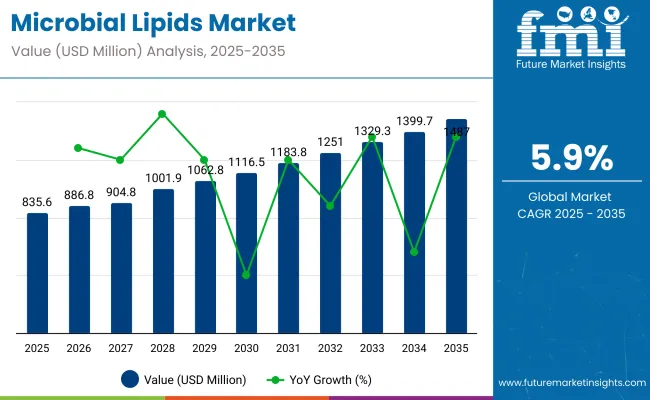

The microbial lipids market has been projected to reach a valuation of USD 835.6 million in 2025, advancing to USD 1,487.5 million by 2035, marking an absolute increase of USD 651.9 million a near 1.8x growth over the decade. This expansion has been underpinned by a compound annual growth rate (CAGR) of 5.9%, signaling rising industrial validation of microbial lipids as scalable and sustainable alternatives to plant and animal-derived lipids.

| Metric | Value |

|---|---|

| Microbial Lipids Estimated Value in (2025E) | USD 835.6 million |

| Microbial Lipids Forecast Value in (2035F) | USD 1,487.0 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

In the first half of the forecast period (2025 to 2030), the market is expected to rise from approximately USD 835.6 million to USD 1,116.5 million, accounting for 43% of the total decade gain. Early growth has been driven by heightened interest in yeast- and algae-derived lipid formulations for functional foods and omega-3 enriched dietary supplements. Nutritional alignment and traceability advantages have positioned microbial lipids favorably within nutraceutical and vegan nutrition sectors.

From 2030 to 2035, the market is forecasted to accelerate from USD 1,116.5 million to USD 1,487.5 million, contributing the remaining 57% of decade growth. This phase is likely to be shaped by the scaling of synthetic biology applications, emergence of lipid-personalized therapeutics, and deeper integration of microbial lipids in cosmetics and biopharma excipients.

Regional expansion in East Asia and Europe is anticipated, supported by biotech manufacturing clusters and progressive bio-ingredient policies. By 2035, microbial lipid technologies are expected to be embedded within circular production ecosystems, with digital fermentation optimization contributing to both yield efficiency and cost parity.

From 2020 to 2024, the microbial lipids market expanded from USD 610 million to USD 835.6 million, driven primarily by increased demand for algae- and yeast-derived omega-rich oils in dietary supplements and functional foods.

During this period, value capture remained concentrated among integrated fermentation companies controlling over 60% of total revenues. Industry leaders such as Corbion, DSM-Firmenich, and Cargill sustained dominance through patented microbial strains, vertically integrated production, and regulatory expertise across food and pharma sectors. Application-based pricing, high purity yields, and EU/US compliance standards served as core differentiators.

By 2025, the market is projected to cross USD 835.6 million, with downstream integration and bioengineering-led strain development expected to shift the value chain. A growing share of market revenue will be driven by custom lipid profiles, encapsulated delivery formats, and precision fermentation platforms collectively expected to exceed 35% of total market value by 2030.

Established lipid producers are now being challenged by synthetic biology start-ups offering modular bio production and AI-driven process control. As a result, ecosystem integration, bio manufacturing scalability, and application-specific lipid tailoring are poised to define competitive success over the next decade.

The microbial lipids market is being propelled by a convergence of health-conscious consumer trends, sustainability mandates, and technological innovation in precision fermentation. Rising scrutiny on traditional lipid sources-due to deforestation, overfishing, and allergen risks has led to microbial lipids being prioritized for their eco-efficiency and tailored functionality. Increased adoption has been observed across nutraceuticals and functional foods, where omega-enriched and cholesterol-free lipid profiles are being preferred. Growth has also been supported by advances in synthetic biology, through which lipid biosynthesis pathways are being optimized for higher yields and specificity.

Regulatory encouragement toward bio-based alternatives has further accelerated development pipelines, particularly in North America, Europe, and East Asia. Pharmaceutical and cosmetic applications are being explored, as microbial lipids are being recognized for their purity, consistency, and biocompatibility. As cost curves continue to decline with fermentation scale-up and digital optimization, market competitiveness is expected to intensify positioning microbial lipids as foundational ingredients across multiple high-growth industries.

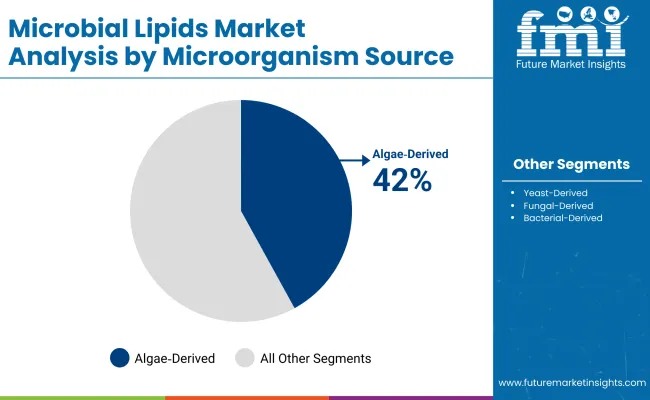

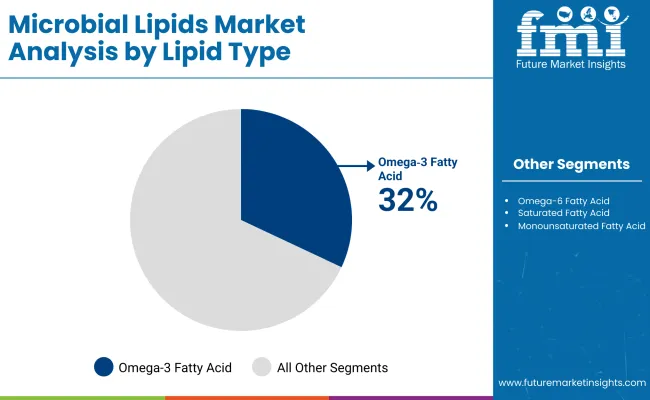

The microbial lipids market has been segmented across multiple strategic dimensions to capture emerging demand trends and value drivers. Key segmentation has been performed by microorganism source, lipid type, application, product form, sales channel, and end user. Among microorganism sources, yeast, fungi, algae, and bacteria are being utilized based on strain specificity, lipid yield, and scalability potential. In lipid type, the market has been differentiated by nutritional function particularly the role of omega fatty acids and phospholipids.

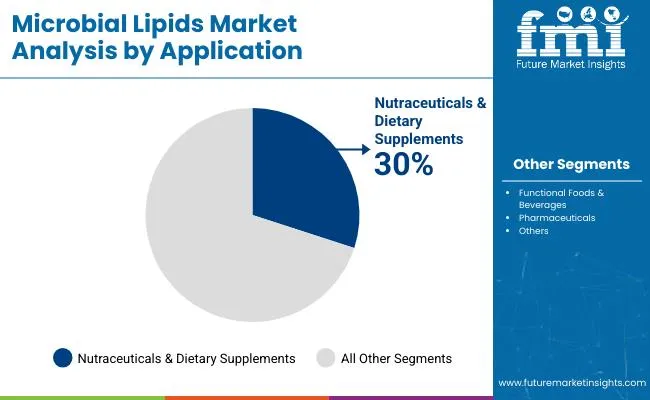

Application-based segmentation includes nutraceuticals, functional foods, pharmaceuticals, cosmetics, feed, and industrial biofuels, reflecting wide cross-industry utility. This granularity enables targeted innovation, regulatory alignment, and pricing strategies. By evaluating these segments, a forward-looking view has been established to identify growth hotspots and investment priorities within the microbial lipid landscape.

| Microorganism Source Segment | Market Value Share, 2025 |

|---|---|

| Algae Derived Lipids | 42.0% |

| Yeast Derived Lipids | 28.0% |

Algae-derived lipids have been positioned as the dominant segment, contributing 42.0% of the market in 2025. This leadership is attributed to their high omega-3 yield, renewable cultivation methods, and regulatory acceptance in food and nutraceutical applications. Algal fermentation systems have been increasingly favored due to their capacity for controlled biosynthesis and scalability in photo bioreactor and heterotrophic setups.

Compared to terrestrial sources, algae offer enhanced productivity with reduced land and water usage. The growth of this segment has also been supported by investments in marine biotechnology, alongside public-private partnerships aimed at developing DHA-rich algal oils. As strain engineering and downstream processing technologies are further refined, algae-derived lipids are expected to reinforce their leading role through both functional superiority and sustainable sourcing.

| Lipid Type | 2025 Share% |

|---|---|

| Omega 3 Fatty Acids (EPA, DHA) | 32.0% |

| Phospholipids | 15.0% |

| Polyunsaturated Fatty Acids | 10.0% |

Omega-3 fatty acids, particularly EPA and DHA, are projected to command 32.0% of the microbial lipids market in 2025. This dominance has been driven by rising consumer awareness of cardiovascular, cognitive, and prenatal health benefits associated with omega-3 intake. Microbial production platforms have been increasingly leveraged to bypass marine supply chains, enabling vegan, allergen-free, and traceable omega-3 sources.

Regulatory agencies have endorsed microbial omega-3s as GRAS (Generally Recognized as Safe), accelerating their incorporation into supplements, infant nutrition, and functional beverages. Moreover, pharmaceutical and clinical nutrition brands have adopted microbial omega-3s to address purity and oxidative stability concerns. With formulation versatility and growing demand for plant-alternative lipids, the omega-3 segment is expected to remain a pivotal driver of value creation.

| Application | 2025 Share% |

|---|---|

| Nutraceuticals & Dietary Supplements | 30.0% |

| Functional Foods & Beverages | 22.0% |

| Pharmaceuticals | 15.0% |

Nutraceuticals and dietary supplements have been estimated to lead the application segment, accounting for 30.0% of market value in 2025. The rising prevalence of lifestyle-related disorders and aging populations has catalyzed demand for bioavailable lipid formats enriched in omega-3s, phospholipids, and sterols. Microbial lipids are being increasingly preferred in supplement formulations for their purity, consistency, and customizable profiles.

The segment has also benefited from clean-label preferences and expanding e-commerce distribution, particularly across North America and Europe. Innovation in capsule, gummy, and softgel delivery forms has further accelerated integration into consumer wellness routines. With continued clinical validation and cross-border regulatory alignment, the nutraceuticals segment is expected to maintain its leadership in driving both volume and premium margins within the microbial lipids market.

Rising production costs, scale-up variability, and bioprocess complexities are challenging microbial lipid adoption, even as demand intensifies across functional food, cosmetic, and nutraceutical industries seeking high-purity, sustainable lipid alternatives.

Increased Demand for Sustainable Omega-3 Alternatives

Heightened consumer focus on plant-based nutrition and marine biodiversity conservation has triggered a pronounced shift toward microbially derived omega-3 fatty acids. Traditional fish oil sources have been constrained by volatile yields, overfishing, and contamination risks. As a result, microalgae and yeast fermentation systems are being prioritized for their ability to produce EPA and DHA without ecological trade-offs. These systems are being scaled using closed-loop fermentation under controlled conditions, allowing for reproducibility, traceability, and allergen-free claims.

Product developers have been increasingly integrating microbial omega-3s into infant nutrition, brain health, and cardiovascular support supplements. Regulatory acceptance in North America, Europe, and Asia has further legitimized these ingredients, while venture-backed firms have accelerated production through synthetic biology innovations. Demand is expected to remain strong across both B2C and B2B nutrition segments.

Convergence of Lipid Biosynthesis with Precision Fermentation Platforms

The microbial lipids sector has been increasingly shaped by its integration into broader precision fermentation platforms. Genetic pathway optimization, CRISPR-enabled strain design, and AI-guided process control have enabled microbial hosts to be tailored for desired lipid profiles and yields.

Rather than standalone lipid production, microbial lipid fermentation is now being embedded within multi-product bio manufacturing ecosystems supporting co-production of proteins, pigments, and co-factors. This convergence has drawn strategic investment from food-tech giants, fueling innovation at the intersection of synthetic biology and ingredient customization. As cost curves decline and versatility increases, microbial lipids are expected to become central to the next generation of bioengineered nutrition systems.

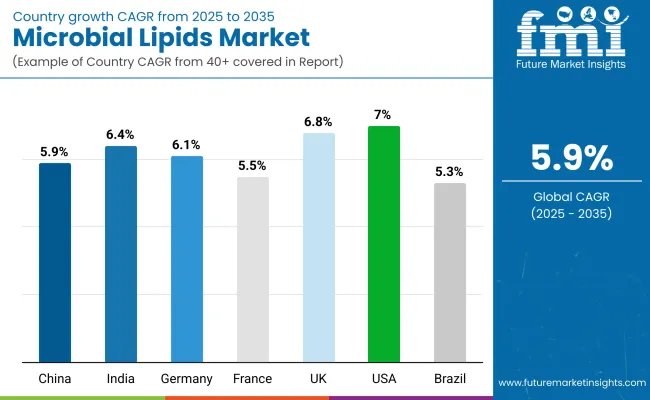

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.9% |

| India | 6.4% |

| Germany | 6.1% |

| France | 5.5% |

| UK | 6.8% |

| USA | 7.0% |

| Brazil | 5.3% |

The global microbial lipids market has been observed to exhibit marked disparities in country-level adoption, shaped by bioeconomy maturity, precision fermentation infrastructure, and nutritional policy orientation. Across advanced and emerging economies alike, microbial lipid technologies are being increasingly integrated into sustainable food systems and next-generation health products.

The United States is projected to lead with a 7.0% CAGR, driven by strong demand for vegan omega-3s, institutional investment in synthetic biology, and the regulatory acceptance of GRAS-approved microbial ingredients. The United Kingdom and India follow closely with 6.8% and 6.4%, respectively, where national biotech agendas and clean-label consumer movements have supported rapid innovation cycles.

Germany’s projected 6.1% CAGR reflects its strategic position in functional food manufacturing and ingredient safety standards, while China (5.9%) continues to scale fermentation-based production through government-supported industrial clusters. France (5.5%) and Brazil (5.3%) are expected to experience more moderate expansion, constrained by slower regulatory pathways and limited domestic manufacturing capacities.

However, localized demand for personalized nutrition and feed innovation is gradually strengthening commercial interest in these regions. As ecosystem partnerships deepen and technology transfer accelerates, microbial lipid adoption is expected to transition from niche applications toward core functional platforms across regions.

| Year | USA Microbial Lipids Market (USD Million) |

|---|---|

| 2025 | 200.5 |

| 2026 | 211.6 |

| 2027 | 223.8 |

| 2028 | 239.4 |

| 2029 | 251.8 |

| 2030 | 265.7 |

| 2031 | 281.2 |

| 2032 | 299.1 |

| 2033 | 314.2 |

| 2034 | 333.1 |

| 2035 | 356.1 |

The microbial lipids market in the United States is projected to expand from USD 200.5 million in 2025 to USD 356.1 million by 2035, reflecting a CAGR of approximately 6.0%. This sustained growth has been driven by increasing demand for sustainable and allergen-free lipid sources, particularly within functional nutrition, clean-label food manufacturing, and plant-based personal care formulations. Omega-3 rich lipids produced via fermentation have been prioritized over marine-derived alternatives due to regulatory alignment and consumer preferences for traceable, vegan ingredients.

High adoption rates have been observed among dietary supplement brands and medical nutrition providers seeking lipid bioavailability and purity. USA-based synthetic biology firms have catalyzed domestic production capacity, attracting venture capital and long-term offtake partnerships. Government-backed incentives supporting biomanufacturing infrastructure and ESG-compliant sourcing have further stimulated market acceleration. In addition, microbial lipid inclusion in animal-free cosmetics and infant formulas has gained regulatory clarity, enabling market diversification.

The microbial lipids market in the UK is projected to witness robust expansion, driven by a CAGR of 6.8% from 2025 to 2035. Increasing regulatory encouragement for sustainable, non-GMO ingredients has created favorable conditions for microbial lipid penetration across food, beauty, and clinical sectors. Algae- and yeast-derived lipids have been prioritized in novel food filings and are being supported by retailer commitments to clean-label sourcing. UK-based bio manufacturing clusters have enabled localized pilot-scale fermentation, particularly for cosmetic-grade phospholipids and sterols.

The microbial lipids market in India is forecasted to grow at a CAGR of 6.4% over 2025-2035, fueled by domestic demand for functional health supplements and dairy alternatives. Urban consumer preference for vegan omega-3s and cholesterol-free oils has been supported by Ayurveda-aligned innovation. Indian contract fermentation facilities are increasingly being used for microbial lipid production under export-grade quality systems. Cost-effective algal fermentation models are being localized, creating competitive alternatives to marine and palm-based oils.

In China, the microbial lipids market is expected to register a CAGR of 5.9% through 2035, supported by government-led industrial biotechnology programs and a robust nutraceutical manufacturing base. Functional food players have prioritized fermentation-based EPA/DHA sources to meet domestic omega-3 demand with lower import dependency. Regulatory harmonization under the “Healthy China 2030” policy has accelerated GRAS-equivalent approvals for microbially derived ingredients. Innovation zones in Jiangsu and Guangdong are scaling precision fermentation infrastructure.

| Countries | 2025 |

|---|---|

| UK | 19.9% |

| Germany | 20.8% |

| Italy | 10.0% |

| France | 14.1% |

| Spain | 10.3% |

| BENELUX | 7.0% |

| Nordic | 5.3% |

| Rest of Europe | 12.7% |

| Countries | 2035 |

|---|---|

| UK | 19.1% |

| Germany | 21.8% |

| Italy | 10.3% |

| France | 13.7% |

| Spain | 11.1% |

| BENELUX | 5.6% |

| Nordic | 5.8% |

| Rest of Europe | 12.6% |

Germany’s microbial lipids market is projected to expand at a CAGR of 6.1% from 2025 to 2035, driven by regulatory leadership in food safety, traceability, and biotech acceptance. Fermentation-based omega fatty acids and phospholipids are being integrated into fortified foods, cosmeceuticals, and prescription-grade nutrition solutions. Germany’s precision fermentation R&D ecosystem, supported by EU Green Deal funding, has catalyzed lipid strain innovation and bioprocess scale-up.

| Microorganism Source | Market Value Share, 2025 |

|---|---|

| Yeast Derived Lipids | 27.0% |

| Fungal Derived Lipids | 17.0% |

| Algae Derived Lipids | 44.0% |

| Bacterial Derived Lipids | 12.0% |

The microbial lipids market in Japan is projected to reach approximately USD 35.1 million in 2025, supported by strong adoption of algae-based and yeast-derived lipid systems. Algae-derived lipids are expected to dominate with a 44.0% share, owing to their clean-label omega-3 content and alignment with Japan’s functional food innovation ecosystem. Yeast-derived oils follow with 27.0%, benefiting from robust application in cosmeceuticals and biopharmaceutical carriers. The segment’s leadership reflects Japan’s investment in marine biotechnology and sustainable aquaculture, where algae-based DHA and EPA have been integrated into nutritional guidelines.

Growth is being driven by the inclusion of microbial lipids in FOSHU-approved products and the rise of personalized nutrition targeting the aging population. The Ministry of Health, Labour and Welfare has encouraged the development of fermentation-derived ingredients through regulatory fast-tracking and R&D incentives. Meanwhile, leading Japanese conglomerates have formed joint ventures with synthetic biology startups to localize strain optimization and downstream lipid purification processes.

| Application | Market Value Share, 2025 |

|---|---|

| Nutraceuticals & Dietary Supplements | 31.0% |

| Functional Foods & Beverages | 23.0% |

| Pharmaceuticals | 14.0% |

| Cosmetics & Personal Care | 12.0% |

| Animal & Aquaculture Feed | 11.0% |

| Biofuels & Industrial Uses | 9.0% |

The microbial lipids market in South Korea is projected to expand steadily through 2035, driven by robust growth across wellness nutrition, food innovation, and sustainable cosmetics. Nutraceutical applications are anticipated to lead with a 31.0% share in 2025, owing to strong consumer preference for algae-based omega-3 supplements and cholesterol-free functional oils. Functional foods and beverages follow at 23.0%, supported by the country’s well-established F&B innovation ecosystem and active demand for clean-label, fortified products.

Government incentives under Korea’s bioeconomy strategy have accelerated local production and R&D in microbial fermentation, particularly within health-focused biotech clusters. Industrial partnerships are being forged between local conglomerates and global synthetic biology platforms to optimize lipid yield and processing efficiency.

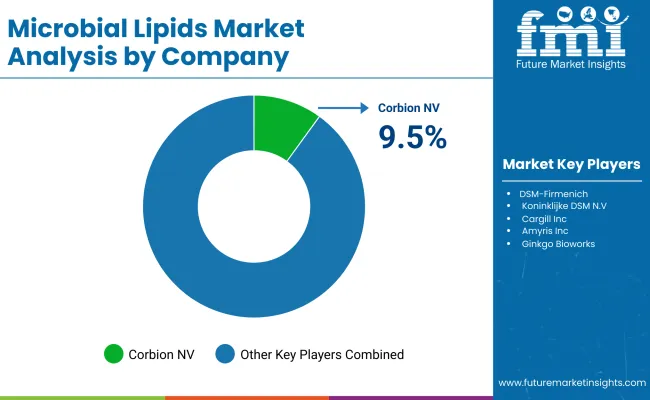

The microbial lipids market is moderately fragmented, with global leaders, mid-sized innovators, and specialized biotechnology firms competing across nutrition, personal care, and industrial applications. Industry leaders such as Corbion NV, DSM-Firmenich, and Cargill, Incorporated have been positioned at the forefront, leveraging fermentation platforms, robust supply chains, and multi-sector regulatory reach. These players have been observed to prioritize expansion into omega-3 formulations, clean-label alternatives, and sustainable lipid portfolios through joint ventures and proprietary strain development.

Mid-sized players including Amyris, Inc., Ginkgo Bioworks, and Roquette Frères have focused on modular production capabilities and synthetic biology toolkits, enabling agile customization across cosmetics, pharmaceuticals, and vegan nutrition. Their capabilities are being expanded through AI-driven pathway optimization and fermentation-as-a-service models. Strategic positioning is being reinforced by downstream partnerships with CPG brands and specialty formulators.

Specialist companies such as TerraVia and Solazyme (both under Corbion) are targeting niche use cases in infant formula lipids, biopolymer intermediates, and microalgae-derived skincare actives. Their core advantage has been established around targeted functionality, feedstock flexibility, and regionalized production models.

Competitive advantage in this market is shifting toward strain IP, platform interoperability, and lifecycle sustainability metrics. Subscription-based ingredient innovation pipelines, carbon-intelligent lipid sourcing, and integration into food-tech ecosystems are expected to define long-term leadership.

Key Developments in Microbial Lipids

| Item | Value |

|---|---|

| Quantitative Units | USD 835.6 million |

| Microorganism Source | Yeast-Derived, Fungal-Derived, Algae-Derived, Bacterial-Derived |

| Lipid Type | Omega-3 Fatty Acids (EPA, DHA), Omega-6 Fatty Acids, Saturated Fatty Acids, Monounsaturated Fatty Acids, Polyunsaturated Fatty Acids, Phospholipids, Sterols |

| Product Form | Microbial Oils, Powders & Concentrates, Emulsions & Encapsulated Forms |

| Application | Nutraceuticals & Dietary Supplements, Functional Foods & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Animal & Aquaculture Feed, Biofuels & Industrial Uses |

| End User | General Consumers, Medical & Clinical Nutrition Patients, Cosmetic Formulators, Animal Nutrition Industry |

| Sales Channel | B2B Ingredient Suppliers, Direct-to-Consumer (D2C), Pharmacies & Drugstores, Food & Beverage Manufacturers, Online Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Corbion NV, DSM-Firmenich, Koninklijke DSM N.V., Cargill Inc., Amyris Inc., Ginkgo Bioworks, TerraVia, Solazyme, Roquette Frères, BASF SE |

| Additional Attributes | Global sales by lipid type and application segment; competitive intensity among biotech and fermentation players; omega-3 demand in infant and senior nutrition; shift toward algae-based DHA; growth of vegan and halal lipid platforms; regulatory fast-tracki ng in EU, US, and APAC regions. |

The global Microbial Lipids is estimated to be valued at USD 835.6 million in 2025.

The market size for the Microbial Lipids is projected to reach USD 1,487.0 million by 2035.

The Microbial Lipids is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key lipid type in the Microbial Lipids Market are microbial oils, powders & concentrates, and emulsions & encapsulated forms, catering to varied formulation needs in food, pharma, and personal care.

In terms of application, the nutraceuticals & dietary supplements segment is projected to contribute the largest share, at 30.0% in 2025, owing to strong adoption of omega-3 enriched microbial oils in heart and brain health products.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microbial Polyketides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microbial Nucleotides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microbial Fermentation Technology Market Size and Share Forecast Outlook 2025 to 2035

Microbial Gene Editing Services Market Size and Share Forecast Outlook 2025 to 2035

Microbial Therapeutic Products Market Size and Share Forecast Outlook 2025 to 2035

Microbial Lipase Market - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Microbial Seed Treatment Business

Analysis and Growth Projections for Microbial Food Culture Business

Microbial Protein Used in Feed Market Analysis by Application, Source, and Region Through 2035

Microbial Identification Market Report – Growth & Forecast 2025-2035

Microbial Feed Additives Market – Growth, Probiotics & Livestock Nutrition

Microbial Bioreactors Market

Microbial Rennet Market

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Hospital Textile Market Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA