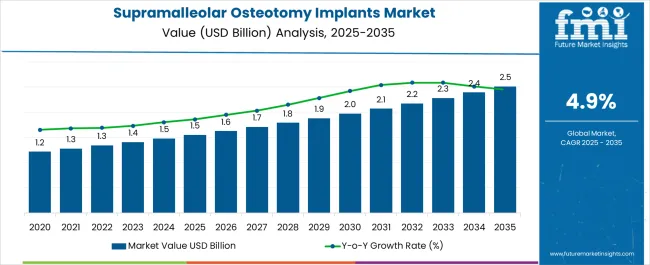

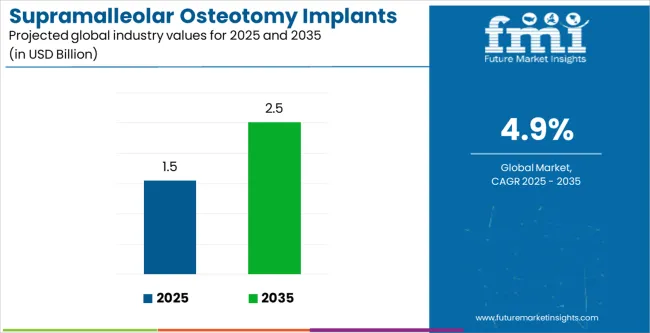

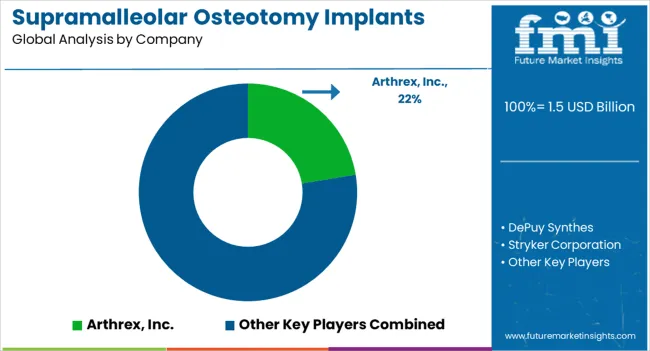

The Supramalleolar Osteotomy Implants Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Supramalleolar Osteotomy Implants Market Estimated Value in (2025 E) | USD 1.5 billion |

| Supramalleolar Osteotomy Implants Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The supramalleolar osteotomy implants market is witnessing consistent growth driven by the increasing prevalence of ankle deformities, rising sports injuries, and growing adoption of corrective surgical procedures. Advancements in implant design, including enhanced biocompatibility, durability, and fixation strength, are supporting better clinical outcomes and patient recovery rates.

Growing awareness among healthcare professionals regarding early corrective procedures for deformities has further strengthened demand. Hospitals and surgical centers are prioritizing advanced osteotomy solutions to reduce revision surgeries and improve long term mobility outcomes.

Additionally, the market is supported by favorable reimbursement policies and an increase in orthopedic surgical volumes globally. With continuous innovation in materials and minimally invasive approaches, the market outlook remains positive, offering opportunities for both established players and emerging medical device manufacturers.

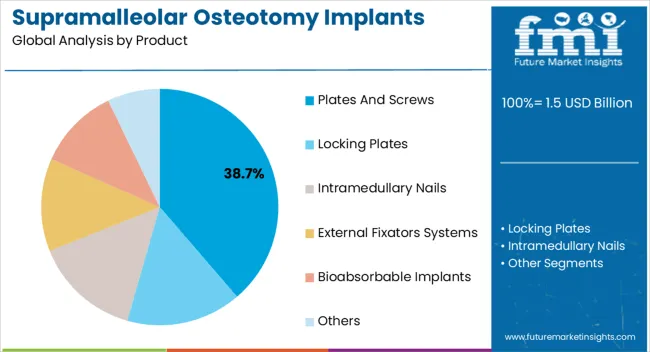

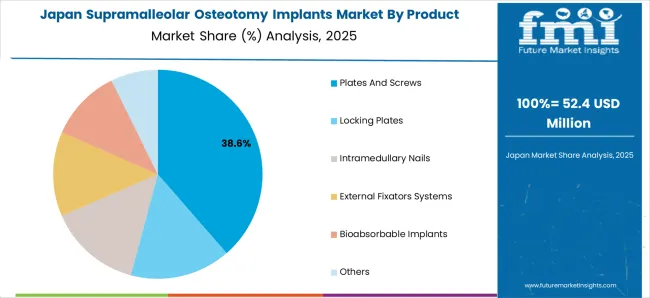

The plates and screws segment is expected to contribute 38.70% of total revenue by 2025 within the product category, positioning it as the leading segment. This growth is attributed to the high preference for rigid fixation, structural stability, and versatility across complex deformity correction cases.

Plates and screws provide reliable alignment and load bearing capacity, enabling surgeons to achieve precise corrective outcomes. Their proven clinical efficacy and widespread availability in hospitals and surgical centers have further reinforced their dominance.

Continuous advancements in material strength and modular designs have also enhanced their adoption across orthopedic practices.

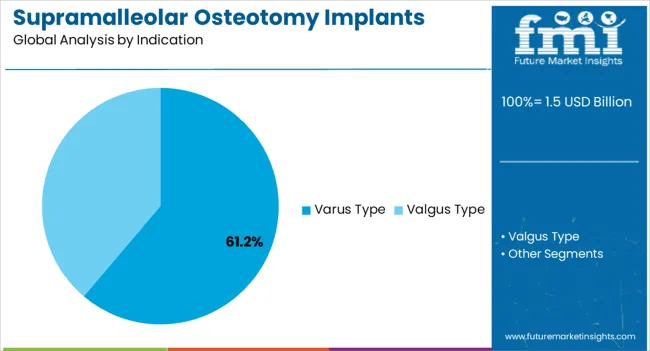

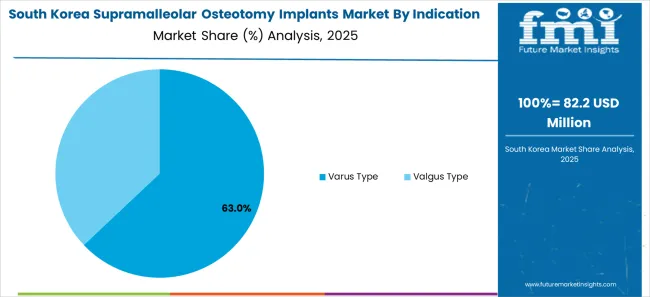

The varus type indication segment is projected to account for 61.20% of total market revenue by 2025, making it the most prominent indication category. The higher prevalence of varus deformities in the ankle and its significant impact on gait and joint stability have accelerated the need for corrective surgeries.

Effective correction of varus deformities has been prioritized to reduce long term joint degeneration and osteoarthritis risks, driving the adoption of supramalleolar osteotomy implants.

Clinical studies highlighting improved functional outcomes in varus cases have further supported the segment’s dominance.

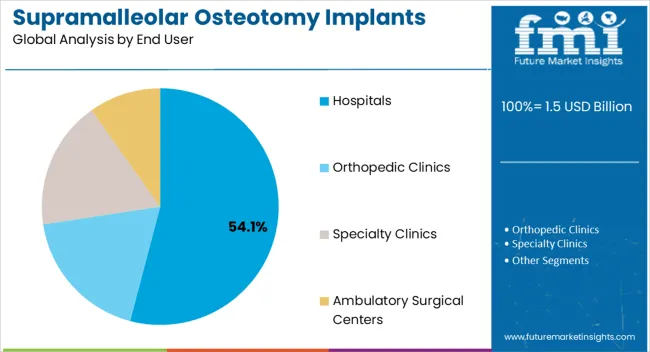

The hospitals segment is anticipated to hold 54.10% of total market revenue by 2025 under the end user category, positioning it as the leading segment. Hospitals have emerged as the primary centers for supramalleolar osteotomy procedures due to their access to advanced surgical equipment, skilled orthopedic surgeons, and post operative care facilities.

The ability to manage complex deformity correction cases and ensure comprehensive patient recovery has strengthened hospital adoption.

Furthermore, supportive insurance coverage and rising patient preference for specialized care have reinforced the dominance of hospitals in this market.

From 2020 to 2025, the global supramalleolar osteotomy implants market experienced a CAGR of 4.2%, reaching a market size of USD 1.5 billion in 2025.

From 2020 to 2025, the global supramalleolar osteotomy implants industry witnessed steady growth due to the rising incidence and recognition of ankle-related conditions have driven the demand for SMO implants. There has been a significant increase in the awareness and diagnosis of ankle-related conditions such as ankle arthritis, malalignment, and instability. This has led to a greater number of patients seeking treatment options, including supramalleolar osteotomy.

Future Forecast for Supramalleolar Osteotomy Implants Industry:

Looking ahead, the global supramalleolar osteotomy implants industry is expected to rise at a CAGR of 5.2% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 2.5 billion by 2035.

The future of SMO implants lies in the realm of customization. Advances in imaging technology, computer-assisted design (CAD), and 3D printing enable the creation of patient-specific implants tailored to an individual's anatomy. This customization potential can lead to improved implant fit, better alignment, and enhanced surgical outcomes.

Surgical techniques for supramalleolar osteotomy have advanced, allowing for improved precision, reduced invasiveness, and better patient outcomes. These advancements have contributed to the increased adoption of SMO procedures, driving the demand for SMO implants.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 2.5 million |

| CAGR % 2025 to End of Forecast (2035) | 5.7% |

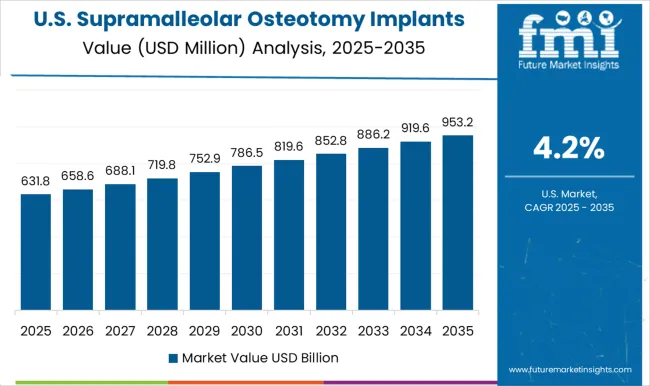

The supramalleolar osteotomy implants industry in the United States is expected to reach a market size of USD 2.5 million by 2035, expanding at a CAGR of 5.7%. Due to the rising incidence and recognition of arthritis conditions have driven the demand for SMO implants in the country. According to the Centers for Disease Control and Prevention, around 1.5 million persons in the United States had osteoarthritis in 2024. This has led to a greater number of patients seeking treatment options, including supramalleolar osteotomy.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 134.4 million |

| CAGR % 2025 to End of Forecast (2035) | 5.9% |

The supramalleolar osteotomy implants industry in the United Kingdom is expected to reach a market share of USD 134.4 million by 2035, expanding at a CAGR of 5.9% during the forecast period. Surgeons in the UK have been adopting advanced surgical techniques for ankle realignment and stabilization, including SMO.

These techniques have been refined over time, resulting in improved outcomes and increased patient awareness. As patients become more aware of treatment options, they are seeking SMO procedures as a means to alleviate their ankle conditions.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 251.2 million |

| CAGR % 2025 to End of Forecast (2035) | 6.8% |

The supramalleolar osteotomy implants industry in China is anticipated to reach a market size of USD 251.2 million by 2035, moving at a CAGR of 6.8% during the forecast period. The supramalleolar osteotomy implants industry in China is expected to grow prominently due to the increasing collaborative research and clinical advancements in implants. The China has a strong research and clinical community that focuses on orthopedics and ankle surgery.

Collaborations between implant manufacturers, surgeons, and researchers have led to advancements in the understanding and treatment of ankle conditions. These collaborations contribute to the development of improved implant designs and surgical techniques, creating a favorable environment for the adoption of SMO implants.

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 184.7 million |

| CAGR % 2025 to End of Forecast (2035) | 6.6% |

The supramalleolar osteotomy implants industry in Japan is estimated to reach a market size of USD 184.7 million by 2035, thriving at a CAGR of 6.6%. The market in Japan is predicted to grow because factors such as aging demographics, sports injuries, and an active lifestyle contribute to the rise in ankle problems.

Ankle-related conditions such as ankle arthritis, malalignment, and instability are becoming more prevalent in the Japan population. As a result, there is a growing demand for effective surgical interventions like SMO, which drives the need for SMO implants.

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 136.7 million |

| CAGR % 2025 to End of Forecast (2035) | 6.4% |

The supramalleolar osteotomy implants industry in South Korea is expected to reach a market size of USD 136.7 million by 2035, expanding at a CAGR of 6.4% during the forecast period. The market in South Korea is forecasted to witness growth due to surge in technological advancements in implant design.

he development of innovative implant designs has contributed to the increased demand for SMO implants. Modern SMO implants offer improved stability, fixation, and compatibility with minimally invasive techniques. These advancements make the procedure more appealing to both patients and surgeons, leading to a higher demand for SMO implants in the South Korea.

The plates and screws is expected to dominate the supramalleolar osteotomy implants industry with a CAGR of 5.1% from 2025 to 2035. This segment captures a significant market share in 2025 due to recent developments in plates.

A nickel-titanium alloy known as nitinol having shape-memory properties encourages a constant compressive force to fractured surfaces. Nitinol staples offers benefits that make them a significant implant material. Many key osteotomy plates market manufactures are incorporating nitinol to their products which is boosting the demand.

The varus deformities are expected to dominate the supramalleolar osteotomy implants industry with a CAGR of 5.4% from 2025 to 2035. There is a constant need for improvements in the treatment choices for osteoarthritis of the varus deformity. This covers the creation of novel surgical procedures, materials for implants, and methods for joint preservation that can lead to improved outcomes, quicker recoveries, and longer-lasting effects. Patients and medical professionals are looking for therapies that can cure varus-type osteoarthritis in a way that is efficient and long-lasting.

The hospital segment is expected to dominate the supramalleolar osteotomy implants industry with a CAGR of 4.7% from 2025 to 2035. With the help of cutting-edge medical technology, this industry sector gains a sizeable market share in 2025 and offers patients improved surgical results. Due to the accessibility of trained healthcare personnel and specialized services, hospitals have a high adoption rate for osteotomy implantation treatments.

The supramalleolar osteotomy implants sector is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must employ smart techniques.

Key Strategies Used by the Participants

Product Development

Companies spend a lot of money on R&D to create new products that increase efficiency, reliability, and cost-effectiveness. Product innovation enables firms to distinguish themselves from their competitors while also meeting the changing needs of their customers.

Strategic Alliances & Collaborations

Key industry leaders typically form strategic alliances and collaborations with other businesses in order to leverage their strengths and expand their market reach. Such partnerships may also provide companies with access to new technologies and markets.

Expansion into Emerging Markets

The supramalleolar osteotomy implants industry is quickly increasing in emerging markets such as China and India. To boost their presence in these locations, key companies are expanding their distribution networks and establishing local production plants.

Acquisitions and mergers

Mergers and acquisitions are frequently used by key players in the supramalleolar osteotomy implants business to consolidate their market position, extend their product range, and gain access to new markets.

Key Developments in the Supramalleolar Osteotomy Implants Market:

The global supramalleolar osteotomy implants market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the supramalleolar osteotomy implants market is projected to reach USD 2.5 billion by 2035.

The supramalleolar osteotomy implants market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in supramalleolar osteotomy implants market are plates and screws, locking plates, intramedullary nails, external fixators systems, bioabsorbable implants and others.

In terms of indication, varus type segment to command 61.2% share in the supramalleolar osteotomy implants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Osteotomy Plates Market Trends and Forecast 2025 to 2035

High Tibial Osteotomy (HTO) Plates Market Growth – Trends & Outlook 2025-2035

China High Tibial Osteotomy (HTO) Plates Market Insights – Size, Trends & Forecast 2025-2035

India High Tibial Osteotomy (HTO) Plates Market Insights – Trends, Demand & Forecast 2025-2035

Japan High Tibial Osteotomy (HTO) Plates Market Analysis – Demand, Trends & Forecast 2025-2035

Canada High Tibial Osteotomy (HTO) Plates Market Report – Trends, Demand & Forecast 2025-2035

United States High Tibial Osteotomy (HTO) Plates Market Insights – Growth, Share & Forecast 2025-2035

Bio-Implants Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Gel Implants Market Analysis - Trends, Share & Forecast 2025 to 2035

Smart Implants Market Size and Share Forecast Outlook 2025 to 2035

Brain Implants Market Size and Share Forecast Outlook 2025 to 2035

Cheek Implants Market

Spinal Implants and Devices Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Breast Implants Market

Ocular Implants Market

Facial Implants Market

Struts Implants Market

Medical Implants Precision Machining Service Market Size and Share Forecast Outlook 2025 to 2035

Steroid Implants Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Humeral Implants Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA