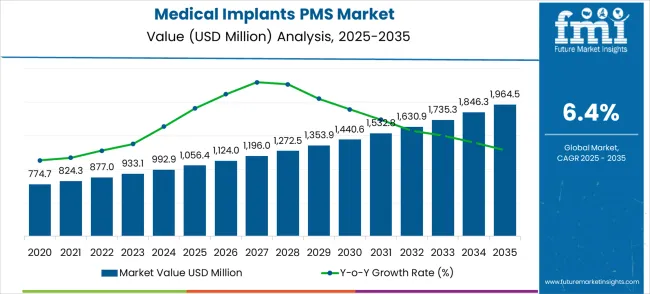

The medical implants precision machining service market is expected to reach USD 1,056.4 million in 2025 and USD 1,964.5 million by 2035, growing at a CAGR of 6.4%. Between 2021 and 2025, the market shows steady acceleration, increasing from USD 774.7 million to USD 1,056.4 million. This period represents the market's early growth phase, with incremental annual growth as demand for high-quality precision-machined medical implants rises. The primary drivers during this time include increased demand in joint replacement and dental implant sectors, where technological advancements and patient needs are continuously evolving.

Between 2025 and 2029, the market experiences an acceleration phase, with growth speeding up due to breakthroughs in implant technology and the expansion of surgical applications. For example, in 2026, the market value rises to USD 1,124.0 million, followed by USD 1,196.0 million in 2027, showing an enhanced demand curve. This acceleration is due to continuous technological improvements, regulatory changes, and greater adoption of medical implants. There is a slight deceleration observed in 2029 when the market growth starts to moderate after peaking in 2028 at USD 1,272.5 million.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,056.4 million |

| Forecast Value in (2035F) | USD 1,964.5 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

The medical implants precision machining service market exhibits clear cyclical growth patterns, typically experiencing accelerated growth every 3-4 years. From 2021 to 2025, the market grows from USD 774.7 million to USD 1,056.4 million. This period is marked by steady annual increases, driven by growing demand for medical implants like joint replacements and dental implants. Significant spikes in market value are observed in 2026, 2027, and 2028, where values reach USD 1,124.0 million, USD 1,196.0 million, and USD 1,272.5 million, respectively. These fluctuations are largely influenced by technological advancements in precision machining and an uptick in medical procedures that require highly customized and durable implants.

The cyclical nature of the market becomes evident as growth continues to accelerate from 2029 onwards, moving from USD 1,353.9 million in 2029 to USD 1,964.5 million by 2035. Intermediate years, such as 2030 (USD 1,440.6 million) and 2031 (USD 1,532.8 million), show incremental growth, following a predictable pattern. The period between 2029 and 2035 is driven by advancements in machining technologies, increased manufacturing capacity, and rising global demand for sophisticated surgical solutions. Regulatory changes, such as stricter implant standards and healthcare reforms, further fuel this growth.

Market expansion is being supported by the increasing complexity of modern medical implants and the corresponding demand for advanced precision machining services capable of handling sophisticated geometries, tight tolerances, and specialized biocompatible materials. Modern medical devices require exceptional manufacturing precision to ensure proper fit, function, and biocompatibility in critical surgical applications. Advanced multi-axis machining technologies provide the capabilities needed to produce complex implant features, intricate surface textures, and precise dimensional accuracy required for successful medical device performance.

The growing focus on personalized medicine and custom implant solutions is driving demand for flexible machining services that can accommodate low-volume, high-precision manufacturing requirements. Regulatory compliance requirements and quality assurance standards are creating opportunities for specialized machining service providers with validated processes and comprehensive documentation capabilities. The rising adoption of advanced materials including titanium alloys, cobalt-chromium alloys, and specialty polymers is also contributing to increased demand for machining services with expertise in processing challenging biocompatible materials.

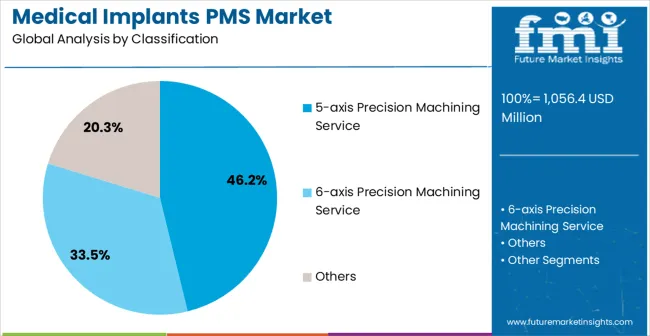

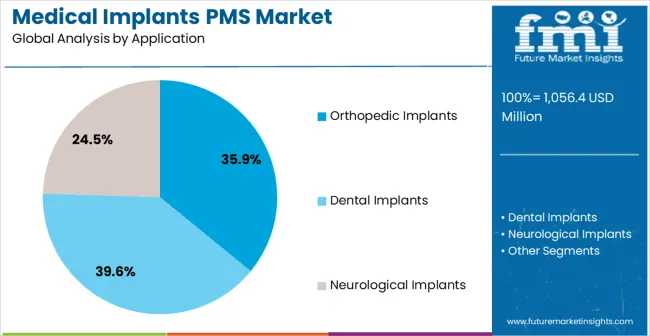

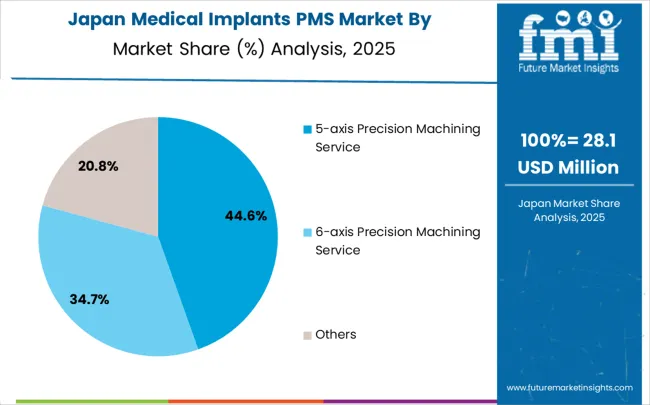

The market is segmented by service type, implant type, and region. By service type, the market is divided into 5-axis precision machining service, 6-axis precision machining service, and others. Based on implant type, the market is categorized into orthopedic implants, dental implants, and neurological implants. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The 5-axis precision machining service segment is expected to account for 46.2% of the medical implants precision machining service market in 2025, solidifying its dominance in medical device manufacturing. The 5-axis machining technology offers superior capabilities for producing complex geometries, allowing for single-setup manufacturing and achieving enhanced surface finishes. This precision service is essential for handling intricate implant designs and performing difficult material removal tasks. Its efficiency directly addresses the need for high precision and quality in medical implant production. With growing demand for highly precise and complex medical devices, 5-axis machining services continue to see significant adoption, reinforcing their central role in medical device manufacturing.

The dental implants segment is projected to account for 39.6% of the medical implants precision machining service demand in 2025, positioning it as the largest segment in the market. Rising demand for restorative dental procedures and cosmetic dentistry drives the need for precision in dental implant manufacturing. Dental implants require intricate geometries, including screw threads, abutments, and surface finishes, to ensure osseointegration, stability, and long-term performance. The growing emphasis on patient-specific solutions and digital dentistry further accelerates demand for highly specialized machining services. As dental care awareness expands globally and the aging population increasingly seeks tooth replacement solutions, dental implants remain the leading driver of precision machining service adoption.

The medical implants precision machining service market is advancing steadily due to increasing medical device complexity and growing demand for high-precision manufacturing capabilities that meet stringent regulatory requirements. The market faces challenges including high equipment investment costs, complex quality validation processes, and stringent regulatory compliance frameworks for medical device manufacturing. Innovation in advanced machining technologies and automated quality control systems continue to influence service capabilities and market expansion patterns.

The growing adoption of advanced multi-axis machining systems is enabling superior manufacturing capabilities for complex medical implant geometries through enhanced positioning accuracy, reduced setup time, and improved surface finish quality. Six-axis and advanced machining centers equipped with automated tool changing and part handling systems provide comprehensive manufacturing solutions while maintaining the precision requirements essential for medical device applications. These technologies offer exceptional dimensional accuracy and repeatability, particularly beneficial for high-volume production operations and custom implant manufacturing requiring consistent quality standards.

Modern precision machining service providers are incorporating advanced quality control systems and real-time process monitoring technologies to ensure compliance with medical device manufacturing standards and regulatory requirements. Digital measurement systems enable comprehensive dimensional verification, surface quality analysis, and process documentation that support FDA and ISO certification requirements. These technologies improve manufacturing consistency while providing detailed traceability and quality assurance documentation necessary for medical device validation and regulatory compliance.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| Brazil | 6.7% |

| United States | 6.1% |

| United Kingdom | 5.4% |

| Japan | 4.8% |

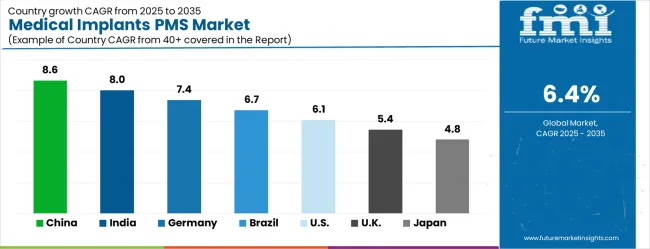

The medical implants precision machining service market is experiencing robust growth globally, with China leading at 8.6% CAGR through 2035, driven by rapid expansion of medical device manufacturing capabilities, increasing healthcare infrastructure investment, and growing adoption of advanced machining technologies. India follows at 8.0%, supported by expanding medical device industry, cost-effective manufacturing capabilities, and increasing government support for healthcare sector development. Germany shows strong growth at 7.4%, emphasizing precision engineering excellence and advanced medical technology development programs. Brazil records 6.7%, focusing on healthcare infrastructure modernization and medical device manufacturing expansion. The United States demonstrates 6.1% growth, prioritizing medical technology innovation and advanced manufacturing capabilities. The United Kingdom shows 5.4% expansion, supported by medical technology research excellence and precision manufacturing development. Japan maintains 4.8% growth, leveraging precision manufacturing expertise and advanced medical device technology capabilities.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The medical implants precision machining service market in China is projected to grow at a CAGR of 8.6% from 2025 to 2035. With a rapidly expanding healthcare industry and increasing demand for advanced medical devices, China is becoming a key player in the medical implants sector. The growing aging population and rise in chronic diseases drive the need for orthopedic and dental implants, resulting in increased demand for precision machining. As the country continues to enhance its manufacturing capabilities, China is expected to remain a global leader in medical implant machining services, particularly in cost-effective solutions. The market is also supported by local manufacturers adopting advanced technologies for precision machining.

The medical implants precision machining service market in India is forecasted to grow at a CAGR of 8.0% from 2025 to 2035. The country’s growing healthcare sector, driven by both domestic demand and medical tourism, is fostering the demand for advanced medical implants. The rise in lifestyle-related diseases and the country’s expanding middle class are further fueling demand for orthopedic and dental implants. India offers a cost-effective manufacturing environment, which, combined with its skilled labor force, is helping the market to expand. The increasing adoption of advanced precision machining technologies for implants positions India as an attractive destination for international medical device manufacturers.

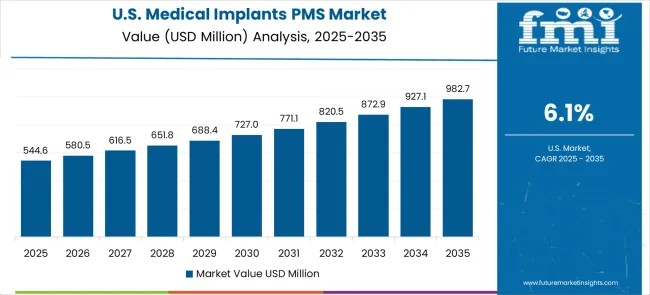

The medical implants precision machining service market in the United States is projected to grow at a CAGR of 6.1% from 2025 to 2035. The USA remains one of the largest markets for medical implants due to an aging population and high healthcare expenditures. The demand for orthopedic and dental implants continues to rise, supported by advancements in surgical techniques and medical technologies. The need for precision machining services is increasingly important as implant designs become more complex. The U.S. is also home to cutting-edge technologies and innovation in the field of medical devices, ensuring the country’s continued dominance in implant manufacturing and precision machining.

Demand for medical implants precision machining service in Germany is forecast to grow at a CAGR of 7.4% from 2025 to 2035. Known for its highly developed healthcare system, Germany’s demand for medical implants, particularly orthopedic and dental implants, is increasing. The strong focus on medical innovation and high-quality production standards makes it a leader in the global implant machining market. As the demand for more customized and complex implants rises, Germany’s manufacturing capabilities in precision machining play a pivotal role. The ongoing advancements in technology further position Germany as a key player in meeting the market’s growing needs for high-precision machining services.

The medical implants precision machining service market in Brazil is anticipated to rise at a CAGR of 6.7% from 2025 to 2035. Brazil’s medical implant market is gaining traction due to the rising demand for both dental and orthopedic implants. The country’s medical tourism sector, particularly for implant-related treatments, is a key driver of growth. Brazil’s cost-effective manufacturing capabilities and skilled labor force make it an attractive location for medical device production. As the demand for customized implants increases, precision machining services will become more critical to meeting global standards. Brazil’s growing healthcare sector supports the increasing need for precision machining of medical implants.

The medical implants precision machining service market in the United Kingdom is expected to rise at a CAGR of 5.4% from 2025 to 2035. The UK is seeing a steady increase in demand for medical implants, particularly in orthopedics and dental care. The country’s advanced healthcare system and focus on high-quality medical solutions are key contributors to the growth of this market. As the need for customized implants rises, precision machining services play an increasingly important role in meeting the demand for high-quality implants. The UK’s strong position in medical research and development also supports its competitiveness in the global medical implant market.

The medical implants precision machining service market is expected to expand at a CAGR of 4.8% from 2025 to 2035. Japan’s aging population continues to drive demand for orthopedic and dental implants. The country’s advanced manufacturing technologies are enabling the production of highly precise and complex implants. Japan is also adopting innovative technologies such as robotics and AI in its precision machining processes, which will further support the market. The ongoing need for quality implants, driven by increasing healthcare needs, positions Japan as a leader in medical device precision machining within Asia.

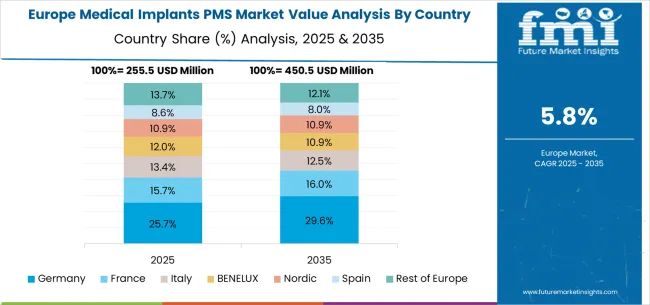

The medical implants precision machining services (PMS) market in Europe is projected to grow from USD 255.5 million in 2025 to USD 450.5 million by 2035, registering a CAGR of 5.8% over the forecast period. Germany will remain the leader, increasing from 25.7% in 2025 to 29.6% by 2035, supported by its strong medical device manufacturing base and advanced precision machining capabilities. France will contribute 15.7% in 2025, rising to 16.0% by 2035, reflecting continued demand from orthopedic and implant manufacturing clusters. Italy will account for 13.4% in 2025, softening slightly to 12.5% by 2035, showing mature but steady market demand.

The BENELUX region will hold 10.2% in 2025, easing to 10.9% by 2035, supported by regional medtech hubs and contract manufacturing growth. The Nordic countries will capture 8.6% in 2025, declining modestly to 8.0% by 2035, reflecting slower growth in specialized implant machining. Spain will represent 13.7% in 2025, decreasing to 12.1% by 2035, reflecting moderate adoption despite expansion in healthcare facilities. Meanwhile, the Rest of Europe will decline from 13.7% in 2025 to 12.1% by 2035, as precision machining adoption is concentrated in larger Western European clusters.

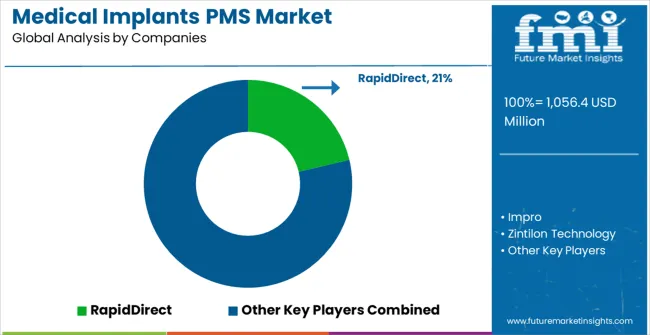

The medical implants precision machining service market is characterized by competition among specialized contract manufacturers, precision machining companies, and medical device service providers focusing on high-quality manufacturing solutions for critical healthcare applications. Companies are investing in advanced multi-axis machining systems, comprehensive quality control programs, regulatory compliance capabilities, and technical expertise to deliver reliable, precise, and cost-effective machining services for complex medical implant applications. Technology innovation, regulatory validation, and manufacturing excellence are central to strengthening service capabilities and market positioning in this highly regulated sector.

RapidDirect, China-based, provides comprehensive precision machining services with focus on rapid prototyping, low-volume production, and advanced materials processing for medical device applications. Impro, Hong Kong, delivers sophisticated manufacturing solutions with focus on complex geometry production and comprehensive quality assurance programs. Zintilon Technology offers specialized medical device machining services with focus on titanium and advanced alloy processing capabilities. Proto Labs Inc., USA, provides rapid manufacturing services with focus on automated quoting, fast turnaround times, and comprehensive material selection for medical applications.

Owens Industries, USA, delivers precision machining services with focus on high-volume production and advanced quality control systems for medical device manufacturers. ARCH Medical Solutions Corp provides specialized orthopedic implant machining with focus on regulatory compliance and comprehensive validation programs. Donatelle offers polymer and metal machining services for medical device applications with focus on biocompatible materials processing. Tamshell, Xometry, Elimold, McCormick Industries, AT-Machining, Team-Metal, and AFT Micromécanique provide specialized precision machining services across diverse medical implant applications, maintaining focus on quality assurance, regulatory compliance, and advanced manufacturing capabilities for critical healthcare component production.

Medical implants precision machining services represent a critical enabler of advanced healthcare delivery, with the global market valued at USD 1,056.4 million in 2025 and projected to reach USD 1,964.5 million by 2035, growing at a 6.4% CAGR. These specialized manufacturing services produce life-critical components including orthopedic joints, dental implants, and neurological devices requiring sub-micron tolerances, biocompatible surface finishes, and complete traceability. Market growth is driven by aging populations, increasing surgical volumes, personalized medicine trends, and advancing implant technologies. However, scaling requires coordinated efforts across regulatory compliance, advanced manufacturing capabilities, quality assurance systems, and specialized workforce development.

Medical Device Manufacturing Zones: Establish specialized manufacturing districts with streamlined FDA/CE marking approval processes, subsidized clean-room facilities, and co-located testing laboratories. Provide tax incentives for companies investing in 5-axis and 6-axis CNC equipment meeting medical device manufacturing standards.

Regulatory Pathway Optimization: Develop fast-track approval processes for precision machining services supporting innovative implant designs while maintaining stringent quality standards. Create centralized databases for machining parameter validation and material traceability requirements across different regulatory jurisdictions.

Advanced Manufacturing Research: Fund national institutes focusing on medical device manufacturing technologies including additive-subtractive hybrid systems, in-situ quality monitoring, and biocompatible surface treatment processes. Support development of AI-driven quality control systems specific to medical implant machining.

Workforce Development Programs: Establish specialized training centers for medical device machinists, quality engineers, and regulatory compliance specialists. Partner with technical schools to create certification programs covering GMP requirements, cleanroom protocols, and medical device traceability systems.

Supply Chain Resilience: Develop strategic stockpiles of medical-grade titanium, cobalt-chrome alloys, and PEEK materials to ensure continuity of critical implant manufacturing. Support domestic development of specialized tool manufacturers serving the medical device industry.

Quality Standards and Best Practices: Develop comprehensive machining protocols for different biocompatible materials including surface roughness requirements, dimensional tolerance specifications, and contamination control procedures. Create standardized validation protocols for 5-axis and 6-axis machining processes in medical applications.

Material Science Advancement: Coordinate research on advanced biocompatible materials including titanium alloys with enhanced osseointegration properties, PEEK composites with radiopaque additives, and biodegradable polymer systems requiring precision machining capabilities.

Technology Validation Frameworks: Establish testing facilities validating new machining technologies for medical device applications, including laser processing, electrical discharge machining (EDM), and hybrid manufacturing systems. Develop performance benchmarks for different implant geometries and material combinations.

Regulatory Compliance Guidance: Provide comprehensive resources covering FDA 510(k) submission requirements for machined components, ISO 13485 implementation for precision manufacturing, and international harmonization of quality system requirements.

Innovation Roadmapping: Create industry-wide technology roadmaps identifying key performance targets for machining accuracy, surface finish quality, and production throughput while maintaining medical device quality requirements.

Ultra-Precision Machining Systems: Develop next-generation 5-axis and 6-axis CNC machines with nanometer-scale positioning accuracy, in-situ measurement capabilities, and adaptive control systems compensating for thermal drift and tool wear in medical device manufacturing.

Smart Manufacturing Integration: Implement Industry 4.0 technologies including real-time quality monitoring, predictive maintenance algorithms, and digital twin systems enabling virtual validation of machining processes before production. Develop AI-driven optimization systems for complex implant geometries.

Specialized Tooling Solutions: Create cutting tools optimized for biocompatible materials including diamond-coated tools for titanium machining, ultrasonic-assisted cutting systems for hard ceramics, and cryogenic cooling systems preventing thermal damage to sensitive materials.

Surface Treatment Technologies: Advance plasma coating systems, ion implantation equipment, and laser surface texturing capabilities creating bioactive surfaces promoting osseointegration. Develop controlled atmosphere processing systems preventing oxidation of reactive metals.

Quality Assurance Automation: Provide automated inspection systems using coordinate measuring machines (CMM), optical scanning, and X-ray computed tomography for complete dimensional verification of complex implant geometries.

Regulatory Compliance Excellence: Implement comprehensive quality management systems meeting FDA 21 CFR Part 820, ISO 13485, and MDR requirements. Maintain complete batch traceability from raw material certification through final inspection and packaging.

Specialized Manufacturing Capabilities: Develop expertise in machining challenging biocompatible materials including titanium alloys, cobalt-chrome systems, ceramic composites, and biodegradable polymers. Invest in specialized equipment for micro-machining, thread forming, and surface texturing operations.

Customer Partnership Models: Offer comprehensive design-for-manufacturing support including material selection guidance, tolerance optimization, and process validation services. Provide prototype development capabilities accelerating customer product development cycles.

Global Service Networks: Establish manufacturing facilities in key medical device markets while maintaining centralized quality oversight and technical expertise. Develop capabilities supporting both high-volume production and low-volume custom implant manufacturing.

Innovation Collaboration: Partner with medical device OEMs, research institutions, and material suppliers on next-generation implant designs requiring advanced manufacturing capabilities. Participate in clinical studies validating new manufacturing processes and surface treatments.

Advanced Manufacturing Infrastructure: Finance construction of state-of-the-art medical device manufacturing facilities incorporating cleanroom environments, precision machining centers, and comprehensive quality assurance systems. Structure investments with milestones tied to regulatory approvals and customer certifications.

Technology Innovation Investment: Back companies developing breakthrough manufacturing technologies including hybrid additive-subtractive systems, AI-driven quality control, and novel surface treatment processes. Support joint ventures between machining service providers and medical device technology companies.

Market Expansion Financing: Fund capacity expansion in high-growth markets including China, India, and emerging economies where healthcare infrastructure development is driving implant demand. Support establishment of regional technical centers providing local engineering and regulatory support.

Vertical Integration Opportunities: Finance strategic acquisitions enabling service providers to control critical supply chain elements including specialized material processing, advanced surface treatments, and quality assurance services. Support partnerships with implant design companies and clinical research organizations.

Digital Transformation Investment: Provide capital for digitalization initiatives including manufacturing execution systems (MES), statistical process control implementation, and customer portal development. Support development of digital platforms connecting implant designers with precision machining capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,056.4 million |

| Service Type | 5-axis Precision Machining Service, 6-axis Precision Machining Service, Others |

| Implant Type | Orthopedic Implants, Dental Implants, Neurological Implants |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | RapidDirect, Impro, Zintilon Technology, Proto Labs Inc., Owens Industries, ARCH Medical Solutions Corp, Donatelle , Tamshell, Xometry, Elimold, McCormick Industries, AT-Machining, Team-Metal, AFT Micromécanique |

| Additional Attributes | Dollar sales by service type and material composition, regional adoption trends across medical device markets, competitive landscape analysis with established precision machining companies and emerging medical technology service providers, manufacturer preferences for 5-axis versus 6-axis machining capabilities, integration with advanced quality control systems and regulatory compliance frameworks |

The global medical implants precision machining service market is estimated to be valued at USD 1,056.4 million in 2025.

The market size for the medical implants precision machining service market is projected to reach USD 1,964.5 million by 2035.

The medical implants precision machining service market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in medical implants precision machining service market are 5-axis precision machining service, 6-axis precision machining service and others.

In terms of application, orthopedic implants segment to command 39.6% share in the medical implants precision machining service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA