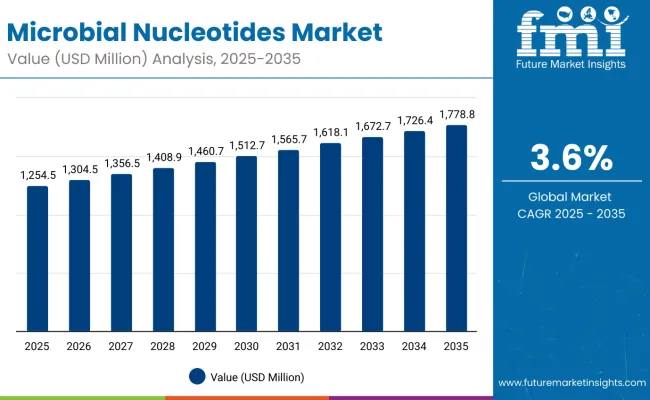

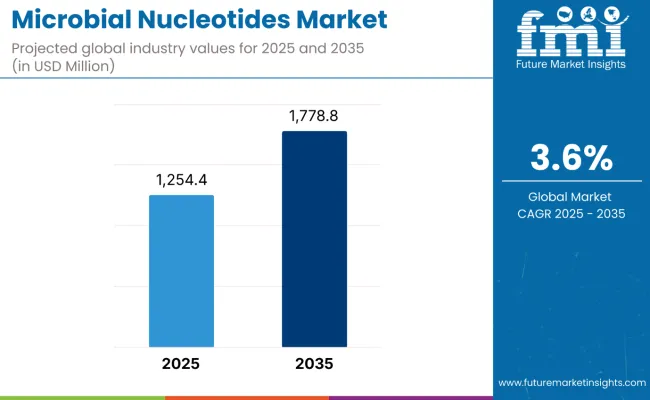

The global microbial nucleotides market is projected to grow from USD 1,254.5 million in 2025 to approximately USD 1,778.8 million by 2035, recording an absolute increase of USD 524.3 million over the forecast period. This translates into a total growth of 41.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.4X during the same period, supported by increasing demand for nutritional supplements, rising awareness about functional foods, and growing applications in infant nutrition and pharmaceutical industries.

Microbial Nucleotides Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,254.5 million |

| Forecast Value in (2035F) | USD 1,778.8 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

Between 2025 and 2030, the microbial nucleotides market is projected to expand from USD 1,254.5 million to USD 1,493.8 million, resulting in a value increase of USD 239.3 million, which represents 45.6% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for functional foods, increasing adoption in infant nutrition applications, and growing penetration of nucleotide-based supplements in emerging markets. Pharmaceutical and biotechnology companies are expanding their microbial nucleotide portfolios to address the growing demand for high-quality nucleotide ingredients for various therapeutic and nutritional applications.

From 2030 to 2035, the market is forecast to grow from USD 1,493.8 million to USD 1,778.8 million, adding another USD 285.0 million, which constitutes 54.4% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized nutrition channels, integration of advanced fermentation technologies, and development of personalized nutrition protocols. The growing adoption of evidence-based nutritional science and healthcare provider recommendations will drive demand for clinically proven microbial nucleotides with enhanced bioavailability and safety profiles.

Between 2020 and 2025, the microbial nucleotides market experienced steady expansion, driven by increasing recognition of nucleotides' importance in immune function and cellular metabolism. The market developed as food manufacturers and nutrition companies recognized the need for high-quality nucleotide ingredients to enhance product formulations. Clinical research and regulatory approvals began emphasizing the importance of microbial nucleotides in achieving better nutritional outcomes for infants and specialized patient populations.

Market expansion is being supported by the increasing awareness of nucleotides' role in immune function, growth, and development, particularly in infant nutrition applications. Modern food manufacturers and nutrition companies are increasingly focused on functional ingredients that can enhance product efficacy, improve nutritional value, and address specific health needs. The proven benefits of nucleotides in supporting immune system development, cellular repair, and metabolic functions make them essential components of premium nutritional products.

The growing emphasis on personalized nutrition and functional foods is driving demand for high-quality microbial nucleotides that address individual health needs and developmental requirements. Food and beverage manufacturers' preference for clean-label, naturally-derived ingredients is creating opportunities for innovative microbial nucleotide production. The rising influence of clinical research and evidence-based nutrition protocols is also contributing to increased adoption of proven microbial nucleotide formulations across different applications and consumer segments.

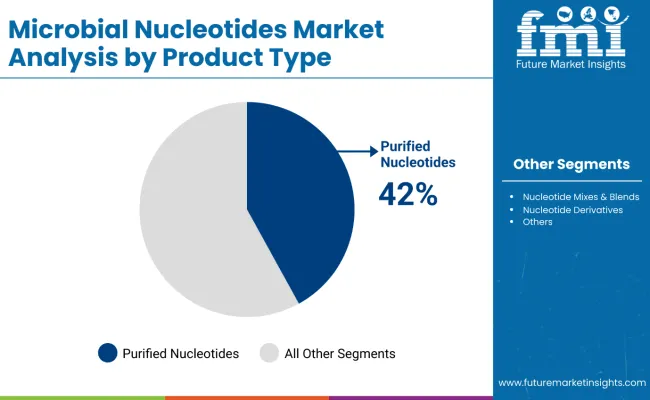

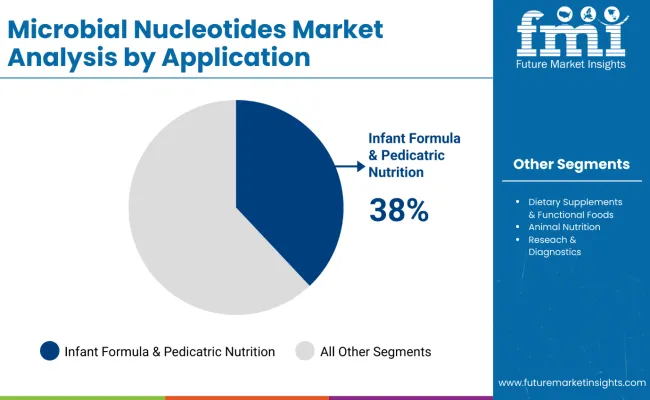

The market is segmented by product type, application, end user, and region. By product type, the market is divided into purified nucleotides, nucleotide mixes & blends, nucleotide derivatives, and others. Based on application, the market is categorized into infant formula & pediatric nutrition, dietary supplements & functional foods, animal nutrition, and research & diagnostics. In terms of end user, the market is segmented into nutraceutical & food companies, infant formula manufacturers, pharmaceutical & biotech firms, animal feed manufacturers, and academic & research institutes. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The purified nucleotides segment is projected to account for 42.0% of the microbial nucleotides market in 2025, reaffirming its position as the category's dominant product type. Food manufacturers and nutrition companies increasingly recognize the superior quality and bioavailability of purified nucleotides for premium nutritional applications, particularly in infant formula and specialized dietary supplements. This segment addresses the growing demand for high-purity ingredients that meet stringent quality standards and regulatory requirements.

This product type forms the foundation of most premium nutritional formulations, as it represents the most clinically validated and widely accepted nucleotide form in the industry. Regulatory approvals and extensive research continue to strengthen confidence in these formulations. With increasing recognition of nucleotides' importance in immune function and cellular metabolism, purified nucleotides align with both immediate nutritional needs and long-term health goals. Their superior bioavailability and consistent quality ensure sustained market dominance, making them the central growth driver of microbial nucleotide demand.

Infant Formula & Pediatric Nutrition is projected to represent 38.0% of microbial nucleotides demand in 2025, underscoring its role as the primary application driving market growth. Healthcare providers and nutrition specialists recognize that nucleotides play crucial roles in infant development, immune system maturation, and cognitive function, making them essential components of modern infant formulas. These applications require the highest quality standards and most rigorous safety testing protocols.

The segment is supported by the growing awareness among parents and healthcare providers about the importance of nucleotides in early childhood development and immune system support. Additionally, regulatory bodies are increasingly recognizing the benefits of nucleotide supplementation in infant nutrition, leading to expanded approval and recommendations. As clinical understanding of nucleotides' role in infant health advances, these applications will continue to play a crucial role in driving market growth, reinforcing their essential position within the microbial nucleotides industry.

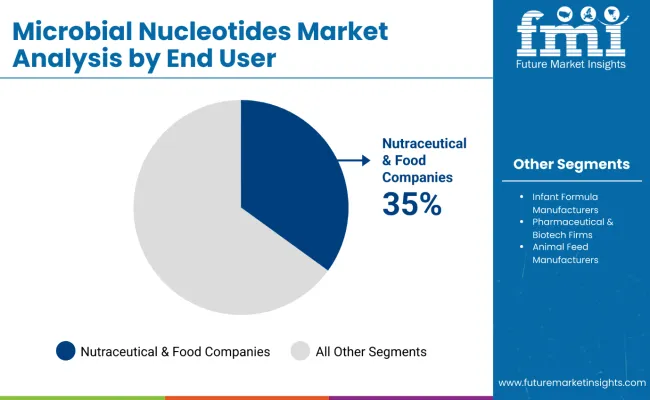

Nutraceutical & Food Companies are projected to represent 35.0% of microbial nucleotides demand in 2025, establishing their position as the leading end user category. These companies increasingly recognize the value of incorporating high-quality nucleotides into their product formulations to enhance nutritional profiles and meet consumer demand for functional ingredients. The segment benefits from the growing trend toward functional foods and the increasing consumer awareness of nucleotides' health benefits.

This end user category drives innovation in product development and formulation strategies, as nutraceutical and food companies seek to differentiate their offerings through scientifically-backed ingredients. The segment is supported by regulatory frameworks that encourage the use of safe and effective functional ingredients, along with growing consumer willingness to pay premium prices for enhanced nutritional products. With increasing focus on preventive healthcare and wellness-oriented consumption patterns, nutraceutical and food companies continue to expand their nucleotide-enhanced product portfolios, reinforcing their dominant position in driving market demand.

The microbial nucleotides market is advancing steadily due to increasing recognition of nucleotides' health benefits and growing demand for functional food ingredients. However, the market faces challenges including complex production processes, high manufacturing costs, and stringent regulatory requirements. Innovation in fermentation technologies and purification processes continue to influence product development and market expansion patterns.

Expansion of Functional Food and Nutraceutical Applications

The growing adoption of functional foods and nutraceutical products is enabling more sophisticated nucleotide formulations and targeted health applications. Food manufacturers are incorporating microbial nucleotides into various product categories, including sports nutrition, immune support supplements, and elderly nutrition products. Specialty nutrition channels provide access to targeted consumer segments who can benefit from nucleotide supplementation.

Integration of Advanced Fermentation Technologies and Production Systems

Modern biotechnology companies are incorporating advanced fermentation technologies such as precision fermentation, optimized microbial strains, and automated production systems to enhance nucleotide production efficiency and quality. These technologies improve product consistency, enable cost-effective scaling, and provide better control over nucleotide purity and composition. Advanced production platforms also enable development of specialized nucleotide formulations and early identification of potential quality issues.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

| China | 6.1% |

| Brazil | 3.1% |

| USA | 2.1% |

| France | 3.7% |

| UK | 3.4% |

| Germany | 2.9% |

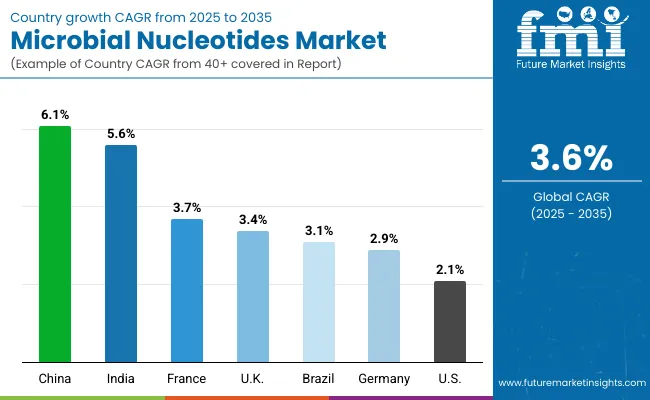

The microbial nucleotides market is experiencing varied growth globally, with China leading at a 6.1% CAGR through 2035, driven by expanding food and beverage industry, increasing health consciousness, and growing demand for functional ingredients. India follows at 5.6%, supported by rising disposable income, increasing awareness of nutritional supplements, and expanding infant nutrition market. France shows growth at 3.7%, emphasizing advanced food technology and premium nutrition products. The UK records 3.4% growth, focusing on functional foods and dietary supplements. The USA shows 2.1% growth, representing a mature market with established consumption patterns and regulatory frameworks.

The report covers an in-depth analysis of 40+ countries;seven top-performing countries are highlighted below.

Revenue from microbial nucleotides in China is projected to exhibit steady growth with a CAGR of 6.1% through 2035, driven by rapid expansion of the food and beverage industry and increasing consumer focus on functional nutrition. The country's growing middle class and rising health consciousness are creating significant opportunities for nucleotide-enhanced products across infant nutrition, dietary supplements, and functional foods. Major international and domestic companies are establishing comprehensive production and distribution networks to serve the growing demand for high-quality nutritional ingredients.

Revenue from microbial nucleotides in India is expanding at a CAGR of 5.6%, supported by increasing health awareness, growing infant nutrition market, and expanding pharmaceutical and nutraceutical industries. The country's large population and increasing focus on preventive healthcare are driving demand for effective nutritional supplement solutions. International nutrition companies and domestic manufacturers are establishing distribution channels to serve the growing demand for quality functional ingredients.

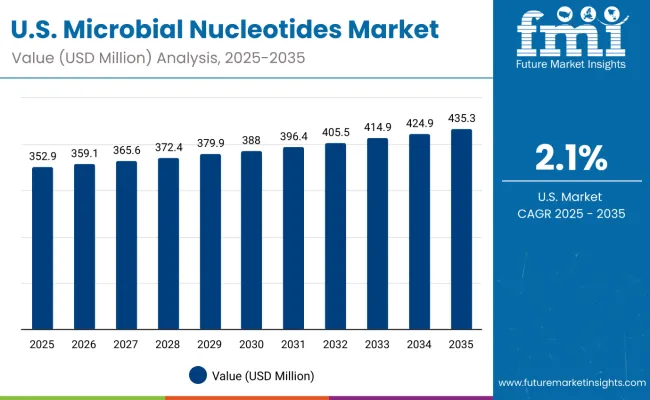

Demand for microbial nucleotides in the USA is projected to grow at a CAGR of 2.1%, supported by well-established nutrition and supplement industries and evidence-based health recommendations. American food manufacturers and supplement companies consistently utilize nucleotides for premium nutritional products and specialized applications. The market is characterized by mature consumption patterns, comprehensive regulatory frameworks, and established relationships between manufacturers and ingredient suppliers.

Revenue from microbial nucleotides in Brazil is projected to grow at a CAGR of 3.1% through 2035, driven by food industry development, increasing health consciousness, and growing demand for functional food ingredients. Brazilian food manufacturers are increasingly adopting nucleotide ingredients for premium product formulations, supported by expanding domestic production capabilities and improved ingredient availability.

Revenue from microbial nucleotides in the UK is projected to grow at a CAGR of 3.4% through 2035, supported by consumer preference for premium nutrition products and comprehensive food safety regulations that facilitate appropriate use of functional ingredients. British food manufacturers consistently utilize established protocols for nucleotide incorporation, emphasizing product quality and consumer health benefits within competitive market dynamics.

Revenue from microbial nucleotides in Germany is projected to grow at a CAGR of 2.9% through 2035, supported by the country's advanced food technology infrastructure, comprehensive quality control systems, and systematic approach to functional ingredient utilization. German food manufacturers emphasize evidence-based nucleotide utilization within structured quality frameworks that prioritize product effectiveness and consumer safety.

Revenue from microbial nucleotides in France is projected to grow at a CAGR of 3.7% through 2035, supported by the country's innovative food industry, established nutrition research infrastructure, and systematic approach to functional food development. French food manufacturers emphasize evidence-based nucleotide utilization within integrated product development frameworks that prioritize consumer health and product differentiation.

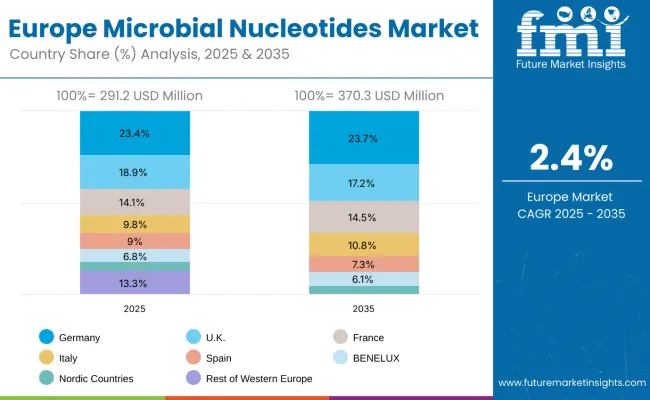

The microbial nucleotides market in Europe is projected to expand steadily through 2035, supported by increasing adoption of functional food ingredients, rising consumer awareness of nutritional benefits, and ongoing innovation in food technology applications. Germany will continue to lead the regional market, accounting for 23.4% in 2025 and rising to 23.7% by 2035, supported by advanced food technology infrastructure, comprehensive quality standards, and robust food manufacturing sector. The United Kingdom follows with 18.9% in 2025, decreasing slightly to 17.2% by 2035, driven by premium nutrition focus, regulatory compliance standards, and established supplement industry.

France holds 14.1% in 2025, increasing to 14.5% by 2035 as food manufacturers expand functional ingredient utilization and demand grows for innovative nutrition solutions. Italy contributes 9.8% in 2025, growing to 10.8% by 2035, supported by traditional food industry modernization and growing health-conscious consumer base. Spain represents 9.0% in 2025, declining to 7.3% by 2035, with market dynamics shifting toward core European markets.

BENELUX markets together account for 6.8% in 2025, decreasing to 6.1% by 2035, maintaining focus on high-quality ingredient applications and regulatory compliance. The Nordic countries represent 4.8% in 2025, declining to 4.3% by 2035, with demand supported by health-focused consumer preferences and premium nutrition products. The Rest of Western Europe moderates from 13.3% in 2025 to 16.2% by 2035, as emerging food markets capture greater share of regional nucleotide ingredient demand.

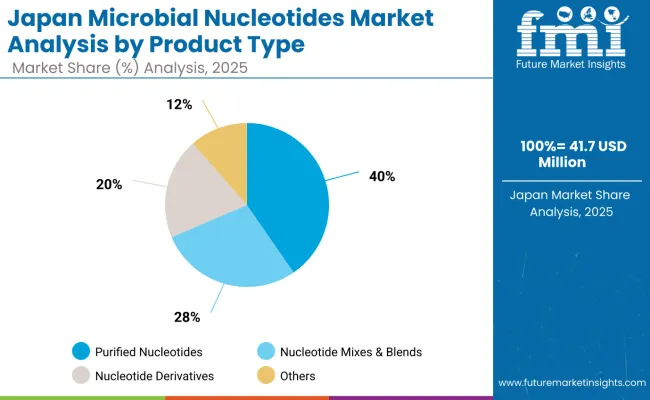

The microbial nucleotides market in Japan is set to remain diversified across several product types in 2025, reflecting manufacturing capabilities and consumer preferences for functional ingredients. Purified Nucleotides dominate with a 40.4% share in 2025, supported by their central role in premium infant nutrition products, dietary supplements, and functional food applications.

Nucleotide Mixes & Blends represent 28.2% in 2025, gaining popularity from their cost-effectiveness and versatility in various food applications. Nucleotide Derivatives hold 19.9%, sustained by their specialized applications in pharmaceutical and research sectors.

Meanwhile, other nucleotide products account for 11.5%, reflecting growing interest in innovative formulations and specialized applications across diverse market segments.

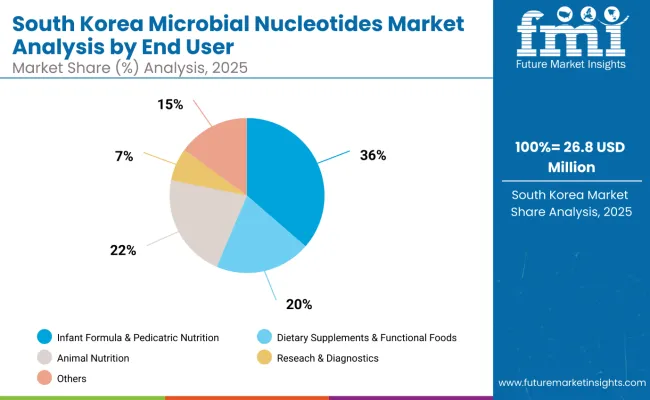

The microbial nucleotides market in South Korea in 2025 is shaped by strong demand across core application areas, reflecting both consumer preferences and regulatory guidelines. Infant Formula & Pediatric Nutrition accounts for the largest share at 36.3%, supported by high birth rates, premium nutrition focus, and increasing parental awareness of nucleotide benefits in infant development.

Dietary Supplements & Functional Foods follows with 20.0%, driven by rising health consciousness, aging population concerns, and wider acceptance of nutritional supplementation protocols. Animal Nutrition contributes 21.7%, supported by the established use of nucleotides in livestock and aquaculture applications to enhance animal health and productivity.

Research & Diagnostics holds 6.8%, reflecting growing academic and pharmaceutical research activities utilizing nucleotide compounds. The remaining applications represent smaller but growing segments, highlighting opportunities for expanded clinical adoption and innovative product development.

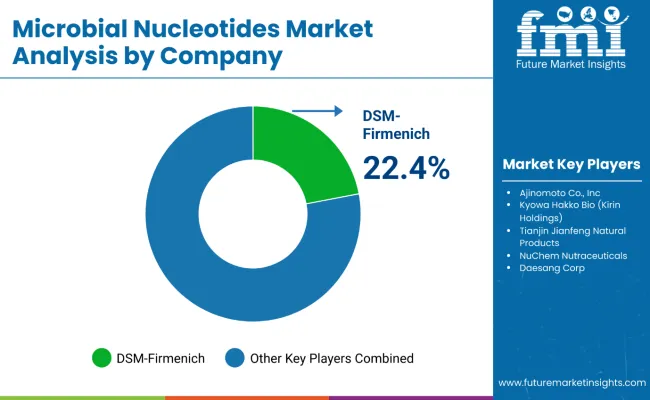

The microbial nucleotides market is characterized by competition among established biotechnology companies, specialty ingredient manufacturers, and pharmaceutical firms. Companies are investing in fermentation technology, quality control systems, strategic partnerships, and customer education to deliver high-quality, safe, and effective nucleotide solutions. Product development, clinical validation, and market access strategies are central to strengthening product portfolios and market presence.

DSM-Firmenich leads the market with 22.4% global value share, offering clinically-proven microbial nucleotides with a focus on quality and bioavailability. Ajinomoto Co., Inc. provides comprehensive nucleotide ingredient solutions with emphasis on fermentation expertise and product consistency. Kyowa Hakko Bio focuses on innovative production technologies and specialized purification processes for premium nucleotide products. Tianjin Jianfeng Natural Products delivers cost-effective nucleotide solutions with strong manufacturing capabilities.

NuChem Nutraceuticals operates in specialty nutrition markets with focus on bringing innovative nucleotide formulations to targeted applications. Daesang Corp. provides comprehensive ingredient portfolios including nucleotide products across multiple food and nutrition sectors. Sigma-Aldrich specializes in research-grade nucleotides and analytical solutions for pharmaceutical and academic applications. Zhejiang Nucleotide Biotech focuses on scalable production technologies and competitive pricing strategies to enhance market accessibility.

Key Players in the Microbial Nucleotides Market

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,254.5 Million |

| Product Type | Purified Nucleotides, Nucleotide Mixes & Blends, Nucleotide Derivatives, Others |

| Application | Infant Formula & Pediatric Nutrition, Dietary Supplements & Functional Foods, Animal Nutrition, Research & Diagnostics |

| End User | Nutraceutical & Food Companies, Infant Formula Manufacturers, Pharmaceutical & Biotech Firms, Animal Feed Manufacturers, Academic & Research Institutes |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | DSM-Firmenich, Ajinomoto Co., Inc., Kyowa Hakko Bio, Tianjin Jianfeng Natural Products, NuChem Nutraceuticals, Daesang Corp., Sigma-Aldrich, Zhejiang Nucleotide Biotech |

| Additional Attributes | Dollar sales by product type and application, regional demand trends, competitive landscape, manufacturer preferences for specific formulations, integration with specialty nutrition channels, innovations in fermentation technologies, quality control monitoring, and nutritional outcome optimization |

The global microbial nucleotides market is valued at USD 1,254.5 million in 2025.

The size for the microbial nucleotides market is projected to reach USD 1,778.8 million by 2035.

The microbial nucleotides market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product type segments in the microbial nucleotides market are purified nucleotides, nucleotide blends/mixes, and nucleoside derivatives.

In terms of product type, purified nucleotides segment is set to command 42.0% share in the microbial nucleotides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microbial Polyketides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microbial Fermentation Technology Market Size and Share Forecast Outlook 2025 to 2035

Microbial Gene Editing Services Market Size and Share Forecast Outlook 2025 to 2035

Microbial Lipids Size and Share Forecast Outlook 2025 to 2035

Microbial Therapeutic Products Market Size and Share Forecast Outlook 2025 to 2035

Microbial Lipase Market - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Microbial Seed Treatment Business

Analysis and Growth Projections for Microbial Food Culture Business

Microbial Protein Used in Feed Market Analysis by Application, Source, and Region Through 2035

Microbial Identification Market Report – Growth & Forecast 2025-2035

Microbial Feed Additives Market – Growth, Probiotics & Livestock Nutrition

Microbial Bioreactors Market

Microbial Rennet Market

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Hospital Textile Market Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA