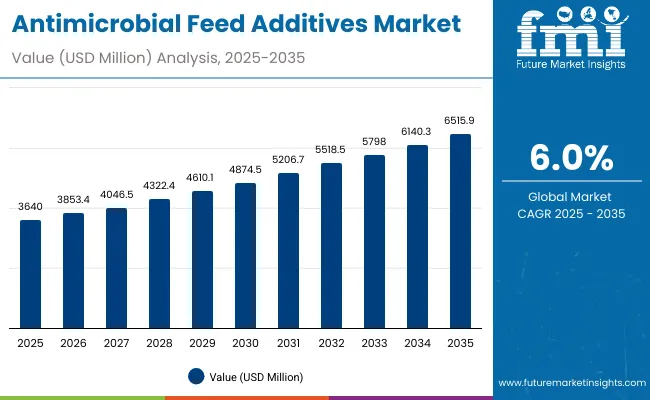

The Antimicrobial Feed Additives Market is expected to record a valuation of USD 3,640.0 million in 2025 and USD 6,515.9 million in 2035, with an increase of USD 2,875.9 million, which equals a growth of nearly 79% over the decade. The overall expansion represents a CAGR of 6.0% and a 2X increase in market size.

Antimicrobial Feed Additives Market Key Takeaways

| Metric | Value |

|---|---|

| Global Market Estimated Value (2025E) | USD 3,640.0 million |

| Global Market Forecast Value (2035F) | USD 6,515.9 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 3,640.0 million to USD 4,874.5 million, adding USD 1,234.5 million, which accounts for 43% of the total decade growth. This phase records steady adoption in poultry, swine, and aquaculture nutrition, driven by rising concerns over disease resistance, productivity enhancement, and regulatory transitions reducing antibiotics. Acidifiers and probiotics dominate this period as they cater to over 45% of applications requiring safe and compliant alternatives to antibiotics.

The second half from 2030 to 2035 contributes USD 1,641.4 million, equal to 57% of total growth, as the market jumps from USD 4,874.5 million to USD 6,515.9 million. This acceleration is powered by widespread deployment of phytogenics, probiotics, and enzyme-based additives, aligning with global regulatory frameworks and consumer demand for antibiotic-free meat and dairy. Aquaculture and pet feed segments gain pace in this period, supported by rising aquafeed innovation and premiumization of companion animal diets. By the end of the decade, phytogenics and probiotics together capture a larger share above 35% of the market. Liquid formulations gain momentum due to higher bioavailability, lifting their share beyond 27% of total value by 2035.

From 2020 to 2024, the Antimicrobial Feed Additives Market expanded steadily from a hardware-style antibiotics-driven market to a diversified landscape with probiotics, acidifiers, and phytogenics gaining traction. During this period, the competitive landscape was dominated by multinational feed additive suppliers controlling nearly 70% of revenue, with leaders such as Cargill, DSM-Firmenich, and Evonik focusing on integrated feed solutions for livestock. Differentiation relied on cost efficiency, proven efficacy, and regulatory adaptability, while probiotics and prebiotics were often bundled with enzyme packages rather than a primary revenue stream. Service-based nutrition consulting had minimal traction, contributing less than 10% of the total market value.

Demand for antimicrobial feed additives will expand to USD 3,640.0 million in 2025, and the revenue mix will shift as probiotics, phytogenics, and acidifiers grow to over 60% share. Traditional antibiotic leaders face rising competition from plant-extract players, probiotic innovators, and organic acid producers offering customized formulations and integrated programs. Major feed additive vendors are pivoting to hybrid models, integrating digital feed formulation platforms, gut health analytics, and sustainability certification to retain relevance. Emerging entrants specializing in essential oil blends, bacteriophage applications, and peptide-based antimicrobials are gaining share. The competitive advantage is moving away from antibiotic efficacy alone to ecosystem strength, compliance, and recurring contracts with integrators.

Advances in acidifiers, phytogenics, and enzyme-based feed technologies have improved efficiency and pathogen resistance management, allowing more effective replacement of antibiotics. Acidifiers have gained popularity due to their suitability for gut health management, pathogen inhibition, and improved feed conversion ratios. The rise of organic acids and essential oils has contributed to enhanced productivity while meeting consumer preferences for sustainable, antibiotic-free meat and dairy. Industries such as poultry, swine, and aquaculture are driving demand for antimicrobial feed solutions that integrate seamlessly into existing feeding systems.

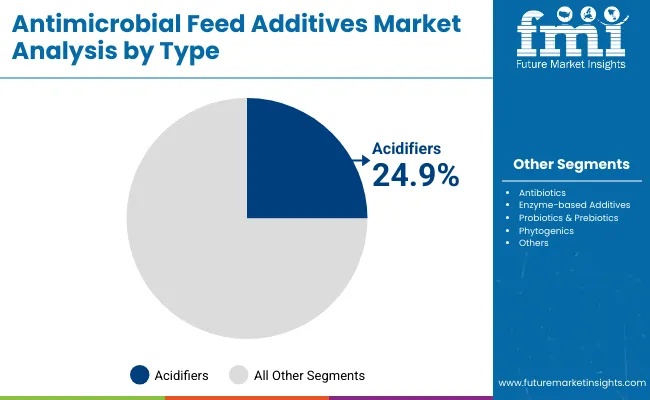

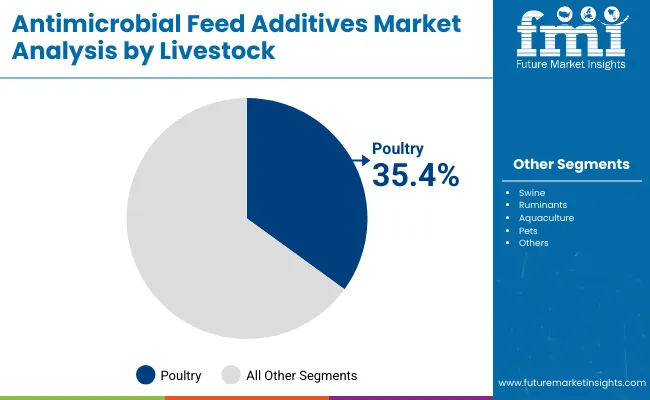

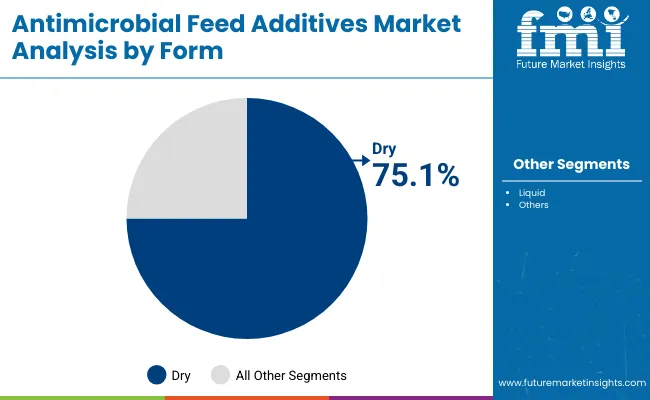

Expansion of automated feed formulation, precision livestock farming, and antibiotic-reduction policies has fueled market growth. Innovations in probiotics, prebiotics, and enzyme blends, along with synergistic combinations of acidifiers and plant extracts, are expected to open new application areas. Segment growth is expected to be led by acidifiers in type categories, poultry in livestock, and liquid formulations in delivery, due to their adaptability and compliance with regulations across major markets.

The market is segmented by type, livestock, form, distribution channel, and region. Types include antibiotics, acidifiers, enzyme-based additives, probiotics & prebiotics, phytogenics, and others, highlighting the diverse portfolio of antimicrobial strategies. Livestock classification covers poultry, swine, ruminants, aquaculture, and pets to cater to different nutritional requirements. Based on form, the segmentation includes dry premixes and liquid formulations, balancing cost-effectiveness and bioavailability. Distribution channels span direct sales (B2B to feed manufacturers and integrators), distributors/wholesalers, and online platforms, reflecting evolving procurement models. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Type | Market Value Share (%) |

|---|---|

| Acidifiers | 24.9% |

| Others | 75.1% |

The acidifiers segment is projected to contribute 24.9% of the Antimicrobial Feed Additives Market revenue in 2025, maintaining its lead as the dominant type category. This is driven by ongoing demand for organic and inorganic acids that effectively improve digestive health, nutrient absorption, and pathogen inhibition in poultry and swine. Acidifiers are prioritized by feed manufacturers as reliable antibiotic alternatives that deliver consistent performance without regulatory hurdles.

The segment’s growth is also supported by the development of blended acidifier solutions that enhance stability and improve gut microbiota modulation. As antibiotic bans and restrictions intensify across Europe, North America, and Asia-Pacific, acidifier manufacturers are enhancing portfolios with next-generation synergistic formulations combining acids with phytogenics and probiotics.

While acidifiers dominate, other categories such as probiotics & prebiotics (20.0%) and phytogenics (15.0%) are rapidly expanding, reflecting the market’s shift toward holistic gut health management and natural alternatives. Antibiotics, although still holding a 20.1% share, are on a declining growth trajectory with just 1.5% CAGR, underscoring the structural transformation of the industry.

| Livestock | Market Value Share (%) |

|---|---|

| Poultry | 35.4% |

| Others | 64.6% |

The poultry segment is forecasted to hold 35.4% of the market share in 2025, led by its high demand for antimicrobial feed additives to improve feed conversion ratios, disease resistance, and growth performance. Poultry production particularly broilers and layers relies heavily on acidifiers, probiotics, and enzyme blends to ensure flock health under intensive farming conditions.

Other categories include swine (24.6%), supported by gut health strategies to counter post-weaning diarrhea; ruminants (20.0%), focusing on rumen fermentation stability; aquaculture (12.0%), which is the fastest growing at 8.0% CAGR; pets (5.0%), driven by premium pet nutrition; and others (3.0%), including minor livestock categories. Together, these segments underscore poultry’s role as the largest consumer, but highlight aquaculture and pets as fast-emerging growth pockets.

| Form | Market Value Share (%) |

|---|---|

| Dry | 75.1% |

| Others | 24.6% |

The dry form segment is projected to contribute 75.1% of the Antimicrobial Feed Additives Market revenue in 2025, maintaining its dominance due to the ease of handling, stability, and suitability for premixes and bulk feed manufacturing. Dry forms such as powders and premixes are cost-effective and preferred by integrators for large-scale feed applications.

In contrast, liquid formulations (24.9%) are gaining share at a faster CAGR of 6.8%, driven by their higher bioavailability, easier dosing in water systems, and adaptability in aquaculture and pet feed. By 2035, liquid formulations are expected to exceed 27% of the global market value, signaling their growing role in specialized nutrition strategies.

Growing regulatory restrictions on antibiotics, coupled with rising livestock disease burdens and consumer demand for antibiotic-free animal products, are shaping the Antimicrobial Feed Additives Market. While the industry is moving toward probiotics, phytogenics, and acidifiers, challenges persist in cost structures and inconsistent performance across geographies. These factors define the market’s momentum, where compliance, innovation, and integration into livestock farming systems dictate adoption.

Rising Demand for Antibiotic Alternatives in Poultry and Swine

The poultry and swine industries together accounting for more than 60% of global demand are increasingly dependent on antimicrobial feed additives such as acidifiers and probiotics. Regulatory bans in Europe and pressure in North America and Asia-Pacific to curb antibiotic use have accelerated adoption of alternatives that ensure gut health and reduce mortality. Probiotics and phytogenics are seeing strong uptake, supported by poultry integrators’ need to deliver consistent weight gain and meat quality under intensive farming conditions.

Expansion of Aquaculture and Premium Pet Nutrition

Aquaculture is emerging as one of the fastest-growing livestock categories, posting an 8% CAGR, with antimicrobial feed solutions critical for disease management in high-density farming. Concurrently, premiumization in the pet food sector is boosting demand for safe, functional additives. Pet owners prefer antibiotic-free formulations enhanced with probiotics, prebiotics, and natural extracts. This dual growth in aquaculture and pet nutrition expands market scope beyond traditional livestock and offers suppliers opportunities to diversify portfolios.

Cost Volatility of Specialty Ingredients and Formulations

Phytogenics, probiotics, and enzyme-based additives often rely on high-quality raw materials such as essential oils, proprietary microbial strains, and advanced fermentation processes. Their production costs fluctuate due to agricultural volatility and complex manufacturing. As a result, small and mid-sized feed producers face pricing barriers, limiting large-scale adoption, especially in cost-sensitive markets like Latin America and parts of Asia.

Performance Variability Across Geographies

Unlike antibiotics, whose outcomes are predictable, the efficacy of acidifiers, phytogenics, and probiotics varies with feed composition, climate conditions, and livestock genetics. For example, certain probiotic strains may deliver measurable benefits in European poultry farms but show inconsistent results in tropical conditions. This variability creates hesitancy among integrators and farmers, who are wary of investing in solutions without guaranteed returns, slowing penetration in emerging markets.

Synergistic Blends and Customized Formulations

Suppliers are increasingly combining acidifiers, probiotics, and phytogenics into synergistic blends tailored for specific livestock species and farm conditions. These customized formulations improve consistency of outcomes and align with precision livestock farming systems. Companies like DSM-Firmenich and Adisseo are developing integrated gut health packages, ensuring broader adoption among feed manufacturers and integrators.

Digital Integration and Data-Backed Validation

The use of digital tools for feed formulation, microbiome analysis, and additive efficacy tracking is accelerating. Precision livestock farming technologies are enabling real-time monitoring of gut health, allowing validation of additive performance. This trend supports adoption by providing measurable outcomes, reducing skepticism, and creating recurring opportunities for suppliers offering data-backed antimicrobial solutions.

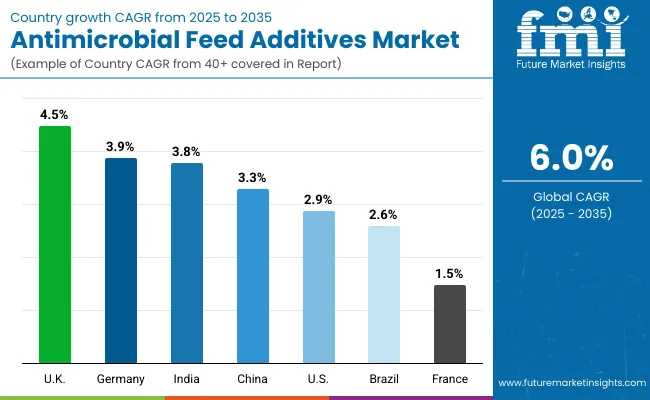

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 3.3% |

| India | 3.8% |

| Germany | 3.9% |

| France | 1.5% |

| UK | 4.5% |

| USA | 2.9% |

| Brazil | 2.6% |

The Antimicrobial Feed Additives Market shows a pronounced regional disparity in adoption speed, strongly influenced by livestock density, feed production modernization, and regulatory mandates on antibiotic alternatives.

South Asia emerges as the fastest-growing region, anchored by India at 3.8% CAGR, supported by a large poultry and aquaculture ecosystem and government-backed initiatives for livestock disease management. East Asia is shaped by China at 3.3% CAGR, where regulatory tightening and productivity enhancement drive consistent demand.

Europe maintains a strong growth profile, led by Germany (3.9%), France (1.5%), and the UK (4.5%), reflecting the region’s long-standing leadership in animal nutrition compliance and innovation. Adoption is boosted by stringent EU bans on antibiotic growth promoters, compelling feed manufacturers to integrate acidifiers, probiotics, and phytogenics. North America shows moderate expansion, with the USA at 2.9% CAGR, reflecting maturity in poultry and swine systems but facing slower regulatory-driven shifts compared to Europe and Asia.

Growth in North America is increasingly service-oriented, with feed integrators favoring bundle-based nutrition programs combining additives with consultancy and digital feed formulation platforms.

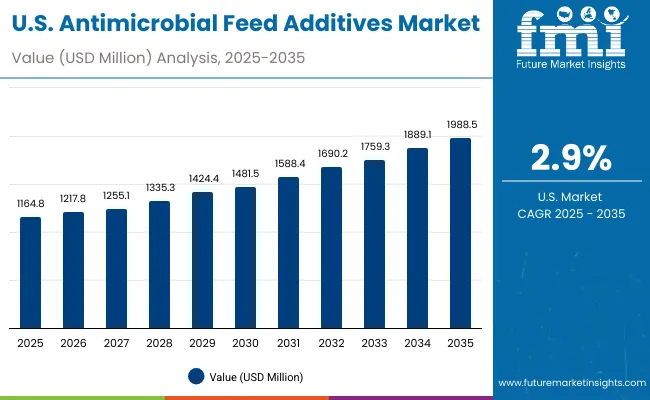

| Year | USA Antimicrobial Feed Additives Market (USD Million) |

|---|---|

| 2025 | 1,164.8 |

| 2026 | 1,217.8 |

| 2027 | 1,255.1 |

| 2028 | 1,335.3 |

| 2029 | 1,424.4 |

| 2030 | 1,481.5 |

| 2031 | 1,588.4 |

| 2032 | 1,690.2 |

| 2033 | 1,759.3 |

| 2034 | 1,889.1 |

| 2035 | 1,988.5 |

The Antimicrobial Feed Additives Market in the United States is projected to grow at a CAGR of 5.5%, led by consistent demand from the poultry and swine industries. Acidifiers dominate adoption, while probiotics and enzyme-based additives are expanding due to antibiotic restrictions. Growth is reinforced by strong integrator systems where bundled nutrition programs ensure scale-driven procurement. Pet feed applications are also gaining traction as premium brands integrate probiotics and phytogenics.

The Antimicrobial Feed Additives Market in the United Kingdom is expected to grow at a CAGR of 4.5%, supported by applications across poultry and ruminant sectors. Integrators are focusing on compliance-driven feed formulations, with probiotics and phytogenics gaining strong adoption. The pet food segment is particularly dynamic in the UK, leveraging premium formulations that incorporate natural antimicrobials. Government support for antibiotic reduction and sustainability goals is further fueling innovation.

India is witnessing rapid growth in the Antimicrobial Feed Additives Market, forecast to expand at a CAGR of 3.8% through 2035. Poultry, which consumes the largest volume of feed additives, drives the bulk of demand, while aquaculture is emerging as the fastest-growing sector. Government initiatives to promote disease control, combined with rising consumer demand for antibiotic-free meat, support adoption. Educational institutes and veterinary training centers are increasingly promoting awareness of safe feed additive usage.

The Antimicrobial Feed Additives Market in China is expected to grow at a CAGR of 3.3%, reflecting regulatory-led transformation of its large livestock sector. The government’s ban on antibiotic growth promoters has accelerated adoption of probiotics, phytogenics, and acidifiers. Poultry and swine remain the largest consumers, while aquaculture is steadily growing as China expands inland fish farming. Local manufacturers are introducing affordable additive blends to penetrate small and mid-scale farms.

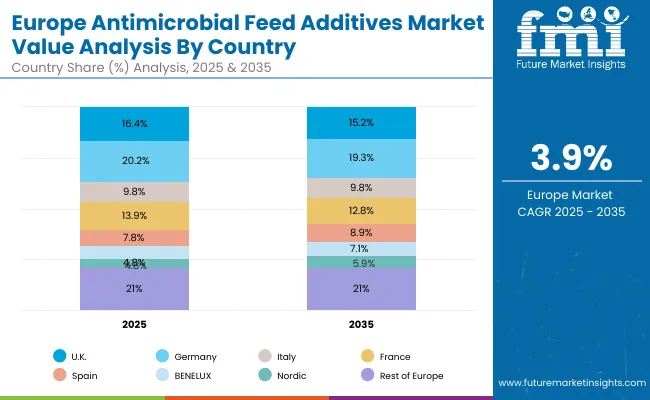

| Countries / Sub-region | 2025 |

|---|---|

| UK | 16.4% |

| Germany | 20.2% |

| Italy | 9.8% |

| France | 13.9% |

| Spain | 7.8% |

| BENELUX | 6.1% |

| Nordic | 4.8% |

| Rest of Europe | 21.0% |

| Countries / Sub-region | 2035 |

|---|---|

| UK | 15.2% |

| Germany | 19.3% |

| Italy | 9.8% |

| France | 12.8% |

| Spain | 8.9% |

| BENELUX | 7.1% |

| Nordic | 5.9% |

| Rest of Europe | 21.0% |

The Antimicrobial Feed Additives Market in Germany is projected to grow at a CAGR of 3.9%, underpinned by its leadership in precision animal nutrition and strict EU compliance frameworks. Feed mills and integrators in Germany are integrating phytogenics, probiotics, and enzyme blends into standard formulations. Regulatory frameworks mandate the elimination of antibiotic growth promoters, reinforcing consistent additive adoption. Collectively, the European market reflects its position as the largest global region with sustained growth in antibiotic alternatives.

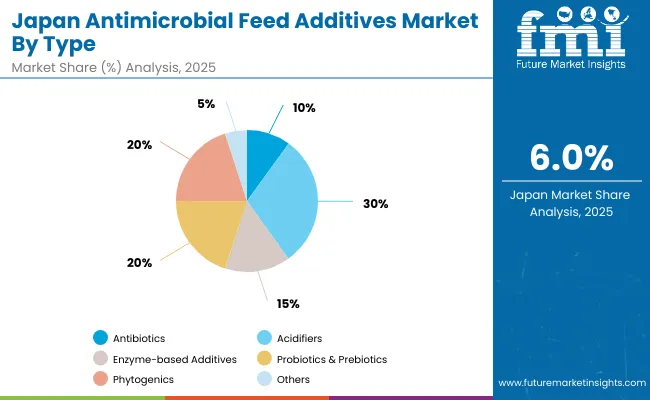

| Type | Market Value Share (%) |

|---|---|

| Acidifiers | 30.1% |

| Others | 69.9% |

The Antimicrobial Feed Additives Market in Japan is projected at USD 195.8 million in 2025, growing to USD 350.4 million by 2035 at a 6.0% CAGR. Acidifiers lead the market with 30.1% share, reflecting their importance in poultry and aquaculture feed. Probiotics and phytogenics each contribute 20%, while enzyme-based additives hold 14.9%. Antibiotics, at 10%, are on a declining trajectory. The shift toward acidifiers and probiotics stems from Japan’s emphasis on food safety, premium meat quality, and regulatory compliance. Advanced aquaculture systems and premium pet food brands are adopting synergistic formulations blending probiotics with essential oils.

| Livestock | Market Value Share (%) |

|---|---|

| Poultry | 40.1% |

| Others | 59.9% |

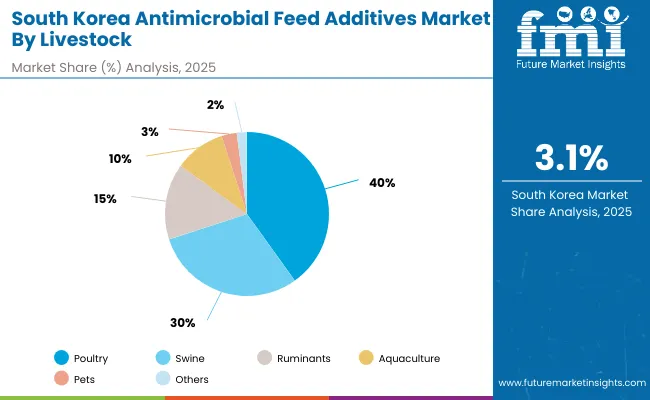

The Antimicrobial Feed Additives Market in South Korea is valued at USD 113.8 million in 2025, growing to USD 154.9 million by 2035 at a CAGR of 3.1%. Poultry dominates with 40.1% share, followed by swine at 29.9%, ruminants at 15%, aquaculture at 10%, pets at 3%, and others at 2%.The dominance of poultry is linked to South Korea’s intensive production systems where feed conversion efficiency is critical. Acidifiers, probiotics, and enzyme-based solutions are heavily used to improve flock health. Swine remains the second-largest segment, where additives support gut stability in post-weaning pigs.

| Company | Global Value Share 2025 |

|---|---|

| DSM- Firmenich | 12.5% |

| Others | 87.5% |

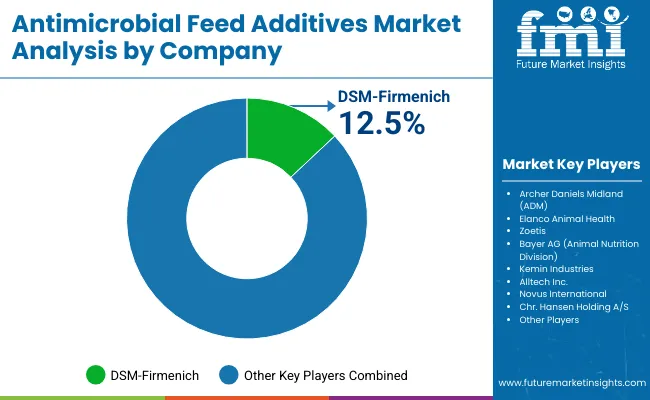

The Antimicrobial Feed Additives Market is moderately fragmented, with global leaders, mid-sized innovators, and specialized nutrition companies competing across diverse livestock and regional markets. Global nutrition leaders such as DSM-Firmenich, Cargill, and Evonik Industries hold significant market share, driven by extensive portfolios in probiotics, acidifiers, and enzyme-based solutions. DSM-Firmenich leads the global market with 12.5% share in 2025, leveraging its integrated brand presence (Biomin, ROVIMIX, and other specialized lines) and strong R&D capabilities. These companies focus on antibiotic alternatives, sustainability certifications, and bundled additive programs for poultry, swine, and aquaculture feed integrators.

Established mid-sized players, including Kemin Industries, Alltech, and Novus International, cater to rising demand for phytogenics, probiotics, and customized blends. Their strength lies in providing portable, farm-ready solutions with proven gut health outcomes. By combining enzyme technologies with organic acids and essential oils, they have accelerated adoption among integrators seeking natural but performance-driven feed strategies.

Specialized providers such as Adisseo, Phibro Animal Health, and Nutreco’sTrouw Nutrition division focus on targeted antimicrobial applications, including aquaculture health, ruminant feed efficiency, and precision nutrition platforms. These players emphasize regional adaptability and niche product innovation, offering tailored formulations to meet the varying requirements of Europe, Asia-Pacific, and Latin America.

Competitive differentiation in the Antimicrobial Feed Additives Market is shifting away from individual product categories toward integrated solutions combining feed additives, digital formulation platforms, and technical support services. Ecosystem strategies such as microbiome analytics, data-backed efficacy trials, and subscription-based nutrition programs are becoming decisive for long-term customer retention and global expansion.

Key Developments in Antimicrobial Feed Additives Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,640.0 million |

| Type | Antibiotics, Acidifiers, Enzyme-based Additives, Probiotics & Prebiotics, Phytogenics, and Others (bacteriophages, peptides, novel antimicrobials) |

| Livestock | Poultry, Swine, Ruminants (cattle, sheep, goats), Aquaculture, Pets/Companion Animals, and Others |

| Form | Dry (powders, premixes) and Liquid |

| Distribution Channel | Direct Sales (B2B with feed manufacturers and integrators), Distributors/Wholesalers, and Online Platforms |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | DSM- Firmenich, Cargill, Inc., Archer Daniels Midland (ADM), Elanco Animal Health, Zoetis, Bayer AG (Animal Nutrition Division), Kemin Industries, Alltech Inc., Novus International, Chr. Hansen Holding A/S, Phibro Animal Health Corporation, Evonik Industries AG, Nutreco N.V. (Trouw Nutrition), Adisseo (Bluestar Adisseo), and Biomin (part of DSM- Firmenich) |

| Additional Attributes | Dollar sales by type, livestock, and form; adoption trends in poultry, swine, and aquaculture; rising demand for probiotics and phytogenics as antibiotic alternatives; growth in liquid formulations; distribution channel transformation with B2B dominance; sector-specific growth in poultry integrators, aquaculture, and premium pet food; regional trends shaped by antibiotic bans in Europe, regulatory tightening in Asia, and integrator-driven adoption in North America; innovations in synergistic blends, acidifier-phytogenic combinations, and data-backed probiotic efficacy. |

The Antimicrobial Feed Additives Market is estimated to be valued at USD 3,640.0 million in 2025.

The market size for the Antimicrobial Feed Additives Market is projected to reach USD 6,515.9 million by 2035.

The Antimicrobial Feed Additives Market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in the Antimicrobial Feed Additives Market are antibiotics, acidifiers, enzyme-based additives, probiotics & prebiotics, phytogenics, and others.

In terms of livestock, the poultry segment is expected to command 35.4% share in the Antimicrobial Feed Additives Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Hospital Textile Market Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wound Care Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Car Care Products Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Susceptibility Tester Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

Antimicrobial Nanocoatings Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Antimicrobial Regenerative Wound Matrix Market - Growth & Forecast 2025 to 2035

Antimicrobial Coil Coating Market Growth - Trends & Forecast 2025 to 2035

Antimicrobial Susceptibility Testing Market Growth – Industry Forecast 2025-2035

Antimicrobial Polymer Films Market Insights – Growth & Forecast 2024-2034

Antimicrobial Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA