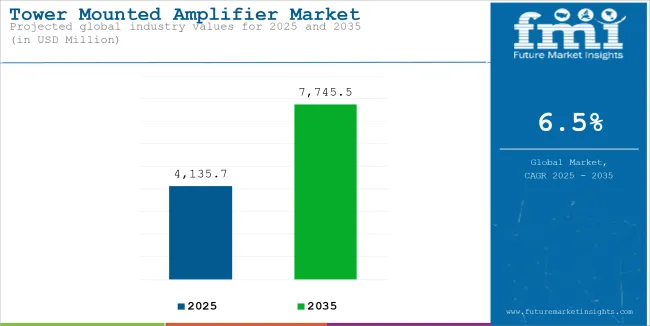

The global tower mounted amplifier market is poised for significant growth, expanding from USD 4,135.7 Million in 2025 to USD 7,745.5 Million by 2035. The market grows at a CAGR 6.5% from the period 2025 to 2035.

Tower Mounted Amplifiers (TMAs) is an important component in the modern telecommunications infrastructure, mounted at the top of the cell tower to improve signal quality and coverage. These special devices amplify a weak uplink signal from mobile devices before it reaches the base station receiver, thereby enhancing the network performance by reducing the signal-to-noise ratios.

The strategic placement of TMAs near antennas minimizes signal loss in feeder cables, thereby extending network coverage and enhancing data throughput. Their implementation has become particularly vital in urban environments where signal interference poses substantial challenges. TMAs play an essential role in optimizing network efficiency by reducing the power requirements of mobile devices and extending battery life.

Global Tower Mounted Amplifier Market Assessment

| Attributes | Description |

|---|---|

| Industry Size (2025E) | USD 4,135.7 million |

| Industry Value (2035F) | USD 7,745.5 million |

| CAGR (2025 to 2035) | 6.5% |

Advanced filtering capabilities enable precise signal processing across multiple frequency bands. Built-in monitoring systems track performance metrics and signal quality. Weather-resistant casings protect internal components from harsh environmental conditions. Low noise amplification ensures minimal signal distortion. Remote configuration options allow real-time adjustments to amplification parameters. Dual-band and triple-band support accommodates various network configurations.

Mobile network operators deploy TMAs to enhance coverage in urban and rural areas. Industrial facilities use TMAs for reliable wireless connectivity in manufacturing environments. Public safety networks rely on TMAs for emergency communication systems. Transportation hubs integrate TMAs to maintain consistent signal strength. Sports venues utilize TMAs for high-density crowd coverage. Commercial buildings implement TMAs for improved indoor signal reception.

The below table presents the expected CAGR for the global tower mounted amplifier market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the memory interconnect industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 5.8%, followed by a higher growth rate of 6.3% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.8% (2024 to 2034) |

| H2 2024 | 6.3% (2024 to 2034) |

| H1 2025 | 6.1% (2025 to 2035) |

| H2 2025 | 6.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 6.1% in the first half and remain higher at 6.7% in the second half. In the first half (H1) the market witnessed an increase of 30 BPS and in the second half (H2), the market witnessed an increase of 40 BPS.

Rising Network Densification Demands Push Tower Mounted Amplifier Adoption Rates Higher

Network densification has reached critical mass across major metropolitan regions. Tower deployment data reveals exponential growth in signal enhancement requirements, particularly in newly developed commercial zones. Urban expansion continues to strain existing network infrastructure, forcing operators to seek advanced amplification solutions. Recent construction projects incorporate dedicated TMA zones, reflecting growing awareness of connectivity requirements.

Shopping complexes, office towers, and residential high-rises consistently report signal challenges that demand immediate TMA deployment. Transport hubs have emerged as prime examples of successful high-density TMA applications, demonstrating significant improvements in network performance. Stadium renovations and entertainment venue upgrades now prioritize TMA installations as essential infrastructure components.

Commercial district redevelopment plans routinely include comprehensive TMA deployment strategies to ensure seamless connectivity. Building codes across multiple jurisdictions have evolved to accommodate TMA requirements, streamlining installation processes.

Global 5G Infrastructure Development Accelerates Tower Mounted Amplifier Integration

The telecommunications sector stands at a pivotal point in 5G infrastructure development. Field tests demonstrate substantial improvements in network performance through strategic TMA placement. Industrial parks lead early adoption rates, showcasing practical applications of 5G-enabled TMAs in manufacturing environments. Research collaborations between equipment manufacturers and network operators continue to yield optimization breakthroughs.

Smart city initiatives drive standardization of TMA specifications, creating predictable deployment frameworks. Transport networks report enhanced connectivity metrics following targeted TMA installations. Commercial zones demonstrate measurable improvements in network reliability through comprehensive TMA coverage. Technical specifications for 5G TMAs have evolved rapidly, reflecting real-world deployment experiences. Manufacturing facilities document productivity gains linked to reliable 5G coverage enabled by modern TMA systems.

Substantial Capital Requirements Create Barriers to Tower Mounted Amplifier Deployment

Financial analysis reveals significant upfront costs associated with comprehensive TMA deployments. Equipment pricing remains elevated despite increased market competition. Installation expenses create substantial barriers for smaller network operators. Maintenance contract terms often strain operational budgets. System upgrade requirements demand significant capital allocation.

Training programs require substantial resource investment. Weather protection measures add considerable costs to initial deployments. Remote location installations involve complex logistical expenses. Network expansion projects face funding challenges due to high TMA costs. Equipment certification processes add to overall deployment expenses.

The industry showcased a CAGR of 5.7% during the period between 2020 and 2024. The industry reached a value of USD 3,910.7 million in 2024 from USD 3,130.4 million in 2020.

The Tower Mounted Amplifier market has grown significantly in the world from 2020 to 2024 due to increased demand for improved network infrastructure and expansion in 5G technology. Ongoing investment by telecom operators to increase capacity and improve the delivery of service helped the market. Growth within this period was primarily driven by the rise of mobile broadband consumption and proliferation of IoT devices, all of which are in need of better solutions to amplify networks.

On the other hand, the market is estimated to grow at a CAGR of 6.5% during the forecasted period between 2025 and 2035. The market is expected to grow swiftly as it has a potential to reach a value of USD 7,745.5 million in 2035 from USD 4,135.7 million in 2025.

Considering the global rollout of 5G networks and the expected growth of wireless data traffic, demand is expected to continue to grow from 2025 to 2035 but at an accelerating rate. Indeed, with an increasing number of telecom operators turning their attention to 5G and even 6G technologies, demand for high-performance, efficient TMAs continues to rise. It also highlights that, in particular, emerging markets in the Asia-Pacific and Africa are expected to continue the high-growth trajectory in the TMA market, with much investment in developing and improving their respective telecommunication infrastructures.

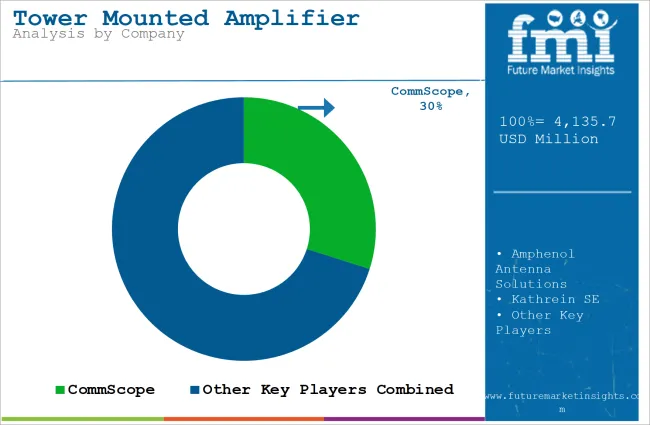

Global powerhouses CommScope, Kathrein, and Amphenol control major telecom contracts across continents. Advanced manufacturing facilities in strategic locations enable rapid product deployment. Recent 5G contracts highlight their dominance in high-performance TMAs.

Research centers constantly develop enhanced filtering technologies and remote monitoring systems. Established supply chains withstand market disruptions through diversified component sourcing. Brand recognition drives continued success in emerging markets. They represent about 35 to 40 percent of the marketplace.

Radio Frequency Systems, ACE Technologies, and Microlab excel in regional markets through specialized products. Factory expansions support growing demand from mid-sized operators. Technical support teams provide localized solutions across target regions. Distribution partnerships strengthen market presence in developing countries.

Product development focuses on specific frequency bands and deployment scenarios. Strategic acquisitions expand technical capabilities. As such, this would translate to approximately 15-20% in terms of considering market size capture for Tier 2.

Local manufacturers capture specific market segments through competitive pricing. Manufacturing operations concentrate near primary customer bases. Limited product ranges focus on essential features for regional requirements. Direct relationships with tower companies drive steady orders.

Engineering teams adapt designs for local environmental conditions. Service networks provide rapid response within operational territories. Startups and regional software providers servicing local markets would account for roughly 25-30% of the total market size.

The section highlights the CAGRs of countries experiencing growth in the tower mounted amplifier market, along with the latest advancements contributing to overall market development. Based on current estimates India, China and USA market are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 8.9% |

| China | 7.8% |

| Germany | 6.3% |

| GCC Countries | 7.0% |

| United States | 6.7% |

The telecom revolution in India has transformed the TMA market landscape. Rural connectivity drives remain at the forefront, with state governments pushing for complete digital inclusion. Local operators face unique challenges in signal optimization across diverse terrains - from the Himalayas to coastal regions. Telecom giants have ramped up their TMA installations, particularly in tier-2 and tier-3 cities where network congestion poses significant challenges.

Recent infrastructure sharing agreements between operators have created new opportunities for TMA deployments. The surge in mobile gaming and video streaming platforms has forced operators to enhance their signal quality, especially in dense urban areas. Local manufacturing initiatives have also reduced TMA costs, making them more accessible to smaller operators. Temperature variations across regions have sparked demand for specialized TMAs built for extreme conditions.

American telecom operators continue aggressive network enhancement programs across major metropolitan zones. Urban development patterns have created specific signal challenges, particularly in newly developed business districts. The explosion of IoT devices has pushed carriers to strengthen their network infrastructure through strategic TMA placements. Recent spectrum auctions have opened new frequency bands, driving demand for compatible TMAs.

Silicon Valley tech campuses showcase innovative TMA deployments for seamless connectivity. The manufacturing sector's digital transformation has sparked interest in private networks, boosting TMA requirements. Rural broadband initiatives have created fresh markets for TMA solutions. Sporting venues and entertainment complexes increasingly demand dedicated signal enhancement solutions.

Chinese industrial zones lead TMA adoption rates, driven by smart manufacturing requirements. Domestic manufacturers have achieved significant breakthroughs in TMA technology, reducing reliance on imports. The rapid expansion of high-speed rail networks has created specialized TMA deployment opportunities. Smart city projects across provinces have standardized TMA specifications for urban deployments.

Local governments actively support TMA research and development through dedicated tech zones. Manufacturing automation trends have sparked demand for reliable signal coverage in factory settings. The integration of 5G in public transport systems has opened new markets for specialized TMAs. Recent infrastructure projects showcase innovative TMA applications in challenging environments.

The section provides detailed insights into key segments of the tower mounted amplifier market. This section analyzes the growth and market share in the tower mounted amplifier market among key segments.

Network operators drive rapid TMA market expansion through aggressive infrastructure development. Rising data consumption patterns force continuous network optimization efforts. Rural coverage initiatives create fresh deployment opportunities across underserved regions. Urban network densification programs demand advanced signal amplification solutions. Recent spectrum acquisitions push operators toward enhanced coverage solutions.

Competition among carriers sparks network improvement projects. 5G rollouts require sophisticated TMA installations for optimal performance. Network sharing agreements create additional deployment scenarios. Growing enterprise connectivity demands influence operator investment decisions. Infrastructure modernization programs prioritize signal enhancement technologies.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Network Operators (End User) | 7.9% |

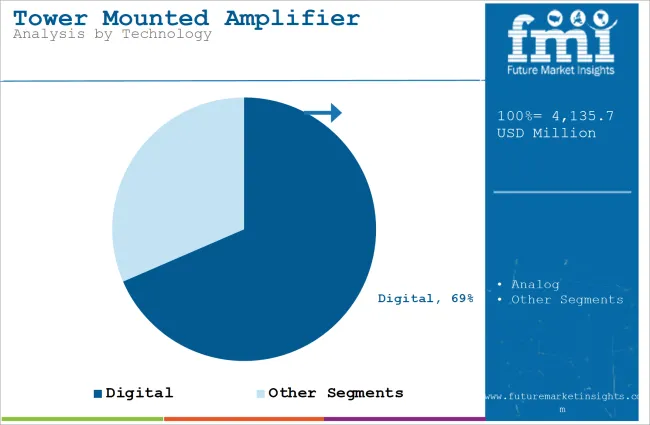

Digital technology dominates the TMA market through superior signal processing capabilities and reduced interference levels. Advanced digital filters enable precise frequency selection, crucial for modern network deployments. Real-time monitoring systems allow operators to optimize performance remotely, reducing maintenance costs. Digital TMAs support multiple frequency bands simultaneously, essential for network sharing agreements.

Integration with network management systems provides detailed performance analytics. Automated fault detection capabilities minimize network downtime. Recent installations demonstrate significant improvements in signal quality and coverage reliability. Energy efficiency gains through digital control systems reduce operational expenses.

| Segment | Value Share (2025) |

|---|---|

| Digital (Technology) | 68.5% |

Market leaders dominate through extensive distribution networks and advanced manufacturing capabilities. Regional players capture market share through specialized products and local support services. Patent portfolios protect innovative technologies while driving licensing revenues. Strategic partnerships between manufacturers and operators strengthen market positions. Recent mergers consolidate technical expertise and production capacity.

Competition centers on energy efficiency improvements and remote monitoring capabilities. Price pressures in emerging markets spark cost-optimization efforts. Research investments focus on multi-band support and signal processing enhancements. Supply chain diversification strengthens competitive advantages. Quality certifications differentiate products in crowded market segments.

Industry Update

In terms of solution, the segment is divided into Single Band and Multi Band.

In terms of deployment, the segment is segregated into Analog and Digital.

In terms of industry, the segment is segregated into Network Operators and Infrastructure Providers.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA).

The Global Tower Mounted Amplifier industry is projected to witness CAGR of 6.5% between 2025 and 2035.

The Global Tower Mounted Amplifier industry stood at USD 4,135.7 million in 2025.

The Global Tower Mounted Amplifier industry is anticipated to reach USD 7,745.5 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 8.5% in the assessment period.

The key players operating in the Global Tower Mounted Amplifier industry includes CommScope, Kaelus, Filtronic, Westell Technolgies, Comba Telecom Systems and Huawei Technologies among others.

Table 01: Global Tower Mounted Amplifier Market Volume (‘000 Units) Forecast by Product Type, 2022-2027

Table 02: North America Tower Mounted Amplifier Market Value (US$ Mn) by Product Type, 2012-2021

Table 03: North America Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Product Type, 2022-2027

Table 04: North America Tower Mounted Amplifier Market Value (US$ Mn) by Modularity, 2012-2021

Table 05: North America Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Modularity, 2022-2027

Table 06: Western Europe Tower Mounted Amplifier Market Value (US$ Mn) by Product Type, 2012-2021

Table 07: Western Europe Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Product Type, 2022-2027

Table 08: Western Europe Tower Mounted Amplifier Market Value (US$ Mn) by Modularity, 2012-2021

Table 09: Western Europe Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Modularity, 2022-2027

Table 10: Eastern Europe Tower Mounted Amplifier Market Value (US$ Mn) by Product Type, 2012-2021

Table 11: Eastern Europe Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Product Type, 2022-2027

Table 12: Eastern Europe Tower Mounted Amplifier Market Value (US$ Mn) by Modularity, 2012-2021

Table 13: Eastern Europe Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Modularity, 2022-2027

Table 14: Latin America Tower Mounted Amplifier Market Value (US$ Mn) by Product Type, 2012-2021

Table 15: Latin America Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Product Type, 2022-2027

Table 16: Latin America Tower Mounted Amplifier Market Value (US$ Mn) by Modularity, 2012-2021

Table 17: Latin America Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Modularity, 2022-2027

Table 18: APEJ Tower Mounted Amplifier Market Value (US$ Mn) by Product Type, 2012-2021

Table 19: APEJ Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Product Type, 2022-2027

Table 20: APEJ Tower Mounted Amplifier Market Value (US$ Mn) by Modularity, 2012-2021

Table 21: APEJ Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Modularity, 2022-2027

Table 22: Japan Tower Mounted Amplifier Market Value (US$ Mn) by Product Type, 2012-2021

Table 23: Japan Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Product Type, 2022-2027

Table 24: Japan Tower Mounted Amplifier Market Value (US$ Mn) by Modularity, 2012-2021

Table 25: Japan Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Modularity, 2022-2027

Table 26: MEA Tower Mounted Amplifier Market Value (US$ Mn) by Product Type, 2012-2021

Table 27: MEA Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Product Type, 2022-2027

Table 28: MEA Tower Mounted Amplifier Market Value (US$ Mn) by Modularity, 2012-2021

Table 29: MEA Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Modularity, 2022-2027

Table 30: Global Tower Mounted Amplifier Market Value (US$ Mn) by Product Type, 2012-2021

Table 31: Global Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Product Type, 2022-2027

Table 32: Global Tower Mounted Amplifier Market Value (US$ Mn) by Modularity, 2012-2021

Table 33: Global Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast by Modularity, 2022-2027

Figure 01: Global Tower Mounted Amplifier Market Value (US$ Mn), 2022-2027

Figure 02: Global Tower Mounted Amplifier Market Share by Product Type, 2022(F)

Figure 04: Global Tower Mounted Amplifier Market Share by Modularity, 2022(F)

Figure 03: Global Tower Mounted Amplifier Market Share by Product Type, 2027(F)

Figure 05: Global Tower Mounted Amplifier Market Share by Modularity, 2027(F)

Figure 06: Global Tower Mounted Amplifier Market Share by Region, 2022(F)

Figure 07: Global Tower Mounted Amplifier Market Share by Region, 2027(F)

Figure 08: Global Tower Mounted Amplifier Market Size and Y-o-Y Growth (US$ Mn), 2022-2027

Figure 09: Global Tower Mounted Amplifier Market Absolute $ Opportunity (US$ Mn), 2022-2027

Figure 10: U.S. Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 11: U.S. Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 12: Canada Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 13: Canada Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 14: North America Tower Mounted Amplifier Value Share (%) & BPS Analysis by Country, 2022-2027

Figure 15: North America Tower Mounted Amplifier Market Value Y-o-Y Growth Comparison by Country, 2022-2027

Figure 16: North America Tower Mounted Amplifier Market Attractiveness Index by Country, 2022-2027

Figure 17: North America Tower Mounted Amplifier Market Attractiveness Index by Product Type, 2022-2027

Figure 18: North America Tower Mounted Amplifier Market Attractiveness Index by Modularity, 2022-2027

Figure 19: Germany Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 20: Germany Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 21: France Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 22: France Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 23: U.K. Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 24: U.K. Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 25: Spain Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 26: Spain Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 27: Italy Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 28: Italy Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 29: Nordic Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 30: Nordic Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 31: BENELUX Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 32: BENELUX Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 33: Rest of Western Europe Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 34: Rest of Western Europe Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 35: Western Europe Tower Mounted Amplifier Value Share (%) & BPS Analysis by Country, 2022-2027

Figure 36: Western Europe Tower Mounted Amplifier Market Value Y-o-Y Growth Comparison by Country, 2022-2027

Figure 37: Western Europe Tower Mounted Amplifier Market Attractiveness Index by Country, 2022-2027

Figure 38: Western Europe Tower Mounted Amplifier Market Attractiveness Index by Product Type, 2022-2027

Figure 39: Western Europe Tower Mounted Amplifier Market Attractiveness Index by Modularity, 2022-2027

Figure 40: Russia Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 41: Russia Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 42: Poland Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 43: Poland Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 44: Rest of Eastern Europe Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 45: Rest of Eastern Europe Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 46: Eastern Europe Tower Mounted Amplifier Value Share (%) & BPS Analysis by Country, 2022-2027

Figure 47: Eastern Europe Tower Mounted Amplifier Market Value Y-o-Y Growth Comparison by Country, 2022-2027

Figure 48: Eastern Europe Tower Mounted Amplifier Market Attractiveness Index by Country, 2022-2027

Figure 49: Eastern Europe Tower Mounted Amplifier Market Attractiveness Index by Product Type, 2022-2027

Figure 50: Eastern Europe Tower Mounted Amplifier Market Attractiveness Index by Modularity, 2022-2027

Figure 51: Brazil Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 52: Brazil Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 53: Mexico Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 54: Mexico Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 55: Rest of Latin America Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 56: Rest of Latin America Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 57: Latin America Tower Mounted Amplifier Value Share (%) & BPS Analysis by Country, 2022-2027

Figure 58: Latin America Tower Mounted Amplifier Market Value Y-o-Y Growth Comparison by Country, 2022-2027

Figure 59: Latin America Tower Mounted Amplifier Market Attractiveness Index by Country, 2022-2027

Figure 60: Latin America Tower Mounted Amplifier Market Attractiveness Index by Product Type, 2022-2027

Figure 61: Latin America Tower Mounted Amplifier Market Attractiveness Index by Modularity, 2022-2027

Figure 62: China Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 63: China Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 64: India Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 65: India Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 66: ASEAN Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 67: ASEAN Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 68: Australia and New Zealand Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 69: Australia and New Zealand Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 70: Rest of APEJ Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 71: Rest of APEJ Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 72: APEJ Tower Mounted Amplifier Value Share (%) & BPS Analysis by Country, 2022-2027

Figure 73: APEJ Tower Mounted Amplifier Market Value Y-o-Y Growth Comparison by Country, 2022-2027

Figure 74: APEJ Tower Mounted Amplifier Market Attractiveness Index by Country, 2022-2027

Figure 75: APEJ Tower Mounted Amplifier Market Attractiveness Index by Product Type, 2022-2027

Figure 76: APEJ Tower Mounted Amplifier Market Attractiveness Index by Modularity, 2022-2027

Figure 77: Japan Tower Mounted Amplifier Market Attractiveness Index by Product Type, 2022-2027

Figure 78: Japan Tower Mounted Amplifier Market Attractiveness Index by Modularity, 2022-2027

Figure 79: GCC Countries Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 80: GCC Countries Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 81: North Africa Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 82: North Africa Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 83: South Africa Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 84: South Africa Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 85: Rest of MEA Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 86: Rest of MEA Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 87: MEA Tower Mounted Amplifier Value Share (%) & BPS Analysis by Country, 2022-2027

Figure 88: MEA Tower Mounted Amplifier Market Value Y-o-Y Growth Comparison by Country, 2022-2027

Figure 89: MEA Tower Mounted Amplifier Market Attractiveness Index by Country, 2022-2027

Figure 90: MEA Tower Mounted Amplifier Market Attractiveness Index by Product Type, 2022-2027

Figure 91: MEA Tower Mounted Amplifier Market Attractiveness Index by Modularity, 2022-2027

Figure 92: North America Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 93: North America Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 94: Latin America Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 95: Latin America Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 96: Eastern Europe Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 97: Eastern Europe Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 98: Western Europe Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 99: Western Europe Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 100: APEJ Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 101: APEJ Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 102: Japan Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 103: Japan Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 104: MEA Tower Mounted Amplifier Market Value (US$ Mn), 2012-2021

Figure 105: MEA Tower Mounted Amplifier Market Value (US$ Mn) and Y-o-Y Growth Forecast, 2022-2027

Figure 106: Global Tower Mounted Amplifier Value Share (%) & BPS Analysis by Region, 2022-2027

Figure 107: Global Tower Mounted Amplifier Market Value Y-o-Y Growth Comparison by Region, 2022-2027

Figure 108: Global Tower Mounted Amplifier Market Attractiveness Index by Region, 2022-2027

Figure 109: Global Tower Mounted Amplifier Value Share (%) & BPS Analysis by Product Type, 2022-2027

Figure 110: Global Tower Mounted Amplifier Market Value Y-o-Y Growth Comparison by Product Type, 2022-2027

Figure 111: Global Tower Mounted Amplifier Market Attractiveness Index by Product Type, 2022-2027

Figure 112: Global Tower Mounted Amplifier Value Share (%) & BPS Analysis by Modularity, 2022-2027

Figure 113: Global Tower Mounted Amplifier Market Value Y-o-Y Growth Comparison by Modularity, 2022-2027

Figure 114: Global Tower Mounted Amplifier Market Attractiveness Index by Modularity, 2022-2027

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Tower Mounted Amplifier Market Share & Industry Leaders

UK Tower Mounted Amplifier Market Trends – Size, Share & Growth 2025-2035

USA Tower Mounted Amplifier Market Growth – Demand, Trends & Forecast 2025-2035

Japan Tower Mounted Amplifier Market Report – Demand, Trends & Industry Forecast 2025-2035

Germany Tower Mounted Amplifier Market Analysis - Growth, Applications & Outlook 2025 to 2035

GCC Countries Tower Mounted Amplifier Market Insights - Demand, Size & Industry Trends 2025 to 2035

Tower Crane Rental Market Growth – Trends & Forecast 2025 to 2035

Tower Crane Market Growth - Trends & Forecast 2025 to 2035

Remote Towers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Telecom Tower Power System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Cat Trees & Towers Market

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Transmission Towers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA