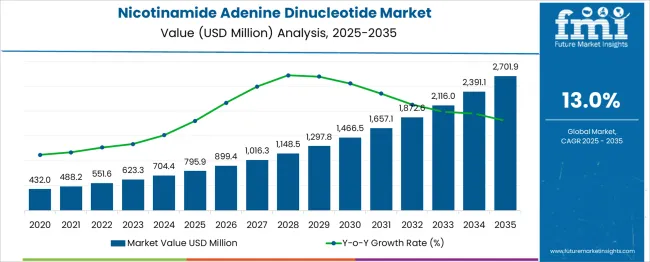

The nicotinamide adenine dinucleotide (NAD⁺) market is projected to grow from USD 795.9 million in 2025 to USD 2,701.9 million by 2035, registering a robust CAGR of 13.0%. This rapid growth reflects the increasing adoption of NAD⁺ in anti-aging therapeutics, dietary supplements, and metabolic disorder treatments. The absolute dollar opportunity over 2020-2035 is substantial, with the market expanding from USD 432.0 million in 2020 to USD 2,701.9 million in 2035. The incremental market value between consecutive years highlights a consistently expanding opportunity, with peak yearly additions occurring in the latter half of the forecast period as awareness and technological advances accelerate demand. Breaking down the growth, the absolute dollar opportunity from 2025 to 2030 amounts to nearly USD 2.3 billion cumulatively, driven by increasing NAD⁺ supplementation and pharmaceutical integration. From 2030 to 2035, the market experiences an even steeper growth trajectory, adding approximately USD 1.7 billion in value. This reflects broader commercialization, rising consumer health awareness, and ongoing research fueling therapeutic applications. Companies entering this market can capitalize on high-value segments such as anti-aging, neurology, and metabolic health. Overall, the NAD⁺ market represents a high-growth, high-opportunity landscape with significant investment and expansion potential.

| Metric | Value |

|---|---|

| Nicotinamide Adenine Dinucleotide Market Estimated Value in (2025 E) | USD 795.9 million |

| Nicotinamide Adenine Dinucleotide Market Forecast Value in (2035 F) | USD 2701.9 million |

| Forecast CAGR (2025 to 2035) | 13.0% |

The Nicotinamide Adenine Dinucleotide market is experiencing accelerated growth, fueled by its central role in cellular metabolism, energy regulation, and age-related health interventions. As NAD gains traction for its potential benefits in mitochondrial function, DNA repair, and oxidative stress mitigation, industries across nutraceuticals, food fortification, and therapeutic nutrition are increasingly incorporating it into product formulations. Advances in biotechnology and enzymatic synthesis have improved production efficiency, allowing higher purity levels suitable for human consumption.

Regulatory alignment in key regions and increasing consumer awareness around longevity and bioenergetics have further boosted its uptake. Leading manufacturers are investing in scalable fermentation technologies and novel delivery systems to enhance stability and absorption.

The convergence of wellness trends, preventative healthcare strategies, and rising research into NAD precursors like NMN and NR is creating favorable conditions for market expansion. Over the next decade, demand is expected to grow steadily, supported by innovation in personalized nutrition and integration of NAD into holistic health programs addressing cognitive, metabolic, and muscular health.

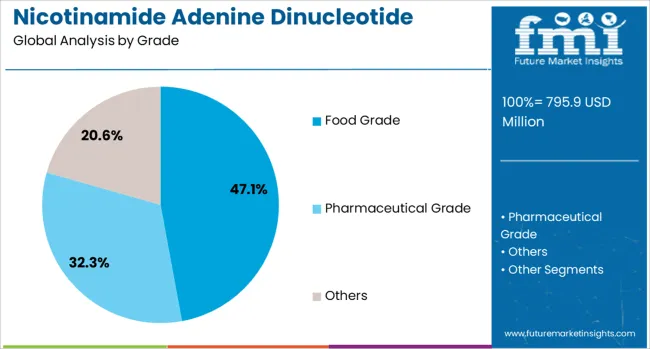

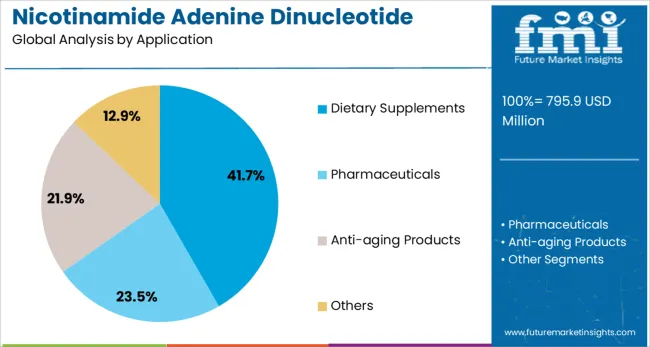

The nicotinamide adenine dinucleotide market is segmented by grade, application, and region. By grade, the market is divided into food grade, pharmaceutical grade, and others. In terms of application, it is classified into dietary supplements, pharmaceuticals, anti-aging products, and others. Regionally, the nicotinamide adenine dinucleotide industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food grade segment is projected to account for 47.1% of the total revenue share in the Nicotinamide Adenine Dinucleotide market in 2025, positioning it as the leading grade type. This segment’s prominence is being driven by the rising use of NAD in fortified food and beverage products aimed at enhancing cellular energy and metabolic support.

Food grade NAD formulations are increasingly used in functional health products due to their compatibility with regulatory standards and their ability to maintain stability during food processing. As consumers prioritize clean label and wellness-enhancing ingredients, food grade NAD is gaining preference for its perceived natural bioactivity and role in anti-aging nutrition.

The segment is further benefiting from increased investments in manufacturing practices that ensure consistent quality and purity, making it suitable for mass-market applications. The growing popularity of performance nutrition and age-targeted food categories has reinforced the demand for food grade NAD, solidifying its leadership in both established and emerging health-conscious markets.

The dietary supplements segment is expected to capture 41.7% of the Nicotinamide Adenine Dinucleotide market’s revenue share in 2025, making it the dominant application category. This growth is being fueled by increasing consumer focus on cellular health, longevity, and energy optimization. Supplement formulations featuring NAD or its precursors have gained traction among aging populations and wellness-driven individuals due to their potential in enhancing mitochondrial efficiency and reducing fatigue.

The segment is also supported by the expanding reach of e-commerce distribution and targeted digital marketing campaigns promoting NAD-based supplements as part of daily health regimens. Clinical research highlighting the benefits of NAD in metabolic health, cognitive performance, and DNA repair mechanisms has further validated its use in dietary supplementation.

Formulators are increasingly utilizing advanced encapsulation technologies to improve the bioavailability of NAD in supplement form, which has strengthened consumer confidence and recurring usage. As proactive health management becomes mainstream, dietary supplements are set to remain a key driver of market expansion.

The NAD⁺ market is growing as interest rises in compounds supporting cellular energy, metabolism, and healthy aging. NAD⁺ plays a vital role in mitochondrial function, DNA repair, and enzymatic reactions, making it popular in dietary supplements, anti-aging products, and therapeutic research. North America and Europe lead adoption due to high consumer awareness, research funding, and established nutraceutical industries. Asia-Pacific is emerging with rising disposable income, increasing health awareness, and expanding supplement markets. Innovations such as NAD⁺ precursors, liposomal formulations, and injectable solutions enhance bioavailability and therapeutic potential. The increasing demand for wellness products, combined with research-backed claims and premium formulations, is fueling market growth across global regions.

NAD⁺ is increasingly incorporated in supplements and functional beverages aimed at promoting longevity, cognitive support, and metabolic health. It is known to enhance cellular repair mechanisms, improve energy metabolism, and mitigate age-related decline. Consumers seeking science-backed wellness solutions are adopting NAD⁺-enriched products for anti-aging and overall vitality. Healthcare professionals and wellness influencers are helping drive awareness and trust. Formulations with NAD⁺ precursors, such as nicotinamide riboside (NR) or nicotinamide mononucleotide (NMN), are gaining popularity for their enhanced absorption and efficacy. The growing focus on proactive health management and performance optimization has further expanded demand. Regions with higher disposable income and established supplement markets are seeing rapid uptake, while emerging economies are catching up through awareness campaigns and increasing accessibility.

Advances in NAD⁺ synthesis and delivery methods are improving market potential. Innovative formulations include liposomal encapsulation, powders, tablets, and injectable solutions that enhance bioavailability and maintain molecular stability. Manufacturers are exploring fermentation and enzymatic production methods for high-purity NAD⁺ and its precursors. Combining NAD⁺ with other bioactive compounds, such as antioxidants or anti-inflammatory agents, supports multifunctional health benefits. Quality control and standardization of NAD⁺ content are critical to ensuring efficacy and regulatory compliance. Collaborations with research institutions validate clinical benefits and support premium positioning. Companies offering high-purity, scientifically validated formulations gain a competitive edge, enabling adoption across dietary supplements, wellness products, and therapeutic applications. Continued innovation ensures the ingredient meets consumer expectations for safety, performance, and multifunctional use.

NAD⁺ formulations provide value to manufacturers by enabling premium product lines in the anti-aging and wellness sectors. High potency and demonstrated efficacy allow brands to charge premium pricing and target health-conscious consumers. Efficient production methods and sourcing of NAD⁺ precursors ensure consistent supply and scalability. Standardized formulations reduce batch-to-batch variability, supporting label claims and regulatory compliance. The versatility of NAD⁺ allows integration into beverages, capsules, powders, and injectables, expanding commercial opportunities. Manufacturers investing in validated quality control, traceable supply chains, and bioavailability-focused formulations strengthen brand credibility. Operational efficiency, product differentiation, and consistent supply are key factors driving adoption and supporting growth in the global NAD⁺ market.

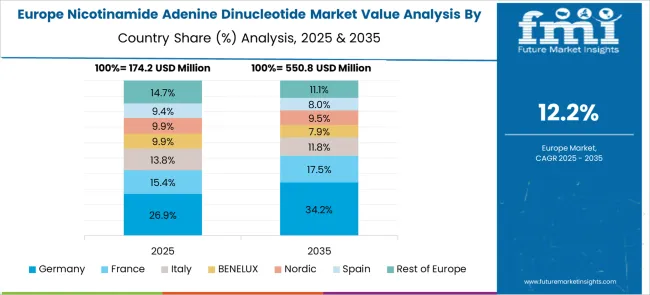

North America and Europe dominate the NAD⁺ market due to strong research infrastructure, high consumer awareness, and established supplement industries. Asia-Pacific is emerging as a key growth region, driven by rising disposable income, increasing interest in wellness products, and growing e-commerce penetration. Latin America and the Middle East are gradually adopting NAD⁺ formulations as consumer awareness increases. Market players are focusing on region-specific distribution, product customization, and partnerships with healthcare professionals to enhance penetration. Local production of NAD⁺ precursors and tailored supplement solutions support adoption in emerging markets. Regional dynamics, including healthcare awareness, regulatory frameworks, and economic growth, shape market trends, ensuring wider global adoption of NAD⁺ products.

| Country | CAGR |

|---|---|

| China | 17.6% |

| India | 16.3% |

| Germany | 15.0% |

| France | 13.7% |

| UK | 12.4% |

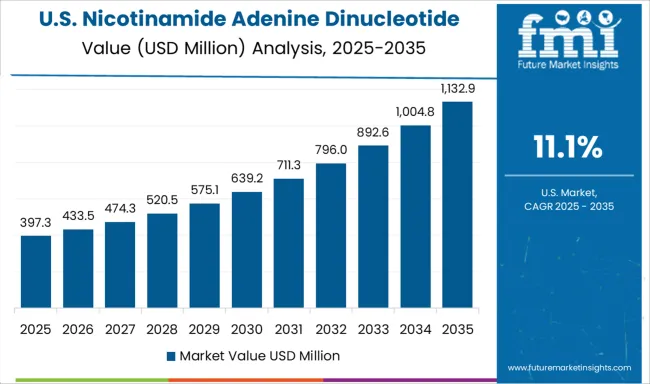

| USA | 11.1% |

| Brazil | 9.8% |

The nicotinamide adenine dinucleotide (NAD) market is expected to expand at a robust CAGR of 13.0%, driven by its increasing applications in anti-aging, supplements, and therapeutic interventions. China leads with 17.6% growth, supported by extensive production capacities and advanced biotechnological facilities. India follows at 16.3%, with growth fueled by rising investments in nutraceuticals and pharmaceutical manufacturing. Germany shows 15.0% growth, reflecting a focus on high-purity production and stringent regulatory standards. The UK grows at 12.4%, driven by consumer adoption in health and wellness products. The USA records 11.1% growth, highlighting research-driven product development and expanding clinical applications. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the nicotinamide adenine dinucleotide (NAD) market with 17.6% growth. Rising use in anti-aging, pharmaceuticals, and nutraceuticals drives market expansion. Compared to India, China benefits from strong research infrastructure and large-scale production facilities. The cosmetic sector increasingly incorporates NAD for skin rejuvenation and antioxidant benefits. Pharmaceutical companies use NAD precursors in therapies targeting metabolic disorders and neurological conditions. Government incentives for biotech innovation encourage development of high-purity NAD products. Collaborative projects between universities and private companies enhance technological advancement. Export demand from Asia-Pacific and global markets further supports growth. Investments in supply chain efficiency and regulatory compliance ensure market stability. Overall, China combines industrial scale, research capabilities, and government support to lead the global NAD market.

NAD market in India grows at 16.3%, driven by increasing applications in nutraceuticals, pharmaceuticals, and dietary supplements. Compared to Germany, India emphasizes cost-efficient production methods and raw material sourcing. Growing awareness of NAD’s role in cellular health and metabolism supports adoption across consumer health products. The cosmetic industry uses NAD for anti-aging and skin wellness formulations. Pharmaceutical research focuses on NAD precursors to treat metabolic and neurological disorders. Academic-industry partnerships drive product innovation and improve extraction methods. Government initiatives for biotechnology and nutraceutical development encourage sustainable growth. Expansion of e-commerce channels enhances product availability and consumer reach. Overall, India combines affordability, research initiatives, and growing consumer demand to strengthen its position in the global NAD market.

Germany shows steady growth at 15.0% in the NAD market. High-quality standards, strict regulatory requirements, and advanced biotech infrastructure support market stability. Compared to the United Kingdom, Germany emphasizes precision manufacturing and purity in NAD formulations. Cosmetic and pharmaceutical applications lead demand, focusing on anti-aging and metabolic health products. Research institutes and private companies collaborate to develop efficient production processes and innovative applications. Government support for biotechnology and nutraceutical research enhances market opportunities. Exports to neighboring European countries sustain long-term growth. Overall, Germany balances technological excellence, regulatory compliance, and sustainable production to maintain its position in the global NAD market.

The United Kingdom NAD market grows at 12.4%, driven by cosmetic, pharmaceutical, and dietary supplement applications. Compared to the United States, the UK emphasizes strict regulatory adherence and product safety standards. Anti-aging and skin health remain major drivers in the cosmetic sector. Nutraceutical and metabolic health applications expand in response to growing consumer awareness. Manufacturers adopt sustainable extraction and high-purity production techniques. Collaboration between research centers and industry supports development of innovative formulations. Market expansion is aided by e-commerce channels and increasing consumer focus on wellness products. Overall, the UK focuses on regulatory compliance, sustainability, and innovation to grow the NAD market.

The United States advances at 11.1% in the NAD market, driven by pharmaceutical, nutraceutical, and cosmetic applications. Compared to China, the US emphasizes high-purity products and technological innovations. Anti-aging and metabolic health products dominate consumer applications. Pharmaceutical research focuses on NAD precursors for treating metabolic and neurological conditions. Manufacturers invest in sustainable extraction and advanced biotechnology methods. Academic-industry collaborations encourage innovation and product diversification. Growing awareness of health benefits among consumers increases demand for NAD supplements. Overall, the United States combines innovation, regulatory frameworks, and consumer awareness to maintain steady growth in the NAD market.

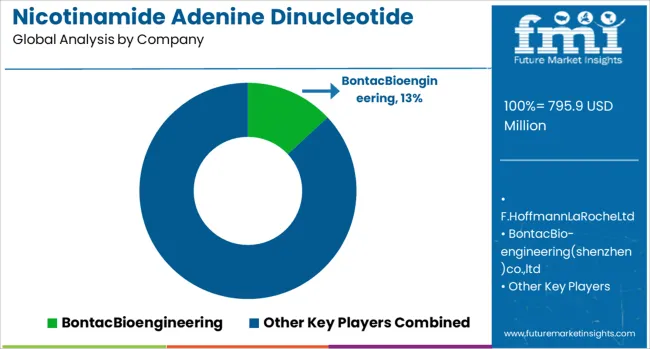

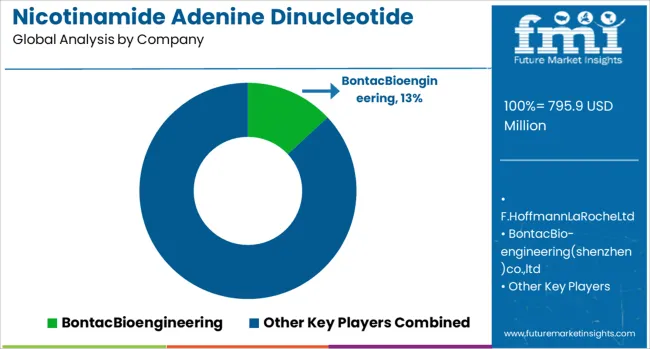

The Nicotinamide Adenine Dinucleotide (NAD⁺) market is expanding rapidly due to growing applications in anti-aging, nutraceuticals, and pharmaceutical industries. F. Hoffmann-La Roche Ltd dominates with strong R&D capabilities and high-quality NAD⁺ production for clinical and therapeutic applications. Bontac Bioengineering (Shenzhen) Co., Ltd. focuses on large-scale industrial production, emphasizing purity, stability, and consistency for both research and commercial use. NutriScience Innovations, LLC and HiMedia Laboratories cater to the dietary supplement and functional food segments, leveraging formulation expertise to enhance bioavailability and consumer adoption.

Hefei Home Sunshine Pharmaceutical Technology Co., Ltd., Shandong Lankang Bio-Technology Co., Ltd., and Xi'an Yinherb Bio-Tech Co., Ltd. provide cost-effective bulk solutions targeting emerging markets, with a focus on scalable production and regulatory compliance. Smaller specialized suppliers such as Krackeler Scientific, Shenzhen Hygieia Biotechnology Co., Ltd., Otto Chemie Pvt. Ltd., and Uthever differentiate through high-purity research-grade NAD⁺, custom formulations, and technical support for laboratory applications.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Grade | Food Grade, Pharmaceutical Grade, and Others |

| Application | Dietary Supplements, Pharmaceuticals, Anti-aging Products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bontac Bioengineering, F. Hoffmann-La Roche Ltd., Bontac Bio-engineering (Shenzhen) Co., Ltd., NutriScience Innovations, LLC, Hefei Home Sunshine Pharmaceutical Technology Co., Ltd., HiMedia Laboratories, Nutrifoods, Krackeler Scientific, Shandong Lankang Bio-Technology Co., Ltd., Xi'an Yinherb Bio-Tech Co., Ltd., OYC Americas, Inc., Shenzhen Hygieia Biotechnology Co., Ltd., Zhejiang Dazhan Biotechnology Co., Ltd., |

| Additional Attributes | Dollar sales in the Nicotinamide Adenine Dinucleotide Market vary by product type including NAD+ and NADH, application across pharmaceuticals, nutraceuticals, and cosmetics, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing demand for anti-aging therapies, metabolic health supplements, and research in cellular health. |

The global nicotinamide adenine dinucleotide market is estimated to be valued at USD 795.9 million in 2025.

The market size for the nicotinamide adenine dinucleotide market is projected to reach USD 2,701.9 million by 2035.

The nicotinamide adenine dinucleotide market is expected to grow at a 13.0% CAGR between 2025 and 2035.

The key product types in nicotinamide adenine dinucleotide market are food grade, pharmaceutical grade and others.

In terms of application, dietary supplements segment to command 41.7% share in the nicotinamide adenine dinucleotide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA