The LEO terminal market is estimated to be valued at USD 9.2 billion in 2025 and is projected to reach USD 57.1 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period.

In 2025, the market size of USD 9.2 billion offers significant potential across satellite communication, ground infrastructure, and logistics applications. Over the decade, the incremental opportunity amounts to USD 47.9 billion, highlighting a rapid growth trajectory. Companies entering early can secure strategic partnerships, scale operations, and position themselves to capture high-value contracts as global demand for low Earth orbit services intensifies year over year.

By 2035, the market is projected to reach USD 57.1 billion, delivering an absolute dollar opportunity of USD 47.9 billion from the 2025 baseline, driven by the high 20.0% CAGR. The year-on-year growth from USD 9.2 billion in 2025 to USD 57.1 billion in 2035 underscores a sharp increase in demand for satellite communication terminals and related infrastructure. Stakeholders who establish early market presence can capture incremental revenue, expand production capacity, and optimize deployment networks, converting rapid market expansion into tangible financial gains over the ten-year horizon.

| Metric | Value |

|---|---|

| LEO Terminal Market Estimated Value in (2025 E) | USD 9.2 billion |

| LEO Terminal Market Forecast Value in (2035 F) | USD 57.1 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

A breakpoint analysis of the LEO Terminal market highlights key phases of growth between 2025 and 2035, emphasizing periods with substantial revenue expansion. The market, starting at USD 9.2 billion in 2025, reaches approximately USD 19.1 billion by 2030, marking the first significant breakpoint where it crosses the USD 19 billion threshold. During this early phase, absolute dollar growth is around USD 9.9 billion, reflecting steady adoption across satellite communication terminals, ground infrastructure, and supporting logistics. Companies entering the market at this stage can secure early contracts, establish supply chains, and position themselves for sustained growth as demand begins to scale rapidly.

The second breakpoint occurs between 2030 and 2035, when the market expands from USD 19.1 billion to USD 57.1 billion. This stage represents the largest absolute dollar increase of approximately USD 38.0 billion, indicating a high-growth phase driven by accelerated deployment of low Earth orbit terminals and rising global demand. Stakeholders focusing on this period can maximize revenue by scaling manufacturing, expanding deployment networks, and capturing high-value contracts. Overall, the breakpoint analysis reveals two distinct stages: moderate growth from 2025–2030 and explosive expansion from 2030–2035, providing clear guidance on strategic investments, capacity planning, and operational scaling to fully leverage the absolute dollar opportunity.

The LEO terminal market is witnessing accelerated growth due to the global push toward low-latency connectivity, rising demand for remote coverage, and technological innovations in antenna design. With LEO satellite networks expanding rapidly, there's a rising need for ground terminals that can support high-speed, resilient communication across diverse geographies.

Governments and enterprises alike are investing in LEO satellite connectivity to bridge digital divides in rural and underserved regions. The convergence of AI-driven beam steering, power-efficient electronics, and mass manufacturing of components is significantly lowering costs and enabling faster deployment.

Strategic collaborations between satellite operators and terminal manufacturers are shaping the next wave of commercially viable, compact LEO terminals.

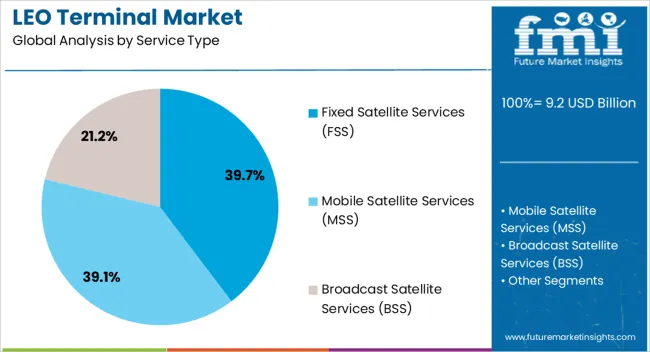

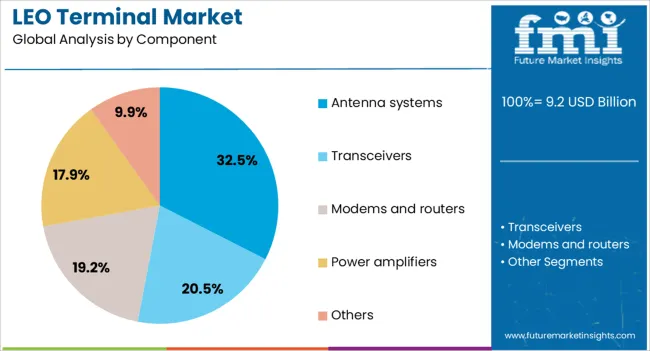

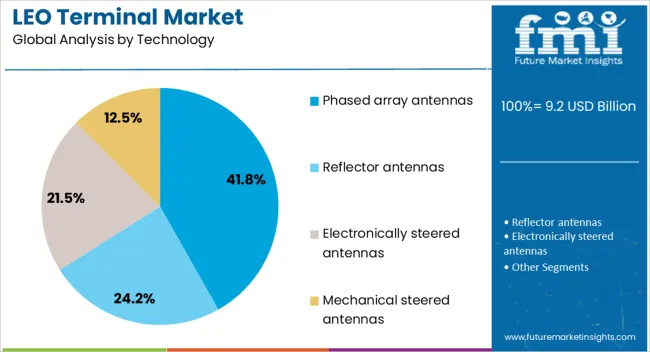

The LEO terminal market is segmented by service type, component, technology, deployment mode, frequency band, end use, and geographic regions. By service type, LEO terminal market is divided into fixed satellite services (FSS), mobile satellite services (MSS), and broadcast satellite services (BSS). In terms of component, LEO terminal market is classified into antenna systems, transceivers, modems and routers, power amplifiers, and others. Based on technology, LEO terminal market is segmented into phased array antennas, reflector antennas, electronically steered antennas, and mechanical steered antennas. By deployment mode, LEO terminal market is segmented into fixed terminals, portable terminals, and aero terminals. By frequency band, LEO terminal market is segmented into Ku-band, Ka-band, X-band, S-band, and L-band. By end use, LEO terminal market is segmented into government and defense and commercial. Regionally, the LEO terminal industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fixed Satellite Services (FSS) are anticipated to account for 39.70% of the LEO terminal market by 2025, making it the leading service type segment. FSS is gaining traction due to its reliability and suitability for continuous, high-capacity communication links. Industries such as telecom, defense, and maritime are increasingly favoring FSS to ensure uninterrupted, point-to-point and point-to-multipoint communication. The integration of FSS with LEO networks enhances their performance by reducing latency while maintaining wide coverage. As use cases for enterprise connectivity, backhaul, and disaster recovery rise, FSS terminals are expected to remain the preferred solution for scalable ground communication infrastructure.

Antenna systems are projected to capture 32.50% of the component share by 2025, emerging as the leading segment in the LEO terminal component market. This dominance is driven by their critical role in tracking and maintaining seamless links with fast-moving LEO satellites. Innovations in compact design, improved beam steering, and multi-band support are enabling enhanced data rates and connectivity stability. As LEO constellations grow denser and user demands increase, high-precision antenna systems will be central to maintaining signal quality and minimizing handover losses. Increased investment in adaptive and electronically steered antennas is further boosting the segment’s technological edge and commercial deployment.

Phased array antennas are expected to lead the technology segment with a 41.80% market share by 2025. These antennas are favored for their ability to electronically steer beams without physical movement, allowing fast tracking of LEO satellites. Their compact form factor, robustness, and scalability make them ideal for applications ranging from land-based terminals to maritime and aeronautical platforms. As demand grows for lightweight, low-power, and highly directional terminals, phased array technology is emerging as the backbone of next-generation LEO connectivity. Advancements in semiconductor integration and cost optimization are accelerating commercialization, positioning phased array antennas as the most viable choice for high-performance, mass-market terminals.

The LEO terminal market is expanding as demand rises for low Earth orbit satellite communication in sectors including broadband internet, defense, maritime, aviation, and remote connectivity. LEO terminals enable high-speed, low-latency data transfer for global communications, bridging gaps in underserved and remote areas. Growth is fueled by the increasing deployment of LEO satellite constellations, demand for real-time connectivity, and adoption of satellite-enabled IoT and enterprise solutions. Companies providing compact, high-throughput, and reliable LEO terminals are positioned to capture opportunities across commercial, governmental, and industrial applications.

LEO terminals face challenges related to high manufacturing costs, technical complexity, and spectrum management. Designing compact, efficient, and low-power terminals capable of tracking fast-moving LEO satellites requires advanced antenna systems and RF components. Integration with existing terrestrial networks and communication protocols adds technical complexity. High initial capital investment for development, deployment, and maintenance can limit adoption, especially in cost-sensitive markets. Spectrum allocation and regulatory approval processes vary by region, adding another layer of complexity for global deployment. Ensuring reliability and consistent connectivity under varying environmental conditions is also a key challenge. Manufacturers must invest in R&D, modular designs, and regulatory compliance to address these issues while delivering commercially viable solutions.

The LEO terminal market is trending toward phased array antennas, flat panel designs, and mobile terminals. Phased array technology allows dynamic beam steering for seamless tracking of multiple LEO satellites without mechanical movement, enhancing performance and durability. Flat panel terminals are gaining popularity due to their lightweight, low-profile design suitable for vehicles, ships, aircraft, and portable applications. Mobility-focused solutions are being developed for on-the-move connectivity in maritime, aviation, and defense sectors. Additionally, integration with satellite backhaul, edge computing, and IoT devices is enabling real-time data applications and broader network coverage. These innovations are making LEO terminals more efficient, versatile, and user-friendly for a variety of commercial and industrial use cases.

LEO terminals offer substantial opportunities in broadband connectivity, defense, and enterprise solutions. Expanding LEO satellite constellations enable high-speed, low-latency internet access for underserved regions, remote communities, and emergency response operations. Defense organizations and government agencies can leverage LEO terminals for secure, reliable, and mobile communications in field operations. Enterprise applications such as shipping, aviation, and energy sectors benefit from real-time connectivity for operations monitoring, logistics, and IoT deployments. Strategic partnerships between LEO satellite operators, terminal manufacturers, and network service providers can accelerate deployment and expand market reach. Investment in multi-purpose, modular, and portable terminals can unlock growth opportunities across diverse sectors requiring resilient and high-performance satellite communication solutions.

The LEO terminal market faces restraints due to infrastructure requirements, regulatory barriers, and growing competition. Establishing reliable ground infrastructure, including gateways, backhaul networks, and maintenance facilities, can be capital intensive and time-consuming. Regulatory approval for spectrum usage and cross-border satellite operations varies, complicating global deployment. Competition from geostationary satellite systems, terrestrial broadband, and emerging low-cost LEO service providers may limit market penetration. Manufacturing costs, supply chain challenges, and the need for continuous technology upgrades add additional operational pressure. Until regulatory alignment, infrastructure development, and cost-effective solutions are achieved, LEO terminal adoption may remain focused on high-value commercial, industrial, and governmental applications rather than broad consumer-level deployment.

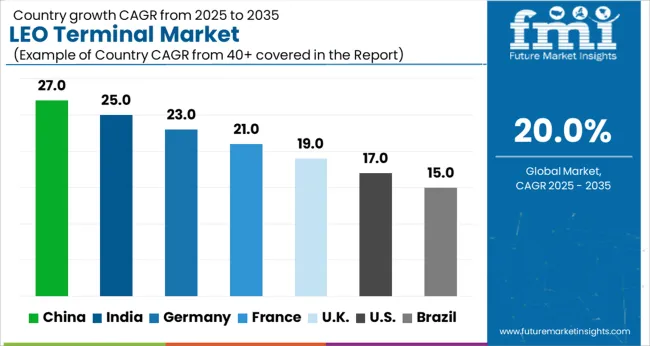

| Country | CAGR |

|---|---|

| China | 27.0% |

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

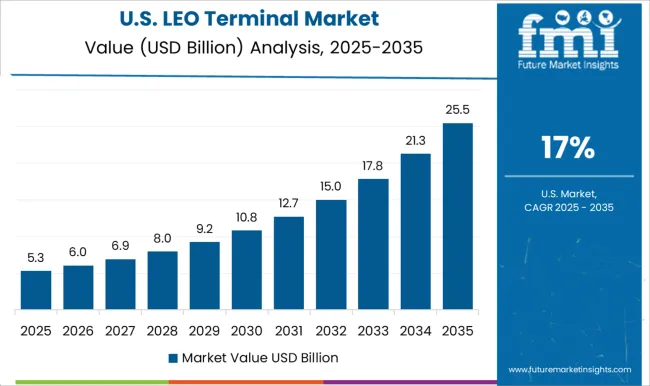

| USA | 17.0% |

| Brazil | 15.0% |

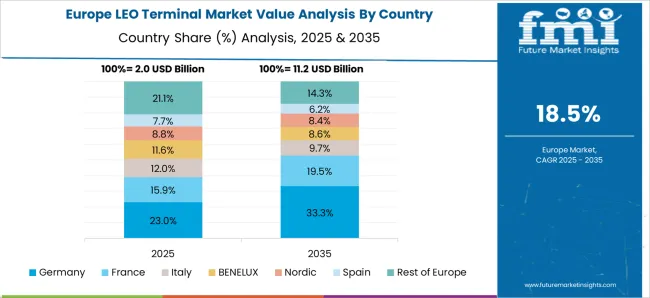

The global LEO terminal market is projected to grow at a CAGR of 20.0% through 2035, supported by increasing demand across satellite communications, broadband connectivity, and aerospace applications. Among BRICS nations, China has been recorded with 27.0% growth, driven by large-scale production and deployment in satellite broadband and communication networks, while India has been observed at 25.0%, supported by rising utilization in aerospace, defense, and communication sectors. In the OECD region, Germany has been measured at 23.0%, where production and adoption for satellite communications and broadband applications have been steadily maintained. The United Kingdom has been noted at 19.0%, reflecting consistent use in aerospace and defense communication systems, while the USA has been recorded at 17.0%, with production and utilization across satellite broadband, aerospace, and defense sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The LEO terminal market in China is expanding at a CAGR of 20.0%, driven by increasing demand for low earth orbit satellite connectivity in telecommunications, defense, and commercial applications. Chinese manufacturers are investing in advanced phased array antennas, compact terminals, and high-speed data transmission technologies to support broadband, IoT, and emergency communication networks. Government initiatives promoting satellite communication infrastructure, national space programs, and smart city development are accelerating adoption. Pilot deployments in remote connectivity, maritime communications, and mobile networks demonstrate operational benefits such as low latency, high bandwidth, and broad coverage. Collaborations between satellite operators, technology firms, and government agencies are enhancing terminal performance, manufacturing scalability, and cost-effectiveness. Growing demand for real-time connectivity and satellite-based services continues to drive China’s LEO terminal market.

LEO terminal market in India is growing at a CAGR of 25.0%, fueled by demand for satellite-based broadband, IoT, and remote connectivity solutions. Terminals are being adopted in defense, telecom, maritime, and emergency communication networks. Manufacturers and startups are investing in compact, lightweight terminals with low latency and high throughput capabilities. Government initiatives promoting national satellite programs, digital infrastructure, and rural broadband connectivity are accelerating market growth. Pilot deployments in remote regions, disaster response, and maritime communications validate operational feasibility. Collaborations between space agencies, technology providers, and telecom companies are enhancing terminal design, performance, and cost efficiency. Increasing focus on real-time communication, IoT integration, and broadband expansion is expected to drive strong growth across India’s LEO terminal market.

LEO terminal market in Germany is recording a CAGR of 23.0%, supported by strong adoption in industrial, telecom, and defense applications. LEO terminals are increasingly used for high-speed broadband, IoT networks, and emergency communication services. Manufacturers are focusing on phased array antennas, compact designs, and high data rate capabilities. Government programs promoting space infrastructure, satellite technology adoption, and digital connectivity are encouraging market growth. Pilot projects in maritime communications, remote connectivity, and industrial IoT demonstrate operational benefits such as low latency, high bandwidth, and improved reliability. Collaborations between satellite operators, technology firms, and research institutes are advancing innovation, manufacturing scalability, and terminal performance. Germany’s emphasis on high-speed connectivity and satellite adoption continues to drive strong market growth.

The United Kingdom is experiencing a CAGR of 19.0% in the LEO terminal market, driven by increasing adoption in defense, telecom, and maritime applications. Terminals are used to enable high-speed, low latency satellite communication for broadband, IoT, and emergency services. Manufacturers are investing in compact, lightweight, and high-throughput terminal solutions. Government initiatives promoting satellite infrastructure, digital connectivity, and smart city applications are supporting market adoption. Pilot deployments in remote connectivity, maritime communications, and defense networks demonstrate operational benefits including improved reliability and low latency. Collaborations between research institutions, satellite operators, and technology providers are enhancing terminal performance, design, and scalability. Rising demand for real-time connectivity and broadband access is expected to continue driving growth in the UK LEO terminal market.

The United States LEO terminal market is growing at a CAGR of 17.0%, supported by adoption in defense, telecommunications, and commercial broadband networks. LEO terminals are deployed for high-speed, low latency connectivity, IoT networks, and emergency communication applications. Manufacturers are focusing on compact terminals, phased array antennas, and high data rate solutions. Government programs promoting space infrastructure, satellite communications, and broadband expansion are driving market adoption. Pilot deployments in defense networks, maritime communications, and remote broadband validate operational feasibility. Collaborations between satellite operators, technology firms, and research institutes are advancing terminal performance, cost efficiency, and scalability. Rising demand for real-time satellite-based services, industrial IoT, and broadband expansion continues to fuel adoption in the USA LEO terminal market.

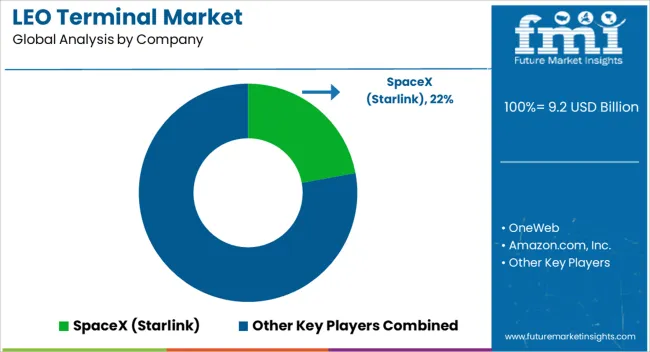

The LEO terminal market is highly competitive, with satellite operators and equipment manufacturers vying for adoption through performance, compatibility, and cost efficiency. SpaceX (Starlink) is positioned as a leader, with product brochures emphasizing low-latency connectivity, global coverage, and plug-and-play user terminals suitable for both residential and enterprise applications. OneWeb competes with LEO terminals designed for maritime, aviation, and rural connectivity, with brochures highlighting seamless satellite handover, compact design, and energy efficiency. Amazon.com, Inc. (Project Kuiper) focuses on scalable, high-bandwidth terminals with brochures presenting modular designs, integration flexibility, and compatibility with future satellite constellations. Telesat provides enterprise-grade terminals targeting government and commercial sectors, with brochures detailing high throughput, secure communications, and deployment options.

Viasat, Inc. emphasizes hybrid LEO and GEO connectivity solutions, with technical literature highlighting latency performance, bandwidth efficiency, and global mobility use cases. Hughes Network Systems delivers user-friendly LEO-capable terminals for broadband and enterprise applications, with brochures providing technical specifications, installation guidelines, and network integration details. Iridium Communications markets terminals compatible with its LEO constellation, with brochures emphasizing reliability, small form factor, and resilience in harsh environments. Other OEMs compete with niche, application-specific terminals, often targeting maritime, defense, or industrial markets with specialized certifications and ruggedization. Strategies in the market are centered on performance optimization, cost reduction, and ecosystem integration. Investment is directed toward antenna design, phased-array technology, and low-power operation. Partnerships with telecom providers, OEM integrators, and government agencies are leveraged to accelerate adoption across consumer, enterprise, and defense applications. Observed industry patterns indicate strong emphasis on plug-and-play deployment, ease of installation, and firmware upgradability to support evolving satellite constellations. Expansion into enterprise and mobility markets is pursued to differentiate from purely consumer-focused offerings.

Scalability, service reliability, and interoperability with multiple LEO networks are being prioritized in roadmap planning. Product brochures serve as primary tools for communicating technical capabilities, operational performance, and deployment options. Key specifications such as data throughput, latency, power consumption, antenna size, and environmental tolerances are presented in tables and diagrams. SpaceX literature highlights ease of setup and global coverage. OneWeb and Telesat brochures emphasize secure communications, low-latency routing, and mobility use cases. Amazon and Viasat materials focus on modularity, high-bandwidth performance, and integration flexibility. Hughes and Iridium brochures provide deployment guidance, network compatibility, and reliability metrics. Brochures are increasingly digital and interactive, allowing network planners, integrators, and end-users to evaluate terminal suitability rapidly. Market success is determined not only by technical performance but also by how clearly brochures convey operational benefits, interoperability, and long-term reliability, making technical literature essential for competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.2 billion |

| Service Type | Fixed Satellite Services (FSS), Mobile Satellite Services (MSS), and Broadcast Satellite Services (BSS) |

| Component | Antenna systems, Transceivers, Modems and routers, Power amplifiers, and Others |

| Technology | Phased array antennas, Reflector antennas, Electronically steered antennas, and Mechanical steered antennas |

| Deployment Mode | Fixed terminals, Portable terminals, and Aero terminals |

| Frequency Band | Ku-band, Ka-band, X-band, S-band, and L-band |

| End Use | Government and defense and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SpaceX (Starlink), OneWeb, Amazon.com, Inc., Telesat, Viasat, Inc., Hughes Network Systems, and Iridium Communications |

| Additional Attributes | Dollar sales vary by terminal type, including portable, fixed, and vehicle-mounted LEO terminals; by application, such as broadband connectivity, IoT networks, emergency communication, and enterprise solutions; by end-use industry, spanning telecom, defense, maritime, and aviation; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by expanding LEO satellite constellations, rising demand for global high-speed connectivity, and increasing adoption of IoT services. |

The global LEO terminal market is estimated to be valued at USD 9.2 billion in 2025.

The market size for the LEO terminal market is projected to reach USD 57.1 billion by 2035.

The LEO terminal market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in LEO terminal market are fixed satellite services (fss), mobile satellite services (mss) and broadcast satellite services (bss).

In terms of component, antenna systems segment to command 32.5% share in the LEO terminal market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LEO Satellite Market Size and Share Forecast Outlook 2025 to 2035

Ileostomy Market

Paleo Food Market Trends - Growth & Consumer Demand 2025 to 2035

Nucleotide Market Analysis - Size, Growth, and Forecast 2025 to 2035

Nucleotide Premixes Market Analysis by form, application and region Flavors Through 2035

USA Nucleotide Premixes Market Report – Size, Trends & Industry Forecast 2025-2035

Supramalleolar Osteotomy Implants Market Size and Share Forecast Outlook 2025 to 2035

Oligonucleotide API Market – Demand, Trends & Forecast 2024-2034

Yeast Nucleotides Market Analysis by Product Type, Nature, Form and Application Through 2035

Turmeric Oleoresin Market – Growth & Demand 2025 to 2035

Single Nucleotide Polymorphism (SNP) Genotyping Market

Microbial Nucleotides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spice Oils and Oleoresins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antisense Oligonucleotides Market Size and Share Forecast Outlook 2025 to 2035

Nicotinamide Adenine Dinucleotide Market Size and Share Forecast Outlook 2025 to 2035

Demand for Spice Oils and Oleoresins in the EU Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Asia Pacific Essential Oil and Oleoresin Business

Terminal Brushing & Greasing Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Terminal Sterilization Services Market Size and Share Forecast Outlook 2025 to 2035

Terminal Management System Market Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA