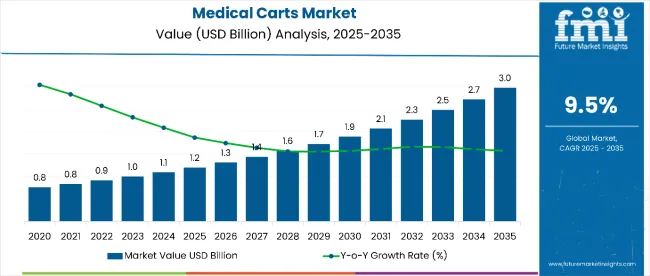

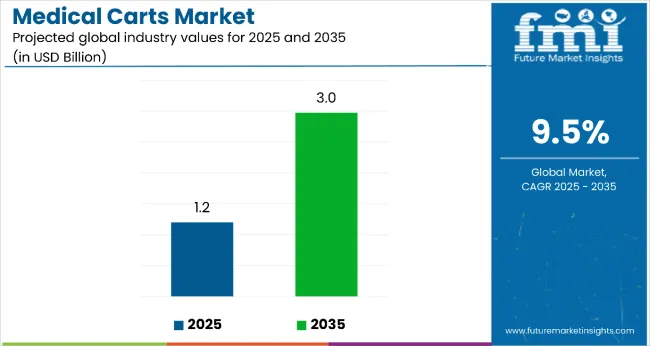

The medical carts market is estimated to be valued at USD 1.2 billion in 2025. It is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5%. The market is projected to add an absolute dollar opportunity of USD 1.87 billion over the forecast period. This reflects a 2.6 times growth at a compound annual growth rate of 9.5%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1.2 billion |

| Projected Value (2035F) | USD 3.0 billion |

| CAGR (2025 to 2035) | 9.5% |

The market's evolution is expected to be shaped by rising healthcare digitization, demand for efficient patient care solutions, infection control requirements, and growing preference for mobile healthcare workstations, particularly where organized medical equipment storage and accessibility are required.

By 2030, the market is likely to reach approximately USD 1.9 billion, reflecting an incremental value of USD 700 million during the first half of the decade. The remaining USD 1.17 billion is expected to be realized during the second half, suggesting an accelerated growth pattern. Product innovation in digital integration, ergonomic designs, and specialized cart configurations is gaining traction.

Companies such as Capsa Healthcare and InterMetro Industries Corporation are advancing their competitive positions through investment in technology development, product innovation programs, and global distribution networks. Rising healthcare facility expansion, advancing telemedicine integration, and improved infection control features are supporting expansion into hospital, clinic, and home care applications. Market performance will remain anchored in healthcare efficiency standards, patient safety protocols, and workflow optimization benchmarks.

The market holds a significant and rapidly growing share across its parent markets. Within the global medical equipment market, it accounts for approximately 2.8% due to its specialized mobility and storage capabilities. In the healthcare furniture segment, it commands an 18.5% share, supported by ergonomic design and infection control technology. It contributes nearly 12.4% to the mobile healthcare solutions market and 15.8% to the hospital equipment segment. In smart healthcare devices, medical carts hold around 8.2% share, driven by IoT integration and electronic health record connectivity requirements. Within the point-of-care solutions market, its share is approximately 11.3%, owing to its position as a leading mobile healthcare delivery platform that requires minimal setup.

The market is undergoing a strategic transformation driven by rising demand for emergency carts, digital integration features, and multi-functional healthcare capabilities. Advanced technologies using electronic locking systems, antimicrobial surfaces, and integrated computing systems have enhanced patient safety, workflow efficiency, and infection control, making medical carts essential components of modern healthcare delivery.

Manufacturers are introducing specialized features, including telemedicine integration, battery-powered mobility, and modular configurations tailored for different healthcare settings and clinical procedures, expanding their role beyond basic storage to comprehensive healthcare solutions. Strategic collaborations between cart manufacturers and healthcare technology companies have accelerated innovation in smart features and market penetration.

The medical carts market’s strong growth is driven by increasing healthcare facility expansion, demand for efficient patient care solutions, and rising infection control awareness. These factors make it an attractive equipment category for healthcare providers seeking innovative mobility solutions. The growing preference for organized medical storage, workflow optimization, and point-of-care delivery appeals to healthcare facilities prioritizing efficiency, patient safety, and operational effectiveness.

A growing understanding of mobile healthcare benefits, digital health integration, and ergonomic design importance is further propelling adoption, particularly in hospitals, surgical centers, and emergency departments. Rising healthcare expenditure, expanding telemedicine services, and continuous product innovation are also enhancing market accessibility and healthcare provider adoption.

As smart healthcare solutions and patient safety standards accelerate across global markets and efficiency becomes increasingly important, the market outlook remains highly favorable. With healthcare providers prioritizing workflow optimization, infection control, and digital integration, medical carts are well-positioned to expand across various hospital, clinic, and home care applications.

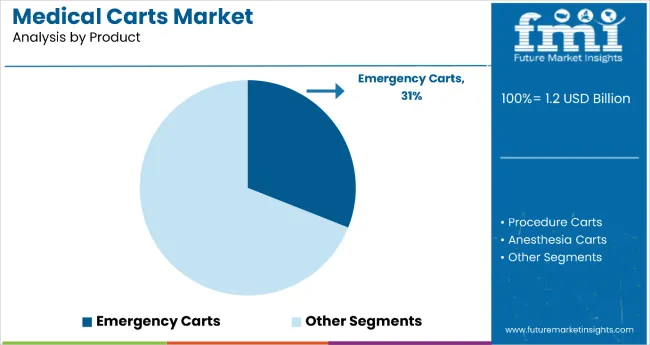

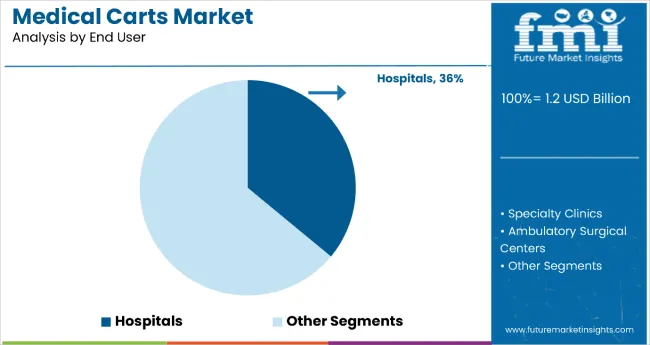

The market is segmented by product, material, energy source, end user, and region. By product, the market is divided into emergency carts, procedure carts, anesthesia carts, computer medical carts, specialty carts, medication carts, and others. Based on material, the market is categorized into polymer, steel, and aluminium. In terms of energy source, the market is bifurcated into powered and non-powered applications. By end user, the market is segmented into hospitals, specialty clinics, ambulatory surgical centers, diagnostic centers, rehab centers, nursing homes, and homecare settings. Regionally, the market is classified into North America, Europe, Asia Pacific, Latin America, the Middle East & Africa.

The emergency carts segment holds a dominant position with 31% of the market share in the product category, owing to their critical role in life-saving procedures, comprehensive medical supply storage, and rapid response capabilities that enable immediate access to essential emergency equipment. Emergency carts are widely deployed across hospital emergency departments, intensive care units, and surgical suites due to their specialized configurations, advanced life support equipment integration, and standardized medication storage that significantly improve emergency response times and patient outcomes.

They enable healthcare professionals to deliver immediate critical care while maintaining excellent organization and accessibility standards in high-pressure medical scenarios. As demand for advanced emergency preparedness, standardized protocols, and rapid response systems grows, the emergency segment continues to gain preference in both traditional and specialized healthcare environments.

Manufacturers are investing in advanced crash cart development, automated medication dispensing, and integration with hospital information systems to enhance functionality, expand clinical applications, and improve emergency care delivery. The segment is poised to grow further as global healthcare standards emphasize emergency preparedness and critical care optimization becomes more prevalent.

Hospital applications remain the core market segment with 36% of the market share in 2025, as they provide comprehensive healthcare solutions, diverse departmental requirements, and 24-hour operational support for various clinical procedures and patient care activities. Their functional versatility supports multiple healthcare delivery methods, including emergency response, routine patient care, medication management, and diagnostic procedures, making them essential equipment for modern hospital operations.

Hospital medical carts also ensure workflow optimization, improved patient safety, and enhanced staff efficiency compared to traditional fixed storage systems, while offering mobility and accessibility suitable for diverse clinical environments. This makes them indispensable in contemporary healthcare delivery and patient-centered care environments.

Ongoing demand for healthcare efficiency solutions and the operational requirements for modern hospital management are key trends driving the sustained relevance of hospital applications in this equipment category.

In 2024, global medical cart adoption grew by 15% year-on-year, with North America and Europe taking significant market shares. Applications include emergency response, medication management, and mobile computing solutions. Manufacturers are introducing specialized features and digital integration options that deliver superior healthcare efficiency and patient-centered convenience. Digital formulations now support smart hospital positioning. Evidence-based clinical studies and workflow optimization research support healthcare provider confidence. Technology providers increasingly supply ready-to-use smart medical carts with integrated electronic systems to reduce operational complexity.

Digital Innovation Accelerates Medical Carts Market Demand

Healthcare facilities and providers are choosing digital medical carts to achieve superior workflow control, enhance patient care delivery, and meet growing demands for smart, connected healthcare equipment. In performance evaluations, digital medical carts deliver up to 80% more efficient medication management compared to traditional storage systems at 30-40% faster response times.

Models equipped with electronic controls maintain optimal functionality throughout extended usage periods and diverse clinical applications. In hospital settings, integrated digital systems help reduce medication errors while maintaining safety standards by up to 70%. Smart connectivity applications are now being deployed for real-time monitoring, increasing adoption in sectors demanding comprehensive healthcare efficiency features.

Cost Pressures, Space Constraints and Training Requirements Limit Growth

Market expansion faces constraints due to higher costs of advanced models, limited space in smaller healthcare facilities, and requirements for staff training on sophisticated systems. Advanced medical cart prices can range from USD 5,000 to USD 25,000, depending on feature selection and technology requirements, impacting facility budgets and leading to procurement delays in cost-sensitive healthcare markets.

Limited floor space restricts deployment in smaller clinics, extending workflow optimization by 40-60% for space-constrained environments. Staff training requirements for digital systems add complexity to implementation, especially for facilities with high staff turnover. Limited awareness of advanced cart benefits restricts scalable adoption, particularly in emerging healthcare markets and traditional care delivery systems.

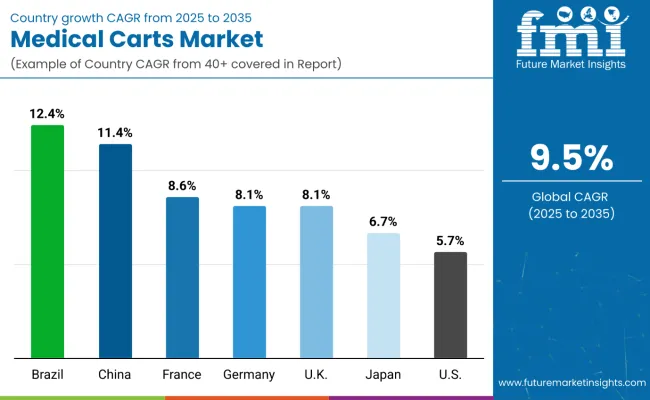

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 12.4% |

| China | 11.4% |

| France | 8.6% |

| Germany | 8.1% |

| UK | 8.1% |

| Japan | 6.7% |

| USA | 5.7% |

Brazil leads the medical carts market with the highest projected CAGR of 12.4% from 2025 to 2035, driven by healthcare infrastructure expansion, increasing hospital construction, and growing medical equipment modernization. China follows with a CAGR of 11.4%, supported by rapid healthcare digitization and government healthcare investment initiatives.

France shows robust growth at 8.6%, benefiting from healthcare system modernization and aging population care requirements. Germany and the UK demonstrate consistent growth at 8.1% each, supported by established healthcare networks and digital health integration. Japan and the USA show steady expansion at 6.7% and 5.7% respectively, reflecting mature market dynamics with replacement-driven demand and incremental technology upgrades.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from medical carts in Brazil is projected to grow at a CAGR of 12.4% from 2025 to 2035, significantly exceeding the global average. Growth is fueled by healthcare infrastructure development, hospital modernization programs, and increasing medical equipment procurement across major cities, including São Paulo, Rio de Janeiro, and Brasília. Brazilian healthcare providers are increasingly adopting mobile healthcare solutions as system improvements drive demand for efficient medical equipment.

Key Statistics:

The medical carts market in China is anticipated to expand at a CAGR of 11.4% from 2025 to 2035, reflecting strong healthcare system growth driven by government investment and hospital modernization initiatives. Growth is centered on digital medical cart adoption and smart healthcare solutions in the Beijing, Shanghai, and Guangzhou regions. Advanced features, including IoT connectivity, electronic health record integration, and automated systems, are being deployed for technology-forward healthcare providers seeking operational efficiency and effectiveness.

Key Statistics:

Sales of medical carts in France are projected to flourish at a CAGR of 8.6% from 2025 to 2035, driven by healthcare system digitization and aging population care requirements. Growth has been concentrated in hospital networks and specialized care facilities in the Paris, Lyon, and Marseille regions. Healthcare provider adoption is shifting from traditional equipment storage toward mobile, integrated healthcare solutions. Digital integration and clinical efficiency are leading market deployment strategies.

Key Statistics:

The demand for medical carts in Germany is expected to increase at a CAGR of 8.1% from 2025 to 2035, exceeding the mature European market average. Demand is driven by engineering quality preferences, healthcare efficiency requirements, and robust healthcare infrastructure in Berlin, Munich, and Hamburg markets. Evidence-based clinical outcomes and German engineering standards are increasingly adopted by quality-focused healthcare providers seeking reliable medical equipment.

Key Statistics:

Revenue from medical carts in the UK is projected to rise at a CAGR of 8.1% from 2025 to 2035, supported by NHS modernization programs, digital health initiatives, and healthcare efficiency improvements. Consumer adoption in London, Manchester, and Birmingham is expanding in smart cart solutions, infection control features, and integrated healthcare technology. UK healthcare providers are leveraging advanced cart systems to meet expectations for improved patient care and operational efficiency.

Key Statistics:

The medical carts market in Japan is expected to grow at a CAGR of 6.7% from 2025 to 2035, reflecting mature market dynamics with a focus on advanced technology integration and aging population care solutions. Growth is centered on the adoption of robotic carts and AI-integrated capabilities in the Tokyo, Osaka, and Nagoya regions. Advanced features, including automated medication dispensing, smart navigation systems, and electronic patient monitoring, are being deployed in technology-advanced healthcare facilities and geriatric care centers.

Key Statistics:

The medical carts market in the USA is expected to grow at a CAGR of 5.7% from 2025 to 2035, reflecting mature market dynamics with a focus on replacement cycles and incremental technology upgrades. Growth is centered on regulatory compliance solutions and interoperability features in California, Texas, and New York regions. Advanced features, including HIPAA-compliant systems, EMR integration, and infection control protocols, are being deployed for established healthcare networks and regulatory-conscious medical facilities.

Key Statistics:

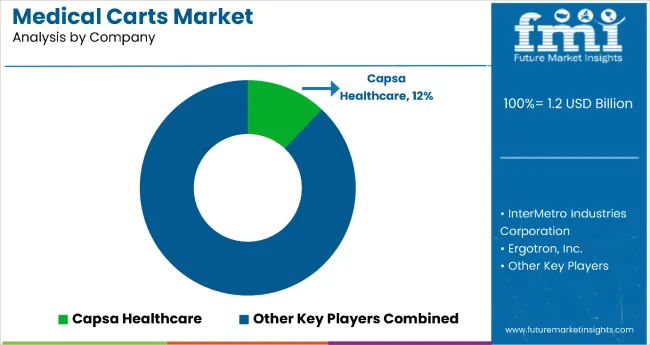

The market is moderately concentrated, featuring a mix of leading healthcare equipment manufacturers, technology innovators, and specialized medical furniture developers with varying degrees of product expertise, distribution capabilities, and healthcare market access proficiency. Capsa Healthcare leads the market with an estimated 12.0% share, primarily driven by its advanced computer cart technology and strong digital health integration in hospital applications. InterMetro Industries Corporation maintains significant market presence through comprehensive product portfolios, established healthcare relationships, and diverse cart configurations that cater to various clinical segments.

Ergotron Inc., Harloff Company, and Midmark Corporation differentiate through specialized designs, clinical innovation, and established relationships with major healthcare networks that serve various hospital departments and care settings. These companies focus on ergonomic features, infection control technology, and comprehensive clinical support programs, addressing growing demand from hospitals, surgical centers, and specialized healthcare facilities.

Regional specialists emphasize innovation in healthcare mobility, clinical workflow optimization, and competitive pricing strategies, creating value in mainstream hospital markets and specialty clinical applications.

Entry barriers remain moderate to high due to challenges in regulatory compliance, clinical validation requirements, and established relationships with healthcare procurement networks across multiple market categories. Competitiveness increasingly depends on clinical innovation capabilities, regulatory expertise, and distribution reach for diverse healthcare and institutional environments.

| Items | Value |

|---|---|

| Quantitative Units (2025) | USD 1.2 billion |

| Product | Emergency Carts, Procedure Carts, Anesthesia Carts, Computer Medical Carts, Specialty Carts, Medication Carts, Others |

| Material | Polymer, Steel, Aluminium |

| Energy Source | Powered, Non-powered |

| End User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Diagnostic Centers, Rehab Centers, Nursing Homes, Homecare Settings |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, Germany, France, United Kingdom, Brazil, Japan, Australia and 40+ Countries |

| Key Companies Profiled | InterMetro Industries Corporation Inc., Capsa Healthcare, Harloff Company, Waterloo Healthcare, Midmark Corporation, Ergotron Inc., Enovate Medical, Armstrong Medical Industries Inc., Jaco Inc., ITD GmbH (ITD Medical Technology), AFC Industries Inc., Medline Industries Inc., Advantech Co. Ltd., MedViron Inc., Howard Industries Inc., Pearson Medical Technologies LLC, CompuCaddy |

| Additional Attributes | Dollar sales by product type, application, and end user; regional demand trends; competitive landscape; integration with digital health and electronic medical records; ergonomic and modular design innovations; infection control features; healthcare infrastructure expansion |

The global medical carts market is estimated to be valued at USD 1.2 billion in 2025.

The market size for medical carts is projected to reach USD 3.0 billion by 2035.

The medical carts market is expected to grow at a 9.5% CAGR between 2025 and 2035.

Emergency carts are projected to lead in the medical carts market with 31% market share in 2025.

In terms of end user, hospitals segment is projected to command 36% share in the medical carts market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

North America Medical Carts Market Growth – Trends & Forecast 2025 to 2035

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA