The growing deployment of 5g networks and increase in demand for improved wireless coverage along with telecommunications infrastructure development to foster USA tower mounted amplifier market growth. The market is set to be worth USD 1,241.3 million in 2025 and effectively grow at a CAGR of 6.7% to participate in USD 2,374.1 million with the aid of using 2035.

Market Attributes and Growth Projections

| Attributes | Values |

|---|---|

| Estimated USA Market Size in 2025 | USD 1,241.3 Million |

| Projected USA Market Size in 2035 | USD 2,374.1 Million |

| Value-based CAGR from 2025 to 2035 | 6.7% |

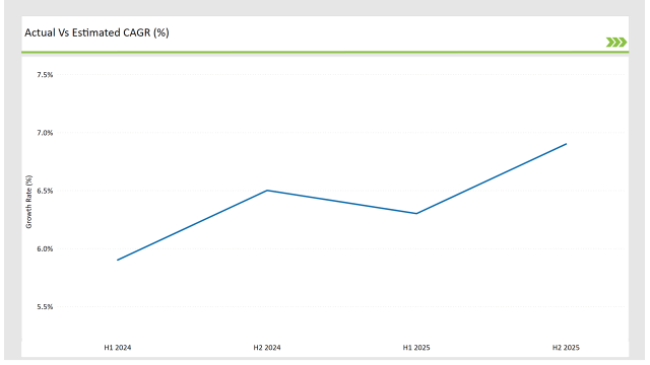

The table below outlines the semi-annual growth rate of the market, providing insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.9% (2024 to 2034) |

| H2 2024 | 6.5% (2024 to 2034) |

| H1 2025 | 6.3% (2025 to 2035) |

| H2 2025 | 6.9% (2025 to 2035) |

The CAGR for the Tower Mounted Amplifier industry shows fluctuations over semi-annual periods, reflecting market dynamics. The industry saw a 60 BPS increase from H1 2024 (5.9%) to H2 2024 (6.5%), indicating stronger growth expectations. However, a 20 BPS decline in H1 2025 (6.3%) suggests a slight market correction. Growth rebounded in H2 2025 (6.9%) with a 60 BPS rise, signalling renewed demand and market confidence. Overall, the industry exhibits an upward trend with periodic adjustments driven by evolving factors

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | CommScope expands production capacity for 5G-compatible TMAs to meet growing demand. |

| Oct-24 | Amphenol acquires a regional TMA manufacturer to strengthen its USA market presence. |

| Mar-24 | Kaelus partners with Verizon to deploy low-noise amplifiers in urban networks. |

| Sep-24 | Microdata Telecom launches multi-band TMAs for improved efficiency and reduced power consumption. |

| Dec-23 | The FCC announces new spectrum allocations, boosting demand for tower-mounted amplifiers. |

5G Expansion Driving Increased Demand for Tower-Mounted Amplifiers (TMAs)

Smart Cities & IoT Integration Bolstering TMA Market Growth

Increased Investments in Network Infrastructure Driving TMA Adoption

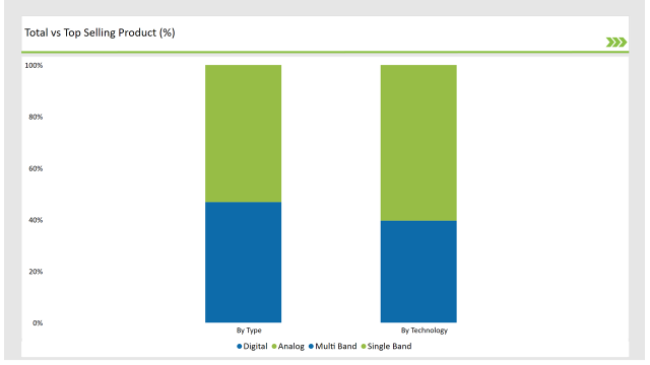

| Type | Market Share (2025) |

|---|---|

| Single Band | 53.2% |

| Multi Band | 46.8% |

| Technology | Market Share (2025) |

|---|---|

| Analog | 60.4% |

| Digital | 39.6% |

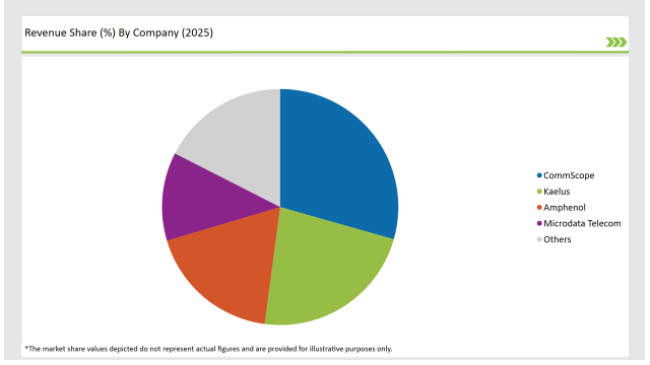

The USA tower mounted amplifier market is highly competitive, with several key players driving innovation and growth.

| Vendors | Market Share (2025) |

|---|---|

| CommScope | 29.4% |

| Kaelus | 22.7% |

| Amphenol | 18.3% |

| Microdata Telecom | 12.1% |

| Others | 17.5% |

Single-band and multi-band amplifiers cater to diverse network demands.

The transition from analog to digital amplifiers continues to evolve.

Network operators dominate, but infrastructure providers also play a key role in telecom expansion.

The market will grow at a CAGR of 6.7% from 2025 to 2035.

The industry will reach USD 2,374.1 million by 2035.

Key drivers include 5G deployment, network densification, and expanding telecom infrastructure.

The West Coast and Northeast USA lead in TMA adoption due to dense urban populations and advanced telecom networks.

The major players include CommScope, Kaelus, Amphenol, and Microdata Telecom, among others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA