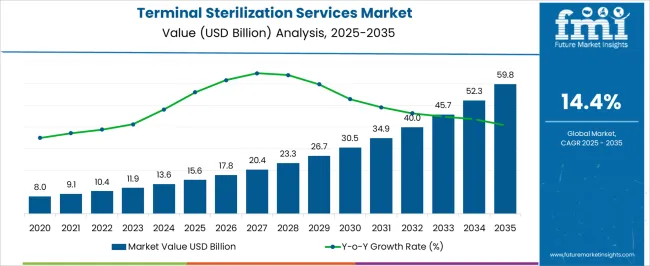

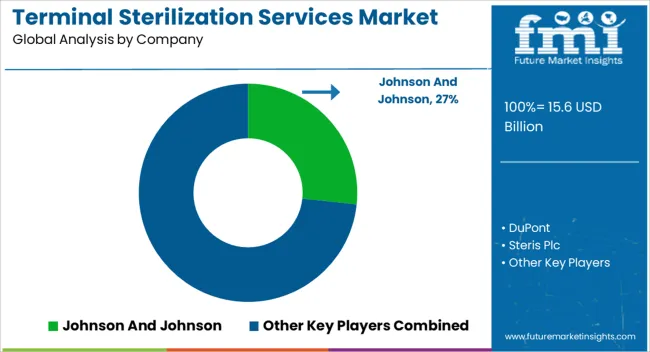

The Terminal Sterilization Services Market is estimated to be valued at USD 15.6 billion in 2025 and is projected to reach USD 59.8 billion by 2035, registering a compound annual growth rate (CAGR) of 14.4% over the forecast period.

| Metric | Value |

|---|---|

| Terminal Sterilization Services Market Estimated Value in (2025 E) | USD 15.6 billion |

| Terminal Sterilization Services Market Forecast Value in (2035 F) | USD 59.8 billion |

| Forecast CAGR (2025 to 2035) | 14.4% |

The terminal sterilization services market is witnessing consistent growth fueled by rising global demand for safe and effective infection control solutions across medical and pharmaceutical sectors. Increasing surgical procedures, stricter sterilization regulations, and the need to ensure microbial safety in healthcare devices are driving widespread adoption of outsourced sterilization services.

Terminal sterilization has emerged as a preferred method due to its ability to sterilize prepackaged products in their final containers, ensuring safety during transport and storage. Ongoing investments in sterilization infrastructure, combined with technological advancements in cycle validation and process control, are enhancing service efficiency and reliability.

As healthcare systems globally intensify efforts toward infection prevention, particularly in post pandemic scenarios, the demand for terminal sterilization services is expected to remain robust across both developed and emerging markets.

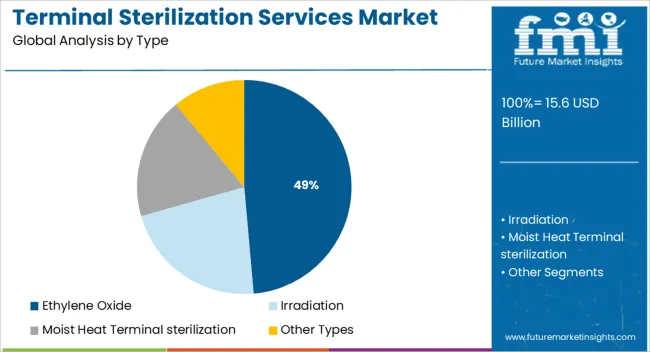

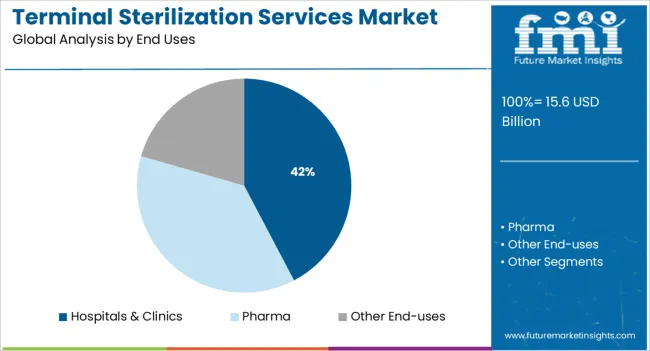

The market is segmented by Type and End Uses and region. By Type, the market is divided into Ethylene Oxide, Irradiation, Moist Heat Terminal sterilization, and Other Types. In terms of End Uses, the market is classified into Hospitals & Clinics, Pharma, and Other End-uses. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ethylene oxide segment is expected to contribute 48.60% of the total revenue by 2025 under the type category, establishing its leadership within the market. This dominance is due to its ability to sterilize temperature sensitive and moisture sensitive medical devices without compromising material integrity.

Ethylene oxide is highly effective against a wide range of microorganisms and allows for deep penetration of complex device geometries. Despite regulatory scrutiny around emissions, its versatility, compatibility with multiple packaging types, and proven efficacy in terminal sterilization processes continue to reinforce its market position.

Investments in emission control systems and regulatory compliant sterilization chambers are further supporting its sustained use across healthcare supply chains.

The hospitals and clinics segment is projected to account for 42.30% of the total revenue by 2025 under the end uses category, marking it as the leading segment. This growth is driven by the increasing volume of surgical procedures, patient inflow, and the critical need to maintain sterile conditions for instruments and reusable devices.

As healthcare institutions face heightened responsibilities for infection prevention and regulatory compliance, outsourcing terminal sterilization services has become a strategic choice. The demand is further supported by limited in house sterilization capacity in many mid sized clinics and the rising need for scalable, validated, and cost effective sterilization processes.

These factors collectively reinforce the leading role of hospitals and clinics in driving demand within the terminal sterilization services market.

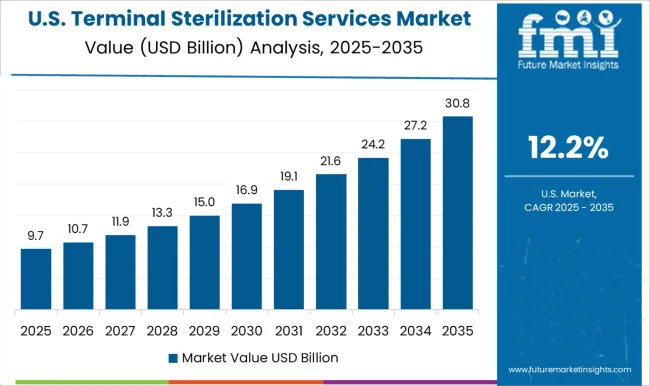

The market value of Terminal sterilization increased at a CAGR of around 10.9% from 2020 to 2024, according to a report done by Future Market Insights, a market research and competitive intelligence firm.

Due to the pandemic, the demand for terminal sterilization surged. Increasing R&D efforts in these industries lead to higher demand for various sterilization techniques, propelling market expansion throughout the projected period.

As per Pharmaceutical Researchers and Manufacturers Association, biopharmaceutical businesses in the USA spent about USD 8 billion in research in 2020. USA Food and Drug Administration & European regulatory bodies have established rigorous standards and guidelines to maintain adequate control of aseptic work areas, such as suggesting and implementing Standard Operating Procedures to lessen the risk of toxicants being transmitted further into the drug processing areas.

Healthcare-Associated Infections (HAIs), the requirement to sterilize reusable high-risk or critical surgical instruments used in increasing surgical procedures, and the regulatory mandate of terminal sterilization or aseptic processing of healthcare products prior to commercialization, have led to the market growth.

The increasing trend of outsourcing sterilization services by the healthcare industry, and the continuous progressive refinement of various sterilization technologies, have further led to market growth. The gradual transition of the medical device market from reprocessed to value-enhanced single-use devices and the need to terminally sterilize a large volume of disposable devices, the steadily increasing and advancing healthcare facilities.

The terminal sterilization sector has gained pace in recent years as a result of surged awareness about diseases and infections caused by non-sterile settings. In addition, there has been a significant increase in funding for hospital infrastructure, research, and public health adaption to terminal sterility.

Companies can develop a sterilization program using the Association for the Advancement of Medical Instrumentation (AAMI) and ISO criteria without the requirement for a big and time-consuming Sterilization technology department. These voluntary consensus standards have also supplied regulatory agencies such as the FDA with a reference point for determining product sterility.

An increase in the occurrence of hospital-acquired infections (HAIs) due to a lack of sanitation and preventative measures is likely to drive the global market over the forecast period. Because it assists in the prevention of infections and disease transmission, sterilization equipment is required for sterilizing and cleaning a range of hospital equipment.

Furthermore, the Terminal Sterilization Services Market will be propelled ahead by the introduction of new products and technological advances in the sterilization process. The first novel medical equipment sterilization technique, the Ozone Sterilization system, has been authorized by the FDA. The maker of the ozone sterilization system is attempting to present this as a competitor with one of the most often used sterilizing technologies, ethylene oxide (EtO).

Despite its toxicity and lengthy aeration time, it is currently the most used 'cold' sterilizing method. TSO3 Inc., the maker, believes the technique is safer, quicker, and much more cost-effective than all those now used to sterilize medical equipment that cannot tolerate high heat or radiation.

In the future years, the Sterilization Services Market is predicted to develop at a high rate. The need for Sterilization Services is expected to surge as the number of hospital-acquired infections (HAIs) rises.

Urinary and vascular catheter-associated infections, HIV infections, surgical site infections, hepatitis B and C, and ventilator-associated infections are the most prevalent HAIs caused by improper sterilizing practices. As technology becomes more accessible to both patients and clinicians, a variety of post-operative intervention options for reducing hospital re-admittance and complications are becoming available.

Active packaging technologies are being used more often in medical equipment, medicines, and products. Such devices absorb target pollutants within the packaging, extending the storability and quality of the products. Active packaging systems with O2 absorbers suggest an alternative for vacuum as well as gas-flushing methods.

Sterile Processing Method at Johnson & Johnson is always looking for ways to increase the storage life & consistency of sterilized medical equipment. Sterile Processing Method worked with CSP Technologies to see if its effective scavenging films might be a viable replacement to traditional gas flushing and purifying methods, as well as to verify CSP goods makes a claim that scavenging films continually eliminate O2 within a confined area to levels as low as 0.1 ppm.

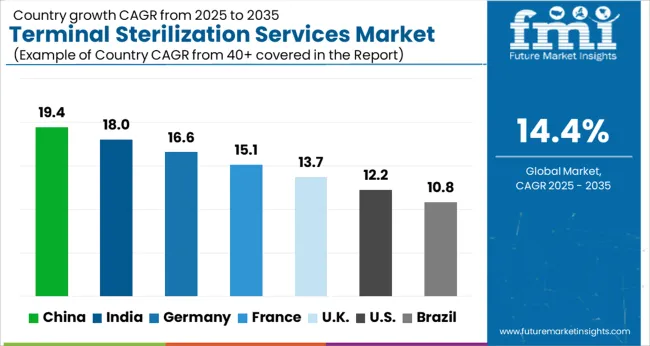

North America is predicted to account for the largest share of the global terminal sterilization services market during the forecast period. A huge client base, greater usage of enhanced sterilization technologies, and highly modern healthcare infrastructure are projected to propel the market in North America in the next years.

Sterility Assurance Level (SAL), throughout North America, two healthcare SAL values have been utilized in procedure: 10-3 and 10-6, which represent the probability with one non-sterile unit in 1,000 or one million processing units, respectively. Because SAL is a potential contaminant, the lesser number, 10-6, gives more guarantee of sterility than that of the bigger number, 10-3.

The market in the Asia Pacific is predicted to have lucrative growth during the projection period, due to improved awareness of current technologies such as sterilization and disinfection among hospitals and clinics, labs and diagnostic centers, and pharmaceutical enterprises operating in the region.

The Sterad Speed Biomedical Indicator/Process Challenging Instruments 15-minute duration to result was commercially available in Asia Pacific on August 25th, 2024, according to Advanced Sterilization Products.

The USA is expected to have the highest market of USD 59.8 Billion by the end of 2035. Upsurge for terminal sterilization of medical products, packaging, and other items is being driven by a growth in the number of operations and the investment being done by the pharmaceutical companies.

In 2020, Eli Lilly announced a USD 72 million investment in an insulin-manufacturing project in the USA. As an outcome, the demand for terminal sterilization is expected to rise in the forthcoming years. Also, MediZAP, North America's premier provider of e-beam terminal sterilization for compounded medications, partnered up with Analytic Laboratory, currently part of Element Materials Technology, to provide sterilized compounded testing facilities, analytical chemistry, & pharmaceutical customers.

The market in the United Kingdom is expected to gross an absolute dollar opportunity of USD 15.6 Billion from 2025 to 2035. The market is expected to reach a valuation of USD 1.9 Billion by 2035, growing at a CAGR of 14.5% during the forecast period.

In Japan, the market is projected to reach USD 1.7 Billion by 2035. Growing at a CAGR of 18.2%, the market in the country is expected to garner an absolute dollar opportunity of USD 15.6 Billion during the forecast period.

The market in South Korea grew at a CAGR of 10% from 2025 to 2035. The market is likely to grow further at a CAGR of 15.1% from 2025 to 2035 to reach a valuation of USD 763 Million by 2035. During the forecast period, the market is expected to gross an absolute dollar opportunity of USD 571 Million.

The market for the Ethylene Oxide segment is forecasted to grow at the highest CAGR of over 14% from 2025 to 2035. This increase is attributable to the increasing need for enhanced studies based on past patterns and datasets in order to create data-enriched insight that would assist enterprises in better understanding the present situation.

Andersen Products, Inc. offers Ethylene Oxide Sterilization Systems for sterilizing surgical equipment, optics, electrical equipment, and a variety of polymers. EOGas sterilizers from Andersen Products, Inc. combine innovative effective diffusion techniques with modern microprocessor control. The innovative unit-dose cartridge matches the actual load level, lowering gas usage significantly. Most products sterilize in an average cycle period of 16 hours, including aeration.

Some of the key players in the terminal sterilization services market include Johnson And Johnson, DuPont, Steris Plc, Getinge Group, Cantel Medical, Matachana Group, Sterigenics International LLC, and Olympus Corp.

The following are some of the most recent developments from key terminal sterilization service providers

Similarly, recent developments related to companies in the terminal sterilization services market have been tracked by the team at Future Market Insights, which are available in the full report.

The global terminal sterilization services market is estimated to be valued at USD 15.6 billion in 2025.

The market size for the terminal sterilization services market is projected to reach USD 59.8 billion by 2035.

The terminal sterilization services market is expected to grow at a 14.4% CAGR between 2025 and 2035.

The key product types in terminal sterilization services market are ethylene oxide, irradiation, moist heat terminal sterilization and other types.

In terms of end uses, hospitals & clinics segment to command 42.3% share in the terminal sterilization services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Terminal Brushing & Greasing Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Terminal Management System Market Size, Share, and Forecast 2025 to 2035

Terminal Automation Market Growth - Trends, Analysis & Forecast by Offerings, End-User and Region through 2035

Terminal Sterilization Market - Demand & Forecast 2025 to 2035

LEO Terminal Market Size and Share Forecast Outlook 2025 to 2035

LNG Terminal Market Size and Share Forecast Outlook 2025 to 2035

POS Terminal Market Insights – Growth & Trends 2024-2034

Bulk Terminal Market Forecast and Outlook 2025 to 2035

SatCom Terminal Market Analysis - Growth, Demand & Forecast 2025 to 2035

Mini POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

Wireless POS Terminal Market Growth – Trends & Industry Forecast 2025 to 2035

Biometric PoS Terminals Market by Technology, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Restaurant POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Very Small Aperture Terminal (VSAT) Market Size and Share Forecast Outlook 2025 to 2035

Automated Container Terminal Market Analysis by Automation, Product, Project, and Region: Forecast for 2025 to 2035

Contactless Payment Terminals Market

Bromodomain and Extraterminal Domain (BET) Inhibitors Market

Automated Parcel Delivery Terminals Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA