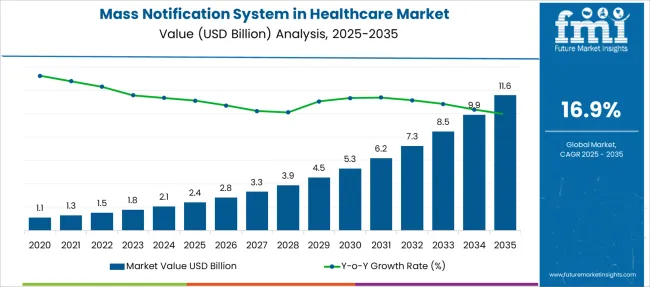

The Mass Notification System in Healthcare Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 11.6 billion by 2035, registering a compound annual growth rate (CAGR) of 16.9% over the forecast period.

| Metric | Value |

|---|---|

| Mass Notification System in Healthcare Market Estimated Value in (2025 E) | USD 2.4 billion |

| Mass Notification System in Healthcare Market Forecast Value in (2035 F) | USD 11.6 billion |

| Forecast CAGR (2025 to 2035) | 16.9% |

The mass notification system in healthcare market is expanding as healthcare facilities prioritize rapid and effective communication to enhance patient safety and operational efficiency. The increasing complexity of hospital environments has raised the need for integrated notification solutions capable of addressing emergencies, security threats, and critical operational updates in real time. Industry discussions highlight growing regulatory requirements and accreditation standards that emphasize communication readiness in healthcare settings.

Investments in digital infrastructure and smart building technologies have supported the adoption of advanced mass notification systems. Hospitals are focusing on systems that enable clear, immediate alerts across diverse staff and patient populations to reduce response times and improve crisis management.

The rising frequency of health emergencies and security incidents has further accelerated market demand. Future growth is expected to be driven by enhanced system interoperability, integration with other building management tools, and scalable solutions suitable for healthcare facilities of varying sizes. Segment growth is anticipated to be led by in-building mass notification systems as the preferred product type and hospitals as the primary end-user segment.

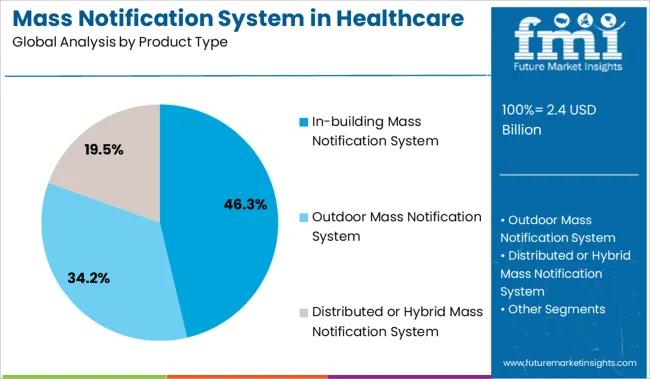

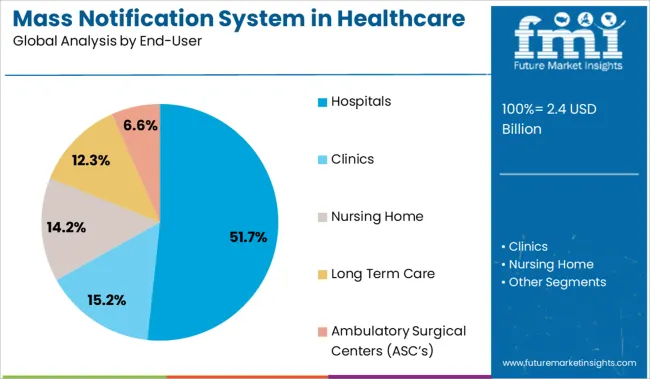

The market is segmented by Product Type and End-User and region. By Product Type, the market is divided into In-building Mass Notification System, Outdoor Mass Notification System, and Distributed or Hybrid Mass Notification System. In terms of End-User, the market is classified into Hospitals, Clinics, Nursing Home, Long Term Care, and Ambulatory Surgical Centers (ASC’s). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The in-building mass notification system segment is projected to hold 46.3% of the market revenue in 2025, maintaining its leadership as the dominant product type. Growth in this segment has been driven by the critical need for reliable, localized communication within healthcare facilities. These systems are designed to deliver immediate alerts to personnel and patients during emergencies such as fires, security breaches, or medical crises. The ability to integrate audio, visual, and digital messaging has enhanced system effectiveness.

Healthcare administrators value in-building solutions for their capability to reach specific zones quickly, minimizing confusion and ensuring coordinated responses. As healthcare campuses grow in size and complexity, demand for scalable and flexible in-building notification systems is expected to increase.

This segment will continue to lead due to its essential role in maintaining patient safety and operational continuity.

The hospitals segment is projected to account for 51.7% of the mass notification system in healthcare market revenue in 2025, retaining its position as the primary end-user. Hospitals have unique communication needs driven by large staff numbers, vulnerable patient populations, and the necessity for swift coordinated action in emergencies. The adoption of mass notification systems has been influenced by a focus on improving patient safety outcomes and meeting regulatory compliance.

Hospitals require systems that can support multi-channel messaging including voice alarms, text notifications, and integration with emergency response teams. Increasing incidents such as pandemics, security threats, and natural disasters have emphasized the value of mass notification capabilities.

As hospitals continue to expand their technological infrastructure, the demand for effective notification solutions is expected to rise, securing this segment’s leadership in the market.

| Market Statistics | Details |

|---|---|

| H1,2024 (A) | 13.0% |

| H1,2025 Projected (P) | 13.8% |

| H1,2025 Outlook (O) | 14.0% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | (+) 20 ↑ |

| BPS Change : H1,2025 (O) - H1,2024 (A) | (+) 100 ↑ |

Future Market Insights analyzes a comparison for mass notification system in healthcare market from H1,2024 to H1,2025. As per FMI, the difference in the BPS values observed in the mass notification system in healthcare market in H1, 2025 - outlook over H1, 2025 projected reflects growth of 20-unit.

Mass notification system providers now have more options to connect their products with IoT technologies and offer standalone systems as a result of the growth of the healthcare IoT. This factor drives the growth of mass notification system in healthcare market.

In addition, when compared to H1-2024, the market is anticipated to grow by 100 points in H1-2025. Due to the rise in mass casualty, there is a rising need for emergency communication tools like mass notification systems in healthcare facilities.

This therefore opens up possibilities for providing real-time clinical communication using IP-based software and other relevant equipment which in turn drives the demand for mass notification system in healthcare market.

Mobile-based mass notification apps are the current trend in the mass notification systems in the healthcare market. Due to the rising adoption of smartphones and cost-effectiveness, the operations and business processes in the healthcare sector are gaining traction towards mobility.

The mass notification system in healthcare market demand is estimated to rise at 16.9% CAGR between 2025 and 2035 in comparison with 12.4% CAGR registered during 2012 to 2024.

The global mass notification system in healthcare market is anticipate to witness an increase in revenue from ~USD 1,521.5 Million in 2025 to ~USD 3,326.5 Million by 2035. By application, hospitals segment is dominating the global mass notification systems in healthcare market. By product type distributed or hybrid mass notification system segment is projected to grow at highest CAGR of 20.9% during 2025 to 2027.

Due to many benefits offered by the mass notification systems, healthcare organizations across the globe are increasingly deploying these systems in order to achieve a better communication system and run an efficient and modern business.

For instance, according to an article published by Health Facilities Management, a publication of the American Hospital Association, provided few cases where healthcare organizations were using the mass notification system to enhance their business operations.

The cases were:

Therefore, adoption of mass notification system in healthcare institutes fuels the demand for the mass notification system in healthcare.

Currently, demand for emergency communication platforms such as mass notifications systems in healthcare centers is growing due to increasing number of mass casualty. This in turn creates huge opportunities for using IP-based software and other related devices to provide real-time clinical communication. This software will enable an organization to connect with multiple channels to provide enhanced communication services.

The emergence of healthcare IoT has created new opportunities for mass notification service providers to integrate their solution with IoT technologies to provide standalone systems. The present mass notification systems provide multiple communication channels such as SMS, email, phone calls etc. The deployment of a standalone system that activates all the channels quickly will create huge opportunity to improvise the communication systems.

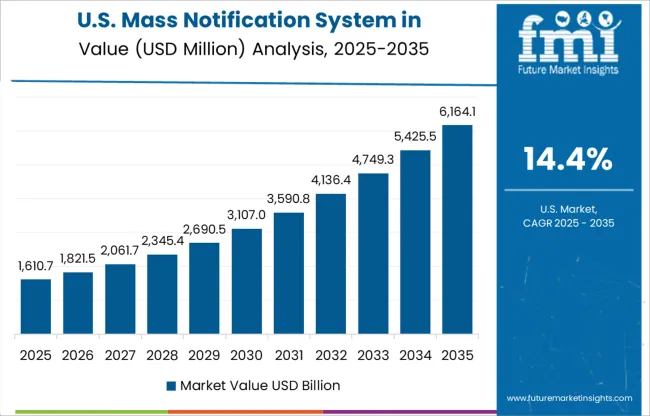

The sales revenue in USA is estimated to increase at an impressive rate of around 5.3% CAGR between 2025 and 2035. USA market is anticipated to create an absolute dollar opportunity of USD 2.4 Million during 2025 to 2027.

The growth of mass notification system in healthcare market in US has been significant in recent years. This attributes to factors such as growing adoption and development of pioneering technologies, increasing demand for fast message delivery in emergency cases, and presence of key vendors in the region. In addition, the demand for duress-based solutions across education and healthcare sector has been increased. USA government focuses on public safety and supports the development in healthcare facilities. It is expected to drive the demand for mass notification system in healthcare solutions in the country.

India is set to register exponential growth of mass notification system in healthcare market with a CAGR of 9.3% during 2025 to 2027. India market is anticipated to create an absolute dollar opportunity of USD 148.9 Million during 2025 to 2027.

According to India Tourism Statistics, 697,300 foreign tourists came for medical treatment in India in the year 2020. Healthcare is India’s largest sector both in terms of employment and revenue. The Indian healthcare market shows impressive growth in healthcare sector due to its strengthening services, coverage, and rising expenditure by private as well as public players. Thus India is expected to show significant growth in mass notification system in healthcare market in coming years.

UK is predicted to remain one of the most attractive markets during the forecast period. According FMI, UK is expected to account for nearly 25.7% of the Western Europe market share in 2024.

UK is one of the prominent country considering healthcare industry and witnesses major marketing and manufacturing pharmaceuticals and clinical products. UK government also supports the investment in life sciences and give R&D tax breaks. Due to stringent rule and regulations by UK government and presence of developed infrastructure for healthcare sector, the demand for mass notification system in healthcare has been increased.

By product type, in-building mass notification system segment is expected to contribute the revenue share of more than 56.4% in 2025. Moreover, distributed or hybrid mass notification system segment is expected to grow at highest CAGR of 20.9% during 2025 to 2027.

In-building mass notification system provides features such as improve response times, engage and align employees, boost efficiency levels, tighten up communication, and many more. It allows staff to communicate with management in the shortest time possible. Due to such benefits, the demand for the in-building mass notification system segment has been increased in recent years.

By end-user, hospitals segment is expected to showcase higher market share of 45.4% during 2025 to 2027. Moreover, long term care segment expected to reach 2.5X by 2035.

Mass notification system in healthcare vertical is a broadcast communications tool that helps in communicating with large number of people in lesser time. It is an integral component of any healthcare organization, especially hospitals. It majorly used in case of emergencies and routine communication. Thus, the demand for mass notification system in hospitals across the globe is increasing in recent years.

Mass notification system in healthcare market players are focusing on developing innovative solutions in order to increase its client base and increase its presence in the market. The key players develop mass notification system that provides various innovative solutions in different applications.

| Attribute | Details |

|---|---|

| Market value in 2025 | USD 1,521.5 million |

| Market CAGR 2025 to 2035 | 16.9% |

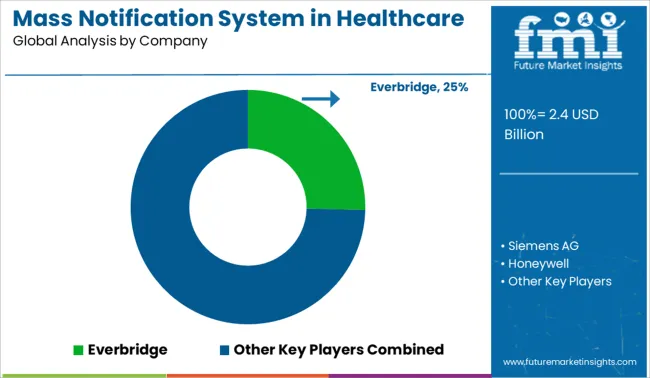

| Share of top 5 players | Around 20% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2012 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Western Europe; Eastern Europe; Latin America; Asia Pacific Excluding Japan; Japan; Middle East and Africa |

| Key Countries Covered | USA, Canada, Germany, UK, France, Italy, Spain, Russia, Poland, China, Japan, South Korea, India, Australia and New Zealand, Turkey, Northern Africa, and South Africa |

| Key Segments Covered | Product Type, End-User, Region |

| Key Companies Profiled | Eaton Corporation; Honeywell International Inc.; Siemens AG; AtHoc, Inc.–(BlackBerry Limited); Everbridge, Inc.; ONSOLVE, LLC; Singlewire Software, LLC; Desktop Alert, Inc.; Mircom Group of Companies; Alert Media Inc.; Spok, Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global mass notification system in healthcare market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the mass notification system in healthcare market is projected to reach USD 11.6 billion by 2035.

The mass notification system in healthcare market is expected to grow at a 16.9% CAGR between 2025 and 2035.

The key product types in mass notification system in healthcare market are in-building mass notification system, outdoor mass notification system and distributed or hybrid mass notification system.

In terms of end-user, hospitals segment to command 51.7% share in the mass notification system in healthcare market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Massoia Bark Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

Mass Transfer Trays Market Size and Share Forecast Outlook 2025 to 2035

Massage Therapy Service Market - Growth & Forecast 2025 to 2035

Massage Guns Market Analysis – Demand, Growth & Forecast 2025–2035

Industry Share Analysis for Massage Therapy Service Providers

Massive MIMO Market

Massage Equipment Market

Mass Finishing Consumables Market Size and Share Forecast Outlook 2025 to 2035

Mass Loaded Vinyl (MLV) Market Size and Share Forecast Outlook 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Mass Notification Systems Market Analysis by Component, Solution, Application, and Industry, and Region Through 2035

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Biomass Gasification Market Size and Share Forecast Outlook 2025 to 2035

Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Hand Massager Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Spatial Mass Spectrometry Market Size and Share Forecast Outlook 2025 to 2035

Vending Massage Chair Payment Solution Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA