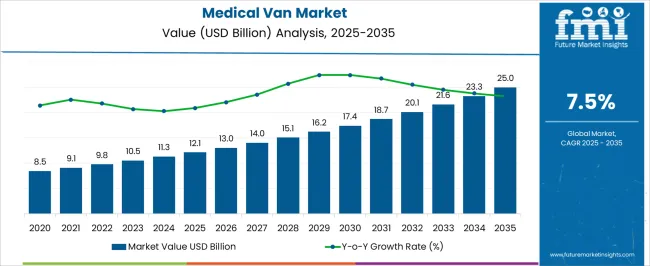

The medical van market is projected to grow from USD 12.1 billion in 2025 to USD 25.0 billion in 2035, reflecting a CAGR of 7.5%. This represents an absolute dollar opportunity of USD 12.9 billion over the decade. The market is expected to expand steadily, reaching USD 13.0 billion in 2026, USD 15.1 billion in 2029, USD 17.4 billion in 2031, and USD 23.3 billion in 2034.

The consistent growth trajectory highlights increasing demand for medical vans across healthcare and emergency services, providing manufacturers and investors with opportunities to capture incremental revenue and strengthen their market position over the forecast period. From an absolute dollar perspective, annual incremental growth starts at around USD 0.6–0.7 billion in the early years and rises to approximately USD 2.0 billion in the later stages, culminating in USD 12.9 billion by 2035. Intermediate benchmarks, such as USD 11.3 billion in 2025, USD 16.2 billion in 2030, and USD 21.6 billion in 2033, illustrate predictable growth phases. This enables stakeholders to plan production, fleet expansion, and distribution strategies efficiently. Capturing both steady yearly increments and the cumulative USD 12.9 billion opportunity ensures maximum revenue potential in the medical van market over the ten-year horizon.

| Metric | Value |

|---|---|

| Medical Van Market Estimated Value in (2025 E) | USD 12.1 billion |

| Medical Van Market Forecast Value in (2035 F) | USD 25.0 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

Continuing with the medical van market, a breakpoint analysis highlights key periods of accelerated growth. Between 2025 and 2027, the market rises from USD 12.1 billion to USD 13.0 billion, marking the early growth phase where initial fleet expansion drives moderate incremental gains. Another significant breakpoint occurs around 2029–2031, as the market grows from USD 15.1 billion to USD 17.4 billion, reflecting a period of faster expansion and higher absolute dollar growth.

These stages are critical for manufacturers and investors to optimize production, secure supply chains, and capture revenue during periods of increasing demand. The final major breakpoint is observed between 2033 and 2035, when the market increases from USD 23.3 billion to USD 25.0 billion, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 16.2 billion to USD 21.6 billion, acting as bridging periods that sustain momentum. Identifying these breakpoints enables stakeholders to strategically plan investments, scale operations efficiently, and maximize revenue potential. Focusing on these pivotal stages ensures capturing both incremental and cumulative opportunities in the medical van market.

The market is experiencing significant growth driven by increasing demand for rapid and reliable patient transport solutions across healthcare systems globally. The current market dynamics are shaped by rising healthcare infrastructure investments, expanding emergency medical services, and growing awareness about timely medical interventions.

The future outlook is favorable due to technological advancements in vehicle design, integration of medical equipment, and government initiatives aimed at improving pre-hospital care. The increasing prevalence of chronic diseases and emergencies requiring prompt response further supports market expansion.

The trend toward full-size vans equipped with advanced medical capabilities is also contributing to market growth, as they offer greater space and flexibility for medical personnel and equipment. The market is positioned for sustained development driven by rising healthcare accessibility and the need for efficient patient transport across both urban and rural regions.

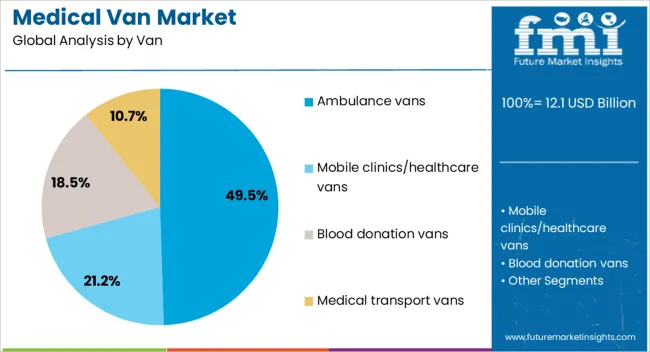

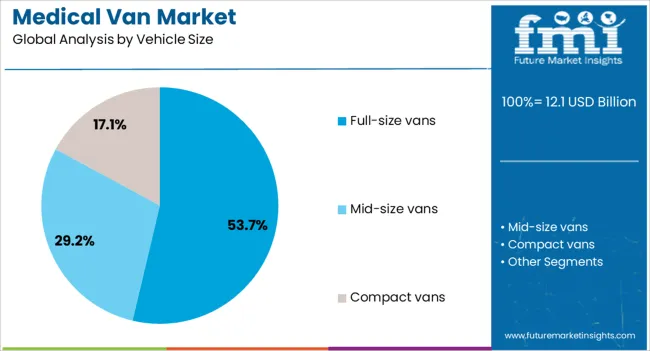

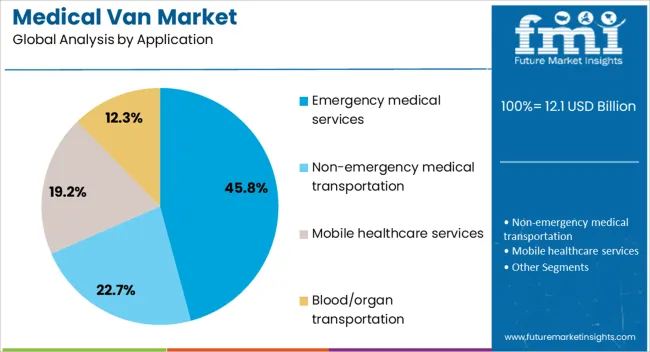

The medical van market is segmented by van, vehicle size, application, vehicle conversion, and geographic regions. By van, medical van market is divided into Ambulance vans, Mobile clinics/healthcare vans, Blood donation vans, and Medical transport vans. In terms of vehicle size, medical van market is classified into Full-size vans, Mid-size vans, and Compact vans.

Based on application, medical van market is segmented into Emergency medical services, Non-emergency medical transportation, Mobile healthcare services, and Blood/organ transportation. By vehicle conversion, medical van market is segmented into Type III (Van Conversion), Type I (Modular/Remountable), and Type II (Cab-Chassis). Regionally, the medical van industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ambulance vans segment is expected to hold 49.5% of the market revenue share in 2025, making it the leading van type. This leadership is attributed to the critical role these vans play in emergency response and patient transport.

Ambulance vans provide essential on-the-go medical support, combining mobility with integrated life-saving equipment. The growth in this segment has been driven by increasing investments in emergency healthcare infrastructure and a rising number of government initiatives focused on improving emergency medical services.

Their adaptability to various emergency scenarios and ability to be rapidly deployed have made ambulance vans indispensable for both public and private healthcare providers. The segment benefits from ongoing innovations in vehicle design and onboard medical technology, enabling improved patient outcomes during transport.

Full-size vans are projected to command 53.7% of the market revenue share in 2025, establishing them as the dominant vehicle size. Their popularity is largely due to the ample interior space, which allows for the installation of sophisticated medical equipment and accommodates medical personnel comfortably during transport.

The segment’s growth is supported by increasing demand for multifunctional vehicles that can be customized for diverse medical applications beyond emergency services, including mobile clinics and vaccination drives. Full-size vans also provide greater stability and safety, which are crucial for patient care during transit.

As healthcare providers seek to enhance service delivery and operational efficiency, full-size vans are being increasingly preferred due to their versatility and capacity.

The emergency medical services application segment is anticipated to represent 45.8% of the market revenue share in 2025, reflecting its leading position in terms of use. This dominance stems from the vital need for rapid response and patient stabilization in pre-hospital environments.

Emergency medical service providers require reliable and well-equipped vehicles that can operate in diverse conditions and reach patients promptly. The growth of this segment has been reinforced by government policies emphasizing timely emergency care and investments in upgrading ambulance fleets.

The segment also benefits from technological advancements such as telemedicine integration and enhanced communication systems within vans, which improve coordination and patient monitoring. As demand for efficient emergency medical interventions increases globally, this application segment is expected to maintain its strong market presence.

The medical van market is expanding as healthcare providers seek mobile solutions to deliver diagnostic, preventive, and primary care services directly to communities. Medical vans are equipped with medical devices, diagnostic tools, and telemedicine capabilities, enabling healthcare access in rural, underserved, and urban areas with limited medical infrastructure.

Rising awareness of preventive care, government healthcare outreach programs, and initiatives for community health services drive demand. Manufacturers offering modular, customizable, and technologically advanced medical vans with onboard laboratories, imaging equipment, and electronic health record integration gain a competitive edge. Additionally, integration with mobile health monitoring, telemedicine platforms, and rapid deployment designs enhances service delivery, making medical vans a critical component of modern healthcare outreach strategies worldwide.

Market growth is restrained by high acquisition costs and operational complexities of medical vans. Equipping vans with advanced diagnostic tools, refrigeration units for vaccines, imaging systems, and telemedicine infrastructure requires significant investment. Operational challenges include vehicle maintenance, trained medical staff, fuel or energy supply, and route planning for efficient service delivery. Compliance with local healthcare regulations, licensing, and road safety standards further adds to operational complexity. Additionally, harsh weather conditions or rough terrains can impact van performance and equipment reliability. Until manufacturers develop cost-effective, durable, and energy-efficient medical van solutions, adoption may remain limited to government programs, large hospitals, NGOs, and regions with sufficient healthcare funding.

Technological advancements are shaping the medical van market, with innovations improving patient care, operational efficiency, and data management. Mobile diagnostic tools, portable imaging devices, point-of-care testing equipment, and electronic health record systems enhance service delivery. Integration with telemedicine platforms enables remote consultation, specialist support, and real-time patient monitoring. Connected devices, IoT-enabled health tracking, and AI-driven analytics help optimize treatment and preventive care. Solar-powered or hybrid vans improve energy efficiency for off-grid operations. Modular designs allow vans to be adapted for specific healthcare services such as vaccination, maternal care, dental check-ups, or chronic disease management. These trends highlight the convergence of healthcare, mobility, and digital technology in expanding medical access.

Opportunities in the medical van market are fueled by government programs, NGO initiatives, and corporate social responsibility projects aimed at improving healthcare access. Expanding rural healthcare infrastructure, vaccination drives, chronic disease management programs, and mobile testing campaigns increase demand for equipped medical vans. Emerging markets with growing populations and limited healthcare facilities present significant opportunities. Manufacturers offering flexible, modular, and technology-enabled vans can capture new contracts with public health departments, private clinics, and international aid organizations. Additionally, integrating telehealth solutions, portable labs, and real-time patient data systems enhances operational efficiency and opens avenues for partnerships with digital health and medical device companies.

Market growth is restrained by intense competition, regulatory compliance requirements, and fleet management challenges. Multiple manufacturers compete on price, customization, technology integration, and after-sales support. Compliance with healthcare regulations, road transport standards, and safety certifications varies by region, adding complexity and increasing costs. Operational challenges, including route optimization, staffing, vehicle maintenance, and supply chain logistics, can affect efficiency and service quality. Additionally, the lifespan and durability of mobile medical equipment and vans are critical for ROI and sustained adoption. Until manufacturers address regulatory alignment, operational efficiency, and maintenance solutions, growth may remain concentrated among well-funded healthcare organizations and government-led mobile health programs.

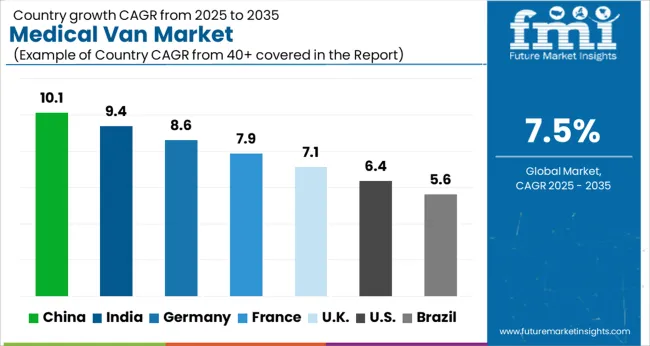

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

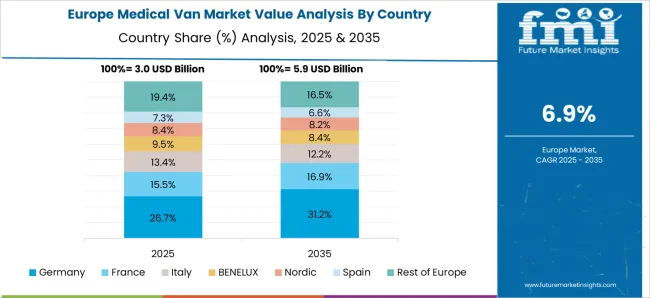

The global medical van market was projected to grow at a 7.5% CAGR through 2035, driven by demand in mobile healthcare, diagnostic services, and emergency medical applications. Among BRICS nations, China recorded 10.1% growth as large-scale production and deployment facilities were commissioned and compliance with medical and safety standards was enforced, while India at 9.4% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 8.6% maintained substantial output under strict industrial and health regulations, while the United Kingdom at 7.1% relied on moderate-scale operations for mobile medical and diagnostic services. The USA, expanding at 6.4%, remained a mature market with steady demand across healthcare and emergency service segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The medical van market in China is growing at a CAGR of 10.1% due to rising demand for mobile healthcare solutions in urban and rural areas. Hospitals, clinics, and government agencies are adopting medical vans to provide diagnostics, vaccination, emergency care, and outreach services in remote or underserved regions. Growth is supported by increasing healthcare infrastructure, government initiatives promoting mobile medical services, and rising awareness of preventive care. Manufacturers provide vans equipped with advanced medical equipment, diagnostic tools, and telemedicine capabilities to ensure effective healthcare delivery. Distribution networks through healthcare providers, government tenders, and commercial leasing partners enhance market accessibility. Adoption is further driven by the expansion of community health programs and growing demand for flexible and mobile healthcare solutions. China remains a key market due to large population, healthcare modernization efforts, and supportive government policies.

India is witnessing growth at a CAGR of 9.4% in the medical van market due to increasing demand for mobile healthcare services in urban and rural regions. Hospitals, clinics, and non-governmental organizations are adopting medical vans for diagnostics, vaccination drives, telemedicine, and emergency response. Growth is supported by rising government healthcare initiatives, community outreach programs, and awareness of preventive healthcare. Manufacturers provide fully equipped vans with advanced diagnostic tools, medical equipment, and communication systems to support mobile care. Distribution through healthcare providers, government tenders, and private leasing partners ensures accessibility across states. Adoption is further fueled by rising population, need for rural healthcare coverage, and corporate healthcare programs. India continues to see strong market growth as mobile medical vans offer cost effective and flexible solutions for reaching underserved populations.

Germany is growing at a CAGR of 8.6% in the medical van market due to rising adoption of mobile healthcare services, outpatient care, and emergency response solutions. Hospitals, clinics, and private healthcare providers are utilizing medical vans to deliver preventive care, diagnostics, and patient monitoring in urban and semi-urban areas. Manufacturers offer vans equipped with advanced medical devices, telemedicine solutions, and patient monitoring systems for reliable and efficient care delivery. Growth is supported by government programs promoting mobile healthcare, aging population needs, and increased focus on outpatient and community care. Distribution through healthcare networks, private leasing, and service providers ensures availability. Adoption is further driven by healthcare modernization, preventive health programs, and flexible service requirements. Germany’s healthcare infrastructure and technology adoption make mobile medical vans an important market segment.

The United Kingdom market is expanding at a CAGR of 7.1% due to rising demand for mobile healthcare, community health services, and emergency response solutions. Medical vans are deployed by hospitals, clinics, and public health agencies to provide diagnostics, preventive care, vaccination drives, and telemedicine services. Manufacturers provide vans equipped with advanced medical instruments, monitoring systems, and telecommunication technology to ensure high quality care delivery. Growth is supported by government healthcare initiatives, rising awareness of preventive health, and increasing demand for flexible and mobile medical services. Distribution through healthcare networks, leasing companies, and government tenders ensures widespread availability. Adoption is further encouraged by population healthcare needs, aging demographics, and focus on outpatient services. The United Kingdom continues to see growth in mobile healthcare as an efficient solution for community and emergency care.

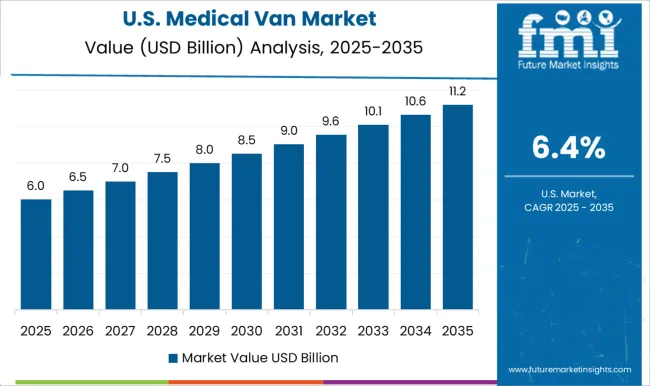

The United States market is growing at a CAGR of 6.4% due to increasing adoption of mobile healthcare solutions in urban, suburban, and rural areas. Hospitals, clinics, public health agencies, and private organizations deploy medical vans for diagnostics, preventive care, vaccination, and emergency services. Manufacturers provide vans equipped with advanced medical tools, telemedicine capabilities, and patient monitoring systems to ensure reliable healthcare delivery. Growth is supported by government programs, healthcare outreach initiatives, and rising population healthcare needs. Distribution through healthcare providers, leasing companies, and government contracts enhances market accessibility. Adoption is further driven by rising focus on preventive health, remote patient monitoring, and flexible healthcare delivery solutions. The United States continues to see steady growth in medical van adoption as an efficient and cost effective solution for mobile and community healthcare.

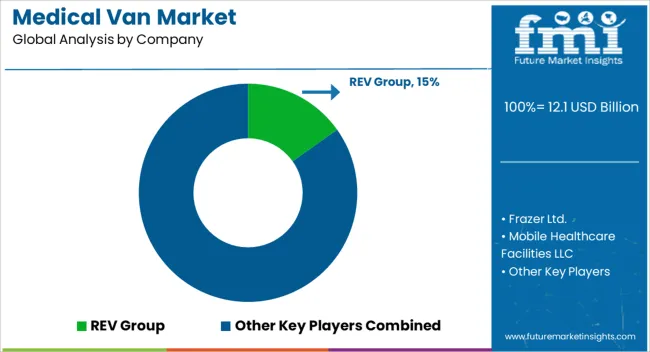

The medical van market is primarily served by REV Group, Frazer Ltd., Mobile Healthcare Facilities LLC, Mercedes-Benz Vans, Demers Braun Crestline, Excellance, Inc., First Priority Emergency Vehicles, Inc., Malley Industries, AEV Ambulance, Leader Emergency Vehicles, and O’Gara Coach. Product brochures emphasize interior layout flexibility, emergency equipment integration, patient capacity, and modular designs. Visuals highlight ergonomic workspaces, onboard diagnostic systems, refrigeration units, and advanced medical storage. Detailed specifications cover electrical systems, climate control, suspension, and chassis configurations suited for urban and rural deployments. Competition is largely influenced by customization, reliability, and compliance with healthcare standards.

REV Group and Demers Braun focus on modular interiors with rapid reconfiguration for multiple medical services. Frazer Ltd. and Excellance, Inc. emphasize lightweight construction and fuel-efficient chassis for longer operational range. Mercedes-Benz Vans leverages advanced mobility features and safety systems, while Mobile Healthcare Facilities LLC and AEV Ambulance highlight telemedicine integration and onboard diagnostics.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.1 Billion |

| Van | Ambulance vans, Mobile clinics/healthcare vans, Blood donation vans, and Medical transport vans |

| Vehicle Size | Full-size vans, Mid-size vans, and Compact vans |

| Application | Emergency medical services, Non-emergency medical transportation, Mobile healthcare services, and Blood/organ transportation |

| Vehicle Conversion | Type III (Van Conversion), Type I (Modular/Remountable), and Type II (Cab-Chassis) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | REV Group, Frazer Ltd., Mobile Healthcare Facilities LLC, Mercedes-Benz Vans, Demers Braun Crestline, Excellance, Inc., First Priority Emergency Vehicles, Inc., Malley Industries, AEV Ambulance, Leader Emergency Vehicles, and O'Gara Coach (manufacturer of Mobile Stroke Units) |

| Additional Attributes | Dollar sales vary by van type, including mobile clinics, diagnostic vans, and telemedicine vans; by application, such as primary healthcare, diagnostic services, vaccination, and emergency care; by end-use, spanning hospitals, government healthcare programs, and NGOs; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for mobile healthcare, rural outreach, and telemedicine adoption. |

The global medical van market is estimated to be valued at USD 12.1 billion in 2025.

The market size for the medical van market is projected to reach USD 25.0 billion by 2035.

The medical van market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in medical van market are ambulance vans, mobile clinics/healthcare vans, blood donation vans and medical transport vans.

In terms of vehicle size, full-size vans segment to command 53.7% share in the medical van market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA