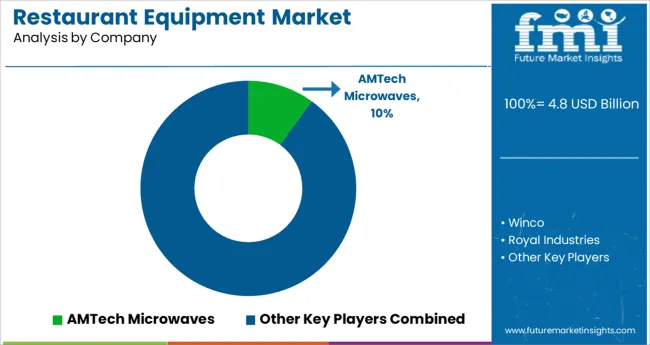

The Restaurant Equipment Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

The restaurant equipment market is evolving rapidly as rising foodservice demand, changing consumer dining habits, and operational efficiency goals converge to shape industry priorities. The market has been witnessing steady adoption of advanced, energy-efficient, and modular equipment across foodservice establishments, as operators aim to optimize kitchen workflows, reduce costs, and comply with environmental standards.

Increasing urbanization, growing hospitality investments, and a preference for high-quality dining experiences are driving establishments to upgrade to reliable, durable equipment that enhances productivity and maintains food safety standards. Future growth is anticipated to be supported by technological innovation, such as smart connected appliances and automated systems, alongside a growing emphasis on sustainability and staff well-being.

Strategic collaborations between manufacturers and restaurant chains, as well as standardization of operational practices, are paving the way for long-term adoption and market expansion.

The market is segmented by Type and Application and region. By Type, the market is divided into Cooking Equipment, Restaurant Work Tables, Food Holding and Warming, and Food Preparation Equipment. In terms of Application, the market is classified into Hotels, Diner, Fast Food Chains, Food Truck, Cart, Or Stand, Cafe, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

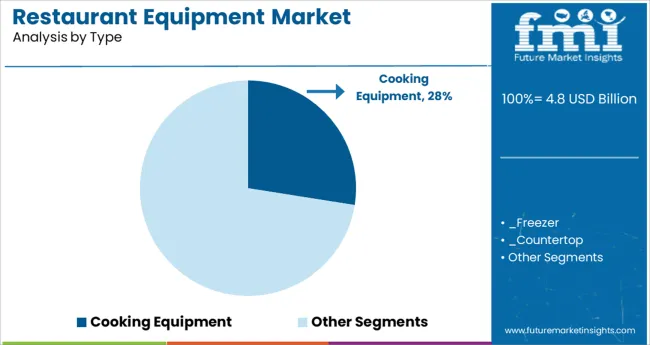

When segmented by type, cooking equipment is expected to account for 27.5% of the total market revenue in 2025, positioning it as the leading type segment. This leadership is attributed to its indispensable role in food preparation and its continuous demand across all scales of foodservice operations.

The durability, versatility, and critical function of cooking equipment in ensuring food quality and consistency have driven its sustained dominance. Industry practices reveal that kitchens prioritize investment in reliable ovens, grills, fryers, and ranges that can withstand high-volume usage and deliver uniform results.

Advancements in energy efficiency, multifunctional designs, and compact formats have further strengthened its appeal by enabling space optimization and lowering operating costs. The ability of cooking equipment to directly influence throughput, menu flexibility, and operational efficiency has reinforced its significance as the cornerstone of commercial kitchen setups.

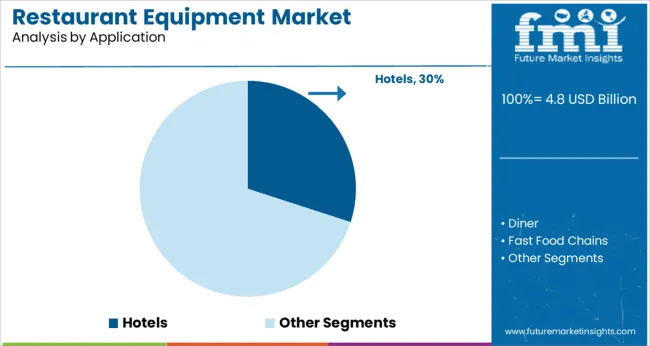

When segmented by application, hotels are projected to capture 30.0% of the total market revenue in 2025, making it the leading application segment. This prominence is supported by the consistent demand for high-quality kitchen infrastructure in hospitality environments, where foodservice is integral to guest satisfaction and brand positioning.

Hotels have been prioritizing investments in modern, efficient, and aesthetically pleasing kitchen setups that cater to diverse cuisines and large-scale operations. The need to maintain high standards of hygiene, deliver varied menu offerings, and support round-the-clock service has driven the adoption of advanced restaurant equipment in this segment.

Strategic renovations, expansion of luxury and boutique properties, and alignment with sustainability goals have further reinforced hotel operators’ commitment to upgrading kitchen facilities. The ability of restaurant equipment to enhance operational efficiency, minimize downtime, and contribute to a superior guest experience has ensured its continued dominance in the hotel application category.

Consumer adoption of energy-efficient appliances is made easier by rising consumer awareness of energy use and environmentally friendly activities, which benefits the sales of restaurant equipment.

Global standards for energy usage place a strong emphasis on lowering GreenHouse Gas (GHG) emissions in order to lessen the growing effects of climate change. End users increasingly favor appliances with the ENERGY STAR label, which denotes the equipment's high energy efficiency and lowers operating and maintenance expenses in cafés, restaurants, and institutional kitchens.

According to data from the Energy Star program of the USA Environmental Protection Agency (EPA), end-user operators who employ food service equipment with the ENERGY STAR designation can save around 340 MMBTU annually, or USD 5,300.

Due to their increased production efficiency and cheap running costs, restaurant equipment adoption is considerable. They are mostly used in food service enterprises. The increased demand for food items prepared using modern restaurant equipment and the introduction of restaurant equipment with ENERGY STAR certification would both help the adoption of these products.

| Attributes | Details |

|---|---|

| Restaurant Equipment Market CAGR (2025 to 2035) | 7.9% |

| Restaurant Equipment Market Size (2025) | USD 4.8 billion |

| Restaurant Equipment Market Size (2035) | USD 10.2 billion |

Food safety is the primary goal of any restaurant equipment manufacturer, and the creation of these devices demands competent workers who can run both manual and automated machinery.

The integration of automated food service equipment is more expensive and is accompanied by an increase in the need for skilled laborers and other automated facilities. As a result, the machines' overall setup and maintenance costs rise, which restricts the restaurant equipment market expansion.

With a market share of 32.6%, cooking equipment dominates the restaurant equipment market during the forecast period.

The need for cooking equipment in general and convenience stores, full-service and quick-service restaurants, etc., is expected to increase tremendously. The rise in popularity of inventive cooking and baking has given consumers a range of dining options. Restaurants engage in various types of cooking equipment as a result, which spurs the expansion of the restaurant equipment market.

Due to the rising demand for ware washing equipment in commercial kitchens to maintain a clean environment, and utensils for offering clients safe food products, this market is predicted to increase significantly.

Similar to this, it is predicted that food holding and warming equipment is likely to continue to develop as a result of the need to store vast quantities of food products.

Hotels are anticipated to experience considerable growth as a result of the youth’s desire for such lounges. The global restaurant equipment industry is dominated by the hotel sector, which holds a 37.1% market share.

The adoption of new restaurant equipment technologies for cooking, storing, and serving food in full-service restaurants has been aided by consumers' preferences for novel cuisines at affordable rates.

However, due to the slow adoption of restaurant equipment, the general and retail shop segment is likely to experience sustained expansion.

Due to rising investments, particularly from the end-use industries, the US restaurant equipment market is anticipated to have the largest market share of 28.5% by 2035.

With more hotels, restaurants, and business travel, the market for restaurant equipment is expanding. According to the Restaurant Performance Index of the National Restaurant Association, the USA restaurant industry was worth roughly USD 3.3 billion in 2020.

The USA has over 1 million restaurants, which is a significant growth driver for the demand for restaurant equipment. Revenue for hotels, restaurants and food service businesses rises when consumers spend more of their discretionary cash on non-essential luxury items like travel and dining out.

The demand for restaurant and hotel equipment distributors rises as hotels and restaurants can expand their businesses and replace their current equipment as more money comes in, giving new opportunities to the restaurant equipment market players.

UK restaurant equipment is expected to develop at a 4.9% CAGR by 2035.

The rapidly expanding hotel sector around the world is fueling Europe's restaurant equipment market expansion. The exponential rise in the number of food service businesses, notably in the UK, can also be linked to the rising need for this equipment.

With more hotels and restaurants opening up and the travel and tourism business growing throughout the continent, the food service industry in Europe is predicted to experience substantial market expansion.

Restaurants are increasingly embracing technologically advanced food service equipment to improve their offerings, driving the demand for restaurant equipment. Additionally, it is projected that during the next few years, there is likely to be a huge demand for restaurant equipment due to the increased demand for bakery and confectionery items in Germany, the UK, and France.

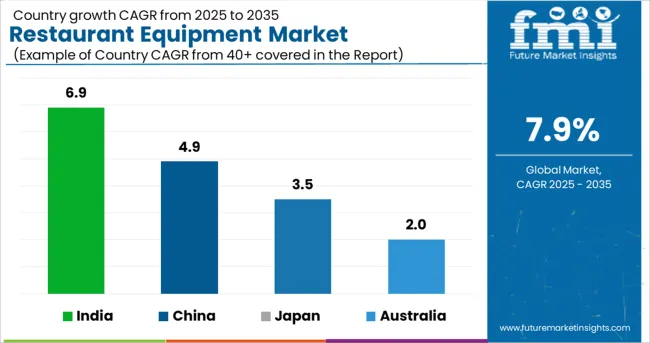

| Countries | Market Share/CAGR |

|---|---|

| Japan | 3.5% |

| Australia | 2.0% |

| China | 4.9% (CAGR) |

| India | 6.9% (CAGR) |

The Asia Pacific market is expected to rise exponentially over the forecast period as a result of the country's, China's, and Japan's developing hospitality industries. According to data provided by the National Restaurant Association of India (NRAI), chances for restaurant equipment market expansion exist, as the country's food service sector is predicted to reach over USD 4.8 billion by the end of 2025.

In addition, the rising demand for frozen food items in China and Japan is anticipated to fuel regional market expansion for restaurant equipment. Additionally, restaurants are including a variety of cuisines on their menus, since more and more patrons are trying new meals and developing a taste for various cuisines.

Restaurants' preference for modern equipment encourages manufacturers of restaurant equipment to advance their technological concepts.

During the forecast period, there is a great need for modern restaurant equipment due to rising awareness about food safety and smart kitchen gadgets. As a result, the development of IoT, Big Data, and Industry 4.0 has sparked the growth of smart food companies that produce technology-based machinery.

This assists restaurants in achieving the greatest degree of food safety while lowering costs, reducing waste, improving traceability, and minimizing risks related to diverse food serving ways that are quickly becoming a major restaurant equipment market trend.

To improve the customer experience and grab business opportunities in the restaurant equipment market, manufacturers are creating products based on AI and IoT technology. For instance, Samsung introduced a 21-inch IoT-enabled refrigerator with Bixby voice control in July 2020.

According to the safety guidelines established by numerous regulatory authorities worldwide, businesses are required to sell restaurant equipment that has been certified and tested. These safety requirements seek to establish a secure atmosphere for patrons and restaurant owners alike.

Equipment safety standards have been set by the National Sanitation Foundation (NSF), a non-profit organization in the USA that performs product testing, inspections, and certifications while ensuring that sanitation and food safety standards are upheld by the end-use industry.

Standards have been created for the type of material utilized, the design, and the architecture of the equipment, with food safety being given top emphasis.

Quick-service restaurants include Subway, McDonald's, Burger King, KFC, Taco Bell, and Wendy's. A rise in the number of quick-service restaurants has led to an increase in the demand for cooking appliances like fryers and ovens, due to changes in how people eat and how busy they are, as well as an increase in disposable income, the number of women working and increasing digitalization.

All of these elements consequently have a big impact on the sales of the restaurant equipment. The Vollrath Company, LLC unveiled a new line of frozen beverage granita machines in May 2020. These small-sized machines are used to make a wide range of milk-based, cold, frozen, and high-margin beverages, such as ice tea, coffee, frozen cocktails, granitas, smoothies, and many more.

The increasing use of sustainable technology equipment has forced major players in restaurant equipment to concentrate on business methods like partnerships, mergers, and acquisitions that are advantageous to their companies.

To combat food waste by grocery stores, hypermarkets, and supermarkets, major manufacturers are working with solution providers to develop technology that is customer-centric.

Recent Developments in the Restaurant Equipment Market:

The global restaurant equipment market is estimated to be valued at USD 4.8 billion in 2025.

It is projected to reach USD 10.2 billion by 2035.

The market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types are cooking equipment, _freezer, _countertop, _burner, _baskets & bowls, _others, restaurant work tables, food holding and warming and food preparation equipment.

hotels segment is expected to dominate with a 30.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

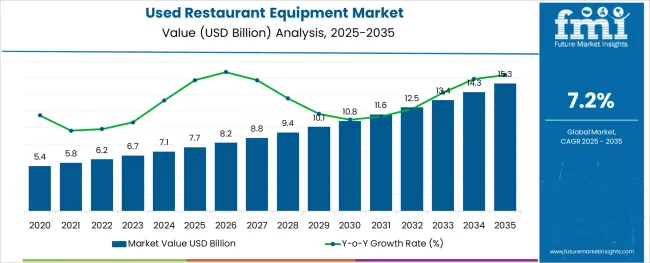

Used Restaurant Equipment Market Size and Share Forecast Outlook 2025 to 2035

Restaurant POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Restaurant Fryers Market Size and Share Forecast Outlook 2025 to 2035

Restaurant Griddle Market Size and Share Forecast Outlook 2025 to 2035

Restaurant Glassware Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Market Share in Restaurants & Mobile Food Services

Restaurants & Mobile Food Services Market Trends – Forecast 2025 to 2035

Analysis and Growth Projections for Restaurant Takeout Business

POS Restaurant Management System Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA