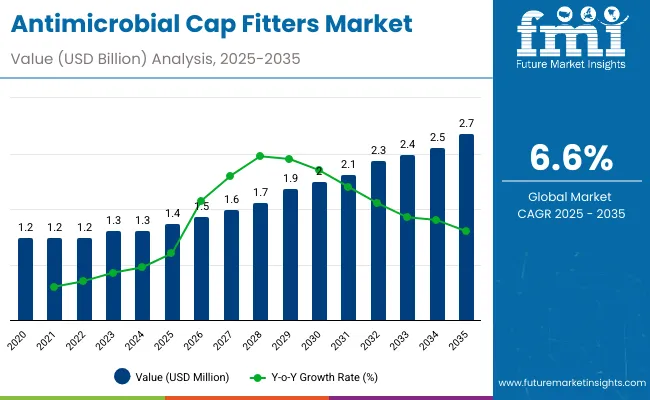

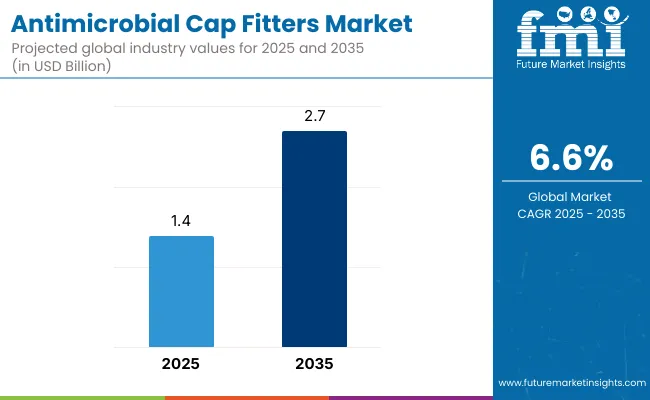

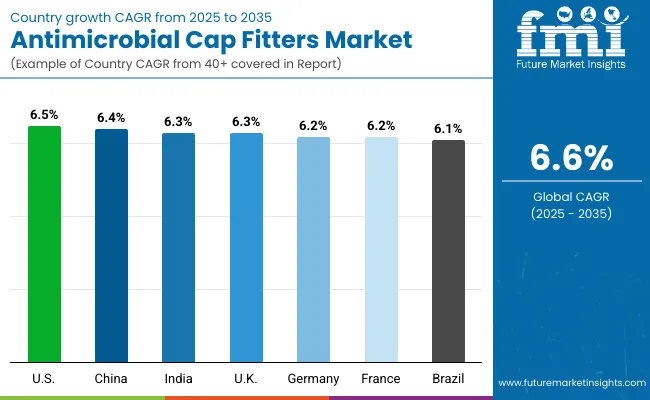

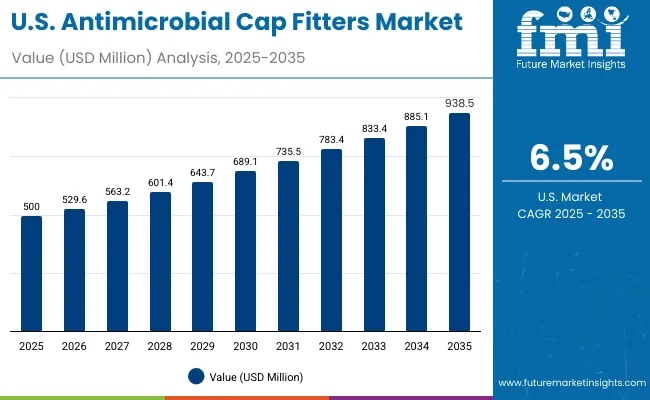

The global antimicrobial cap fitters market will increase from USD 1.4 billion in 2025 to USD 2.7 billion by 2035, growing at a CAGR of 6.6%. Demand is driven by infection control standards, sterile packaging requirements, and increased use of antimicrobial coatings across medical packaging. Screw caps remain the preferred type for their reliability in sealing precision bottles. Between 2025 and 2030, technological advancements in coating integration and IoT-enabled monitoring will strengthen industry adoption. By 2035, Asia-Pacific is expected to lead market expansion, driven by pharmaceutical and healthcare production scaling.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.4 billion |

| Forecast Value in (2035F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

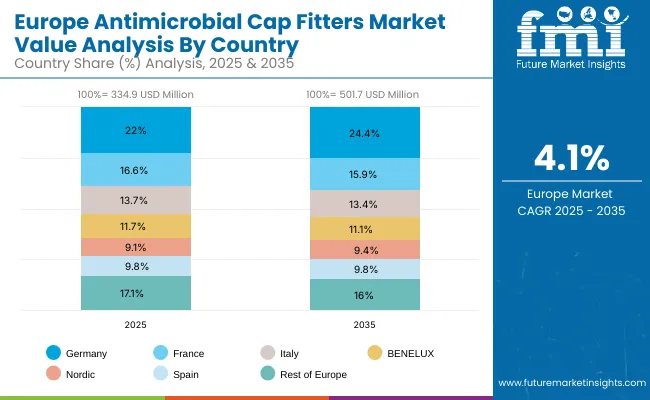

From 2020 to 2024, antimicrobial packaging innovations accelerated due to heightened infection awareness and hygiene protocols. Adoption of UV-C sterilization and silver-ion coatings strengthened manufacturing compliance. By 2035, the market is set to reach USD 2.7 billion, supported by healthcare infrastructure expansion and automated cap fitting technologies. Asia-Pacific will lead manufacturing with significant adoption in Japan and South Korea. Europe will maintain strong demand across medical-grade and food-safe containers.

The market’s expansion is driven by rising health and safety regulations, growth in pharmaceutical packaging, and the need for contamination-free closures. Increasing consumer preference for hygienic packaging and innovations in bio-resistant coatings are key factors driving adoption across industries.

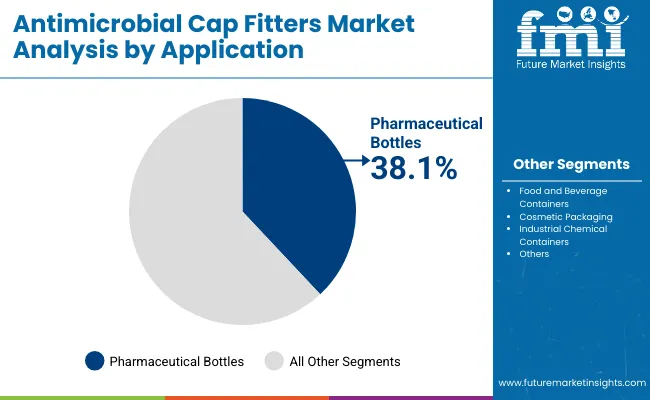

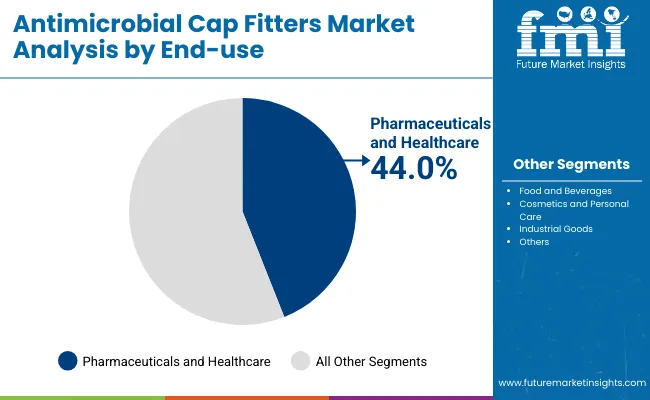

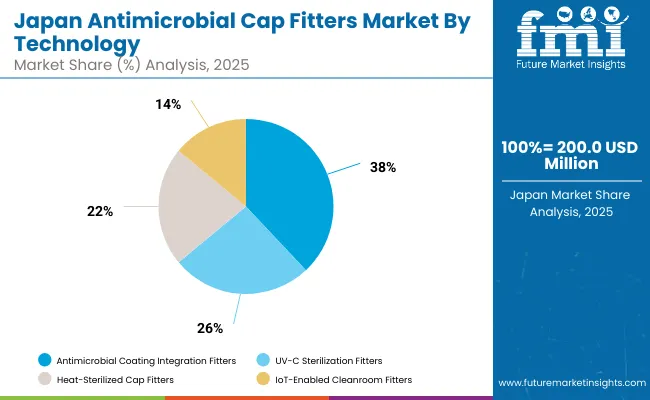

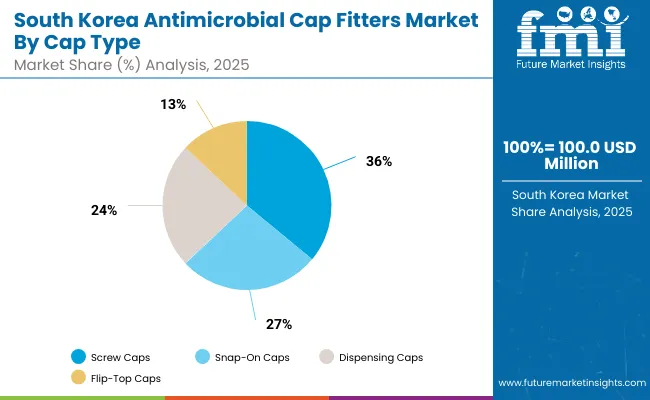

The market is segmented by technology, cap type, application, end-use industry, and region. Technology segmentation includes UV-C sterilization fitters, antimicrobial coating integration fitters, heat-sterilized cap fitters, and IoT-enabled cleanroom fitters, ensuring hygiene and contamination control. Cap type covers screw caps, snap-on caps, dispensing caps, and flip-top caps, designed for secure sealing and consumer convenience. Application segmentation includes pharmaceutical bottles, food and beverage containers, cosmetic packaging, and industrial chemical containers, highlighting diverse utilization across sectors. End-use industries include pharmaceuticals and healthcare, food and beverages, cosmetics and personal care, and industrial goods, supporting stringent safety standards. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

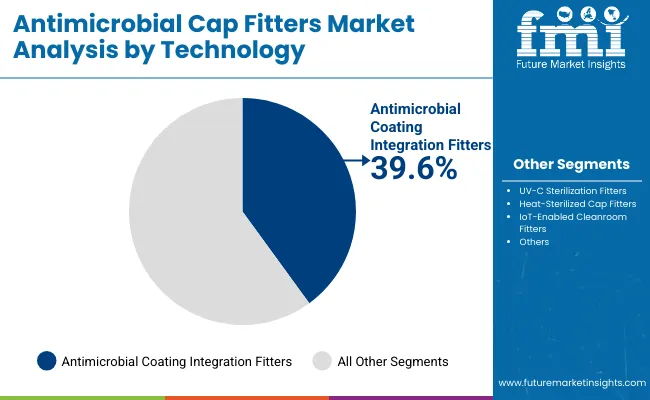

Antimicrobial coating integration fitters are projected to hold a 39.6% share in 2025, driven by their precision in applying uniform coatings that inhibit microbial growth. These systems ensure sterility in packaging components used for food, pharmaceutical, and medical applications. Their ability to integrate seamlessly within automated packaging lines enhances operational efficiency and contamination control.

Demand is reinforced by regulatory emphasis on cleanroom-compatible equipment and safe packaging processes. Manufacturers are investing in antimicrobial technologies to extend shelf life and safeguard product integrity. As hygiene standards strengthen globally, these fitters remain the preferred technology in sterile packaging operations.

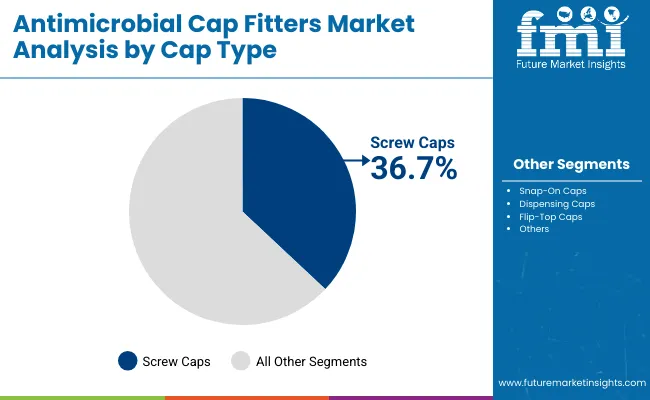

Screw caps are forecast to account for 36.7% of the market in 2025, supported by their secure sealing and ease of integration into high-speed filling systems. They provide reliable closure performance across pharmaceuticals, personal care, and nutraceutical packaging, ensuring protection against contamination and leakage.

Adoption is bolstered by their adaptability to various bottle materials and closure sizes. Continuous innovations in tamper-evident and child-resistant screw designs enhance safety compliance. With growing production automation, screw caps remain the dominant choice for efficient and contamination-free sealing.

Pharmaceutical bottles are projected to represent 38.1% of the market in 2025, as they meet stringent regulatory standards for contamination-free packaging. These bottles require advanced antimicrobial closures and coating systems to maintain sterility throughout filling, capping, and distribution.

Demand is driven by the expansion of injectable and liquid medication categories. Manufacturers prioritize fitters that ensure secure closure under aseptic conditions. As global pharmaceutical production scales up, the reliance on antimicrobial bottle sealing continues to strengthen.

The pharmaceuticals and healthcare sector is expected to hold a 44.0% share in 2025, propelled by strict infection prevention protocols. Antimicrobial closure technologies are essential in maintaining product safety, particularly in vaccine, biologic, and sterile solution packaging.

Hospitals and medical supply manufacturers increasingly adopt these systems to reduce contamination risk. Regulatory mandates for hygiene assurance drive continuous upgrades in antimicrobial sealing technologies. As clinical supply chains expand, this sector remains the dominant end-use industry for antimicrobial cap fitters.

Stringent hygiene protocols in pharmaceutical and medical packaging industries are propelling demand for antimicrobial closures.

High production costs of antimicrobial coatings limit affordability in low-volume packaging.

Integration of IoT sensors for sterilization tracking and cleanroom automation creates future potential.

Hybrid coatings, smart fitters with sterilization tracking, and biocompatible materials are shaping market innovation.

The global antimicrobial cap fitters market is expanding steadily as healthcare, pharmaceutical, and food industries prioritize sterile and hygienic packaging. Asia-Pacific leads in market share, driven by pharmaceutical manufacturing expansion and cost-effective automation, while North America advances through smart cap technology and robotics. Europe maintains its strength with strict hygiene regulations and innovation in antimicrobial coating systems. The integration of UV sterilization, IoT connectivity, and cleanroom-compatible machinery is transforming production efficiency and safety standards worldwide.

The USA will grow at 6.5% CAGR, supported by regulatory mandates for sterile packaging modernization. Rising adoption in biopharma and vaccine production is fuelling demand for antimicrobial closure systems. Automation in filling and capping lines is increasing efficiency and traceability. The strong focus on FDA-compliant sterile packaging solutions is enhancing competitiveness across both pharmaceutical and food sectors.

Germany will expand at 6.2% CAGR, emphasizing cleanroom-compliant fitters and precision-engineered solutions. Local advancements in antimicrobial coatings and metal-polymer composites are strengthening export potential. Automation across pharmaceutical facilities is ensuring consistency and compliance with EU hygiene directives. Germany’s robust R&D base continues to drive innovation in sustainable and energy-efficient cap fitting technologies.

The UK will grow at 6.3% CAGR, supported by continuous innovation in healthcare and food packaging. R&D investments in antimicrobial resin technologies are creating safer and more durable cap designs. The food and beverage industry is increasingly adopting hygienic closure systems to align with sustainability and safety standards. Automation and AI integration in cap fitting lines are improving process precision and reducing contamination risks.

China will grow at 6.4% CAGR, driven by large-scale expansion of antimicrobial packaging capacity and medical manufacturing. Local firms are deploying hybrid antimicrobial coatings to enhance performance and compliance. Rapid automation in pharmaceutical and diagnostic equipment sectors is fuelling adoption. With strong export growth in sterile packaging, China is reinforcing its role as a global supplier of antimicrobial fitters and components.

India will grow at 6.3% CAGR, supported by healthcare and cosmetics industry expansion. Rising pharmaceutical exports are accelerating adoption of antimicrobial closures and cap fitters. Local manufacturing capacity for automated lines is improving with government support under “Make in India.” Strengthened regulatory oversight on sterile packaging is driving domestic innovation and quality compliance.

Japan will grow at 6.9% CAGR, pioneering UV-based and IoT-enabled sterilization fitters. Integration of smart antimicrobial systems in hospitals, biotech packaging, and laboratories is driving innovation. Compact modular fitters are increasingly favored for space-efficient production environments. Collaboration between technology and healthcare firms is enhancing Japan’s export potential in intelligent sterile packaging systems.

South Korea will lead with 7.0% CAGR, leveraging its expertise in smart antimicrobial and diagnostics packaging technologies. Biotech and healthcare manufacturers are rapidly adopting automated, sensor-enabled cap fitters. National R&D initiatives are advancing nano-coating and self-sterilizing material technologies. Export growth to global pharmaceutical firms is solidifying South Korea’s position as a hub for advanced antimicrobial packaging machinery.

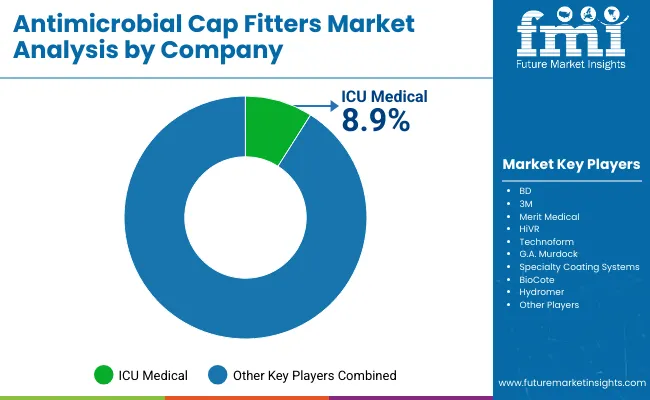

The market is moderately consolidated, led by ICU Medical, BD, Merit Medical, Technofrom, G.A. Murdock, Specialty Coating Systems, BioCote, Hydromer, HiVR, and 3M. Companies are investing in antimicrobial formulations, automation, and biocompatibility compliance for high-performance closures.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| By Technology | Antimicrobial Coating, UV-C Sterilization, Heat-Sterilized, IoT Cleanroom |

| By Cap Type | Screw, Snap-On, Dispensing, Flip-Top |

| By Application | Pharmaceutical Bottles, Food & Beverage, Cosmetics, Chemicals |

| By End-Use Industry | Pharmaceuticals & Healthcare, Food & Beverages, Cosmetics, Industrial |

| Key Companies Profiled | ICU Medical, BD, Merit Medical, Technofrom, G.A. Murdock, Specialty Coating Systems, BioCote, Hydromer, HiVR, 3M |

| Additional Attributes | Market driven by sterile packaging needs, antimicrobial innovations, and IoT-enabled quality assurance. |

The Antimicrobial Cap Fitters Market is valued at USD 1.4 billion in 2025.

The Antimicrobial Cap Fitters Market is projected to reach USD 2.7 billion by 2035.

The market will grow at a CAGR of 6.6%.

Antimicrobial Coating Integration Fitters lead with a 39.6% share.

Pharmaceutical Bottles dominate with a 38.1% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antimicrobial Glass Powder Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Additives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Car Care Products Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Susceptibility Tester Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

Antimicrobial Nanocoatings Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Antimicrobial Regenerative Wound Matrix Market - Growth & Forecast 2025 to 2035

Antimicrobial Coil Coating Market Growth - Trends & Forecast 2025 to 2035

Antimicrobial Susceptibility Testing Market Growth – Industry Forecast 2025-2035

Antimicrobial Polymer Films Market Insights – Growth & Forecast 2024-2034

Global Antimicrobial Hospital Textile Market Insights – Trends & Forecast 2024-2034

Antimicrobial Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA