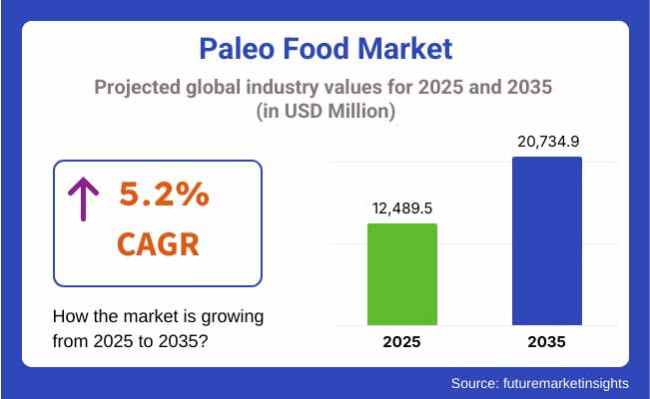

The paleo food market is projected to hit USD 12,489.5 million by 2025, then rise to USD 20,734.9 million by 2035 with a growth rate of 5.2%. Over the years, the paleo trend has sped up. With the rise of online shopping and digital change, the paleo product market is booming.

Growth in plant-based paleo options is adding to this boost, along with more creative paleo snacks and drinks, more paleo-approved food and drinks, and people liking these new products more. Plus, better ways to keep food fresh and getting clean-labeled stuff help the market grow.

Over the next ten years, the paleo food market is set to grow a lot. This is due to more people wanting clean, high-protein, and simple foods. More folks are learning about old diets, and the need for gluten-free and grain-free options is going up. The Paleo diet has been known for ages. It tries to copy our ancestors' eating habits. The diet suggests real whole foods, less dairy, grains, and sugar. Instead, it prefers lean meats, fish, veggies, fruits, and nuts when possible.

North America is set to lead the paleo food market. People there know a lot about eating clean. More folks want high-protein meals and foods with no grains. You can find lots of paleo brands in stores. The USA and Canada are ahead because keto and Whole30 diets are popular. They have more paleo protein bars and snacks in stores and online.

The market is growing because of paleo meal kits. More people buy grass-fed and free-range meat. Drinks like bone broth and collagen drinks are in demand too. Also, the government is helping with organic and non-GMO food. This support is helping the market grow even more.

Europe has a big share of the paleo food market. Countries like Germany, the UK, France, and Italy lead in making organic and natural foods. More people want dairy-free and grain-free items. Rules help with clean food labels too. The EU has strict food label rules, more people enjoy old diets, and paleo-friendly breads and sweets are part of market growth.

Paleo protein powders and meal replacements are on the rise. People want grass-fed dairy choices like ghee and nut cheeses. Top paleo snacks are growing in stores and online too. Europe aims to cut down on processed foods and use natural ingredients, leading to new product ideas.

The Asia-Pacific will see the fastest growth in the paleo food market. This is due to more people knowing about gluten-free and grain-free diets. Also, there is a higher need for high-protein and less processed foods. Plus, more money is being put into making organic and non-GMO foods. Countries like China, Japan, India, and Australia are leading in paleo-friendly meat, drinks that help health, and clean-label packaged foods.

China's growing health food area is helped by stricter rules on food safety and labels. More people are also using paleo diets in fitness groups, which boosts the market. In India, there is more need for nut flours and dairy-free foods. Urban areas want special diet foods, and online sales of health foods are going up. This helps the market grow. Japan and Australia lead in grass-fed meat and collagen foods, which makes the market grow more in the region.

Challenges

High Product Costs and Limited Consumer Awareness

One big challenge for the paleo food market is cost. The price for paleo-approved foods, like grass-fed meat, organic veggies, and non-GMO nuts and seeds, is high. This makes it hard for everyone to buy. Plus, not many people know about the paleo diet, especially in poor areas. Some think the diet isn't healthy and this makes it hard to sell.

Keeping paleo foods fresh without using chemicals is tough. The shelf life is short since these foods are less processed. Companies need new ways to keep these foods fresh, which is also a tough job.

Opportunities

Paleo-Plant Hybrid Diets, AI-Personalized Nutrition, and Sustainable Packaging

The paleo food market has a chance to grow a lot despite problems. There's a rise in paleo-plant diets mixing old-style eating with plant protein. This makes diets more inclusive and more people accept them. The use of AI to make custom diet plans using genetic and health info is becoming popular.

It opens up new ways for digital health. People want packaging that's good for the earth, which helps the market grow. Ready-to-eat paleo meals, grain-free bars, and clean-label snacks are becoming popular among busy and sporty people. This is good for market growth.

From 2020 to 2024, the paleo food market saw steady growth. This rise happened because more people wanted clean, high-protein, grain-free diets. The trend for natural, whole foods helped more paleo products to appear. Items like meat snacks, nut flours, and dairy-free goods grew popular.

There was also a jump in foods good for gut health, rich in probiotics, and collagen-infused options. But there were problems too. Prices were high, supply chains were tight, and there wasn't enough variety in regular stores. These issues made it hard for everyone to adopt paleo foods widely.

In the years 2025 to 2035, big changes are coming to the paleo food market. Smarter ways to get food and the use of AI to make nutrition fits people better will drive this shift. New products like lab-made meat and better farming ways will change things.

Also, new methods like precise fermentation, tracking with blockchain, and green packaging will boost customer trust and grow the market. People who care about their health will want clear, lasting, and nutrient-rich food. So, the paleo food world will change with cool new ideas meeting different diet needs.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with organic, non-GMO, and gluten-free certifications. |

| Technological Advancements | Use of traditional food processing methods and limited ingredient innovation. |

| Industry Applications | Primarily focused on packaged snacks, protein bars, and grain-free baked goods. |

| Adoption of Smart Equipment | Limited automation in paleo food manufacturing. |

| Sustainability & Cost Efficiency | Initial adoption of ethically sourced meats and organic ingredients. |

| Data Analytics & Predictive Modeling | Basic trend analysis and consumer preference tracking. |

| Production & Supply Chain Dynamics | Dependence on conventional farming and regional ingredient sourcing. |

| Market Growth Drivers | Demand driven by health-conscious consumers, fitness trends, and dietary restrictions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter labeling requirements, sustainability certifications, and carbon footprint disclosures. |

| Technological Advancements | Development of AI-powered personalized nutrition, lab-grown meats, and bioactive paleo ingredients. |

| Industry Applications | Expansion into functional foods, gut-health solutions, and sustainable protein alternatives. |

| Adoption of Smart Equipment | Integration of IoT-enabled production lines, smart inventory management, and AI-driven supply chain optimization. |

| Sustainability & Cost Efficiency | Full transition to regenerative farming, eco-friendly packaging, and zero-waste production models. |

| Data Analytics & Predictive Modeling | AI-powered demand forecasting, personalized dietary recommendations, and blockchain-enabled supply chain transparency. |

| Production & Supply Chain Dynamics | Diversification into alternative proteins, decentralized production hubs, and sustainable supply chain practices. |

| Market Growth Drivers | Growth fueled by advancements in sustainable food technology, precision nutrition, and global health awareness. |

The paleo food market in the USA is growing. More people want clean and grain-free foods. They look for high-protein snacks that are less processed. Paleo meal delivery is getting popular too. The FDA and USDA set rules for food labels and organic tags on these products.

There are more paleo snacks and meal options now. Companies invest in grass-fed and free-range meats. The demand for paleo baked goods and non-dairy choices is also rising. New ideas in personal diets and smart meal apps are shaping trends in this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

The paleo food market in the UK is growing because more people are learning about old-style diets. There's a big want for low-carb and gluten-free things. They also like foods that fit paleo rules. Groups like the FSA and BNF check paleo food rules and claims.

More paleo meal kits, more store spots for paleo bars and nut snacks, and more folks liking honey and coconut sugar help the market grow. Also, money spent on green and lasting paleo packaging shapes the market, too.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.0% |

The paleo food market in the European Union is growing well. This is due to strict EU food rules, a rise in demand for organic and grass-fed meat, and more interest in dairy and grain alternatives that fit the paleo diet. The European Food Safety Authority (EFSA) and the European Commission (EC) ensure food safety and label standards.

Countries like Germany, France, and Italy are leading. They show more use of paleo-certified protein supplements, more stores sell paleo-friendly bread and baked goods, and there is growth in drinks and foods such as collagen-based drinks. Also, studies on gut-friendly paleo diets and fermented products help the market grow.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.2% |

The paleo food market in Japan is growing. More people are now keen on high-protein foods that are not much processed. Grass-fed and organic proteins are in more demand. Natural sweeteners are also becoming popular in Paleo foods. The food safety rules are set by the Japan Ministry of Health, Labour, and Welfare (MHLW) and Japan Organic & Natural Foods Association (JONA).

Japanese firms are spending money to make paleo-friendly snacks. They are also making more seafood-based paleo meals and plant-based paleo protein powders. There is also a rise in nut and coconut-based paleo drinks, all changing the trends in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

The paleo food market in South Korea is growing well. This is due to more people knowing about grain-free diets. There is also a higher want for clean-label proteins and more paleo-friendly shops opening up. The South Korean Ministry of Food and Drug Safety (MFDS) and the Korea Health Supplements Association (KHSA) look after food safety and food labeling rules.

New paleo meal shakes, the rise in high-protein, low-carb snacks, and more paleo-friendly home meal replacement (HMR) foods are changing trends. Also, money is being put into sustainable meat and farming for paleo food. This is becoming more popular.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The paleo food market is growing fast. This is due to the increasing demand for unprocessed, high-protein foods that are clean. They also know more about eating like our ancestors did and are choosing diets without grains or dairy. Among the different kinds of products, meat and nuts & seeds are the most popular. These foods give lots of nutrition, important fats, and fit well with paleo diets.

Meat-laden dishes are commonplace in fast food, protein-rich bites, and natural eating plans. They have key building blocks, good fats, and nutrients. These meals are liked by gym-goers, athletes, and adherents of high-protein, low-carb meal programs.

The passion for meat-laden paleo food grows because people want grass-fed meat. They prefer it free of antibiotics and raised in a good way. As more folks look for protein-packed diets, paleo meal delivery services gain popularity. Plus, new tech in livestock care, plant-based animal feed, and clean-label meat production improves quality and boosts their market.

Though they have many perks, there are issues like worries about meat's impact on nature, the high price of organic and grass-fed meat, and strict laws on processed meat. Still, new ideas like lab-made meat, better farming, and smart diet advice are said to make them greener and more liked.

Nuts and seeds are used a lot in trail mixes, nut butter, and baking that is grain-free. They have healthy fats, plant proteins, and key minerals. These foods help those on the paleo diet with snacks and making meals their way.

More people are choosing nuts and seeds. They like the heart-healthy fats and use nut flours for baking without grains. Clean, simple snacks are getting more popular too. New tech helps find allergens, grows nuts in better ways, and makes seeds more nutritious - people trust these products more now.

Still, there are issues. Some worry about allergies, changing prices of raw nuts, and that nuts have too much fat. But new mixes of nuts and seeds, AI tools to help control portions, and protein from different seeds are making these foods even better. This should make more people buy and try different products.

The primary driving force behind the demand for paleo foods is from the end-user. Bakery goods and snacks are the top choices. They are famous because they are grain-free, gluten-free, and low in carbs.

Paleo-friendly baked goods like grain-free bread, almond flour muffins, and coconut flour items are popular. They offer fewer carbs and more fiber than regular bakery products. They are good for health-conscious people, those who can't eat gluten, and folks on the keto diet.

More people now buy paleo baked goods because there's a higher need for gluten-free and dairy-free options. There's also more interest in using coconut and nut flours, and more brands are offering paleo choices. Tech helps too, making better grain-free flours, coconut farming, and improving the taste of these goods.

But, using alternative flours can be costly, these goods don't last as long without preservatives, and they can be hard to find in big stores. Innovations in tech for baking, ways to naturally preserve these goods longer, and new mixes of paleo and keto products can help these items become easier to find and buy.

Paleo snacks are found in energy bars, nut packs, beef jerky, and dried fruit mixes. They give easy and healthy snack choices for busy people. These snacks provide quick energy without added sugars or fake stuff.

More people want paleo snacks because they prefer high-protein, low-sugar options. Many paleo brands are now available, and online stores make buying easier. New ideas in making snacks with AI, finding better protein sources, and mixing fruits and nuts make these snacks more appealing and nutritious.

Yet, there are challenges. Other healthy snacks like keto and plant-based are strong competitors. High prices for paleo snacks and limited knowledge in new markets are issues. But, new ways to enhance flavors with AI, custom paleo snack plans, and eco-friendly packaging may boost their use and consumer interest.

The paleo food market is growing bigger. A growing number of individuals are seeking natural and unprocessed foods and showing a preference for grain-free products as well.The market gets a push from those following paleo and keto diets. People now know more about clean-label foods.

There are more paleo-certified products in stores. Companies make organic, gluten-free, and protein-rich foods. This makes customers trust them more and stick to their diets. The market has top health brands, snack makers, and organic food producers. They all help in making new paleo snacks, protein bars, meat treats, and grain-free choices.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Paleo Treats Inc. | 18-22% |

| Caveman Foods | 14-18% |

| The Paleo Diet® Foods | 12-16% |

| Epic Provisions (General Mills) | 10-14% |

| Primal Kitchen (Kraft Heinz) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Paleo Treats Inc. | Develops paleo-friendly desserts, cookies, and snack bars made with natural ingredients. |

| Caveman Foods | Specializes in paleo protein bars, grain-free granola, and nut-based snacks. |

| The Paleo Diet® Foods | Manufactures paleo-approved meal solutions, snacks, and cooking essentials. |

| Epic Provisions (General Mills) | Provides grass-fed meat snacks, protein bars, and bone broth-based paleo products. |

| Primal Kitchen (Kraft Heinz) | Focuses on paleo-certified condiments, dressings, and protein-based meal solutions. |

Key Company Insights

Paleo Treats Inc. (18-22%)

Paleo Treats leads the paleo food market, offering clean-label, grain-free desserts and snacks for health-conscious consumers.

Caveman Foods (14-18%)

Caveman Foods specializes in paleo protein snacks, ensuring high-protein, natural ingredient-based options for active lifestyles.

The Paleo Diet® Foods (12-16%)

The Paleo Diet® Foods provides nutrient-rich meal solutions, optimizing compliance with paleo dietary guidelines.

Epic Provisions (General Mills) (10-14%)

Epic Provisions focuses on high-quality, grass-fed meat snacks, ensuring paleo-friendly protein sources with clean ingredients.

Primal Kitchen (Kraft Heinz) (6-10%)

Primal Kitchen develops paleo condiments and meal enhancers, making clean eating more accessible.

Other Key Players (30-40% Combined)

Several specialty health food brands, organic food manufacturers, and protein snack companies contribute to advancements in paleo-certified, grain-free, and nutrient-dense products. These include:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Metric Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Metric Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 6: Global Market Volume (Metric Tons) Forecast by End-Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Metric Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Metric Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 12: North America Market Volume (Metric Tons) Forecast by End-Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Metric Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Metric Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 18: Latin America Market Volume (Metric Tons) Forecast by End-Use, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Metric Tons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Europe Market Volume (Metric Tons) Forecast by Product Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Europe Market Volume (Metric Tons) Forecast by End-Use, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (Metric Tons) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: East Asia Market Volume (Metric Tons) Forecast by Product Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: East Asia Market Volume (Metric Tons) Forecast by End-Use, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (Metric Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia Market Volume (Metric Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 36: South Asia Market Volume (Metric Tons) Forecast by End-Use, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (Metric Tons) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Oceania Market Volume (Metric Tons) Forecast by Product Type, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 42: Oceania Market Volume (Metric Tons) Forecast by End-Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Metric Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Metric Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Metric Tons) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Metric Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Metric Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 13: Global Market Volume (Metric Tons) Analysis by End-Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Metric Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Metric Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 31: North America Market Volume (Metric Tons) Analysis by End-Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Metric Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Metric Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 49: Latin America Market Volume (Metric Tons) Analysis by End-Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Metric Tons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Europe Market Volume (Metric Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 67: Europe Market Volume (Metric Tons) Analysis by End-Use, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (Metric Tons) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: East Asia Market Volume (Metric Tons) Analysis by Product Type, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 85: East Asia Market Volume (Metric Tons) Analysis by End-Use, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (Metric Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia Market Volume (Metric Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 103: South Asia Market Volume (Metric Tons) Analysis by End-Use, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Oceania Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 111: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (Metric Tons) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: Oceania Market Volume (Metric Tons) Analysis by Product Type, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: Oceania Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 121: Oceania Market Volume (Metric Tons) Analysis by End-Use, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 125: Oceania Market Attractiveness by End-Use, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Metric Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Metric Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Metric Tons) Analysis by End-Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The overall market size for the paleo food market was USD 12,489.5 Million in 2025.

The paleo food market is expected to reach USD 20,734.9 Million in 2035.

Growing consumer preference for clean-label and grain-free diets, increasing demand for high-protein and low-carb foods, and rising awareness of health benefits associated with paleo diets will drive market growth.

The USA, Canada, Germany, the UK, and Australia are key contributors.

Paleo snacks are expected to dominate due to their convenience, nutritional benefits, and rising popularity among health-conscious consumers.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA