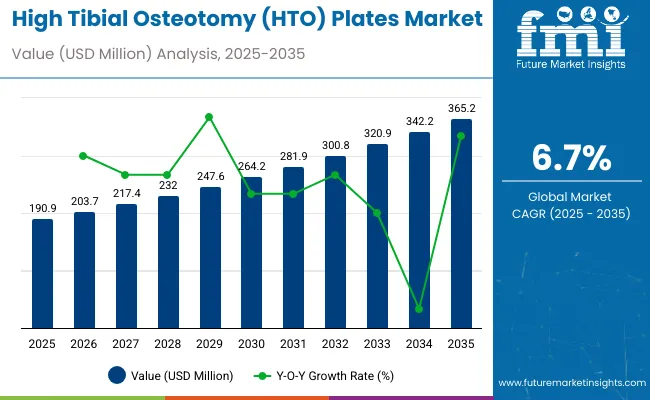

The global sales of high tibial osteotomy plates are estimated to be worth USD 190.9 million in 2025 and anticipated to reach a value of USD 365.2 million by 2035. Sales are projected to rise at a CAGR of 6.7% over the forecast period between 2025 and 2035. The revenue generated by high tibial osteotomy plates in 2024 was USD 179.7 million.

The demand for High Tibial Osteotomy (HTO) plates growth is driven rising aging population and rising incidence in obesity rates which increases the cases of varus malalignment and partial knee osteoarthritis. Yet, a shift toward joint-preserving solutions is making HTO plates as the preferred choice for younger generation, active patients seeking alternatives to total knee replacement. Technological developments with respect to anatomically contoured plates and polyaxial screws are significantly improving load distribution and reducing complications.

These innovations enhance recovery times and expand the appeal of HTO procedures. Rising incidence of sports-related knee injuries further boost the market demand, with athletes and active individuals seeking reliable, non-replacement solutions.

Additionally, the growing adoption of intraoperative navigation systems ensures precision, increasing surgeon confidence. Emerging markets are seeing rapid adoption as healthcare access improves, while evolving reimbursement frameworks in developed markets lower financial barriers. These combined factors are driving substantial growth for HTO plates.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 179.7 million |

| Estimated Size, 2025 | USD 190.9 million |

| Projected Size, 2035 | USD 365.2 million |

| Value-based CAGR (2025 to 2035) | 6.7% |

The increase in sales of high tibial osteotomy plates mainly from product differentiation and innovation driven by developments including anodized surfaces and polyaxial screws. Anodized surfaces significantly increase the longevity and resistance to corrosion of a plate, together with its biocompatibility that prevents adverse reaction with the implant. Similarly, the polyaxial screw promotes better flexibility concerning fixation angles due to which an optimal alignment to achieve can be ensured as required by any individual patient. These innovations address important needs in orthopedic surgery, such as improved ease of use, enhanced stability, and better patient recovery rates.

As healthcare professionals increasingly focus on advanced features that improve surgical outcomes and patient satisfaction, demand for such innovative products increases. In addition, these innovations give manufacturers a competitive advantage in meeting diverse clinical requirements while remaining cost-effective. This focus on product enhancement not only attracts more surgeons but also encourages healthcare facilities to adopt advanced solutions, contributing significantly to the growing sales within the osteotomy plate market.

Knee osteoarthritis is a growing global health concern, leading to chronic pain, mobility issues, and decreased quality of life for millions. As populations age and risk factors such as obesity and sedentary lifestyles become more prevalent, the incidence of knee osteoarthritis continues to rise. This increasing burden is driving demand for joint-preserving surgical interventions, such as High Tibial Osteotomy (HTO), especially among younger, active patients who seek alternatives to total knee replacement.

Regulatory oversight in the High Tibial Osteotomy (HTO) plates market ensures that these orthopedic implants meet stringent safety, quality, and performance standards across global markets. Authorities like the U.S. FDA, EU MDR, and China’s NMPA enforce rigorous approval processes, including clinical evaluations and biocompatibility testing. In addition, manufacturers must comply with international standards for risk management and quality assurance.

The below table presents the expected CAGR for the global high tibial osteotomy plates market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2035, the business is predicted to surge at a CAGR of 7.6%, followed by a slightly lower growth rate of 7.2% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 7.6% (2024 to 2034) |

| H2 | 7.2% (2024 to 2034) |

| H1 | 6.7% (2025 to 2035) |

| H2 | 6.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 6.7% in the first half and decrease moderately at 6.2% in the second half. In the first half (H1) the market witnessed a decrease of 90.00 BPS while in the second half (H2), the market witnessed a decrease of 100.00 BPS.

Knee Osteoarthritis remains as a significant burden to the healthcare system with its high incidence rate towards varus malalignment which primarily requires HTO plates implantation for treatment. These conditions are common in an aging population and in the obese, who are also on the increase in the world at large. Approximately 528 million people worldwide were living with osteoarthritis, a significant increase of 113% since 1990, according to WHO.

High Tibial Osteotomy (HTO) is a well-established surgical treatment for unicompartmental knee osteoarthritis, especially in younger adults and also active patients who wish to delay or avoid total knee replacement. This increasing patient population results in a constant demand for HTO procedures.

There has been lot of developments across High Tibial Osteotomy space and new HTO plates were introduced with anatomical designs, lightweight materials, presence of polyaxial screws, and anodized surfaces which remains a key factors towards for the demand. All these help improve surgical accuracy, increase strength, and decrease the possibility of surgical complications, thus making the procedures more effective and attractive both to the surgeon and the patient. Product development is further engaged in constructing plates to be used for minimally invasive techniques that ensure decreased recovery periods and minimal discomfort post-treatment.

Thus, in conclusion, growing cases of knee osteoarthritis and varus malalignment, along with ongoing technological advancements in HTO plate design, is boosting the sales of HTO plates and continue to grow over the forecasted period with CAGR of 6.7%.

The customized HTO plates are designed according to the anatomical and biomechanical needs of the patient, resulting in high accuracy outcomes of surgery. The use of advanced imaging techniques such as CT and MRI scans helps manufacturers design perfectly matching custom-fit plates for the given tibial bone structure of the patient.

This trend does not only increase the accuracy of surgery but also decreases intraoperative time and reduces complications associated with implant misalignment or improper fixation. Moreover, patient-specific implants enhance post-operative recovery and increase the overall satisfaction of patients.

Another significant advantage of 3D printing is that it enables manufacturers to innovate with material, such as titanium or bioresorbable composites that provide superior strength, biocompatibility, and eventual biodegradation in certain cases. Such an advanced approach is increasingly finding acceptance among healthcare providers, moving the healthcare sector towards personalized medicine.

The high cost of implants strongly inhibits the sales growth of HTO plates. Exclusive, pricey plates with anodized surfaces and polyaxial screws have limited accessibility among patients, especially in underdeveloped healthcare insurance regions and low-income areas.

The entire cost of the procedure includes preoperative imaging, hospital costs, and rehabilitation after surgery, which acts as a further deterrent to patients-especially in emerging markets where concentrated healthcare budgets are prevalent. Besides the cost-related barriers, the lack of trained orthopedic surgeons is another limiting factor for the widespread use of HTO procedures. An HTO with modern implants requires a high degree of technical expertise and precision, which many surgeons are not adequately trained in, especially in remote areas where access to advanced medical education is limited.

Thus, surgeons often opt for more conventional or less complicated alternatives, such as total knee replacement or non-surgical interventions, which further lowers the demand for HTO plates. These factors form a vicious cycle, where high prices deter patients and fewer experienced surgeons mean that even fewer procedures are carried out. Collectively, these factors limit the market expansion for HTO plates, perpetuating limited adoption and accessibility.

Improved health coverage and affordable reimbursement policies in developed countries are significantly increasing the availability of High Tibial Osteotomy procedures. Policy reforms aimed at reducing the cost of treatments and expensive implants are easing the HTO plate market's greatest challenge: the high cost of procedures and expensive implants. As patients are relieved of the financial pressure required to undergo these treatments, reimbursement policies have encouraged a wider population to opt for HTO as an alternative to Total knee replacement.

Patients are more likely to undergo an HTO when reimbursement policies have coverage for advanced implants and surgical cost, especially in cases where they use innovative plates with anodized surfaces and polyaxial screws. These types of advanced plates are costlier but provide better clinical outcomes and faster recovery times. By aligning the reimbursement policies with those clinical benefits, healthcare providers are more likely to recommend HTO over other knee preservation or replacement options.

Reimbursement policies also encourage hospitals and surgeons to embrace advanced HTO techniques. As the financial risk is minimized, providers are more likely to invest in the required equipment and training for optimal execution of HTO procedures.

The global high tibial osteotomy plates industry recorded a CAGR of 5.4% during the historical period between 2020 and 2024. The growth of high tibial osteotomy plates industry was positive as it reached a value of USD 179.7 million in 2024 from USD 145.7 million in 2020.

Historically, the reason why HTO procedures could not gain wider acceptance was the lack of good-quality implants. Though TKR could be an alternative option, it had its limitations as well and therefore was always being investigated. Poorer correlation of the plates with the anatomy was also another drawback with early HTO plates, which were also technically demanding procedures.

However, during the last 10 to 15 years, the scenario has changed significantly for HTO plates. Improvements in plate design include anatomically contoured plates, polyaxial screws, and anodized surfaces, which improved clinical outcomes to make HTO a more favorable choice for patients with unicompartmental knee osteoarthritis.

The HTO plates industry is presently growing, which is attributed to the increasing awareness of joint-preserving alternatives to TKR, especially among the elderly and those diagnosed with early-stage osteoarthritis. Growing demand for less invasive procedures with improved patient outcomes has hastened the adoption of advanced plate technologies. Improved healthcare reimbursement policies in developed markets also make HTO procedures more accessible, further propelling market growth.

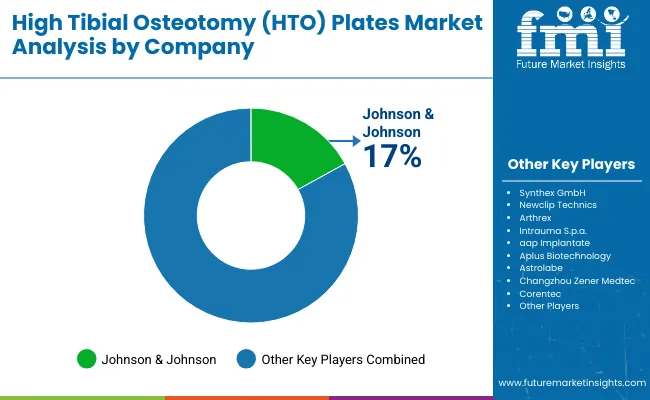

Tier 1 companies comprise market leaders with a significant market share of 51.3% in global market. These companies engage in strategic partnerships and acquisitions to expand their product portfolios and access cutting-edge technologies. Additionally, they emphasize extensive clinical trials to validate the efficacy and safety of their products. Prominent companies in tier 1 include Johnson & Johnson, Conmed Corp., Arthrex, and Newclip Technics.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market and holds around 39.1% market share. They typically pursue partnerships with academic institutions and research organizations to leverage emerging technologies and expedite product development.

These companies often emphasize agility and adaptability, allowing them to quickly bring new treatments to market, additionally targeting specific types medical conditions. Additionally, they focus on cost-effective production methods to offer competitive pricing. Prominent companies in tier 2 include Synthex GmbH, HankilTech Medical, Corentec, Jeil Medical Corporation and others.

Finally, Tier 3 companies, such as Changzhou Zener Medtec, DTM - Deva Tibbi Malzemeler, Kangli Medicaland and others They specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the high tibial osteotomy plates sales remain dynamic and competitive.

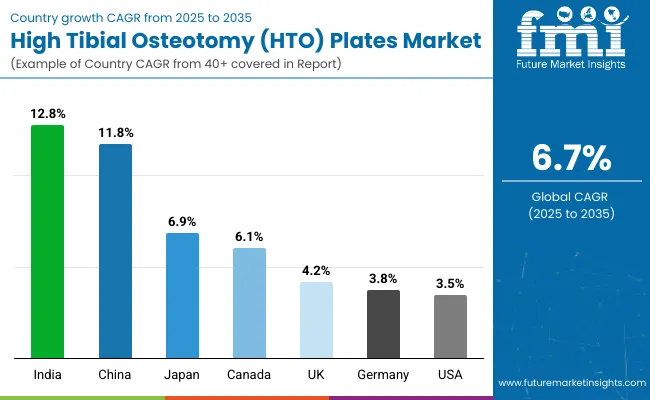

The section below covers the industry analysis for the high tibial osteotomy plates market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle Ease & Africa, is provided. The United States is anticipated to remain at the forefront in North America, with higher market share through 2035. In South Asia & Pacific, India high tibial osteotomy (HTO) plates market is projected to witness a CAGR of 12.8% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.5% |

| Canada | 6.1% |

| China | 11.8% |

| Japan | 6.9% |

| India | 12.8% |

| Germany | 3.8% |

| UK | 4.2% |

The United States high tibial osteotomy (HTO) plates market is expected to grow at a CAGR of 3.5% from 2025 to 2035, remaining the market leader in North America for high tibial osteotomy plates market. The USA is home to some of the most established orthopedic companies, including Arthrex, DePuy-Synthes (Johnson & Johnson) and others, which provide a wide range of innovative HTO plates. These companies have a strong influence in the adoption of advanced surgical techniques, such as HTO, which are effective in addressing knee alignment issues, particularly in patients with unicompartmental osteoarthritis.

There is also a well-established and developed healthcare structure in the USA, that supports the acceptance of the latest advancements in surgical procedures and medical devices. The aggregate population count of aged people and the growing trend of developing osteoarthritis in knees imply the increasing requirement for knee-preserving procedures, such as HTO, in the market. Favorable reimbursement policies and insurance coverage have also fueled the availability and reach of HTO procedures for the patient, thus driving the growth of the market.

Germany holds maximum share in Europe for sales of HTO plates, and will grow at an impressive CAGR of 3.8% between 2025 and 2035, fueled by its strong healthcare infrastructure as well as intense focus on research and development. First, Germany has lately had a high focus on research and development in the medical device section, which has brought innovation into the HTO plates, both for professionals and patients. Germany is famous for having specific clinical trials and tests, which leads to the introduction of the latest technologies improving the efficiency of HTO procedures.

Increased awareness of knee preservation among the patients is the second significant factor that has kept the HTO plate market on the rise. German doctors have lately recommended more and more patients to pursue HTO as opposed to replacement surgery of knee as patients are approaching for less invasive, longer treatment of osteoarthritis.

Lastly, local rules and a tendency to follow higher standards in health care make Germany a very competitive market for the orthopedic companies. More manufacturers are ready to focus their attention on the German market due to its tight safety and quality protocols, and this boosts confidence in the market and increases HTO plates sales.

Japan high tibial osteotomy (HTO) plates market is expected to lead the Asia & Pacific region with a CAGR of 6.9% through 2035 in the high tibial osteotomy plates market. With an expanding geriatric population pool the risk for osteoarthritis and degeneration of the knee joint also increasing.

Rapidly growing geriatric population is ultimately increasing demand for orthopedic procedures, including which includes high tibial ostomy as well. With increasing prevalence of osteoarthritis and degeneration of the knee joint among the elderly, a more pronounced need for surgical intervention like HTO to delay or prevent knee replacement surgeries arises.

Apart from it a solid focus on minimally invasive surgical techniques has been laid in Japan. As HTO is a procedure that preserves a joint, with fewer requirements for having to replace a full knee, it leans towards its preference of less invasive techniques and cheaper procedures with no or minimal tissue disturbance. This need now propels HTO plates as a popular alternative for addressing knee problems.

The strong regulatory environment for medical devices in Japan ensures that only quality and reliable products are allowed into the market. This has resulted in increased patient and medical professional confidence in the effectiveness of HTO procedures, further contributing to the growth of the HTO plate market.

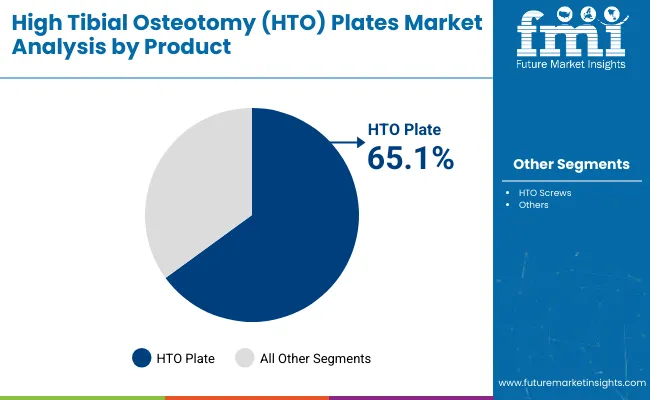

The section contains information about the leading segments in the industry. By product, the HTO plate segment holds the highest market share of 36.0% in 2025.

| By Product | Value Share (2025) |

|---|---|

| HTO plate | 65.1% |

The HTO plate segment holds a significant share of the HTO plates market as the plates give superior support and stability for healing. It transmits forces through a greater area of the bone so as not to fracture the bone or its possible misalignment, which are among the possible complications of this kind of procedure, especially for HTO where proper bone alignment is highly dependent on success.

More flexibility is not offered by using plates. Plates, especially those with polyaxial screws, will allow the surgeon to adapt to more angles of fixation for more anatomic adaptation to the needs of the patient, making them more desirable in complex cases or more complex patient anatomy. Additionally, HTO plates are also more expensive than screws because they are made more complex and with high-grade materials along with additional functionality.

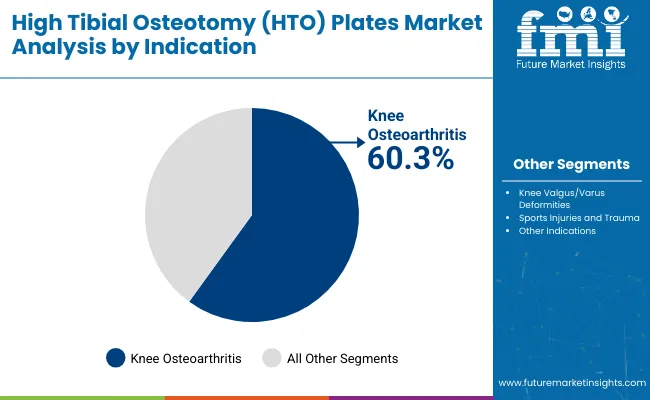

| Value Share (2025) | Value Share (2025) |

|---|---|

| Knee Osteoarthritis | 60.3% |

The prevalence of Knee Osteoarthritis (OA) is also considerable in the HTO plates market, primarily among the aging population. Cartilage in the knee deteriorates gradually, leading to knee OA being a common condition in the majority. This would subsequently cause pain and stiffness in the joint, where surgical intervention is required for HTO to correct knee alignment and symptomatology. Knee OA is likely to result in varus malalignment, placing increased stress across the inner aspect of the knee. High Tibial Osteotomy is an effective procedure for addressing this problem by altering the distribution of load across the knee and promoting function.

The further success and efficiency of HTO procedures in treating knee OA have fueled more demand. Patients receive better post-operative outcomes as there are advancements in HTO plates, like the ones made for better fixation and alignment. Hence, the advancement in HTO plates has led to being preferred over other indications for treating knee OA.

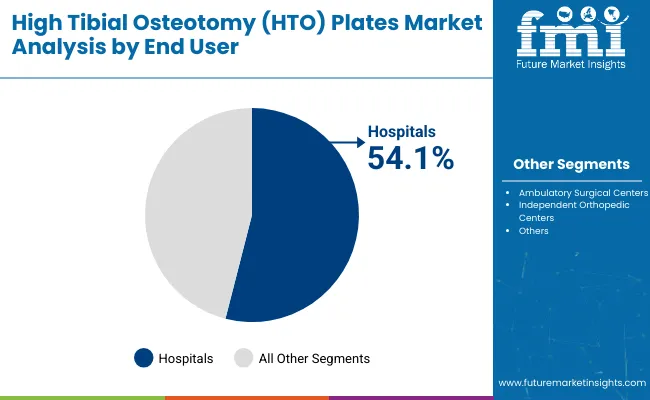

| By End User | Value Share (2025) |

|---|---|

| Hospitals | 54.1% |

Hospitals are a dominant force in the High Tibial Osteotomy (HTO) plates market because of their central position in healthcare delivery, especially orthopedic surgery. As the primary institutions for surgical treatments, hospitals are well-equipped with specialized surgical teams, advanced diagnostic tools, and post-operative care systems necessary for the proper execution of complex procedures such as High Tibial Osteotomy. The availability of orthopedic surgeons who can perform knee surgery and the available infrastructure to cope with the inflow of patients makes hospitals a place for treatment.

In addition, hospitals also offer a much more comprehensive treatment process, as they can deliver pre-operative diagnosis, surgery, and rehabilitation, providing an all-around care environment. This all-round care makes a patient more likely to choose treatment in a hospital when they have their knee alignment corrected.

The market players are using strategies to stay competitive, such as product differentiation through innovative formulations, strategic partnerships with healthcare providers for distribution. Another key strategic focus of these companies is to actively look for strategic partners to bolster their product portfolios and expand their global market presence.

In terms of product, the industry is divided into- HTO Plates and HTO Screws.

In terms of material, the industry is segregated into- Titanium Plates, Stainless Steel Plates, Biodegradable/Composite Plates.

In terms of indication, the industry is segregated into- Knee Osteoarthritis, Knee Valgus/Varus Deformities, Sports Injuries and Trauma and Other Indications

In terms of end user, the industry is segregated into- Hospitals, Ambulatory Surgical Centers and Independent Orthopedic Centers

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global high tibial osteotomy plates market is projected to witness CAGR of 6.7% between 2025 and 2035.

The global high tibial osteotomy plates industry stood at USD 179.7 million in 2024.

The global high tibial osteotomy plates market is anticipated to reach USD 365.2 million by 2035 end.

India is set to record the highest CAGR of 12.8% in the assessment period.

The key players operating in the global high tibial osteotomy plates market include Johnson & Johnson, Synthex GmbH, Newclip Technics, Arthrex, Intrauma S.p.a., aap Implantate, Aplus Biotechnology, Astrolabe, Changzhou Zener Medtec, Corentec, DTM - Deva Tibbi Malzemeler, Groupe Lépine, HankilTech Medical, I.T.S., Intercus, Jeil Medical Corporation and Others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Material, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Technique, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Attractiveness by Technique, 2023 to 2033

Figure 14: Global Market Attractiveness by Material, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Technique, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 28: North America Market Attractiveness by Technique, 2023 to 2033

Figure 29: North America Market Attractiveness by Material, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Technique, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Technique, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Technique, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 58: Europe Market Attractiveness by Technique, 2023 to 2033

Figure 59: Europe Market Attractiveness by Material, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Technique, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Technique, 2023 to 2033

Figure 74: South Asia Market Attractiveness by Material, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Technique, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Technique, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Technique, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by Material, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Technique, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Material, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Technique, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by Material, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 118: MEA Market Attractiveness by Technique, 2023 to 2033

Figure 119: MEA Market Attractiveness by Material, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

China High Tibial Osteotomy (HTO) Plates Market Insights – Size, Trends & Forecast 2025-2035

India High Tibial Osteotomy (HTO) Plates Market Insights – Trends, Demand & Forecast 2025-2035

Japan High Tibial Osteotomy (HTO) Plates Market Analysis – Demand, Trends & Forecast 2025-2035

Canada High Tibial Osteotomy (HTO) Plates Market Report – Trends, Demand & Forecast 2025-2035

United States High Tibial Osteotomy (HTO) Plates Market Insights – Growth, Share & Forecast 2025-2035

Osteotomy Plates Market Trends and Forecast 2025 to 2035

High Security Registration Plates Market Size and Share Forecast Outlook 2025 to 2035

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA