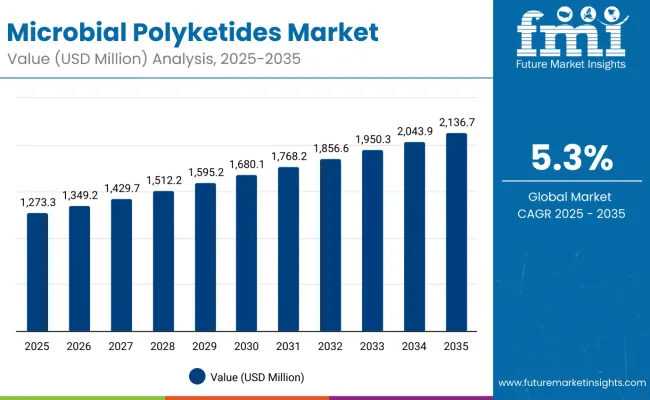

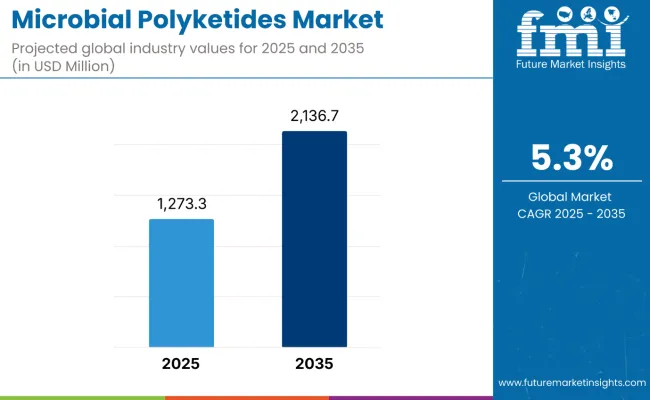

The global microbial polyketides market is projected to grow from USD 1,273.3 million in 2025 to approximately USD 2,136.7 million by 2035, recording an absolute increase of USD 863.4 million over the forecast period. This translates into a total growth of 67.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.7X during the same period, supported by increasing demand for natural bioactive compounds, rising pharmaceutical research activities, and growing focus on biotechnology-based drug discovery and development.

Microbial Polyketides Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,273.3 million |

| Forecast Value in (2035F) | USD 2,136.7 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

Between 2025 and 2030, the microbial polyketides market is projected to expand from USD 1,273.3 million to USD 1,641.2 million, resulting in a value increase of USD 367.9 million, which represents 42.6% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for natural pharmaceutical compounds, increasing biotechnology research investments, and growing adoption of microbial fermentation technologies in drug manufacturing. Pharmaceutical and biotechnology companies are expanding their microbial polyketide portfolios to address the growing demand for innovative therapeutic solutions derived from natural sources.

From 2030 to 2035, the market is forecast to grow from USD 1,641.2 million to USD 2,136.7 million, adding another USD 495.5 million, which constitutes 57.4% of the overall ten-year expansion. This period is expected to be characterized by expansion of biotechnology manufacturing capabilities, integration of advanced fermentation technologies, and development of novel polyketide-based therapeutic compounds. The growing adoption of precision medicine and personalized therapeutics will drive demand for specialized microbial polyketides with enhanced bioactivity and specificity profiles.

Between 2020 and 2025, the microbial polyketides market experienced steady expansion, driven by increasing recognition of natural product drug discovery and growing acceptance of biotechnology-based manufacturing processes. The market developed as pharmaceutical companies recognized the potential of microbial polyketides in developing next-generation therapeutics. Clinical research and regulatory frameworks began emphasizing the importance of natural bioactive compounds in achieving better therapeutic outcomes for various medical conditions.

Market expansion is being supported by the increasing demand for novel pharmaceutical compounds and the corresponding need for innovative drug discovery platforms. Modern pharmaceutical companies are increasingly focused on natural product-based drug development that can provide unique mechanisms of action, improved therapeutic efficacy, and reduced side effect profiles. The proven bioactivity of microbial polyketides in treating various conditions including cancer, infections, and metabolic disorders makes them essential components of contemporary drug discovery programs.

The growing emphasis on sustainable manufacturing and green chemistry is driving demand for biotechnology-based production methods that utilize microbial fermentation systems. Healthcare provider preference for naturally-derived therapeutic compounds with well-characterized safety profiles is creating opportunities for innovative product development. The rising influence of precision medicine and personalized therapeutics is also contributing to increased adoption of specialized microbial polyketides across different therapeutic areas and patient populations.

The market is segmented by product type, end user, and region. By product type, the market is divided into Active Pharmaceutical Ingredients (APIs) & Drug Products, Research-Grade Reagents, Food & Agro Biocontrol Products, and Others. Based on end user, the market is categorized into Pharmaceutical Companies, Life-Science Research / Academia, Biotech & Synthetic Biology Firms, Food & Agro Industries, and Others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

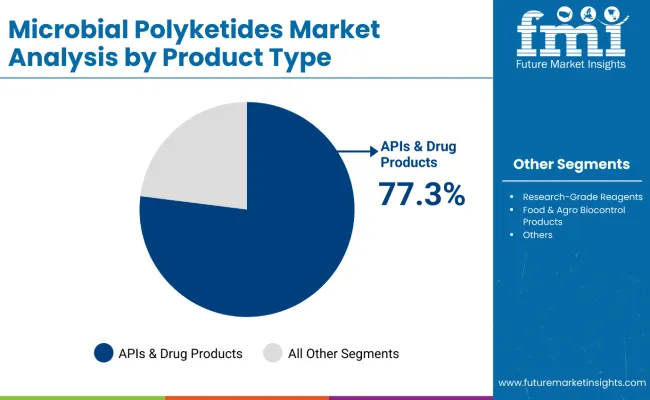

The Active Pharmaceutical Ingredients (APIs) & Drug Products segment is projected to account for 77.3% of the microbial polyketides market in 2025, reaffirming its position as the category's dominant product type. Pharmaceutical companies increasingly recognize the therapeutic potential of microbial polyketides in developing innovative drugs for various medical conditions, particularly in oncology, infectious diseases, and metabolic disorders. This segment addresses the critical need for novel therapeutic compounds with unique mechanisms of action and improved efficacy profiles.

This product type forms the foundation of most drug development programs focusing on natural products, as it represents the most commercially viable and clinically validated application of microbial polyketides. Regulatory approvals and extensive clinical research continue to strengthen confidence in these compounds. With increasing recognition of the therapeutic potential of natural bioactive molecules requiring specialized manufacturing approaches, APIs & Drug Products align with both research and commercial development goals. Their broad therapeutic utility across multiple indications ensures sustained market dominance, making them the central growth driver of microbial polyketides demand.

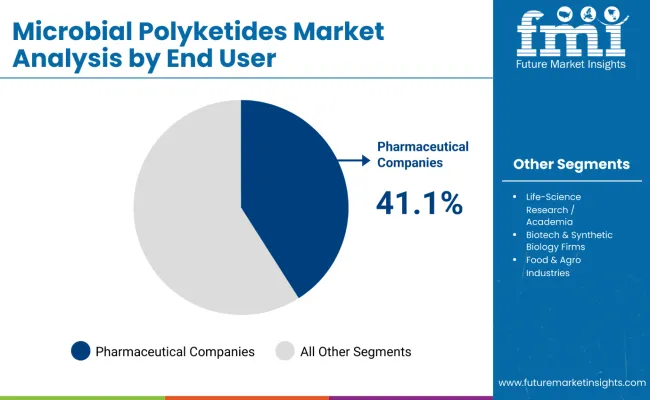

Pharmaceutical Companies are projected to represent 41.1% of microbial polyketides demand in 2025, underscoring their role as the primary end user driving market adoption. These companies recognize that microbial polyketides offer unique advantages in drug discovery and development, providing access to novel chemical structures and bioactivities that cannot be easily synthesized through traditional chemical methods. The segment benefits from established drug development pipelines and commercial manufacturing capabilities.

The segment is supported by the pharmaceutical industry's focus on innovative therapeutic solutions and the growing recognition that natural products can provide breakthrough therapeutic opportunities. Additionally, pharmaceutical companies are increasingly adopting biotechnology-based manufacturing processes that can produce complex bioactive compounds efficiently and sustainably. As clinical understanding of polyketide mechanisms and therapeutic applications advances, pharmaceutical companies will continue to play a crucial role in translating research discoveries into commercial therapeutic products, reinforcing their essential position within the microbial polyketides market.

The microbial polyketides market is advancing steadily due to increasing recognition of natural product drug discovery and growing demand for innovative biotechnology-based manufacturing processes. However, the market faces challenges including complex regulatory pathways for natural products, technical difficulties in large-scale fermentation, and concerns about intellectual property protection. Innovation in fermentation technologies and synthetic biology approaches continue to influence product development and market expansion patterns.

Expansion of Biotechnology Manufacturing Capabilities and Synthetic Biology Platforms

The growing adoption of advanced biotechnology manufacturing facilities is enabling more sophisticated polyketide production and optimization. Synthetic biology platforms offer comprehensive compound development services, including strain engineering, fermentation optimization, and downstream processing capabilities that are particularly important for complex polyketide molecules. Specialized biotechnology companies provide access to cutting-edge technologies and expertise for polyketide discovery and development.

Integration of Artificial Intelligence and Machine Learning in Drug Discovery

Modern biotechnology companies are incorporating artificial intelligence and machine learning technologies such as predictive modeling, compound optimization algorithms, and automated screening systems to enhance polyketide discovery and development. These technologies improve compound identification efficiency, enable rational strain engineering approaches, and provide better prediction of therapeutic potential. Advanced computational platforms also enable personalized compound design and early identification of promising therapeutic candidates or potential safety concerns.

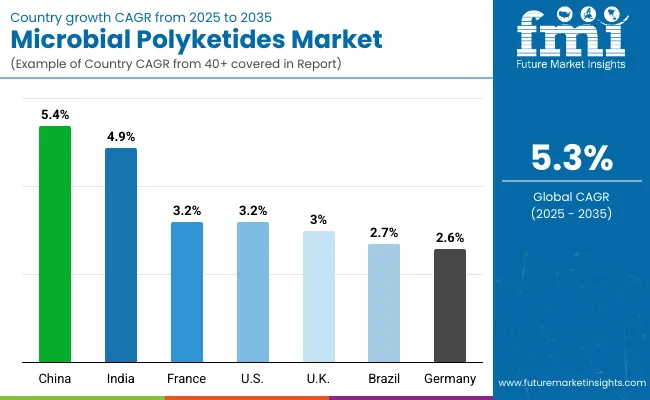

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 4.9% |

| China | 5.4% |

| Brazil | 2.7% |

| USA | 3.2% |

| France | 3.2% |

| UK | 3.0% |

| Germany | 2.6% |

The microbial polyketides market is experiencing varied growth globally, with China leading at a 5.4% CAGR through 2035, driven by expanding biotechnology infrastructure, increasing pharmaceutical research investments, and growing focus on natural product drug discovery. India follows at 4.9%, supported by growing biotechnology sector development, increasing recognition of traditional medicine integration with modern drug discovery, and expanding pharmaceutical manufacturing capabilities. Europe shows growth at 3.6%, focusing on advanced biotechnology research and comprehensive regulatory frameworks for natural products. The USA shows 3.2% growth, representing a mature market with established biotechnology infrastructure and regulatory pathways. Brazil demonstrates growth at 2.7%, emphasizing improved access to biotechnology resources and natural product research development.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from microbial polyketides in China is projected to exhibit steady growth with a CAGR of 5.4% through 2035, driven by ongoing biotechnology sector expansion and increasing government support for pharmaceutical innovation. The country's expanding biotechnology infrastructure and growing availability of specialized research facilities are creating significant opportunities for polyketide research and development. Major international and domestic biotechnology companies are establishing comprehensive research and manufacturing networks to serve the growing demand for novel therapeutic compounds across urban and developing regions.

Revenue from microbial polyketides in India is expanding at a CAGR of 4.9%, supported by increasing biotechnology capabilities, growing pharmaceutical research activities, and expanding natural product research programs. The country's large pharmaceutical manufacturing base and increasing focus on innovative drug discovery are driving demand for advanced polyketide research and development solutions. International biotechnology companies and domestic research institutions are establishing collaborative networks to serve the growing demand for natural product-based therapeutic development.

Demand for microbial polyketides in the USA is projected to grow at a CAGR of 3.2%, supported by well-established biotechnology research systems and advanced drug discovery capabilities. American pharmaceutical and biotechnology companies consistently utilize polyketide research for innovative drug development and natural product discovery programs. The market is characterized by mature research protocols, comprehensive funding mechanisms, and established relationships between academic institutions and commercial biotechnology companies.

Revenue from microbial polyketides in Brazil is projected to grow at a CAGR of 2.7% through 2035, driven by natural resource utilization, increasing biotechnology research capabilities, and growing recognition of biodiversity-based drug discovery importance. Brazilian research institutions are increasingly adopting polyketide research approaches for natural product discovery, supported by expanding academic-industry partnerships and improved research accessibility.

Revenue from microbial polyketides in the UK is projected to grow at a CAGR of 3.0% through 2035, supported by academic research excellence and comprehensive biotechnology research frameworks that facilitate appropriate use of polyketide research for innovative drug discovery programs. British research institutions consistently utilize established protocols for natural product research, emphasizing scientific innovation and therapeutic optimization within integrated academic-industry partnerships.

Revenue from microbial polyketides in Germany is projected to grow at a CAGR of 2.6% through 2035, supported by the country's well-established research infrastructure, comprehensive biotechnology capabilities, and systematic approach to natural product research. German research institutions emphasize evidence-based polyketide research utilization within structured academic frameworks that prioritize scientific excellence and innovation.

Revenue from microbial polyketides in France is projected to grow at a CAGR of 3.2% through 2035, supported by the country's comprehensive research infrastructure, established biotechnology capabilities, and systematic approach to natural product discovery. French research institutions emphasize evidence-based polyketide research utilization within integrated academic frameworks that prioritize scientific innovation and therapeutic development.

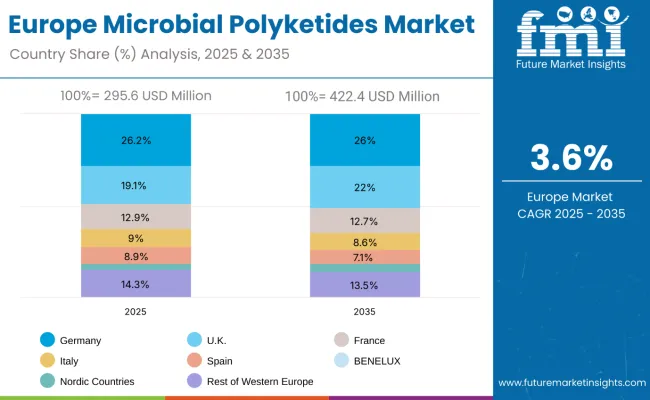

The microbial polyketides market in Europe is projected to expand steadily through 2035, supported by increasing adoption of natural product research in biotechnology, rising prevalence of drug-resistant diseases requiring novel therapeutic approaches, and ongoing clinical innovation in natural product-based therapeutics. Germany will continue to lead the regional market, accounting for 26.2% in 2025 and maintaining 26.0% by 2035, supported by a strong biotechnology research base, comprehensive funding mechanisms, and robust pharmaceutical research infrastructure.

The United Kingdom follows with 19.1% in 2025, increasing to 22.0% by 2035, driven by academic research excellence, biotechnology innovation integration, and broadening pharmaceutical company networks. France holds 12.9% in 2025, edging up to 12.7% by 2035 as research institutions expand natural product discovery protocols and demand grows for specialized therapeutic development programs.

Italy contributes 9.0% in 2025, remaining broadly stable at 8.6% by 2035, supported by strong regional biotechnology programs and growing pharmaceutical research participation. Spain represents 8.9% in 2025, adjusting to 7.1% by 2035, underpinned by developing biotechnology capabilities and expanding academic-industry partnerships.

BENELUX markets together account for 6.8% in 2025, moving to 6.1% by 2035, supported by innovation-friendly regulatory frameworks and academic-industry collaboration. The Nordic countries represent 2.9% in 2025, increasing to 4.1% by 2035, with demand fueled by progressive research systems and early adoption of biotechnology-based natural product discovery.

The Rest of Western Europe moderates from 14.3% in 2025 to 13.5% by 2035, as larger core markets capture a greater share of investment, clinical research, and adoption of natural product research protocols.

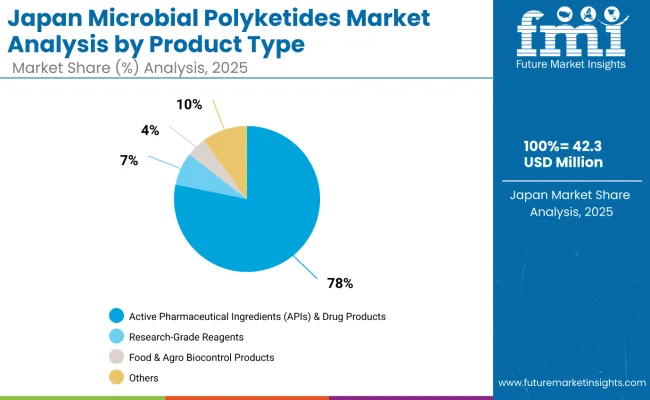

The microbial polyketides market in Japan is set to remain diversified across several product applications in 2025, reflecting clinical preferences in biotechnology practice and evolving manufacturing patterns. Active Pharmaceutical Ingredients (APIs) & Drug Products combinations dominate with a 78.2% share in 2025, supported by their central role in pharmaceutical manufacturing, drug development programs, and therapeutic compound production.

Research-Grade Reagents represent 7.3% in 2025, gaining traction from academic research institutions and biotechnology companies focusing on compound characterization and analytical applications. Food & Agro Biocontrol Products hold 4.4%, sustained by their growing use in sustainable agriculture and food preservation applications.

Meanwhile, Others category accounts for 10.1%, driven by emerging applications in cosmetics, nutraceuticals, and specialized industrial uses. This segment reflects the growing role of biotechnology innovation and experimental applications entering commercial practice, highlighting Japan's leadership in advanced biotechnology research and development.

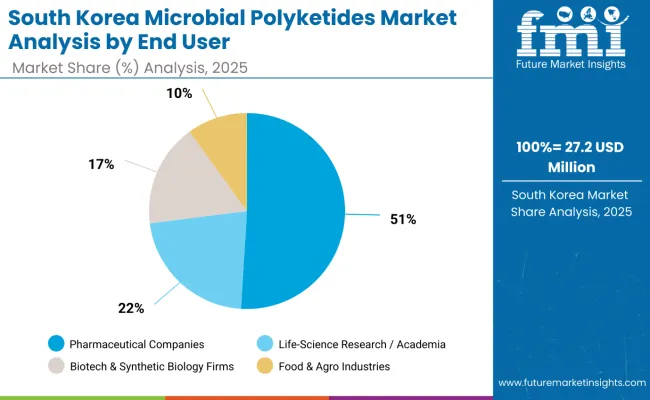

The microbial polyketides market in South Korea in 2025 is shaped by strong demand across core end user segments, reflecting both industrial capabilities and research priorities. Pharmaceutical Companies account for the largest share at 50.8%, supported by robust pharmaceutical manufacturing sector, biotechnology investment, and increasing focus on drug development programs.

Life-Science Research / Academia follows with 22.5%, driven by expanding research infrastructure, government support for biotechnology research, and growing academic-industry collaboration. Biotech & Synthetic Biology Firms contribute 16.3%, supported by the emerging biotechnology sector and increasing venture capital investment in synthetic biology applications.

Food & Agro Industries hold 10.4%, reflecting growing interest in sustainable agricultural solutions and food biotechnology applications. This segment demonstrates South Korea's commitment to biotechnology innovation across multiple sectors, highlighting opportunities for continued market expansion and technological advancement.

The microbial polyketides market is characterized by competition among established pharmaceutical companies, specialized biotechnology firms, and natural product research organizations. Companies are investing in research and development, biotechnology infrastructure, strategic partnerships, and academic collaborations to deliver innovative, effective, and accessible polyketide-based solutions. Drug discovery, natural product research, and commercialization strategies are central to strengthening product portfolios and market presence.

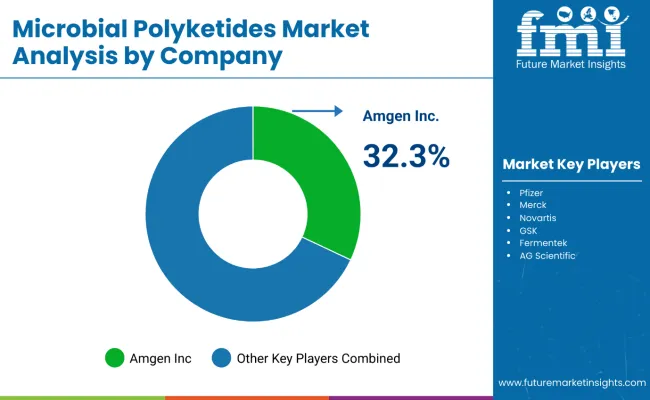

Amgen Inc., USA-based, leads the market with 32.3% global value share, offering advanced polyketide research capabilities with a focus on therapeutic innovation and commercial development. Pfizer provides comprehensive pharmaceutical research programs including polyketide-based drug discovery with emphasis on clinical translation and market accessibility.

Merck focuses on innovative biotechnology platforms and specialized research capabilities for natural product discovery. Novartis delivers established research programs with strong academic partnerships and pharmaceutical development acceptance. GSK operates with focus on therapeutic innovation and comprehensive drug discovery portfolios.

Fermentek and AG Scientific provide specialized research reagents, fermentation capabilities, and technical services to enhance market accessibility and research institution access to essential polyketide research tools and technologies.

Key Players in the Microbial Polyketides Market

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,273.3 Million |

| Product Type | Active Pharmaceutical Ingredients (APIs) & Drug Products, Research-Grade Reagents, Food & Agro Biocontrol Products, Others |

| End User | Pharmaceutical Companies, Life-Science Research / Academia, Biotech & Synthetic Biology Firms, Food & Agro Industries, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Amgen Inc., Pfizer, Merck, Novartis, GSK, Fermentek, AG Scientific |

| Additional Attributes | Dollar sales by product type and end user application, regional demand trends, competitive landscape, research institution preferences for specific compounds, integration with biotechnology research platforms, innovations in fermentation technologies, therapeutic development monitoring, and clinical outcome optimization |

The global microbial polyketides market is valued at USD 1,273.3 million in 2025.

The size for the microbial polyketides market is projected to reach USD 2,136.7 million by 2035.

The microbial polyketides market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key application segments in the microbial polyketides market are active pharmaceutical ingredients (APIs) & drug products, nutraceuticals & dietary supplements, and cosmetics & personal care products.

In terms of application, active pharmaceutical ingredients (APIs) & drug products segment is set to command 77.3% share in the microbial polyketides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microbial Nucleotides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microbial Fermentation Technology Market Size and Share Forecast Outlook 2025 to 2035

Microbial Gene Editing Services Market Size and Share Forecast Outlook 2025 to 2035

Microbial Lipids Size and Share Forecast Outlook 2025 to 2035

Microbial Therapeutic Products Market Size and Share Forecast Outlook 2025 to 2035

Microbial Lipase Market - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Microbial Seed Treatment Business

Analysis and Growth Projections for Microbial Food Culture Business

Microbial Protein Used in Feed Market Analysis by Application, Source, and Region Through 2035

Microbial Identification Market Report – Growth & Forecast 2025-2035

Microbial Feed Additives Market – Growth, Probiotics & Livestock Nutrition

Microbial Bioreactors Market

Microbial Rennet Market

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Hospital Textile Market Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA