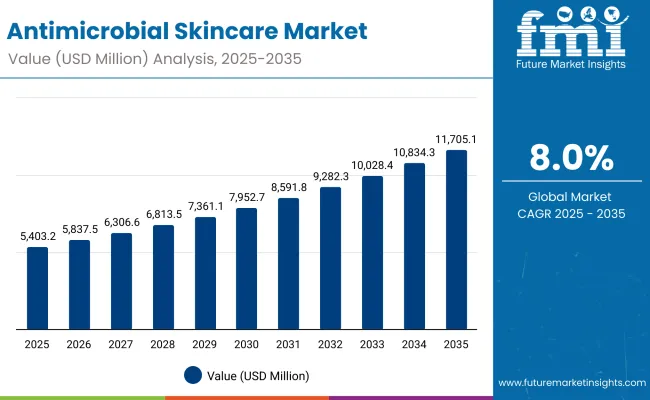

The Antimicrobial Skincare Market is expected to record a valuation of USD 5,402.0 million in 2025 and USD 11,705.1 million in 2035, with an increase of USD 6,303.1 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 8.0% and a 2X increase in market size.

Antimicrobial Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Antimicrobial Skincare Market Estimated Value in (2025E) | USD 5,403.2 million |

| Antimicrobial Skincare Market Forecast Value in (2035F) | USD 11,705.1 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 5,402.0 million to USD 7,952.7 million, adding USD 2,550.7 million, which accounts for 40% of the total decade growth. This phase records steady adoption in acne control, hand hygiene, and sensitive-skin care, driven by rising dermatology awareness. Hand creams & gels dominate this period as they cater to over 40% of applications requiring daily antimicrobial protection.

The second half from 2030 to 2035 contributes USD 3,752.4 million, equal to 60% of total growth, as the market jumps from USD 7,952.7 million to USD 11,705.1 million. This acceleration is powered by widespread adoption of silver-ion and triclosan-alternative formulations, AI-driven personalization in e-commerce, and dermatology-clinic-based post-procedure care. Acne control and wound-healing segments together capture a larger share above 50% by the end of the decade. E-commerce platforms add recurring revenue, increasing the digital channel share beyond 45% in total value.

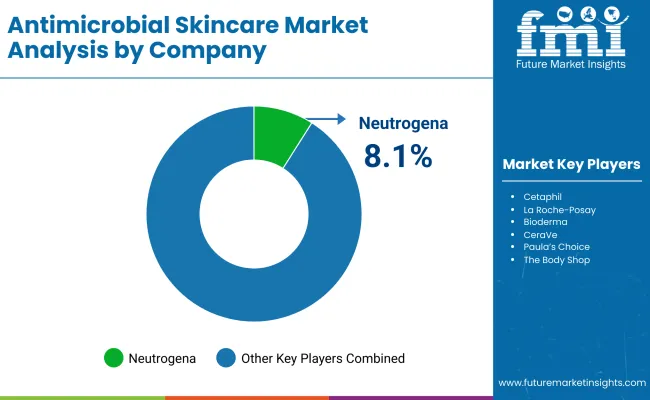

From 2020 to 2024, the Antimicrobial Skincare Market grew steadily, supported by heightened hygiene awareness, rising prevalence of acne-related conditions, and increased consumer focus on sensitive-skin formulations. During this period, the competitive landscape was led by multinational cosmetic and dermocosmetic brands that controlled a majority of revenues, with players such as Neutrogena, Cetaphil, and La Roche-Posay strengthening pharmacy and dermatology clinic channels. Competitive differentiation relied on clinical credibility, ingredient innovation, and dermatologist endorsements, while e-commerce was still emerging as a complementary channel.

Demand for Antimicrobial Skincare is expected to expand to USD 5,402.0 million in 2025, with the revenue mix shifting toward e-commerce, specialty beauty retail, and dermatology-clinic driven adoption. Traditional leaders face rising competition from digital-first brands that leverage influencer-led marketing, microbiome-safe formulations, and personalized skincare platforms. The competitive advantage is moving away from product positioning alone to ecosystem strength, including omnichannel distribution, sustainability credentials, and recurring consumer engagement through subscription-based models.

The growing awareness of infection prevention and skin barrier protection has significantly boosted demand for antimicrobial skincare products. Consumers are increasingly seeking cleansers, serums, and creams formulated with antibacterial and antiviral ingredients such as silver ions, benzoyl peroxide, and tea tree oil. Post-pandemic hygiene habits and dermatologist-endorsed formulations are driving adoption across both mass-market and premium skincare categories globally.

Continuous advancements in bioactive and natural antimicrobial agents are expanding product portfolios and consumer appeal. Brands are introducing multifunctional formulations that combine acne treatment, wound healing, and sensitive-skin care benefits. The integration of eco-safe triclosan alternatives, salicylic acid, and plant-derived actives has enhanced product efficacy and sustainability, attracting both health-conscious and eco-aware consumers, thereby supporting steady market expansion through 2035.

The antimicrobial skincare market is segmented by product type, key ingredient, application, end user, distribution channel, and region. By product type, the market covers cleansers, hand creams and gels, face serums, body lotions, and spot treatments that address a wide range of skin hygiene needs. Key ingredients include benzoyl peroxide, tea tree oil, triclosan alternatives, silver ions, and salicylic acid, representing both clinical and natural antimicrobial actives.

Applications span acne control, wound healing, hand and foot care, and post-procedure care, targeting diverse consumer concerns. End users include adults, teens, sensitive-skin users, and men, reflecting the market’s broad demographic appeal. Distribution channels comprise pharmacies and drugstores, e-commerce, specialty beauty retail, and hospital or dermatology clinics. Regionally, the market scope covers North America, Europe, East Asia, South Asia, and emerging regions such as the Middle East, Africa, and Latin America, highlighting a globally expanding consumer base for antimicrobial skincare solutions.

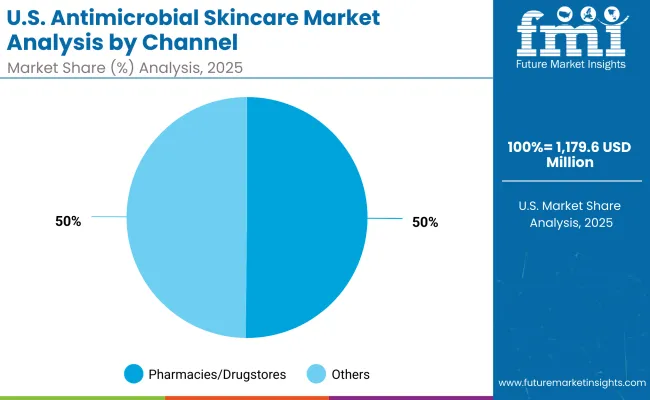

| Channel | Value Share% 2025 |

|---|---|

| Pharmacies/drugstores | 48.5% |

| Others | 51.5% |

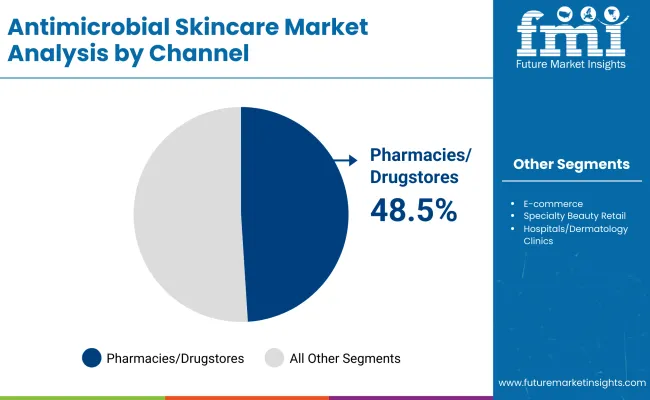

The pharmacies and drugstores segment is projected to contribute 48.5% of the Antimicrobial Skincare Market revenue in 2025, maintaining its position as the leading distribution channel. This dominance is supported by strong consumer trust in professional skincare advice and the growing presence of dermatologist-endorsed brands within retail pharmacy chains. Pharmacies and drugstores provide convenient access to both prescription and over-the-counter antimicrobial skincare products, particularly for acne control and sensitive-skin treatment.

The segment’s continued growth is further driven by the expansion of pharmacy-based beauty sections and the rising popularity of medically oriented skincare lines. As consumers prioritize safety, efficacy, and clinical validation, pharmacy retailers are strengthening partnerships with major brands to offer science-backed formulations. The pharmacies and drugstores channel is expected to remain a critical pillar of market distribution through 2035.

| Application | Value Share% 2025 |

|---|---|

| Acne control | 46.5% |

| Others | 53.5% |

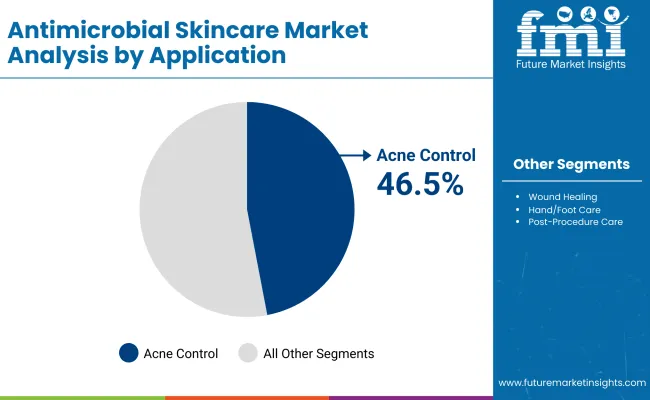

The acne control segment is forecasted to hold 46.5% of the Antimicrobial Skincare Market share in 2025, driven by the growing prevalence of acne-related skin conditions across both teens and adults. Consumers are increasingly turning to antimicrobial formulations that target acne-causing bacteria while maintaining skin balance, with ingredients such as benzoyl peroxide, salicylic acid, and tea tree oil leading demand.

The segment’s strength lies in its ability to bridge therapeutic and cosmetic benefits, as acne-control products are now integrated into daily skincare routines. The trend toward gentle, microbiome-friendly formulations and dermatologist-tested solutions has further propelled product innovation in this category. As consumers continue to seek effective yet skin-safe treatments for persistent acne and breakouts, the acne control segment is expected to remain the largest contributor to market revenue through 2035.

| Product Type | Value Share% 2025 |

|---|---|

| Cleansers | 40.4% |

| Others | 59.6% |

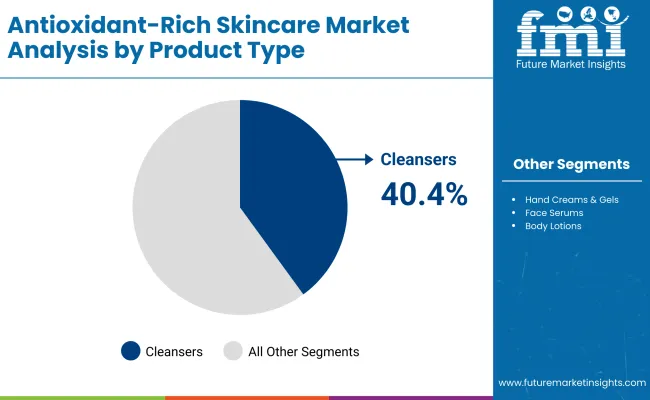

The cleansers segment is projected to account for 40.4% of the Antimicrobial Skincare Market revenue in 2025, solidifying its position as the leading product type. Cleansers remain a cornerstone in antimicrobial skincare due to their frequent use in daily hygiene routines and their effectiveness in removing impurities, bacteria, and excess sebum without compromising skin health. The growing popularity of antibacterial face and hand cleansers enriched with silver ions, tea tree oil, and mild surfactants has amplified this segment’s expansion.

Continuous product innovation focusing on gentle formulations, pH balance, and hydration has strengthened consumer trust and brand loyalty in this category. Additionally, rising awareness of hand hygiene post-pandemic has fueled the adoption of antimicrobial face and body cleansers globally. Given their multifunctional role in cleansing, treatment, and prevention, cleansers are expected to maintain their dominance in the antimicrobial skincare market throughout the forecast period.

Rising Incidence of Skin Infections and Acne Disorders

The increasing prevalence of bacterial and fungal skin infections, along with persistent acne conditions, is a key growth driver for the antimicrobial skincare market. Consumers are becoming more aware of the role of microbes in skin health and are actively seeking products that provide targeted antibacterial protection without irritation. The expansion of dermatology clinics, coupled with the availability of over-the-counter antimicrobial products, has further accelerated product adoption across both therapeutic and cosmetic skincare segments worldwide.

Innovation in Natural and Sustainable Antimicrobial Ingredients

Growing consumer preference for clean-label and eco-friendly skincare formulations is driving innovation in antimicrobial ingredients. Manufacturers are shifting from traditional chemical agents like triclosan toward plant-derived and biocompatible actives such as tea tree oil, silver ions, and fermented botanicals. This shift not only enhances product safety and consumer trust but also aligns with global sustainability goals. As brands invest in green chemistry and bioactive formulations, natural antimicrobial skincare products are expected to capture an increasing market share through 2035.

Regulatory Challenges and Ingredient Safety Concerns

Stringent regulatory frameworks surrounding antimicrobial agents and preservatives pose a major restraint for the market. Ingredients such as triclosan and certain parabens have faced global scrutiny due to potential toxicity and environmental impact, compelling brands to reformulate or seek alternative actives. Compliance with diverse regional safety standards increases costs and time-to-market, especially for multinational brands. These regulatory hurdles can limit innovation pace and restrict smaller players from entering highly regulated markets like the USA and the EU.

Integration of Dermatologist-Endorsed and Clinical Skincare Lines

A notable trend in the antimicrobial skincare market is the growing influence of dermatologist-endorsed brands and clinical skincare lines. Consumers increasingly trust products supported by medical expertise and clinical validation, leading to a rise in hybrid formulations that combine antimicrobial efficacy with skin-restorative properties. Brands like Neutrogena, La Roche-Posay, and CeraVe are expanding their clinical portfolios with microbiome-safe, barrier-strengthening solutions. This professional-driven trend is reshaping brand positioning and encouraging greater collaboration between dermatologists and skincare manufacturers.

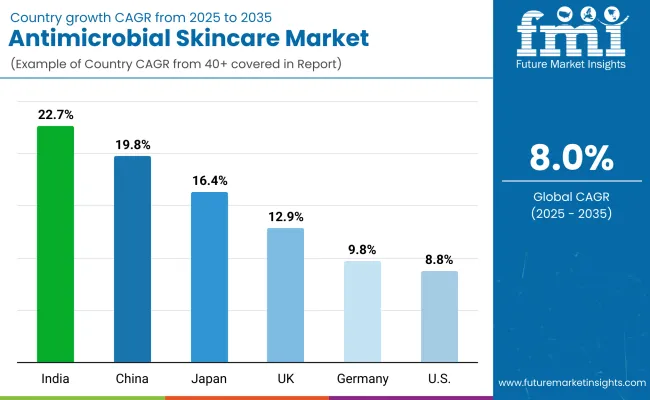

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.8% |

| USA | 8.8% |

| India | 22.7% |

| UK | 12.9% |

| Germany | 9.8% |

| Japan | 16.4% |

The global Antimicrobial Skincare Market exhibits strong regional variation in growth, driven by consumer awareness, dermatological infrastructure, and product innovation intensity. Asia-Pacific leads the expansion, with India (22.7%) and China (19.8%) showing exceptional growth due to surging consumer demand for acne-control and hygiene-based skincare products. Rising disposable incomes, urban pollution levels, and preference for dermatologist-approved formulations have accelerated adoption in both countries. India’s beauty and personal care sector is rapidly shifting toward functional skincare, while China’s market benefits from e-commerce expansion and local brand innovation centered on natural antimicrobial actives.

Japan (16.4%) is another key growth hub, characterized by demand for high-efficacy, sensitive-skin-safe formulations that align with its strong cosmetic technology base. Europe maintains steady momentum, led by the UK (12.9%) and Germany (9.8%), where regulatory standards and consumer trust in clinically tested products drive market expansion. Increasing preference for sustainable and microbiome-friendly antimicrobial skincare is particularly notable in these mature markets. The USA (8.8%) demonstrates consistent growth supported by premiumization trends, strong brand presence, and the popularity of dermatology-linked skincare routines. However, the market’s maturity limits its growth relative to emerging Asian economies. Overall, Asia-Pacific remains the most dynamic region, expected to outpace Western markets through sustained innovation, influencer-driven digital marketing, and rapid retail penetration across pharmacies and online platforms.

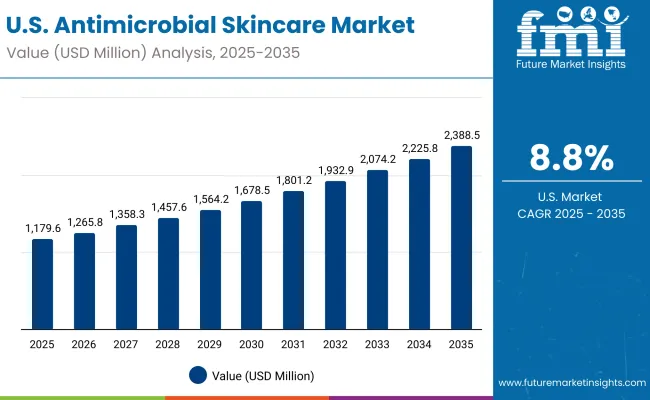

| Year | USA Antimicrobial Skincare Market (USD Million) |

|---|---|

| 2025 | 1,179.61 |

| 2026 | 1,265.84 |

| 2027 | 1,358.37 |

| 2028 | 1,457.67 |

| 2029 | 1,564.22 |

| 2030 | 1,678.56 |

| 2031 | 1,801.26 |

| 2032 | 1,932.93 |

| 2033 | 2,074.22 |

| 2034 | 2,225.85 |

| 2035 | 2,388.55 |

The Antimicrobial Skincare Market in the United States is projected to expand from USD 1,179.6 million in 2025 to USD 2,388.6 million by 2035, registering a steady CAGR of 8.8%. Growth is driven by rising demand for acne-control, wound-care, and sensitive-skin products, supported by increased awareness of antimicrobial hygiene. Pharmacies and drugstores, holding a 50.2% market share in 2025, remain the primary sales channel due to consumer reliance on dermatologist-endorsed and clinically proven formulations. However, e-commerce channels are rapidly gaining traction as consumers favor digital convenience, online dermatology consultations, and subscription-based delivery models.

The USA market benefits from strong penetration of brands such as Neutrogena, CeraVe, and La Roche-Posay, which are actively expanding their antimicrobial product portfolios. Acne prevalence among teens and adults, combined with rising post-procedure care in dermatology clinics, continues to support product diversification. Ingredient-wise, benzoyl peroxide, salicylic acid, and tea tree oil remain top-performing actives, while silver-ion and triclosan-alternative formulations are emerging as preferred options in response to evolving regulatory and safety standards.

The Antimicrobial Skincare Market in the United Kingdom is forecasted to grow at a CAGR of 12.9% between 2025 and 2035, driven by strong consumer awareness of dermatology-led skincare and rising adoption of clinically validated antimicrobial formulations. With a global market share of 7.9% in 2025, the UK ranks among the most advanced European markets for premium and prescription-backed skincare products. However, its share is projected to moderate to 6.8% by 2035, as high-growth regions like China and India continue to outpace Western markets.

The UK market benefits from well-established pharmacy retail networks, with trusted dermocosmetic brands such as La Roche-Posay, Eucerin, and Bioderma leading in distribution partnerships and in-clinic recommendations. Younger consumers continue to favor acne-control and anti-inflammatory products, while mature audiences are increasingly drawn to antimicrobial cleansers and lotions designed for sensitive or aging skin. E-commerce is accelerating rapidly, driven by digital-savvy consumers who rely on online dermatology consultations, influencer reviews, and personalized product recommendations.

Moreover, regulatory policies promoting triclosan-free and sustainable antimicrobial formulations are shaping brand innovation strategies. Local and multinational manufacturers are aligning with clean-beauty standards and microbiome-safe technologies to enhance efficacy and consumer trust. Overall, the UK remains a pivotal market in Europe’s antimicrobial skincare landscape, balancing clinical sophistication, sustainability, and digital engagement to sustain growth through 2035.

The Antimicrobial Skincare Market in India is poised for exceptional growth, projected to expand at a CAGR of 22.7% from 2025 to 2035 the highest among major global markets. This rapid rise is fueled by accelerating urbanization, higher disposable incomes, and increasing skincare awareness among the youth population. Antimicrobial products are transitioning from niche medical use to mainstream skincare, particularly in acne management, wound-healing, and sensitive-skin care categories. The market’s momentum is reinforced by the popularity of dermatology-led and pharmacy-endorsed brands offering targeted antimicrobial solutions.

Tier-2 and Tier-3 cities are emerging as key growth zones, supported by affordable local product introductions, rising e-commerce penetration, and expanded pharmacy retail coverage. Consumers are increasingly favoring formulations with tea tree oil, benzoyl peroxide, and salicylic acid, while post-procedure and hand/foot antimicrobial care products are witnessing growing adoption due to the rise of cosmetic dermatology clinics and wellness-focused routines.

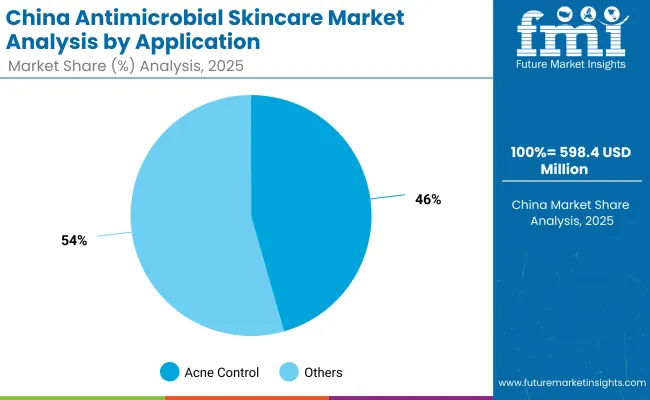

The Antimicrobial Skincare Market in China is projected to grow at an impressive CAGR of 19.8% between 2025 and 2035, marking one of the fastest growth trajectories globally. With an estimated market value of USD 598.4 million in 2025, China accounts for 11.1% of the global market, underscoring its expanding influence within the Asia-Pacific skincare landscape. This growth is primarily driven by a younger consumer base, increasing acne prevalence, and rising awareness of dermatologist-recommended formulations. The acne control segment, representing 45.6% of national sales, dominates demand due to consumer emphasis on high-performance antibacterial and anti-inflammatory skincare.

Rapid e-commerce adoption through leading platforms such as Tmall, JD.com, and Douyin is revolutionizing access to both domestic and international antimicrobial skincare brands. Consumers are increasingly gravitating toward silver-ion, tea tree oil, and salicylic acid formulations, reflecting a shift toward clinically proven yet safe alternatives to restricted or synthetic antimicrobials. Furthermore, China’s expanding dermatology and cosmetic surgery market is amplifying demand for post-procedure and wound-healing care, positioning antimicrobial skincare as a hybrid between medical and cosmetic categories.

Local brands are strengthening market presence with affordable, plant-based, and naturally derived products, while global players leverage brand heritage, clinical validation, and dermatologist endorsements to appeal to premium consumers. This dual-market dynamicbalancing mass affordability and clinical sophisticationwill define long-term growth. Innovation in formulation, digital brand engagement, and adherence to China’s evolving cosmetic regulations will remain key success factors for sustained expansion.

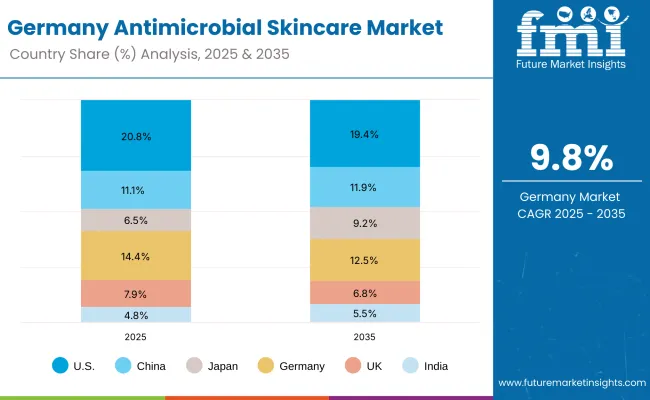

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.8% |

| China | 11.1% |

| Japan | 6.5% |

| Germany | 14.4% |

| UK | 7.9% |

| India | 4.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.4% |

| China | 11.9% |

| Japan | 9.2% |

| Germany | 12.5% |

| UK | 6.8% |

| India | 5.5% |

The Antimicrobial Skincare Market in Germany is projected to expand at a CAGR of 9.8% between 2025 and 2035, reflecting steady growth underpinned by high dermatological standards, regulatory alignment, and a strong preference for sensitive-skin and clinically validated products. Germany holds a 14.4% global market share in 2025, which is expected to adjust slightly to 12.5% by 2035, as faster-growing Asian markets capture larger volumes. The country remains a core European hub for dermocosmetics, with pharmacies and dermatology clinics serving as the main distribution channels.

The market is largely driven by consumer reliance on dermatologist-recommended brands such as Eucerin, La Roche-Posay, and Bioderma, which lead in antimicrobial and microbiome-safe skincare formulations. Acne-control and sensitive-skin solutions dominate the product landscape, fueled by EU-driven restrictions on controversial ingredients like triclosan and by the consumer shift toward silver-ion and salicylic acid-based products for safety and sustainability. Germany’s rigorous compliance environment encourages innovation in clean formulations that meet both dermatological and ecological standards.

In addition, the country’s medical aesthetics and post-procedure care sectors are creating new growth opportunities for antimicrobial wound-healing and recovery skincare. The adoption of digital health platforms, teledermatology, and e-commerce channels is expanding accessibility, particularly among tech-savvy younger consumers, while older demographics prioritize reparative and protective skincare products. The growing emphasis on sensitive-skin protection, sustainability, and clinical efficacy is expected to drive continued premiumization and long-term brand loyalty across Germany’s antimicrobial skincare market.

| USA by Channel | Value Share% 2025 |

|---|---|

| Pharmacies/drugstores | 50.2% |

| Others | 49.8% |

The Antimicrobial Skincare Market in the United States is valued at USD 1,179.6 million in 2025, accounting for approximately 20.8% of the global market. Pharmacies and drugstores maintain a marginal lead with 50.2% share, underscoring the continued consumer trust in OTC dermatologist-endorsed antimicrobial products. These outlets remain the preferred point of sale for cleansers, creams, and gels designed to treat acne, wounds, and sensitive-skin concerns, bolstered by robust regulatory compliance and clinical validation.

At the same time, e-commerce and specialty retail channels are rapidly closing the gap, capturing 49.8% of market share as digital convenience, direct-to-consumer (D2C) models, and personalized product recommendations reshape consumer behavior. Influencer-driven marketing, subscription skincare models, and AI-powered skin diagnostics are fueling online adoption across younger demographics.

Key growth opportunities lie in microbiome-safe antimicrobial formulations, silver-ion and post-procedure recovery skincare, and natural actives such as benzoyl peroxide and tea tree oil that align with consumer demand for efficacy and gentleness. The expanding consumer base now includes men and sensitive-skin users, reflecting a shift toward inclusive and preventive skincare routines. With innovation focused on safety, efficacy, and skin balance, the USA market is expected to sustain steady growth through 2035.

| China by Application | Value Share% 2025 |

|---|---|

| Acne control | 45.6% |

| Others | 54.4% |

The Antimicrobial Skincare Market in China is valued at USD 598.4 million in 2025, representing 11.1% of the global market, with acne control products leading at 45.6%. This dominance reflects the influence of a large teen and young adult population, heightened exposure to urban pollution, and growing awareness of dermatology-led skincare solutions. Rising social media engagement and influencer marketing are encouraging consumers to invest in targeted antimicrobial treatments addressing acne, inflammation, and blemish control.

Significant opportunities exist in silver-ion-based formulations, triclosan alternatives, and salicylic acid-enriched serums, which are increasingly viewed as safe, effective, and compliant with China’s regulatory standards. Furthermore, the expanding medical aesthetics and dermatology clinic sector is boosting demand for post-procedure and wound-healing antimicrobial care, positioning the category as a bridge between therapeutic and cosmetic skincare.

E-commerce ecosystemsdominated by Tmall, JD.com, and Xiaohongshu (RED)are key to market access, facilitating both international brand expansion and the rise of innovative local players offering affordable, ingredient-transparent products. As the government promotes domestic R&D and science-backed skincare, brands focusing on microbiome-safe, sustainable, and dermatologist-recommended formulations are expected to capture strong growth.

The Antimicrobial Skincare Market presents a moderately fragmented competitive landscape, encompassing multinational cosmetic giants, pharmaceutical-aligned dermocosmetic brands, and emerging niche specialists. Global leaders such as Neutrogena, Cetaphil, La Roche-Posay, and Bioderma dominate the competitive spectrum, underpinned by strong dermatological credibility, clinical testing, and broad distribution reach across pharmacies, dermatology clinics, and e-commerce platforms. Their leadership is reinforced by expansive product portfolios spanning antimicrobial cleansers, serums, and creams, with continued innovation in acne control, wound care, and sensitive-skin solutions.

Mid-tier brands, including CeraVe, Eucerin, and Paula’s Choice, are scaling rapidly through microbiome-safe innovations and multifunctional formulations that deliver both hydration and antibacterial efficacy. Their digital-first strategies leverage influencer partnerships, online dermatology education, and subscription-based sales models to strengthen brand visibility among young and sensitive-skin consumers.

Niche players such as Murad, The Body Shop, and Aveeno are carving unique positions by emphasizing natural antimicrobials, wellness-driven skincare, and sustainability-focused product lines. Their differentiation lies in localizing ingredient preferences such as botanical and plant-based actives and maintaining high engagement within specialty retail and digital ecosystems.

Overall, the market’s competitive differentiation is evolving around ingredient innovation notably silver ions, antimicrobial peptides, and triclosan alternatives alongside regulatory transparency, clinical validation, and omnichannel accessibility. Brands that successfully merge scientific credibility with sustainable innovation are best positioned to capture long-term growth and consumer loyalty in the antimicrobial skincare sector.

Key Developments in Antimicrobial Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 5,403.2 Million |

| Product Type | Cleansers, Hand creams & gels, Face serums, Body lotions, Spot treatments |

| Key Ingredient | Benzoyl peroxide, Tea tree oil, Triclosan alternatives, Silver ions, Salicylic acid |

| Application | Acne control, Wound healing, Hand/foot care, Post-procedure care |

| Channel | Pharmacies/drugstores, E-commerce, Specialty beauty retail, Hospitals/dermatology clinics |

| End User | Adults, Teens, Sensitive skin users, Men |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Neutrogena, Cetaphil, La Roche-Posay, Bioderma, CeraVe, Eucerin, Paula’s Choice, Murad, The Body Shop, Aveeno |

| Additional Attributes | Dollar sales by product format and channel, growth in multifunctional formulations combining antimicrobial and barrier-repair properties, adoption trends in clinical dermatology and over-the-counter markets, rising consumer awareness of skin microbiome protection, sector-specific demand in post-surgical and wound-care skincare, regulatory scrutiny over antimicrobial agents (especially triclosan and parabens), innovations in natural botanicals and bio-based antimicrobials, and regional adoption shaped by hygiene awareness campaigns and rising urbanization. |

The global Antimicrobial Skincare Market is estimated to be valued at USD 5,403.2 million in 2025.

The market size for the Antimicrobial Skincare Market is projected to reach USD 11,705.1 million by 2035.

The Antimicrobial Skincare Market is expected to grow at 8.0% CAGR between 2025 and 2035.

The key product types in the Antimicrobial Skincare Market include cleansers, hand creams & gels, face serums, body lotions, and spot treatments.

In 2025, the acne control segment is expected to contribute a significant share, accounting for 46.5% of global market value.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Hospital Textile Market Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Additives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Car Care Products Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Susceptibility Tester Market Size and Share Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA