestinal treatment in the hospitals and specialty centers across the country is being integrated with advanced technologies to improve the healthcare infrastructure.

Product approvals are handled by NMPA, which confirms that lifting agents match international safety standards. Local manufacturers focus on research for cost-effective and high-quality formulations, and international companies penetrate through strategic alliances.

The strengthening trend in preventive healthcare and early-stage cancer detection is projected to fuel substantial industry expansion over the forecast years. Moreover, synergistic government policies and rising healthcare expenditure are providing profitable opportunities for local as well as international players in China.

The submucosal lifting agent industry in India is expected to register a 10.0% CAGR between 2025 and 2035, thereby emerging as one of the fastest developing industries across the globe. There is a surge in investment levels within the country’s healthcare sector - reflected in an increase of endoscopic procedures and improvement in access to gastrointestinal treatment.

Ability to perform bendable ligation provides minimal invasive surgical procedure increase the need of effective lifters such factors help to rise consciousness towards colorectal cancer with other gastrointestinal diseases has led demand for effective vessels that are improve process of minimally invasive surgical procedures.

The regulatory environment, overseen by the Central Drugs Standard Control Organization (CDSCO), is adapting to balance the need for product safety and efficacy with the desire to promote innovation. Various overseas organizations are rapidly increasing their investments in India in association with domestic distributors and hospitals.

Combined with the government’s push for healthcare access, and an increasing penchant for medical tourism, demand for advanced medical solutions is booming. The continual growth of endoscopic procedures will, therefore, lead to India emerging as a major contributor to the growth of the global submucosal lifting agent industry.

Poloxamer 188 and Polyoxyl-15-hydroxystearate, Gellan gum and Polysaccharide, Sodium Hyaluronate, Cellulose, Absorbable Starch Polymers, Poloxamers

Polyps, Adenomas, Early-stage Cancers, Gastrointestinal Mucosal Lesions, Others

Hospitals, Specialty Clinics, Surgical Centers, Others

North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East and Africa (MEA)

Submucosal lifting agents are used in endoscopic procedures to elevate lesions, polyps, and tumors from the mucosal layer of the gastrointestinal tract, making their removal safer and more effective.

The rising prevalence of gastrointestinal diseases, increasing adoption of minimally invasive endoscopic procedures, and advancements in lifting agent formulations are key factors driving industry growth.

Asia-Pacific, particularly China and India, is expected to witness the highest growth due to increasing healthcare investments, rising awareness about colorectal cancer, and improving access to advanced medical technologies.

Recent innovations include biodegradable lifting agents, longer-lasting formulations for extended elevation, and agents with enhanced viscosity to improve endoscopic resection efficiency.

Regulatory bodies such as the FDA, EMA, and NMPA set stringent safety and efficacy standards for new products, influencing approval timelines and shaping competition among manufacturers.

Table 01: Global Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 02: Global Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 03: Global Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 04: Global Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 05: Global Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Region

Table 06: Global Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Region

Table 07: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 08: North America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 09: North America Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 10: North America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 11: North America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 12: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 13: Latin America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 14: Latin America Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 15: Latin America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 16: Latin America Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 17: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 18: Europe Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 19: Europe Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 20: Europe Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 21: Europe Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 22: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 23: South Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 24: South Asia Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 25: South Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 26: South Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 27: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 28: East Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 29: East Asia Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 30: East Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 31: East Asia Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 32: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 33: Oceania Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 34: Oceania Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 35: Oceania Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 36: Oceania Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Table 37: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 38: Middle East and Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 39: Middle East and Africa Market Volume (Units) Analysis and Opportunity Assessment 2017 to 2033, By Ingredient

Table 40: Middle East and Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By Application

Table 41: Middle East and Africa Market Value (US$ Million) Analysis and Opportunity Assessment 2017 to 2033, By End User

Figure 1: Global Market Volume (Units), 2017 to 2022

Figure 2: Global Market Volume (Units) and Y-o-Y Growth (%) Analysis, 2023 t

Figure 3: Global Market, Pricing Analysis per unit (US$), in 2022

Figure 4: Global Market, Pricing Forecast per unit (US$), in 2033

Figure 5: Global Market Value (US$ Million) Analysis, 2017 to 2022

Figure 6: Global Market Forecast and Y-o-Y Growth, 2023 to 2033

Figure 7: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023

Figure 8: Global Market Value Share (%) Analysis 2023 and 2033, By Ingredient

Figure 9: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, By Ingredient

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, By Ingredient

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, By Application

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, By Application

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, By Application

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, By End User

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, By End User

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, By End User

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, By Region

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, By Region

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, By Region

Figure 20: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 21: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 22: North America Market Value Share, By Ingredient (2023 E)

Figure 23: North America Market Value Share, By Application (2023 E)

Figure 24: North America Market Value Share, By End User (2023 E)

Figure 25: North America Market Value Share, by Country (2023 E)

Figure 26: North America Market Attractiveness Analysis By Ingredient, 2023 to 2033

Figure 27: North America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 28: North America Market Attractiveness Analysis By End User, 2023 to 2033

Figure 29: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 30: United States Market Value Proportion Analysis, 2022

Figure 31: Global Vs. United States Growth Comparison

Figure 32: United States Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 33: United States Market Share Analysis (%) By Application, 2023 to 2033

Figure 34: United States Market Share Analysis (%) By End User, 2023 to 2033

Figure 35: Canada Market Value Proportion Analysis, 2022

Figure 36: Global Vs. Canada. Growth Comparison

Figure 37: Canada Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 38: Canada Market Share Analysis (%) By Application, 2023 to 2033

Figure 39: Canada Market Share Analysis (%) By End User, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 41: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 42: Latin America Market Value Share, By Ingredient (2023 E)

Figure 43: Latin America Market Value Share, By Application (2023 E)

Figure 44: Latin America Market Value Share, By End User (2023 E)

Figure 45: Latin America Market Value Share, by Country (2023 E)

Figure 46: Latin America Market Attractiveness Analysis By Ingredient, 2023 to 2033

Figure 47: Latin America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 48: Latin America Market Attractiveness Analysis By End User, 2023 to 2033

Figure 49: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 50: Mexico Market Value Proportion Analysis, 2022

Figure 51: Global Vs Mexico Growth Comparison

Figure 52: Mexico Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 53: Mexico Market Share Analysis (%) By Application, 2023 to 2033

Figure 54: Mexico Market Share Analysis (%) By End User, 2023 to 2033

Figure 55: Brazil Market Value Proportion Analysis, 2022

Figure 56: Global Vs. Brazil. Growth Comparison

Figure 57: Brazil Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 58: Brazil Market Share Analysis (%) By Application, 2023 to 2033

Figure 59: Brazil Market Share Analysis (%) By End User, 2023 to 2033

Figure 60: Argentina Market Value Proportion Analysis, 2022

Figure 61: Global Vs Argentina Growth Comparison

Figure 62: Argentina Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 63: Argentina Market Share Analysis (%) By Application, 2023 to 2033

Figure 64: Argentina Market Share Analysis (%) By End User, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 66: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 67: Europe Market Value Share, By Ingredient (2023 E)

Figure 68: Europe Market Value Share, By Application (2023 E)

Figure 69: Europe Market Value Share, By End User (2023 E)

Figure 70: Europe Market Value Share, by Country (2023 E)

Figure 71: Europe Market Attractiveness Analysis By Ingredient, 2023 to 2033

Figure 72: Europe Market Attractiveness Analysis By Application, 2023 to 2033 203

Figure 73: Europe Market Attractiveness Analysis By End User, 2023 to 2033

Figure 74: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 75: United Kingdom Market Value Proportion Analysis, 2022

Figure 76: Global Vs. United Kingdom Growth Comparison

Figure 77: United Kingdom Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 78: United Kingdom Market Share Analysis (%) By Application, 2023 to 2033

Figure 79: United Kingdom Market Share Analysis (%) By End User, 2023 to 2033

Figure 80: Germany Market Value Proportion Analysis, 2022

Figure 81: Global Vs. Germany Growth Comparison

Figure 82: Germany Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 83: Germany Market Share Analysis (%) By Application, 2023 to 2033

Figure 84: Germany Market Share Analysis (%) By End User, 2023 to 2033

Figure 85: Italy Market Value Proportion Analysis, 2022

Figure 86: Global Vs. Italy Growth Comparison

Figure 87: Italy Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 88: Italy Market Share Analysis (%) By Application, 2023 to 2033

Figure 89: Italy Market Share Analysis (%) By End User, 2023 to 2033

Figure 90: France Market Value Proportion Analysis, 2022

Figure 91: Global Vs France Growth Comparison

Figure 92: France Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 93: France Market Share Analysis (%) By Application, 2023 to 2033

Figure 94: France Market Share Analysis (%) By End User, 2023 to 2033

Figure 95: Spain Market Value Proportion Analysis, 2022

Figure 96: Global Vs Spain Growth Comparison

Figure 97: Spain Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 98: Spain Market Share Analysis (%) By Application, 2023 to 2033

Figure 99: Spain Market Share Analysis (%) By End User, 2023 to 2033

Figure 100: Russia Market Value Proportion Analysis, 2022

Figure 101: Global Vs Russia Growth Comparison

Figure 102: Russia Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 103: Russia Market Share Analysis (%) By Application, 2023 to 2033

Figure 104: Russia Market Share Analysis (%) By End User, 2023 to 2033

Figure 105: BENELUX Market Value Proportion Analysis, 2022

Figure 106: Global Vs BENELUX Growth Comparison

Figure 107: BENELUX Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 108: BENELUX Market Share Analysis (%) By Application, 2023 to 2033

Figure 109: BENELUX Market Share Analysis (%) By End User, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 111: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 112: East Asia Market Value Share, By Ingredient (2023 E)

Figure 113: East Asia Market Value Share, By Application (2023 E)

Figure 114: East Asia Market Value Share, By End User (2023 E)

Figure 115: East Asia Market Value Share, by Country (2023 E)

Figure 116: East Asia Market Attractiveness Analysis By Ingredient, 2023 to 2033

Figure 117: East Asia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 118: East Asia Market Attractiveness Analysis By End User, 2023 to 2033

Figure 119: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 120: China Market Value Proportion Analysis, 2022

Figure 121: Global Vs. China Growth Comparison

Figure 122: China Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 123: China Market Share Analysis (%) By Application, 2023 to 2033

Figure 124: China Market Share Analysis (%) By End User, 2023 to 2033

Figure 125: Japan Market Value Proportion Analysis, 2022

Figure 126: Global Vs. Japan Growth Comparison

Figure 127: Japan Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 128: Japan Market Share Analysis (%) By Application, 2023 to 2033

Figure 129: Japan Market Share Analysis (%) By End User, 2023 to 2033

Figure 130: South Korea Market Value Proportion Analysis, 2022

Figure 131: Global Vs South Korea Growth Comparison

Figure 132: South Korea Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 133: South Korea Market Share Analysis (%) By Application, 2023 to 2033

Figure 134: South Korea Market Share Analysis (%) By End User, 2023 to 2033

Figure 135: South Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 136: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 137: South Asia Market Value Share, By Ingredient (2023 E)

Figure 138: South Asia Market Value Share, By Application (2023 E)

Figure 139: South Asia Market Value Share, By End User (2023 E)

Figure 140: South Asia Market Value Share, by Country (2023 E)

Figure 141: South Asia Market Attractiveness Analysis By Ingredient, 2023 to 2033

Figure 142: South Asia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness Analysis By End User, 2023 to 2033

Figure 144: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 145: India Market Value Proportion Analysis, 2022

Figure 146: Global Vs. India Growth Comparison

Figure 147: India Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 148: India Market Share Analysis (%) By Application, 2023 to 2033

Figure 149: India Market Share Analysis (%) By End User, 2023 to 2033

Figure 150: Indonesia Market Value Proportion Analysis, 2022

Figure 151: Global Vs. Indonesia Growth Comparison

Figure 152: Indonesia Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 153: Indonesia Market Share Analysis (%) By Application, 2023 to 2033

Figure 154: Indonesia Market Share Analysis (%) By End User, 2023 to 2033

Figure 155: Malaysia Market Value Proportion Analysis, 2022

Figure 156: Global Vs. Malaysia Growth Comparison

Figure 157: Malaysia Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 158: Malaysia Market Share Analysis (%) By Application, 2023 to 2033

Figure 159: Malaysia Market Share Analysis (%) By End User, 2023 to 2033

Figure 160: Thailand Market Value Proportion Analysis, 2022

Figure 161: Global Vs. Thailand Growth Comparison

Figure 162: Thailand Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 163: Thailand Market Share Analysis (%) By Application, 2023 to 2033

Figure 164: Thailand Market Share Analysis (%) By End User, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis, 2017 to 2022

Figure 166: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 167: Oceania Market Value Share, By Ingredient (2023 E)

Figure 168: Oceania Market Value Share, By Application (2023 E)

Figure 169: Oceania Market Value Share, By End User (2023 E)

Figure 170: Oceania Market Value Share, by Country (2023 E)

Figure 171: Oceania Market Attractiveness Analysis By Ingredient, 2023 to 2033

Figure 172: Oceania Market Attractiveness Analysis By Application, 2023 to 2033

Figure 173: Oceania Market Attractiveness Analysis By End User, 2023 to 2033

Figure 174: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 175: Australia Market Value Proportion Analysis, 2022

Figure 176: Global Vs. Australia Growth Comparison

Figure 177: Australia Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 178: Australia Market Share Analysis (%) By Application, 2023 to 2033

Figure 179: Australia Market Share Analysis (%) By End User, 2023 to 2033

Figure 180: New Zealand Market Value Proportion Analysis, 2022

Figure 181: Global Vs New Zealand Growth Comparison

Figure 182: New Zealand Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 183: New Zealand Market Share Analysis (%) By Application, 2023 to 2033

Figure 184: New Zealand Market Share Analysis (%) By End User, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 186: Middle East and Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 187: Middle East and Africa Market Value Share, By Ingredient (2023 E)

Figure 188: Middle East and Africa Market Value Share, By Application (2023 E)

Figure 189: Middle East and Africa Market Value Share, By End User (2023 E)

Figure 190: Middle East and Africa Market Value Share, by Country (2023 E)

Figure 191: Middle East and Africa Market Attractiveness Analysis By Ingredient, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness Analysis By Application, 2023 to 2033

Figure 193: Middle East and Africa Market Attractiveness Analysis By End User, 2023 to 2033

Figure 194: Middle East and Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 195: GCC Countries Market Value Proportion Analysis, 2022

Figure 196: Global Vs GCC Countries Growth Comparison

Figure 197: GCC Countries Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 198: GCC Countries Market Share Analysis (%) By Application, 2023 to 2033

Figure 199: GCC Countries Market Share Analysis (%) By End User, 2023 to 2033

Figure 200: Türkiye Market Value Proportion Analysis, 2022

Figure 201: Global Vs. Türkiye Growth Comparison

Figure 202: Türkiye Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 203: Türkiye Market Share Analysis (%) By Application, 2023 to 2033

Figure 204: Türkiye Market Share Analysis (%) By End User, 2023 to 2033

Figure 205: South Africa Market Value Proportion Analysis, 2022

Figure 206: Global Vs. South Africa Growth Comparison

Figure 207: South Africa Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 208: South Africa Market Share Analysis (%) By Application, 2023 to 2033

Figure 209: South Africa Market Share Analysis (%) By End User, 2023 to 2033

Figure 210: Northern Africa Market Value Proportion Analysis, 2022

Figure 211: Global Vs Northern Africa Growth Comparison

Figure 212: Northern Africa Market Share Analysis (%) By Ingredient, 2023 to 2033

Figure 213: Northern Africa Market Share Analysis (%) By Application, 2023 to 2033

Figure 214: Northern Africa Market Share Analysis (%) By End User, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Submucosal Injections Market - Growth & Forecast 2025 to 2035

Lifting Columns Market Size and Share Forecast Outlook 2025 to 2035

Cow Lifting Harness Market – Industry Insights & Growth 2025-2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Manual Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Hydraulic Lifting Column Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven Agent-Based Modeling – Predictive Insights & Analysis

Reagent Bottle Market Growth & Industry Forecast 2025 to 2035

Reagent Filling Systems Market Analysis – Growth & Forecast 2024-2034

Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Wetting Agent Market Size and Share Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Sealing Agent for Gold Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA